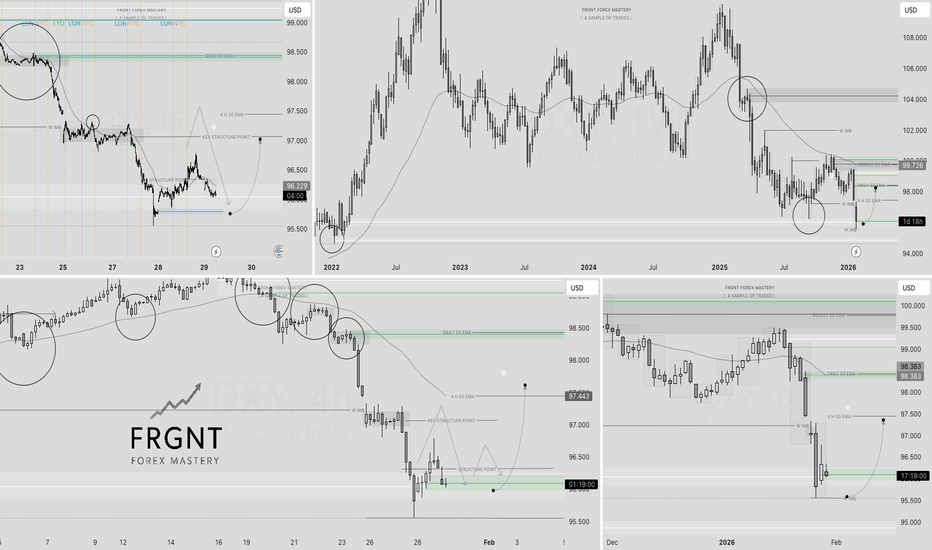

WIILL THE DXY CONTINUE SELLING OFF?📅 Q1 | W4 | D29 | Y26

📊 DXY — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

Dxyforecast

DXY BULLISH CASE OUTLOOKThe US Dollar Index (DXY) trades near 96 after dipping to multi-year lows, but the monthly chart shows strong bullish reversal potential.

Key Technical Points:

Decisive breakout above the 15-year descending trendline (from 2015 highs), invalidating the long-term downtrend. The old trendline now provides dynamic support around 94–95.

Price action forms an ascending channel projecting higher into 2027–2030, with targets toward 105–115 if momentum holds.

Recent oversold conditions (low RSI) and capitulation dips signal mean-reversion upside. Holding above 95–96 sets up rebounds to 98.80 resistance, then 100+ psychological levels.

Fundamental Drivers:

US economic outperformance persists vs. Europe/Japan, with yield advantages drawing capital inflows.

Geopolitical risks and safe-haven demand favor USD during global uncertainty.

Potential Fed hawkishness (sticky inflation, policy pauses) or fiscal stimulus/tariffs could sustain higher rates longer than expected.

Historical patterns show deep weakness often precedes strong recoveries, as seen post-2020.

Outlook:

Current consolidation near channel support is a buying setup. A hold above 95 targets 100 short-term and 110+ longer-term in a sustained uptrend. Risks include aggressive Fed cuts, but technical breakout and US resilience favor bulls on dips. The dollar's "decline" narrative looks premature—watch for rebound acceleration.

