Nasdaq 100 (NQ): Hyper-Extended Momentum – Breakout or Exhaust

Category: Trend Analysis / Support & Resistance

Ticker: NQ1! (CME)

Analysis:

We are looking at the Nasdaq 100 Futures (NQ1!) on the 1H timeframe using the Dynamic Support & Resistance (DSRTL) system. The market is currently displaying a textbook example of a high-momentum breakout that has pushed into statistical extremes.

Here is the breakdown of the current technical landscape based on the indicator's Matrix Logic:

1. The "Hyper Extension" State (S1 / D1)

The indicator’s dashboard has triggered a "HYPER EXTENSION" alert. This specific state occurs when two conditions are met simultaneously:

• Static Breakout (S1): Price has cleared the horizontal resistance structures (indicated by the volume clusters).

• Dynamic Overextension (D1): Price has pierced above the upper limit of the dynamic trend channel (the purple trendlines).

2. Bias: Extreme Bullish

The current bias is rated as "Extreme Bullish". The trend is undeniably strong, confirmed by the positive Volume Delta (+965) shown on the dashboard. The price action is aggressive, creating a steep angle of ascent that has moved away from the mean.

3. The Warning Signal: Exhaustion Risk

While the trend is up, the system issues a cautionary note: "Exhaustion Risk. Trail stops."

In technical terms, when price action moves into "D1" (Dynamic Overextension), it indicates that the asset is trading significantly above its standard deviation or channel geometry. Historically, markets often seek mean reversion or consolidation after such rapid expansions to sustain the trend.

Key Levels to Watch:

• Dynamic Support (Immediate): The top of the purple channel (approx. 25,220) acts as the first layer of defense. A retest of this level is common after a breakout.

• Static Support (Structural): The breakdown level of the previous resistance, now turning into support around the 24.95K region.

Scenario Conclusion:

This is a pure momentum play. Traders should be aware that while the path of least resistance is up, the probability of a "snap-back" or consolidation increases the further price stretches above the dynamic channel. This is not a signal to short the trend immediately, but rather a signal to manage risk tightly on existing long positions.

Disclaimer: This analysis is for educational purposes only and explains the logic of the DSRTL technical indicator. It does not constitute financial advice.

Demandandsupplyzones

Support and Resistance in Crypto: Why They Work1. Introduction

Every trader has heard of support and resistance. They are the most common levels drawn on charts, and for good reason: markets consistently react to them.

But what makes these levels so powerful? Why do millions of traders watch them and why does price often respect them?

Support and resistance are not magic. They are simply psychological levels, supply and demand zones, and self-fulfilling expectations all converging.

2. Defining Support and Resistance

Support: A price level where demand is strong enough to stop price from falling further. Traders buy here, creating a “floor.”

Resistance: A price level where selling pressure outweighs demand, stopping price from rising further. Traders sell here, creating a “ceiling.”

Think of them as zones, not exact lines. Markets are messy, and price often wicks through before reacting.

3. Why They Work: The Psychology

Support and resistance function because traders remember these levels:

Fear & Greed: Traders who missed buying at support wait for price to return. Sellers at resistance wait to “get out at breakeven.”

Anchoring: Once a level has reacted multiple times, more traders trust it.

Stop Placement: Traders often put stop losses beyond support/resistance, creating liquidity pools that attract price.

In short: these levels represent collective memory of the market.

4. The Supply and Demand Connection

Behind every level is a simple truth: markets move because of imbalances.

At support, buyers step in, creating excess demand.

At resistance, sellers dominate, creating excess supply.

5. Types of Support and Resistance

Not all levels are created equal. Common ones include:

Horizontal Levels – obvious highs/lows on the chart.

Trendlines – diagonal support/resistance following direction of trend.

Moving Averages – dynamic levels that act as support in uptrends and resistance in downtrends.

Psychological Round Numbers – like $1,000 or $2,000 on ETH, where traders naturally cluster orders.

6. How Traders Use Them

Support and resistance are used in multiple ways:

Entries: Buying near support, selling near resistance.

Exits: Taking profit at resistance, cutting loss below support.

Stop Loss Placement: Stops often go just below support or above resistance.

Breakouts: When resistance breaks, it can turn into new support (and vice versa).

7. Limitations and Traps

Support and resistance are not invincible.

False Breakouts: Price can wick beyond levels to trigger stops before reversing.

Changing Market Conditions: A strong support can fail in a new trend.

Overcrowding: When everyone sees the same level, liquidity hunts occur.

Good traders combine S/R with confirmation, volume, candlestick signals, or broader market context.

