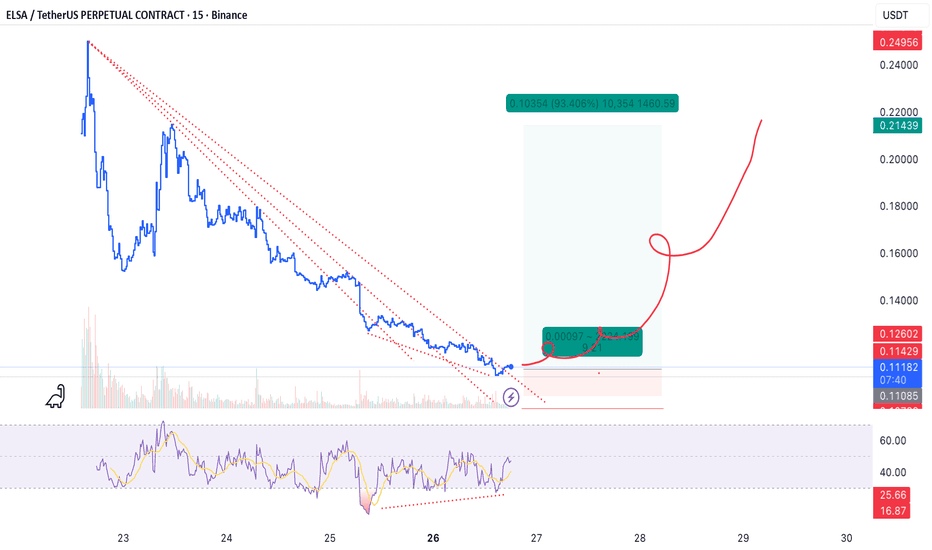

ELSA - Clear bullish divergenceLONG – ELSA

On the 15-minute timeframe, a high-probability preferred pattern has been identified. RSI is deeply oversold and showing clear bullish divergence on M15, signaling momentum exhaustion on the sell side. This condition is confirmed across higher timeframes (H1 and H4), where selling pressure is visibly weakening, indicating seller exhaustion.

Previously, price repeatedly broke the descending trendline, confirming a deterioration of the bearish structure. However, strong buying pressure has not yet emerged. For this reason, the plan is to wait for a volume expansion as confirmation, in line with classical price–volume analysis. Given the historical behavior of this pattern and momentum setup, a buying surge is expected in the near term.

🎯 TP: 0.21439

🛡️ SL: 0.010687

📊 RR: 1 : 9.21

Trade thesis: multi-timeframe RSI divergence + seller exhaustion + repeated bearish trend breaks, with volume confirmation as the final trigger, forming a high RR long opportunity.

ELSA

LONG – ELSALONG – ELSA

On the 15-minute timeframe, we have observed a breakdown of the bearish trend structure, indicating a potential shift from distribution to accumulation. At this stage, the strategy prioritizes waiting for an increase in volume for confirmation, ensuring the breakout is supported by real buying pressure and reducing the risk of a false move.

From a technical perspective, this setup aligns with Dow Theory principles (break of lower highs/lower lows), combined with volume confirmation from classical technical analysis and price action. Once volume expands in agreement with price, the probability of short-term bullish continuation is significantly strengthened.

🎯 TP: 0.01590

🛡️ SL: 0.012269

📊 RR: 1 : 3.92

Trade thesis: bearish trend break + volume confirmation → a cautious long setup with an attractive risk-to-reward profile.

ELSA can reach higher pricePreviously, ELSA shares experienced rejection in the support area of the 250 price range and then rose to the current price. The current price is likely to form a harmonic pattern, namely Bearish Bat with an increase to the price around 410 - 430. The current market condition is bullish.

#Disclaimer: Not a suggest to buy or sell

ELSA Nice move to the upsideAS we can see here in the chart, Elsa had a nice breakout to the upside and currently consolidating to absorb more power in order to continue moving up. AS for me, I am looking for a nice price to entry.

For Elsa also it has a possibility to have HIGH TIGHT FLAG pattern. look it up on google then compare it to ELSA Chart.

LetsGO