COPPER IS PRIMED AND READYSo this decade precious metals have finally shown volatility. Gold and Silver have been a highlight especially with the past Administration boasting EV, GREEN-NEW DEAL, and now with AI; Precious metals are showing that people as of right now prefer a physical safe haven asset rather than “code” like cryptocurrency. Even now with the Trump administration, space exploration and the ongoing need and increasing demand for more precious metals is obviously making these assets worth looking at BUT one metal that stands out the most but no one is talking about, is COPPER (CU)!

COPPER is by far primed and ready to show what its really made of. Often overlooked, with pennies being disclosed as being “worthless,” it takes more to produce 1 penny than what its actual value is, with only 2-4% of modern day pennies being made of Copper (CU) and 96%+ being zinc and other over supplied metals. Why?

By 2026 the US Government will stop printing pennies, and any 1 cents transactions will now be rounded to the nearest Nickel.

Gold and Silver showed similar chart patterns, and experienced almost the same innovations that lead to its increase demand thus leading to price being bullish as well. One thing that leads me to believe COPPER IS VERY UNDERVALUED is the FACT that silver mining and gold mining can be done by basically any individual with an increased appetite to fund a business venture of 1mil+, and in this day and age thats more common than you think. But copper mining takes at least 10times more money, and it takes at least 15 years to get a Copper Mine up and ready before you start to dig your first ore. With that being said, and the fact that most copper mines if not all of them up to unow, are starting to show depletion…. its TIME.

Technical analysis is easy here, basic trend and resistance/support and price action on the monthly outlook. This asset will be like when your daddy or great granddaddy bought gold cheap!

Commodities

Happy New Year 2026 — Trade Smart, Stay Disciplinedwe step into 2026, may clarity replace noise, patience replace haste, and execution replace hesitation.

May every trade be planned, every risk calculated, and every loss treated as tuition—not failure. Wishing all traders a year of emotional control, consistent decision-making, and an equity curve that trends steadily upward.

Happy New Year 2026 — trade smart, manage risk, and let probabilities work in your favor.

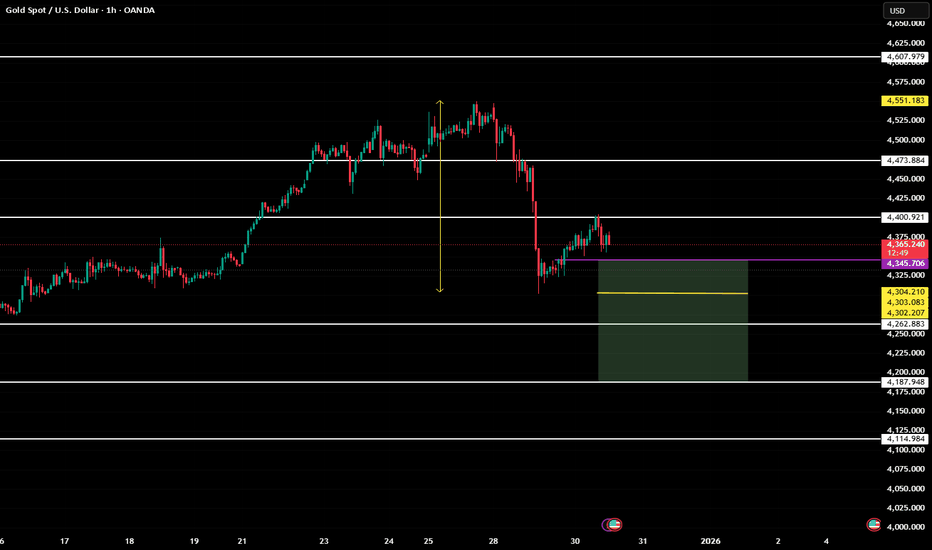

Gold After the Flush — Stabilization, Not ReversalOn the 1H timeframe, Gold (XAU/USD) has just completed a sharp impulsive sell-off, breaking the prior short-term structure and accelerating downside momentum. The decline was fast and vertical, suggesting liquidity-driven selling rather than a controlled trend transition. This type of move typically exhausts sellers in the short term but does not automatically signal a trend reversal.

