MARKETS week ahead: September 15 – 21Markets are gearing up for the forthcoming FOMC meeting and surging expectations over a 25 basis points rate cut. These expectations have been priced during the week, where the S&P 500 reached a fresh, new all time highest level, ending the week at 6.584. On the same expectations the price of gold surged to another all time highest level, closing the week at $3.643. The 10Y US Treasury benchmark dropped below the 4,0% at one moment, however, returned a bit back as of the end of the week at 4,068%. This time the crypto market was also in the eye of the investors, where BTC managed to break the $115K resistance, ending the week modestly below the $116K.

The previous week started with the annual revision of non-farm payrolls, revealing a decline of 911,000 jobs, adding to concerns about a cooling U.S. labour market. In August, the Producer Price Index (PPI) fell by 0.1% month-over-month, bringing the annual rate to 2.6%, while core PPI also dropped 0.1%. Both figures came in below market expectations of a 0.3% increase. Meanwhile, inflation rose 0.4% for the month and 2.9% year-over-year, with core inflation slightly elevated at 0.3% monthly and 3.1% annually. Preliminary data from the University of Michigan showed September’s consumer sentiment at 51.8, slightly below the forecast of 54.9, while inflation expectations held steady at 4.8%. Declining jobs market increased market expectations to almost certain that the Fed will cut interest rates by 25 basis points on September 17th.

Nvidia and OpenAI are reportedly in talks to fund a multibillion dollar AI infrastructure project in the U.K., centred on building new data centres, in partnership with cloud firm Nscale. The agreement is expected to be unveiled during President Trump’s state visit to Britain next week. Governments globally are increasingly trying to attract the tech giants to bolster their domestic “sovereign AI” capabilities.

Gemini Space Station shares surged over 40% on Friday during their debut on the Nasdaq, opening at $37.01 under the ticker GEMI after being priced at $28, and reaching a high of $40.71. Founded by Tyler and Cameron Winklevoss, the company was valued at $4.4 billion and joins a growing wave of crypto firms going public amid a loosening regulatory environment under current US Administration.

News are reporting that investors have poured over $7 trillion into cash-like assets such as money market funds and high-yield savings, benefiting from recent Fed rate hikes. However, with the Federal Reserve expected to cut interest rates soon, these safe assets may lose appeal, prompting a shift toward riskier investments like stocks and bonds. Experts warn that a massive market rally fuelled by this "wall of cash" is unlikely unless rates drop close to zero. Historical data shows significant outflows from money funds only occur during major economic crises when rates are very low.

CRYPTO MARKET

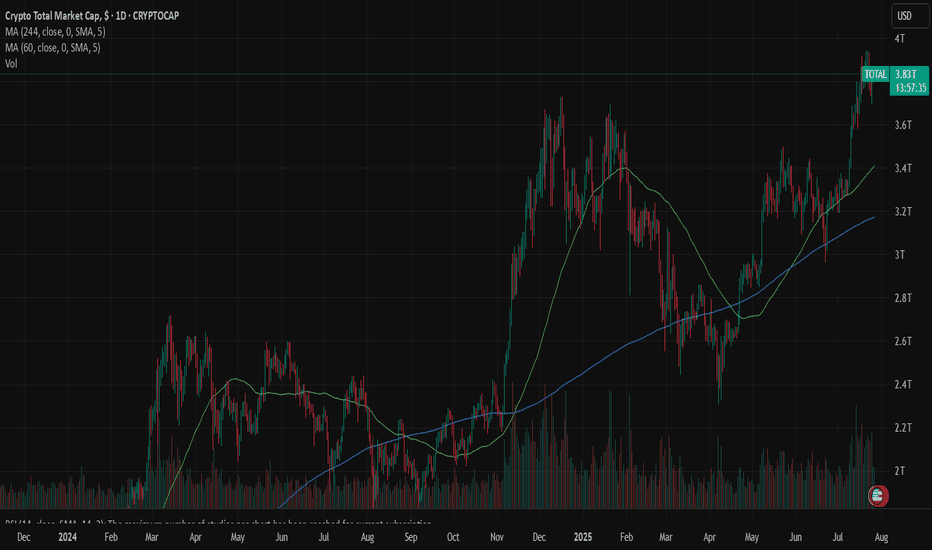

A green week on the crypto market, supported by investors' expectation that the Fed will cut interest rates at their FOMC meeting, on September 17th. Almost all coins gained on this expectation surging the value of crypto coins mostly between 10% to 20%. At the same time total crypto capitalization passed the $4B mark, which represents another significant milestone for the crypto market. On a weekly level, total crypto market capitalization was increased by 8%, adding total $290B to its market cap. Daily trading volumes remained at higher levels, with turnovers of around $298B on a daily level. Total crypto market capitalization increase from the beginning of this year currently stands at +25%, with a total funds inflow of $803B.

BTC was the coin to lead the market, however, other altcoins also performed well during the week. BTC gained $115B of funds, increasing its value by 5,2% for the week. ETH had a good week with a gain of 10,3%, adding $53B to its market cap. XRP gained almost 13% w/w, adding $21,5B to its value. Solana and Polkadot are worth mentioning, as both coins gained above 20% for the week. Certainly, the star of the week was DOGE, with an incredible weekly gain of 41%. Ospreys Dogecoin ETF started trading during the previous week, attracting investors' funds and letting the coin surge by 41%.

Increased activity was also reflected in circulating coins. During the previous week, EOS increased the number of its coins on the market by 0,6%, while Algorand gained 0,5% of coins. Stellar managed to add 0,3% new coins to the market, same as Uniswap.

Crypto futures market

Investors' increased interest in ETH was recently exposed both on the spot and the crypto futures market. As per CME, the ETH futures open interest on this market has hit records of over $10B, as a reflection of institutional investors demand. ETH futures gained more than 7% during the previous week for all maturities. Futures expiring in December this year closed the week at $4.792, and those with the expiration date a year later were last traded at $5.143. This is a huge milestone as the long term futures returned once again to levels above the $5K mark.

BTC futures also gained more than 4,5% for all maturities. Futures maturing in December this year were last traded at $119.565, and those maturing a year later closed the week at $126.490.

Cryptomarketcap

SOL & Memes | Is Solana season here ?From Weekend Hero to Market King

Sol szn is here ? YESS, We are 70% up since our last analysis and recent data strongly suggests we might be entering the early days of SOL mania, Here’s why

1.SOL Outperformed BTC and ETH This Weekend: Solana delivered significantly better returns compared to Bitcoin and Ethereum over the weekend. don't let me compare it with Eth cuz it will break Eth holders Soul

2.Market Cap Milestone: Solana's total market capitalization hit an all time high earlier today, now making up 3.53% of the entire cryptocurrency market with a valuation of $114.3 billion.

3.Dominating Daily Net Inflows: As of now, SOL tops the leaderboard for daily net inflows.

4.Revenue Growth: Last week, Solana’s Real Economic Value (the revenue it generates) doubled its previous all-time high.

5.Meme coins often choose the Solana blockchain for a variety of reasons, primarily due to its unique technical advantages and its growing ecosystem. Here’s why: Low Transaction Costs, High Throughput and Scalability, Fast Transaction Speed, Strong Community and Ecosystem,Developer-Friendly Environment, Early Mover Advantage...

6.Weekend Trading Volumes: Between Saturday and Sunday night, SOL trading volumes surpassed those of all major altcoins.

All of this recent movement is huge for two specific groups of people:

-My wife, who has been worried sick since I told her I invested 100% of my life savings in Solana!

