DYDX/USDT — Buyers on the Edge, Breakout or Breakdown?DYDX is once again testing its major demand zone between $0.53 and $0.58, an area that has consistently acted as a strong defensive wall for buyers over the past several months.

Each dip into this region has triggered a solid rebound — suggesting institutional or large-scale accumulation at the bottom of the range. However, with momentum fading and volume drying up, this support zone is now under serious pressure.

---

Market Structure & Technical Pattern

Primary trend: DYDX remains in a broad consolidation phase following its steep decline from the $2.2 peak.

Dominant pattern: Horizontal accumulation base — the price is trapped between a solid support zone at $0.53–$0.58 and strong resistance at $0.73–$0.82.

Market sentiment: Neutral-to-bearish; buyers still defend the base, but bullish momentum has yet to show meaningful confirmation.

At this point, the reaction around $0.53–$0.58 will determine DYDX’s next macro direction — whether it’s ready to rebound or fall into a deeper correction.

---

Bullish Scenario — Rebound from the Accumulation Zone

If DYDX holds above $0.53 and confirms a bounce with increasing volume and higher lows, the pair could initiate a mid-term reversal setup.

Breakout confirmation would occur once price breaks:

$0.73 (initial resistance) → leading to

$0.82, and then

$1.10 and $1.31 as the next targets.

As long as $0.53 remains intact, this base may serve as a launchpad for the next impulsive move upward.

---

Bearish Scenario — Breakdown Below Support

Conversely, if DYDX closes a daily candle below $0.53, the accumulation structure will shift into a distribution phase, signaling continuation of the broader downtrend.

Potential downside targets include:

$0.41 (previous low),

and if selling pressure extends, $0.30–$0.35 could be revisited.

A breakdown below $0.53 could trigger short-term capitulation, as this area has acted as a strong demand zone since early 2025.

---

Conclusion

DYDX is now sitting at a critical decision zone between $0.53 and $0.58 — a level that has defined the market structure for months.

Buyers still show resilience, but the market demands volume confirmation and a structural breakout to signal true bullish reversal.

As long as the base holds, the probability of recovery remains alive.

But a daily close below $0.53 would likely confirm a breakdown and a shift to a bearish continuation phase.

--

#DYDX #DYDXUSDT #CryptoAnalysis #TechnicalAnalysis #SupportResistance #BreakoutSetup #AccumulationZone #AltcoinAnalysis #CryptoTrading #DeFiToken #MarketStructure #PriceAction #CryptoInsights

Dydxusdtanalysis

DYDX/USDT — Testing Historical Support: Bounce or Breakdown?Full Analysis:

DYDX is currently standing at a critical decision point. The chart shows price retesting the demand zone $0.50–$0.59 (yellow box), which has acted as strong support multiple times since March, June, and August 2025. This zone remains the last stronghold before price revisits the previous low at $0.41.

On the macro view, DYDX is still in a downtrend since the peak at $2.64 (Dec 2024). However, in the mid-term, price is moving sideways inside a broad range of $0.41–$0.82, suggesting accumulation or consolidation before the next major directional move.

---

🔹 Bullish Scenario

If the $0.50–$0.59 zone holds once again, a strong rebound is possible.

Early confirmation: a daily close above $0.64–$0.68, showing buyer rejection at the demand area.

Next resistance targets: $0.73 (range high) → if broken, extension targets are $0.82 → $1.10 → $1.31.

Additional bullish signals: long lower wick candles around support, increasing buy volume, and formation of higher lows.

📈 Swing strategy (bullish): accumulate around $0.52–$0.59, stop-loss below $0.48, profit targets at $0.73–$0.82.

---

🔻 Bearish Scenario

If price fails and closes daily below $0.50, a confirmed breakdown is in play.

Downside targets: $0.41 (previous low), with further bearish continuation possible if that level breaks.

Breakdown of this zone will confirm a continuation of the macro downtrend, likely forming new lower lows.

Additional bearish confirmations: strong daily close below $0.50, heavy sell volume, repeated lower highs pattern.

📉 Swing strategy (bearish): short after breakdown & failed retest of $0.50–$0.52, stop-loss above $0.60, first target $0.41.

---

🔍 Pattern & Market Structure

Range-bound: DYDX has been consolidating within $0.41–$0.82 for months.