After the sell-off, price is now stabilizing above a clearly defined support zone around 4,300–4,320. The current candles show smaller bodies and overlapping ranges, indicating that bearish momentum has slowed. However, this behavior should be interpreted as temporary absorption, not confirmation of bullish control. Structurally, the market remains below the descending trendline that guided the sell-off.

From a price action perspective, the rebound from support is corrective in nature. The market is forming a sequence of short-term higher lows, but these are developing inside a broader bearish leg, not as part of a confirmed trend change. Until price reclaims and holds above the prior breakdown area near 4,380–4,400, upside moves should be treated as pullbacks rather than trend continuation.

In terms of market context, this type of reaction is typical after a high-volatility flush, especially ahead of low-liquidity periods and year-end positioning. With no immediate macro catalyst forcing aggressive dollar weakness, gold lacks the conditions for a clean upside expansion at this stage. As a result, price is likely to rotate between support and the first supply reaction zone before the next directional decision.

In summary, gold is currently in a post-selloff consolidation phase. The support zone is holding for now, but the broader structure remains vulnerable. A sustained recovery would require acceptance back above key resistance levels, while failure to build continuation could expose price to another test of support or a deeper retracement. Patience and level-based execution remain critical in this environment.

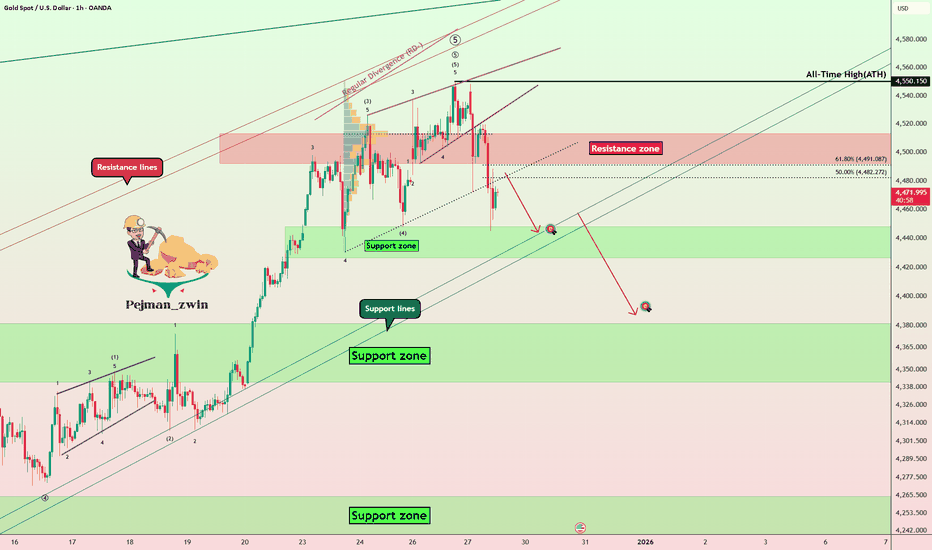

Gold at a Crossroad: Correction Phase Still in ControlHello Traders,

OANDA:XAUUSD is currently trading in a critical transition zone following a sharp rejection from the all-time high (ATH) near 4,550. The sell-off from this level was impulsive and decisive, indicating strong profit-taking and distribution at premium prices. However, the subsequent price action shows stabilization rather than continuation, suggesting the market has entered a rebalancing phase after extreme volatility.

From a market structure perspective, the breakdown below the former support zone around 4,430–4,450 marked a short-term structural shift. This zone now acts as a key resistance, where prior demand has turned into supply. Price is currently trading below this level, confirming that the market has not yet regained bullish control. At the same time, sellers have failed to extend price significantly lower after the initial breakdown, which limits immediate downside momentum.

The rebound from the 4,300–4,320 support zone is technically significant. This area aligns with a higher-timeframe demand zone where buying interest has previously emerged. The reaction here shows that buyers are still active at discounted prices, but the recovery remains corrective in nature, characterized by overlapping candles and measured upside moves rather than impulsive expansion.