8. Closing Thought

Support and resistance work because markets are driven by human behavior and collective memory. They reflect where buyers and sellers previously fought and where they are likely to fight again.

But the real edge isn’t just knowing the levels. It’s knowing how to act when price reaches them, and how to manage risk if they fail.

BTCUSD on the 30m timeframe1. Trend Context

BTCUSD on the 30m timeframe remains in a clear downtrend, forming consistent Lower Highs and Lower Lows.

2. Key Zones

SZ (Supply Zone): 114,250 – 114,750. Origin of the strong selloff, major resistance if price retraces upward.

SR (Structure Reversal): 113,000 – 113,250. Previously marked a short-term structural shift, now likely to act as dynamic resistance.

DZ (Demand Zone): 111,200 – 111,750. Price is currently testing this zone, which serves as short-term support.

3. Trading Scenarios

If DZ holds, a short-term bounce toward SR is possible.

If price rejects at SR, it offers a favorable short setup in line with the prevailing downtrend.

If DZ breaks, the downtrend may extend with a target around 110,000 or lower.

Please like and comment below to support our traders. Your reactions will motivate us to do more analysis in the future 🙏✨

CARR: Demand Zone Confluence Points to Potential UpsideCARR’s chart is showing some very interesting price action setups. Let’s break it down step by step, moving from the higher timeframe to the lower timeframe for better clarity.

📊 Weekly Timeframe Analysis

On the weekly chart , price has approached a fresh demand zone . This zone stands out because:

It was created by a very strong leg-out candle , showing institutional strength.

The size and momentum of the move away from this level suggest it’s a high-quality zone .

🔎 Daily Timeframe Confluence

When we move down to the daily chart , the picture becomes even more convincing:

Price has halted exactly at the daily demand zone.

This daily zone is nested inside the weekly zone , giving a strong confluence.

The formation candle of this daily demand zone was a sharp move up, confirming quality.

The follow-through candle was a gap-up, showing aggressive buying interest.

The follow-through candle from the daily demand zone has broken the downtrend trendline . This is a strong achievement of this zone, making it very good.

🎯 Trading Plan Perspective 🎯

Currently, price is still trading inside the daily demand zone. This creates a potentially favorable risk-to-reward opportunity .

Wait for a clear sign of strength , such as a bullish candlestick pattern.

Enter a long trade once confirmation is seen.

Place your stop loss just below the demand zone.

Target at least a 1:2 risk-to-reward ratio .

“Opportunities don’t come every day in trading, but when price aligns across timeframes, it’s worth paying close attention.”

✨ Stay patient, follow your plan, and let the market come to you. 🚀

BTCUSD Short: Dump Of Supply ZoneHello, traders! The price auction for BTC has been operating within a large ascending channel, a structure defined by key pivot points that have established the 109500 demand area as support and the 113200 supply area as resistance. This bullish framework has guided the price through a series of higher highs and higher lows, confirming the buyer's initiative and the strength of the current uptrend.

Currently, the auction is at a critical inflection point at the top of this channel. The price has rallied to directly test the channel's ascending supply line, which forms a confluence of resistance with the horizontal 113200 - 113600 supply zone. This is a key area where sellers are expected to become active and challenge the prevailing bullish momentum.

The primary scenario anticipates a corrective move from these highs. The expectation is that sellers will defend the supply zone and reject the price, initiating a downward rotation back towards the channel's support line. A failure to break out higher would confirm a short-term correction is underway. The take-profit for this rotational play is therefore set at 110100 points, targeting a key liquidity area above the primary demand zone. Manage your risk!

How to Identify Support and Resistance in Markets with AnologyHello Friends,

Welcome to RK_Chaarts,

Today we are going to learn & understand real work of Supports and Resistances in markets,

and Market structure with very good examples (Educational Post)

The Market's Architecture: Support and Resistance

This is an excellent analogy for understanding two of the most worthful concepts in technical analysis: support and resistance. By thinking of the market as a multi-story building, we can visualize how price moves and what happens when it hits certain levels.

- The Core Analogy: The Building and the Elevator

- Imagine the market as a large building with many floors. The price of an asset (like a stock or a cryptocurrency) is like an elevator moving up and down within this structure. The floors and ceilings of the building are not physical barriers but represent specific price points that the market has collectively agreed upon as important.

- The Floor (Support)

The floor of a building provides a solid base and prevents the elevator from falling further. In the market, this is called a support level. A support level is a price point where buying pressure is strong enough to stop the price from declining. When the "elevator" (price) reaches the floor, it finds enough buyers to give it a lift, preventing a deeper fall. A strong support level is like a thick concrete floor—it has been tested multiple times and holds firm, showing that there is significant demand for the asset at that price.

