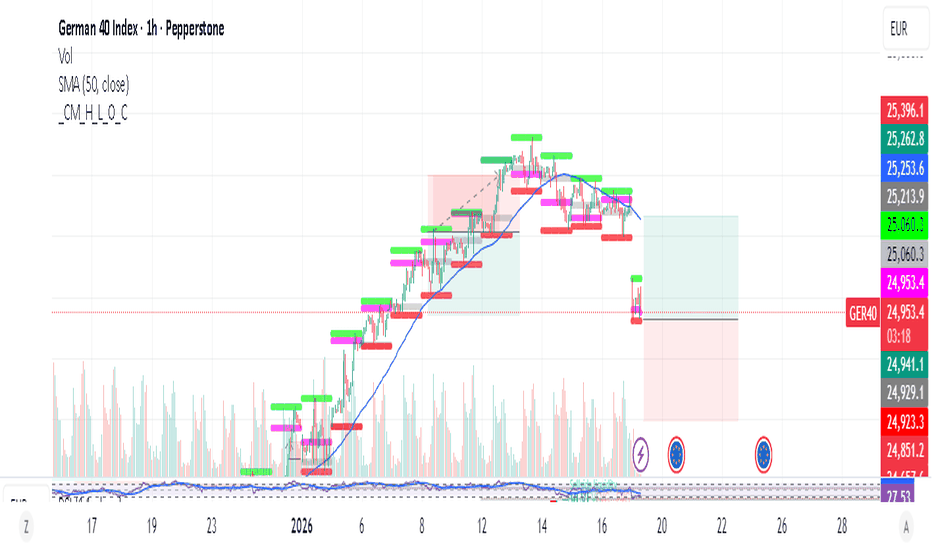

DAX/GER - YOU DONE IT AGAIN - 2ND TIMES OF THE DAYDAX target hit again today.

GDP numbers came in strong, so there’s no fundamental reason for fear.

The current sell‑off is purely CPI‑driven sentiment, not structural weakness.

I’m positioned long on DAX at 24400–24425, and the setup remains intact.

DAX Trade Plan

Current Long Position

Entry: 24400–24425

Target 1: 24465–24476

Target 2: 24515–24545

Market Expectations

CPI Fear = Opportunity

The market is reacting emotionally ahead of CPI, not logically.

GDP strength confirms underlying resilience.

US Session Outlook

I expect DAX to recover before the US market opens, supported by a rebound in US indices.

NASDAQ: Recovery expected

DOW: Targeting 49200–49500

This aligns with current liquidity flow and the typical pre‑CPI positioning unwind.

Confidence Stays High

The structure is clean, the fundamentals are supportive, and fear‑based selling rarely sustains.

We stay disciplined, follow the targets, and ride the recovery.

LETS GO

Daxanalysis

DAX.GER - LETS GOTeam Update – DAX Trade Plan

Eight hours ago, we went long on DAX and successfully hit our target.

Momentum has continued to hold, so we are taking the next setup.

New Long Position

Entry Zone: 24440–24455

Stop Loss: 23283

Targets Target 1: 24486–24515 - Take 30% partial. Move stop loss to breakeven

Target 2: 24555–24630

Expectation: Either during European market open, or Before the US market open

The structure is clean, liquidity is aligned, and continuation is highly probable.

LETS GO

DAX/GER - Market Outlook & Trade PlanGreat work today — BOTH UK100 and AUS200 smashed their targets.

Momentum is lining up exactly as expected.

Now shifting focus to DAX with a clean, disciplined plan:

DAX Trade Plan

Entry Zone

Buy Limit: 24300–24320

STOP LOSS

SL: 23260

Target 1: 24365–24415 - Take partial profits. Move stop loss to breakeven

Target 2: 24435–24600

Expected to be reached by the next US market open

Rough estimate: ~20 hours from now

Market Timing Expectations

European Open Tomorrow

We expect Target 1 to be hit comfortably during the first phase of European market activity.

