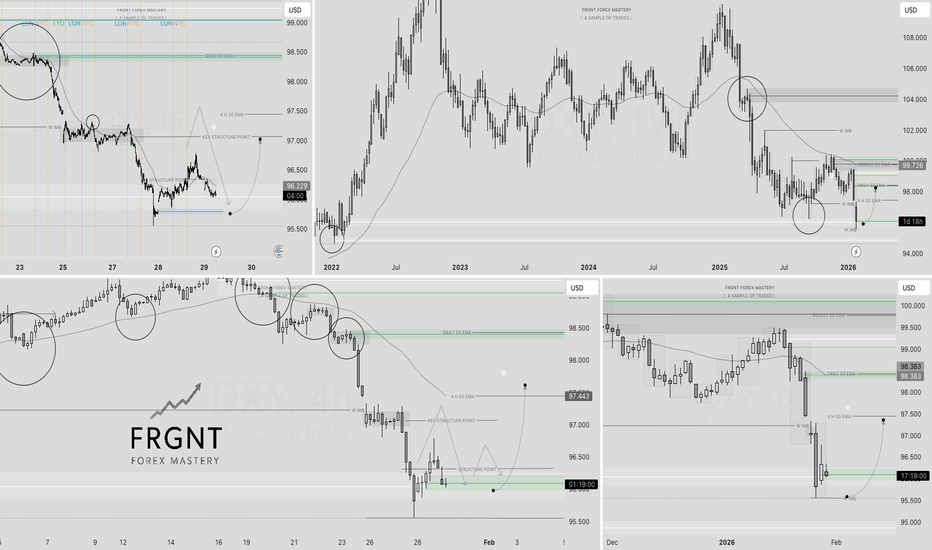

DXY OVERVIEW | FRGNT DAILY FORECAST |Q1 | W6 | D10 | Y26📅 Q1 | W6 | D10 | Y26

📊 DXY OVERVIEW | FRGNT DAILY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

Dxylong

DXY | FRGNT WEEKLY FORECAST | Q1 | W6 | Y26📅 Q1 | W6 | Y26

📊 DXY | FRGNT WEEKLY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

Q1 | D4 | W5 | Y26 DXY — FRGNT DAILY FORECAST📅 Q1 | D4 | W5 | Y26

📊 DXY — FRGNT DAILY FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

DXY | FRGNT | CONTINUED USD ROCKET | Y26Q1 | D3 | W5 | Y26📅 Q1 | D3 | W5 | Y26

📊 DXY — FRGNT DAILY FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

FRGNT FUN COUPON FRIDAY ! -DXY — Q1 | W4 | D30 | Y26📅 Q1 | W4 | D30 | Y26

📊DXY — FRGNT DAILY CHART FORECAST

FRGNT FUN COUPON FRIDAY !

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

WIILL THE DXY CONTINUE SELLING OFF?📅 Q1 | W4 | D29 | Y26

📊 DXY — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

DXY BULLISH CASE OUTLOOKThe US Dollar Index (DXY) trades near 96 after dipping to multi-year lows, but the monthly chart shows strong bullish reversal potential.

Key Technical Points:

Decisive breakout above the 15-year descending trendline (from 2015 highs), invalidating the long-term downtrend. The old trendline now provides dynamic support around 94–95.

Price action forms an ascending channel projecting higher into 2027–2030, with targets toward 105–115 if momentum holds.

Recent oversold conditions (low RSI) and capitulation dips signal mean-reversion upside. Holding above 95–96 sets up rebounds to 98.80 resistance, then 100+ psychological levels.

Fundamental Drivers:

US economic outperformance persists vs. Europe/Japan, with yield advantages drawing capital inflows.

Geopolitical risks and safe-haven demand favor USD during global uncertainty.

Potential Fed hawkishness (sticky inflation, policy pauses) or fiscal stimulus/tariffs could sustain higher rates longer than expected.

Historical patterns show deep weakness often precedes strong recoveries, as seen post-2020.

Outlook:

Current consolidation near channel support is a buying setup. A hold above 95 targets 100 short-term and 110+ longer-term in a sustained uptrend. Risks include aggressive Fed cuts, but technical breakout and US resilience favor bulls on dips. The dollar's "decline" narrative looks premature—watch for rebound acceleration.

Breaking: US Dollar Index (DXY) Extends Cool-OffThe U.S. dollar weakened for a second straight session, with the DXY index edging lower as currency markets reacted to growing geopolitical uncertainty. Traders are starting to pull back from the dollar as a safe haven, choosing to stay cautious ahead of what many describe as a messy global outlook.