Dynamic indicators support this neutral view. Price remains below the 34 EMA and 89 EMA, both of which are flattening after a prior bullish slope. This behavior typically reflects a loss of directional momentum and the development of a range. A sustained move above these moving averages would be required to shift momentum back to the upside, while rejection below them would reinforce resistance.

From a macro standpoint, gold is currently influenced by mixed drivers. U.S. Treasury yields have stabilized after recent volatility, while the U.S. dollar is holding firm but not accelerating. This macro balance reduces the probability of an immediate directional breakout and instead supports range-bound price behavior, especially as markets approach year-end liquidity conditions.

In conclusion, gold is not confirming a bullish continuation, nor signaling a bearish expansion at this stage. The market is trading between defined support at 4,300–4,320 and resistance at 4,430–4,450, with ATH supply overhead near 4,550. Until price either reclaims resistance with strong acceptance or breaks support with follow-through, gold remains in a neutral, level-driven environment, where discipline, confirmation, and risk management are more important than directional bias.

Happy New Year 2026 TRADERSAs we close the chapter on 2025, it’s worth acknowledging what this year truly tested — not just strategies, but discipline, patience, and emotional control. The market offered moments of clarity and long stretches of uncertainty, sharp trends followed by brutal consolidations, and powerful macro moves that rewarded preparation while punishing impulse. Every win came from respecting structure, and every loss carried a lesson for those willing to learn from it.

To all traders who stayed committed to the process managing risk, protecting capital, and waiting for high-probability setups this year has strengthened you more than any single trade ever could. Progress in trading is built quietly, over time, through consistency and self-control.

As we step into 2026, may your decisions be calm, your risk disciplined, and your confidence grounded in experience rather than emotion. May you trade with clarity, adapt quickly, and continue evolving with the market. Wishing every trader health, resilience, and a year ahead filled with focus, growth, and sustainable profitability.

HAPPY NEW YEAR 2026

Gold 1H – Smart Money Breakdown Targets 4040 Liquidity🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (30/12)

📈 Market Context

Gold has suffered a sharp breakdown following year-end positioning flows, marking its largest single-day drop in weeks. According to today’s hot ForexFactory update, bearish momentum is accelerating as price decisively breaks below key technical levels, with downside targets now aligning toward the $4040–4050 liquidity zone.

This move appears driven less by fresh macro catalysts and more by portfolio rebalancing, profit-taking, and thin liquidity conditions, typical of late-December trading. Despite some dip-buying interest emerging intraday, the broader flow suggests distribution rather than accumulation, keeping Gold vulnerable to further downside sweeps before any sustainable recovery.

Smart Money behavior in this environment favors sell-side continuation with corrective pullbacks, rather than impulsive trend reversals.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase: Bearish displacement after HTF distribution

Key Idea: Sell premium pullbacks; buy only at deep discount liquidity

Structural Notes:

• Clear CHoCH confirmed after loss of prior bullish structure

• Strong bearish displacement created inefficiencies below

• Previous bullish trendline invalidated

• Price trading below equilibrium, attempting weak corrective retrace

• Internal liquidity partially cleared; external sell-side liquidity rests below

• Resistance zone aligns with prior supply and breakdown origin

💧 Liquidity Zones & Triggers

• 🔴 SELL GOLD 4480 – 4490 | SL 4500

• 🟢 BUY GOLD 4310 – 4320 | SL 4300

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → continuation

🎯 Execution Rules (matching your exact zones)

🔴 SELL GOLD 4480 – 4490 | SL 4500

Rules:

✔ Pullback into premium resistance / supply

✔ Bearish MSS or CHoCH on M5–M15

✔ Downside BOS with impulsive displacement

✔ Entry via bearish FVG refill or refined supply OB

Targets:

4420

4370

4310 – extension if bearish momentum persists

🟢 BUY GOLD 4310 – 4320 | SL 4300

Rules:

✔ Sell-side liquidity sweep into deep discount

✔ Bullish MSS / CHoCH confirms absorption

✔ Upside BOS with strong bullish displacement

✔ Entry via bullish FVG fill or demand OB retest

Targets:

4370

4420

4480 – only if structure flips bullish

⚠️ Risk Notes

• Bearish momentum dominates after structural breakdown

• Year-end liquidity increases fake pullbacks and stop hunts

• No trade without MSS + BOS confirmation

• Expect volatility during U.S. session and around USD yield headlines

• Reduce position size if volatility expands unexpectedly

📍 Summary

Gold has transitioned from accumulation to distribution, with Smart Money now favoring downside continuation toward deeper liquidity pools. The plan is clear:

• Sell premium pullbacks at 4480–4490, or

• Buy only at deep discount 4310–4320 after confirmation

Let liquidity be engineered.

Let structure confirm intent.

Smart Money waits — retail reacts. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Every President TermThe president’s influence is real — but limited.

Markets are forward‑looking. They price in expectations months or years ahead. So even if a president announces a policy, the market may have already reacted long before it becomes reality.

Below numbers are taken from Year Starting January until December of finishing Year.

During Trump 1st Term 2017-2020

SP500 is up 67%

Gold is up 57%

Silver is up 54%

US M2 is up 43%

During Biden Term 2021-2024

SP500 is up 52%

Gold is up 45%

Silver is up 19%

US M2 is up 11%

During Trump 2nd Term 2025-2028 (Dated until 2025 Dec 30)

SP500 is up 19%

Gold is up 50%

Silver is up 130%

US M2 is up 3%

I would expect by the end of Trump Term, SP500 will be moving close to Gold Gains,

May be 30% up from here making SP500 close to 10000

I will look back this post on 2028 January to see if I need to correct my thesis

News Only Matters When It Breaks Market StructureDow × News × Market Structure

In trading, news is not powerful because the numbers are big or small. Most information is already priced in by the market. What truly determines the impact of news is not the headline itself, but whether it forces the market to change its existing structure.

According to Dow Theory, a trend remains in place until there is clear evidence of reversal. This leads to a simple reality: good news will not push price higher if the primary trend is still bearish, and bad news will not crash the market if a bullish structure remains intact.

That is why market reactions to news often look “strange.” Sometimes CPI comes out better than expected and price barely moves. Other times bad news hits and price only shakes briefly before continuing in the same direction. The issue is not that the news is wrong, but that it is not strong enough to break the current structure.

News only becomes meaningful when it does one of two things: breaks a key high or low, or ends an existing sequence of higher highs–higher lows or lower highs–lower lows. When price closes beyond the old structure, the market has accepted new information and entered a different phase of movement.

On the other hand, if price spikes on news and then quickly returns to the prior range, the structure has not changed. These moves are mostly noise—emotionally charged, but trendless. The market is merely releasing energy, not changing direction.

In practice, many of the strongest moves actually come from news that is not particularly surprising. That is because the structure was already in a vulnerable state. The news acts as the final catalyst, not the root cause.

So the real task is not “trading the news,” but reading the structure before the news hits. Define the trend using Dow Theory, mark the key structural levels, and then observe whether the news has enough force to break them. Only when structure changes and price confirms does news truly gain trading value.

The strongest news is not the one that creates the biggest volatility, but the one that forces the market to change how it moves. If structure is not broken, every reaction is just an opinion. Only when structure fails does the market give a real answer.

Gold has given a new high but has dropped back into supportNot an easy situation here on gold but the zones are pretty well defined. We are looking to see how gold treats the bearish supply recently created above the range, as well as monitor how the lows are being treated coming into the new year.

We are expecting much bullish discovery on the horizon as there is no real indication it will slow its growth curve as of yet.

Be sure to subscribe for more clear breakdowns

OKLO: watching for top formation NYSE:OKLO : as long as price remains below the 175–183 local resistance zone, I’m watching for at least a mid-term top formation, with selling pressure likely to start dominating. The first support levels to watch are 135–125.

A confirmed break above 183 would shift the odds toward one more upside leg into the 210 macro-resistance area.