DXY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

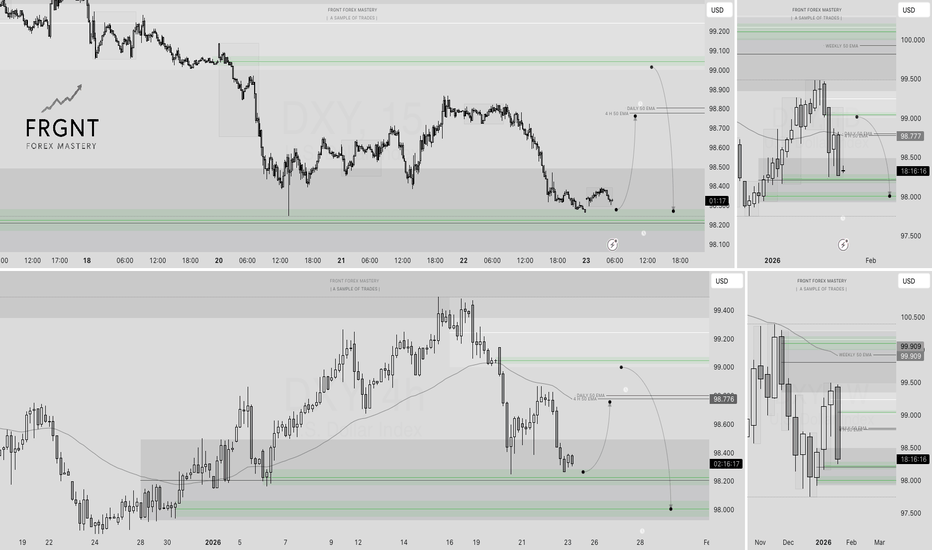

DXY — FRGNT DAILY CHART FORECAST. Q1 | W4 | D28 | Y26📅 Q1 | W4 | D28 | Y26

📊 DXY — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

DXY ANALYSIS 01.27.2026It's time to take a look at the DXY chart. It's been already 3 months after the last update on this index. You can check out what I was talking about at that moment, and we can see how the setup played out perfectly, if you have had any swing-positional trades on EUR/USD or GBP/USD, Congratz! I made enough tricky moves with exchanging money from EUR to USD and trading currency pairs also. Currenty, the falldown of DXY is ongoing, the DXY fell to the minimum level of 2022 in March. Ray Dalio recently published an article where he talks about the USA is in the latest stages of one of the biggest economy cycles, and unsustainable debt can lead to printing money process that can cause the deeper fall of USD. So in my opinion, it's still not the end, and we have still a lot of space for deep fall and I think we can even reach 90 points in near months. Thus, playing with long positions on EUR and GBP still makes sense, EUR/USD is already on 1.19 level. Also, taking into account different data on Bloomberg, most US traders keep betting on deeper selloff, and betting against a weaker dollar hits record premium. On top of that, the dollar's drop has been exacerbated by rumors the US government might be willing to team up with Japanese monetary policy in order to put a floor under the slumping yen. So it's not surpising why XAUUSD is hitting new all time high because traders and investors tend to allocate their funds to defensive assets and stocks in such market conditions due to high pressure on dollar.

DXY — FRGNT DAILY CHART FORECAST Q1 | W4 | D26| Y26📅 Q1 | W4 | D26| Y26

📊 DXY — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

DXY crossed very important line- is THIS why FED will Hold RatesAs we wait for the expexted Rate freeze decison by the FED on Wednesday, I thought it would be a good time to just remind ourselves of some Historical and yet not very often Mentoned FACTS.

The Principle thing to fully understand is that Rate Cuts DEVALUE the American Doller.

Simply put, The saved Doller returns less than it does when Rates are higher.

As we see from the chart above, Almost every single meaningful round of Rate cuts has led to the $ loosing Value.

The only 2 occasions where that did not happen was in the first 2 rounds after the American Doller got rid of Gold as a Backing in 1971.

The Rate cuts between May 1974 and October 1977 caused an ebb and Flow that ultimetly ended up with the $ worth slightly Less in 1977 than it was in 1974 but it had risen in that Time

And the Cuts in June 1981 to March 1983 did Nothing at all to curb the rise in Value of the $.

This was most likely due to the beginnings of Henrey Kissengers "Petro Doller".

But ever since then, as you can see on the Chart above, Rates FELL everytime Interest rates were Cut.

Infact, if you look, you will notice that from the point were Nikon anexed the $ from Gold,in 1971, there has only been ONE occasion where the $ has had the same value, or more, than it did that day.

Over all, the $ has LOST value, as the falling Trend line shows.

Note the Horizontal Dotted line that the $ bounced off over on the left side of the chart. The Base line.

In September 2006, the $ fell Below that line. and it continued falling untill, in 2008, the BANKS called it a day, Crashed the Markets, Wiped the slates clean, borrowed money off governments that it had once lent to and started again.

The Success of this move is seen in this chart below.

The Ever rising channel the $ has been in .......Till NOW......

The first round of Rate cuts since entering the rising channel were in 2019 - 2020 and had the effect of bringing the DXY back down to the lower trend line of that rising channel.

We entered the 2nd round of Rate cuts since 2008, in September 2024 and again, we see DXY PA being brought down to the lower trend line.

The problem is, DXY PA JUST FELL OUT OF CHANNEL, it has fallen through this line of support.

Further Rate Cuts would do what they always have down, devalue the $ and push the $ Deeper below this line.

