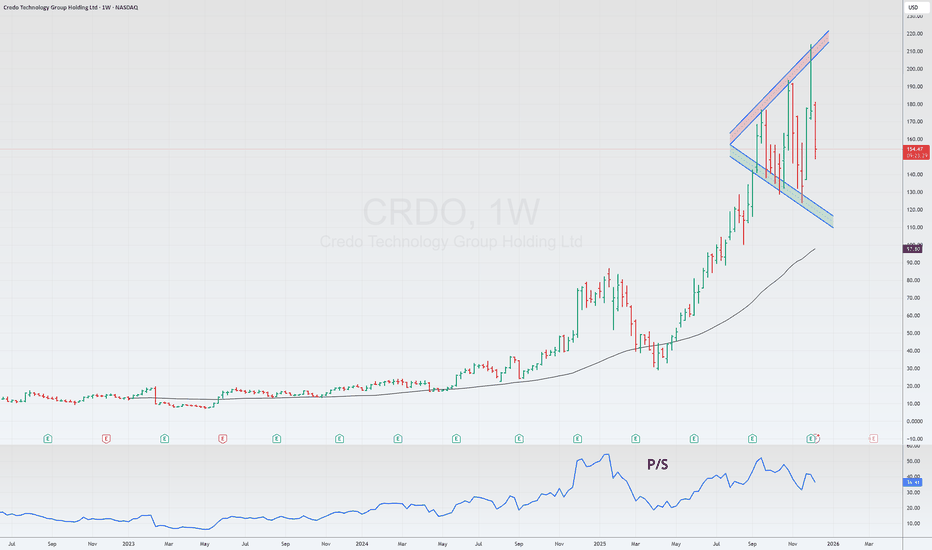

CRDO📌Credo — one of the hottest AI-driven stocks this year. With gains of nearly 200%, record-breaking quarters, and management beating estimates by 37%. The current price reflects not just success, but a picture-perfect future.

Here’s why the stock is overvalued and carries a high risk of a pullback.

1. Valuation

Forward P/E ~60 for 2026 and ~48 for 2027

For comparison, NVIDIA trades at a P/E of ~45.

P/S 36

Even with strong growth, this valuation leaves no room for error. The slightest miss in quarterly performance would trigger a painful compression of multiples.

CRDO

$CRDOCredo Technology Group Holding Ltd. (CRDO) has reached a definitive inflection point, as emphatically demonstrated by its stellar fiscal second-quarter 2026 performance. The company is experiencing a powerful acceleration in its growth trajectory, fueled primarily by the explosive adoption of its Active Electrical Cable (AEC) solutions and rapidly deepening engagements with the world's largest hyperscale data center operators. This momentum is further bolstered by a successful strategic initiative to diversify its customer base, which is set to amplify and stabilize its revenue growth for the foreseeable future.

The quarterly results underscore this transformative phase. Revenue soared to $268 million, marking a substantial 20% increase from the prior quarter and a staggering 272% surge compared to the same period last year. Central to this outperformance is the AEC business, which continues to be Credo's fastest-growing segment and is fundamentally reshaping data center interconnect standards.

A key indicator of Credo's strategic market penetration is its customer profile. In Q2, four separate hyperscalers each accounted for more than 10% of total revenue, a testament to the widespread adoption of Credo's high-reliability, high-performance connectivity solutions. Management highlighted a pivotal development: while the fourth major hyperscaler has reached full volume production, a fifth hyperscaler has now emerged and begun contributing initial revenues. This expansion of the flagship customer roster, coupled with management's comment that customer forecasts have "strengthened across the board," signals a major broadening of demand.

The technical superiority of Credo's AECs is driving this industry shift. The company notes that AECs have become the de facto standard for inter-rack connectivity, actively displacing optical solutions for distances up to 7 meters. This transition is driven by compelling advantages: Credo's AECs offer up to 1,000 times greater reliability while consuming 50% less power than traditional optical cables. As artificial intelligence clusters scale toward hundreds of thousands and even millions of GPUs, these attributes—reliability, power efficiency, signal integrity, and low latency—have become mission-critical. Credo's unique architecture, encompassing purpose-built SerDes technology, robust IC design, and a system-level approach, is specifically engineered to meet these extreme demands of next-generation AI infrastructure.

The financial outlook reflects this powerful momentum. For the fiscal third quarter, management anticipates revenue to jump approximately 27% sequentially at the midpoint. For the full fiscal year 2026, revenue is projected to grow more than 170% year-over-year. This guidance is underpinned by the expectation that each of its top four customers will grow significantly this fiscal year. The ongoing expansion and deepening of relationships within the hyperscaler ecosystem are poised to act as a sustained catalyst for growth, potentially well into fiscal 2026, 2027, and beyond. Importantly, this growing and diversifying customer base meaningfully reduces the risks associated with client concentration and enhances the stability of top-line growth.