Recovery Window

First 6–8 hours: Market should stabilise and build structure

Following 16–24 hours: Strong recovery expected, aligning with US session momentum

This aligns with current liquidity cycles and the broader recovery pattern we’ve been tracking.

LETS GO

Germany 40 :: Trend-Aligned Bullish Trade Setup📈 GERMANY 40 (DAX 40) INDEX - BULLISH PULLBACK CONTINUATION 🚀

Day/Swing Trade Strategic Entry Guide | CFD Market Opportunity

🎯 TRADING SETUP OVERVIEW

Asset: DAX 40 Index (German Blue-Chip Equities) 🇩🇪

Current Market Level: ≈ 24,896 - 24,950 EUR (As of Jan 27, 2026)

52-Week Range: 18,489.91 - 25,507.79 EUR

YTD Performance: +16.13% | Month Trend: +2.48% | Weekly: -1.72%

Market Trend: Bullish with Pullback Consolidation Phase ✅

📊 TECHNICAL ANALYSIS - PRICE ACTION SETUP

Bullish Thesis: SMA Pullback + Reversal Confirmation

✨ Strategy Structure:

Primary Trend: Uptrend Intact (ATH: 25,507.79 on Jan 13, 2026) 📈

Current Correction: Healthy consolidation zone between 24,400 - 24,950

Technical Signal: Simple Moving Average (SMA) pullback with support validation

Market Cycle: Transitioning from retracement phase → acceleration phase

🎪 ENTRY STRATEGY - TIERED LIMIT LAYER APPROACH

"Smart money enters at strength, not at desperation!" 💡

TIER 1 - AGGRESSIVE ENTRY (First Confirmation Signal)

Price Level: 24,700 EUR ✅

Rationale: Tests 61.8% Fibonacci retracement + Daily support zone

Risk Profile: Medium - Immediate technical resistance above

TIER 2 - OPTIMAL ENTRY (Recommended Sweet Spot)

Price Level: 24,800 EUR 🎯

Rationale: Key consolidation support + Previous PoC (Point of Control)

Risk Profile: Best Risk/Reward Ratio

Volume Profile Strength: High liquidity, support bounce evidence

TIER 3 - CONSERVATIVE ENTRY (Maximum Confirmation)

Price Level: 24,900 EUR 📍

Rationale: Final retest of recent swing high + SMA convergence zone

Risk Profile: Lower volatility entry, higher probability confirmation

Entry Execution: Use LIMIT ORDERS ONLY for superior execution

Avoid MARKET ORDERS (slippage risk in index trading)

Set entries 5-10 minutes before Frankfurt Open (8:00-9:00 CET)

Stack 3 positions across all tiers to maximize edge

🎲 TARGET LEVELS - PROFIT TAKING STRATEGY

PRIMARY TARGET: 25,500 EUR 🚀

Distance from Entry: +600 to +800 points

Technical Reason:

📌 Fibonacci Resistance Cluster (78.6% projection)

📌 Previous ATH breakout zone (25,507.79)

📌 Overbought RSI signals exit at this junction

📌 Institutional resistance + Order clustering

Risk Factor: Strong resistance confluences - expect rejection/consolidation

SECONDARY TARGET: 25,200 EUR ⭐

Conservative Exit: Take partial profits here (50% position)

Reason: Second resistance tier, risk management checkpoint

TRAILING PROFIT STRATEGY:

Lock gains at +400 points minimum

Trail stop-loss above recent swing lows

DISCLAIMER: Risk management is YOUR responsibility ⚠️

🛑 STOP LOSS MANAGEMENT - CAPITAL PRESERVATION

Recommended SL Placement: 24,600 EUR 💪

Distance from Optimal Entry (24,800): -200 points loss maximum

Technical Justification:

📍 Sits below key daily support pivot (24,412.21)

📍 Below 61.8% Fibonacci support zone

📍 If this breaks = trend reversal confirmed

Risk per Trade: 2-3% portfolio allocation recommended

AGGRESSIVE SL (For Strong Risk Appetite): 24,650 EUR

Tighter, reduces loss magnitude

Increases stop hunts/whipsaws probability

CONSERVATIVE SL (For Capital Preservation): 24,400 EUR

Allows more room for consolidation noise

Slightly wider but higher survival rate

⚠️ CRITICAL DISCLAIMER: Your stop-loss placement is YOUR decision based on risk tolerance. Don't copy blindly. Adjust to YOUR account size and risk parameters!