Is the FED the only reason the $ is loosing Value?

NO, The DXY is facing a huge backlash internationaly now.

BRICS being one of the biggest problems.

It is NOT there to Harm the $ , as some suggest. It is the next step in the idea of OPEN MARKETS, were anyone will try and find the best deal.

The Deals in question here are international settlements.

The USD used to be the only available method of international settlement and the USA took commision on every deal, worth $Billions annualy.

BRICS does Not use the $ and so the USA looses money, the $ not required and so, looses Value..

That is a VERY simplaistic explanation....but highlights the headwind the $ is sailing into, amoung many others.

The Job of the FED, a group of independant BANKERS<,,is to protect the $......

A RAISE in rates would earn more money..but Harm industry

To Hold Rates were they are and try and pacify the Fall

Reduce Rates further, make American goods and services cheaper to buy but devalue tie USD<

Is the fact that the USD has fallen out of Channel the real reason the FED will Hold Rates, possinly all year ?

A possible target for the $ longer term is that Horizontal Dotted line that was mentioned earlier.

And in the Meantime..GOLD.....Still winning.

Should the USD jump back obto the GOLD BACKED SYSTEM?

DXY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Q1 | W4 | Y26 OK DXY - IS THE SELL OFF OVER ?📅 Q1 | W4 | Y26

OK DXY - IS THE SELL OFF OVER ?

A single weekly bearish candle has engulfed months of prior price action 📉, signalling a decisive shift in higher-timeframe momentum.

With the DXY now showing signs of a momentum melt 🔥, focus naturally turns to whether price is preparing for a corrective retracement into the imbalances and inefficiencies left behind at the highs 🧲.

Within FRGNT Mastery, the DXY is marked and treated as a core framework instrument 🧭 — not for direct trading, but as a directional and timing tool ⏱️ for USD-cross pairs such as GBPUSD, AUDUSD and EURUSD .

By applying the FRGNT interpretation of Smart Money Concepts (SMC) 🧠 — specifically HTF structure shifts, displacement, liquidity draws and imbalance mitigation — we can begin to establish potential points of turnaround 🔄 on the DXY.

Once a DXY reaction or point of inflection is identified 📍, that information becomes a high-probability confluence ✅ for execution on the main pairs. This allows bias, expectation and timing to align 🎯, rather than treating each USD pair in isolation.

Key focus points:

📊 Weekly / Daily DXY structure and imbalance zones

🔍 Confirmation of reaction using FRGNT SMC principles

🔗 Translation of DXY behaviour into bias for GBPUSD, AUDUSD and EURUSD

⚡ Execution only once LTF confirmation aligns with HTF DXY context

Used correctly, the DXY acts as the anchor ⚓ while the USD-cross pairs provide the opportunity — ensuring trades are taken with broader dollar flows, not against them 🚀

📅 Q1 | W4 | Y26

📊 DXY — FRGNT WEEKEND FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

DXY Outlook : Momentum Still Favours Further WeaknessThe Dollar Index continues to show signs of weakening momentum, and the current structure suggests that sellers remain in control. The move highlighted on the chart reflects how price is responding to pressure rather than strength, indicating that downside risks are still present. As long as this behavior remains intact, the bias stays cautious on the upside and supportive of further downside.

Disclosure: We are part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in our analysis.

DXY — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST📅 Q1 | D23 | W3 | Y26

📊 DXY — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

Breaking: US Dollar Index (DXY) Extends Cool-OffThe U.S. dollar weakened for a second straight session, with the DXY index edging lower as currency markets reacted to growing geopolitical uncertainty. Traders are starting to pull back from the dollar as a safe haven, choosing to stay cautious ahead of what many describe as a messy global outlook.

This move isn’t about one data point or a single headline. Instead, it reflects a market that is nervous about global politics, conflict risks, and sudden policy shifts. When uncertainty rises like this, forex markets often turn volatile, and that’s exactly what traders are preparing for.

Why the Dollar Is Under Pressure

Part of the pressure on the dollar comes from falling U.S. Treasury yields, which reduce the appeal of holding dollars compared to other currencies. When yields dip, the dollar usually follows, especially if investors are willing to take on more risk elsewhere.

At the same time, some traders are rotating into other major currencies, including the euro and yen, as they wait for a clearer direction. The result is a softer DXY, even though the U.S. economy itself hasn’t shown major weakness.