Market Valuation and Technical Context

The market has recognized Credo's hyper-growth phase and strategic positioning, reflecting it in both valuation and share price performance. CRDO currently trades at a forward 12-month Price/Sales multiple of 28.87, which is significantly higher than the Electronic-Semiconductors sector average of 7.9. This premium valuation underscores investor confidence in Credo's superior growth profile and its leadership in the high-value AI connectivity market.

This confidence is further evidenced in recent share price action. Over the past month, CRDO shares have surged 40.6%, outperforming the broader Electronics-Semiconductors industry, which saw growth of 25.4%.

From a technical analysis perspective, the stock's price structure shows key Fibonacci retracement levels derived from its recent major move, which can serve as potential support zones in any corrective phase. The main support level is identified at 0.302 Fibonacci retracement, corresponding to a price of $134.00. Subsequent support levels are situated at the 0.5 retracement ($110.50) and the 0.618 retracement ($86.12). These levels provide a framework for understanding potential areas of buyer interest should the stock consolidate its substantial gains.

CRDO: Cloud + EMAs Aligning for Upside ContinuationCRDO - CURRENT PRICE : 162.95

CRDO is showing a bullish reversal setup as price rebounds and closes back above the EMA50 while holding firmly above the Ichimoku Cloud , signaling the major trend remains intact. Momentum is improving with RSI rising above 50 and not yet overbought, supported by increasing volume on the recent bullish white candlestick.

Today’s move above the 20-day SMA adds a positive layer to the short-term trend structure. Short term targets are 175.00 and 185.00 while support is 148.00.

ENTRY PRICE : 160.00 - 162.95

FIRST TARGET : 175.00

SECOND TARGET : 1.85

SUPPORT : 148.00

CRDO Earnings Swing: High-Conviction Call Play Amid Pre-EarningsCRDO QuantSignals V3 Earnings | 2025-12-01

Trade Type: BUY CALLS

Confidence: 65% (Medium conviction)

Expiry: 2025-12-05 (4 days)

Strike: $175.00

Entry Range: $12.40 – $13.90 (mid: $13.15)

Target 1: $19.80 (+50%)

Target 2: $26.70 (+100%)

Stop Loss: $9.25 (-30%)

24h Move: +16.48% (pre-earnings run-up)

Flow Intel: Neutral

Earnings Estimate: $0.50

Analysis Summary:

Katy AI predicts bearish movement (-17.92%) but composite bullish score (+5.3) favors calls.

Technicals: Overbought stochastics (89.4), resistance at $183.69, support $170.

News/Sector: Strong semiconductor momentum, 240% revenue growth, 100% historical beat rate.

Options Flow: Neutral, implied volatility high (174%), balanced delta 0.4–0.6.

Risk Level: HIGH – due to AI conflict, overbought technicals, and extreme IV.

Positioning Notes:

Use smaller position size due to risk/conflict.

Monitor for IV crush post-earnings.

Tight stop loss recommended.

Quick Trade Setup:

Instrument: CRDO

Direction: CALL (LONG)

Strike: 175.00

Entry Price: 13.15

Target: 19.80 / 26.70

Stop Loss: 9.25

Expiry: 2025-12-05

Position Size: 2% portfolio

Worthy Stocks Above 100M TTM RevenueTo follow up from my previous post, here's a more comprehensive list of stocks worth your attention with at least 100M revenue in the last year.

These stocks are picked for being money printers that are rewarded for R&D and buybacks.

I hope this is helpful and good luck!

Credo Technology Group (CRDO) – Powering the AI Data Center BoomCompany Snapshot:

Credo Technology NASDAQ:CRDO is a rising star in AI infrastructure, delivering high-speed, low-power connectivity solutions that are mission-critical to modern data centers.

Key Catalysts:

AI Infrastructure Tailwinds 🧠🏢

Direct exposure to Active Electrical Cables (AEC) and PCIe retimers

Positioned for rapid demand acceleration from AI, cloud, and hyperscale data centers

AEC chip market expected to grow 15x from $68M (2023) to $1B+ by 2028

Sticky Software + Hardware Model 🧩

PILOT software platform offers real-time diagnostics and performance tuning

Enables a recurring revenue model and strengthens customer retention

Scalable, Energy-Efficient Portfolio ⚡🌐

High-bandwidth, low-power design aligns with sustainability goals of large data centers

Integrated solutions are already seeing early adoption momentum

Investment Outlook:

✅ Bullish Above: $51.00–$52.00

🚀 Upside Target: $90.00–$92.00

📈 Growth Drivers: AI infrastructure demand, software expansion, chip market scale

💡 Credo isn’t just riding the AI wave—it’s building the rails for it. #CRDO #AIInfrastructure #Semiconductors