#DYDX/USDT#DYDX

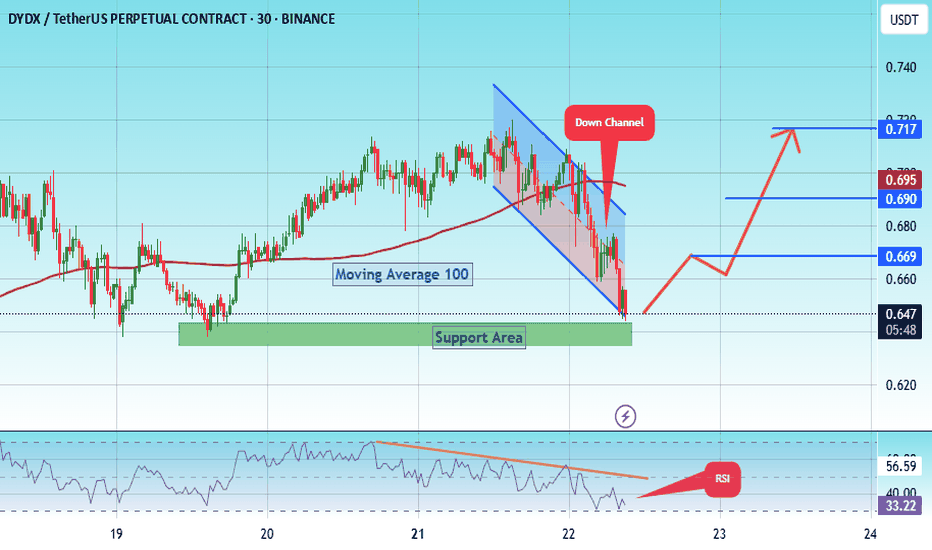

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 0.640.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.638, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.650

First target: 0.669

Second target: 0.690

Third target: 0.717

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Dydxanalysis

DYDX/USDT — Buyers on the Edge, Breakout or Breakdown?DYDX is once again testing its major demand zone between $0.53 and $0.58, an area that has consistently acted as a strong defensive wall for buyers over the past several months.

Each dip into this region has triggered a solid rebound — suggesting institutional or large-scale accumulation at the bottom of the range. However, with momentum fading and volume drying up, this support zone is now under serious pressure.

---

Market Structure & Technical Pattern

Primary trend: DYDX remains in a broad consolidation phase following its steep decline from the $2.2 peak.

Dominant pattern: Horizontal accumulation base — the price is trapped between a solid support zone at $0.53–$0.58 and strong resistance at $0.73–$0.82.

Market sentiment: Neutral-to-bearish; buyers still defend the base, but bullish momentum has yet to show meaningful confirmation.

At this point, the reaction around $0.53–$0.58 will determine DYDX’s next macro direction — whether it’s ready to rebound or fall into a deeper correction.

---

Bullish Scenario — Rebound from the Accumulation Zone

If DYDX holds above $0.53 and confirms a bounce with increasing volume and higher lows, the pair could initiate a mid-term reversal setup.

Breakout confirmation would occur once price breaks:

$0.73 (initial resistance) → leading to

$0.82, and then

$1.10 and $1.31 as the next targets.

As long as $0.53 remains intact, this base may serve as a launchpad for the next impulsive move upward.

---

Bearish Scenario — Breakdown Below Support

Conversely, if DYDX closes a daily candle below $0.53, the accumulation structure will shift into a distribution phase, signaling continuation of the broader downtrend.

Potential downside targets include:

$0.41 (previous low),

and if selling pressure extends, $0.30–$0.35 could be revisited.

A breakdown below $0.53 could trigger short-term capitulation, as this area has acted as a strong demand zone since early 2025.

---

Conclusion

DYDX is now sitting at a critical decision zone between $0.53 and $0.58 — a level that has defined the market structure for months.

Buyers still show resilience, but the market demands volume confirmation and a structural breakout to signal true bullish reversal.

As long as the base holds, the probability of recovery remains alive.

But a daily close below $0.53 would likely confirm a breakdown and a shift to a bearish continuation phase.