Technically, the chart depicts a bullish flag pattern a breakout above the flag could resort to a bullish reversal in the long term.

DXY — FRGNT WEEKLY CHART FORECAST Q1 | W3 | Y26📅 Q1 | W3 | Y26

📊 DXY — FRGNT WEEKLY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

DXY — FRGNT DAILY CHART FORECAST Q1 | D13 | W2 | Y26📅 Q1 | D13 | W2 | Y26

📊 DXY — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

US Dollar Index Outlook | Trend Strength vs Key Resistance💰 DXY (US DOLLAR INDEX) - SWING TRADE OPPORTUNITY 📊

Bullish Momentum Play with WEIGHTED MA Breakout Confirmation

🎯 MARKET CONTEXT

Current Price: 98.53 | Trend: Consolidation Zone (97.00 - 100.00 Range)

Status: Preparing for breakout above Monday highs at 98.85 🚀

After the worst annual performance since 2017 (-9.3% in 2025), the DXY is regaining momentum in early 2026. Bulls are establishing strong demand at critical support levels with both 50-hour and 200-hour moving averages acting as backstops. The technical setup suggests a potential run toward the 99.30-99.50 resistance zone on breakout confirmation.

📈 TECHNICAL SETUP - LAYERING STRATEGY (Thief Entry Method)

Entry Strategy: Multiple Limit Order Layers 🎰

Using the Smart Layering Technique for optimal risk-adjusted positioning:

Layer 1 Entry @ 98.40 💰 Support Zone Entry (33% Position Size)

This is your first buy trigger at the lower support consolidation zone. Activate your first limit buy here to catch early momentum before the main move. This layer catches sellers panicking at support levels. Strong psychological anchor for building position.

Layer 2 Entry @ 98.50 📊 HULL MA Pull-Back Zone (33% Position Size)

Your second layer activates at the HULL moving average pullback confirmation point. This is where momentum traders get shaken out—perfect opportunity to add. Average your cost higher while securing better entry confirmation. This level shows institutional interest.

Layer 3 Entry @ 98.60 🚀 Accumulation Zone (34% Position Size)

Your final layer triggers at the upper consolidation band where accumulation is strongest. By this point, you've built 100% of your position with an average cost significantly lower than a single market order. This creates psychological momentum as you're "buying strength" into the breakout zone.

Pro Tip: You can adjust layer spacing based on volatility. Wider layers = patience for perfect fills. Tighter layers = aggressive accumulation for faster positioning. This method reduces average entry cost while managing drawdowns effectively. Smart traders stack positions like this instead of FOMO market buying. 🎯

Stop Loss (SL): 98.20 🛑

Hard stop at the 4-hour support consolidation level. This represents a breach of the lower Rectangle boundary.

⚠️ Disclaimer: This is MY suggested SL. You maintain complete control over your risk management. Scale your position size accordingly to your personal risk tolerance. Only risk what you can afford to lose completely. This is NOT financial advice—trade at your own risk.

Target Zone (TP): 99.30 - 99.50 🎊

Primary Resistance Level where overbought conditions + trapped short sellers create a natural profit-taking zone. This level aligns with Monday's highs (98.85) and extends toward the 99.30 psychological level.

⚠️ Disclaimer: This is my projected resistance zone based on technical analysis. Market conditions change rapidly. Take partial profits at 99.30 and trail your stop on remaining position. You decide your exit strategy—this is guidance, not a guarantee.

🔗 RELATED PAIRS TO WATCH (Correlation Analysis)

1️⃣ EUR/USD (FX: FX:EURUSD ) 📉

Correlation: NEGATIVE (inverse to DXY)

Current Level: ~1.1716 | Watch: 1.3520-1.3560 range

Key Driver: Euro manufacturing weakness (Dec: 9-month low) supports USD strength

Action: If DXY breaks 99.30, expect EUR/USD to test 1.15 support levels

2️⃣ GBP/USD (FX: FX:GBPUSD ) 💷

Correlation: NEGATIVE (inverse to DXY)

Current Level: ~1.3445 | 2026 Forecast: 1.36-1.40 range expected

Key Driver: BOE cutting rates more gradually than Fed = GBP resilience likely

Action: Sterling strength could limit DXY upside; watch for BOE communications

3️⃣ USD/JPY (FX: FX:USDJPY ) 🇯🇵

Correlation: POSITIVE (moves WITH DXY)

