EGLD/USDT — Descending Triangle at a Critical Demand Zone🔎 Overview

The EGLD/USDT (1D, Binance) chart is currently forming a classic descending triangle pattern:

Lower Highs are pressing price downward along the yellow trendline.

A strong horizontal demand zone at 11.40 – 13.50 USDT has been repeatedly tested as support.

Price is compressing toward the apex of the triangle → as the range tightens, the likelihood of a strong breakout or breakdown increases significantly.

---

🧩 Technical Pattern Details

Descending Triangle → historically leans bearish, but can flip bullish if the breakout occurs with strong volume.

Volume has been contracting, a typical sign of market indecision before a large move.

Support Zone 11.40 – 13.50 → key demand area; losing this level may trigger a strong sell-off.

Dynamic Resistance: the descending yellow trendline remains the critical barrier for bulls.

---

📊 Bullish Scenario

Confirmation: Daily close above the descending trendline with strong volume.

Upside Targets:

First hurdle: 16.29 USDT

Next: 18.20 → 20.85 USDT

Mid-term if momentum expands: 33.48 – 38.67 USDT

Reasoning: A breakout above a descending triangle often sparks a short-covering rally, leading to fast gains.

---

📉 Bearish Scenario

Confirmation: Daily close below 11.40 USDT.

Downside Targets:

Immediate: 11.00 – 10.50 USDT

Extension: 9.60 USDT (next major low on chart).

Reasoning: Breaking a multi-tested demand zone confirms sellers’ dominance, likely triggering a continuation of the downtrend.

---

🎯 Strategy & Risk Management

Conservative Approach: Wait for confirmation (breakout/breakdown) + retest → safer entries.

Aggressive Approach: Long near the demand zone with tight stop-loss below 11.40 (higher risk due to bearish bias of the pattern).

Stop Loss: Below demand zone for longs, above broken support (retest) for shorts.

Risk/Reward: Minimum 1:2 R:R ratio to keep trades profitable over time.

---

🚀 Conclusion

EGLD/USDT is at a make-or-break level.

A breakout above the trendline could fuel a rally toward 18–20 USDT.

A breakdown below 11.40 USDT opens the door to 9.60 USDT or lower.

The market is compressing, and the next decisive daily close with volume will likely set the direction. This is a high-watch setup.

#EGLD #EGLDUSDT #Elrond #CryptoAnalysis #TechnicalAnalysis #ChartPattern #DescendingTriangle #SupportResistanc #CryptoTrading #BullishScenario #BearishScenario

Egldusdtsignal

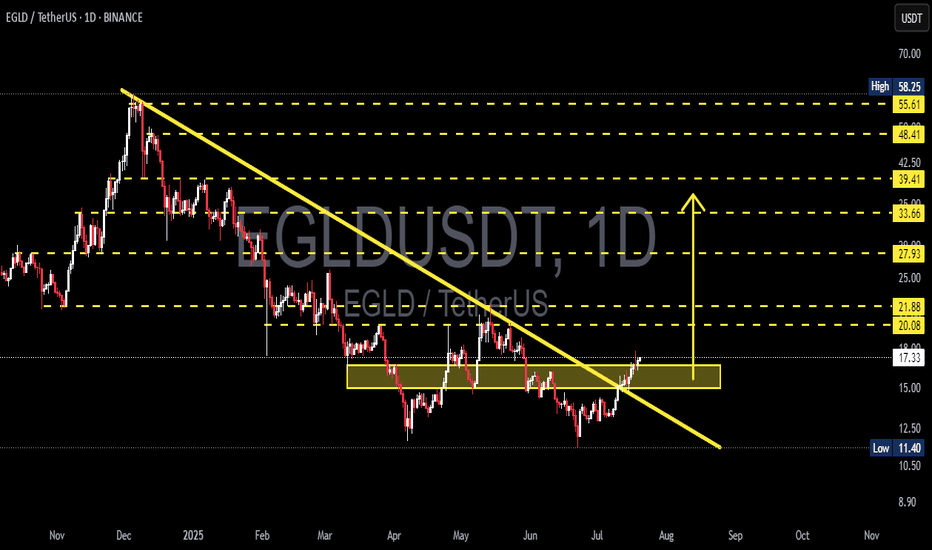

EGLD Breaks Key Downtrend – Is This the Beginning?📊 Detailed Technical Analysis (Daily Timeframe):

🔍 1. Market Structure & Chart Pattern

Major Downtrend Line Breakout – Reversal Signal:

After being stuck under a persistent downtrend for nearly 9 months, EGLD has officially broken out of the descending trendline, signaling a potential shift from distribution to expansion phase. This breakout is significant and could mark the beginning of a new bullish trend.