This move isn’t about one data point or a single headline. Instead, it reflects a market that is nervous about global politics, conflict risks, and sudden policy shifts. When uncertainty rises like this, forex markets often turn volatile, and that’s exactly what traders are preparing for.

Why the Dollar Is Under Pressure

Part of the pressure on the dollar comes from falling U.S. Treasury yields, which reduce the appeal of holding dollars compared to other currencies. When yields dip, the dollar usually follows, especially if investors are willing to take on more risk elsewhere.

At the same time, some traders are rotating into other major currencies, including the euro and yen, as they wait for a clearer direction. The result is a softer DXY, even though the U.S. economy itself hasn’t shown major weakness.

Technically, the chart depicts a bullish flag pattern a breakout above the flag could resort to a bullish reversal in the long term.

Pending Double Bottom looking for break above 99.300 areaPending Double Bottom looking for break above 99.300 area

Looks slightly bearish but COT Report wasn't strong for the EURO

Always use care in analytics as I am not a professional trader.

-----------------------------------------------------------------------------------------------------------------------------------------------------------

Dealer : Asset Manager/ : Leveraged : Other : Nonreportable :

Intermediary : Institutional : Funds : Reportables : Positions :

Long : Short : Spreading: Long : Short : Spreading: Long : Short : Spreading: Long : Short : Spreading: Long : Short :

-----------------------------------------------------------------------------------------------------------------------------------------------------------

EURO FX - CHICAGO MERCANTILE EXCHANGE (CONTRACTS OF EUR 125,000)

CFTC Code #099741 Open Interest is 883,672

Positions

52,405 536,979 4,035 555,117 151,001 34,300 103,621 78,229 16,508 22,362 14,407 3,744 91,580 44,469

Changes from: January 6, 2026 Total Change is: 1,857

7,246 -19,193 231 11,451 6,022 1,257 -15,949 9,259 916 -1,218 -454 250 -2,327 3,569

Percent of Open Interest Represented by Each Category of Trader

5.9 60.8 0.5 62.8 17.1 3.9 11.7 8.9 1.9 2.5 1.6 0.4 10.4 5.0

USD Index (DXY) Outlook: Bullish Structure HoldingThe Dollar Index is holding above the key 99.00-98.90 support zone and trading within a rising structure. Price has respected the ascending trendline and previous BOS-CHOCH levels showing buyers are still active. As long as DXY stays above 98.80 the bias remains bullish with upside targets around 99.85 and 100.20. A pullback toward 99.00-98.90 can be seen as a healthy retracement before continuation while a clear break below 98.50 would weaken the bullish outlook.

From a fundamental perspective the dollar is supported by expectations that the Federal Reserve will keep interest rates higher for longer as inflation remains sticky and the U.S. economy shows relative resilience compared to other major economies. Safe haven demand also favors USD amid global uncertainty and geopolitical risks. However any softer U.S. inflation or labor data could trigger short term pullbacks. Overall fundamentals currently align with the moderate bullish technical bias shown on the chart.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

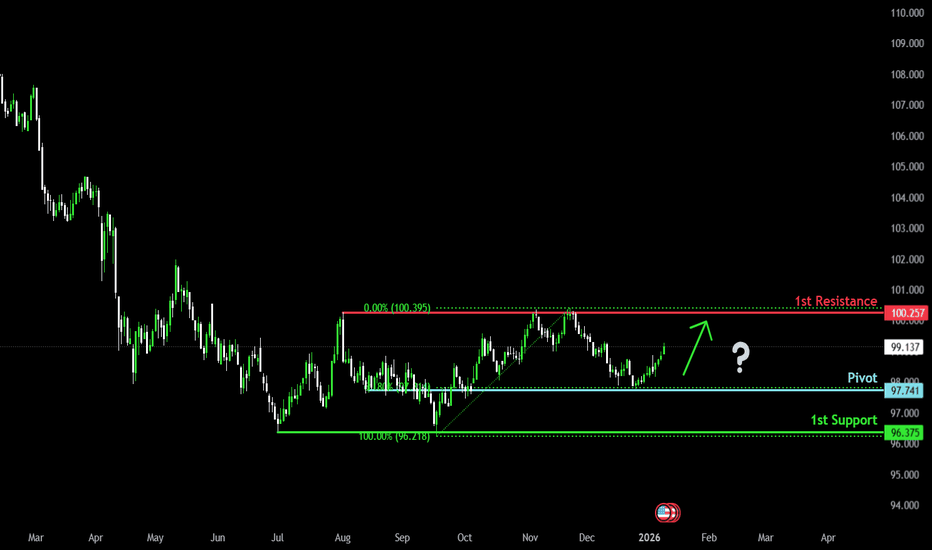

Bullish bounce off?US Dollar Index (DXY) has bounced off the pivot, which aligns with the 61.8% Fibonacci retracement, and could rise to the multi-swing high resistance.