--

#DYDX #DYDXUSDT #CryptoAnalysis #TechnicalAnalysis #SupportResistance #BreakoutSetup #AccumulationZone #AltcoinAnalysis #CryptoTrading #DeFiToken #MarketStructure #PriceAction #CryptoInsights

#DYDX/USDT Breakout from Falling Wedge | #DYDX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.563, which represents a strong support point.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 moving average.

Entry price: 0.588

First target: 0.600

Second target: 0.628

Third target: 0.653

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#DYDX/USDT#DYDX

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.612.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.606, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.656.

First target: 0.670.

Second target: 0.690.

Third target: 0.717.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

DYDX/USDT — Testing Historical Support: Bounce or Breakdown?Full Analysis:

DYDX is currently standing at a critical decision point. The chart shows price retesting the demand zone $0.50–$0.59 (yellow box), which has acted as strong support multiple times since March, June, and August 2025. This zone remains the last stronghold before price revisits the previous low at $0.41.

On the macro view, DYDX is still in a downtrend since the peak at $2.64 (Dec 2024). However, in the mid-term, price is moving sideways inside a broad range of $0.41–$0.82, suggesting accumulation or consolidation before the next major directional move.

---

🔹 Bullish Scenario

If the $0.50–$0.59 zone holds once again, a strong rebound is possible.

Early confirmation: a daily close above $0.64–$0.68, showing buyer rejection at the demand area.

Next resistance targets: $0.73 (range high) → if broken, extension targets are $0.82 → $1.10 → $1.31.

Additional bullish signals: long lower wick candles around support, increasing buy volume, and formation of higher lows.

📈 Swing strategy (bullish): accumulate around $0.52–$0.59, stop-loss below $0.48, profit targets at $0.73–$0.82.

---

🔻 Bearish Scenario

If price fails and closes daily below $0.50, a confirmed breakdown is in play.

Downside targets: $0.41 (previous low), with further bearish continuation possible if that level breaks.

Breakdown of this zone will confirm a continuation of the macro downtrend, likely forming new lower lows.

Additional bearish confirmations: strong daily close below $0.50, heavy sell volume, repeated lower highs pattern.

📉 Swing strategy (bearish): short after breakdown & failed retest of $0.50–$0.52, stop-loss above $0.60, first target $0.41.

---

🔍 Pattern & Market Structure

Range-bound: DYDX has been consolidating within $0.41–$0.82 for months.

Demand Zone in Play: The $0.50–$0.59 zone has been tested three times — each test weakens it, but also increases chances of a strong bounce if buyers step in.

Decision Point: Price action here will decide whether DYDX forms a base for reversal or continues its macro bearish trend.

---

📌 Conclusion

DYDX is testing a critical historical support at $0.50–$0.59. Holding this zone could spark a rebound toward $0.73–$0.82, but a confirmed breakdown below $0.50 would likely extend the bearish trend toward $0.41.

Traders should wait for daily close confirmation before committing, as this area is the true “battle zone” between bulls and bears.

⚠️ Disclaimer: This analysis is not financial advice. Always manage risk and use stop-loss according to your strategy.

#DYDX #DYDXUSDT #Crypto #Altcoins #TechnicalAnalysis #SwingTrading #SupportResistance #PriceAction

