Cronos: poised for a move? key levels to watch this weekCronos. Waiting for this thing to finally wake up or just tired of the slow bleed? Alt market is still in risk-off mode and, according to industry sources, headlines around centralized platforms and regulation keep exchange-linked coins under pressure. Price is chopping sideways, but it's doing it right under a heavy supply zone - not my favorite place to marry a long.

On the 4H chart Cronos is in a clean downtrend with a ladder of supply blocks from 0.080 to 0.090. RSI is stuck around 50 after failing to break higher, so momentum is more "dead cat" than fresh trend. I lean short from this consolidation, expecting sellers to defend the 0.080-0.082 zone and push price back to the recent liquidity pockets below. I might be wrong, but a straight moonshot through all that supply would really surprise me.

My base plan: look for rejection wicks or bearish candles around 0.080-0.082 and aim for 0.072 first, then 0.068 as an extended target ✅. If Cronos closes a clean 4H above 0.084 and holds it as support, that invalidates the short idea and opens a squeeze toward 0.090-0.095 instead. I'm flat for now and waiting for price to tap the zone and show its hand.

Cronos

Cronos: Approaching the Target ZoneCrypto.com coin Cronos has continued its move toward the green Target Zone between $0.06 and $0.02. We expect the low of the large wave correction to form within this range. A sustained upward move should only become the main focus once this significant bottom is in place. There is a 29% probability that the low of the green wave alt. has already been reached. If that’s the case, the next step could be a breakout above the resistance at $0.39, rather than a drop below the $0.07 support.

Cronos (CRO) Weekly Chart Analysis: Back at Cycle Lows Cronos is starting to get interesting again from a higher timeframe perspective. When you zoom out on the weekly chart, CRO has a very clear history of sharp cyclical spikes followed by long periods of flat, compressed price action. These expansions typically happen fast, and the retracements tend to grind slowly back to key baseline levels.

Right now, CRO is sitting almost exactly at that long term equilibrium zone it has returned to multiple times. This is essentially the “cycle floor” where previous moves have bottomed out before major expansions. The dotted level you’re hovering near on the chart represents a multi-year demand zone that has repeatedly acted as a reset point.

A few key observations:

- CRO has shown it can produce explosive moves when liquidity cycles back into the ecosystem.

- It’s currently trading near the bottom of its historical range, a zone where volatility compresses before trend changes.

- Unlike many small caps, CRO has a massive platform behind it (Crypto.com), which means strong branding, user flow, and ongoing development that can continue feeding utility demand.

- The slow bleed back to cycle lows is typical in assets that rely on broader exchange-driven hype cycles rather than pure organic network activity.

This doesn’t imply a breakout is imminent, but structurally this is where smart money tends to at least start paying attention. Price is back at historical value, sentiment is washed out, and the chart is coiled in a multi-year compression phase. If the platform sees growth or renewed marketing pushes in the next cycle, CRO has plenty of room to re-expand.

In short: CRO is back at its long term base, supported by a major ecosystem, and showing the same early conditions that preceded prior upward cycles. This is the zone to watch.

Cronos Approaches Key Trendline, Potential 30% Surge Toward 0.28Hello✌️

Let’s analyze Cronos's price action both technically and fundamentally 📈.

🔍Fundamental analysis:

In simple English:

Morpho’s launch on Cronos could make lending with BTC and ETH easier and boost CRO use for gas and collateral, a good sign for Cronos DeFi growth. 🚀

📊Technical analysis:

OKX:CROUSDT is approaching a crucial monthly trendline, and holding this level while breaking nearby resistance could trigger a potential 30% rally toward $0.28. Traders may watch for confirmation of bullish momentum at these key levels. 📈💎

📈Using My Analysis to Open Your Position:

You can use my fundamental and technical insights along with the chart. The red and green arrows on the left help you set entry, take-profit, and stop-loss levels, serving as clear signals for your trades.⚡️ Also, please review the TradingView disclaimer carefully.🛡

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

CRONOS Giant Bull Flag can lead it to 0.85000 just like in 2021.Cronos (CROUSD) has been trading within a Bullish Megaphone through the entirety of its current Bull Cycle. Ahead of its first 1W Golden Cross, the pattern draws many similarities with the Bullish Megaphone of the previous Cycle.

More specifically, it appears we are inside a Bull Flag similar to April - May 2021, which after testing and holding the 1W MA100 (green trend-line), it rebounded and peaked just above the 1.618 Fibonacci extension.