-Our followers, who got worded up on SOL around this time last year and load the dip at 20$

But will these trends hold, especially after ETH and BTC ETFs wrap up their first trading day of the week? Probably not but it’s worth noting how impressive this is, given Ethereum’s market cap is 3.3x larger than Solana’s, and Bitcoin’s is a staggering 16x bigger!

As you can see Sol ready for correction and pullback then it gets ready for Sol Mania

BTC Buy Zone Forming – Potential Bullish Breakout AheadAnalysis:

Trend Structure: After a corrective decline from the $124K resistance area, BTC has rebounded strongly, forming a rising channel (highlighted in blue).

Support Levels: Strong demand observed near $107,200, aligning with the 0.868 Fibonacci retracement, making it a crucial support zone.

Buy Zone: Chart highlights the $114K–$116K range as a buy zone before continuation of the upward trend.

Resistance Levels: Key resistance remains around $124K–$126K, which is the next major target if the bullish momentum sustains.

Outlook: As long as BTC stays above $114K support, the bias remains bullish, with a potential rally towards $120K–$124K. A breakdown below $112K would invalidate the bullish scenario.

✅ Bias: Bullish continuation

🎯 Targets: $120,000 → $124,000

🛑 Invalidation: Break below $112,000

BTCUSDT 1H Chart Analysis !!BTCUSDT 1H Chart Analysis

Current Price

BTC is trading near $111,000, sitting right on top of the trendline support.

The 111K MA (Moving Average) is also aligned here, adding extra strength to this support zone.

Resistance Zone

The most important level above is $113,000.

This has acted as a ceiling multiple times; a clean breakout with volume could send BTC quickly higher.

Bullish Scenario 🚀

If BTC breaks $113K with strength, the next upside targets are:

$115,000 (psychological resistance)

$117,000 (measured move from the ascending structure).

Strong breakout here may trigger short squeezes, fueling momentum.

Bearish Scenario ⚠️

If BTC fails to hold the trendline + MA support, price could drop back into the $109K–108K demand zone (highlighted green box).

Below $108K, downside risk increases sharply.

Market Context

Structure is higher-lows, showing buyers still defending dips.

But BTC is stuck in a range between support ($111K) and resistance ($113K).

BTC is at a decision point.

✅ Break above $113K = bullish continuation toward $115–117K.

❌ Rejection and break below support = pullback into $109–108K demand zone.

MARKETS week ahead: September 8 – 14Last week in the news

The previous week was marked with surprisingly low August Non-farm payrolls of only 22K new jobs in the U.S. Figures increased market expectations that the Fed will cut rates at the FOMC meeting in September. Market reaction at Friday's trading session was strong. The S&P 500 reached another all time highest level and then tumbled back toward the 6.481, within the same day. The 10Y US Treasury benchmark dropped down from 4,2% to 4,0%. Although the US Dollar remained relatively flat during the week, the price of gold reached a new all time highest level, ending the week at $3.586. This week the crypto market was left aside, with BTC closing the week by testing the $110K.

U.S. labour market data took centre stage in the markets last week. On Wednesday, the JOLTs Job Openings report showed 7.181 million positions for July, falling short of the expected 7.3 million. Friday delivered another surprise, with August Non-Farm Payrolls revealing just 22K new jobs, which was well below the 75K anticipated by the market. Meanwhile, the unemployment rate edged up by 0.1 percentage points to 4.3%. Average hourly earnings rose by 0.3% in August, marking a 3.7% y/y increase. A significant drop in the US jobs data increased market expectations that the Fed will now certainly have a good grounds to cut interest rates by 25 basis points at September FOMC meeting.

Nobel laureate Joseph Stiglitz cautions that bond markets haven’t fully accounted for the weakening U.S. fiscal outlook, particularly the temporary boost from tariff revenues that won't last as businesses readjust supply chains. He suggests that the current projections are overly optimistic and that the true financial position of the U.S. may be significantly worse. Stiglitz’s remarks signal that investors should brace for deeper fiscal and inflationary risks than markets currently anticipate

There has been a lot of media coverage related to the announced split of shares of Kraft Hainz, aimed to unlock brand value. Shares of the company were losing value during the year, with a stock loss of around 21% over the period of the past year. Famous investor Warren Buffett commented on the split, expressing disappointment, noting that breaking up will not resolve the deeper challenges the company is facing. The proposed spin-off will create two distinct, independently traded entities, one centered on sauces and spreads, the other on grocery staples, a strategy aimed at unlocking shareholder value after years of sluggish performance.

The European Commission has levied a €2.95 B (US $3.45 B) antitrust fine against Google for abusing its dominance in the adtech market by favouring its own services, marking the company’s fourth major EU penalty. Regulators have given Google 60 days to propose remedies to end these self-preferencing practices, warning that failure to comply could lead to divestitures. Google has announced plans to appeal the decision, calling it unjustified and warning it could harm numerous European businesses. Meanwhile, the U.S. President has criticized the penalty and threatened retaliatory trade measures, escalating tensions between the U.S. and the EU.

CRYPTO MARKET

The crypto market remained relatively calm during the previous week. Investors were more concerned with surprisingly weak US jobs data, increasing expectations that the Fed might make a move in rate cuts at their September FOMC meeting. They were positioning accordingly, in which sense US equities, bond and gold markets were affected. Total crypto market capitalization was increased by modest 1% during the week, adding $28B to its total market cap. Daily trading volumes dropped to the level of $222B on a daily basis, from last week's $311B. Total crypto market capitalization increase from the beginning of this year currently stands at +16%, with a total funds inflow of $513B.

For the week, crypto coins showed mixed performance, with a blend of gains and losses across major and altcoins. BTC had steady movements, with a weekly gain of 1,4% and an inflow of $30,5B. This week, ETH was a modest losing side of -1,4% (-7,5B). Major altcoins on the market finished the week relatively flat. Market favorites Solana, ADA, XRP, BNB all finished the week almost without a change from the end of the previous week. Avalanche managed to add 3,3% to its market value. At the same time, Maker had an excellent week with a gain of 13,1%. Monero was traded higher by 4,4% and Filecoin was up by 2,7%. Another coin with a significant weekly gain was ZCash, with a surge of 11,3%.

Although the value of coins remained relatively flat, there has been increased activity with circulating coins. This week Stellar managed to add 1,1% new coins to the market. Miota`s number of coins closed the week higher by 0,8%. This week Filecoins added 0,2% to its total circulating coins. XRP should be also mentioned, as this coin continues to increase its number on the market, this week by 0,2%.

Crypto futures market

The crypto futures market showed some divergence from BTC and ETH price movements, following developments on the spot market. Bitcoin futures experienced consistent gains across all maturities, with w/w increases ranging around 2,7%. Futures with maturity in December this year closed the week at $114.205, and those maturing a year later were last traded at $121.000.

In contrast, ETH futures saw moderate declines across the board, with w/w changes around 0,4%. For the moment, the market is showing subdued expectations for ETH in the near to mid-term. However, ETH futures continue to hold strongly above the $4K mark. December 2025 finished the week at $4.435, while December 2026 was last traded at $4.780.

MARKETS week ahead: August 31 – September 4Last week in the news

The market sentiment during the previous week was driven by PCE data. As the inflation was in line with expectations, the sentiment about Fed rate cut was further supported. The US equity markets continued to surge, with the S&P 500 reaching the new all-time highest level at 6.500 and closing the week at 6.460. In expectation of rate cuts, the price of gold surged, closing the week at $3.446. The US 10Y continued to test the 4,2% supporting level, ending the week at 4,23. The sentiment around the BTC and the crypto market was not in a positive territory, where BTC slipped down to the levels below the $109K.

