LHX Analysis: $1B Space Deal Signals GrowthThe Strategic Pivot

L3Harris Technologies (NYSE: LHX) is redefining the defense landscape. While the stock has climbed 38.6% year-to-date, recent developments suggest the rally is just beginning. The catalyst is a massive $843 million contract with the Space Development Agency (SDA). This deal confirms L3Harris as a primary player in modern warfare infrastructure. With projected revenues hitting $22 billion and free cash flow nearing $2.7 billion, the fundamentals are robust. This analysis dissects the strategic drivers behind this growth.

Geopolitics & Geostrategy: The High Ground

Modern conflict has shifted to orbit. Major powers are actively militarizing space to secure communications and surveillance advantages. The SDA contract for infrared satellites places L3Harris at the center of this geopolitical contest. Governments demand persistent missile warning capabilities to counter hypersonic threats from rivals. L3Harris provides the "eyes in the sky" necessary for national survival. This geostrategic necessity ensures long-term demand for their orbital assets.

Industry Trends: From Armor to Dat

The defense industry is moving away from heavy manufacturing toward intelligence and connectivity. Tanks and ships are vulnerable without secure data links. L3Harris specializes in this exact niche: avionics, electronic warfare, and sensing. They are not building the metal shell; they are building the brain. This trend favors agile tech integrators over traditional heavy metal defense contractors. The market values high-margin electronics over low-margin hardware.

Technology & Science: Infrared Precision

The science behind the new SDA contract is critical. These satellites utilize advanced infrared sensors to track heat signatures from missile launches. Developing these sensors requires elite engineering and physics capabilities. L3Harris has mastered the suppression of "background noise" in space to detect small targets. This scientific edge creates a high barrier to entry for competitors. Few companies possess the technical heritage to execute this level of precision engineering.

Business Models & Economics: Cash Flow Efficiency

L3Harris operates on a highly efficient financial model. The company generated nearly $2.7 billion in free cash flow (FCF) recently. This liquidity allows them to fund internal Research and Development (R&D) without relying on expensive debt. In a high-interest-rate macroeconomic environment, cash is king. Their ability to self-fund innovation while paying dividends makes them attractive to institutional investors. The economic engine here is stability combined with growth.

Cyber & High-Tech: Hardened Systems

Space assets are prime targets for cyberattacks. L3Harris integrates "cyber-resilience" directly into its satellite architecture. They do not just build communication radios; they build encrypted networks that withstand jamming and spoofing. This convergence of hardware and cybersecurity is a key selling point. Defense clients pay a premium for systems that operate reliably in contested electronic environments.

Management & Leadership: Organic Discipline

The leadership team at L3Harris is executing a disciplined strategy. Instead of relying solely on expensive acquisitions, they are driving "organic growth." The recent financial report highlights this internal efficiency. Management focuses on operational excellence and clearing supply chain bottlenecks. This focus has improved margins and delivery times. Investors trust leadership that delivers on promises without overleveraging the balance sheet.

Patent Analysis: Protecting Intellectual Property

A review of the sector suggests L3Harris holds a "moat" of intellectual property. Their patent portfolio likely covers proprietary sensor integration and waveform technologies. These patents legally protect their market share in tactical communications. Competitors cannot easily replicate their avionics suites without infringing on protected tech. This IP fortress secures future revenue streams and keeps margins high.

Forecast: The Trajectory

L3Harris is currently undervalued relative to its potential. The $843 million contract is a signal, not an anomaly. As global tensions rise, the premium on space-based intelligence will increase. The company’s focus on high-tech sensors, strong cash flow, and strategic positioning makes it a formidable stock. Traders should view the current price as an entry point before the full value of these space contracts materializes in 2026 earnings.

Defensetech

SkyWater (SKYT) — Trusted U.S. Specialty Foundry Scaling UpCompany Overview

SkyWater NASDAQ:SKYT is a U.S.-based specialty semiconductor foundry serving defense, aerospace, and advanced computing with radiation-hardened, mixed-signal, and MEMS technologies—delivering secure, domestic manufacturing.

Key Catalysts

Onshoring Tailwind: DoD Trusted Foundry status + Fab 25 (Texas) acquisition position SKYT to capture CHIPS Act–driven demand.

Record Results: Q3’25 revenue $150.7M (record) on strong wafer demand and Texas contributions; margin trend improving with mix and scale.

Strategic Edge: Early leadership in quantum computing manufacturing adds long-term, high-margin optionality.

