DASH: Focus on 64 AreaIn my previous post, I shared my view on a potential decline as a C-wave within an ABC corrective structure.

That move has now played out, suggesting the correction is complete.

At this stage, DASH is showing a more constructive structure, and I think we may see this asset trade toward 64.

There are two possible paths from here:

• A move higher starting from the current area

• A brief dip toward 59 before continuation toward 64

Any move into the 58.7 area would invalidate this outlook.

Dashusd

DASH: The Equilibrium Trap - Why This Setup Leans BearishDASH dropped 5.70% in 24 hours and now sits at $65.47, right in the middle of its macro range between $96.57 and $36.18. We're at equilibrium with weak volume and bearish structure. The question isn't if we move, but which direction breaks first.

1. THE TECHNICAL REALITY 📉

• Price trading below both EMA20 ($67.44) and EMA50 ($68.67), short-term bias is down

• Descending resistance trendline from $96.57 sits at $76.46, creating a clear ceiling

• Unfilled bearish FVG between $68.75-$67.51 acts as magnet for any relief bounce

• We're trapped in a descending channel until proven otherwise

2. THE INDICATORS ⚖️

Bearish Signals:

• Volume at 205K vs 606K average (26.2% oscillator), weak participation screams no conviction

• Price below key moving averages with stacked overhead resistance

• ADX at 21.9 shows weak trend environment favoring continuation lower

Bullish Signals:

• MACD showing early bullish cross (MACD -1.6995 above signal -1.8219)

• Stochastic at 30.7 approaching oversold territory

• MFI at 55.6 shows slightly positive money flow

The Conflict:

RSI sits neutral at 49.5 with room to drop. We've got mixed signals in a low-conviction environment, structure leans bearish, but momentum indicators haven't committed yet.

3. THE TRADE SETUP 🎯

🔴 Scenario A: Bearish Continuation

• Trigger: Rejection at bearish FVG zone ($67.51-$68.75) or EMA20

• Entry: $67.44 area on bounce failure

• Target 1: HMA55 at $63.20

• Target 2: Lower Bollinger Band at $61.92

• Stop: 4H close above $68.75 (fills FVG, invalidates structure)

🟢 Scenario B: Bullish Reversal

• Trigger: Reclaim of $81.47 premium zone (triggers CHoCH)

• Entry: Retest of $81.47 as support after breakout

• Target: $96.57 resistance

• Invalidation: Failure to hold above $81.47 on retest

MY VERDICT

Structure and volume profile favor the bears at 62% confidence, but we're in equilibrium with weak momentum, this isn't a slam-dunk trade. The higher probability play is waiting for a bounce into the $67.44-$68.75 resistance zone to short against, or a test of HMA55 support at $63.20 to gauge buyer conviction. Don't chase price in the middle of nowhere, that's how you get chopped up.

#DASH/USDT – Bullish Breakout Setup | 1H Chart Analys#DASH

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 64, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 67

First Target: 69.69

Second Target: 73.26

Third Target: 78.03

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

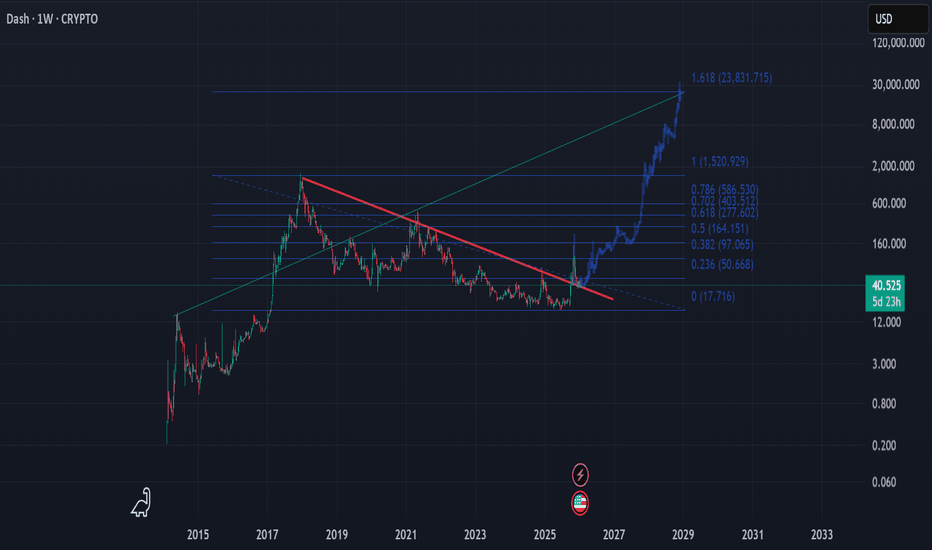

DASH price analysis💥 Just eight years in a downtrend — that’s the story of #DASH 😅