As you can see the Fibonacci structure between the two Megaphones is quite similar, giving high probabilities of a continuation. As a result, as long as the 1W MA00 holds, we expect Cronos to dip some more and then rebound to 0.85000 (Fib 1.618 ext).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Phemex Analysis #106: Is Cronos (CRO) Ready for a Comeback?Cronos (CRO), the native token of the Crypto.com ecosystem, has had a turbulent year but is beginning to show signs of recovery. After plunging to lows near $0.08 in early July, CRO rallied to $0.38 by end-August, before retracing and trading today around $0.25. This rebound has fueled optimism among holders who see CRO as a long-term play on exchange tokens and blockchain adoption.

Beyond price action, CRO continues to be supported by its strong ecosystem. As the gas token for the Cronos Chain, it powers DeFi apps, NFT platforms, and GameFi projects while offering utility within Crypto.com’s exchange. The combination of real-world usage and a dedicated user base gives CRO a strong foundation for potential growth.

With CRO now consolidating under key resistance, the market is watching closely to see if it can stage a sustained comeback. Let’s explore the possible scenarios ahead.

Possible Scenarios

1. Bullish Breakout Toward $0.33 - $0.38

If CRO manages to reclaim $0.28 with rising volume, it could trigger a bullish continuation toward $0.33 and potentially $0.38, aligning with prior resistance zones.

Pro Tips:

Enter after confirmation of a breakout close above $0.28.

Scale out profits at $0.33 and $0.38.

Use stop-loss orders slightly below $0.25 to protect capital.

2. Range-Bound Consolidation $0.24–$0.28

CRO may continue to oscillate between support at $0.24 and resistance at $0.28, as traders wait for clearer market direction.

Pro Tips:

Buy near $0.24 support and sell close to $0.28 resistance.

Avoid overtrading in the middle of the range.

Watch volume shifts as a signal of an impending breakout.

3. Bearish Pullback Toward $0.15

If CRO fails to hold $0.24 on strong sell volume, the bearish trend could resume, sending price back toward $0.15, its support before recent rally.

Pro Tips:

Reduce exposure if $0.24 fails to hold with conviction.

Long-term investors may consider DCA at deeper supports ($0.12–$0.15).

Look for reversal signals like RSI divergence before re-entering.

Conclusion

CRO has rebounded strongly from its summer lows and is now consolidating in a key zone. With real utility across the Crypto.com ecosystem and the Cronos blockchain, it remains a token with strong long-term potential. Traders should keep an eye on the $0.28 breakout level and the $0.24 support zone to navigate the next move effectively. Whether CRO is on the verge of a sustained comeback or preparing for another test of support, disciplined strategies will be essential to capture opportunities.

🔥 Tips:

Armed Your Trading Arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

$CRO price pumped hard after the big news:🚀 The price of CRYPTOCAP:CRO skyrocketed after major news:

SPAC-company Yorkville Acquisition Corp, TMTG, and Cryptocom signed a final merger agreement.

They are launching Trump Media Group CRO Strategy, Inc. — a new digital asset management firm focusing on acquiring #CRONOS.

💹 Key details:

▪️ Yorkville Acquisition Corp plans to file for listing Class A shares on Nasdaq under ticker MCGA

▪️ Charter capital:

• 6.3B #CRO (~19% of supply) ≈ $1B (avg. price $0.159)

• $200M in fiat

• $220M in warrants

• + $5B credit line

🤔 But here’s the catch…

As the old trader’s saying goes:

"Buy the rumor — sell the news"

OKX:CROUSDT is still far from ATH ($1), but the news already seems to be “priced in”.

So we may see a distribution phase coming… if it hasn’t started yet.

⚖️ And the key point:

the further CRYPTOCAP:CRO price moves from the $0.159 average set in the deal, the less appealing it looks to buy right now.

And next… 👇

🧠 DYOR | This is not financial advice, just thinking out loud.