July’s PCE inflation report came in right on target to market forecast, with headline PCE up 0.2% month-over-month and core PCE up 0.3%, reinforcing expectations for a Federal Reserve rate cut in September. The revised second estimate for Q2 U.S. GDP showed stronger-than-expected growth at 3.3% annualized, up from the initial 3.0%, fuelled largely by increased consumer spending and business investment. According to the CME Group’s FedWatch tool, there's now an approximately 87% chance of a 25-basis-point cut at next month’s FOMC meeting, all of which supports market optimism ahead of upcoming labour data. The week ahead is bringing the release of non-farm payrolls and JOLTs.

The Federal Reserve’s ongoing quantitative tightening has entered a more uncertain phase as usage of its overnight reverse repo facility, once a $2.6 trillion liquidity buffer,has plunged to just $32 billion, signaling that this tool is nearly exhausted. With the reverse repo effectively drained, further balance sheet reductions will increasingly come directly from bank reserves, currently around $3.3 trillion, raising the risk of strains in short-term funding markets. To mitigate this risk and maintain control over interest rate policy, the Fed is relying on its Standing Repo Facility (SRF) as a contingency for future liquidity support. However, analysts remain cautious, warning that the Fed must tread carefully to avoid a repeat of the 2019 episodic funding stress.

A federal appeals court ruled 7–4 that most of former President Trump’s sweeping global tariffs, imposed under the International Emergency Economic Powers Act (IEEPA), are unlawful, finding that the law does not explicitly authorize tariffs, a power reserved for Congress. Nonetheless, the court has allowed the tariffs to remain in effect until mid-October to permit time for appeal, likely setting the stage for a potential U.S. Supreme Court review. The US President responded by denouncing the court’s decision and signalling his intent to pursue the case further.

El Salvador will redistribute its entire national Bitcoin reserve—valued at approximately $682 million from a single address into multiple new wallet addresses to enhance security and reduce exposure. Each address will hold no more than 500 BTC (around $54 million), a strategic limit designed to minimize risk in the event of a security breach. To maintain transparency, the country’s National Bitcoin Office will launch a public dashboard displaying the total holdings across all addresses.

CRYPTO MARKET

Bitcoin dropped to around $108K last week due to a combination of technical sell signals, large “whale” liquidations, and ETF outflows, which also triggered margin call liquidations. This decline reflected a broader pullback across the cryptocurrency market, despite ongoing institutional interest. Notably, a major investor reportedly sold about 24,000 BTC, sparking forced liquidations that accelerated the price drop. Due to general crypto market correction, the total crypto market capitalization dropped by 6% for the week, with an outflow of $217B. Daily trading volumes were modestly decreased to the level of $311B on a daily basis, from $468B traded the week before. Total crypto market capitalization increase from the beginning of this year currently stands at +15%, with a total funds inflow of $485B.

Over the past week, major crypto coins experienced mostly negative performance. Bitcoin fell sharply to the levels below $109K, with total value decrease of 5,5% and funds outflow of $127,5B. ETH continues to trade above the $4K, still, with a weekly decrease in value of 8,5% and funds outflow of $48B. Other prominent coins such as XRP (-7,1%), Litecoin (-8,2%) and BNB (-2,6%) also posted losses. Market favorite Solana managed to sustain the $200 level, with a relatively small weekly loss of 1,5%. The majority of altcoins finished the week with a single-digit loss. Among rare coins which finished the week in positive territory were POL (previous Matic) with a weekly gain of 2%, and DASH with a plus of 1%.

With respect to coins in circulation, the week was surprisingly calm, with only a few changes. BNB decreased the number of its coins on the market by -0,1%. On the other side were coins like Stellar, DASH, Solana or Filecoin which increased their circulating coins by 0,1%.

Crypto futures market

Crypto futures expressed broader weakness, similar to the spot market. BTC futures experienced a week-on-week decline of around 7,5% for all maturities. Futures maturing in December this year ended the week at $110.985, and those maturing a year later were last traded at $117.505. Despite the price drop, the BTC futures curve remains upward sloping, suggesting that while near-term sentiment is bearish, traders still expect higher prices in the long term.

A similar situation is with ETH futures, which were traded lower by more than 10% on a weekly basis. The steepest drop occurred for maturities in August 2025 which were traded down by 11,3%. December 2025 closed the week at $4.458, and December 2026 was last traded at $4.800. The structure of the futures curve indicates that there is still long-term bullish positioning priced into the market.

MARKETS week ahead: August 24 – 29Last week in the news

Fed Chair Powell's speech at Jackson Hole Symposium brought a significant shift in market sentiment on Friday. Markets welcomed the information regarding a potential rate cut in the coming period. The US equity markets were the major weekly gainers, where S&P 500 added 1,52% on Friday, closing the week in a plus of 0,3% at the level of 6.466. The US Dollar lost in value on the news, pushing the price of gold 0,98% higher, and close $3.371. The 10Y US benchmark yields also strongly reacted, easing to the level of 4,25%. Among weekly gainers was also BTC, which tested the resistance at $117K.

In his speech at the Jackson Hole Symposium on Friday, Fed Chair Jerome Powell took a balanced tone, acknowledging progress in bringing inflation down while emphasizing the need for continued vigilance. He noted that inflation has eased from its peak but remains above the Fed's 2% target. Powell indicated that the Fed is prepared to adjust monetary policy as needed, suggesting that if inflation continues to decline sustainably, a rate cut could be considered in the near future. However, he also stressed that the Fed will act cautiously, monitoring economic data closely to avoid reigniting inflation. Overall, his remarks signaled a potential shift toward monetary easing, but with a clear message that the path forward depends on continued improvement in inflation dynamics.

The U.S. government will acquire a 9.9% equity stake in Intel for $8.9 billion by converting previously awarded CHIPS Act grants and Secure Enclave program funds into non-voting common stock. This passive investment does not grant the government any board or governance rights, though it includes a five-year warrant to potentially purchase an additional 5% if Intel’s foundry ownership drops below 51%. The agreement follows tensions between President Trump and Intel CEO Lip-Bu Tan, but industry observers suggest this move aims to bolster U.S. semiconductor manufacturing and national technological leadership.

The U.S. and EU have introduced more specifics on their updated trade framework, with clear 15 percent tariffs set for pharmaceuticals, semiconductors, lumber, and automobiles, offering some clarity to already imposed tariffs. However, many businesses remain wary—uncertainties around customs rules, enforcement, and the deal’s long-term reliability continue to create unease.

Apple is reportedly in early talks with Google to use Google's Gemini AI model to power a revamped version of Siri, sparking investor optimism. Following the news, Alphabet’s stock climbed approximately 4%, while Apple’s stock also gained around 2%.

According to UBS Weekly Intelligence, the biggest tech spenders (based on combined capex and R&D intensity relative to sales) are Meta, Intel, and Oracle, while the lightest spenders include Mastercard, Uber, and Accenture. Other notable names include Microsoft (36 %), Amazon (31 %), Alphabet (35 %), and Apple (11 %) — a useful gauge of how tech firms are prioritizing investment amid the AI-driven market environment.

CRYPTO MARKET

Crypto assets surged after Fed Chair Powell's Jackson Hole remarks hinted at an interest rate cut as soon as next month, fuelling renewed risk-on sentiment. Bitcoin rallied back above $117K from below $112K, while crypto-linked stocks like MicroStrategy and Coinbase gained around 5–7%. Altcoins such as Ether and Solana also climbed sharply. Ether gained 15% on Friday, surpassing the $4,8K level. Regardless of Friday's higher push toward the higher grounds, the total crypto market capitalization remained relatively flat on a weekly level. By managing to cover weekly losses, the crypto market cap gained quite modest $9B in total cap during the week. At the same time, daily trading volumes were significantly increased to the level of $468B on a daily basis, from $312B traded the week before. Total crypto market capitalization increase from the beginning of this year currently stands at +22%, with a total funds inflow of $702B.

