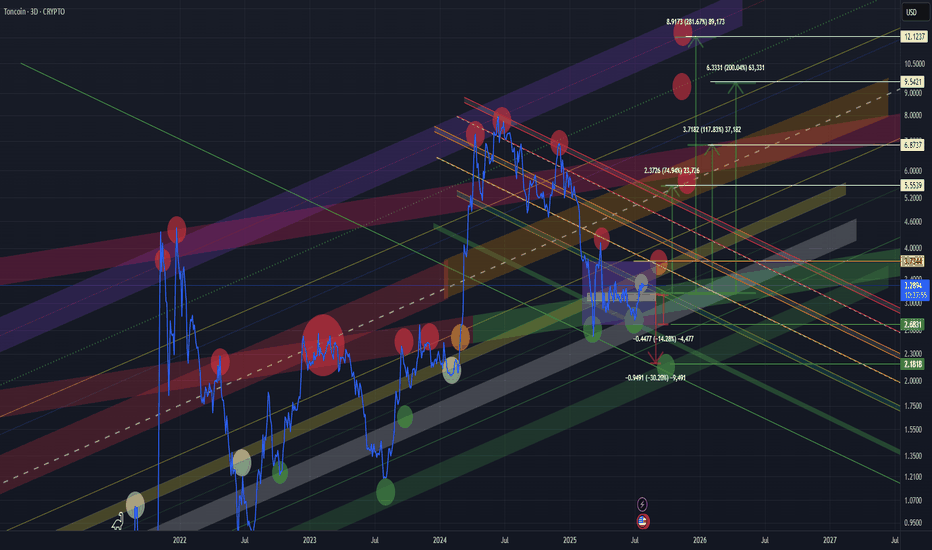

TONUSD TONUSDT TONCOIN mid- to long-termIn my view, we are still in the accumulation phase. The current price action and reactions at key levels suggest ongoing accumulation.

🔻 Bearish Scenarios:

In the short term, a retest of the lower boundary of the accumulation zone (purple box) is possible if the market weakens.

The worst-case scenario would be a move down to the lower green support zone, which has historically triggered strong bullish reactions. This is a critical demand area.

🔼 Bullish Scenarios:

A confirmed breakout and hold above the white line (within the purple box) would signal strength and a potential move higher.

We would then likely see a retest of the upper boundary of the accumulation zone.

A breakout and consolidation above the yellow line would open the door for a move toward the wider yellow channel, which could act as a final target zone

🚨 High-Risk Zone:

The yellow channel might represent the final phase of the current move.

From there, we could see either a sharp correction

Or, if trend strength and macro conditions allow, a continuation towards a new ATH (purple line).

📌 📌 📌 :

All marked lines and zones represent key support and resistance levels.

Price reaction at these areas will be crucial for decision-making.

As always, risk management and trend confirmation are essential.

Durov

TON Main trend 16 03 2025Logo of rhymes. Gann fan for understanding the logic of trend development and dynamic levels of support and resistance.

Time frame 1 week, for full orientation in the trend and potential targets. Key price reversal zones on which the trend development depends are shown with arrows. Conservative and adequate targets in the medium and long term. Everything above, as for me, should not worry you much, but this is purely my opinion, nothing more.

🟡 Pay attention how clearly the percentages of large triangles and time reversal zones are worked out according to the algorithm. Someone who is far from trading says that TA does not work on cryptocurrency.

TA is a banal logic, an exchange algorithm (you need to be tied to something), real supply/demand (market participants) and manipulative supply/demand, that is, large market participants (exchanges, funds, creators).

In the development of the trend, there is a fractal behavior of the price in the trend at the moment. Perhaps this logic will continue. The secondary, downward trend formed a wedge-shaped formation, as before.

1 day time frame

🟣 Currently locally an aggressive buyback is taking place (probably, as an excuse for the price movement, some positive news was released) from the dynamic support of the fan (on the 5-minute time frame, after the impulse-buyback, a bullish triangle was formed in consolidation, and now its goals are being realized). If after a rollback on the senior time frame (1 day, 1 week) this zone is preserved - a reversal of the secondary trend. At the moment, the price is moving within the wedge canvas, locally there is a complete absorption of the bearish candle on the weekly time frame.

