Corn CFD Outlook: Institutional Breakout Setup Explained🌽 CORN VS DOLLAR: BULLISH MOMENTUM CONFIRMED | Swing/Day Trade Opportunity

📊 MARKET OVERVIEW

Asset: CORN Futures (ZCH26) / USD

Current Price: $446.40 (Dec 23, 2025)

Market Status: ✅ Simple Moving Average Breakout Confirmed

Trade Type: Swing / Day Trade

Signal: 🟢 BULLISH SETUP ACTIVE

🎯 TRADE PLAN: "THIEF STRATEGY"

Entry Strategy - Layered Limit Orders (Multiple Entry Points)

The "Thief Strategy" uses multiple limit buy orders to average into positions at different price levels:

Suggested Layer Entries:

🔹 Layer 1: $444 (Current support zone)

🔹 Layer 2: $446 (Mid-range entry)

🔹 Layer 3: $448 (Breakout confirmation)

Note: You can increase/decrease layers based on your capital allocation and risk tolerance

Alternative: ✅ ANY PRICE LEVEL ENTRY - Current market allows flexible entry as breakout is confirmed

🛡️ RISK MANAGEMENT

Stop Loss (SL):

Thief OG's SL: $442

⚠️ IMPORTANT DISCLAIMER: Dear Traders (Thief OG's) - I am NOT recommending you set only my SL. This is YOUR trade, adjust your stop loss based on YOUR strategy, risk tolerance, and account size. Trade at your own risk.

💰 PROFIT TARGETS

Primary Target:

Target Price: $458

Rationale: Simple Moving Average acts as a strong resistance level (police barricade). Potential overbought conditions + trap formations suggest TAKE PROFITS at this level.

⚠️ IMPORTANT DISCLAIMER: Dear Traders (Thief OG's) - I am NOT recommending you set only my TP. Take profits at YOUR own discretion based on your trading plan. Make money, secure money at YOUR OWN RISK.

📈 CORRELATED PAIRS TO WATCH

Agricultural Complex:

ZW (Wheat) - Current: $514.38 (+1.06%) ↗️

Grains correlation - watch for sector strength

ZS (Soybeans) - Current: $1,053.55 ↘️

Inverse correlation - weakness supports corn demand

ZO (Oats) - Monitor for broader grain sentiment

Dollar Index:

DXY (US Dollar Index) - Current: 97.93 ↘️

KEY INVERSE CORRELATION: Weaker dollar = bullish for commodities

Dollar at October 2025 lows supports corn rally

Energy:

CL (Crude Oil) - Watch ethanol production correlation

🌍 FUNDAMENTAL FACTORS (LATEST)

✅ BULLISH CATALYSTS:

1. Supply-Demand Dynamics (USDA WASDE Dec 2025):

📉 US corn ending stocks reduced to 2.029 billion bushels (-125 million bushels)

📈 Exports raised to 3.2 billion bushels (RECORD HIGH)

✅ Strong export pace exceeding 2024 records

2. Export Demand Surge:

US export sales reaching record levels to Mexico, Colombia and other buyers

Outstanding US sales and inspections pointing to faster shipments

Recent sales: 186,000 MT to unknown destinations

3. Ethanol Production at ALL-TIME HIGHS:

US ethanol output rose to record weekly levels

Increased feedstock demand tightening available supplies

4. Dollar Weakness:

DXY fell to 97.93 on December 23, 2025, down 9.49% over the last 12 months

Weaker USD makes US corn more competitive globally

5. Supply Chain Issues:

Ukrainian shipments running below a year ago because of harvest and logistical delays

Prompt physical supplies tightened outside the US

6. Brazilian Factors:

Brazilian sellers withholding inventory focusing on planting

Creates near-term supply gaps favoring US exports

⚠️ RISK FACTORS TO MONITOR:

1. Federal Reserve Policy:

Markets pricing in two quarter-point rate reductions in 2026

Affects dollar direction and commodity flows

2. China Purchase Commitments:

Monitor China's soybean purchases (affects corn indirectly)