Following CRYPTOCAP:ZEC , it looks like privacy coin fans are trying to “wake up” #DASHUSDT — and price action is finally showing signs of life 📈

📊 If buyers can hold above $90–100, it will signal a true breakout from the long-term trendline and a solid consolidation above it.

That could open the door for a careful long entry, especially since we still have room for around x5 upside to reach the 2021 highs 💪

🤔 Do you believe #DASH can reclaim its former glory,

or has its time already passed?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud

#DASH/USDT – Bullish Breakout Setup | 1H Chart Analys#DASH

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at the 48 price level. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 49.50

First target: 51.60

Second target: 54

Third target: 56.81

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

DASHUSDT : 8-Year Descending Wedge Breakout?Dash (DASH) is showing early signs of a macro trend reversal on the monthly timeframe after trading inside a descending wedge for over 105 months (~3,120 days).

Price has consistently made lower highs and lower lows since the 2017 peak, compressing within well-defined downward-sloping trendlines. This long-term structure appears to be resolving to the upside, with price reclaiming key levels and pressing into the wedge resistance.

Key Points:

- 105-month compression following the 2017 cycle top

- Well-respected descending wedge structure

- Bullish expansion from long-term support

- Historical context suggests mean reversion potential after extended underperformance

If DASH can confirm a monthly close above wedge resistance, it would signal a structural trend change and open the door for a multi-leg recovery toward higher macro levels. Long consolidations on higher timeframes often precede powerful expansion phases.

Cheers

Hexa

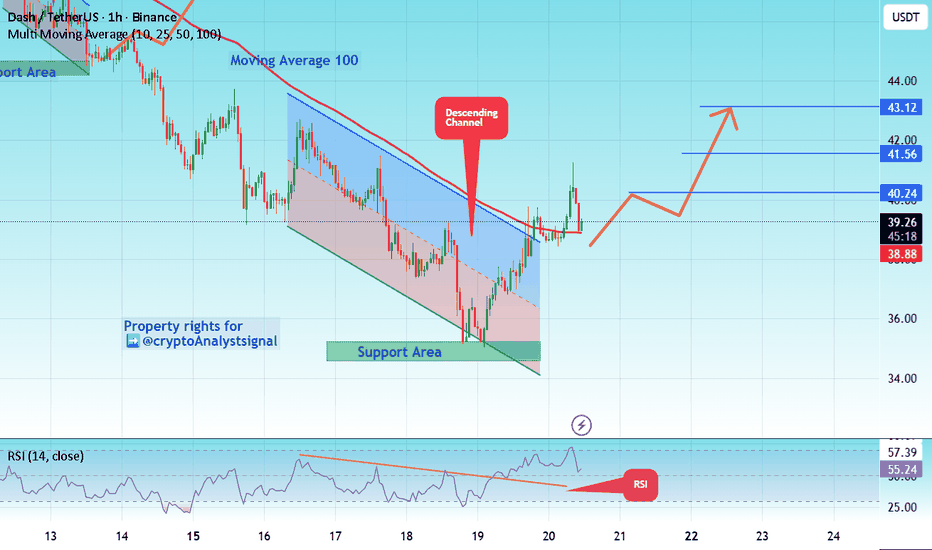

#DASH/USDT – Bullish Breakout Setup | 1H Chart Analys#DASH

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 41.50. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 42.50

First target: 43.52

Second target: 46.86

Third target: 46.34

Stop loss: Below the support zone in green.

Don't forget a simple thing: capital management.

For inquiries, please leave a comment.

Thank you.

#DASH/USDT – Bullish Breakout Setup | 1H Chart Analys#DASH

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

We are seeing a bearish trend in the Relative Strength Index (RSI), which has reached near the lower boundary, and an upward bounce is expected.

There is a key support zone in green at 43.12, and the price has bounced from this level several times. Another bounce is expected.

We are seeing a trend towards stabilizing above the 100-period moving average, which we are approaching, supporting the upward trend.