The previous week was significant for ETH, since this coin attracted the majority of investors attention and also funds. ETH ended the week by 7% higher from the week before, adding more than $37B to its market cap. ETH also managed to reach ATH at the level of $4.877. BTC is closing this week by 2,13% lower from the week before, after dropping during Saturday trading to the level of $115K. Other altcoins were traded in a mixed manner, with either small gains, or small weekly losses. Among higher gainers were LINK, with an increase in market cap of 14.5%, ZCash had a very good week, with a gain of 16%, while market favorite Solana was last traded higher by 7,5% w/w. This week Maker closed with a higher drop in value of 7,3%.

Regarding circulating coins, the situation was also a bit mixed. On one side was Polkadot, with a weekly increase of circulating coins by 0,6%. On the opposite side was Filecoin, with a decrease in the number of coins on the market by 0,6%. This sort of action is indeed rarely seen, when Filecoins is in question. ADA was another coin with an increase in circulating coins by 0,3%. BTC should be especially mentioned, as its circulating supply was increased by 0,1% w/w.

Crypto futures market

While BTC futures saw a week of softening prices, ETH futures rallied significantly, reflecting diverging market sentiment between the two leading crypto currencies. BTC futures experienced moderate decline across all maturities, with the largest weekly drop in March 2026 of -2,08% and June 2026 of 1,93%. The weekly price changes indicate a slightly firmer long-term sentiment, as December 2026 closed the week at $126.795 and December this year dropped by 0,9% at the level of $119.845.

In contrast, ETH futures showed strong bullish momentum, with weekly gains of around 10% across all maturities. The highest rise was in October 2025 of 10,3%, suggesting a robust market outlook for ETH in both the short and long term. At the same time ETH futures maturing in December 2026 reached their all time highest level at $5.347, while December 2025 was closed at $4.994.

MARKETS week ahead: August 18 – 24Last week in the news

The U.S. July inflation showed that the U.S. economy is for the moment ready to absorb implemented trade tariffs without their significant impact on inflation. The relieving conclusion pushed the market sentiment to higher grounds, where the S&P 500 managed to reach a new all time highest level, still, ending the week at 6.449. Based on the same grounds, but also on easing geopolitical tension, the price of gold passed through a price correction, closing the week at $3.335. On the other hand, a mixed data related to increased US retail sales in combination with Michigan consumer sentiment, pushed the 10Y US benchmark yields back to 4,3% level. BTC had its new, shiny moment at $123,5K, but without buying of the US government for its strategic reserves, the price retraced back to $117K.

Posted US macro data showed some results which might be treated as a bit contradictory, as per analysts. The July inflation was holding at 0,2% m/m, and was in line with market expectations. It also showed that the US economy at this moment is ready to absorb the effects of implemented tariffs. However, on the other hand, retail sales in July increased by 0,5% m/m, implying a possibility of future increased inflation level coming from domestic demand. This sentiment was reflected in University of Michigan inflation expectations which were increased to 4,9% from previous 4,5% for a year and to 3,9% from previous 3,4% for the five year period.

US Treasury Secretary Scott Bessent said in an interview for Fox Business that the U.S. government will not purchase new BTCs for its Strategic Bitcoin Reserve. Instead, the plan is to keep existing Bitcoin holdings and to build the reserve only through seized assets and cease selling any of the Bitcoin currently held. It is estimated that existing BTC holdings are currently valued between $15 and $20 billion, and were acquired through criminal forfeitures. This stance marks a shift from earlier speculation that the government might expand its crypto holdings via market purchases, suggesting instead a more passive, forfeiture-driven reserve strategy.

News reported that Warren Buffett's Berkshire Hathaway has sold another portion of Bank of America shares of 26,3 million, decreasing its stake in shareholding structure to 8,1%. Analysts commented that this move will not have any significant impact on the value of BoA shares. The fund also sold 20 million shares of Apple in the Q2, continuing a multi-quarter trend of trimming its Apple position, though Apple remains its biggest equity holding. On the other hand, news reported that these sales followed broader strategic rebalancing, considering that the fund initiated or increased its stakes in companies like UnitedHealth, Chevron, Dominos Pizza and others.

China’s industrial production and retail sales growth both slowed significantly in July, with factory output rising only 5.7%—its weakest pace since November 2024—and retail sales climbing just 3.7%, the slowest gain since December 2024. Weakness also extended to fixed-asset and property investment, which lagged expectations, alongside a rise in unemployment—painting a subdued picture of domestic demand despite some policy support. Analysts warn this slowdown could drag GDP growth below the official 5% target in the coming quarters, likely prompting Beijing to consider further stimulus measures.

CRYPTO MARKET

Quite a mixed trading week on the crypto market. The minute BTC managed to reach a fresh, new all time highest level, the comment from the US Treasury Secretary Scott Bessent spoiled another BTC victory. In his interview, Bessent noted that the US government will not buy new Bitcoin for its Strategic Bitcoin Reserve but will rely solely on seized assets to grow it. Existing holdings, valued at $15–$20 billion, will be retained, signaling a shift to a passive, forfeiture-based strategy. The crypto market corrected its valuation, however, managed to end the week with a small gain of 1%, adding modest $35B to its cap. Daily trading volumes remained elevated, trading around $321B on a daily basis. Total crypto market capitalization increase from the beginning of this year currently stands at +21%, with a total funds inflow of $693B.

Although BTC managed to achieve a new ATH, still, the coin is ending the week with an weekly increase of 0,6% and inflow of $13B to its market cap. For the second week in a row ETH managed to outperform BTC, as the coin closed the week with a gain of 3,5% and inflow of almost $19B to its market cap. This week ADA should be specially mentioned, as this coin gained a significant 13,5% w/w. Positive weekly closing also had LINK, with an increase in value of 6,2%, BNB was traded higher by 3,8%, while Tron surged by 3,8%. Solana also had a relatively solid trading week, with a positive close of 3,6%, increasing its market cap by $3,5B. Other major coins closed the week in negative territory, like XRP, with a drop in value of 4,7% and outflow of $9B. It should be noted that a vast number of altcoins finished the week in negative territory.

Increased activity was also reflected in circulating coins. XRP managed to add 0,2% of new coins to the market. ADA had one of rare moments, where its number of circulating coins surged by even 0,5% w/w. This week Filecoin was also the one with a significant increase in coins in circulation by 0,8%.

Crypto futures market

Mixed trading from the spot market was also reflected in the value of crypto futures contracts. BTC short term futures were last traded with a small weekly change of around 0,9%, while longer term futures managed to gain between 1,7% and 2,18% on a weekly basis. Futures maturing in December this year were last traded at $120.905, and those maturing a year later closed the week at $127.330.

ETH futures closed the week by around 7,9% higher from the previous week's closing prices. This increase refers to all maturities. Futures maturing in December 2025 were last traded at $4.533 and those maturing in December 2026 closed the week at $4.863.

XRPUSDT Consolidation Within Ascending Support – Potential BreakThe chart shows higher lows forming along an ascending trendline, suggesting underlying bullish pressure despite previous lower highs.

Price is currently consolidating inside a rectangle pattern (green zone), sitting above the key support near $2.98.

The red resistance zone around $3.57 is a major breakout point — a successful breach could lead to a strong bullish move.

The PPO indicator is showing a slight recovery from negative territory, indicating momentum is attempting to shift upward.