🔗 CORRELATED PAIRS TO WATCH - CONFLUENCE TRADING

POSITIVE CORRELATIONS (Move Together ↔️)

1. EUR/USD 💱 - EUROPEAN CURRENCY STRENGTH

Ticker: EURUSD / FX:EURUSD

Why It Matters: DAX composed of Eurozone exporters; EUR strength = DAX benefits

Current Level: ~1.1700 (Monitor resistance/support)

Watch Signal: Break above 1.1700 = additional bullish catalyst for DAX

Impact: 0.70+ correlation coefficient

2. EUROSTOXX 50 📊 - BROADER EUROPEAN EQUITIES

Ticker: ^STOXX50 / TVC:ESTX50

Why It Matters: DAX is largest component; often leads EStoxx movement

Setup Advantage: Confirm DAX strength via European sector index

Divergence Risk: If DAX rallies but EuroStoxx lags = weakness warning

3. S&P 500 / SPX 🇺🇸 - GLOBAL RISK SENTIMENT BAROMETER

Ticker: ^GSPC / TVC:SPX500

Why It Matters: Risk-on/risk-off appetite flows across Atlantic

Current Level: ~6,915 (Monitor Fed decision impact)

Correlation Context: 0.65+ during bull markets; weakens in crisis

Trade Signal: SPX strength > DAX often precedes 24-48hr DAX surge

4. FTSE 100 📍 - UK EQUITY BENCHMARK

Ticker: ^FTSE / TVC:UK100

Why It Matters: Close correlation to DAX; financials + commodities exposure

Monitor: If FTSE breaks key support = risk-off signal for DAX

INVERSE CORRELATIONS (Opposite Moves) ⚡

1. USD/INDEX 💪 - US DOLLAR STRENGTH

Ticker: DXY / USDINDEX

Why It Matters: Strong USD = headwind for DAX exporters

Watch: If DXY rallies above 109 = potential DAX pressure

Setup: Weakness in USD = tailwind for continental Europe stocks

2. VIX / VOLATILITY INDEX 😰

Ticker: ^VIX / CVIX

Why It Matters: Rising fear = risk-off = DAX weakness

Safe Zone: VIX below 18 = bullish backdrop for DAX

Warning Signal: VIX spike above 25 = trend reversal risk

📰 FUNDAMENTAL & ECONOMIC FACTORS - MACRO DRIVERS FOR 2026

🇩🇪 GERMAN ECONOMIC STRENGTH NARRATIVE ✅

1. FISCAL STIMULUS BOOST 💰 (Major Positive)

€127 Billion Defense + Infrastructure Spending (2026):

Government approved new €500B special fund for infrastructure

Defense spending exempted from debt brake (1%+ of GDP)

Multiplier effect expected Q2-Q4 2026

Impact on DAX: Infrastructure/defense contractors (Rheinmetall, Airbus) → Upside

Status: Already approved, beginning implementation phase

2. ECONOMIC RECOVERY TRAJECTORY 📈

Bundesbank Forecast: GDP stagnation 2025 → +1.2% growth 2026-2027

Growth Driver: Export resurgence starting Q2 2026

Manufacturing Momentum: German Composite PMI = 52.5 (3-month high, Jan 2026)

Implication: Peak pessimism already priced in; upside surprise likely

3. INFLATION NORMALIZATION ✨ (Supportive for Equities)

German HICP Inflation: 2.0% (Dec 2025) - At ECB 2% target!