Trade policy uncertainty with new administration

3. South American Weather:

Brazilian corn planting 97% complete

Watch for production updates (Jan 2026 WASDE)

4. Technical Resistance:

Price approaching June 2025 highs around $450

Strong resistance zone requires momentum confirmation

📊 UPCOMING ECONOMIC EVENTS TO WATCH:

USDA WASDE Report - January 12, 2026 ⭐

Weekly Export Sales - Every Thursday

CFTC Commitment of Traders - Weekly Friday releases

Fed Policy Decisions - Monitor rate cut timing

Brazilian Crop Progress - Ongoing through Q1 2026

💡 TRADING STRATEGY SUMMARY:

✅ Setup Type: Bullish SMA breakout with fundamental support

✅ Entry Method: Layered limit orders OR current market price

✅ Risk/Reward: Favorable with tight stop vs. extended target

✅ Timeframe: Swing trade (multi-day) or day trade (intraday moves)

✅ Confirmation: Export data + dollar weakness + supply tightening

⚠️ FINAL DISCLAIMER:

This analysis is for educational purposes only. I am NOT providing financial advice or recommendations. Every trader must:

✅ Conduct their own due diligence

✅ Use proper position sizing for their account

✅ Set stop losses based on their risk tolerance

✅ Take profits according to their trading plan

✅ TRADE AT YOUR OWN RISK

Past performance does not guarantee future results.

🔔 ENGAGEMENT:

👍 LIKE if you found this analysis helpful!

💬 COMMENT your thoughts and trade setups below

📊 FOLLOW for more commodity market analysis

Let's make profitable trades together, Thief OG's! 🚀

Cornusdsetup

CORN Bulls in Control? Retest Pullback Confirms Trend Bias🌽 CORN Institutional Edge Plan (Swing/Day Trade Setup)

🔍 Market Context

CORN (CFD on US Corn Futures) is showing signs of bullish momentum after testing a key resistance area. Institutional order flow hints at accumulation in the mid-420s region — a potential pullback zone before continuation higher.

🧭 Thief Strategy Plan — Layered Entries

This setup follows the “Thief Strategy”, a layered entry approach using multiple buy limit orders to capture volatility and improve average entry cost.

📈 Layered Buy Zones:

1️⃣ 428

2️⃣ 430

3️⃣ 432

(Traders may extend layers based on risk appetite and confirmation signals.)

🛑 Protective Stop (Thief SL): Around 424

🎯 Profit Zone (Thief TP): Around 445

🧠 Plan Insight

Expecting a resistance retest pullback to confirm the bullish structure.

Momentum aligns with higher-timeframe bias after institutional demand emerged near 420s.

Targets align with overbought resistance and prior liquidity traps — best to secure profits and protect gains as price nears 445.

💡 Note: Each trader should manage risk independently. This setup is educational only — showing how to structure a layered “Thief-style” plan, not a recommendation to buy/sell.

🔗 Correlated Assets to Watch

OANDA:WHEATUSD – Often mirrors agricultural flow shifts.

$SOYBEANUSD – Moves inversely at times; watch for divergence.

TVC:DXY – A stronger dollar can pressure commodity prices.

OANDA:SPX500USD – Risk appetite correlation; strong equities can support commodity demand.

🕵️♂️ Thief’s Key Notes

Dear Ladies & Gentlemen (Thief OG’s) — this plan shows how I structure entries, not where you should trade.

You can make money — then take money — at your own risk.

Manage your own stop-loss, target, and position sizing like a pro.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

📜 Disclaimer:

This is a Thief-style trading strategy created just for fun and educational purposes.

Not financial advice. Trade responsibly.

