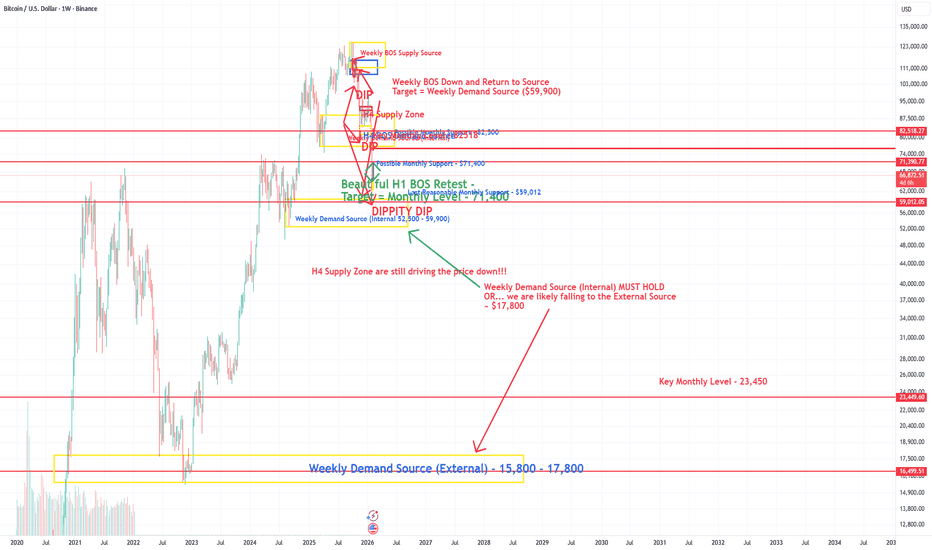

BTC Outlook - Can the "Week" Say I am Strong??!!!!Hey, Traders. Well, BTC is still on this wild ride and things are not looking too good for the Bulls and enthusiasts. If you've been following us, you've seen how this market structure has been playing out near perfectly for those who can understand what is really going on.

The focus for today's post is on the Weekly chart. As the WORD says in Joel 3:10, "let the weak say I am Strong". That is a call to action...to get up and take a stand. Well, for BTC that is the call for right now. If there is any chance that BTC holds up and stands its ground, it is going to be NOW and on the weekly chart. BTCs Week needs to say I am strong! Let's dive in:

Where are we now:

We have seen BTC follow our plan and fall down to near exactly the Weekly Demand Source we highlighted a couple of weeks ago. This level at $59,900 was the initial target after we saw a breakdown of market structure around the $110K price range. That was a 50%+ fall from all time highs, and a huge shock to most of the crypto world. But, it is an awakening to the fact that BTC is not exempt from following market structure, no matter how opportunistic it is. Since hitting this support level, we've seen an expected bullish response and push back up to the last Key Monthly Level we had identified at ~$71,400.

So, What is next?:

From here we are most likely to see a retest of this Weekly Demand Source (52,500 - 59,900). This baby is still falling unless and until we get at least an H4 Break of Structure back up to show that the Bulls have had enough! So far, that has not happened, and so the Fall continues.

We have another Key Monthly level sitting at around $59,012. I'm highlighting that as the last "reasonable" level to keep the price up. This level and the Weekly Demand Source are overlapping so the confluences here MUST be strong enough to hold, or it is Curtains for BTC. We need to watch this Weekly Source closely and look for any cracks in it. If we get an H4 candle close below that $52,500 floor, it is a dangerous sign for BTC. The daily will be the stronger indicator of the problem, so if we get that H4 close below, you need to watch the daily like a hawk!

What if this last support fails:?

If this last line of defense - the Weekly Demand Source (internal) and the Monthly level fail, the only strong support for BTC would be the external Weekly Demand Source way down at 15,800 - 17,800. That is scary but don't think it can't happen. It absolutely can! A weekly candle close below the existing Weekly Demand Source at $52,500 will almost certainly trigger another Major fall. There will likely be some "dead cat bounce" supports at around 40-45K and then again at 25-28K, but again, if the weekly gives up this $52,500 area, it is unlikely that any of these other attempts will stop the price.

