ENS/USDT at Critical Zone - Breakout or Continuation Downtrend?ENS/USDT on the Daily (1D) timeframe is still trading within a strong bearish trend, characterized by a clear structure of lower highs and lower lows. Since the previous peak, selling pressure has dominated the market, keeping price action firmly inside a well-defined descending structure.

Currently, price is moving around the mid–lower area of the channel, indicating a technical rebound rather than a confirmed trend reversal.

---

Pattern Explanation – Descending Channel

The primary pattern visible on this chart is a Descending Channel, which is commonly classified as a bearish continuation pattern.

Key characteristics observed:

The upper resistance line continues to press price lower, forming consistent lower highs.

The lower support line slopes downward, creating lower lows.

Price respects the channel structure with multiple reactions.

The channel’s median line acts as a dynamic support/resistance zone.

This pattern suggests that sellers remain in control, and as long as price stays inside the channel, the overall trend remains bearish.

---

Key Levels

Resistance Levels:

12.20 USDT (horizontal resistance & rejection zone)

14.75 USDT

16.60 USDT

19.50 USDT

21.80 USDT

Support Levels:

10.00 USDT (psychological & local support)

8.50 USDT

6.70 USDT (lower channel boundary & major support)

---

Bullish Scenario

The bullish scenario becomes valid only after a clear and confirmed breakout.

Bullish confirmation:

Daily candle closes above the upper boundary of the Descending Channel.

Market structure shifts into higher highs and higher lows.

Ideally supported by increasing volume.

Bullish targets (step-by-step):

12.20 USDT

14.75 USDT

16.60 USDT

19.50 USDT

A valid breakout from this channel may signal a trend reversal from bearish to bullish.

---

Bearish Scenario

The bearish scenario remains the primary bias.

Bearish confirmation:

Price fails to break the channel resistance.

Strong rejection occurs near 12.20 USDT or the upper channel line.

Breakdown below short-term support.

Bearish targets:

10.00 USDT

8.50 USDT

6.70 USDT

As long as price remains inside the Descending Channel, any upward move is likely to be a lower high.

---

Conclusion

ENS/USDT continues to trade within a clear bearish structure, supported by a well-respected Descending Channel pattern. The recent upward movement appears to be a technical pullback, not a confirmed trend reversal.

Traders should wait for strong breakout confirmation before shifting bias to bullish.

---

#ENSUSDT #ENS #CryptoAnalysis #TechnicalAnalysis #DescendingChannel #BearishTrend #Altcoin #CryptoMarket #PriceAction

ENS

ENSUSDT — Massive Bounce or Final Breakdown?After months of wide consolidation, Ethereum Name Service (ENS) is once again testing one of its most critical structures — the golden confluence zone between 16.5–14.0 USDT, which has served as a major battleground between buyers and sellers since 2022.

This isn’t just a price range:

It’s where ENS repeatedly formed higher lows and launched new rallies.

It’s also aligned perfectly with the multi-month ascending trendline, creating a high-value technical confluence.

The market is holding its breath — waiting for a decisive move.

---

Technical Structure & Pattern

Ascending Trendline: still intact since 2023, providing medium-term bullish structure.

Horizontal Support 16.5–14.0: long-term demand zone with multiple reactions in the past; a true make-or-break level.

Compression Phase: price is coiling tighter against support — signaling a potential volatility expansion soon.

---

📈 Bullish Scenario

If ENS manages to close above 16.5 on the weekly timeframe with a strong bullish candle (such as a pinbar or bullish engulfing), a rebound could unfold toward:

Initial targets: 19.8 → 23.6 USDT

Extended targets: 30.4 → 37.0 USDT

This golden zone could act as a launchpad for the next major bullish leg. Long-term buyers may see this as a high-reward accumulation opportunity with limited downside risk.

---

📉 Bearish Scenario

However, a weekly close below 14.0 would confirm a structural breakdown, potentially triggering a deeper move toward:

Next supports: 12.0 → 9.5 USDT

Extreme target: 7.5 – 6.56 USDT, the historical low on the chart.

Such a breakdown would invalidate the medium-term higher-low structure and confirm full bearish control.

---

Conclusion

ENS stands at a technical cliff — this 16.5–14.0 zone will decide whether it marks the foundation for a new bullish cycle or the start of a major downtrend.

Traders who stay patient and wait for clear weekly confirmation will find the best opportunities here — with defined risk and strong potential reward.