Forecast Path: 2.1% (2026) → 1.9% (2027) → 2.0% (2028)

Real Wage Growth: +8.5% minimum wage increases announced

Equity Impact: Lower inflation removes rate hike fears; supports valuations

4. ECB POLICY STANCE 🏦 (Supportive Hold)

ECB Rate Decision: HOLD at 2.0% deposit rate through 2026

Rationale: Inflation at target (2%), growth resilient at 1.4%

Next Hike Expected: Mid-2027 only (if inflation accelerates)

Market Impact: Monetary accommodation extended; liquidity supportive

⚠️ HEADWIND FACTORS TO MONITOR 🚨

1. US TARIFF UNCERTAINTY 🎯

Trump Administration Risk: 200% threats on French goods, potential EU tariffs

DAX Impact: Export-dependent companies (SAP, Siemens, Allianz) face pressure

Mitigation: German fiscal spending partially offsets export weakness

2. GEOPOLITICAL TENSIONS 🌍

Recent De-escalation: Greenland concern subsided (net positive for risk sentiment)

Ongoing Risks: Russia/Ukraine, Middle East remain volatile

Market Effect: Drives intermittent VIX spikes; creates trading noise

3. CHINA COMPETITIVE PRESSURE 🐉

EV Transition Challenge: German auto industry facing Chinese EV competition

DAX Exposures: BMW, Mercedes, Volkswagen at risk long-term

Silver Lining: German tech (SAP, Infineon) + defense spending counters

📅 UPCOMING ECONOMIC CALENDAR - KEY DATES TO WATCH

Jan 28-29, 2026 🇺🇸 US Fed Decision (HIGH IMPACT) - Watch for rate hold + forward guidance signals that could shift risk sentiment

Jan 30, 2026 🏦 ECB Policy Decision (MEDIUM IMPACT) - Expected rate hold at 2.0%; confirmation keeps monetary accommodation supportive

Late Jan 2026 💻 SAP Q4 Earnings (HIGH IMPACT) - Tech sector bellwether; strong results = DAX upside catalyst

Feb 2026 🏭 German Factory Orders (MEDIUM IMPACT) - Measures economic momentum; growth above forecast = bullish for exporters

Q1 2026 📊 German GDP Data (HIGH IMPACT) - Recovery confirmation; expected +1.2% growth validates our bullish thesis

Feb/Mar 2026 📈 ECB Inflation Data (MEDIUM IMPACT) - Maintains 2% target check; any spike above = potential rate hike concerns

💡 TRADER'S EDGE - THIEF TRADER PHILOSOPHY

"The market rewards patience, position sizing, and profit-taking discipline more than perfect timing."

TRADING COMMANDMENTS 📜

✅ DO THIS:

Plan your trade → Trade your plan (No emotion)

Use limit entries at calculated levels (Avoid chase buying)

Take profits incrementally (50% at target 2, trail the rest)

Respect stops (Losses are learning fees)

Scale position size to risk tolerance (2-3% loss = survival mode)

❌ AVOID THIS:

FOMO entries at market price (Slippage killer)

Holding through TP target (Greed loses gains)

Moving stops against you (Stop-hunt protection lost)

Averaging down in downtrends (Pyramid to danger)

Ignoring correlation signals (Confluence > single indicator)

🎯 RISK DISCLOSURE & IMPORTANT WARNINGS ⚠️

THIS IS NOT FINANCIAL ADVICE!

💼 Trader's Acknowledgment:

Index CFD trading carries EXTREME RISK - 80%+ of retail traders lose capital

You can lose MORE than your initial deposit (leverage = double-edged sword)

Past performance (DAX +16.13% YTD) ≠ Future results

Geopolitical/economic shocks can gap markets against your stops

ONLY risk capital you can afford to lose completely

🔐 Your Responsibility:

This analysis is educational framework, not a trading signal

Entry price selection (24,700 / 24,800 / 24,900) is YOUR choice

Stop-loss placement must match YOUR risk tolerance

Take-profit levels are suggestions—adjust to YOUR psychology

Consult a licensed financial advisor before trading

Use demo account first to validate edge

🚀 FINAL WISDOM - TRADER'S MANTRA

"In trading, capital preservation beats capital accumulation. A small, consistent edge + compound returns = wealth."

The Setup is Clear. Entry signals are prepared. Confluence is established. Now it's YOUR move.