If price fails to break out, a retest of the ascending trendline or the grey demand zone below $3.00 could occur before the next attempt upward.

Overall, XRP is coiling for a breakout, with $3.57 as the key resistance to watch and $2.98 as critical support.

Stablecoins as the New Macro Liquidity ProxyFor years, macro liquidity in crypto was gauged through broad monetary metrics like M2 or Total Market Cap. But those days are fading.

With the rise of regulated stablecoins—and new TradingView tickers like CRYPTOCAP:STABLE.C (Stablecoin Market Cap) and CRYPTOCAP:STABLE.C.D (Stablecoin Dominance)—we now have real-time, on-chain liquidity metrics that better reflect how institutional and retail capital enters the crypto ecosystem.

🔑 Why These Tickers Matter

• STABLE.C = Capital injection.

→ Tracks aggregate growth of major stablecoins, serving as a proxy for dry powder entering the system.

• STABLE.C.D = Sentiment signal.

→ Measures stablecoin dominance relative to the crypto market.

→ Rising dominance = risk-off (capital parked).

→ Falling dominance = risk-on (capital deploying).

Together, they offer a macro lens on risk appetite and capital inflow , updated in real-time—something no traditional metric can match.

🔍 How We Use Them

These metrics are now integrated into our Crypto Macro Cockpit , where:

• Stablecoin cap growth signals liquidity expansion or contraction

• Dominance slope helps identify regime shifts (risk-on vs risk-off)

We're beginning to see consistent patterns:

➤ Surges in STABLE.C precede market rallies

➤ Spikes in STABLE.C.D often align with rotation tops or periods of caution

📎 Implication

Stablecoins are no longer just trading tools—they’re macro indicators.

If ETFs are the Trojan horse for institutional entry, stablecoins are the bloodstream.

As we transition into a new cycle, these tickers might become the most important charts you’re not watching.

💬 Would love to hear from others—are you using STABLE.C or STABLE.C.D in your analysis? What signals are you seeing?

MARKETS week ahead: August 11 – 17Last week in the news

Although there is a positive sentiment on financial markets, still, a level of precaution among investors could be also observed. Markets used the previous week to both digest the latest US macro data and to prepare for the July inflation report coming in the week ahead. The US equity markets finished the week in a positive territory, with S&P 500 reaching the level of 6.389. On the same ground, the 10Y US benchmark yields corrected a bit last week's push toward the 4,20%, by ending this week at 4,28%. The price of gold was under the impact of “misinformation” of Swiss officials that the 39% imposed tariffs on Swiss goods also refer to gold imported from this country. Gold reached the level of $3.398. The US Presidential order that 401 (k) pension plans could include cryptocurrencies, pushed the BTC to higher grounds, ending the week above the $116K.

During the previous week there has not been much of currently significant US macro data scheduled for a release, in which sense, investors have used it to set the trading for the week ahead, when US July inflation data are set to be released. At the same time, news that occupied US equity markets came from Apple, whose shares rose by 13% within a week. Namely, its CEO, Tim Cook, met last week with the U.S. President in the Oval Office, to discuss the plans of Apple to invest $600B over the next four years in the U.S. Analysts have interpreted the move as an effort to appease the U.S. President, who has repeatedly called for IPhones to be manufactured domestically. Tim Cook commented that IPhone will not be assembled in the US for a while.

Another news that attracted market attention was that the U.S. President Donald Trump has signed an executive order permitting cryptocurrency investments in 401(k) retirement plans, potentially unlocking billions of dollars for the asset class. The order also extends to private equity investments, significantly expanding the range of assets retirement plan providers can allocate funds to. Analysts are noting that this move could not only boost crypto prices but also deepen the integration of digital assets into the mainstream financial system.

The US Federal Appeals Court currently reviews challenges to implemented tariff policy, by the U.S. Administration. As per former House Speaker Paul Ryan, the Supreme Court might invalidate duties imposed under the International Emergency Economic Powers Act of 1977. Commenting on this news, the US President warned U.S. courts against blocking his tariff policy, highlighting its “positive impact” on the stock market and cautioning that such interference could trigger a severe economic downturn, comparing it with the one that occurred in 1929. In the U.S.

As Reuters is reporting, global equity funds faced significant selling pressure last week, with investors pulling out a net $7.82 billion amid U.S. tariff announcements and signs of economic weakness fuelling risk aversion. Meanwhile, money market funds saw their largest weekly inflows since January, attracting $135.37 billion as investors sought safer assets. Despite heavy outflows from U.S. equity funds, European and Asian equities, along with sector funds in communication services, industrials, and tech, saw notable inflows. Additionally, global bond funds attracted nearly $21 billion, led by strong demand for short-term, euro-denominated, and high-yield bonds.

CRYPTO MARKET

Another positive news hit the crypto market, when the U.S. President signed an executive order, which permits crypto investments for the U.S. pension 401(k) plan. Analysts are noting its significance, considering the high amount of funds which are held in these funds, part of which could be distributed also in the crypto currencies. Such a move would certainly increase the prices of BTC and some altcoins, through increased demand for these coins. This news mostly pushed altcoins to higher grounds during the previous week. Total market capitalization was increased by 8% on a weekly basis, adding total $274B to its market cap. Daily trading volumes were modestly increased to the level of $314B on a daily basis. Total crypto market capitalization increase from the beginning of this year currently stands at +20%, with a total funds inflow of $658B.

Although BTC gained during the previous week, still the coin was left in the shadow of altcoins. The star of the week certainly was ETH, with an increase in value of 23%, certainly not recently seen for this coin. ETH attracted $97B of new funds, surpassing BTC, which attracted $73B and an increase in value of 3,2% w/w. XRP is also a coin with a significant weekly gain of 14,2% and a cap increase of $24B. Market favorite Solana had a surge in value of 13% or $11,5B. DOGE also had a strong shift in value of 24%, while Stellar, Uniswap, Theta also had a surge of more than 20%. ADA, Monero, Filecoin surged by around 15% each, while the majority of other altcoins gained around 10% on a weekly basis. Overall, an extremely good week for altcoins.

As for coins in circulation, there has not been much change compared to the previous week. Stellar had a surge in value, but it also increased the number of coins on the market by 0,2%. This week was another week with IOTAs coin surge by 0,8%. Solana increased its number of coins by 0,2%.

Crypto futures market

Following spot market developments, crypto futures significantly gained in value during the previous week. As ETH managed to pass the $4K mark, so the crypto futures followed, surging by almost 16% on a weekly basis. ETH futures maturing in December this year closed the week at $4.197, and those maturing in December 2026 were last traded at $4.509.

BTC futures gained almost 3% for all maturities. Futures with maturity in December this year closed the week at $119.875, and those maturing in December next year reached the last price at $126.940. Just as a reminder, the historically highest price reached for this maturity was $129.355.

MARKETS week ahead: August 4 – 10Last week in the news

US macroeconomic data took center stage during the previous week, with major correction occurring on Friday, after the NFP July data were released. Investors fear of economic consequences of implementing trade tariffs pushed US equity markets to downside. The S&P 500 lost 1,5% on Friday, closing the week at the level of 6.238. On the same grounds the price of gold strongly gained 2,2% on Friday, reaching the last price at $3.362. Strong reaction also came from US Treasury yields, where the 10Y US benchmark dropped to the level of 4,22%. This time the crypto market was also affected, where BTCs price dropped sharply, closing the week around the $113K level.