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

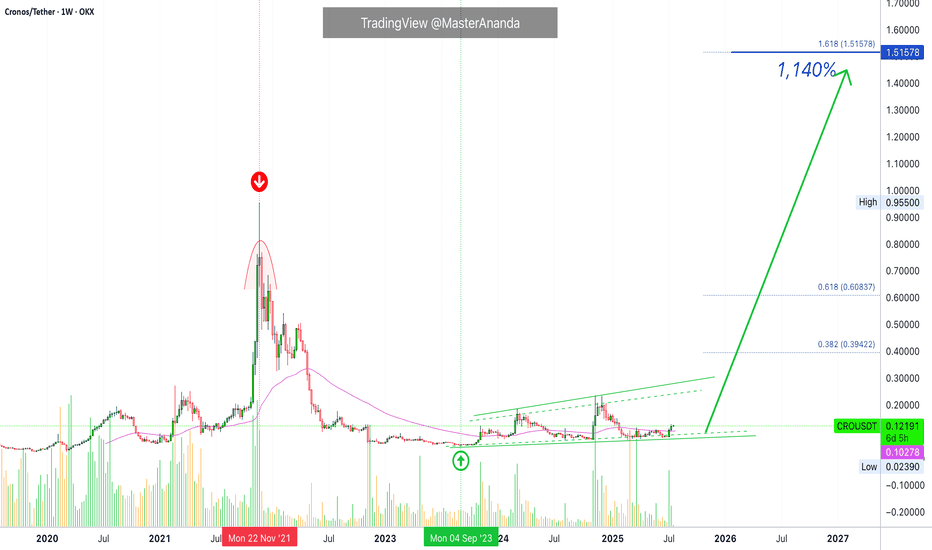

Cronos 2025/26 New All-Time High Revealed · PP: 1,140%Cronos has all the classic signals ready, confirmed and combined. RCC. And this opens the doors for a major advance which will not be shown fully on this chart. That is because I am using the linear chart for perspective but the log chart is needed to see all the major targets. Just trust, it is going to move very high in this bullish cycle run.

Good afternoon my fellow Cryptocurrency trader, I hope you are having a wonderful day.

Didn't I told you that you would see so much growth, that you will become complacent at some point? We are not there yet, but we will get there and you will have new challenges to face. Believe it or not, taking profits, using your earnings, will be one of the hardest things to do but the only right choice. A win is only a win when you close when prices are up.

Just as you cannot incur a loss unless you sell when prices are down; you cannot secure a win unless you sell when prices are up. When a pair grows 1,000%, you should take profits, period. When a pair growths 500%, it is wise to secure, 10%, 20%, etc. A plan is needed to achieve maximum success.

How you approach the market will depend on your goals, your capital, your trading style, which projects are available to you in your home-country, and so on.

A long-term investor does not need to sell, can continue to buy, accumulate and hold for a decade or more. Can you see? Each strategy is dependent on the person behind it.

CROUSDT · Trading weekly above EMA55 while still near the bottom. The bottom is revealed when we compare current candles size and location to the 2021 high price.

Last but not least, notice how each time there is a strong increase in trading volume the weekly session ends up closing green. Bullish volume is dominating this chart. A long-term accumulation phase.

Without further ado, the next and easy all-time high target is $1.51 but it can go much higher. Total profits reaching 1,140%.

Thank you for reading.

Namaste.

CRO at a Turning Point ?This is CRO on the daily chart.

Price has interacted multiple times with the key resistance at **0.10649** (black line). It’s now testing that level again, and there's a real possibility it flips it into support.

On top of that, CRO is attempting to reclaim the 200MA, while the 50MA is starting to flatten out—potential signs of a longer-term shift.

That said, this process might take some time and could be volatile. CRO’s relatively small market cap of \$3.33B and this week’s major macro events (starting today with CPI) could add pressure in both directions.

Always take profits and manage risk.

Interaction is welcome.

Cronos Rallies 18% After Truth Social Files for Blue-Chip ETFOKX:CROUSDT is a leading candidate for a Binance listing this month, following the proposed Crypto Blue-Chip ETF filed by Truth Social with the SEC. The fund includes 70% Bitcoin, 15% Ethereum, 8% Solana, 5% Cronos, and 2% XRP , positioning Cronos as a key asset in the fund.

Of the tokens in the proposed fund, only Cronos (CRO) is not currently listed on Binance. If the SEC approves the Crypto Blue-Chip ETF, Binance could fast-track the listing of Cronos . This move would likely draw more liquidity and investor interest toward CRO, fueling its price growth.

OKX:CROUSDT price surged by 17.8% over the last 24 hours, signaling strong momentum. If the ETF listing is approved and Binance acts swiftly, CRO could break through key resistance levels, potentially surpassing $0.1007. This upward movement would benefit investors, continuing the positive trend for the altcoin.

Cronos (CRO) Soars +20% – Can the Rally Push to $0.10?Over the past 24 hours , the Cronos project with the CRO ( COINBASE:CROUSD ) token has seen a price increase of nearly +20% .

Let's see if we can still profit from the movement of the CRO token .

What is Cronos (CRO)?