Double Bottom + Accumulation Range:

Price action shows a clear double bottom formation within the $13.00–$16.50 range, which acted as a strong accumulation zone. This horizontal structure suggests buyers have been silently accumulating before triggering this breakout.

Resistance Turned Support (RBS):

The breakout is now being retested around the $17 level. If EGLD holds this area, it would confirm a support flip, which is a classic bullish signal. Holding above this zone would give bulls full control over the next moves.

🟢 2. Bullish Scenario (Base Case):

If the breakout sustains with increasing momentum:

✅ Short-Term Targets:

$20.08 and $21.88 – minor historical resistance levels.

✅ Mid-Term Targets:

$27.93 and $33.66 – key levels aligning with measured move targets and Fibonacci retracements.

✅ Long-Term Targets:

$39.41, $48.41, up to $55.61–$58.25 – previous key highs and psychological zones.

💡 If EGLD successfully retests and holds above $17.00, it presents a strong opportunity for trend-following entries with favorable risk-reward.

🔴 3. Bearish Scenario (Alternative Case):

If this breakout fails (false breakout scenario):

⚠️ Price could fall back into the previous accumulation range between $13.00–$15.50.

A breakdown below that range could drag EGLD further down toward $11.40, or even $10.00 – a crucial long-term support zone.

Lack of volume or weak bullish confirmation would be early signs of a failed breakout.

🧠 4. Sentiment & Broader Context:

🌐 This breakout comes at a time when altcoin capital rotation is starting to emerge as BTC dominance cools off.

🚀 EGLD, as a smart contract platform, historically performs well during altseason waves and ecosystem narratives.

✅ Final Thoughts:

> EGLD has printed a significant breakout from long-term bearish control. With accumulation completed and momentum building, this may be the beginning of a bullish cycle. However, staying above the $17 level is the key validation to confirm this trend reversal.

#EGLD #EGLDUSDT #CryptoBreakout #AltcoinSeason #TrendReversal #CryptoAnalysis #TechnicalAnalysis #BullishSetup #DoubleBottom

EGLD/USDT In the crucial area, it shows bounce from the support💎 The recent market dynamics surrounding #EGLD have indeed been quite notable.

💎 Currently resting on the support area, EGLD has historically demonstrated a tendency to bounce strongly when reaching this level, often leading to significant upward movements.

💎 There's potential for EGLD to repeat this pattern, and if it manages to break above the resistance, there's further potential for the price to continue its upward trajectory and reach the strong resistance area.

💎 However, if EGLD fails to hold above the support area, there's a possibility it may break below, indicating weakness and potentially leading to a decline to the next lower support area around $28.3.

💎 When EGLD reaches the key support, it must bounce back, as this demand zone holds significant importance. Reclaiming the price above the support area is essential for any further attempts to reach the strong resistance.

💎 If EGLD fails to do so and breaks below the demand zone, it could signal a bearish momentum, resulting in a significant downward movement.

MyCryptoParadise

iFeel the success🌴

EGLDUSDT Elliott Waves Analysis (Local Setup)Hello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity. Thank you!

Everything on the chart.

Entry: market and lower

Targets: 52 and 60

after first target reached move ur stop to breakeven

Stop: under 40 (depending of ur risk). ALWAYS follow ur RM .

RR: 1 to 4

risk is justified

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

Dont Forget, always make your own research before to trade my ideas!

Open to any questions and suggestions

EGLDUSDT Analysis (Local Setup)Hello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity. Thank you!

Everything on the chart.

Entry: market and lower

Target zone: 70-75

after first target reached move ur stop to breakeven

Stop: ~47 (depending of ur risk). ALWAYS follow ur RM .

Risk/Reward: 1 to 3

risk is justified

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

Dont Forget, always make your own research before to trade my ideas!

Open to any questions and suggestions.