Golden Anchor: The Multi-Domain Resilience of BullionThe price of gold recently surged past $4,045 per ounce, cementing its role as a strategic global asset. This upward trend, pushing the year-to-date gain above 50%, is not merely speculative. It reflects deeply rooted structural forces across multiple global domains, from macroeconomics to high-tech demand. Investors are proactively using gold as a vital hedge against accelerating global uncertainty and fiat currency debasement.

Geopolitics & geostrategy: The De-Dollarization Hedge

Persistent geopolitical tensions drive sustained demand for gold's safe-haven status. Heightened conflict risks and unpredictable US tariff policies create global market volatility. In this fragmented landscape, gold acts as a politically neutral reserve asset, mitigating counterparty risk. Central banks globally are strategically accumulating gold to diversify away from the US dollar, accelerating the de-dollarization trend. This shift enhances national economic sovereignty, fueling gold's ascent.

Macroeconomics: Fiscal Dominance and Rate Cuts

Weakening US economic indicators directly reinforce gold’s appeal. A dip in the University of Michigan’s Consumer Sentiment Index signals broad economic unease. This fragility increases market bets on an earlier and more aggressive Federal Reserve rate-cutting cycle. Lower interest rates reduce the opportunity cost of holding non-yielding gold, boosting its price. Furthermore, the fiscal dominance prevalent in developed economies promotes gold as a critical hedge against the debasement of G7 fiat currencies.

Central Bank & Investment Demand Dynamics

Central bank purchases provide a formidable structural floor for gold prices. Despite the recent price correction, global central banks remain net buyers. They added 220 tonnes in Q3 2025 alone, representing a strategic, long-term commitment to gold. Poland, Kazakhstan, and Azerbaijan are notable accumulators. Retail and institutional investors are also turning to gold ETFs and physical bullion, viewing gold as essential financial insurance during systemic shocks.

Technology, Science, and High-Tech Demand

Technological advancements, particularly the boom in Artificial Intelligence, subtly support gold demand. While gold's main drivers remain macroeconomic, the high-tech sector consumes gold in electronic components and specialized circuits. Industrial demand remains resilient, offsetting a decline in jewelry consumption due to high prices. The massive, energy-intensive growth of AI and data centers indirectly creates a strategic need for high-value, reliable assets like gold to back infrastructure growth and hedge associated capital risks.

Technical Outlook and Consolidation Phase

Gold exhibits high long-term conviction but faces short-term consolidation after its historic rally. The price peaked at over $4,380 per ounce in mid-October before profit-taking began. Analysts expect the price to remain range-bound in the near term, with a maximum pullback risk around the strong $3,500/oz support level. Key technical resistance levels above the current peak are seen at $4,420/oz and $4,500/oz. Investors should utilize short-term dips as strategic long-term accumulation opportunities.

Economicuncertainty

Is the Golden Arches Losing Its Shine?McDonald's, a global fast-food icon, recently reported its most significant decline in U.S. same-store sales since the peak of the COVID-19 pandemic. The company experienced a 3.6 percent drop in the quarter ending in March, a downturn largely attributed to the economic uncertainty and diminished consumer confidence stemming from President Donald Trump's tariff policies. This performance indicates that the unpredictable nature of the trade war is prompting consumers to curb discretionary spending, directly impacting even seemingly resilient sectors like fast food through reduced customer visits.

The link between sinking consumer sentiment and tangible sales figures is evident, as economic analysts note the conversion of "soft data" (sentiment) into "hard data" (sales). While some commentators suggest that McDonald's price increases have contributed to the sales slump, the timing of the decline aligns closely with a period of heightened tariff-related anxiety and a contraction in the U.S. economy during the first quarter. This suggests that while pricing is a factor, the broader macroeconomic environment shaped by trade tensions plays a critical role.

In response, McDonald's emphasizes value offerings to attract and retain customers navigating a challenging economic landscape. The company's struggles mirror those of other businesses in the hospitality sector, which also report reduced consumer spending on dining out. The situation at McDonald's serves as a clear illustration of how complex trade policies and the resulting economic uncertainty can have far-reaching consequences, affecting diverse industries and altering consumer behavior on a fundamental level.

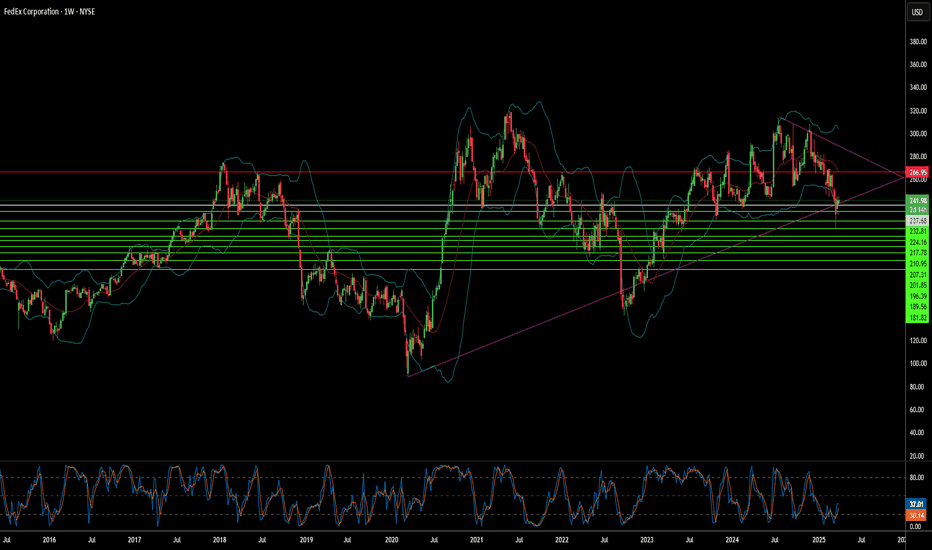

FedEx: Balancing Act or Precarious Gamble?Recent market activity highlights significant pressure on FedEx, as the logistics giant grapples with prevailing economic uncertainty. A notable drop in its stock price followed the company's decision to lower its revenue and profit outlook for fiscal year 2025. Management attributes this revision to weakening shipping demand, particularly in the crucial business-to-business sector, stemming from softness in the US industrial economy and persistent inflationary pressures. This development reflects broader economic concerns that are also impacting consumer spending and prompting caution across the corporate landscape.

In response to these domestic headwinds, FedEx has adopted a more conservative operational stance, evidenced by a reduced planned capital spending for the upcoming fiscal year. This move signals an emphasis on cost management and efficiency as the company navigates the current economic climate within its established markets. It suggests a strategic adjustment to align spending with the revised, more cautious revenue expectations.

However, this domestic caution contrasts sharply with FedEx's concurrent and ambitious expansion strategy in China. Despite geopolitical complexities, the company is making substantial investments to enlarge its footprint, building new operational centers, upgrading existing gateways, and increasing flight frequencies to enhance connectivity. This dual approach underscores the central challenge facing FedEx: balancing immediate economic pressures and operational adjustments at home while pursuing a long-term, high-stakes growth initiative in a critical international market, all within an uncertain global environment.