Cronos is an EVM-compatible blockchain built on the Cosmos SDK. It supports DeFi, NFTs, faster payments, and even AI‑capable dApps. Its native token, CRO, powers fees, staking, and ecosystem activities.

Why CRO Jumped +20% Today (July 8)

Technical leap: Sub-second block times and faster throughput

Better UX: Real-world ready for fast DeFi, payments, and AI dApps

Increased adoption: Greater utility across CAPITALCOM:CROUSD ecosystem

Trader momentum: Volume surges and speculative interest

Strategic roadmap alignment: Upgrades following gas fee improvements ---------------------------------------------------------------------

Now let's examine the CRO token chart on the 4-hour time frame from a technical analysis perspective.

CRO token is currently trying to break the Resistance zone($0.0960-$0.0925) .

Also, in terms of Elliott wave theory , this CRO token price increase with high momentum should be in the form of wave 3 and we can expect a correction to the Potential Reversal Zone(PRZ) for CRO .

I expect CRO to re-attack the Resistance zone($0.0960-$0.0925) after entering the PRZ and rise to at least near $0.1(Round Number) .

Note: Stop Loss (SL) = $0.847= Worst Stop Loss(SL)

Note: If the CRO token breaks the Resistance zone($0.0960-$0.0925) without correction, we can expect a break of the Resistance lines.

Note: It is better to enter a trade if you find the right trigger for a Long position, as a Short position is more risky.

Please respect each other's ideas and express them politely if you agree or disagree.

Cronos Analyze (CROUSD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Cronos: Bear Market VibesCronos is resisting the persistent selling pressure after last week's low, but it should soon turn sustainably downward again. We anticipate the imminent bottom of the overarching turquoise corrective wave 2 within the green Target Zone between $0.06 and $0.02. According to our primary scenario, once CRO reaches this new bear market low, it can quickly move upward in the next impulse wave, with the resistances at $0.14 and $0.23 serving at most as temporary pauses.

Cronos is on the move, Could we see it hit $1 soon?The chart is a weekly candlestick chart of CRONOS (CRO) against USD on TradingView, showing price action from late 2023 to a projected point in 2025. Let’s break down the key elements:

Price Movement and Trend:

CRONOS experienced a notable peak around mid-2024, reaching approximately $0.24000, followed by a sharp decline.

After the peak, the price entered a downtrend, forming a descending triangle pattern, which is typically bearish but can lead to a breakout in either direction.

The price has since stabilized in an "Accumulation Zone" between $0.07197 and $0.08925, with the current price at $0.08925 as of April 1, 2025.

Descending Triangle Pattern:

The descending triangle is defined by a downward-sloping resistance line (yellow) and a horizontal support line around $0.08925.

This pattern often signals a potential breakout. A break above the resistance could indicate a bullish reversal, while a break below support might lead to further downside.

The resistance line is currently around $0.13000 to $0.15000, based on the slope.

Accumulation Zone:

The price is in an "Accumulation Zone" between $0.07197 and $0.08925, suggesting that buyers are holding this level and potentially accumulating positions.

Multiple tests of this support level indicate strong buying interest, which could set the stage for a breakout if bullish momentum builds.

Target Projection (TG 1S):

The chart projects a target labeled "TG 1S" at $0.42000, a significant increase from the current price.

This target is likely based on the height of the descending triangle pattern added to the breakout point, a common technical analysis method.

However, reaching $1 (as requested) would require a much larger move, approximately an 11x increase from the current price of $0.08925.

Support and Resistance Levels:

Key support is at $0.07197, with the current price at $0.08925.

Resistance from the descending triangle is around $0.13000 to $0.15000, with a previous high at $0.17018.

A break above $0.17018 could open the door to higher levels, but reaching $1 would require sustained momentum and likely strong fundamental catalysts.

Historical Context and Feasibility of $1:

CRONOS reached an all-time high of around $0.96 in November 2021 during a crypto bull market, so $1 is within historical precedent.

However, the current market environment (as of April 2025) would need to see significant bullish momentum, possibly driven by broader crypto market trends, adoption of the Cronos ecosystem, or major developments in the Crypto.com platform (which CRONOS is tied to).

The $0.42000 target is a more immediate goal, but $1 would require an extraordinary rally, likely over a longer timeframe.

Timeframe:

The chart extends into mid-2025, and the $0.42000 target appears to be a medium-term projection.

Reaching $1 might take longer, potentially into late 2025 or beyond, depending on market conditions.