Investment Outlook

Bullish above: $13.50–$14.00

Target: $30–$32 — supported by secure supply positioning, Fab 25 ramp, and expanding defense/advanced-compute programs.

📌 SKYT — the secure U.S. foundry levered to defense, CHIPS, and next-gen compute.

Can AI See What Bullets Cannot?VisionWave Holdings is transforming from an emerging defense technology provider into a critical AI infrastructure and platform integrator, positioning itself to capitalize on urgent global demand for autonomous military systems. The company's strategic evolution is driven by heightened geopolitical instability in Eastern Europe and the Indo-Pacific, where conflicts, such as the war in Ukraine, have fundamentally shifted battlefield doctrine away from traditional heavy armor toward agile, autonomous platforms. With the military unmanned ground vehicle market projected to reach $2.87 billion by 2030 and a structural shift toward Manned-Unmanned Teaming doctrine adding sustained long-term demand, VisionWave's timing aligns with accelerating procurement cycles across NATO allies.

The company's competitive advantage centers on its Varan UGV platform, which integrates proprietary 4D imaging radar technology and independently actuated suspension to deliver superior mission resilience in extreme environments. Unlike conventional sensors, VisionWave's 4D radar adds elevation data to standard measurements, achieving detection ranges exceeding 300 meters while maintaining reliable operation through fog, rain, and darkness capabilities essential for 24/7 military readiness. This technological foundation is strengthened by the company's partnership with PVML Ltd., which creates a "secure digital backbone" that resolves the critical Security-Speed Paradox by enabling rapid autonomous operations while maintaining strict security protocols through real-time permission enforcement.

VisionWave's recent institutional validation underscores its transition from emerging player to credible defense-AI equity. The company raised $4.64 million through warrant exercises without issuing new equity, demonstrating financial discipline and strong shareholder confidence while minimizing dilution. Strategic appointments of Admiral Eli Marum and Ambassador Ned L. Siegel to its Advisory Board establish crucial operational bridges to complex international defense procurement systems, accelerating the company's path from pilot validations in 2025 to scaled commercialization. Combined with S&P Total Market Index inclusion and a 5/5 technical rating from Nasdaq Dorsey Wright, VisionWave presents a comprehensive value proposition at the intersection of urgent geopolitical demand and next-generation autonomous defense technology.

BigBear (BBAI) — Expanding AI Leadership in Defense IntelligenceCompany Overview:

BigBear.ai Holdings, Inc. NYSE:BBAI is a leading provider of AI-powered decision intelligence for defense, supply chain, and digital identity markets—offering investors exposure to the rapidly growing AI and analytics sector focused on mission-critical applications.

Key Catalysts:

Defense expansion: New U.S. Navy partnership for UNITAS 2025 and strategic alliance with Tsecond strengthen BigBear.ai’s role in real-time, edge-based AI processing via ConductorOS and BRYCK platforms.

Long-term contracts: Over $178 million in multi-year defense deals provide strong revenue visibility and recurring income stability.

Strategic momentum: Growing adoption across national security agencies underscores BigBear.ai’s position in U.S. defense modernization efforts.

Investment Outlook:

Bullish above: $6.80–$7.00

Upside target: $17.00–$18.00, supported by defense partnerships, scalable AI deployment, and national security demand.

#BigBearAI #ArtificialIntelligence #DefenseTech #NationalSecurity #EdgeComputing #AIAnalytics #Investing #BBAI

Viasat, Inc. (VSAT) – Company Overview & OutlookViasat, Inc. NASDAQ:VSAT is entering a transformational growth phase, combining satellite technology leadership with deep defense partnerships and bold moves into mobile connectivity.

🔭 Key Catalysts

ViaSat-3 F2 Launch (Oct 2025):

Will more than double global bandwidth, unlocking capacity for high-speed global coverage.

Inmarsat Acquisition (2023):

Expanded Viasat’s presence in mobility and underserved markets, solidifying global dominance in secure satellite services.

🛡️ Government Strength

Trusted provider to U.S. military & intelligence agencies.

Backed by multi-year, high-margin defense contracts—offering stability and innovation runway.

📱 Direct-to-Device (D2D) Frontier

New Equatys JV with Space42 (Sept 2025) grants access to the largest coordinated satellite spectrum block.

Enables satellite-to-smartphone connectivity, targeting emerging markets where terrestrial broadband lags.

📈 Technical Outlook

Bullish bias above $26.00–$27.00.