Entry Price: 39.00

First Target: 40.24

Second Target: 41.56

Third Target: 43.12

Remember a simple principle: Money Management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.

DASH - YOU CAN'T FIGHT PHYSICS! CORRECTIONS ARE INEVITABLE!📣 Hello everyone!

1. DASH currently has an ideal bull market structure.

Microphases of growth are impulsive and lightning-fast: In September, in 6 days +95%, in October in 5 days + 115%, in November in 5 days +263%

The correction microphases grow proportionally over time, which is the absolute norm: 6 days, 17 days, and the current correlation can probably stretch to 21-28 days!

2. If the bull market structure is maintained until the end of 2025, the DASH price may test the 2021 maximum in the region of $476!!

_________________________________________

Total: while the minimum of the last consolidation of $ 38.72 has not been violated, I believe that we should remain cautiously optimistic about DASH and give the bulls time to prove themselves once again. I believe that this time we are dealing with a breakdown of the 8-year bearish trend and now is the earliest phase of the long-term bull market in this coin.

That's all for today, I wish you good luck in making independent trading decisions and profit. Please analyze the information you receive from me, always think only with your head!

Goodbye! ✊

#DASH/USDT – Bullish Breakout Setup | 1H Chart Analys#DASH

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

We are seeing a bearish bias in the Relative Strength Index (RSI), which has reached near the lower boundary, and an upward bounce is expected.

There is a key support zone in green at 44.40, and the price has bounced from this level several times. Another bounce is expected.

We are seeing a trend towards stabilizing above the 100-period moving average, which we are approaching, supporting the upward trend.

Entry Price: 45.00

First Target: 45.68

Second Target: 46.81

Third Target: 48.30

Remember a simple principle: Money Management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.

DASH Breakout: Reversal or Trap?

Yello Paradisers, is this the beginning of a massive DASH reversal or just another fakeout that will punish impatient bulls?

💎#DASHUSDT has just broken out of a well-defined Falling Wedge formation, a classic bottoming pattern that often signals the end of a correction and the start of a new bullish phase. The move comes after a strong bounce from the major demand zone around $45–46, a level that has consistently attracted buyers and proven itself as a high-liquidity reaction area.

💎The breakout above the descending trendline shows that sellers are losing control, but the structure still demands confirmation. What matters now is whether the market delivers a clean retest. Ideally, a pullback toward the broken trendline or a dip back into the upper portion of the $45–46 demand zone would serve as a strong confirmation and potential entry trigger for the next impulsive move.

💎If buyers step in with strength on the retest, #DASH could start grinding higher toward the first resistance around $49–50, and if momentum sustains, the price may even push toward the more significant resistance region near $55.

💎That said, this structure is still fragile. A failure to hold the demand zone, particularly if price breaks below $44, would invalidate the bullish scenario and put DASH back at risk of deeper downside.

It’s not about being early, it’s about being right. Stay sharp and don’t let emotions dictate your trades. That’s the only way you make it far in this game.

MyCryptoParadise

iFeel the success🌴

DASH/USDT Is Testing the Downtrend Wall — Major Move Incoming?DASH/USDT is approaching a critical decision point that could define its next major trend.

Price has been suppressed under a dominant descending trendline since early November, and now the market is once again testing this structure — a technical barrier that has repeatedly rejected buyers.

But there’s a key development:

Bearish momentum is weakening.

The recent series of small higher-lows and tightening volatility indicates compression — a classic precursor to a large expansion move.

The horizontal levels shown (55 – 62 – 70 – 83 – 98 – 135) aren’t just resistance lines;

they are liquidity pockets where strong reactions historically occur.

---

📈 Bullish Scenario (Potential Large Reversal)

A confirmed breakout above the descending trendline and a 4H close above $55 would signal a major shift in structure.

If the breakout is validated:

Target 1 → $62

Target 2 → $70 (key psychological zone)

Target 3 → $83

Target 4 → $98

Target 5 → $135 (full recovery zone)

A clean breakout could mark the beginning of a mid-term trend reversal after weeks of downward pressure.

---

📉 Bearish Scenario (Rejection & Continuation)

If price gets rejected again at the trendline, sellers remain firmly in control.

A strong rejection would open the door to:

Support 1 → $44

Support 2 → $41 (major local low)

Break below $41 → new lower-lows likely, extending the broader downtrend

A sharp bearish candle at the trendline typically signals aggressive selling from larger participants.