Pivot: 97.74

1st support: 96.37

1st Resistance: 100.25

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

US Dollar Index Outlook | Trend Strength vs Key Resistance💰 DXY (US DOLLAR INDEX) - SWING TRADE OPPORTUNITY 📊

Bullish Momentum Play with WEIGHTED MA Breakout Confirmation

🎯 MARKET CONTEXT

Current Price: 98.53 | Trend: Consolidation Zone (97.00 - 100.00 Range)

Status: Preparing for breakout above Monday highs at 98.85 🚀

After the worst annual performance since 2017 (-9.3% in 2025), the DXY is regaining momentum in early 2026. Bulls are establishing strong demand at critical support levels with both 50-hour and 200-hour moving averages acting as backstops. The technical setup suggests a potential run toward the 99.30-99.50 resistance zone on breakout confirmation.

📈 TECHNICAL SETUP - LAYERING STRATEGY (Thief Entry Method)

Entry Strategy: Multiple Limit Order Layers 🎰

Using the Smart Layering Technique for optimal risk-adjusted positioning:

Layer 1 Entry @ 98.40 💰 Support Zone Entry (33% Position Size)

This is your first buy trigger at the lower support consolidation zone. Activate your first limit buy here to catch early momentum before the main move. This layer catches sellers panicking at support levels. Strong psychological anchor for building position.

Layer 2 Entry @ 98.50 📊 HULL MA Pull-Back Zone (33% Position Size)

Your second layer activates at the HULL moving average pullback confirmation point. This is where momentum traders get shaken out—perfect opportunity to add. Average your cost higher while securing better entry confirmation. This level shows institutional interest.

Layer 3 Entry @ 98.60 🚀 Accumulation Zone (34% Position Size)

Your final layer triggers at the upper consolidation band where accumulation is strongest. By this point, you've built 100% of your position with an average cost significantly lower than a single market order. This creates psychological momentum as you're "buying strength" into the breakout zone.

Pro Tip: You can adjust layer spacing based on volatility. Wider layers = patience for perfect fills. Tighter layers = aggressive accumulation for faster positioning. This method reduces average entry cost while managing drawdowns effectively. Smart traders stack positions like this instead of FOMO market buying. 🎯

Stop Loss (SL): 98.20 🛑

Hard stop at the 4-hour support consolidation level. This represents a breach of the lower Rectangle boundary.

⚠️ Disclaimer: This is MY suggested SL. You maintain complete control over your risk management. Scale your position size accordingly to your personal risk tolerance. Only risk what you can afford to lose completely. This is NOT financial advice—trade at your own risk.

Target Zone (TP): 99.30 - 99.50 🎊

Primary Resistance Level where overbought conditions + trapped short sellers create a natural profit-taking zone. This level aligns with Monday's highs (98.85) and extends toward the 99.30 psychological level.

⚠️ Disclaimer: This is my projected resistance zone based on technical analysis. Market conditions change rapidly. Take partial profits at 99.30 and trail your stop on remaining position. You decide your exit strategy—this is guidance, not a guarantee.

🔗 RELATED PAIRS TO WATCH (Correlation Analysis)

1️⃣ EUR/USD (FX: FX:EURUSD ) 📉

Correlation: NEGATIVE (inverse to DXY)

Current Level: ~1.1716 | Watch: 1.3520-1.3560 range

Key Driver: Euro manufacturing weakness (Dec: 9-month low) supports USD strength

Action: If DXY breaks 99.30, expect EUR/USD to test 1.15 support levels

2️⃣ GBP/USD (FX: FX:GBPUSD ) 💷

Correlation: NEGATIVE (inverse to DXY)

Current Level: ~1.3445 | 2026 Forecast: 1.36-1.40 range expected

Key Driver: BOE cutting rates more gradually than Fed = GBP resilience likely

Action: Sterling strength could limit DXY upside; watch for BOE communications

3️⃣ USD/JPY (FX: FX:USDJPY ) 🇯🇵

Correlation: POSITIVE (moves WITH DXY)