Watching for a breakout toward $45.00–$46.00 in the coming quarters.

🛰️ Sector Context

The satellite communications space is heating up with rising demand for resilient, global connectivity. Viasat is strategically aligned to capture market share in both the defense-tech and consumer mobile broadband sectors.

🔍 Ticker: NASDAQ:VSAT

📅 Watch Dates: Oct 2025 (ViaSat-3 F2 Launch), Sept 2025 (Equatys D2D Partnership)

📊 Sector: Satellite Communications / Defense / Broadband

Is the Future of Warfare Already Here?AeroVironment (NASDAQ: AVAV) has transformed from a niche drone provider into a critical enabler of modern asymmetric warfare, capitalizing on a fundamental shift in military doctrine. The company's unprecedented growth marks a new era in which small, intelligent, and cost-effective unmanned systems are increasingly dominating traditional, asset-heavy military strategies. This transformation has been catalyzed by real-world validation in the Russia-Ukraine conflict, which has served as a live-fire laboratory demonstrating the strategic utility of low-cost, attritable unmanned systems. The U.S. Department of Defense has responded with initiatives like Replicator, designed to deliver thousands of autonomous systems at unprecedented scale, creating a perfect alignment with AeroVironment's core competencies.

The technological evolution driving this market shift centers on artificial intelligence and machine learning integration. AeroVironment's systems, including the P550 and Red Dragon loitering munitions, represent a strategic leap from manual operation to semi- and fully autonomous capabilities. These AI-enabled systems have proven their battlefield effectiveness, with autonomous navigation raising target engagement success rates from 10-20% to an impressive 70-80% by eliminating vulnerabilities to jamming and human error. The company's adoption of the Modular Open Systems Approach (MOSA) design philosophy allows warfighters to reconfigure systems in under five minutes, creating unprecedented tactical flexibility. This shift from hardware-centric to software-defined platforms enables "evolutions at the speed of software and warfare," positioning AeroVironment at the forefront of defense innovation.

AeroVironment's financial performance validates this strategic positioning, with fiscal year 2025 delivering record revenue of $820.6 million—a 14% year-over-year increase. The Loitering Munition Systems segment surged over 83% to a record $352 million, while record bookings of $1.2 billion and a funded backlog that nearly doubled to $726.6 million provide clear indicators of sustained future revenue. The transformative $4.1 billion all-stock acquisition of BlueHalo in May 2025 diversifies the company's portfolio across air, land, sea, space, and cyber domains, creating a combined entity expected to deliver over $1.7 billion in revenue with enhanced capabilities in counter-UAS, directed energy, and cyber warfare.

The company's competitive moat extends beyond financial metrics to encompass a robust intellectual property portfolio built on decades of aerospace innovation. From pioneering human-powered aircraft to solar-powered prototypes, AeroVironment has consistently achieved industry "firsts" that now translate into specialized patents covering critical capabilities, such as the "wave-off feature" for loitering munitions and enhanced frequency hopping technologies. With continuous R&D investment exceeding $94 million annually and a hybrid "buy-or-build" innovation strategy, the company maintains its technological edge in a rapidly evolving sector. While the high forward P/E ratio of 76.47 may concern some investors, the underlying business fundamentals—evidenced by record bookings, growing backlog, and transition to stable programs of record—justify the premium valuation for a company uniquely positioned to capitalize on the future of warfare.

How Does One Platform Navigate Eight Global Disruptions at Once?GitLab has emerged as a dominant force in the DevSecOps landscape during 2025, achieving a remarkable 29% year-over-year revenue growth to reach $759 million annually in fiscal Q4 2025. The platform's success stems from its ability to address multiple converging global challenges simultaneously, from geopolitical tensions and cybersecurity threats to economic volatility and technological transformation. Key milestones include GitLab Dedicated for Government earning FedRAMP Moderate authorization, enabling accelerated public sector adoption, and strategic partnerships like Sigma Defense's implementation that reduced U.S. Navy software deployment times from months to days.

The convergence of geopolitical and geostrategic factors has created unprecedented demand for GitLab's solutions. Rising data sovereignty requirements and U.S.-China tech rivalries have driven nations to enforce strict data residency laws, making GitLab's single-tenant SaaS architecture particularly attractive for compliance. Defense contractors and government agencies increasingly rely on GitLab's integrated DevSecOps capabilities to strengthen national security positions, with organizations like Sigma Defense achieving 90% cost reductions while dramatically accelerating vulnerability fixes and software deployment cycles.

