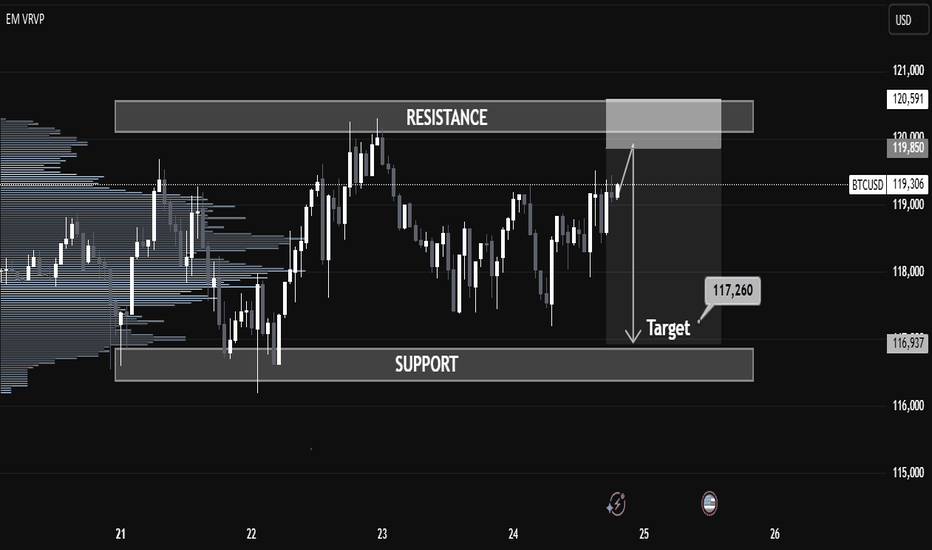

BTCUSD Key Supply Zone Rejection – Bearish Target Mapped BTCUSD Key Supply Zone Rejection – Bearish Target Mapped (Educational Breakdown)

⸻

🧠 Technical Analysis (1H Chart):

• Range Structure: BTCUSD is currently trading within a well-defined consolidation range between the Resistance Zone ($119,850–$120,591) and the Support Zone ($116,937).

• Volume Profile (VRVP): Volume is noticeably thick near the mid-range, suggesting accumulation/distribution behavior. Price is struggling to break above the value area high near $120K.

• Resistance Rejection: After testing the upper supply zone, price failed to sustain bullish momentum and is showing signs of exhaustion – a possible sign of institutional selling.

• Target Zone: If price rejects this resistance again, a strong move toward the target level of $117,260 is expected. This aligns with:

• Mid-range liquidity sweep

• Low-volume node (LVN) below current price

• Fair Value Gap fill near $117,200–$116,900

⸻

🧩 Key Concepts Highlighted:

• Support & Resistance Mapping

• Volume Profile Readings

• Institutional Order Flow Bias

• Target Projection using Smart Money Concepts

⸻

⚠ Educational Insight:

This setup is a perfect example of how to combine Volume Profile + Price Action to identify liquidity traps and smart entries. Always wait for confirmation near key zones — not every level breaks!

⸻

✅ Trade Plan (Not Financial Advice):

• Watch for bearish engulfing/rejection wick at resistance

• Short entry below $119,000 with SL above $120,600

• Target: $117,260 / Final TP: $116,937 zone

Educationalchart

Trade Ascending Parallel Channel With 3 Points + Pivot PointTrade Ascending Parallel Channel With 3 Points + Pivot Point Indicator

Connect your three points using the parallel channel. First, connect two points which are your higher lows. Next, connect the third point which is the swing high. The swing high is the higher high.

In this example, a pin bar formed at the higher low. Pin Bar wick touches pivot point level and channel support level. Volume Indicator is "green" and pin bar is "white." Conditions are great to enter the market at pin bar closing price.

Bullflag -The Bullish patternThe Flag pattern is one of the best-known continuation pattern in trading which happen after an uptrend.On-chart you can see a good pump and after a minor consolidation zone.This consolidation zone is important to calm down slowly indicators and calm volume,after this step we can see a growth of volume and a breakout

What is the target of a bullflag?

The first target of confirmed can be derived from measured move tehnique.The first target of bullflag is the vertical distance between the lower and the uper point of flag

The second target is the size of the FLAGPOLE(measure the flagpole size and you will put this size at the breaking point from the bullflag

It s important to book some profit also after the first target(size of flag).

If the flag during too much will fail.Keep your eyes on it all time and have a stop-loss

Have fun and good luck!