Will you wait for confirmation? Will you scale entries? Will you honor your stops?

The market doesn't care about your opinion. It only respects price action and risk management.

Trade with purpose. Trade with discipline. Trade to survive another day.

🎲 May your entries be precise, your exits be profitable, and your psychology be unshakeable. 💪

DAX/GER - what should we do, Team, last week I keep mentioned that the DAX in February will have correction hit around 24800-24400 - and it will

I have successfully made 30% today on UK100 and DAX last week another 20% on my challenge account.

Today I am going long DAX at 94969-52 ranges

with STOP LOSS at 24925

Target 1 at 25047-25069

Target 2 at 25087-25146

LETS GO.

Dax - Short Term Buy IdeaH1 - Strong bullish momentum.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------

DAX30/GER30 - 3RD TIME LUCKYTeam, twice we are kicking ass on DAX/GER today

Now the price are at 25249 which is much better than price we short earlier.

Time to short at 25247-25255 - please ADD more at 35296-25315

STOP LOSS at 25365

Target 1 at 25215-25193

Target 2 at 25186-25155

PLEASE ALWAY FOLLOW TO RULE, take partial in 1st target and bring stop loss to BREAK EVEN..

Thats our safety rule.

LETS GO !

DAX30/GER30 - YOU DONE IT AGAINTeam, 12 hours ago we short the DAX at 25198 and our 1st target hit.

Again we have opportunity to short better price at 25227-25232 ranges

if it is heading toward 25245-60 ranges, we add for more short position and better volume

STOP LOSS at 25315

Target 1 at 25185-25167

Target 2 at 25140-25132

NOTE: FEBRUAY, I STILL expect the market will pull down toward 24800-24400

LETSO GO

DAX/GER - THEY DONE IT AGAINTeam, last two days I been able to make quite good profit on DAX,

yes, you need to understand where the market move and able to take on scalping trade,

Last two days, it has reached new high, but also give you room to short and take profit around 25000-25030

The price currently at 25198 and when the real market open, it could retest the old high at 25225-30. twice it reach that level resistance

Just encase it break out, it likely to heading toward 25250-60 ranges, and it will start to drop back toward 25085-50

So short now at this level 25198-25203 - STOP LOSS at 25315

We need to give room if the market goes against us toward 25250-25260 then I will short more heavier at this level.

Target 1 at 25167-25145

Target 2 at 25087-25050

NOTE: I STILL expect the market will pull down toward 24600-24400

Last 6 months ago, I was prove my trading $1000 turn into 100k in 6 months

I recently prove again $400, turn over 22k in 6 weeks, using scalping and swing trade.

All my trades post daily in my Community.

LETS GO

DAX30/GER30 - WAKE UP AT 4AMTeam, I just wake up at 4am

Earlier we kill the DAX with both target hit, please check previous posted.

NOW, we have opportunity to short at much more better price, as I expect the retest will come back.

Time to short at 24877-24886, STOP LOSS at 24965

Target 1 at 24832-24816 - take partial and bring stop loss to BE

Target 2 at 24796-24785

LETS GO AND KILL THE BEAST.

NOTE: I expect the market will drop once the REAL EUROPEANING market opening which is estimate 14-16 hours from here!

DAX30/GER30 - THE TIME HAS COMETeam, sound a little funny, but DAX took some viagra today so I wait for the pump to be exhausted.

We are shorting at 24786, with stop loss at 24880 just to be safe

I expect next 6-12 hours, market will dump toward our target

Target 1 at 24732-24715 PLEASE TAKE PARTIAL AND BRING STOP LOSS TO BREAK EVEN

Target 2 at 24696-24675

TODAY WE HAVE UK100.FTSE100 SHORT AGAIN and target hit

NOW LETS GO.

DAX30/GER30 - Short Setup — Structured Trade PlanTeam, it has been a while since we trade DAX, since holiday season, i just take it easy and do more scalping trade.

Earlier Execution

Short entry: 23,459

Partial TP: 23,426

Nice scalp — clean reaction, good risk control.