Economic pressures and technological evolution have further accelerated GitLab's adoption across sectors. The platform delivers a compelling ROI of 483% within three years for large organizations, while the broader DevOps market grows at a 19.1% CAGR. GitLab's integrated approach addresses critical pain points, including toolchain consolidation, embedded security, and AI-powered automation, positioning it as essential infrastructure for cloud-native development. The company's strategic focus on eliminating silos through unified workflows from code to cloud has resonated particularly well with enterprises seeking to reduce complexity and operational costs.

Looking ahead, GitLab's intellectual property strategy and continued innovation in AI integration, exemplified by GitLab Duo's capabilities in code generation and vulnerability detection, suggest sustained competitive advantages. The platform's ability to serve diverse sectors-from federally-funded research centers requiring secure collaboration to high-tech firms demanding cutting-edge automation-demonstrates its versatility in addressing the complex, interconnected challenges defining the modern technology landscape.

Nano Nuclear (NNE) –Powering the Future of Clean U.S. Energy 🇺sCompany Snapshot:

Nano Nuclear Energy NASDAQ:NNE is a pioneering U.S.-based microreactor company developing compact, modular nuclear power solutions for defense, medical, and national grid applications.

Key Catalysts:

Nuclear Innovation Meets Energy Independence 🔌

NNE is at the forefront of advanced nuclear tech, supporting America’s push toward energy resilience and decarbonization.

Its microreactors are designed for fast deployment, critical for defense bases, hospitals, and remote power needs.

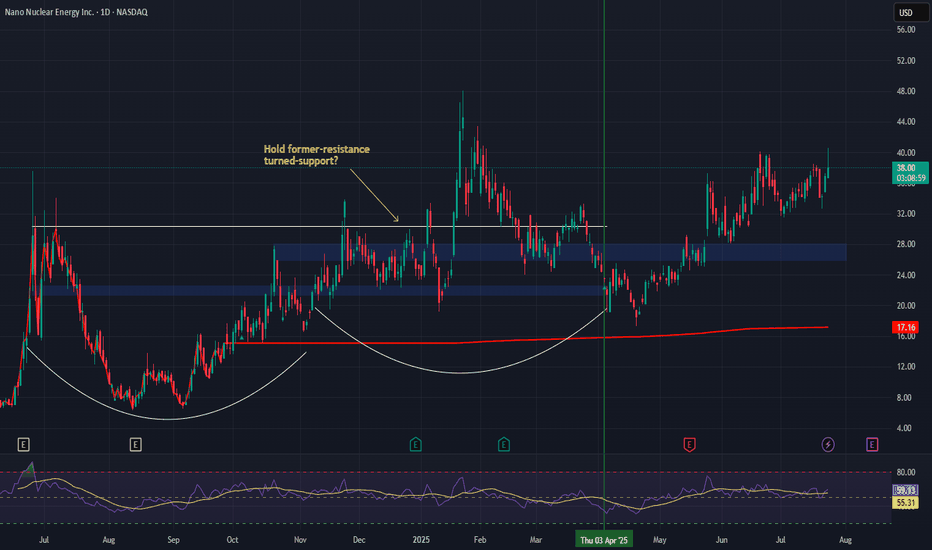

Strong Market Momentum 📈

Since our initial entry on April 3rd, NNE has surged 74%, reflecting rising investor interest in nuclear solutions.

After printing a higher high, the stock is pulling back toward a key support zone.

Policy & Investor Tailwinds 📊

U.S. energy policy is increasingly focused on nuclear as a clean base-load source, giving NNE a strategic edge.

Growing institutional attention on microreactors as scalable, next-gen energy infrastructure.

Investment Outlook:

Bullish Entry Zone: $26.00–$27.00

Upside Target: $58.00–$60.00, supported by innovation, policy alignment, and long-term energy demand.

🔆 NNE is shaping up as a high-conviction play on America’s nuclear energy future.

