#EDU/USDT Forming Bullish Momentum#EDU

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.1418. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.1441

First target: 0.1454

Second target: 0.1469

Third target: 0.1491

Don't forget a simple principle: money management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.

EDUUSDT

EDUUSDT UPDATE#EDU

UPDATE

DGB Technical Setup

Pattern: Falling Wedge Pattern

Current Price: 0.1494

Target Price: 0.2235

Target % Gain: 50.30%

Technical Analysis: EDU is trading inside a falling wedge pattern on the 1D chart, which is a bullish reversal structure. Price is currently hovering near the wedge resistance, and a confirmed breakout above the descending trendline could trigger a strong upside move toward the highlighted target zone. Momentum is gradually improving, supporting the bullish scenario.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

edu looking good good but need confirmation Edu Over all Consolidating Within Descending Channel Range, And Now Showing Signs Of Recovery Towards Descending Trendline Which Is Next Resistance Around 0.17$ Edu Needs To Clear Blue Box Resistance To Target Trendline, If Trendline Got Cleared Then It Can Give Another Rally But Currently Our Target Should Be Trendline

EDU – Bear Flag Breakdown Potential with Lower Targets AheadThe recent price action on EDUUSDT is forming a clear bear flag on the 3D timeframe. After a strong impulsive drop, the market has been consolidating inside an upward-sloping channel — a classic continuation pattern in a downtrend.

Price is now losing support at the lower boundary of the channel, suggesting the bear flag may be close to confirming a breakdown. If momentum continues to the downside, the next liquidity zones are located significantly lower.

Key observations:

Structure aligns with a bear flag , often signaling continuation of the prior sell-off.

Price is testing the lower trendline of the channel with increasing weakness.

A confirmed breakdown opens the path toward the next demand zones.

Downside Targets:

$0.09–$0.08

$0.055–$0.045

As long as price remains below the flag resistance, downside continuation remains the dominant scenario.

#EDU/USDT Forming Bullish Momentum#EDU

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.1580. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.1615

First target: 0.1657

Second target: 0.1710

Third target: 0.1785

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

EDUUSDT UPDATE#EDU

UPDATE

EDU Technical Setup

Pattern: Falling Wedge Pattern

Current Price: $0.168

Target Price: $0.239

Target % Gain: 44.55%

Technical Analysis: EDU is breaking out of a falling wedge pattern on the 4H chart, signaling bullish continuation potential. Price has successfully moved above the descending resistance trendline, confirming the breakout structure. The projected measured move from the wedge points toward the highlighted upside target zone, which aligns with prior resistance and reclaim levels. As long as price holds above the breakout area, momentum favors further upside expansion.

Time Frame: 4H

Risk Management Tip: Always use proper risk management.

#EDU/USDT Forming Bullish Momentum#EDU

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.1460. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward move.

Entry price: 0.1500

First target: 0.1540

Second target: 0.1591

Third target: 0.1663

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

#EDU/USDT Forming Bullish Momentum#EDU

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.1700, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.1760

First target: 0.1790

Second target: 0.1853

Third target: 0.1911

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

#EDUUSDT #1D (ByBit) Descending trendline breakout and retestOpen Campus is pulling back to 100EMA regained support where it seems likely to bounce and recover midterm.

⚡️⚡️ #EDU/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Long)

Leverage: Isolated (1.0X)

Amount: 5.1%

Current Price:

0.1598

Entry Targets:

1) 0.1587

Take-Profit Targets:

1) 0.3456

Stop Targets:

1) 0.0963

Published By: @Zblaba

NYSE:EDU BYBIT:EDUUSDT.P #1D #OpenCampus #Education opencampus.xyz

Risk/Reward= 1:3.0

Expected Profit= +117.8%

Possible Loss= -39.3%

Estimated Gaintime= 2-3 months

EDU/USDT – Volume Expansion Setup🔹 EDU/USDT – Volume Expansion Setup

EDU continues to show strong structure after the last move up, holding steady inside the volume box. The pair is building momentum with consistent volume increase on the lower time frames, showing clear accumulation signals.

If the current structure remains stable, EDU can continue this short-term uptrend and target the next resistance zone around $0.48, where the main reaction level is expected.

We follow the data and volume development closely — as long as the price stays supported inside the box, the momentum remains valid for a potential breakout continuation toward the upper range.

EDUUSDT Forming Bullish MomentumEDUUSDT is currently showing a strong bullish momentum pattern, indicating that buyers are firmly in control and price action is building toward a significant upward breakout. The structure suggests consistent higher lows with increasing volume, signaling that accumulation is happening in the background. As the market gains traction, EDUUSDT could be on the verge of a major push to the upside, aligning perfectly with the broader bullish sentiment across select altcoins.