- The Ceiling (Resistance)

- The ceiling of a building sets the upper limit for the elevator's movement on a given floor. This is the market's resistance level. A resistance level is a price point where selling pressure is strong enough to prevent the price from rising further. When the "elevator" hits the ceiling, it encounters a large number of sellers who are ready to take profits, pushing the price back down. A strong resistance level is like a low ceiling—the price hits it and retreats, indicating that many investors believe the asset is overvalued at that point.

Breaking Through: New Levels

The most dynamic part of the analogy is what happens when the elevator breaks through a floor or ceiling.

Breakout (Breaking the Ceiling):

When the price has enough momentum to push through the resistance level (the ceiling), it has essentially moved to a new, higher floor. This is a significant event. The old ceiling, which was previously a barrier, now becomes the new floor. This is a key trading principle: old resistance often becomes new support. The market has established a new, higher trading range, and if the price falls back to that level, it will likely find buyers there, who now see it as a good value.

Breakdown (Breaking the Floor):

Once if price falls from that floor (Support level) which is called as Breakdown in technical language, then lower floor can be the next stop for elevator (Next Support for price), The old floor, which once provided support, now becomes a new ceiling. This is the reverse principle: old support often becomes new resistance. If the price tries to rally back up, it will likely get stuck at this old support level, as it's now seen as a good place to sell.

Structural Integrity (Volume)

Think of market Volume like a construction team. When a lot of people are involved (high volume), the structure is stronger.

Imagine a ceiling in the market. If lots of buyers (high volume) break through it, that's like a robust construction team building a new floor. It's unlikely to collapse.

On the other hand, if sellers break through a floor with high volume, that's a strong sign they're serious about the downward move.

But if the volume is low, it's like a weak construction team. Even if they break through, the move might not last. It's like a flimsy wall that could easily be reversed.

So, volume gives us a sense of whether the market's moves are strong and reliable, or weak and likely to change.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

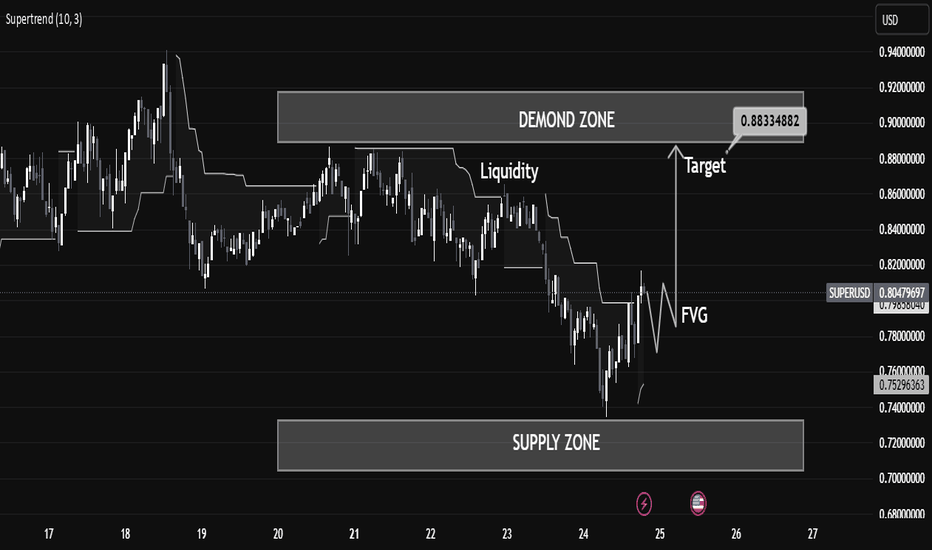

Smart Money Trap Identified! FVG + Liquidity Grab“Smart Money Trap Identified! FVG + Liquidity Grab Before Super USD Skyrockets to Target Zone ”

⸻

🧠 Technical Breakdown:

1. Liquidity Sweep (Manipulation Phase):

We see price aggressively sweep local liquidity around July 23, likely triggering stop-losses of early longs or breakout traders. This is a classic Smart Money trap, where big players induce volatility to grab liquidity before a move in the real direction.

2. Fair Value Gap (FVG):

A clear bullish FVG (imbalance) has formed post-liquidity grab, suggesting a potential institutional entry zone. This imbalance typically acts as a magnet for price and an entry point for Smart Money after manipulation.

3. Demand Zone & Target Projection:

• Price is now reacting from a well-defined Demand Zone, with clear rejection wicks indicating aggressive buying interest.

