Cloudflare: The Edge AI Infrastructure PowerhouseCloudflare recently shattered Q4 2025 analyst expectations with surging revenue and robust guidance. The company reported significant growth fueled by AI demand. Investors responded with enthusiasm, driving shares higher. Analysts like Guggenheim promptly raised price targets to $140. Cloudflare now stands as a primary beneficiary of the AI infrastructure boom.

The Patent Moat and Technical Edge

Cloudflare dominates the edge computing landscape through relentless innovation. Its proprietary "Workers" platform remains a patent-protected goldmine for the firm. Recent acquisitions of Astro and Human Native expand these technical capabilities. These moves integrate high-performance web development with AI-ready content streams.

The company aggressively secures intellectual property that optimizes global data routing. This patent strategy creates a formidable moat against legacy competitors. Their VMFE templates further streamline developer workflows at the edge. Cloudflare transforms the network into a programmable, intelligent fabric.

Geostrategy and Geopolitical Resilience

Data sovereignty now dictates global technology strategy. Cloudflare’s massive distributed network addresses these geopolitical shifts effectively. They provide localized security in an increasingly fragmented digital world. This geostrategy reduces latency while ensuring strict regulatory compliance.

The company acts as a neutral digital bridge across borders. Their infrastructure protects critical assets against state-sponsored cyber threats. This positioning makes Cloudflare essential to national digital defenses. They turn geopolitical volatility into a structural market advantage.

Industry Trends: The Rise of Agentic AI

Agentic AI represents the next major technological frontier. Cloudflare positions itself as the essential infrastructure for these autonomous agents. Industry trends favor decentralized, low-latency processing for real-time AI. The "Connectivity Cloud" meets this demand by moving compute closer to the user.

They are no longer just a content delivery network. Cloudflare provides the "neurons" for the global AI brain. Large language models require the speed that only edge networks provide. This shift secures Cloudflare’s relevance for the next decade.

Management, Leadership, and Culture

Matthew Prince leads with a clear, long-term vision. The leadership team prioritizes engineering excellence over short-term marketing gains. This culture fosters rapid product development and seamless deployment. They maintain a competitive edge through agile, founder-led decision-making.

Management demonstrates disciplined capital allocation and impressive operational leverage. They successfully transitioned from a self-service model to enterprise dominance. This leadership stability reassures institutional investors during market swings. Their internal culture attracts top-tier talent in a competitive field.

Macroeconomics and Business Model

The SaaS business model delivers high margins and recurring revenue. Upselling existing clients remains a core economic driver for the company. Cloudflare thrives even as businesses tighten their overall budgets. Cybersecurity and AI infrastructure remain non-discretionary expenses for modern firms.

High-tech integration remains their primary engine for economic growth. The company’s "freemium" funnel efficiently captures the next generation of giants. This creates a self-sustaining cycle of growth and market penetration. Cloudflare hedges against inflationary pressures through essential service pricing.

Cybersecurity and the Science of Defense

Cyber threats evolve with increasing speed and terrifying complexity. Cloudflare utilizes advanced machine learning to preempt these sophisticated attacks. Their scientific approach to network traffic analysis remains unparalleled. They turn massive global data sets into actionable security intelligence.

The company thwarts record-breaking DDoS attacks with automated precision. This technical superiority protects the fundamental integrity of the internet. By securing the edge, they protect the entire digital ecosystem. Cloudflare remains the definitive shield for the modern enterprise.

Edgecomputing

BigBear (BBAI) — Expanding AI Leadership in Defense IntelligenceCompany Overview:

BigBear.ai Holdings, Inc. NYSE:BBAI is a leading provider of AI-powered decision intelligence for defense, supply chain, and digital identity markets—offering investors exposure to the rapidly growing AI and analytics sector focused on mission-critical applications.

Key Catalysts:

Defense expansion: New U.S. Navy partnership for UNITAS 2025 and strategic alliance with Tsecond strengthen BigBear.ai’s role in real-time, edge-based AI processing via ConductorOS and BRYCK platforms.

Long-term contracts: Over $178 million in multi-year defense deals provide strong revenue visibility and recurring income stability.

Strategic momentum: Growing adoption across national security agencies underscores BigBear.ai’s position in U.S. defense modernization efforts.

Investment Outlook:

Bullish above: $6.80–$7.00

Upside target: $17.00–$18.00, supported by defense partnerships, scalable AI deployment, and national security demand.

#BigBearAI #ArtificialIntelligence #DefenseTech #NationalSecurity #EdgeComputing #AIAnalytics #Investing #BBAI

NET — AI Infrastructure Leader Launches Stablecoin InnovationCompany Overview:

Cloudflare, Inc. NYSE:NET is a global leader in cloud connectivity and cybersecurity, delivering secure, scalable, and high-performance infrastructure for the modern internet. The company is evolving into a key enabler of AI-driven applications, with its Workers platform gaining strong enterprise traction to power large-scale intelligent workloads.

Key Catalysts:

Fintech breakthrough: The launch of the NET Dollar stablecoin bridges AI, cloud, and financial infrastructure, enabling automated machine-to-machine (M2M) payments and introducing new recurring revenue models.

Enterprise growth: Added 219 new large customers in Q2 2025, highlighting accelerating adoption and market leadership.

AI ecosystem expansion: Increasing integration of Cloudflare’s edge computing network within enterprise AI frameworks positions it at the core of the next-generation digital economy.