Chart:

Macro view:

Previously:

On macro-bottom potential (May 1): www.tradingview.com

BTC/USDT | Will it make a move? (READ THE CAPTION)As you can see in the 4-hour chart of BTC, it is still struggling in the same zone it has been for the past 4-5 weeks, going up and down between the IFVG and the Demand zone. BTC will probably fall down to the high of the IFVG, at 86,662. There are no clear indication whatsoever as to when BTC will make a move, but when it does, it'll most likely be a very sharp move.

Current targets for BTC: 88,413, 89,409 and 90,406

Gold Breaks Records This Christmas — What’s Next?For the first time in history, Gold ( OANDA:XAUUSD ) has reached new all-time highs during the Christmas period, setting a remarkable record.

The question now is whether gold will continue to rise.

It’s important to note that when an asset hits all-time highs, technical analysis can become a bit more challenging, and it’s crucial to consider previous support and resistance levels.

Personally, I find that taking long positions at all-time highs can be risky due to the high likelihood of overbuying, so I tend to be more cautious about entering new long positions.

This period is usually characterized by consolidation or mild directional moves, rather than strong breakouts.

Important trends and decisive moves in Gold often emerge after the holidays, when liquidity returns and institutional positioning resumes in early January.

At the moment, Gold has started to decline with the new week and is moving below the resistance zone($4,513-$4,492).

From an Elliott Wave perspective, it seems that the main wave 5 may have completed at these all-time highs, and the wave patterns are clearly visible, so we can wait for correction waves.

I expect that Gold may attempt to retest the support line, and if it breaks that support lines and the support zone($4,448-$4,426), it could potentially drop to around $4,393.

What do you think? Will 2026 be another bullish year for gold, or should we expect a correction? I’d love to hear your thoughts!

First Target: Support lines

Second Target: $4,393

Stop Loss(SL): $4,529(Worst)

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Gold Going To 5000 in 2026 Here Is Why!Why Gold Is Likely to Rise in 2026 If Rates Fall to 3.0%

Gold historically performs best during periods of declining interest rates, and expectations for two additional rate cuts in 2026 — moving the policy rate from 3.75% down to 3.0% — create a structurally supportive environment for gold.

1. Falling Rates Reduce the Opportunity Cost of Gold

Gold does not generate yield. When interest rates are high, investors are rewarded for holding cash or bonds. As rates fall, the opportunity cost of holding gold decreases, making it more competitive versus yield-based assets.

2. Rate Cuts Typically Weaken the US Dollar

Lower interest rates reduce the relative attractiveness of dollar-denominated assets. Historically, rate-cut cycles lead to dollar weakness, which directly supports higher gold prices since gold is priced in USD and becomes cheaper for non-US buyers.

3. Real Yields Are the Key Driver

Gold responds most strongly to real yields (nominal rates minus inflation). If the Fed cuts rates while inflation declines slowly or remains sticky, real yields compress, which has been one of the most consistent catalysts for strong gold rallies.

At a personal level, this is exactly the dynamic I focused on in 2025. I didn’t trade gold because of hype or headlines, but because the macro setup was clear: falling real yields, rising liquidity, and asymmetric upside. By leveraging only at specific moments when momentum aligned with macro conditions, I was able to compound aggressively and ended the year up over 4,300% trading gold alone. Not because gold is easy — but because timing and context matter far more than prediction.

4. Rate Cuts Signal Economic Fragility

Multiple rate cuts are rarely bullish for growth assets at first. They usually signal economic slowdown, stress in credit markets, or financial instability. In these environments, investors seek protection, and gold historically benefits from this shift toward safe-haven positioning.

5. Liquidity Cycles Favor Hard Assets

Lower rates ease financial conditions and expand global liquidity. Increased liquidity tends to flow into hard assets and stores of value, especially when confidence in fiat stability weakens. Gold sits at the center of that liquidity rotation.

Conclusion

If the Federal Reserve delivers two rate cuts in 2026, bringing rates from 3.75% to 3.0%, the macro backdrop strongly favors higher gold prices. Lower opportunity costs, a weaker dollar, declining real yields, and heightened uncertainty together create a high-probability bullish environment for gold, increasing the likelihood of new all-time highs during the 2026 cycle.