Current Level: ~156.65 | 10-Month Low: 157.89 (Nov 2025)

Key Driver: BOJ Intervention Risk + Rate Hike Expectations

Action: BOJ still holds limited rate hike probability until July—JPY weakness supports USD strength

4️⃣ DXY vs USD/CAD (FX: OANDA:USDCAD ) 🇨🇦

Correlation: MIXED (commodity-sensitive)

Watch Level: Canadian economic data + BoC policy divergence

Key Driver: CAD weakness when risk-off sentiment dominates

Action: Oil prices + BoC dovish stance = support for USD/CAD upside

📰 FUNDAMENTAL & MACRO DRIVERS (Live as of Jan 8, 2026)

🚨 SHORT-TERM CATALYSTS (This Week/Next Week)

✅ US Employment Data (Jobs Report - Jan 10)

Latest: -105K jobs (WORSE than +64K expected)

Impact: Signals economic weakness BUT triggers "safety trade" into USD

Watch: If jobs continue weak → confirms Fed rate cuts → longer-term DXY weakness

Action: Initial dip likely, then reversal higher on safe-haven demand

✅ Fed Rate Cut Expectations - CRITICAL

Market Pricing: 2 x 25bp cuts in 2026 (vs Fed's 1 cut projection)

Fed Communication Risk: Multiple Fed officials saying more dovish stance needed

Richmond Fed President Barkin: Monetary policy requires "finely tuned judgments"

Impact: Rate cut expectations = DXY headwind long-term, but near-term bounces likely

✅ ISM Manufacturing PMI (Already Released)

Dec Data: Sharpest contraction since 2024 | Services PMI also revised lower

Impact: Economic slowdown narrative = negative for USD long-term

But: Safe-haven demand provides near-term support

✅ Geopolitical Risk - Venezuela Situation

Recent: US military action in Venezuela sparked brief safe-haven rally

Current: Concerns eased; initially pushed DXY to 98.80, faded back to 98.50

Watch: Any escalation = temporary USD strength; normalization = weakness

📊 MID-TERM DRIVERS (Next 1-3 Months)

🔴 Federal Reserve Independence Concerns

Timeline: Fed Chair selection happening THIS MONTH (Trump announcement)

Market Fear: New Chair (May 2026) may prioritize rate cuts over inflation control

DXY Impact: Significant structural selling pressure if dovish chair appointed

Watch: Trump's nominee announcement = potential volatility catalyst

🔴 US Inflation Data (CPI Reports)

Status: Core inflation sticky; any surprise UP = DXY support

Risk: If inflation surprises DOWN = accelerates rate cut timeline = DXY weakness

Watch: Jan 15 & Feb 12 CPI releases

💚 US Fiscal Policy Uncertainty

Wildcard: Trade policy, tariffs, government spending debates

Scenario 1: Tariffs trigger inflation → Fed stays hawkish → DXY stronger

Scenario 2: Fiscal stimulus accelerates early 2026 → inflation risk → mixed effects

🌍 INTERNATIONAL FACTORS

🇪🇺 Eurozone Economic Weakness

Factory Activity: 9-month low in December

Support: Lower inflation readings in Germany/France (good news for ECB)

DXY Impact: Euro weakness = relative USD strength support ✅

🇯🇵 Bank of Japan (BOJ) Policy

Current: BOJ raised rates 2x in 2025 but YEN still underperformed

Forward View: Markets pricing <50% chance of BOJ hike until July 2026

DXY Impact: Yen weakness = carry trade pressure = mild USD strength

💡 2026 DXY SCENARIO ANALYSIS

BASE CASE: "V-Shaped" Year

H1 2026: DXY expected to decline toward 94.00 as Fed cuts rates

H2 2026: Rebound above 99.00 as fiscal stimulus drives inflation + yields higher

Current Position (98.53): Setting up for H1 weakness, but near-term bounces likely

BULL CASE (Our Setup) 🚀

Thesis: Consolidation breaks above 99.30 → tests 100.00

Catalyst: Labor data weakness + geopolitical safety bid extension

Resistance: 99.30-99.50, then 100.00 psychological level

Risk: Only viable if jobs report doesn't accelerate rate cut expectations

BEAR CASE 📉

Thesis: Fed cuts rates aggressively → DXY collapses toward 94.00

Catalyst: New dovish Fed Chair + prolonged economic weakness

Support: 97.50-97.00 rectangle lows become prime targets

Timeline: Likely unfolding H1 2026

⚡ KEY TAKEAWAYS FOR TRADERS

1️⃣ Entry: Use the 3-layer method at 98.40 / 98.50 / 98.60—cost-averages your fills