Demand Zone in Play: The $0.50–$0.59 zone has been tested three times — each test weakens it, but also increases chances of a strong bounce if buyers step in.

Decision Point: Price action here will decide whether DYDX forms a base for reversal or continues its macro bearish trend.

---

📌 Conclusion

DYDX is testing a critical historical support at $0.50–$0.59. Holding this zone could spark a rebound toward $0.73–$0.82, but a confirmed breakdown below $0.50 would likely extend the bearish trend toward $0.41.

Traders should wait for daily close confirmation before committing, as this area is the true “battle zone” between bulls and bears.

⚠️ Disclaimer: This analysis is not financial advice. Always manage risk and use stop-loss according to your strategy.

#DYDX #DYDXUSDT #Crypto #Altcoins #TechnicalAnalysis #SwingTrading #SupportResistance #PriceAction

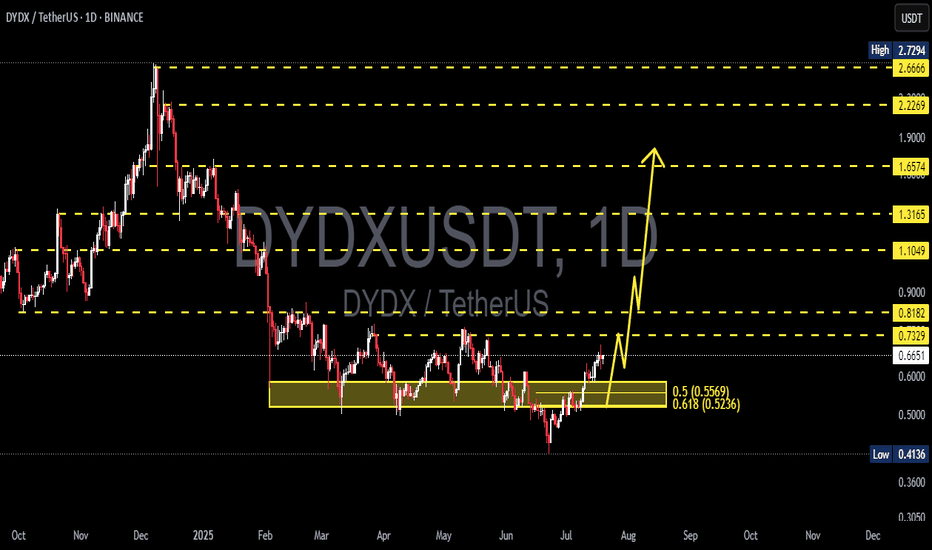

DYDX/USDT Poised for a Massive Breakout – Is a Rally Toward $2+?✨ Comprehensive and Engaging Technical Analysis:

DYDX/USDT is entering a highly compelling technical phase, showing signs of a potential trend reversal after breaking out from a prolonged accumulation zone that lasted nearly 5 months. This breakout on the daily timeframe (1D) is a classic early signal for a major upward move — often favored by swing traders and mid-term investors.

🔍 Accumulation Zone & Fibonacci Golden Pocket

The range between $0.52 and $0.56 represents the Fibonacci retracement levels of 0.5 and 0.618 — commonly referred to as the "golden pocket".

This area historically acts as a strong accumulation zone, where institutional players often enter the market.

Multiple rejections and support confirmations within this zone reinforce its significance.

📈 Structure Breakout:

DYDX has officially broken above the horizontal structure near $0.6566 and further confirmed momentum beyond $0.7329.

The price action is forming a Double Bottom Pattern and potentially an Inverted Head & Shoulders, both of which are high-conviction bullish reversal patterns.

✅ Bullish Scenario (Primary Bias):

As long as DYDX holds above the $0.66–$0.73 breakout range, it remains on track for a significant bullish impulse. Key upside targets include:

Target (Resistance) Significance

$0.8182 Minor horizontal resistance

$1.1049 Key level from prior supply zone

$1.3165 Previous major reaction area

$1.6574 Multi-timeframe major resistance

$2.2269 – $2.6666 Fibonacci extension & historical distribution zone

$2.7294 Previous all-time high

💡 This structure offers a potential upside of over +200% if fully played out.

❗ Bearish Scenario (Alternative):

A failed retest and drop below $0.6566 would suggest a false breakout.

A breakdown below $0.52 would invalidate the bullish setup and could send DYDX back to $0.41, its previous macro support.