---

#ENSUSDT #EthereumNameService #CryptoAnalysis #TradingView #SupportResistance #Trendline #Breakout #BullishScenario #BearishScenario #TechnicalAnalysis #CryptoWeekly #ENSAnalysis #CryptoChart

ENSUSDT – Final Pressure at Critical Zone: Buyer or Seller Wins?Overview

ENS price is currently at a decisive point — compressed within a descending triangle formation, narrowing right above the major demand zone between 17.5–19.5 USDT.

After a prolonged correction from its local highs, the market is now facing an intense battle between fading selling pressure and persistent buying defense around this key support.

The upcoming move will likely define the next major trend for ENS in the following weeks.

---

Structure and Pattern

Main Pattern: Descending Triangle — signaling consistent selling pressure but also potential for a strong reversal if a breakout occurs.

Critical Zone: The 17.5–19.5 USDT area acts as a long-standing demand zone that has repeatedly held price throughout 2025.

Short-Term Dynamics: The series of lower highs forming the descending trendline indicates a phase of accumulation or waiting for a key catalyst.

---

Bullish Scenario – Reversal from Demand Zone

If ENS manages to break above the descending trendline and close a daily candle above 24.15 USDT, it would confirm a valid bullish breakout from the pattern.

Confirmation: A daily candle with strong volume closing above the trendline.

Upside Targets: 24.15 → 27.7 → 30.67 → 37.6 → up to 47.9 USDT if momentum continues.

Strategy: Wait for a retest around the breakout area for confirmation. Maintain a stop-loss below 17.5 to manage risk.

Such a breakout could mark the beginning of a major reversal, especially if supported by rising volume and positive sentiment within the Ethereum Name Service (ENS) and Web3 ecosystem.

---

Bearish Scenario – Breakdown from Historical Support

Conversely, if selling pressure pushes the price below the 17.5 USDT zone, the mid-term structure may shift into a bearish continuation.

Confirmation: A daily close below 17.5 with strong volume.

Downside Targets: 15.0 → 12.0 → potential retest of the historical low at 11.9.

Strategy: Consider short positions after a breakdown and retest of the former support-turned-resistance area.

A confirmed breakdown below this demand zone would reinforce the narrative that buyers are losing control, opening the door to a new downward trend phase.

---

Technical Conclusion

ENS is currently at a critical inflection point — the 17.5–19.5 zone represents the buyers’ last stand.

A breakout above the descending trendline could ignite a significant rally toward 30–37 USDT,

while a breakdown below the demand zone could extend the correction into the 12–15 USDT range.

Watch price reaction and volume within the yellow zone, as it will determine the winner of this crucial market battle.

---

#ENS #ENSUSDT #CryptoAnalysis #TechnicalAnalysis #PriceAction #DescendingTriangle #SupportResistance #BreakoutTrading #SwingTrade #Web3 #EthereumNameService #CryptoTrading

ENS/USDT 4HOUR CHART UPDATE !! ENS/USDT

ENS is trading around $21.50, currently testing the upper trendline of a well-defined falling channel.

Price has formed a bullish breakout structure, supported by higher lows on the 4H timeframe.

the

Volume shows early accumulation signs, suggesting buyers are stepping in near $20–$21.

Long Setup:

Entry zone: $20.5 – $21.5

Stop-loss: Below $19.8 (below the structure support)

Targets:

🎯 $25.0 → First target

🎯 $27.5 → Second target

🎯 $29.9+ → Extended swing target

DYOR | NFA

ENS Ready for 100% Up MoveNow the price is at the Weekly support and forming a wedge pattern and ready to break from this pattern , enter after the strong candle close in weekly .

and at the same time Bitcoin dominance is decreasing and altcoins dominance is started increasing , so look on all the altcoins

and follow proper risk management , it has very good chances to move UP side but first we have to protect the down side , where risk management comes into game .

Follow for more Ideas and potential coins/ Stocks .

ENS/USDT — Fibonacci Zone: Bullish Reversal or Bearish BreakdownChart Overview (1W Timeframe)

ENS/USDT is currently trading at the critical zone of 22.4 – 24.1 USDT, a decisive area because:

It represents a flip zone (previous resistance that may now act as strong support).

It aligns with a Fibonacci confluence at 0.5 (≈24.05) and 0.618 (≈22.39), making it a high-probability demand area.

This zone will decide whether ENS confirms a bullish continuation or faces a bearish breakdown in the coming weeks.