🔴 Also, if there is a test of this reversal zone (less likely) , then the price can consolidate according to the logic of the descending wedge. Price consolidation, especially not overcoming the dynamic former fan support on a repeated retest — a decline to begin with to the median (red dotted line) of the range. On the chart you will see an "illogical" head and shoulders. This is an extremely unlikely scenario, but I will describe it just in case, so that you take this into account in your money management (not risk management).

DOGS token price for mid-term and expected targets for this yearthis is my new idea for this token

Unfortunately, things went worse than expected, and the bull season was delayed from normal, but let's look positively and remember that patience is the key

half a cent to 1 cent is the decent target for this token in the mid-term for this year

But there is a possibility of the price falling to the level of 0.00017 first

Good Luck.

Taking a Long Position in TONUSDTAfter thorough analysis, I’ve decided to take a long position in TONUSDT, as the market currently aligns with all my key criteria for entry.

Here’s what I see:

1. Bollinger Bands indicate a potential bounce, as the price is trading near the lower band, suggesting oversold conditions.

2. Moving Averages (MA) have provided additional confirmation, showing support at the current levels.

3. Support Lines are holding steady, and current market conditions suggest a favorable environment for a potential upward move.

Given these factors, I believe this is a good opportunity to enter the market.

Position Details:

• Margin: $30

• Leverage: Cross setup

• Total Position Size: $453

Risk Level:

This trade is classified as medium risk, considering the current market volatility and the use of cross margin.

Why TON?

The fundamentals and technicals for TON look promising. The market has shown resilience even in challenging conditions, and the alignment of indicators makes this setup particularly appealing.

As always, proper risk management is key. Let’s see how this plays out!

What’s your take on TON right now? Share your thoughts

$TON large-scale trafficTON ends the accumulation phase after negative events related to Telegram and Pavel Durov. The court ruling on the Telegram case will be issued soon, which will undoubtedly have a positive impact on TON's price. The TON ecosystem continues to thrive and receive more and more projects. Creating tappable coins like NOT and others untie the hands for manipulators, as it is a transparent system for raising funds for the project, as well as a simple consensus. In the most positive scenario, I would stick to the plan as on the chart with the formation of 5 elliot waves as well as a trend change after consolidating above the 50 EMA. A number of hedge funds and market makers have also made big deals here. Get ready!

Horban Brothers!

TON Toncoin potential SelloffTelegram CEO Pavel Durov has been charged for failing to prevent extremist and illegal content on the messaging platform and placed under judicial supervision, according to the Paris prosecutor's office on August 28.

Durov must report to the police twice a week and is barred from leaving France, the prosecutor's office stated on X.

Parisian investigative judges have also ordered the Russian-born Telegram co-founder to post 5 million euros in bail.

Meanwhile, TON Toncoin is currently in a bearish falling wedge pattern, with a new price target of $3.9.

NOT/USDT: POTENTIAL FALLING WEDGE PATTERN! ACCUMULATE HERE!!Hey everyone!

If you're enjoying this analysis, a thumbs up and follow would be greatly appreciated!

NOT/USDT looks good here. It is forming a falling wedge-like structure in the daily time frame and currently hovering near the lower trendline of the wedge. It is a good area to accumulate some on the spot or with low leverage.

Entry range:- $0.0070-$0.0076

Target:- 150-200%

SL:- $0.006(For leverage)

What are your thoughts on NOT's current price action? Do you see a bullish pattern? Share your analysis in the comments below!

TON. We tend to see what we want to seeI believe in the long term future of TON blockchain. It has a developing ecosystem, Nice UI and foremost - its HUGE USERBASE (Telegram).

Do you remember, how Reddit's NFT marketplace overcame OpenSea within few months after its launch? The secret was its userbase. MAU of Telegram is twice as big as Reddit. Imagine what will it bring to the table. Imagine Ethereum had 800m users at the start of its crypto invasion.

It is just a matter of time, when they will launch a full scale advertisement to drive the mass adoption of their wallet and the use of the blockchain by average user. And I do believe they will start this campaign right before the actual Bull cycle start. At the moment when everyone will become interested in crypto again, somewhere around the BTC halving period.

Meanwhile, back to the chart: we've formed the very similar ascending triangle structure within the ascending channel, as it was earlier, but smaller. Not sure if we will go through the roof right now, i'm thinking we'll go down to the triangle support for the last time in September and up to the highs of the channel from there.

We tend to see what we want to see, don't we? Let's check how it will play out this time!