• The target zone (0.88334882) sits just below a previous supply zone, aligning with a potential distribution area where Smart Money may begin profit-taking.

4. Supertrend Indicator:

The supertrend has flipped bullish, confirming potential momentum shift, supporting the bullish bias as long as the FVG holds.

5. Confluence Factors:

✅ Liquidity Grab

✅ FVG Reaction

✅ Demand Zone Bounce

✅ Supertrend Confirmation

✅ High-Risk/High-Reward Entry Before Smart Money Run

⸻

🎯 Trade Idea (For Educational Purpose Only):

• Entry: On pullback into the FVG zone

• Stop Loss: Below the recent swing low or Demand Zone

• Target: 0.8833 (inside the upper supply/demand imbalance)

⸻

🧠 Educational Note:

This chart beautifully showcases how market makers operate — manipulate liquidity, fill imbalances, and target inefficiencies. Always think like Smart Money, not retail traders.

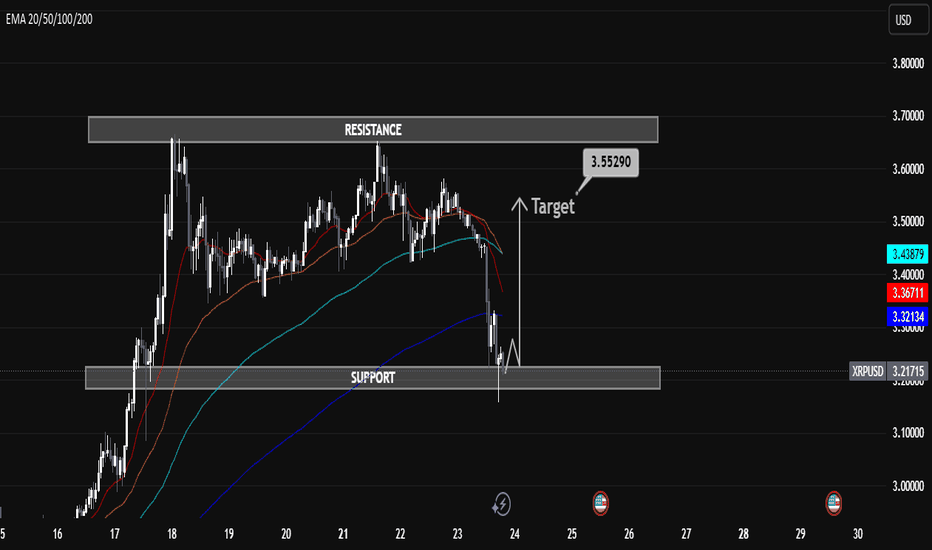

XRP/USD H1 Educational Market Analysis – Support-Based XRP/USD H1 Educational Market Analysis – Support-Based Long Opportunity

🔍 Structure Overview:

• Support Zone: $3.21 – $3.23

This level has acted as a strong liquidity pool and base for past bullish moves. Price has tapped into it, showing signs of potential demand returning.

• Resistance Zone: $3.65 – $3.70

Acts as a key supply zone, where previous bullish attempts failed. Targeting this area after a rebound is technically sound if structure confirms.

⸻

🔄 Price Action Insights (H1):

• Price broke down through EMAs (20/50/100/200), confirming short-term bearish pressure.

• A rejection wick from support hints at possible absorption of selling pressure.

• If price forms a higher low structure above $3.25 and reclaims EMAs, a potential bullish reversal may unfold.

⸻

🧠 Educational Note:

• H1 charts are ideal for intraday strategies, and this structure provides a clear example of:

• Support-resistance dynamics

• The use of EMAs as trend confirmation tools

• Reversal vs. continuation setups

⸻

🎯 Intraday Bullish Scenario:

• If price holds above $3.21 and breaks above the $3.40 (EMA cluster), bulls may push toward the $3.55290 target.

• This level aligns with the mid-range of the resistance zone, offering scalp-to-swing potential.

⸻

🚫 Bearish Risk:

• Failure to hold $3.21 could lead to a deeper correction toward $3.10 or even $3.00.

• Confirmation of bearish continuation would be a lower high rejection from EMAs without reclaiming them.

⸻

📌 Summary:

On the H1 chart, XRP is at a critical support. Watch for a clean bounce and break above EMAs for a move toward $3.55. However, losing $3.21 could attract further downside. Use price action confirmation before entries.

MARA supply and demand; swing tradeI'm looking at the weekly chart here, we have an interesting zone between 14.00$ and 14.68$. We've had decent amount of price action correlating to the areas going back to December of 2020. I set my trade idea with a stop loss at 12.95$ just in case of a liquidity flush , we're still getting at least a 3.5 to 1 ratio, with 2 other targets. This could take till May 2026 to conclude, would consider this a swing trade so could take months or more.