---

🔹 Market Structure & Pattern

After a strong rebound from the 2023 lows, ENS formed a swing high in 2025 but failed to break higher → early signs of consolidation.

The price is now retesting the golden support zone (22–24), acting as a pivotal decision level.

Instead of a classic pattern (e.g., H&S, triangle), the chart shows signs of range accumulation vs. distribution → making reaction at key levels the primary focus.

---

🔹 Bullish Scenario

Condition: Weekly close above 24.05 and ideally above 27.58.

📈 Upside targets:

1. 27.58 USDT → minor resistance, confirmation level.

2. 30.47 USDT → key psychological & structural resistance.

3. 37.39 – 40.87 USDT → major supply zone.

4. 47.59 USDT → extended target if strong momentum continues.

✅ Bullish confirmation = strong green weekly candle closing above the zone with rising volume.

---

🔹 Bearish Scenario

Condition: Weekly close below 22.39 (0.618 Fib).

📉 Downside targets:

1. 18.29 USDT → 0.5 retracement support.

2. 17.04 USDT → 0.618 retracement support.

3. 6.66 USDT (historical low) → only if a deep breakdown unfolds.

⚠️ A breakdown and failed retest below 22.39 would confirm a larger distribution phase.

---

🔹 Key Takeaways for Traders

The 22.4 – 24.1 USDT zone is the “make-or-break level.”

Holding this level → opens the door for a multi-month bullish trend.

Losing this level → signals risk of a mid-term bearish move.

Risk management is crucial on the weekly timeframe — stops should be clear (e.g., below 22 for long setups).

---

🎯 Conclusion

ENS is testing its golden Fibonacci zone — the defining level for its next major move.

Bullish case: Hold & breakout → potential targets 30–47 USDT.

Bearish case: Breakdown → risk of decline toward 18–17, possibly 6.6 in the long term.

📌 All eyes on the weekly close around 22–24 USDT — a key zone no swing trader or investor should ignore.

---

#ENS #ENSUSDT #EthereumNameService #CryptoAnalysis #TechnicalAnalysis #SwingTrading #SupportResistance #Fibonacci #PriceAction

Ethereum Name Service (ENSUSDT) — Liquidity Hunt Targets $24-$29Sergio Richi Premium ✅

NYSE:ENS #Crypto #EthereumNameService — Liquidity Hunt Targets $24-$29 | September 07, 2025.

Price (Sept 7, 2025) : $22.210

Asset Overview:

Ethereum Name Service (ENS) is a decentralized naming protocol on the Ethereum blockchain, enabling users to replace complex wallet addresses with readable names like "yourname.eth."

It powers Web3 identity, domain registration, and integrations across dApps, with recent features like L2 Primary Names enhancing cross-chain usability.

Key News (Aug 31 - Sep 6, 2025):

• Ecosystem Boost: ENS launched L2 Primary Names on Sep 2, allowing seamless identity across layers—boosting adoption in DeFi and Web3. Integrations like .locker domains now function as ENS names, expanding utility.

• Token unlock scheduled for Sep 8 could add short-term volatility.

Chart (1D):

💡 Entry & Exit:

Entry: $22.210 (spot long)

🎯 Take Profit 1: $24.400 (+9.86%)

🎯 Take Profit 2: $29.000 (+30.57%)

• Long Max Pain: $21.2035

• Short Max Pain 1: $24.992

• Short Max Pain 2: $30.203

My View:

Looks like smaller traders are heavily shorting ENS, while big whales have jumped into long positions at this point.

So, there’s a good chance we’ll see a move to liquidate those short traders’ positions.

Ethereum Name Servise ENS price analysisFor the second day in a row, trading volumes on the CRYPTOCAP:ETH futures market have exceeded those of CRYPTOCAP:BTC

(Is the market alpha returning or are profits being locked in? Write your thoughts in the comments ?)

💡 And we will write an analysis of the possible movement of the NYSE:ENS price — this is the #Ethereum Name Service management token, which is used to manage the protocol and influence pricing decisions for its .eth addresses and price oracle.

👌 Currently, all forces are preventing the OKX:ENSUSDT price from consolidating above $23.6. But when that happens, it will be a very safe level to buy on a retest.

📊 More risky, but with greater earning potential, are purchases at $17.50 and $14.50.

Set your “buckets” for purchases and wait for them to “fill up.”