#NNE #NuclearEnergy #Microreactor #CleanEnergy #EnergySecurity #DefenseTech #GridStability #Innovation #GreenEnergy #NextGenPower #EnergyIndependence

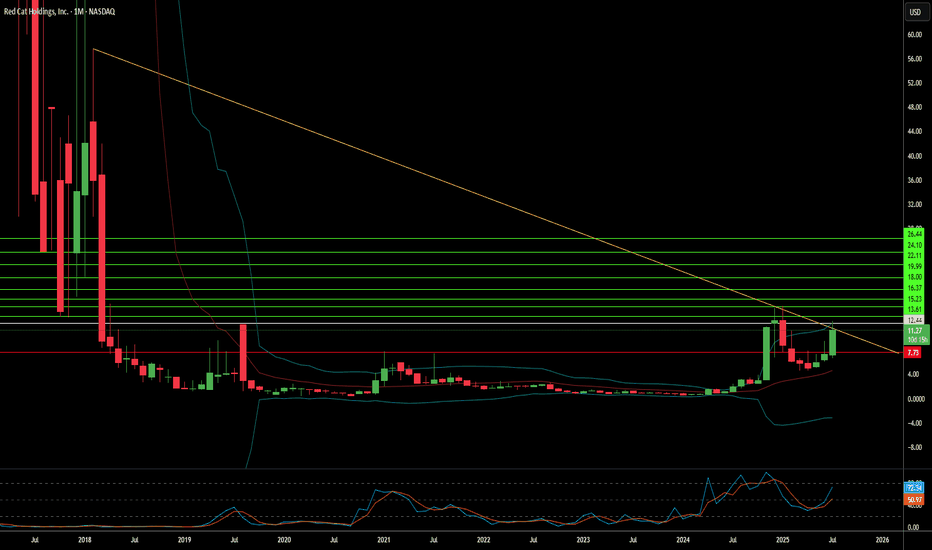

Is Red Cat Holdings a Drone Industry Maverick?Red Cat Holdings (NASDAQ: RCAT) navigates a high-stakes segment of the burgeoning drone market. Its subsidiary, Teal Drones, specializes in rugged, military-grade uncrewed aerial systems (UAS). This niche positioning has attracted significant attention, evidenced by contracts with the U.S. Army and U.S. Customs and Border Protection. Geopolitical tensions, particularly the escalating demand for advanced military drone capabilities, create a favorable backdrop for companies like Red Cat, which offer NDAA-compliant and Blue UAS-certified solutions. These certifications are critical, ensuring drones meet stringent U.S. defense and security standards, differentiating Red Cat from foreign competitors.

Despite its strategic positioning and significant contract wins, Red Cat faces considerable financial and operational challenges. The company currently operates at a loss, with a net loss of $23.1 million in Q1 2025 against modest revenues of $1.6 million. Its revenue projections of $80-$120 million for 2025 underscore the lumpy nature of government contracts. To bolster its capital, Red Cat completed a $30 million equity offering in April 2025. This financial volatility is compounded by an ongoing class action lawsuit. This lawsuit alleges misleading statements regarding the production capacity of its Salt Lake City facility and the value of its U.S. Army Short Range Reconnaissance (SRR) program contract.

The SRR contract, which could involve up to 5,880 Teal 2 systems over five years, represents a substantial opportunity. However, the lawsuit highlights a significant discrepancy, with allegations from short-seller Kerrisdale Capital suggesting a much lower annual budget allocation for the program compared to Red Cat's initially intimated "hundreds of millions to over a billion dollars." This legal challenge and the inherent risks of government funding cycles contribute to the stock's high volatility and elevated short interest, which recently exceeded 18%. For risk-tolerant investors, Red Cat presents a "moonshot" opportunity, contingent on its ability to convert contract wins into sustainable, scalable revenue and successfully navigate its legal and financial hurdles.

Can Ondas Holdings Redefine Defense Tech Investment?Ondas Holdings (NASDAQ: ONDS) is carving a distinct path in the evolving defense technology landscape, strategically positioning itself amid escalating global tensions and the modernization of warfare. The company’s rise stems from a synergistic approach, combining innovative autonomous drone and private wireless network solutions with shrewd financial maneuvers. A pivotal partnership with Klear, a financial technology firm, provides Ondas and its growing ecosystem with non-dilutive working capital. This off-balance-sheet financing mechanism is crucial, enabling rapid expansion and strategic acquisitions within the capital-intensive defense, homeland security, and critical infrastructure sectors without shareholder dilution.

Furthermore, Ondas's American Robotics subsidiary, a leader in FAA Type Certified autonomous drones, recently cemented a strategic manufacturing and supply chain partnership with Detroit Manufacturing Systems (DMS). This collaboration leverages U.S.-based production to enhance scalability, efficiency, and resilience in delivering American Robotics' advanced drone platforms. This domestic manufacturing focus aligns seamlessly with initiatives like the "Unleashing American Drone Dominance" executive order, which aims to bolster the U.S. drone industry, fostering innovation while safeguarding national security against foreign competition.