So make sure to join my channel where I post trade signals so you can make 2026 your best year ever!

GOLD (XAUUSD) – 1H CHART GOLD (XAUUSD) – 1H CHART EXPLANATION

Gold earlier showed a strong uptrend, but near the 4550 area price faced heavy selling pressure. This led to a clear breakdown of structure, followed by a sharp bearish move. After this fall, price is now consolidating, which usually indicates a pause before the next move. As long as Gold stays below the broken support (now resistance), the overall bias remains bearish. This is a zone where patience is required, not aggressive trading.

The current price action suggests that the market is deciding its next direction. Fake moves are possible inside this range, so confirmation is more important than prediction. Traders should strictly wait for a 1-hour candle closing before taking any entry. Candle close confirms whether buyers or sellers are in control and helps avoid false breakouts.

TRADING PLAN (SIMPLE & CLEAR)

SELL SETUP (Preferred)

Entry: Sell only if a 1H candle closes below 4350

Stop Loss: 4420

Targets:

Target 1: 4300

Target 2: 4250

BUY SETUP (Only on Strength)

Entry: Buy only if a 1H candle closes above 4475

Stop Loss: 4415

Targets:

Target 1: 4550

Target 2: 4600

FINAL RULE

No candle closing = No trade

Trade only after confirmation, not on emotion.

Risk small and stay disciplined.

WATCH MORE IDEAS @thetradeforecast

2025 Scoreboard: Year’s Top Winners and Biggest LosersIn 2025, money flowed to safety and profits (metals, stocks) 🚀 and away from high risk (altcoins, most crypto) 📉.

Scoreboard: who won 2025? 📊

- 🥈 Silver: +160%

- 🥇 Gold: +65%

- 🧱 Copper: +43%

- 💻 Nasdaq: +20%

- 📈 S&P 500: +16%

- 🧬 Russell 2000: +13%

- ₿ Bitcoin: −6%

- Ξ Ethereum: −12%

- 🪙 Altcoins: −42%

So: metals and stocks = strong green ✅, crypto = mostly red ❌, especially altcoins.

Why metals pumped so hard 🪙🚀

- People wanted safety, not lottery tickets.

When there is fear about inflation, wars, or central banks, investors rush into gold and silver as “real” money that existed for centuries.

- Metals have real‑world demand.

Silver and copper are needed for solar, EVs, electronics etc., so there is constant buying from industry, not just traders.

Result: a huge wall of money moved into metals, pushing them up far more than Bitcoin.

Why stocks did well 📈💼

- Big Tech keeps making real profits.

AI, cloud, chips and software companies are printing earnings, so investors feel comfortable paying higher prices for their shares.

- Easy to access, easy to trust.

Anyone can buy an S&P 500 ETF in their pension account; rules are clear, liquidity is huge. That means constant passive inflows, even when crypto looks scary.

So stocks became the “default” risk trade, while crypto was left aside.

Why BTC and ETH only dipped a bit

- They are the “blue chips” of crypto.

When crypto is out of favor, funds usually sell altcoins first and keep more BTC and ETH, because they are the most liquid and most trusted.

- Still seen as long‑term bets.

Even in a bad year, many investors believe Bitcoin and Ethereum can recover, so they don’t panic‑dump as hard as they do with small caps.

That is why BTC −6% and ETH −12% look “ok” compared with altcoins −42%.

Why altcoins were destroyed 🧨🪙

- Highest risk, so they get sold first.

When people de‑risk, the order is usually: sell altcoins ➝ then BTC/ETH ➝ maybe later reduce stocks. Altcoins sit at the very end of the risk curve.

- Bad tokenomics + unlocks.

Many altcoins still release new supply to VCs, teams, or farmers. In a weak market, those extra tokens just crush price.

- Old narratives, no real users.

A lot of 2021 themes (random L1s, dead metaverse projects, copy‑paste DeFi) lost momentum. With little real usage, there were more sellers than buyers all year.

End result: altcoins became the worst‑performing major asset class of 2025.

The simple lesson for traders 🧠

- In “fear” years, money runs to real assets and profitable companies (metals, strong stocks) 🛡️.