Current Level: ~156.65 | 10-Month Low: 157.89 (Nov 2025)

Key Driver: BOJ Intervention Risk + Rate Hike Expectations

Action: BOJ still holds limited rate hike probability until July—JPY weakness supports USD strength

4️⃣ DXY vs USD/CAD (FX: OANDA:USDCAD ) 🇨🇦

Correlation: MIXED (commodity-sensitive)

Watch Level: Canadian economic data + BoC policy divergence

Key Driver: CAD weakness when risk-off sentiment dominates

Action: Oil prices + BoC dovish stance = support for USD/CAD upside

📰 FUNDAMENTAL & MACRO DRIVERS (Live as of Jan 8, 2026)

🚨 SHORT-TERM CATALYSTS (This Week/Next Week)

✅ US Employment Data (Jobs Report - Jan 10)

Latest: -105K jobs (WORSE than +64K expected)

Impact: Signals economic weakness BUT triggers "safety trade" into USD

Watch: If jobs continue weak → confirms Fed rate cuts → longer-term DXY weakness

Action: Initial dip likely, then reversal higher on safe-haven demand

✅ Fed Rate Cut Expectations - CRITICAL

Market Pricing: 2 x 25bp cuts in 2026 (vs Fed's 1 cut projection)

Fed Communication Risk: Multiple Fed officials saying more dovish stance needed

Richmond Fed President Barkin: Monetary policy requires "finely tuned judgments"

Impact: Rate cut expectations = DXY headwind long-term, but near-term bounces likely

✅ ISM Manufacturing PMI (Already Released)

Dec Data: Sharpest contraction since 2024 | Services PMI also revised lower

Impact: Economic slowdown narrative = negative for USD long-term

But: Safe-haven demand provides near-term support

✅ Geopolitical Risk - Venezuela Situation

Recent: US military action in Venezuela sparked brief safe-haven rally

Current: Concerns eased; initially pushed DXY to 98.80, faded back to 98.50

Watch: Any escalation = temporary USD strength; normalization = weakness

📊 MID-TERM DRIVERS (Next 1-3 Months)

🔴 Federal Reserve Independence Concerns

Timeline: Fed Chair selection happening THIS MONTH (Trump announcement)

Market Fear: New Chair (May 2026) may prioritize rate cuts over inflation control

DXY Impact: Significant structural selling pressure if dovish chair appointed

Watch: Trump's nominee announcement = potential volatility catalyst

🔴 US Inflation Data (CPI Reports)

Status: Core inflation sticky; any surprise UP = DXY support

Risk: If inflation surprises DOWN = accelerates rate cut timeline = DXY weakness

Watch: Jan 15 & Feb 12 CPI releases

💚 US Fiscal Policy Uncertainty

Wildcard: Trade policy, tariffs, government spending debates

Scenario 1: Tariffs trigger inflation → Fed stays hawkish → DXY stronger

Scenario 2: Fiscal stimulus accelerates early 2026 → inflation risk → mixed effects

🌍 INTERNATIONAL FACTORS

🇪🇺 Eurozone Economic Weakness

Factory Activity: 9-month low in December

Support: Lower inflation readings in Germany/France (good news for ECB)

DXY Impact: Euro weakness = relative USD strength support ✅

🇯🇵 Bank of Japan (BOJ) Policy

Current: BOJ raised rates 2x in 2025 but YEN still underperformed

Forward View: Markets pricing <50% chance of BOJ hike until July 2026

DXY Impact: Yen weakness = carry trade pressure = mild USD strength

💡 2026 DXY SCENARIO ANALYSIS

BASE CASE: "V-Shaped" Year

H1 2026: DXY expected to decline toward 94.00 as Fed cuts rates

H2 2026: Rebound above 99.00 as fiscal stimulus drives inflation + yields higher

Current Position (98.53): Setting up for H1 weakness, but near-term bounces likely