The FOMC meeting was held during the previous week, without changes in the level of interest rates. As per Fed's view, the economy is growing at a solid pace, while they acknowledged increasing risks originating from implemented trade tariffs on inflation and potential slowdown in the future economic growth. There were no comments regarding potential rate cuts in September, except that the Fed will continue further to balance interest rates based on “the incoming data, the evolving outlook and the balance of risks”, as noted by Fed Chair Powell.

A macro data heavy week in the US included data on JOLTs in June of 7,437M, modestly below market forecast of 7,55M. The PCE Price Index in June was relatively steady with 0,3% for the month and 2,6% for the year, which was in line with market expectation. However, what shocked the market on Friday were posted non-farm payrolls data for July of only 73K, although the market estimate was standing at 110K. During Saturday, news was published that the US president Trump requested immediate release of a duty of a Commissioner of labor statistics, due to posts of inaccurate labor data and its frequent revisions. The US President also questioned the accuracy of the July NFP figure of 73K.

During the previous weekend the U.S. finalized the trade-tariffs deal with the European Union. Details of the deal are officially published at the website of the European Commission, and include, among other, tariffs of 15% on imports from the EU, establishment of tariff-rate quotas for imports of steel, aluminium and copper from the EU, cutting the current 50% current tariffs. EU companies will also invest at least $600B in different sectors in the US by 2029.

Interesting news for crypto enthusiasts was posted by Cointelegraph, noting that on July 4, 2025, eight dormant Bitcoin wallets from the Satoshi era collectively moved 80.000 BTC, with each wallet transferring 10.000 BTC. The Satoshi era, generally defined as the period from 2009 to 2011, was when Bitcoin could still be mined or transacted using standard computer processors. The sudden activation of these long-inactive wallets has sparked intense speculation, with some suggesting that emerging quantum computing threats may have prompted the transfers. Still, analysts with a knowledge of blockchain technology commented that coins were not transferred directly to cryptocurrency exchanges but instead moved to newly created SegWit addresses — a move that likely indicates a security upgrade.

CRYPTO MARKET

As the crypto market became part of mainstream markets, it needed to manage both ups and downs of the investors' sentiment, which was usually related to traditional markets. This occurred during the Friday trading session, when investors' fear of future consequences of implemented trade tariffs turned to the negative side. Total crypto market capitalization decreased by 6% on a weekly basis, losing a total $216B. Daily trading volumes were relatively flat on a weekly basis, moving around $304B on a daily basis. Total crypto market capitalization increase from the beginning of this year currently stands at +12%, with a total funds inflow of $384B.

This week BTC was leading the market cap drop, with an decrease in value of 4% w/w and outflow of almost $96B in funds. ETH also had a drop in value of 7,2%, with total funds outflow of $32B. The third coin by total market cap, XRP, was traded around 10% lower, closing the week with total fund outflow of $18,6B. Another coin with a significant drop in the market cap was Solana, of almost 13% w/w, and funds outflow of $13B. Both DOGE and ADA were on a losing side, where DOGE was traded 17,1% lower, losing $6,13B in the market cap, while ADA dropped by 14,6% with an outflow of $4,3B. The majority of other altcoins finished the week with a loss in value between 14% and 18%.

This week there has not been too much activity when circulating coins are in question. Algorand had an increase of coins on the market by 0,2% w/w, while Stellar's number of coins surged by 0,3%. This week Filecoin had a modest increase of 0,1% on a weekly basis, same as ZCash and DOGE.

Crypto futures market

The general drop in the value of crypto coins on the spot market was also reflected to some extent also in the futures market. BTC futures were traded lower by more than 3% for all maturities, while ETH futures had a weekly drop in value of more than 4%. However, it is important that the general levels of the value of futures remain at higher grounds.

BTC futures maturing in December this year closed the week at $116.390, and those maturing in December next year were last traded at $123.490. A similar situation is with ETH futures, which managed to hold grounds above the $3K. Futures maturing in December 2025 closed the week at $3.631, and those maturing a year later were last traded at $3.894.

Bitcoin has an upside to it if we hold above $14,900See what you think it’s simple Auto Fib Retracement and RSI. That’s all I’m using here and also past times and other data outside of this image but inside the CRYPTOCAP:BTC market.

What you think? Up to $118k again before down or sideways? Or will this be the end of the large bull flag formation? We’ll soon find out!

Crypto Total Market Cap (TOTAL) | 1WThe crypto market cap represented by the symbol TOTAL can be considered the most important index for analyzing the cryptocurrency market, although I believe that analyzing Bitcoin itself, given its strong positive correlation with the TOTAL index, would yield similar results. In the attached image, the red line actually indicates the overall resistance level of the symbol, and the drawn parallel channel illustrates the current upward trend of the TOTAL symbol, which is now on the verge of encountering its round resistance at 4 trillion dollars. While we should expect a correction around this level, breaking through the 4 trillion dollar resistance could likely lead to a market cap of 6 to 7 trillion dollars in the next phase. On the other hand, with support at 2.4 trillion dollars based on the 100-week SMA on the weekly timeframe, the 750 billion dollar level—marked by a green zone in the image—can still be considered the most important long-term market support, even before the fifth halving.

I will try to continuously update this analysis of the TOTAL symbol according to market changes and developments. Also, I welcome reading your critiques and comments, so don’t forget to leave a comment!

MARKETS week ahead: July 27 – August 2Last week in the news

Trade tariff (un)certainties shaped market sentiment during the previous week. The US-Japan trade deal was settled which brought some relaxation among investors. The US equities continued with a positive trend, with the S & P 500 reaching fresh all time highest level, ending the week at 6.388. On the same ground the price of gold turned a bit toward the downside, closing the week at $3.336. The relaxation was evident also in 10Y US Treasury yields, which closed Friday trading session at 4,38%. BTC had a short liquidation session on Friday, shortly reaching the $115K level, however, swiftly returned back toward the $118K.

The European Central Bank (ECB) held its July meeting during the previous week, where it held interest rates steady after seven consecutive cuts, signalling a more cautious approach going forward. While its macroeconomic outlook remains unchanged, the ECB sees downside risks to growth, including global trade tensions and weak market sentiment. President Lagarde downplayed concerns about the stronger euro and minor inflation undershooting, emphasizing a data-dependent, meeting-by-meeting policy stance. Although the ECB appears comfortable with its current position, a final rate cut in September is still possible if inflation or macro data disappoint.

President Trump announced a major trade deal with Japan this week, featuring a 15% reciprocal tariff, marking a shift in bilateral trade relations. The U.S. also reached a framework agreement with Indonesia, reinforcing efforts to strengthen trade ties across Asia. Trump signalled that more deals may be finalized before the August 1 tariff deadline, including potential progress with the EU, as a meeting with Commission President von der Leyen is set for Sunday in Scotland. These developments have been well received by investors, easing concerns over trade uncertainty and potential supply chain disruptions.

China unveiled a global AI action plan at the World Artificial Intelligence conference in Shanghai, calling for international cooperation on technology development and governance. Premier Li Qiang proposed establishing a global AI cooperation organization to coordinate regulation and infrastructure, emphasizing equitable access. The plan positions China in contrast to the U.S., favoring multilateralism over America's more block-oriented approach to AI strategy. Featuring participation from over 800 companies including domestic giants Huawei and Alibaba, the conference showcased thousands of AI innovations and signals China's ambition to challenge U.S. dominance in the field.

Palantir's stock achieved a new record high last Friday, rising over 2% and lifting its market cap to around $375B. With the latest move, the company is now holding 20th place as the most valuable U.S. company. The company's shares have more than doubled this year as investors' enthusiasm grows around its AI capabilities and government contract momentum. Analysts attribute the rally to Palantir's strengthened role in AI analytics and expansion in defence-related software and data contracts.