- In those phases, crypto – especially alts – behaves like leverage on risk and gets hit the hardest 💣.

So for the next cycle, think in levels of risk:

cash → metals → big stocks → BTC/ETH → altcoins.

When the macro mood turns defensive again, rotate up this ladder instead of holding the riskiest coins and hoping.

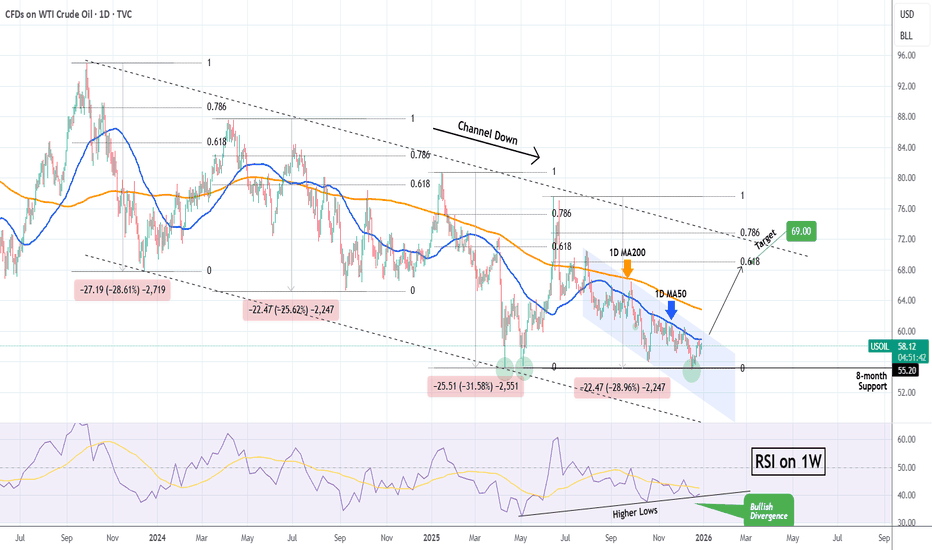

WTI OIL Strong case for a 2-month rally.WTI Oil (USOIL) has been trading within a Channel Down since the September 28 2023 High. Since then, it as had four Bearish Legs (including the current one), which declined on a range of -25.62% to -31.58%. All subsequent rebounds (Bullish Legs) that followed, hit at least their 0.681 Fibonacci retracement levels.

Given that the price rebounded 2 weeks ago on the 8-month Support (55.20) and the 1W RSI has been on Higher Lows (i.e. Bullish Divergence) since May, we may see a new Bullish Leg emerging now.

The one condition that will confirm that will be the price breaking above the blue Channel Down. If that takes place, we will turn bullish for the next two months, targeting $69.00 (Fib 0.618).

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USOIL WILL GO DOWN|SHORT|

✅WTI OIL trades into a clear premium supply zone after buy-side liquidity was taken. Weak bullish follow-through and rejection suggest smart money distribution, favoring a downside move toward resting sell-side liquidity below. Time Frame 6H.

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Gold has been moving in a strong bullish channel, but it is now Technical View:

Resistance Zone: The price is climbing towards a significant supply area between 4540.00 and 4633.00 (marked in red).

Channel Top: This resistance zone aligns perfectly with the upper boundary of the ascending channel.

Expectation: As price hits this upper structure, there is a high probability of a rejection or a pullback. I am watching for bearish reactions from this level to potentially correct downwards (as shown by the arrows).

Trade with care and manage your risk.

OANDA:XAUUSD FOREXCOM:XAUUSD ICMARKETS:XAUUSD SAXO:XAUUSD TVC:GOLD FOREXCOM:GOLD

POSSIBLE BUY SETUP XAUUSD 30MN

🟢 Entry Reason

Price has reacted strongly from a higher-timeframe demand zone.

Sell-side liquidity has been swept, weakening sellers.

Bullish reaction suggests potential CHoCH / momentum shift from demand.

Looking for continuation back toward premium liquidity above.