BULL CASE (Our Setup) 🚀

Thesis: Consolidation breaks above 99.30 → tests 100.00

Catalyst: Labor data weakness + geopolitical safety bid extension

Resistance: 99.30-99.50, then 100.00 psychological level

Risk: Only viable if jobs report doesn't accelerate rate cut expectations

BEAR CASE 📉

Thesis: Fed cuts rates aggressively → DXY collapses toward 94.00

Catalyst: New dovish Fed Chair + prolonged economic weakness

Support: 97.50-97.00 rectangle lows become prime targets

Timeline: Likely unfolding H1 2026

⚡ KEY TAKEAWAYS FOR TRADERS

1️⃣ Entry: Use the 3-layer method at 98.40 / 98.50 / 98.60—cost-averages your fills

2️⃣ Risk: Hard stop at 98.20; size accordingly to your account

3️⃣ Reward: Target 99.30-99.50 for near-term swing (100-150 pips potential)

4️⃣ Watch: Jobs report (Jan 10) = weekly game-changer | Fed chair news (late Jan) = structural pivot

5️⃣ Correlations: Monitor EUR/USD, GBP/USD, USD/JPY for confirmation of DXY momentum

⚠️ TRADING DISCLAIMER

🚨 This is NOT financial advice. I am NOT a licensed financial advisor or analyst. This setup represents my personal technical + macro analysis framework. Markets are unpredictable. All trades carry RISK OF TOTAL LOSS. You are responsible for:

✅ Your own position sizing

✅ Your own stop loss placement

✅ Your own profit target selection

✅ Conducting independent research before entry

Trade responsibly. Risk what you can afford to lose completely. Accept losses gracefully. Consistency beats perfection. 🎯

Last Updated: January 8, 2026

DXY Real-Time Price: 98.57 | 52-Week Range: 96.22 - 110.18

Good luck, traders! May your entries be clean and your exits cleaner. 💼📈

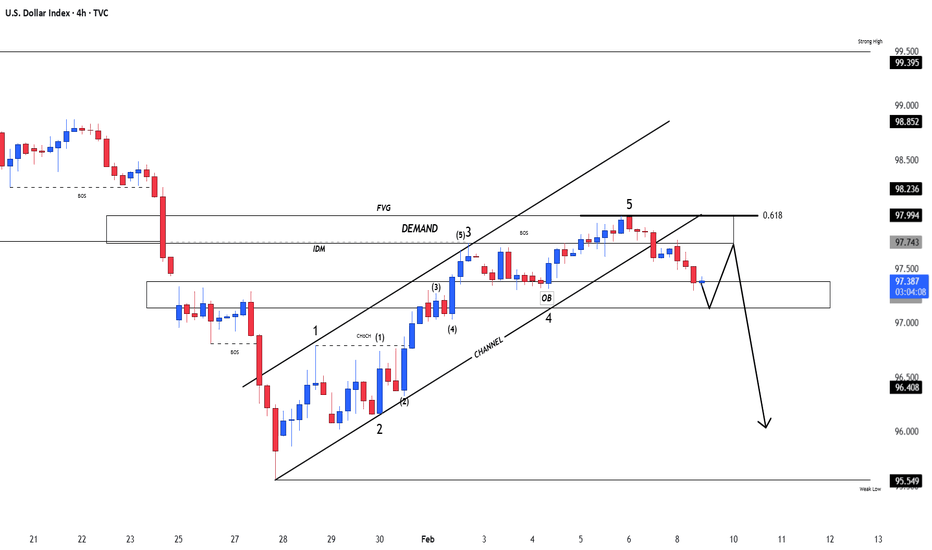

DXY 📉 TVC:DXY (US Dollar Index) Technical Analysis (4H Timeframe)

The overall trend for the Dollar Index is currently bearish, as the price action is trading below a downward-sloping EMA 200 (black line) and consistently forming lower highs and lower lows 📉. The momentum remains weak, with large bearish candles dominating previous impulsive moves. Currently, the price is in a corrective phase, attempting to test the EMA 50 (red line) and the broken structural zone at 98.680 USD. The EMA 50 is trending below the EMA 200, confirming the bearish pressure in the medium term. If the price fails to break back above the current resistance level with strong candle bodies, we expect a continuation of the downtrend toward the next liquidity targets 📉.

🔑 Key Levels to Watch:

Major Resistance Zone: 99.250 USD (Previous Peak & Grey Box) 🚩

Immediate Pivot Resistance: 98.680 USD (Current Test Area) 💡

First Downside Target: 98.150 USD (Recent Support / Grey Box) 🎯

Secondary Support Level: 97.770 USD (Solid Black Line) ⚡

Primary Demand Origin: 97.300 USD (Major Grey Box) 🛡️

Long-term Resistance: 100.344 USD – 100.800 USD 🏗️