Current Bias

Market still in holiday‑flow mode

Liquidity pockets are thin

DAX pushing into premium levels

You’re anticipating a liquidity grab → rejection → short continuation

Entry Zone (Short)

24,465–24,472

This aligns with:

Liquidity above intraday highs

A likely sweep zone before reversal

A premium pricing pocket for shorts

Target 1: 24,426–24,415

Take partial

Move stop to break‑even

Lock in a risk‑free runner

Target 2: 24,389–24,372

Full target zone

LETS GO

DAX40 Momentum Shift: Layered Buy Setup for Clean Profit Flow🚀 DAX40 (GER40) BULLISH BREAKOUT ALERT! | Layer Strategy for MAX Gains 🚀

📈 DAX40 BULLISH BREAKOUT CONFIRMED! 🏆 (Swing/Day Trade Setup with Layer Entry)

📊 Idea: Strong bullish momentum on the GER40 / DAX 40 following a decisive breakout above key moving averages! Perfect setup for a structured "thief-style" layered entry to capitalize on the trend.

🔑 KEY LEVELS & PLAN:

Trend: Bullish (MA Breakout Confirmation)

Entry Strategy: "Thief" Layer Method 🎯

Use multiple BUY LIMIT orders at key dips: 23,600 | 23,700 | 23,800 | 23,900 (Add more layers based on your capital).

This averages your entry and maximizes opportunity on pullbacks.

Stop Loss (SL): 23,400 (Thief OG's Zone ⚠️).

IMPORTANT NOTE: Adjust your SL based on YOUR risk tolerance & strategy! This is a guide, not financial advice. Protect your capital.

Take Profit (TP): Target Zone: 24,500 🎯

Strong resistance & potential overbought trap area. Secure profits wisely!

REMINDER: Manage your own TP. Take money at your own risk.

💎 PRO TRADER NOTES:

This "thief" layer strategy requires patience & discipline. Let the market come to your orders. Never risk more than 1-2% per layer. Trade with a plan, not emotion!

🌍 RELATED PAIRS TO WATCH (KEY CORRELATIONS):

FX:EURUSD : INVERSE Correlation. A stronger Euro can pressure DAX (export-heavy index). Watch for USD weakness supporting DAX rallies.

CAPITALCOM:US30 (Dow Jones) / SP:SPX (S&P 500): POSITIVE Correlation. US market strength often lifts European indices. Key for overall risk sentiment.

ICMARKETS:STOXX50 (Euro Stoxx 50): HIGH Correlation. Broader European index performance.

BUND Futures (/FGBL): INVERSE Correlation. Rising German bond yields (falling prices) can signal economic optimism, often supporting DAX.

EUR/GBP ( OANDA:EURGBP ): UK/EU economic relative strength flows.

👇 LIKE & FOLLOW if you found this useful!

💬 COMMENT your entry levels or chart insights below!

🔔 Click the BELL on my profile for real-time idea alerts!

#DAX #GER40 #TradingView #Breakout #Bullish #SwingTrading #DayTrading #LayerStrategy #TradingPlan #Forex #Indices #Investing #Stocks #ThiefStrategy #EURUSD

DAX30/GER30 - SETTING UP A TRADETeam, we been very successful trading DAX in the past and many successful trade

the current price at 24130, we are not going to suicide at this entry level

We wait for a set up entry at 24000-23960 rangs,

STOP LOSS at 23860

Target 1 at 24085-96

Target 2 at 24115-24150

Target 3 at 24180-24280

Lets be patience to see if our entry price hit, do NOT rush into a trade.

keep an eye on it today once the DAX market open, half an hour after real market open!

LETS GO

GER40 Pullback Is Not a Reversal (Here’s Why)GER40 did not react at the 0.7–0.8 retracement of the previous bearish leg, indicating underlying strength. Price has since formed equal highs (EQH), which now serve as a logical liquidity target for the next upside move.

I expect a brief manipulation or pullback early in the week, followed by bullish expansion toward the 24,500 area.

I’ll share updates as the setup develops — follow for further analysis.