The company's offerings directly address the paradigm shift in modern warfare. Ondas's private industrial wireless networks (FullMAX) provide critical secure communication for C4ISR and battlefield operations, while its autonomous drone solutions (like the Optimus System and Iron Drone Raider for counter-UAS) are integral to evolving surveillance, reconnaissance, and combat strategies. As geopolitical instabilities intensify, driving unprecedented demand for advanced defense capabilities, Ondas’s integrated operational and financial platform is primed for significant growth, attracting considerable investor interest with its innovative approach to capital deployment and technological advancement.

Is BigBear.ai the Next Titan of Defense AI?BigBear.ai (NYSE: BBAI) is emerging as a significant player in the artificial intelligence landscape, particularly within the critical national security and defense sectors. While often compared to industry giant Palantir, BigBear.ai carves its niche by intensely focusing on modern warfare applications, including guiding unmanned vehicles and optimizing missions. The company has recently garnered considerable investor attention, evidenced by its impressive 287% rally over the past year and a notable surge in public interest. This enthusiasm stems from several key factors, including a substantial 2.5x increase in backlog orders to $385 million by March 2025 and a significant ramp-up in research and development spending, signaling robust foundational growth.

BigBear.ai's technological prowess underpins its rising profile. The company develops sophisticated AI and machine learning models for diverse applications, from facial recognition systems deployed at major international airports like JFK and LAX to AI-augmented shipbuilding software for the U.S. Navy. Its Pangiam® Threat Detection and Decision Support Platform enhances airport security by integrating with advanced CT scanner technology, while its ConductorOS platform facilitates secure communication and coordination for drone swarm operations under the U.S. Army's Project Linchpin. These cutting-edge solutions position BigBear.ai at the forefront of AI-driven advancements crucial for evolving geopolitical landscapes and increasing defense AI investments.

Strategic collaborations and a favorable market environment further fuel BigBear.ai's ascent. The company recently formed a significant partnership in the UAE with Easy Lease and Vigilix Technology Investment to accelerate AI adoption across key industries like mobility and logistics, marking a major step in its international expansion. Additionally, multiple contracts with the U.S. Department of Defense, including those for J-35 fleet management and geopolitical risk assessment, underscore its vital role in government initiatives. While BigBear.ai faces challenges, including revenue stagnation, escalating losses, and stock volatility, its strategic market position, growing backlog, and continuous innovation in mission-critical AI solutions present a compelling high-risk, high-reward investment opportunity in the burgeoning defense AI sector.

American Superconductor–Powering the Future of Energy & Defense Company Overview:

NASDAQ:AMSC is at the intersection of three megatrends: grid modernization, clean energy, and military innovation. With proprietary high-temperature superconducting (HTS) technology and a growing portfolio of energy and defense solutions, the company is moving from niche player to strategic infrastructure enabler.

🔑 Growth Catalysts:

📈 Grid Modernization & NWL Acquisition

Grid segment revenue +56% YoY in Q3 2024, accelerated by NWL integration

NWL expands footprint in grid-scale capacitors, transformers, and military-grade systems

Heightened U.S. focus on grid resiliency due to aging infrastructure and climate pressures

🌬️ Renewable Energy Tailwinds

Wind segment grew +58% YoY, bolstered by demand for advanced turbine control systems

Aligns with global decarbonization and offshore wind investment

🛡️ Defense Expansion

HTS tech used in shipboard systems, degaussing solutions, and high-power electronics

NWL opens doors to increased DoD contracts amid rising national security budgets

🔁 Recurring Revenue & Policy Support

Shift toward long-term service and tech licensing agreements

Backed by U.S. energy and defense spending, including DOE and DOD initiatives

📊 Fundamental Highlights:

Lean balance sheet and operating leverage

Strong YoY revenue acceleration across all segments

Diversified exposure to energy, defense, and renewables

📈 Investment Outlook:

✅ Bullish Above: $21.00–$22.00

🚀 Upside Target: $38.00–$40.00

🎯 Thesis: With breakthrough superconducting tech, strategic acquisitions, and bipartisan support for energy security, AMSC is emerging as a small-cap innovator in critical infrastructure.

#AMSC #GridModernization #DefenseTech #Renewables #Superconductors #EnergyResilience #CleanTech