And then, who knows, maybe in 2025, the price of NYSE:ENS will reach its ATH.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

ens sell midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

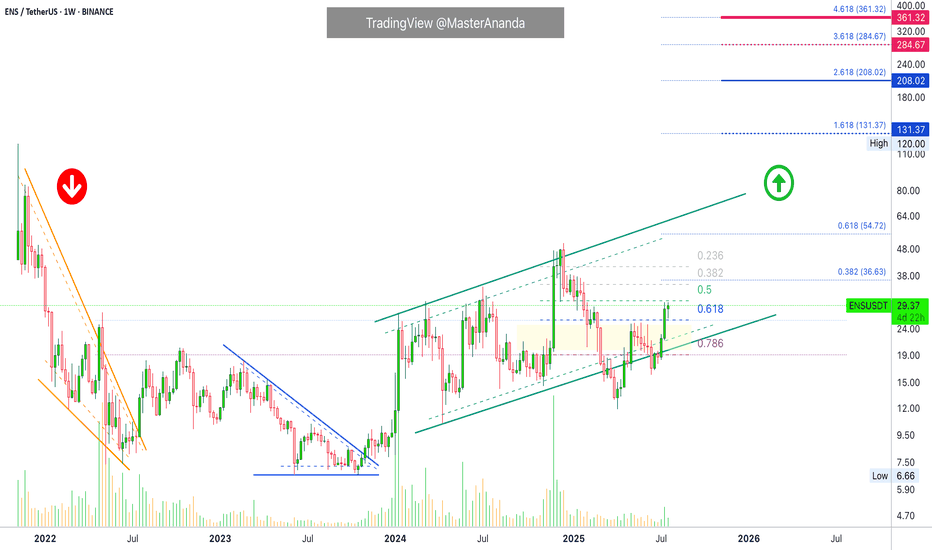

Ethereum Name Service Easy $131 Target · $208 Possible or HigherEthereum Name Service really took off in late 2023. March 2024 did nothing to this project. Here we can see an extended period of higher highs until December 2024. Many projects produced a major high in March 2024 to turn bearish until recently. In December, all of these produced a lower high. You can see how different this chart looks. This is a strong project the chart is saying.

There was a strong correction between December and April, this was a marketwide event. You can see how ENSUSDT moved below 0.786 Fib. retracement for several months just to recover. In June it remained below this level only briefly, for two weeks, and we are now full green.

Last week's candle closed above 0.618 Fib. retracement and we are back in the bullish zone. Full blown bullish as Ethereum Name Service is trading at the highest price since January 2025. Everything shows the market being ready for additional growth.

The recovery above support never supports a crash but instead a bullish continuation. For a crash, we would see a rejection or very weak action around resistance. Instead, we have full green candles with rising volume. Perfect conditions for higher prices. Just what we need and want to see.

The targets here are good, $131 and $208. I don't think this will be the end though and we have another wait and see. I think between $285 and $361 is a better prediction, these targets are also shown on the chart.

How far up do you think ENS will go?

Namaste.

ENS/USDT Weekly Outlook – “Massive Breakout Brewing from Base

Ethereum Name Service (ENS) is currently positioned at a critical inflection point on the weekly chart, signaling a high-probability setup for a massive bullish breakout after nearly 2 years of sideways consolidation and structural base building.

🔍 Technical Pattern Breakdown

This chart reveals a macro Ascending Triangle formation developing since late 2022, with higher lows consistently respecting a rising trendline support and price now retesting the golden pocket Fib zone.

Pattern Formed:

📐 Macro Ascending Triangle + Fibonacci Confluence Zone

📉 Long-Term Accumulation Range: $14.6 – $23.7

Trendline Support:

✅ Rising since 2023, showing buyers consistently stepping in at higher levels

Fibonacci Retracement:

🔑 Price currently sitting between 0.5–0.786 Fib zone from the 2023 rally:

0.5 = $18.33

0.618 = $16.82

0.786 = $14.68

🟢 Bullish Scenario – Potential Multi-Leg Rally

If price holds and rebounds from this support region, we could see a stepped breakout with key resistance levels being taken out one by one:

1. First Resistance – $23.73: Psychological and structural breakout level

2. Second Target – $30.48: Prior major rejection area

3. Third Target – $47.13: 2024 resistance high

4. Macro Target – $69.99 to $85.88: Full breakout potential from triangle width and historical ATH zone

🚀 Upside Potential from Current Levels (~$18): Over 350%

📈 This would confirm the end of the accumulation cycle and signal the start of a long-term bullish phase.