#CORN #Commodities #Futures #InstitutionalTrading #SwingTrade #DayTrading #LayeredEntries #ThiefStrategy #SmartMoney #PriceAction #CommodityMarket #Agriculture #DXY #WHEAT #SOYBEAN #TradingView #ThiefTrader

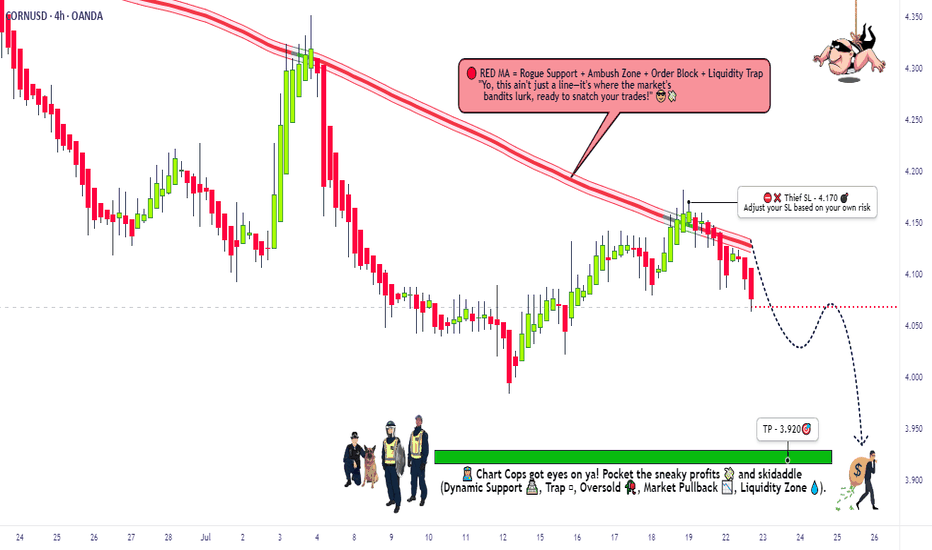

CORN Heist: Steal Short Profits Before Bulls React!🚨 CORN HEIST ALERT: Bearish Raid Ahead! 🚨 Swipe the Loot Before Cops Arrive! 🌽🔻

🌟 Attention, Market Bandits & Profit Pirates! 🌟

🔥 Thief Trading Intel Report 🔥

The 🌽 CORN CFD market is setting up for a bearish heist—time to short-swipe the loot before the bulls rally their defenses! Police barricade (resistance) is holding strong, but oversold conditions + consolidation hint at a trend reversal trap. High-risk, high-reward—just how we like it!

🎯 Heist Strategy (Swing/Day Trade)

Entry (Bearish Raid) 🏴☠️

"Vault’s unlocked! Swipe shorts at any price—OR set sell limits *near 15M/30M pullbacks for a cleaner steal!"*

Stop Loss (Escape Route) 🛑

Thief’s SL at nearest 4H swing high (4.170)—adjust based on your risk tolerance & lot size.

Pro Tip: Tighten SL if trading multiple orders!

Target (Profit Escape) 🎯

3.920 (or bail early if cops (bulls) show up!)

🌽 Market Snapshot: Why CORN is Ripe for a Raid

Neutral trend leaning bearish—consolidation breakout likely!

Key Drivers:

Macro pressure (USD strength, crop reports)

COT data hinting at big players positioning short

Seasonal trends favoring downside

Want full intel? 🔍 Check COT reports & intermarket analysis!

🚨 Trading Alerts (Avoid the Cops!)

News = Volatility Trap! 📰🚔

Avoid new trades during high-impact news.

Trailing stops to lock profits on running heists!

💥 Boost This Heist! 💥

"Like & boost this idea to fuel our next raid! More steals = more profits for the gang! 🏴☠️💰

Stay tuned—another heist drops soon! 🚀🤝

CORNUSD LONG TRADE - PRICE HAS RETESTED NOW GOING UPHey traders,

This is my analysis for Corn currently on the H1 charts.

We can see that corn was trading in this descending triangle pattern.

Price broke out then retested before holding strong.

MACD Bearish momentum also seems to be decreasing

Daily trade analysis and ideas:

Telegram: t.me

Facebook: www.facebook.com

Twitter: forex_dojo

Instagram: www.instagram.com

Website: www.forexshinobi.com

Tiktok: @forexshinobi

ForexShinobi