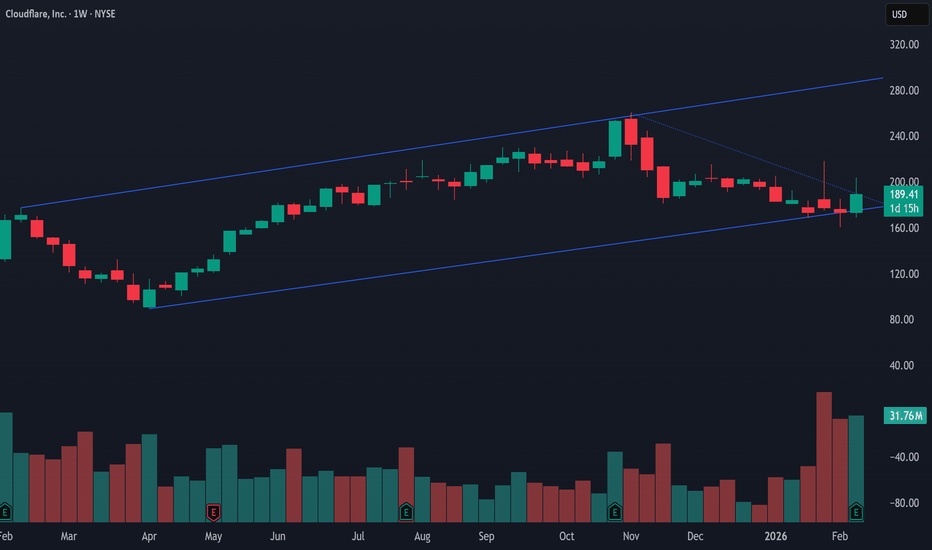

Investment Outlook:

Bullish above: $188–$190

Upside target: $380–$390, supported by AI infrastructure dominance, fintech innovation, and accelerating enterprise demand.

#Cloudflare #AI #Stablecoin #Cybersecurity #Fintech #DigitalInfrastructure #EdgeComputing #Investing #NET

Cloudflare (NET) AnalysisCompany Overview:

Cloudflare NYSE:NET , a global leader in cybersecurity, content delivery networks (CDN), and edge computing, is well-positioned to capitalize on increasing digital transformation and growing demand for secure, efficient cloud infrastructure.

Key Growth Catalysts:

Strategic AI Partnerships 🤝

Cloudflare’s collaboration with Microsoft Azure enhances its AI infrastructure, fostering innovation and bolstering its competitive edge in enterprise cloud solutions.

Zero Trust Leadership in Cybersecurity 🔐

Cloudflare’s Zero Trust platform addresses growing enterprise needs amid rising cyber threats and increased remote work adoption.

Advanced threat intelligence and access controls make it a leader in next-gen cybersecurity solutions.

Edge Computing & IoT Opportunities 🌐

Edge computing solutions are experiencing strong adoption, fueled by:

Growing demand for 5G networks and the IoT revolution.

The edge computing market is projected to reach $87.3 billion by 2026.

Cloudflare’s focus on reducing latency and enhancing network efficiency positions it to capture market share.

Global Expansion & Untapped Markets 🌍

New data centers in underserved regions expand Cloudflare’s global reach, improving service delivery and unlocking revenue opportunities in untapped markets.

Investment Outlook:

Bullish Stance: We are bullish on NET above $90.00-$91.00, supported by strong positioning in AI, cybersecurity, and edge computing, coupled with robust global expansion strategies.

Upside Target: Our price target is **$145.00-$150.00

Vertiv Holdings (VRT) AnalysisCompany Overview: Vertiv Holdings NYSE:VRT is strategically positioned to capitalize on the increasing demand for data center infrastructure, with a particular focus on edge computing and the expanding 5G networks. As companies across various sectors accelerate their digital transformation, Vertiv's role in providing critical infrastructure solutions, including liquid cooling technology, is crucial for the operation and efficiency of modern data centers.

Key Catalysts:

Edge Computing & 5G Growth: The rise of edge computing and 5G networks increases the need for efficient, reliable data center infrastructure, a core competency for Vertiv.

Critical Infrastructure Expertise: Vertiv's leadership in liquid cooling and other essential data center technologies will be increasingly in demand as data centers evolve and expand.

Energy Consumption in Data Centers: With U.S. data centers projected to account for a growing share of electricity consumption, Vertiv’s infrastructure solutions—designed to enhance energy efficiency and optimize operations—are expected to become even more vital.

Digital Transformation: The ongoing shift toward cloud services, AI, and machine learning will fuel greater data center demand, benefitting Vertiv’s business model.

Investment Outlook: Bullish Outlook: We are bullish on VRT above $89.00-$91.00, driven by its market-leading solutions in data center infrastructure and strong growth potential. Upside Potential: Our target range for VRT is $140.00-$145.00, reflecting the company’s strategic position in critical growth sectors like 5G, edge computing, and data centers.

🚀 VRT—Leading Data Center Infrastructure into the Digital Future. #DataCenters #EdgeComputing #5G

FSLY- When the momentum stock loses its momentumTrend line is temporarily broken and there was no strong bounce back after the price crashed to the confluence zone of POC, 50 SMA and fib 38.2 level, indicating a weak demand at this lvl. There is little sign of decreasing selling pressure at this moment.

If FSLY doesn't get back above the resistance and supply zone of 90 convincingly in the next days, party may indeed be over.

Generally speaking, when you see the momentum stock decline significantly after the positive earning, this should be your first warning sign that investors are disappointed that the stock fails to live up to their lofty expectation. This is especially true for momentum stocks with lofty valuation.

Market tops are often made when stocks react negatively to positive earning or when stocks stop going up on positive news.

It is possible though that the short-term negative sentiment is caused by the TikTok news, but it is undeniable that the growth of enterprise clients for FSLY has slowed down recently.

The overall macro is still good for Fastly though as E-commerce is still thriving. I am also bullish on the cybersecurity industry as whole and another market-leading CDN in the edge computing space you can capitalize on is NET.

Thank you for reading through my analysis! Don't forget to click the like and follow me :)

F