---

📌 Key Pattern

Dominant Descending Trendline → guides the entire bearish structure

Compression Price Action → volatility tightening near a major decision point

Potential Trend Reversal Pattern if price breaks above trendline

Liquidity Layering → horizontal levels mark key liquidity pools

The market is now sitting in a “Decision Zone” — a spot where the next major move is usually born.

---

🎯 Summary

DASH is at a rare technical moment:

A retest of the primary trendline that separates reversal from continuation.

Breakout → Trend shift

Rejection → Bearish continuation

This is a moment for confirmation, not prediction.

#DASH #DASHUSDT #CryptoAnalysis #TechnicalAnalysis #BreakoutSetup #TrendReversal #MarketStructure #PriceAction #LiquidityZones

DASH READY TO EXPLODEHey friends! 🔥

After my last Dash idea, a ton of you joined the page — awesome to see so much interest in this coin! Since you clearly like DASH as much as I do, here’s my fresh updated forecast.

I believe we’re heading higher from the current levels.

Targets:

🎯 1st — 65.2

🎯 2nd — 66.4 👈 this is my MAIN target

(🎯 3rd — 68+ ➡️ only if we get strong continuation above 66.3 (still questionable for now, will reassess there))

❌Invalidation level (plan cancelled): close below $63.6

Let’s see how it plays out! 🚀

Like & follow if you’re in the trade, will keep you updated.

FireHoseReel | DASH: Approaches Its Trigger Zone, Stay Sharp!🔥 Welcome FireHoseReel !

Let’s take a closer look at DASH and its key market triggers.

⚡ DASH – 4H Timeframe Analysis

DASH entered a corrective phase after a strong vertical rally and has been completing its pullback using a bearish curve-line.

Each time price touched this curve, it rejected and moved lower.

Now, DASH is reacting to this curve again—its 4th touch—and this curve overlaps with the $63 resistance, creating a key confluence zone.

A breakout above $63 can activate a risky long trigger, but the main long trigger remains at $74, where the structure fully shifts bullish.

📊 Volume Analysis

Volume on DASH has been gradually increasing, though it’s not yet visible on the 4H timeframe.

However, in the 15m and 1H charts, we can see clear buy-side volume spikes forming — a sign that volume may soon transfer upward into higher timeframes.

This rising volume behavior often signals early accumulation and makes DASH a solid candidate to keep on your watchlist.

🔁 DASH/BTC – A Parallel View DASH/BTC shows strong structural similarity to the DASH/USDT chart.

This alignment suggests coordinated whale behavior — essentially, more BTC is being converted into DASH, strengthening the pair.

Trigger zones for both pairs overlap, which gives higher confidence in our trade setups. Setting alerts for both charts is recommended.

📌 Trading Scenarios

🔼 Long Scenario

• Break of $63

• Confirmed by increasing 4H buy volume

• A pullback retest after breakout increases win rate and allows cleaner entry

• Main long confirmation arrives only with a break of $74.

🔽 Short Scenario

• Breakdown of $55.24

• Must be accompanied by high sell volume

• This would open the door for a deeper correction

🛞 Risk Management & Disclaimer

Please remember to always use proper risk management and position sizing. Nothing in this analysis is financial advice. The market can change quickly, so always trade based on your own strategy, research, and risk tolerance. You are fully responsible for your own trades.

DASH: Ready to Remind Everyone Why It Used to MoonIt looks like DASH has fully digested that brutal correction, soaked up liquidity below the range, and is now coiling for another legendary leg up. The old king of privacy coins still knows how to shoot when least expected.

Target: 59.4

Invalidation: 56.2

⚠️ Disclaimer: This is not financial advice. Cryptocurrency trading involves significant risk and can result in the loss of your entire capital. Always do your own research and only trade with money you can afford to lose.

If you’re riding this move with me — smash that Like button, drop a 🚀 in the comments, follow for more alts that are waking up, and turn on notifications so you never miss the next one!

Let’s see if DASH still has that 2017 magic left in it. Who’s in? 👇

DASH shows accumulation breakout potentialIt's highly likely that DASH will break out of its accumulation zone

A typical pattern has formed on the chart

Declining within the channel – forming a bullish formation (pGIP in this case) – transition to growth

A locally developed Head and Shoulders pattern, which is usually followed by growth

Dash is also in the anonymous coin narrative, which is currently performing well...

Current price: $76

Based on the above, it's highly likely that the price could reach $85 and above...