CRYPTO MARKET

The crypto market was traded in a mixed mode during the previous week. Some liquidations were made in BTC, followed by altcoins, however, there were also coins with relatively solid weekly performance. Total crypto market capitalization was increased by 1% on a weekly basis, adding total $39B to its market cap. Daily trading volumes were modestly decreased to the level of $275B on a daily basis, from $333B traded a week before. Total crypto market capitalization increase from the beginning of this year currently stands at +19%, with a total funds inflow of $600B.

BTC had a relatively flat week, with only $3B of funds inflow. On the other hand ETH continues to perform strongly, with another week in a positive territory of 5,3%, increasing its cap by $23B. XRP did not perform well on a weekly basis, as the coin had a drop in value of 7,4% and outflow of $15B. Some of the significant weekly gainers include Litecoin, with a surge of 13% on a weekly basis, Maker was traded higher by 14%, BNB gained 7%, while Solana was higher by 5% same as Uniswap. Other altcoins were traded either with a modest drop in value or with a modest increase in value.

There has been increased activity with circulating coins. Another week in a row, IOTA is increasing the number of coins on the market by 0,8% w/w. EOS had an increase of 0,6%, same as Polkadot. The majority of other altcoins had a modest increase of circulating coins of 0,1%, including XRP.

Crypto futures market

This week the crypto futures market reflected perfectly developments on the spot market, with ETH long term futures managed to pass the $4K level.

BTC futures were traded mostly flat compared to the previous week. Futures maturing in December this year closed the week at $120.810, and those maturing in December 2026 were last traded at $127.500. At the same time, ETH futures were traded around 2,5% higher for all maturities. Futures ending in December 2025 reached the last price at $3.779, while those maturing in December 2026 for the first time ended the trading week at $4.058.

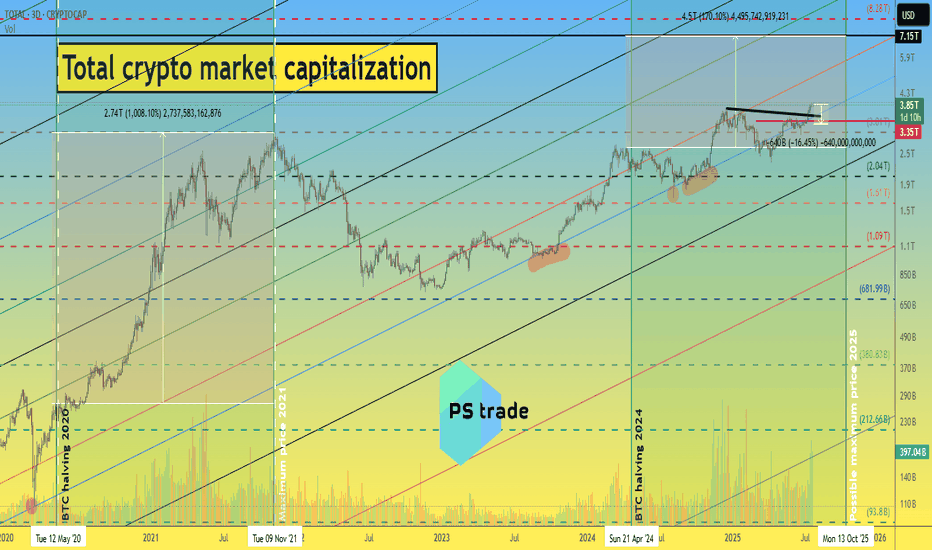

What to expect in the crypto market until 2026 ?!📈 Today, we will look at the graph of the total capitalization of the cryptocurrency market, as well as the implementation of our ideas from 2022 to 2025.

At that time, the cryptocurrency market was in a total depression, there was no talk of BlackRock or MicroStrategy buying cryptocurrencies, and we stubbornly wrote that this was the bottom... and then a miracle happened)

During this time, the total capitalization of the crypto market grew 5 times from $800 million to $4 billion.

ℹ️ You can find all posts in the channel by searching by date:

1️⃣ 18.11.22 - “How much can the crypto market capitalization grow by the end of 2025?”

The growth momentum is slowing down, but the following ideas give hope.

2️⃣ December 30, 2022 - “Plans for 2023-25”

If we are to believe this fractal, which has been working for over 2.5 years, then all the most interesting things are still ahead.

3️⃣ 29.02.2024 - “What to expect from the crypto market in 2024-26”

At the beginning of 2024, the previously published fractal was slightly adjusted to the market situation.

4️⃣ 04.03.2025 - “The total capitalization of the crypto market is on the verge of a foul.”

Then, despite the market depression and a lot of negative news, the total capitalization still managed to stay above the blue trend line.

📊 Cryptocurrency market capitalization as of 22.07.25:

◆ Bitcoin - $2.36 trillion

◆ Ethereum - $442 million

◆ Ripple - $206 billion

◆ SOL and BNB - $110 billion each

◆ USDT and USDC - $162 billion and $65 billion, respectively.

In total, this is $3.45 trillion out of $3.89 trillion of the total crypto market capitalization.

♎️ Too much capital is concentrated in the top 7 projects; we need a process of capital flow and the launch of exponential growth. Especially since all of the above fractals “suggest” that the time has come and anything is possible.

🔃 The total capitalization of the crypto market must continue to remain above the blue trend line, i.e., it cannot be adjusted by more than -13-16% to $3.25-3.35 trillion.

Roughly speaking, the price of CRYPTOCAP:BTC cannot be adjusted by more than -10% due to its high dominance at the moment. (Such an adjustment of the #BTCUSDT price fits into the scenario we published a few days ago.)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

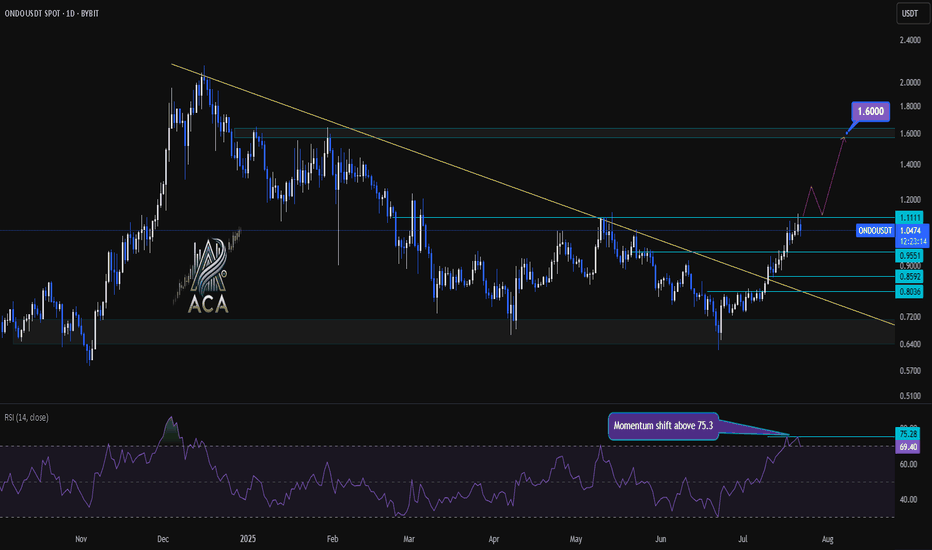

ONDOUSDT Daily Chart Analysis | Momentum Shift & Breakout LevelsONDOUSDT Daily Chart Analysis | Momentum Shift & Breakout Levels

🔍 Let’s dive into the ONDO/USDT daily chart and break down the latest momentum signals, key breakout areas, and targets for bulls.