ABCD PatternGHNI Analysis

Closed at 738.08 (04-07-2025)

Monthly Closing above 648 would be

a positive sign.

784 - 785 is the Resistance for now.

It has the potential to touch 1000 - 1100

if it Crosses & Sustains 785 with Good Volumes.

On the flip side, 680 - 682 & then 657 - 660 may

act as a Support.

Profit taking on Netflix for the summer, only to buy in lowerNASDAQ:NFLX is still in a strong high time frame uptrend, I'm not saying the stock has turned bearish overall, however profits need to be taken when trading and this is one of those times.

I'd prefer to buy back in closer to $1,000 if possible though either way I'll keep 33% of my stack.

EURAUD (BOS + IMB + OTE)Hello traders!

Description: We have STB(Sell to Buy Action) - you can see it on 1H TF, which grab some liquidity and then made BOS. In this moment we can expect that price comeback to 0.5 and then i will look reversal on LFT, after closing IMB.

Entry: Confirmation on LTF in POI. Alarm on 0.5 Fib Level.

Target: HH

P.S: check also previous idea. We still have valid Demand on LTF.

Have a profitable day and don't forget to subscribe for more updates!

If you like this idea drop a like, leave a comment or write your pair, i will check.

EURNZD (BOS + DEMAND + 705 FIB LEVEL)Hello traders!

Description: Now we already in demand + check RSI)))

Entry: Confirmation on LTF in POI

Target: TILL problem zone.

P.S: check also previous idea.

Have a profitable day and don't forget to subscribe for more updates!

If you like this idea drop a like, leave a comment.

EURAUD (BOS 1H + DEMAND + OTE)Hello traders!

Description: Now we already in 0,5 of fib level, price want to close imb and mitigate demand + 705 OTE in case BOS 1H.

Entry: Confirmation on LTF in POI

Target: New HH

P.S: check also previous idea.

Have a profitable day and don't forget to subscribe for more updates!

If you like this idea drop a like, leave a comment.

Accumulation in BANKNIFTY? a rally to 60,000 in near future?Bank Nifty has completed its range of accumulation and is headed for a rally to approx. target of 60k (most likely in strength by this quarter).

The Index was in Spring pad at 13th March,

Broken the Stride at 18th March

24th March was entering into the accumulation zone again in strength,

this all started with a Preliminary Climax price texture on 4th June, followed by a buying climax on 27th June, then an automatic reaction largest to its other price texture which completed on 6th August

a Terminal shakeout from 6th Jan to 11th March, Volume is Increasing on Rallies and reducing on Reactions

A Potential Target of 60,000 is on Cards, won't be surprised if this happens in the coming 2 months too

#TITANCOMPANY Demand ZoneTitan Company Limited, a leading Indian consumer goods company, is primarily known for its watches, jewelry, eyewear, and other lifestyle accessories. The concept of a "demand zone" for Titan Company can be analyzed across various dimensions, including market demand, product portfolio, distribution channels, and customer engagement strategies.

XRP BEFORE & AFTER@XRP Weekly-Monthly Analysis / Retracement...Weekly - Monthly trend: Bearish

Chart Pattern: Head & Shoulders (H&S) - Bearish Continuation Pattern

Bearish Candlesticks signals:

HANGING MAN (Bearish, Single Candlestick pattern) / Weekly Timeframe / 09 DEC 2024

BEARISH ENGULFING (Bearish, Double Candlestick pattern)/ weekly Timeframe / 27 JAN 2025

TWEEZER TOP (Bearish, Double Candlestick pattern) / 1 Day timeframe / 20 FEB 2025

FALLING THREE METHODS (Bearish, five-fold Candlestick pattern) / 1 Day timeframe / 07 MAR 2025

Retracement Fib Price Levels:

0.00% (3.4000)

23.60% (2.6879)

38.20% (2.2474)

50.00% (1.8914)

61.80% (1.5353)

78.60% (1.0284)

100.00% (0.3827)

Good prices for buy (the lower the better):

61.80% (1.5353) – Golden Zone / Golden Pocket

78.60% (1.0284) – Entry Zone

Between 78.60% (1.0284) and 100.00% (0.3827) is the Risk Zone, which we have the Neckline of the ‘’ Quadruple Bottom Pattern ‘’ at the price range ‘’ 0.6291 – 0.7850 ‘’

I am having buy limit at 0.78500 on the neckline of ‘’ Quadruple Bottom Pattern ‘’.