The trading volume for EDUUSDT remains strong, confirming active participation and growing confidence among investors. Momentum indicators are pointing toward a continuation of the current trend, with a potential target range showing gains between 80% to 90%+. A breakout above the recent resistance levels could open the way for an extended rally, especially as traders begin positioning themselves ahead of the move.

Investor interest in EDUUSDT continues to rise, as many see this as a promising project backed by solid fundamentals and renewed technical strength. With bullish energy building across the crypto market, EDUUSDT could emerge as one of the high-performing assets in the near term. A sustained move above key levels may validate this pattern and lead to a substantial price expansion, rewarding early entries.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

EDU/USDT Update - Cycle TokenEDU is now trading inside the volume box area. After the last move up, the price is holding stable with volume increase on the 4H.

As long as EDU stays inside this range, we follow for a possible move to the top of the box around $0.34, where we expect first resistance.

If BTC stays stable, EDU can continue this short-term trend move to test the upper box level.

EDU /USDT consolidating in range_Watch for breakout or breakdownEDU is currently trading within a clear horizontal range. After rebounding strongly from the lower support zone, price is now moving upward toward the range resistance.

Bullish Scenario: If EDU breaks and holds above the upper boundary, it could trigger a breakout rally.

Bearish Scenario: A rejection from resistance may lead to another retest of the range support.

Always wait for confirmation before entering and manage risk wisely.

EDUUSDT Forming Bullish MomentumEDUUSDT is showing a strong bullish momentum pattern, indicating that buyers are stepping in with renewed confidence and accumulation pressure. The recent surge in volume confirms that investor interest is growing rapidly, providing the foundation for a potential major upside move. With the market structure aligning for continuation, the pair looks ready to target a gain of 80% to 90%+ in the coming sessions if momentum holds steady above current support levels.

This bullish setup is supported by consistent higher lows and tightening price action, which often precedes a breakout phase. EDUUSDT’s technical outlook suggests that the ongoing consolidation may soon resolve to the upside, pushing prices toward key resistance levels. Market sentiment remains optimistic as buyers dominate, showing clear signs of accumulation and preparation for a possible expansion move.

The overall trading volume and investor behavior indicate increasing conviction behind EDUUSDT’s upward trajectory. If the price maintains its strength and breaks through resistance with sustained volume, the bullish continuation could accelerate quickly. This setup offers traders a compelling opportunity to follow the momentum and ride the wave of potential growth.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

EDUUSDT | 1H Setup With CDV DivergenceOn EDUUSDT, the green box is not a bad level to try — but only with the right confirmation.

I’d like to see a positive CDV divergence on the 1-hour chart before considering entry. That would suggest buyers are absorbing and quietly stepping in.

Important note: this is a 1-hour analysis, which means it’s not a trend changer. At best, it’s a tactical entry with a possible 5–10% short-term reaction.

The bigger trend remains intact, so I treat this only as a precise bounce setup with tight risk management.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

#EDU/USDT Forming Bullish Reversal#EDU

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.1342, which represents a strong support point.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 Moving Average.

Entry price: 0.1360

First target: 0.1367

Second target: 0.1380

Third target: 0.1393

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

EDU BINANCE:EDUUSDT

#EDU/ USDT

Entry range (0.1200- 0.1380)

SL 4H close below 0.1170

T1 0.1730

T2 0.2800

T3 0.3300

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

#Edu/USDY#EDU

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.1500, which acts as strong support from which the price can rebound.

Entry price: 0.1576.

First target: 0.1670.

Second target: 0.1784.

Third target: 0.1905.

EDUUSDT Forming Bullish ReversalEDUUSDT is showing promising signs of a potential bullish reversal after forming a clear descending channel pattern on the charts. This pattern, often considered a continuation or reversal setup depending on the breakout direction, is currently leaning bullish as the price edges closer to a possible breakout above the upper trendline. With good trading volume supporting the recent price movements, there’s growing confidence that EDUUSDT could rally significantly once the breakout is confirmed, aligning with the expected 70% to 80% upside potential.

Technically, descending channels reflect a period of controlled correction, where sellers gradually lose momentum while buyers accumulate at lower price levels. EDUUSDT has been respecting its channel boundaries well, and the emergence of higher lows on shorter timeframes indicates that buying pressure is slowly building. A decisive breakout above resistance, coupled with a volume surge, could signal the start of a strong bullish wave, attracting more traders to this setup.