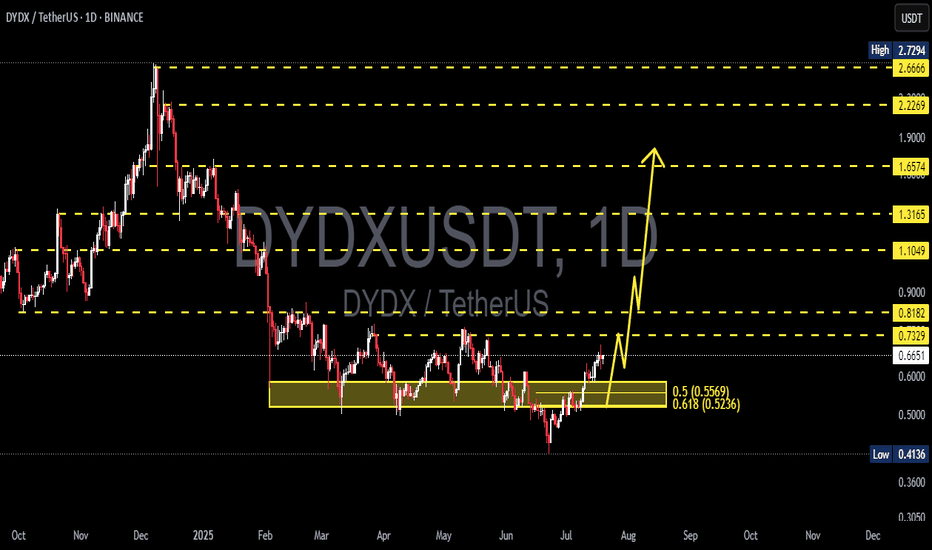

DYDX/USDT Poised for a Massive Breakout – Is a Rally Toward $2+?✨ Comprehensive and Engaging Technical Analysis:

DYDX/USDT is entering a highly compelling technical phase, showing signs of a potential trend reversal after breaking out from a prolonged accumulation zone that lasted nearly 5 months. This breakout on the daily timeframe (1D) is a classic early signal for a major upward move — often favored by swing traders and mid-term investors.

🔍 Accumulation Zone & Fibonacci Golden Pocket

The range between $0.52 and $0.56 represents the Fibonacci retracement levels of 0.5 and 0.618 — commonly referred to as the "golden pocket".

This area historically acts as a strong accumulation zone, where institutional players often enter the market.

Multiple rejections and support confirmations within this zone reinforce its significance.

📈 Structure Breakout:

DYDX has officially broken above the horizontal structure near $0.6566 and further confirmed momentum beyond $0.7329.

The price action is forming a Double Bottom Pattern and potentially an Inverted Head & Shoulders, both of which are high-conviction bullish reversal patterns.

✅ Bullish Scenario (Primary Bias):

As long as DYDX holds above the $0.66–$0.73 breakout range, it remains on track for a significant bullish impulse. Key upside targets include:

Target (Resistance) Significance

$0.8182 Minor horizontal resistance

$1.1049 Key level from prior supply zone

$1.3165 Previous major reaction area

$1.6574 Multi-timeframe major resistance

$2.2269 – $2.6666 Fibonacci extension & historical distribution zone

$2.7294 Previous all-time high

💡 This structure offers a potential upside of over +200% if fully played out.

❗ Bearish Scenario (Alternative):

A failed retest and drop below $0.6566 would suggest a false breakout.

A breakdown below $0.52 would invalidate the bullish setup and could send DYDX back to $0.41, its previous macro support.

In this case, the market may re-enter a range-bound or sideways phase.

⚙️ Conclusion & Trading Strategy:

DYDX/USDT is at a technically critical moment. The recent breakout could mark the beginning of a major reversal trend after months of consolidation. A healthy pullback to the $0.66–$0.73 zone could offer an ideal entry opportunity with tight stop-losses.

For swing traders and trend followers, this may be one of the best risk/reward setups on DYDX in recent months.

#DYDXUSDT #DYDXBreakout #CryptoBullish #AltcoinSeason #CryptoAnalysis #FibonacciLevels #SmartMoney #DYDXRally #TechnicalBreakout

#DyDx Superb opportunity#DYDX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.470.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.445, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.500.

First target: 0.522.

Second target: 0.537.

Third target: 0.559.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#DYDX#DYDX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

We are looking for stability above the 100 moving average.

Entry price: 0.706

First target: 0.741

Second target: 0.766

Third target: 0.800

DYDXUSDT - a real oppurtunity!the coin is currently in a deep bottom compared to its December peak, having dropped over 80%.

Buying now is a rare opportunity that may not come again in the future.

On the 3-day chart there is a nicly breakout of a 4 months downtrend ...

the most important resistance is at the key level—once it breaks, the price will pump insanely.

best regards Ceciliones🎯

DYDXUSDT – Key Resistance Zones Marked!I’ve identified blue boxes as critical resistance areas—these are the levels where price could face heavy selling pressure. But remember, we don’t short blindly—we wait for confirmations.

📊 How I’m Trading This:

✅ Step 1: Watch for CDV confirmation is volume decreasing while price climbs?

✅ Step 2: Look for LTF breakouts downward a clean market structure shift signals entry.