GER40 Trade Idea: The Perfect Pullback Before Liftoff!I enjoy trading GER40, especially during the London session, where we consistently see a phase of manipulation followed by a clean move toward the target. At the moment, the structure is showing a similar pattern.

Although the HTF suggests a broader correction toward the 22,000 area, I’m looking for a short-term setup for next week.

My scenarios:

1) Primary scenario:

A move lower into the first Daily FVG, which is also visible on the 4H and 1H timeframes—confirming its validity. After a test of this zone and a liquidity grab around the 23,700 area, I expect price to move upward toward the 0.70–0.79 Fibonacci retracement, where I will look to take profit.

2) Alternative scenario (less likely):

A deeper correction into the second Daily FVG, which is only visible on the Daily timeframe. Due to its limited confluence, this scenario has lower probability.

Execution plan:

I’ll wait for price to trade into one of these FVGs, then look for LTF reversal signals to execute a long position targeting the 0.70–0.79 Fibonacci zone.

If you enjoy this type of analysis, make sure to follow and like this idea.

DAX/GER - let puck up the entry againTeam, last week, we got our target hit before the BIG dump again yesterday

Found a good entry for DAX at this level 22993-22965

STOP LOSS at 22860

Once it break above 23060, bring stop loss to BREAK EVEN

Target 1 at 23085-23115

Target 2 at 23160-23189

Target 3 at 23230-23500

LETS GO

Dax Short Term Sell IdeaH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

DAX: Sideways at ATH, Q3 Coil → Q4 Pop?Since May the DAX has moved sideways at/near all-time highs. Q3 has been chop as expected, but momentum hasn’t broken—buyers keep defending the 23.4–23.7k shelf. I’m leaning into seasonality and prior behavior: staying long for a push into quarter-end, then I’ll reassess. Plan on scaling out into 24,500 → 24,600 → 24,700 (ATH supply), with risk tucked below the recent range floor.

Technicals

• Structure: Multi-month range at the highs; no decisive lower-low. The 4H view shows repeated rejections of a minor descending supply line while the base at ~23,6xx keeps holding.

• Entry zone: 23,620–23,720 (range support / prior VWAP shelf).

• Invalidation: daily close below 23,200–23,300 (range break).

• Targets: 24,000 (psych), 24,300 (mid-supply), 24,600 (ATH line from your chart).

• Breadth/rotation clues (dashboard): Financials firm, tech mixed, autos soft; overall market still balanced rather than risk-off—consistent with consolidation, not reversal.

• Tape feel: Repeated “muted opens” with buyers showing up later in the session fits the grind-higher playbook into month/quarter end.

Fundamentals

• Macro tone: US risk appetite improved after the Fed’s first cut, even as Powell tempered hopes of an aggressive path—enough to cap deep corrections but still supportive of equities. European desk notes point to a restrained start, not a bear impulse.

• Germany specifics: Headlines flag auto-sector warnings (VW/Porsche) weighing on sentiment, but banks and select industrials offset—matching the mixed sector board rather than broad deterioration.

• Flows/seasonality: Quarter-end & Q4 seasonality often favor indices that have consolidated at highs; with DAX still ~1k points off the record, a range breakout toward 24.3k–24.65k is a reasonable path before re-calibrating.

• Risks to thesis: Another round of negative guidance from autos, hotter-than-expected US data re-pricing fewer cuts, or a clean daily close below 23.2k (range failure).

Trade what’s on the chart, respect the invalidation, and pay yourself into strength.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

DAX/GER30 - TIME TO FISHINGTeam,

thank for your patience, this morning i sent out 12 hours ago to enter this range.

But during the day i found a good entry so we did, in and out quickly with target hit.

NOW IS PERFECT TIME.

We are looking to enter long at 23600-23575 ranges

WITH STOP LOSS at 23540

Once it hit our entry, wait for above 23650, bring stop loss to BE

Target 1 at 23665-23685

Target 2 at 23735-23745

Target 3 at 23705-23865

SO PLEASE BE PATIENT, as soon as I can, I will update the comment.

LETS GO FISHING