So, overall, we are watching this current fall and expecting it to continue until we see signs otherwise. Aggressive traders will stay in sells or shorts until the H4 shows a break of structure...which we have not had yet! Additional sell entries can be taken at new H1 supply zones (or more aggressively at 15 min supply zones).

I hope this helps and that you all are extracting wealth from these markets. Please leave me your comments, questions, thoughts, etc. and if you need any help in learning how to better read the markets, let us know!

Cryptocrash

Wow, BTC! The Dip to the Dip to the Dippity DipHey, Traders. Just a quick follow up on our last BTC analysis and how this once again played like a New York Symphony. This structure we have been following led us all the way from ~110K down to EXACTLY the top of this Weekly Demand Source ~$59,900. If you've been following, see our previous posts on BTC and ETH to see how we have been able to follow this market structure and not fall prey to the mass liquidations and gross losses from those who have been longing BTC.

What Happened: The Market played out like the market does. Many players big and small starting buying the DIP on BTC when it fell to around 103K from All Time Highs, not understanding that there was a MUCH bigger picture playing out. They tried again at around the $80 - 85 area when the Market Makers faked most people out and dragged more buyers in for the kill. Unfortunately, the whole time, the Market was seeking this ~$60K area. If you are able to learn how to read and follow what the market is showing, there is almost ALWAYS a few clear signals that can help you stay out of trouble.

What happens now: Now we are sitting at this major Weekly Demand Zone. There are a LOT of buyers for BTC in this area...worldwide volumes of large buyers who have been waiting for everyone else to get liquidated or to tap out, so they can swoop in and buy what is likely to be the World's most valuable asset.

From here, we need to watch this Weekly Zone and look for bullish confirmation out of it. It doesn't mean that the market will automatically start buying, but it does mean the interest in buying is at substantially high levels. We need to watch the H4 in particular in this area and look for a BOS up out of it. The last H4 Supply zone is sitting up near 75K, so it's not likely that it will push up that strong and break that level. We are more likely to make a bullish response on the H4 and create another potential supply zone that can be more easily broken.

Watch for it...wait for it, and if we get it, be ready to buy! As stated in the previous post, aggressive buyers already have longs set at around the ~55K area.

I pray you all are trading safely and staying ahead of the game. If you need help in analyzing and understanding the markets better, let us know and we'll be glad to help. As always, PLEASE leave me your comments, questions, and suggestions, and I'll reply.

Bitcoin Daily Analysis #11 – November 05, 2025 Scared? 😅

Good — pay close attention to how you feel these days and journal everything. The most valuable financial lessons come exactly from moments like these. 📖

As you can see, Bitcoin is under heavy selling pressure, and its sharp drop around the $100,000 zone has so far been supported by buyers.

If that support breaks again, you could consider opening a short position, but ⚠️ don’t hold it too long — the overall trend remains bullish, and a strong rebound could follow.

Around $104,000, we might see a risky long trigger, but only with tight risk management and a controlled position size.

If Bitcoin tests $104,000 and gets rejected, a deeper correction or even a sharp drop could follow.

We’re in a phase where the market could swing both ways — once it breaks out of this uncertainty, expect a powerful move. ⚡

Macro data and recent economic news still favor Bitcoin, and interestingly, during this decline, the big players have mostly stayed on the sidelines, with lower-than-average trading volume. 📈

No matter which way Bitcoin moves, your risk management will determine your success. 🎯

So avoid emotional decisions and let the chart structure guide you. 📊

Disclaimer:

This content is for informational purposes only and does not constitute financial or investment advice. © DIBAPRISM

Larry D.Kohn

The Crypto Crash: A Brutal Reminder of What MattersLast night, the crypto market went through one of its ugliest moments in history — a true bloodbath.