2️⃣ Risk: Hard stop at 98.20; size accordingly to your account

3️⃣ Reward: Target 99.30-99.50 for near-term swing (100-150 pips potential)

4️⃣ Watch: Jobs report (Jan 10) = weekly game-changer | Fed chair news (late Jan) = structural pivot

5️⃣ Correlations: Monitor EUR/USD, GBP/USD, USD/JPY for confirmation of DXY momentum

⚠️ TRADING DISCLAIMER

🚨 This is NOT financial advice. I am NOT a licensed financial advisor or analyst. This setup represents my personal technical + macro analysis framework. Markets are unpredictable. All trades carry RISK OF TOTAL LOSS. You are responsible for:

✅ Your own position sizing

✅ Your own stop loss placement

✅ Your own profit target selection

✅ Conducting independent research before entry

Trade responsibly. Risk what you can afford to lose completely. Accept losses gracefully. Consistency beats perfection. 🎯

Last Updated: January 8, 2026

DXY Real-Time Price: 98.57 | 52-Week Range: 96.22 - 110.18

Good luck, traders! May your entries be clean and your exits cleaner. 💼📈

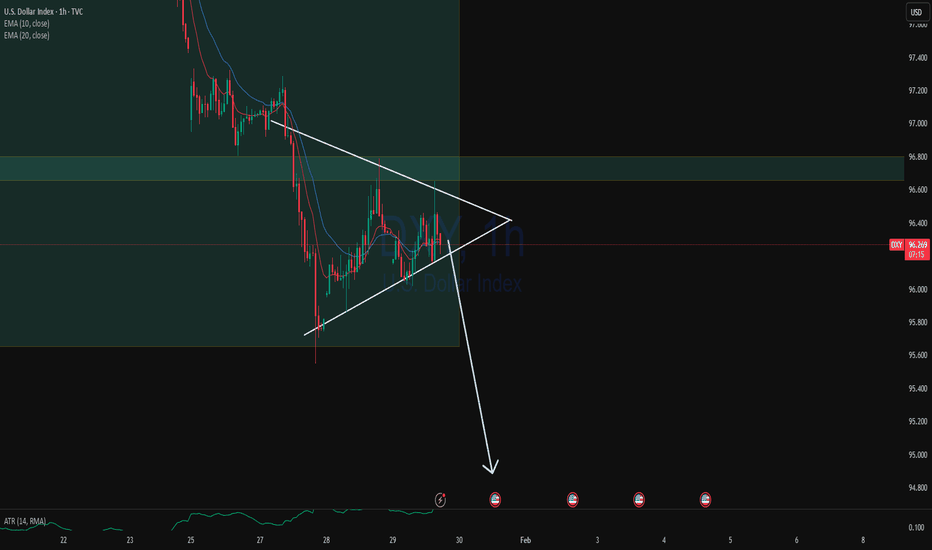

DXY 📉 TVC:DXY (US Dollar Index) Technical Analysis (4H Timeframe)

The overall trend for the Dollar Index is currently bearish, as the price action is trading below a downward-sloping EMA 200 (black line) and consistently forming lower highs and lower lows 📉. The momentum remains weak, with large bearish candles dominating previous impulsive moves. Currently, the price is in a corrective phase, attempting to test the EMA 50 (red line) and the broken structural zone at 98.680 USD. The EMA 50 is trending below the EMA 200, confirming the bearish pressure in the medium term. If the price fails to break back above the current resistance level with strong candle bodies, we expect a continuation of the downtrend toward the next liquidity targets 📉.

🔑 Key Levels to Watch:

Major Resistance Zone: 99.250 USD (Previous Peak & Grey Box) 🚩

Immediate Pivot Resistance: 98.680 USD (Current Test Area) 💡

First Downside Target: 98.150 USD (Recent Support / Grey Box) 🎯

Secondary Support Level: 97.770 USD (Solid Black Line) ⚡

Primary Demand Origin: 97.300 USD (Major Grey Box) 🛡️

Long-term Resistance: 100.344 USD – 100.800 USD 🏗️