DENT/USDT – Major Accumulation Phase at Critical Support!Main Structure

On the weekly timeframe, DENT/USDT shows a prolonged bearish trend since 2021, followed by a long sideways accumulation phase from 2022 until today. Price is now sitting again at the critical historical support zone (0.00042 – 0.00063), a key “basement” level where buyers have repeatedly stepped in.

Key resistance levels:

0.00097 → first pivot resistance

0.00150 → psychological resistance, early trend confirmation

0.00194 → major validation of bullish reversal

0.00374 – 0.00466 → strong historical resistance, mid-term target

0.00734 – 0.01716 → long-term reversal targets

---

📈 Bullish Scenario

1. Rebound from Basement Support

Holding above 0.00042 – 0.00063 would confirm an accumulation / double bottom structure.

A weekly close above 0.00097 with strong volume would be the first bullish confirmation.

2. Upside Targets

Target 1: 0.00150 (+100% from current price)

Target 2: 0.00194

If momentum sustains, the move could extend to 0.0037 – 0.0046

3. Additional Confirmation

Look for volume spikes on breakout.

Watch RSI for potential bullish divergence on new lows.

---

📉 Bearish Scenario

1. Breakdown of Key Support

A weekly close below 0.00042 would invalidate the 2-year accumulation base.

This could trigger new lower lows and potentially a capitulation phase.

2. Bearish Consequences

Longs near the basement may face large stop-loss triggers.

Market could enter a deeper consolidation or distribution zone.

---

🔍 Price Structure & Pattern

Range-bound Accumulation: DENT has moved sideways for almost 3 years, forming a potential base.

Lower Highs: Macro structure remains bearish until a weekly higher high above 0.00194 is confirmed.

Critical Zone: The 0.00042 – 0.00063 range is the “life support” for bulls. A breakdown would flip sentiment to strongly bearish.

---

🎯 Conclusion

DENT is at a make-or-break level:

Bullish case: Holding the basement support could trigger a strong rebound, especially above 0.00097, with targets toward 0.00150 and 0.00194.

Bearish case: A breakdown below 0.00042 ends the multi-year accumulation and risks deeper lows.

For traders, risk management is essential:

Aggressive entries can be taken near support with tight stops.

Conservative traders may wait for confirmation above 0.00097 or 0.00150.

---

#DENTUSDT #DENT #CryptoAnalysis #Altcoins #Accumulation #SupportResistance #BullishScenario #BearishScenario #CryptoTrading

Dentanalysis

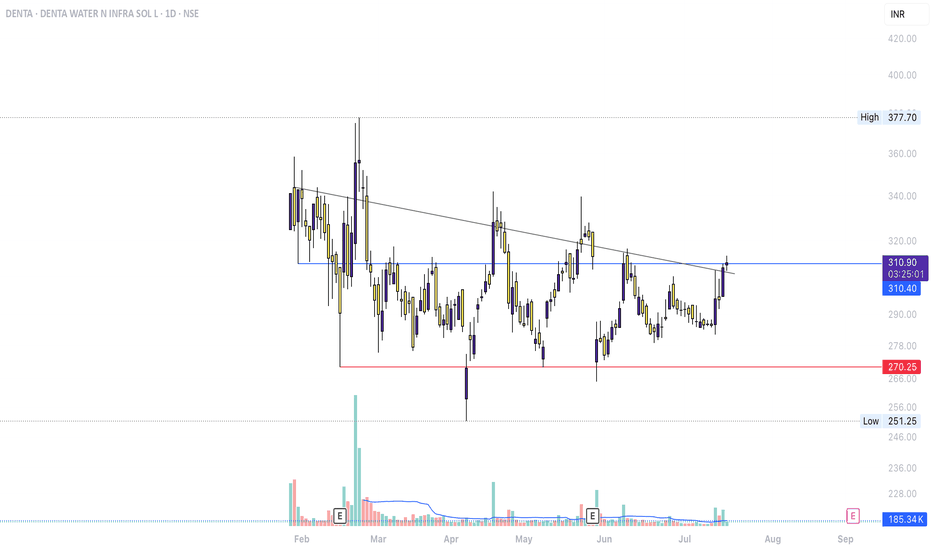

DENTA – SMC & Breakout Structure Analysis (Jul 2025)Accumulation/Distribution: Long consolidation near ₹270–₹311

Break of Structure (BOS): Trendline breakout + recent close above prior top

Neutral toward Bullish: Awaiting volume and price action confirmation to validate trend shift

1. Defined Range Structure

Support ~₹270 (red line) holding over 4+ months

Resistance ~₹311–₹315 (blue line) tested multiple times before today

2. Possible Breakout Attempt

Price has breached the descending trend line—an early mark of bullish structure shift

Close is marginally above resistance, but lacks volume confirmation for breakout validation

3. Volume & Confirmation

No substantial volume spike yet—breakouts typically require accompanying volume

Watch for multi-session closes above ₹315 with sustained volume to support continuation

4. Pullback as an Opportunity

Retracing into ₹305–₹310 could form a higher-low

Such a move would align with healthy trend behavior, offering clearer structure and stronger validation