What began as a reaction to Trump’s tariff announcement quickly turned into a historic liquidation cascade that wiped out over $19 billion in leveraged positions within few hours.

More than 1.6 million traders were liquidated. Bitcoin dropped over 10%, Ethereum and Solana fell even harder, and many small altcoins collapsed by 40–50%, some even more.

It wasn’t just volatility — it was destruction.

Was It Manipulation? Probably.

Everyone was long.

Everyone expected a rally.

Then, as often happens in overleveraged markets, someone pulled the plug. Prices were smashed down violently, liquidations fed liquidations, and what followed looked less like a correction and more like a coordinated sweep.

I’m not the one to shout “manipulation” at every dip — but let’s be honest: this one felt orchestrated.

Still, as they say, all’s fair in love and war . And markets are war . Which means you can’t complain — you have to adapt.

The Real Lesson: Survive First, Profit Later

If there’s one thing this crash reminds us of, how risky leverage is.

Used wisely, it amplifies returns.

Used recklessly, it destroys accounts — fast.

Most traders didn’t got liquidated because they were wrong about direction.

They got liquidated because they were overexposed.

When a 10% drop in Bitcoin wipes out your entire account, the problem isn’t the market — it’s your risk management.

How to Trade Like a Professional

1. Trade with controlled risk.

Never risk more than a small percentage per trade. If you don’t know your stop-loss level before you enter, you’re gambling, not trading.

2. Have a plan.

Every position must have an entry, a target, and an exit plan for when you’re wrong. A trader without a plan becomes prey when the market turns.

3. Avoid leverage on small altcoins.

Alts move fast, lack liquidity, and often get manipulated. Using leverage on them is financial suicide. Stick to spot.

4. Stay realistic.

The market doesn’t owe you a 10x move. Take profits, manage downside, and avoid getting caught in collective optimism.

5. Focus on survival.

Capital preservation is victory in itself. If you can stay in the game after a crash like this, you’ve already beaten 80% of the crowd.

Final Thoughts

Yes, my portfolio is down too. But I’m not panicking — because I wasn’t leveraged, and I had a plan.

Those who treat trading like war — disciplined, strategic, prepared — survive.

Those who treat it like a casino, don’t.

So let this $19B liquidation serve as a brutal reminder:

Don’t trade based on hope, hype, or herd behavior.

Trade with control, clarity, and courage.

Because in markets, like in war — survival always comes before victory.

Bitcoin's drop, opportunity in disguise?Yesterday’s move took me by surprise.

I’ve been bullish on BTC and many altcoins, and without looking for excuses, I didn’t expect what happened last night (mine). The new tariff threats from Trump hit the markets like a hammer, triggering a sharp crypto selloff.

So, the question is — is this the start of a more meaningful drop, or actually an opportunity in disguise?

Looking at Bitcoin’s chart, price broke below the key 118k support zone, almost touching 108k, which I consider the real line in the sand.

In my opinion, bear markets don’t start like this. This drop looks more like a liquidation event — a clean sweep that flushed out weak hands and overleveraged positions.

If BTC dips under 110k again, I’ll be watching closely for buying opportunities. In the short term, at least a recovery toward 118k seems quite probable.

Crypto Market at a Major Crossroad, USDT Dominance Will TellUSDT Dominance has reached the critical descending trendline resistance – a major decision point for the entire crypto market.

🔹 If USDT.D breaks above this trendline and holds, it signals rising demand for stablecoins. This usually means capital is leaving crypto assets, potentially starting a long-term bearish phase for the market.

🔹 On the other hand, if USDT.D fails to break this resistance and gets rejected, it could trigger a decline in dominance. That would suggest money is flowing back into Bitcoin and altcoins, opening the door for a possible new rally.

⚠️ The next few days are crucial. This zone is a macro decision point that may define the medium-to-long-term direction of the crypto market.