In this case, the market may re-enter a range-bound or sideways phase.

⚙️ Conclusion & Trading Strategy:

DYDX/USDT is at a technically critical moment. The recent breakout could mark the beginning of a major reversal trend after months of consolidation. A healthy pullback to the $0.66–$0.73 zone could offer an ideal entry opportunity with tight stop-losses.

For swing traders and trend followers, this may be one of the best risk/reward setups on DYDX in recent months.

#DYDXUSDT #DYDXBreakout #CryptoBullish #AltcoinSeason #CryptoAnalysis #FibonacciLevels #SmartMoney #DYDXRally #TechnicalBreakout

DYDXUSDT Elliott Waves Analysis (Investment Idea)Hello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity. Thank you!

Everything on the chart. (update)

Everything according plan, we got downward movement in 2.3 - 2$ zone, im already in pos.

Closest Targets: 3.3 - 5 - 7.5 - 11

Main(investment) target zone: 10-12$

RR: 1 to 10

Cancellation of setup - decreasing under ~1.1

notes: it's also possible to see 15-17-20$ targets, but for me it's speculative position and i will sell everything by 10-12$

It's not financial advice.

DYOR!

DYDXUSDT Elliott Waves AnalysisHello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity. Thank you!

Everything on the chart.

The initial diagonal have been completed, im waiting for correction and continuation of growth.

Entry zone: 2.4 - 2.1$

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

DYOR!

DYDXUSDT Elliott Waves AnalysisHello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity. Thank you!

Everything on the chart.

Price going by alternative option.

Main target zone: 4.5 - 5$

Stop: under 2 (depending of ur risk).

RR: 1 to 3

ALWAYS follow ur RM.

risk is justified

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

Dont Forget, always make your own research before to trade my ideas!

Open to any questions and suggestions

DYDXUSDT based on 1h chartHello traders, I am expecting a ranging between the Orange order block which is considered to be Premium zone, and the blue oB...

and then a Liquidation upward, then a dump towards the green zone (2.775 - 2.900)

Trade carefully and always move your SL to Entry Point...

enjoy trading <3

🔔 DYDX/USDT Analysis 🚀✨ Market sentiment on DYDX/USDT is turning bullish, as the price shows signs of gaining momentum.

📈💫The current market structure suggests a potential 2x bullish move in the upcoming days, creating an exciting opportunity for traders and investors! 🚀💰

❗️Disclaimer: Remember, this is not financial advice! Always do your own research (DYOR) and make informed decisions.

🔍💡Keep a close eye on the DYDX/USDT pair and stay tuned for further updates! 🚀📊

📊#DYDX double bottom target not achieved, worthy of attention👀➡️We started a rebound after reaching a new historical low in June 2022, and the price is gradually rising in the subsequent development. 📈

🧠According to the Elliott Wave Theory, we are completing the 5th wave.

🧠From a structural point of view, we started to rise with the double bottom long structure as the supporting driving force. At present, the goal of the long structure has not been fully realized, so it is still worth looking forward to🙏

➡️At present, we have completed the adjustment of the daily K cycle and returned to the buying zone near the neckline. We look forward to better performance in the future. 🙏

⚠️Note that technical analysis is for reference only, don’t forget risk management. If you find it useful, please don’t forget to follow, like and share my analysis post📤

"CFX/USDT Long Setup: Bullish Breakout from Falling Wedge PatterTrade Setup for #DYDX/USDT: Long Position

Analysis:

DYDX has broken out of a falling wedge pattern, indicating a potential upward trend.

The current price (CMP) serves as the entry point.

The breakout is being retested, suggesting a potential confirmation of the bullish move.

Entry Point: Current Market Price (CMP)

Additional Positions: Consider adding more if the price drops to $2.870

Targets:

$3.4

$3.9

$4.35

$5.2

$5,8

Stop Loss (SL):

Set the Stop Loss at $2.825 to limit potential losses.

Leverage:

Use leverage cautiously: 5x to 10x.

DYOR

DYDXUSDT Elliott Waves AnalysisHello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity. Thank you!

Everything on the chart.

2 possible options:

growth from current price or through one more decline in zone 2.4 - 2.2

Main target zone: 4.6 - 5$

Stop: (depending of ur risk). ALWAYS follow ur RM.

risk is justified

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

Dont Forget, always make your own research before to trade my ideas!

Open to any questions and suggestions