✅ Step 3: If resistance holds + volume supports = I take the trade. If not, I step aside.

💡 Why This Matters:

Most traders short too early and get wrecked. I wait for clear signs of rejection before entering. That’s the difference between guessing and executing.

🔥 Final Thought:

If price suddenly breaks upwards and holds, I will not insist on a short. But if we see rejection + a retest? Then it’s go time. 🚀

📈 Follow for precision trades—because smart traders wait for the perfect moment. 🔥

A tiny part of my runners:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 ORCAUSDT %29 Reaction with a Simple Blue Box!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

DYDX (dYdX) | DYDX/USDT-Daily Tmeframe

Still in a downtrend since the price is below the 200-day moving average (1.1810 USDT).

Consolidating around 0.78 USDT, meaning no further drop for now, but no strong uptrend either.

RSI (39.84) is still below 50, so buyers aren’t strong yet, but it has exited the oversold zone, which is a good sign.

Low trading volume, meaning big players haven’t stepped in yet.

Don’t rush to buy! Better to wait for a breakout above 0.85 - 0.90 USDT or strong buying momentum.

If you already bought, watch how it reacts to resistance before deciding.

Stop-loss below 0.70 USDT makes sense—stick to it if you enter.

No strong buy signal yet, but it’s stabilizing a bit. If you want to take the risk, use a stop-loss and keep an eye on resistance levels.

Good luck everyone & Be profitable🤘🏼

📌 It's not financial advice 📌

#DYDX/USDT #DYDX

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.00

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.04

First target 1.08

Second target 1.35

Third target 1.20

DYDX swing trades. Indicators analysisBINANCE:DYDXUSDT

This chart based on my indicators set on D timeframe

Take a look explanation

Take Profit - Reject at take profit and exit line

Trade On - 2 signals to sell confirmed

ADZ - Came in again in neutral zone. Might be going lower where whales start accumulate again

Direction - 5Feb got an alert to close position. Waiting drop lower to see accumulation alerts

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

DYDX - Fear before unlockBINANCE:DYDXUSDT

DYDX and upcoming 15% total supply unlock.

Psychology of retail investors always the same! Now everyone see the unlock date and ready to sell their coins because majority think in a same day all funds drop the price. But usually it works in opposite way.

To sell big amount of coins funds and earlier investors need liquidity, so they will sell it step by step.

Now ill not be impress if we will see some big media posts about DYDX and future of this DEX. So after

over 250 days in a range everyone who want it accumulate a lot.

Possible Targets and explanation idea

➡️By ADZ big players accumulate a lot on Weekly timeframe and we can see huge divergency.

➡️ Long time period accumulation in a range.

➡️We got FVG on monthly timeframe in red block zone (full fill will be exactly at 0.23 level by FIb)

➡️We trade in a range exactly at -0.27 zone

➡️3rd Feb day of 15% unlock. But we hypothetically can see moves where funds start sell at 4, 6, 10$ in 3 waves

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

DYDX correction to 5.20$BINANCE:DYDXUSDT

Dydx now underrated. Where ill start buy Dydx again? Where ill take a profit on local correction? And why Dydx can pump to 5.20$?

✅Before we start to discuss, I would be glad if you share your opinion on this post's comment section and hit the like button if you enjoyed it.

Thank you.

Possible Targets and explanation idea

➡️Fib since drop in April.

➡️Perfect call to sell by "Trade On" indicator

➡️Accumulation phase between -0.18 and -0.618 levels

➡️Forming lower low in June and took liquidity. Correction to drop can be at least to 0.5 level by fib 5.20$

➡️2 signals Strong Buy in May and June

➡️Rejected at "Take profit" line. If we capitulate one more time we can drop to 1.05 (now its a "Buy line")

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

* Look at my ideas about interesting altcoins in the related section down below ↓

* For more ideas please hit "Like" and "Follow"!

#DYDX/USDT Ready to go higher#DYDX

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.20

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 1.32

First target 1.38

Second target 1.45

Third target 1.55

#DYDX/USDT Ready to go higher#DYDX

The price is moving in a descending channel on the 30-minute frame and is sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.30

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 1.34

First target 1.36

Second target 1.40

Third target 1.44

DYDX usdt"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"