🟢 Entry

Buy on confirmation inside the 4,350–4,365 demand zone

Conservative entry after bullish engulfing / LTF BOS

🛑 Stop Loss (SL)

Below demand and liquidity low:

4,335–4,330

🎯 Take Profit (TP)

TP1: 4,390–4,405 (internal liquidity / resistance)

TP2: 4,430–4,450 (external buy-side liquidity)

📈 Why This Buy Works

Trading from discount + demand

Liquidity grab completed below lows

Favorable mean-reversion / continuation setup

Clear invalidation below demand

GOLD DAILY CHART ROUTE MAPHey everyone,

Please see our new Daily chart roadmap and trade idea, following the completion of our previous Daily chart setup.

We’ve also updated the Goldturn channel. We currently have a daily body close above 4507, opening the path toward the 4605 AXIS target. A 5 EMA lock would further confirm this move.

If instead we see a rejection at this level with a close below 4507, this would open 4406. A further close below 4406 would expose the channel half-line, which is a stronger primary support level where a bounce is more likely. Only a decisive break below the channel half-line would open the larger swing range, aligning with the channel floor

This is the beauty of our Goldturn channels, which we draw in our unique way, using averages rather than price. This enables us to identify fake-outs and breakouts clearly, as minimal noise in the way our channels are drawn.

We will use our smaller timeframe analysis on the 1H and 4H chart to buy dips from the weighted Goldturns for 30 to 40 pips clean. Ranging markets are perfectly suited for this type of trading, instead of trying to hold longer positions and getting chopped up in the swings up and down in the range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up using our smaller timeframe ideas.

Our long term bias is Bullish and therefore we look forward to drops from rejections, which allows us to continue to use our smaller timeframes to buy dips using our levels and setups.

Buying dips allows us to safely manage any swings rather then chasing the bull from the top.

Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

XAUUSD: Market Analysis and Strategy for December 30Gold Technical Analysis:

Daily Resistance: 4550, Support: 4270

4-Hour Resistance: 4430, Support: 4300

1-Hour Resistance: 4400, Support: 4350

Gold experienced a maximum drop of $247 yesterday, breaking through upward trend support lines on different chart levels, reaching a low of 4302. Today, it has entered an oversold rebound phase, but the medium-to-long-term upward trend remains unchanged. The Bollinger Bands are trending upwards, and the overall price action is within an upward channel. The focus is on the sustainability of the rebound. Support during the NY session is expected in the 4310-4300 range, while resistance is currently around the moving averages at 4397/4440.

The 1-hour chart shows a continued rebound with narrowing Bollinger Bands, indicating a potential new directional choice in the short term. Support on the 1-hour chart is expected around 4350/4324, with resistance at 4400.

Trading Strategy:

BUY: 4324 near

BUY: 4310 near

SELL: 4400 near

More Analysis →

Black Monday: How to get out of a losing position?#XAUUSD OANDA:XAUUSD FOREXCOM:XAUUSD

Gold is currently in a slow upward trend, but due to the significant drop at the beginning of the week yesterday, it will be difficult for gold prices to achieve a direct V-shaped reversal. It is expected to gradually stabilize through repeated fluctuations. My strategy remains primarily bullish, with bearish as a secondary approach. Currently, judging from the hourly and 4-hour charts, the short-term support is around 4365-4355. If it pulls back to this level, we can consider taking a small long position with a stop-loss order. Watch for resistance at 4395-4405. If the price rebounds to this level for the first time during the day and encounters resistance, consider a small short position.

Today, a slow, oscillating pattern is expected to continue. Trading should be conducted within the key range, with appropriate stop-loss orders in place. A steady and cautious approach is advised, and short-term traders should look for opportunities to take profits at resistance levels.

Gold (XAU/USD) Analysis: Gold Pullback After Strong Rally (READ)Today we are posting a new Gold analysis. After our last analysis, gold rallied strongly from $4337 to $4550, delivering more than 2100 pips of profit. After printing a new ATH at $4550, price faced strong selling pressure and has dropped to around $4461 so far.

The downside momentum is heavy, and my first bearish target is $4430. This level is very important. If price finds support there, we could see gold push higher again and move back toward levels above $4500.