Stagnant Dominance Screams No Inflows – Crypto Crash Looming?Overview:

Over the past 43 days (July 12 to August 24, 2025), USDT Dominance has hovered around 4% with slight increases (from ~4% to 4.24%), indicating zero fresh capital inflows into crypto.

Growth in alts like Ethereum stems solely from money rotating out of Bitcoin (BTC.D decline), not new money— a classic redistribution trap. This setup warns of high crash risk, as the market lacks real liquidity support. As of August 24, 2025, USDT.D at 4.24% is priming for a surge, potentially triggering altcoin carnage.

NeoWave Technical Analysis:

The chart shows a completed Diametric correction (7 waves A-B-C-D-E-F-G) in the descending yellow channel, with Wave G accelerating downward. Wave A from ~6.4% to 4.9%, B rebound to 5.7%, C drop to 4.5%, D rise to 5.4%, E decline to 4.3%, F short rally to 4.5%, and G plunging to 4.24%.

Monowave count (~55-70 subwaves) and symmetry (A/C/E/G large, B/D/F small) validate the pattern. The trendline break confirms reversal, targeting the next line at ~4.6% (1.618 Fib extension from F low).

Stagnant dominance over 43 days underlines no inflows—crypto's "growth" is internal shuffling, vulnerable to sudden outflows.

Why Crash Risk is High:

No new cash means the market is floating on borrowed time. Ethereum's pumps owe to BTC rotations, not organic demand—per Statista, USDT dominance rose in May 2025 but stabilized, signaling caution. If USDT.D breaks 4.6%, alts could dump 20-30% as funds park in stables.

Trade Idea (Bullish USDT.D / Bearish Alts):

Entry: Long USDT.D above 4.24% on BOS confirmation; short ETH/alts below $4,800.

Targets: TP1 at 4.6%, TP2 at 5% (channel midline). For ETH: $3,800-$3,500.

Stop Loss: Below 4.1% (R:R ~1:3).

Sizing: 1-2% capital; trail on midline breaks. Watch volume—low inflows mean flash crashes ahead.

Crypto's house of cards—time to hedge! #USDTDominance #NeoWave #CryptoCrash #NoInflows

The Spring of OM: Wyckoff Signals a Rebirth After the CrashMANTRA ( BYBIT:OMUSDT.P ) Technical Analysis: Post-Crash Recovery and Wyckoff Accumulation Insights

TradingView

On April 13, 2025, MANTRA (OM) experienced a significant price drop, declining approximately 88% within 24 hours. This sharp downturn was attributed to a combination of factors, including market-wide volatility and potential large-scale sell-offs. Despite this abrupt decline, technical indicators suggest that OM may be entering a Wyckoff Accumulation Phase, presenting potential investment opportunities.

Understanding the Recent Price Movement

Following the crash, OM's price stabilized around $0.70, with a 24-hour trading volume exceeding $2.3 billion. The Relative Strength Index (RSI) and Commodity Channel Index (CCI) indicators both entered oversold territories, indicating a potential for price reversal.

CoinMarketCap

CentralCharts

Wyckoff Accumulation Phase Analysis

The Wyckoff Method identifies specific phases in market cycles, with the Accumulation Phase characterized by large investors ("smart money") buying assets at lower prices. Key features of this phase include:

Selling Climax (SC): A sharp price decline with high volume, as seen in OM's recent drop.

TradingView

Automatic Rally (AR): A quick rebound following the SC, indicating initial buying interest.

Secondary Test (ST): Price revisits the SC level to test support, often with lower volume.

Spring: A false breakout below support levels to shake out weak holders, potentially observed in OM's price action.

Mudrex

Sign of Strength (SOS): A strong price increase with higher volume, signaling the end of accumulation.

Currently, OM's price behavior aligns with the early stages of this accumulation pattern.

Investment Considerations

For investors considering entry points:

Risk Tolerance: Given the recent volatility, only risk capital should be used.

Technical Confirmation: Await confirmation of the SOS phase before significant investment.

Volume Analysis: Monitor trading volumes for signs of increased institutional interest.