Breaking: Cronos ($CROW) Surged 26%, Gearing For 300% SpikeThe Price of Cronos ($CROW) spiked 26% today amidst breaking out of a falling wedge pattern- The asset is setting coast for 300% surge to recent ATH recorded in the month of December, 2024 last year.

With build-up momentum and RSI at 68 further hinting at a bullish breakout. The falling wedge pattern depicted on the chart started late December, 2024 last- a move that saw Cronos ($CROW) loosed about 76% of market value, tanking hard albeit the rest of the assets were performing exceptionally well.

What Is Cronos ?

Cronos (CRO) is the native cryptocurrency token of Cronos Chain — a decentralized, open-source blockchain developed by the Crypto.com payment, trading and financial services company.

Cronos Chain is one of the products in Crypto.com’s lineup of solutions designed to accelerate the global adoption of cryptocurrencies as a means of increasing personal control over money, safeguarding user data and protecting users’ identities. The CRO blockchain serves primarily as a vehicle that powers the Crypto.com Pay mobile payments app.

Cronos Price Live Data

The live Cronos price today is $0.105093 USD with a 24-hour trading volume of $407,141,786 USD. Cronos is up 27.11% in the last 24 hours, with a live market cap of $2,792,493,512 USD. It has a circulating supply of 26,571,560,696 CRO coins and the max. supply is not available.

Cronos will reach 0.50$1. Price Action and Trend Analysis

Historical Movement (Late 2023 to Early 2025):

The chart shows a significant upward movement starting around late 2023, where the price of CRO/USD spikes sharply from around $0.0600 to a peak near $0.1800 by early 2024. This indicates a strong bullish trend during this period, likely driven by market sentiment, adoption, or other fundamental factors related to Cronos.

After reaching this peak, the price experiences a sharp decline, dropping back to around $0.0728 by mid-2024. This suggests a correction or profit-taking phase following the rally.

From mid-2024 to late 2024, the price consolidates, fluctuating between $0.0600 and $0.0800, indicating a period of indecision or accumulation.

Recent Movement (Late 2024 to March 2025):

Starting around November 2024, the price breaks out again, surging to a new high of approximately $0.1600 by early 2025. This second rally mirrors the earlier one but doesn’t quite reach the previous peak of $0.1800.

Following this peak, the price begins to decline, forming a descending triangle pattern (more on this below). By March 11, 2025, the price is at $0.08138, as indicated on the right side of the chart.

2. Key Technical Patterns and Indicators

Descending Triangle:

The chart highlights a descending triangle pattern, which is typically a bearish continuation pattern. This pattern is characterized by a flat support line (around $0.0728) and a downward-sloping resistance line (the upper trendline of the triangle).

The price has recently broken below the support level of $0.0728, which is a bearish signal. This breakout suggests that sellers have taken control, and the price may continue to decline.

Support and Resistance Levels:

Support: The $0.0728 level acted as strong support during the consolidation phase and the base of the descending triangle. However, the recent break below this level indicates that this support has failed, and the next potential support might be around $0.0600 (a previous low from mid-2024).

Resistance: The upper trendline of the descending triangle (around $0.1000 at the time of the breakout) acted as resistance. Additionally, the $0.1600 level from the recent peak could serve as a future resistance if the price attempts to recover.

Projected Target (Yellow Arrow):

The chart includes a yellow arrow pointing downward, suggesting a projected price target following the breakout from the descending triangle. In technical analysis, the price target for a descending triangle breakout is often calculated by measuring the height of the triangle (from the highest point to the support) and projecting that distance downward from the breakout point.

The height of the triangle is roughly $0.0872 ($0.1600 - $0.0728). Subtracting this from the breakout point ($0.0728) gives a target of approximately $0.0728 - $0.0872 = -$0.0144. Since prices cannot go negative, this suggests the price could approach $0.0000, but in practical terms, it might find support at a previous low like $0.0600 or lower, depending on market conditions.

3. Volume and Momentum

While the chart doesn’t explicitly show volume bars, breakouts from patterns like the descending triangle are typically more reliable when accompanied by high volume. If the breakout below $0.0728 occurred with increased selling volume, it would reinforce the bearish outlook.

The momentum appears to have shifted from bullish (during the rally to $0.1600) to bearish, as evidenced by the descending triangle and the subsequent breakdown.

Cronos To Grow 1,500%, 2,500% Or More In 2025The same August 2024 support that led to a 250% rise is being activated again in February 2025. This will lead to a new and very strong rise. This time the bullish wave will be many times bigger compared to previous ones. Instead of 250% we might end up seeing 1,500%, 2,500% or more.