⏳ Daily Chart Overview

The daily trend shows significant recovery after prolonged downward pressure, with price action now testing critical resistance levels. A key descending trend line has recently been challenged, highlighting a potential shift in market structure.

🔺 Bullish Setup

- Momentum Trigger: The RSI has closed above 75.3, signaling a strong momentum shift and upping the odds for continued upside.

- Breakout Confirmation: Watch for a daily candle close above the $1.1111 resistance level. This would confirm a bullish breakout and could serve as a solid trigger for further upside.

- Trend Line Dynamics: The price has decisively broken above the major descending trend line, which had capped rallies for months—removing a significant area of supply and emboldening bulls.

- Upside Target: Once confirmed, this setup opens the door for an advance towards the $1.60 area, where the next major resistance sits.

📊 Key Highlights

- Daily RSI closing above 75.3 reflects strong market momentum and buyer dominance.

- A daily candle close above $1.1111 can be used as a bullish trigger.

- The long-term descending trend line has been broken, indicating a major momentum shift.

- Immediate upside target stands at $1.60, representing a clear resistance level for profits or further evaluation.

🚨 Conclusion

Momentum is clearly shifting in favor of the bulls as technical barriers fall by the wayside. For traders looking to position long, confirmation above $1.1111 combined with the powerful RSI reading sets the stage for a move towards $1.60—keep these levels on your radar as the setup plays out!

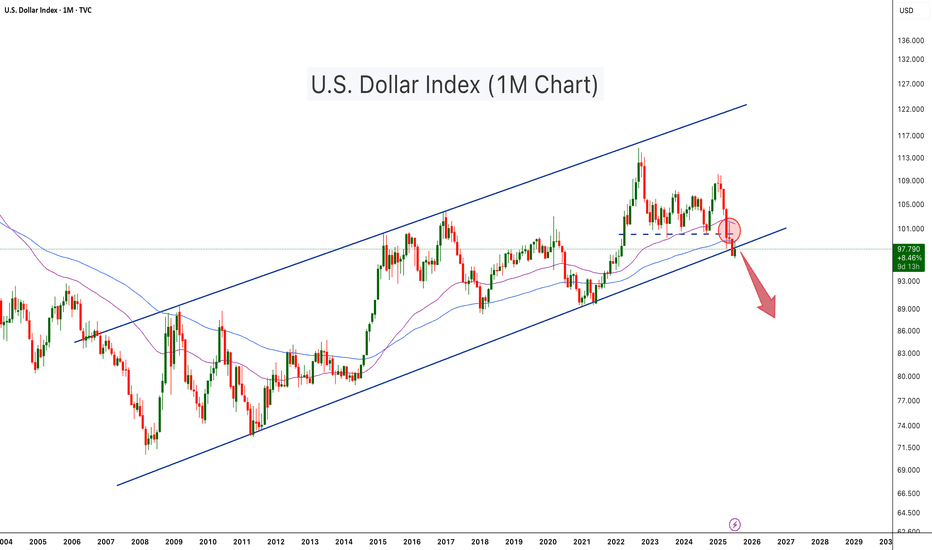

U.S. Dollar Index Loses Key Support – Crypto Bull Run Loading?The U.S. Dollar Index (DXY) has just broken below a long-term ascending channel, which has held since 2008. After losing the key horizontal support (~100 level), DXY retested and rejected from it (red circle), confirming a potential trend reversal. The move is technically significant and hints at further downside, possibly toward the 88–90 zone or lower.

This breakdown aligns with classic macro cycles, where a weaker dollar often fuels bullish momentum in risk assets, especially crypto. Historically:

-DXY downtrends in 2017 and 2020–2021 coincided with major Bitcoin and altcoin bull runs.

-DXY strength during 2018 and 2022 contributed to crypto bear markets.

With DXY now below both horizontal and diagonal support, Bitcoin and the broader crypto market may be entering the next expansion phase, especially if the dollar continues its downward trajectory

-DXY has broken below a 17 year rising channel – a macro bearish signal.

-Rejection from former support turned resistance confirms breakdown.

-A falling DXY historically corresponds with Bitcoin rallies and altseason expansions.

-Declining dollar strength could be the fuel that propels Bitcoin past $140K and Ethereum above $6K.

-A dollar bear trend may fuel total crypto market cap breakout beyond $4T+.

As DXY weakens, liquidity tends to rotate into risk-on assets like crypto. This setup mirrors pre-bull run environments seen in 2017 and 2020. A structural breakdown in the dollar could act as a catalyst for Bitcoin’s next major leg up.

Cheers

Hexa

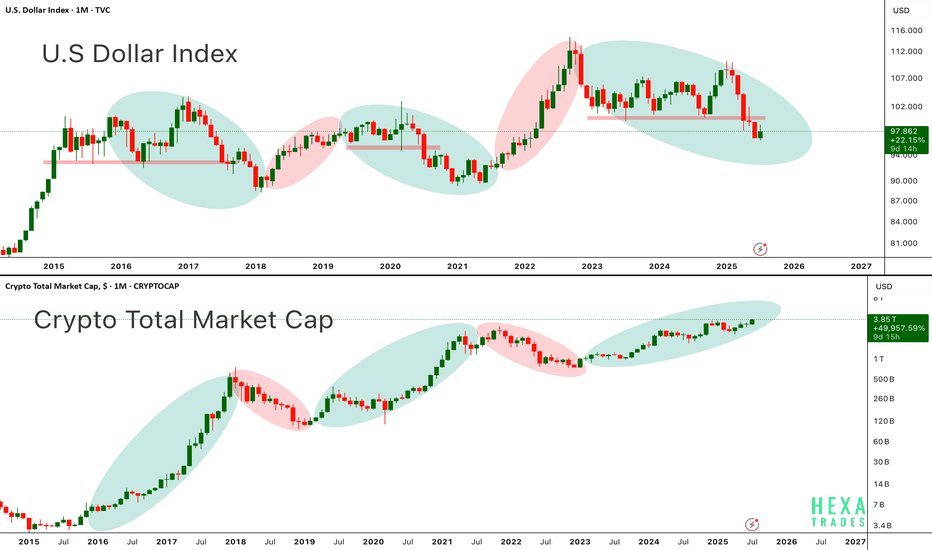

DXY vs. CryptoAbove chart highlights the long standing inverse correlation between the U.S. Dollar Index and the Crypto Total Market Cap a relationship that has guided the macro trend for Bitcoin and altcoins since 2015.

in the first chart, When the dollar weakens (green ovals), crypto tends to rally. When the dollar strengthens (red ovals), crypto markets usually experience corrections or prolonged bear markets.

In the second chart, each period of dollar weakness aligns almost perfectly with explosive crypto upside seen in 2017, 2020–2021, and now potentially again in late 2024 through 2025. Conversely, periods of DXY strength (2018, 2022) coincide with crypto market downturns.

Currently, DXY is entering a downward phase, while the crypto total market cap is pushing higher, now above $3.8 trillion suggesting that a new leg in the crypto bull cycle may be underway. Bitcoin and Ethereum have historically performed best when DXY trends lower, as liquidity shifts into risk-on assets.

Key Points:

-DXY and crypto market cap show a strong inverse macro relationship.

-DXY in a clear downtrend from 2024 highs supportive of further crypto upside.

-Crypto Total Market Cap approaching all-time highs suggesting broad market strength.

-Potential for BTC > $150K and ETH > $6K+ if this macro divergence continues.

-This setup resembles early 2020, right before the massive crypto bull run.

If the dollar continues to weaken structurally, crypto markets led by Bitcoin and Ethereum could see accelerated momentum, pushing into parabolic territory by late 2025.

Cheers

Hexa🧘♀️