Investor sentiment toward EDUUSDT is improving as it nears this key technical point. Market participants are watching closely for a confirmation move, which could trigger a wave of new buying interest. If the breakout holds and price sustains above former resistance zones, EDUUSDT has the potential to hit its projected targets quickly, making it a coin to keep on the radar for short- to mid-term gains.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

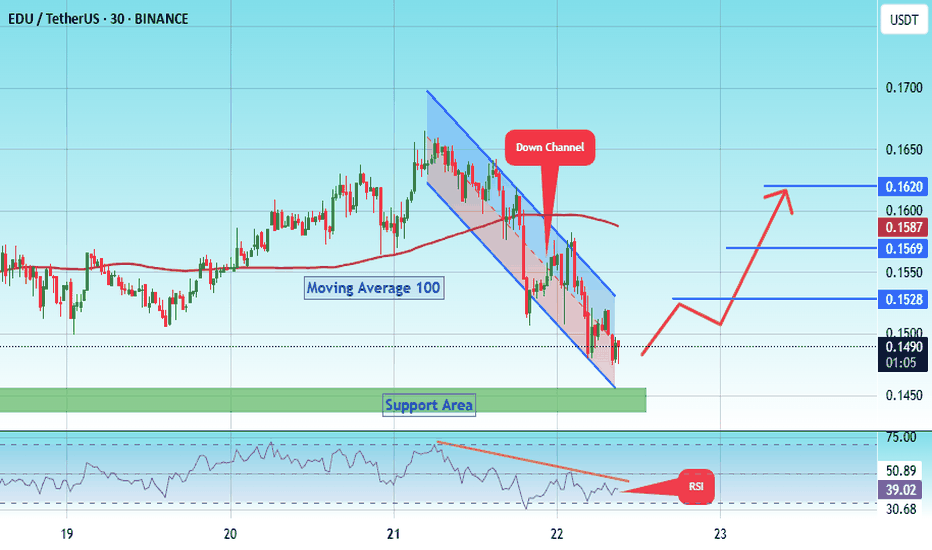

#EDU/USDT#EDU

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 0.1464.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.1442, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.1487

First target: 0.1528

Second target: 0.1570

Third target: 0.1620

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

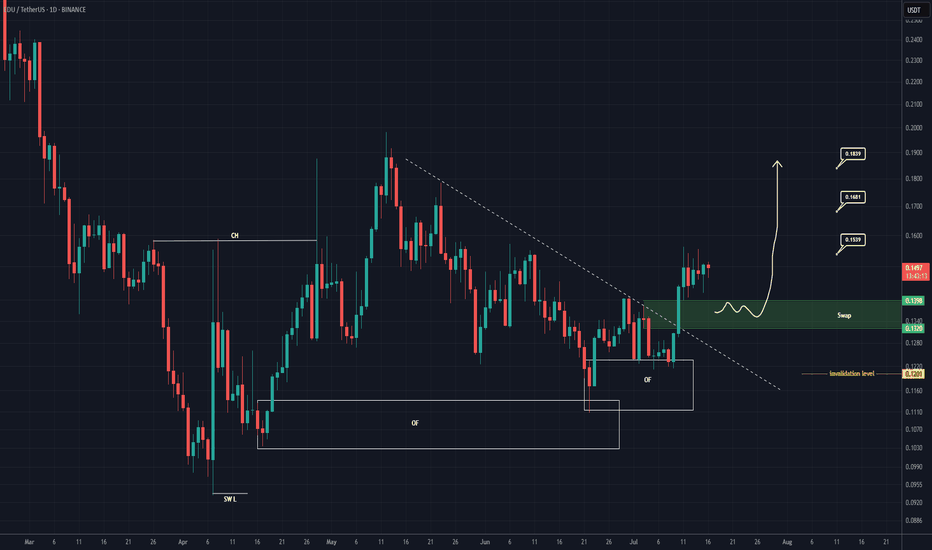

EDU Buy/Long Setup (1D)After forming a swing low, the price has created a bullish Change of Character (CH), and it has flowed well from the origin order blocks.

The trigger line has been broken, and the price has formed a SWAP zone.

Given the bullish signs on the chart, we can consider entering a buy position within the SWAP zone.

The targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

EDUUSDT Forming Descending TriangleEDUUSDT has recently broken out of a descending triangle pattern on the daily timeframe, which is typically a bullish signal when confirmed with volume. The breakout has occurred with notable strength and solid green candle momentum, indicating a potential trend reversal and the beginning of a strong upward move. With price currently trading near $0.1499, this technical breakout opens the door for a projected gain of 60% to 70%+ in the coming days or weeks.

EDU, the native token of the Open Campus project, is gaining attention as the Web3 education narrative grows stronger. As traditional sectors like education integrate blockchain, EDU stands out as a project with real-world utility and adoption potential. The fundamentals are aligning well with the technical picture, and the increased investor interest is starting to reflect in both volume spikes and social media chatter.

If EDUUSDT maintains support above the breakout trendline, traders could see a continuation toward the $0.25 to $0.27 region — aligning with the chart projection of nearly 80% upside. This setup is further supported by increasing market sentiment, and EDU’s strategic partnerships in the education sector make this move fundamentally sound.

This is a high-potential setup for traders looking to ride breakout momentum in trending altcoins. EDU is not just riding the wave of hype but is backed by utility, strong technical structure, and market interest — making it a standout in the current altcoin rotation.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!