Good afternoon my fellow Cryptocurrency trader, this is indeed a very wonderful day.

Notice the high volume present on the chart as support is activated with a higher low, technical double-bottom, and notice all the green sessions. Four consecutive 2D sessions closing green. That's big.

The new b-wave is already developing, already in the making. We have higher highs with a flat bottom, a perfect wide, long-term, bullish consolidation signal.

The first resistance is the upper trendline. This will be broken easily but once it is challenged it is sure to produce a retrace, either big or small. After the retrace, we will see additional growth and this growth is the one that is likely to reach 2,000%+ in the coming months, from bottom to top.

Patience is key. Buy and hold.

Thanks a lot for your continued support.

Namaste.

$CAW Gearing Up for a Surge Amidst Bullish Engulfing PatternBuilt on the Cronos ecosystem, Cro Crow coin was the first NFT deployed on the Cronos chain, on block 946. $CROW token has since seen tremendous growth since listing with an all time low of $0.000000009647 SEED_ALEXDRAYM_SHORTINTEREST1:CAW token sky rocket to $0.0000001525 in a span of 20 days.

For that reason, present chart pattern hints at a potential price uptick with massive surge in the horizon amidst a bullish engulfing pattern. And with the Relative Strength Index (RSI) at 53 it gives more credence to the bullish thesis.

However, in the case of a cool-ff, immediate support lies in the 78.6% Fibonacci Retracement level a point that would serve as demand zone should SEED_ALEXDRAYM_SHORTINTEREST1:CAW retrace. Similarly, a breakout above the 38.2% Fibonacci level could pave way for the bullish surge we envisioned.

Asides the Technical aspect, data from DefiLlama shows about $394.74 million accounts for the total TVL locked. This portrays a growing interest in the Cronos ecosystem.

Crow with knife Price Live Data

The live crow with knife price today is $0.0000000251 USD with a 24-hour trading volume of $270,338 USD. We update our CAW to USD price in real-time. crow with knife is down 8.26% in the last 24 hours, with a live market cap of $19,322,981 USD. It has a circulating supply of 769,861,397,731,578 CAW coins and a max. supply of 777,777,777,777,777 CAW coins.

Cronos (CRO) - Bullish Swing - ResurectionCOINBASE:CROUSD been mostly #Bearish, but things are about to change.

Eventually it found its bottoms.

That's when I loaded #Longs around the 6 and 7 Cents Levels.

Eventually I took profit on the #HODL #Trades at 19 Cents a pop.

* all well documented in the related idea.

What's Next for OKX:CROUSDT ?

As the #BreakOut is now confirmed, a #Bullish Swing is about to start.

That would be the #ElliottWave #Impulse (#MotiveWave).

#AltSeason has started, and MARKETSCOM:BITCOIN is adding fuel.

#AltCoins will most likely get pushed by the #BitcoinDominance ( CRYPTOCAP:BTC.D ) #Retracement.

#TotalMarketCap ( CRYPTOCAP:TOTAL3 & CRYPTOCAP:OTHERS ) are also showing signs of new #ATH coming.

COINBASE:CROUSDC #TechnicalAnalysis

- #ElliottWave A-B-C Sequence

- Primary ⓒ (white) #Impulse

- #Fibonacci Time Zones

- #Fibonacci Retracements Confluence

- #Cypher #Harmonic

My #Long Levels On COINBASE:CROUSD

HODL:

- Entry @ 14 Cents

- TP1 @ 40 Cents

- TP2 @ 60 Cents

#Futures ( CRYPTOCOM:CROUSD.P )

- Moderate Entry @ 14 Cents

- Conservative Entry @ 10 Cents

- TP1 @ 40 Cents

- TP2 @ 60 Cents

Cronos: Dive!Cronos has dived into our beige Target Zone between $0.1322 and $0.0884 and should soon reach the projected low of the green wave . In our Zone, the coin should succeed in a bullish reversal, and the following impulsive wave should propel the price significantly above the resistance at $0.23. As CRO has fulfilled the minimum requirements for the wave correction by entering our Zone, it might even head above the $0.23 mark immediately.

CRO - 4h - Accumulation RangeREMEMBER that a lot of investors sell stocks or crypto for fiscal conditions in 2024 to close the year.

For that, we have low buy liquidity , and even with that pressure on the price , CRO is trying to remaning in the same range as 1 week ago, so a breakout can restart a new HH , so patience.

Im bullish on it if the 0,17usd resistance its broken and became a support.