Understanding the Wyckoff Accumulation Phase can provide insights into potential market reversals.

BITCOIN ($BTC) DIPS TO $82K—FEAR OR FORTUNE?BITCOIN ( CRYPTOCAP:BTC ) DIPS TO GETTEX:82K —FEAR OR FORTUNE?

(1/9)

Good Morning, TradingView! Bitcoin ( CRYPTOCAP:BTC ) slumped to $ 82,000, lowest since Nov ‘24 💰 Market’s glum, let’s unpack this crypto dip! 🌐

(2/9) – PRICE SLIDE

• Drop: $ 82K, 20% off $ 109K high 📊

• Month: Altcoins down 30%+ 💧

• Fear Index: 10/100, rock bottom 😟

CRYPTOCAP:BTC ’s shivering, gloom’s thick!

(3/9) – TECH TELL

• 200-Day MA: $ 81,500, support holds 🌟

• RSI: 28, oversold, bounce hint 🚀

• Past: Aug ‘24 $ 49K to $ 100K 📈

CRYPTOCAP:BTC ’s teetering, rebound or rubble?

(4/9) – MARKET MOOD

• Fear: Lowest since FTX ‘22, $ 16K 🌍

• History: Extreme fear sparks rallies 🌞

• Outflows: $ 1B from ETFs, trade woes 💼

CRYPTOCAP:BTC ’s testing, panic or patience?

(5/9) – RISKS IN PLAY

• Trump: Tariff talk, no crypto juice ⚠️

• Volatility: Bear turn stings 🐻

• Stablecoins: Inflows, sideline cash 🔒

CRYPTOCAP:BTC ’s wobbly, can it dodge the funk?

(6/9) – SWOT: STRENGTHS

• Base: $ 82K holds, tough nut 💪

• Past: Fear flips to gold, $ 100K+ 🏋️

• Liquidity: Central banks ease 🌿

CRYPTOCAP:BTC ’s gritty, battle-tested!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Sentiment sinks 😕

• Opportunities: Fear buys, rate cuts 🌏

Can CRYPTOCAP:BTC vault past the blues?

(8/9) – CRYPTOCAP:BTC ’s $ 82K dip, what’s your take?

1️⃣ Bullish, $ 100K rebound soon 😎

2️⃣ Neutral, Holds, risks linger 🤷

3️⃣ Bearish, $ 70K slide looms 😞

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

CRYPTOCAP:BTC ’s $ 82K slump spooks, fear at 10 🪙 $ 1B ETF outflows sting, but history hints bounce, gem or gloom?

The Future of Meme CoinsWhat does the future hold for meme coins?

I often think meme coins caused the collapse of many "serious" altcoin projects and now the flood of new meme coins will do the same to large cap meme coins.

Too much money being spread thin across them all. Large/Mid cap meme coins like Shiba, Pepe, Doge, Fartcoin, have all been bearish since mid-December 2024 and mid January 2025. TrumpCoin was the nail in the coffin.

This is a nose dive right back to the last support area (white line), where you could potentially long up to the new resistance. (pink line)

BTC remains bearish next targets 57.7k and 56kIn this video, I provide an update on my previous trading analysis.

I'll discuss the current targets for the bearish scenario and highlight the key levels to watch. Additionally, I present a bullish counter-idea and explain where the invalidation of the bearish thesis might occur. This way, you'll be well-prepared no matter which direction the market takes. Stay tuned to catch all the important details!

BTC SHORT The chart indicates a potential move where Bitcoin (BTC) is currently testing an area of interest around 60,715.9 USDT. The price is approaching a key resistance zone marked as MMSM, which could provide a selling opportunity if the price fails to break above it convincingly.

Trade Setup:

Stop Loss: Place a stop loss just above the 62,500 USDT level to protect against potential false breakouts above the resistance zone.

The initial target for this trade would be around the 55,940.7 USDT level, where there is an imbalance wick, which could serve as the first point of profit-taking. Further downside targets could be around the 48,889.4 USDT level, representing a more extended move.