If the price breaks below the purple area shown in the chart and consolidates, a downward movement is likely

DASH Ready to Explode? Breaking the 7-Year Downtrend

Hello everyone,

As we can see in recent weeks, interest seems to be returning to privacy coins, which have been stagnant for years due to regulations and fears of delisting. But the situation now appears to have changed. In fact, the charts of privacy coins all look more or less the same ( CRYPTOCAP:ZEC , SGX:XVG , CRYPTOCAP:PIVX ), with a trendline going back to 2018 that has either just been broken or is about to be broken. Honestly, if you look at these charts, they’re among the most bullish ones across all higher timeframes.

Anyway, let’s do a quick analysis on DASH. As mentioned, in this case the trendline has already been broken, but right now it’s trading just below it. Personally, I believe it will follow exactly the same price action as CRYPTOCAP:ZEC and, once it starts consistently closing above it, it will shoot straight toward its old all-time high.

The setup is very interesting.

Thanks everyone for your attention!

DASHUSDT - Another Leg up ahead!DASH has gained over 300% in the past few weeks and is now in a healthy correction. It formed a consolidation and a falling wedge pattern, which it broke and successfully retested.

It’s starting to climb again.

A golden cross has formed, which should give it the momentum to break the 0.618 Fibonacci resistance, potentially pushing it past the $180 level

Best Regards:

Ceciliones🎯

DASH: Building Momentum Toward 102📈In my view, Dash is currently forming an impulse. From the current levels, I’m expecting a move toward 102.

The invalidation level for this plan is 87.81.

🎯Target - 102

❌ Plan invalidation zone - 87.81

⚠️Disclaimer: This is not financial advice or a call to action — just my personal market view. Always make decisions based on your own risk management, and make sure to trade with stop-losses.

💬If you find this analysis helpful, feel free to leave a reaction, drop a comment, and follow so you don’t miss future updates and new Dash publications🚀

DASH/USDT - Ready for a New Rally? Strong Trendline Break?DASH is entering a highly critical phase. After a deep corrective move, the price has finally broken above the main downtrend line, which has been suppressing every bullish attempt for several sessions. This breakout is not just a casual push — it occurred exactly after the market retested the strong demand zone at $83–$75, an area that has repeatedly acted as an accumulation block for larger players.

The market structure paints a clear story:

Impulsive rally toward $150 → distribution → controlled retracement.

A series of lower highs → well-defined downtrend → bearish pressure gradually fading.

Strong 4H breakout above the trendline → early trend reversal signal.

DASH now stands at an inflection point. Buyers successfully defended the demand zone, and the next move will determine whether this breakout evolves into a full bullish reversal or simply a temporary relief rally.

---

Bullish Scenario (Rising Momentum + Structural Shift)

If the buyers maintain this momentum, the bullish setup becomes very compelling:

1. Successful retest/hold above the broken trendline → validation of the reversal.

2. Clean 4H breakout above $96.9 → opens the next range.

3. Upside targets become:

Target 1: $105

Target 2: $134 (major supply zone)

Primary Target: $149–150 (previous swing high)

A confirmed breakout above $134 would signal the start of a larger markup phase.

---

Bearish Scenario (If the Breakout Turns Into a Fakeout)

The bearish scenario activates only if price breaks back below the $83–$75 demand zone.

A 4H close beneath this region would:

Invalidate the bullish breakout

Shift structure back into bearish continuation

Confirm downside targets toward:

$68

$60

And in an extended selloff, a revisit to the $40 region.

This $83–$75 zone remains the final defensive line for buyers. As long as it holds, bullish bias stays intact.

---

Key Pattern Breakdown

Downtrend Breakout → transition from distribution to accumulation.

Demand Zone Rejection ($83–$75) → shows strong buy-side interest and potential structural reversal.

Potential Higher Low Formation → early stages of bullish trend development.

Continuation Potential if $96.9 is broken with strength.

These elements suggest that DASH may be preparing for the early phase of an uptrend — pending confirmation.

---

Technical Insight

Bulls have successfully defended structural support above the demand zone.

Momentum shift appears after the trendline break.

A confirmed 4H close above $96.9 will likely activate the next leg upward.

Any pullback into the $83–$75 zone remains a high-value accumulation area (as long as the zone holds).

#DASH #DASHUSDT #CryptoAnalysis #Breakout #Reversal #DemandZone #PriceAction #CryptoMarkets #TechnicalAnalysis