Risk/Reward: This setup offers a favorable risk/reward ratio, as the downside potential outweighs the risk if the resistance level holds.

Additional Notes:

- If price breaks and holds above the 62,121.2 USDT level, reconsider the short idea as it would invalidate the current bearish setup/structure.

BTC Bullish Target $70K vs. Bearish Drop to $41K | ICTIn this video, I dive deep into two potential scenarios for the market:

A bullish scenario targeting $70,000 and a bearish scenario pointing towards $41,000.

I explore the concept of a smart money reversal and the market maker sell model to provide a detailed analysis of possible price movements.

Additionally, I discuss the bearish price structure and what it could mean for the market in the near term. Whether you're bullish or bearish, this analysis will help you understand the key levels to watch and the strategies that may unfold.

I would love to get some feedback! 🔥

BTC SHORT TO 41kTrade Rationale:

Price has reached a significant resistance level, and there is a clear bearish structure indicating potential downside movement. The current setup offers a high risk/reward ratio, targeting a return to the previous low, with a stop loss placed just above the recent high.

This trade is based on a continuation of the bearish trend observed over the past several weeks.

Altcoins ready to dump soon.The market cap saw a significant rise from 2017 to 2021, peaking above 1.2T USD.

This was followed by a sharp decline, and subsequent fluctuations between 2021 and 2023.

There is a prominent dip into a highlighted blue zone around late 2022 to early 2023, suggesting a strong support level.

Future Projections (2024-2031):

The projection line indicates a rise in market cap approaching 800B in 2024-2025, touching a region marked as "Buyside Liquidity."

A recommended shorting point is marked in early 2025, suggesting a peak before a decline.

The market cap is projected to dip back into the blue support zone by 2026.

Another significant drop is anticipated around 2027, reaching another highlighted grey support zone, where a buy opportunity is suggested.

Annotations

Short here: Indicated near the projected peak in 2025, suggesting this as an optimal point to short the market.

Buy here: Indicated in the projected dip around 2027, suggesting this as an optimal point to buy.

This analysis can guide investors in timing their trades based on historical trends and projected market movements.

BTC at the bottom of week range!Bitcoin hit the bottom of the range ✅ Alarm was right pointing for range bottom at ~58k, as BTC dipped to 58414 on that move.

Now the main question - is it over? Shortly - if you are a respected TA, you can't say so yet. Why? Because week candle is only developing, so we won't have any clarity till next week close at least. Day candle shown nice bearish impulse with long tail, which can be taken as a first step of a bounce pattern, but to confirm it we'll need another 1-2 Day candle to close. Which brings us back to the idea, that this week it's all about guessing, but no mindful conclusions.

Week close above ~60622-59600 will increase chances for a bounce from range bottom. Close below will keep momentum to dip lower. That is the only thing we can say now for sure.

Nearest liquidity pools:

above - 61840 / 62440 / 63260 / 64920

below - 60235 / 59820 / 59460 / 58040

Lines on the chart:

🔸67577 - May close

🔸63195 - week open

🔸60651 - April close

🔸59112 - March low

🔸56537 - May low

🔸53245 - Nov'21 low

Trend: D 🔽 W 🔼 M 🔼

🤑 F&G: 30 < 51 < 53 < 63 < 64

NOT is not over yetBINANCE:NOTUSDT.P is heading towards 4H FVG around 0.0145 and will dip there in any case before the bounce. Its a good level and correlates with developing Day 20SMA. Wicks below possible even in bullish scenario and might reach 0.012-0.013 zone - this is a good zone to look for long entries.

Its not short signal. I'd rather look for those dips for longs, as now its too late to short with proper risk reward.

If I'm wrong and there will be no dip, condition to return back to bullishness is acceptance above developing VAL (around 0.0186).

Everything else depends on BTCUSDT chart, which looks heavy on week timeframe and if close below 67800 might continue falling lower.