🔴 Bearish Scenario – Breakdown Risk

In the event of a confirmed weekly candle closing below $14.6, we invalidate the ascending triangle and shift bias toward bearish retracement:

Next Support: $10.00

Extreme Bearish Target: $6.65 (macro low from 2022)

🛑 Breakdown from this structure would suggest failure of the accumulation pattern and return to long-term bearish pressure.

💡 Strategic Insight

ENS is one of the rare altcoins currently forming a clean high-timeframe bullish setup. This is the kind of structure institutional or swing traders look for when anticipating early entries before explosive moves.

With a tight invalidation below $14.6 and multiple upside targets, this setup provides a strong risk-reward opportunity.

#ENS #ENSUSDT #AltcoinBreakout #CryptoSetup #Accumulation #TechnicalAnalysis #CryptoTrading #SwingTrade #Fibonacci #AscendingTriangle

The key is whether the price can hold above 25.06

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ENSUSDT 1D chart)

The key is whether the price can be maintained by rising above the important support and resistance zone of 20.93-25.06.

If it fails to rise, it is likely to fall to the support zone of 11.86-14.61, so you should think about a response plan for this.

However, the 20.93 point is a volume profile zone, so you should check whether it is supported when falling to this area.

If it starts to rise,

1st: 28.15

2nd: 33.54

The 1st and 2nd areas above are likely to act as resistance.

-

The indicators used as basic trading strategies are the HA-Low indicator and the HA-High indicator.

The basic trading strategy is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, if it is supported by the HA-High indicator and rises, it is likely to show a stepwise upward trend, and if it is resisted by the HA-Low indicator and falls, it is likely to show a stepwise downward trend.

Therefore, the trading method should be a split trading method.

The end of the stepwise upward trend is a decline, and the end of the stepwise downward trend is an increase.

Therefore, if you buy when the HA-High indicator is supported and rises, a short and quick response is required.

Accordingly, it is not recommended to use the HA-High indicator as the first purchase point.

If you are familiar with day trading, the HA-High indicator may also be a purchase point.

Currently, the HA-Low indicator is formed at the 14.61 point, and the HA-High indicator is formed at the 23.12 point.

-

Depending on the arrangement of the candles, the important support and resistance zones are in the 20.93-25.06 zone.

Therefore, regardless of the current HA-High indicator position, if it shows support above 25.06, it is a time to buy.

However, since the buy zone and resistance zone are close, a quick response is required.

Therefore, the support and resistance points drawn on the 1M, 1W, and 1D charts correspond to important trading strategy points.

In order to draw reliable support and resistance points, objective information is required.

Be careful because the support and resistance points drawn after starting a transaction may reflect your psychological state and become unreliable support and resistance points.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

ENSUSDT - GAMEPLANAlright everyone, focusing on ENSUSDT. The current price action suggests that the immediate target for this move is the blue line I've marked on the chart. This line represents a key level that the market is currently aiming for.

Beyond that, looking lower, you'll see a blue box that I consider to be a beautiful support zone. This area is where I anticipate strong buying interest could emerge, potentially halting any further downside.

As always, my approach is rooted in confirmation. If price reaches the blue line, I'll be scrutinizing the volume footprint to understand the true intentions of market participants. Are we seeing signs of distribution, or is there genuine momentum to push through? I'll also be watching for any CDV (Cumulative Delta Volume) divergences that might signal a shift in the underlying order flow.

Should price retreat towards that lower blue box, I'll be looking for low timeframe (LTF) confirmations to validate its strength as support. A clean retest and bounce from this zone, especially with an uptick in buying volume, would be a strong signal.

Remember, I exclusively focus on assets that show a sudden and significant increase in volume. This selective approach helps me concentrate on where the market is truly showing its hand. ENSUSDT's current movements, coupled with its potential to interact with these key levels, make it an interesting watch.

Keep these levels on your radar. The market is always speaking, and by paying attention to these nuances, we can decipher its true intentions. You can trust my perspective to guide you through these intricate market dynamics.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

#ENS/USDT#ENS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 22.00.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 22.37

First target: 22.80

Second target: 23.17

Third target: 23.69

Ethereum Name Service (ENS) Leaves Accumulation ZoneHere we have two accumulation zone. The "bottom" zone coming at the end of the 2022 bear market and in late 2023, between June and December. And the "higher low" zone which started after the early 2024 bullish breakout.

This latter zone was activated April-May 2024 (1), August-November 2024 (2) and March-April 2025 (3). With the last activation of this zone ENSUSDT ended its correction and is now bullish.

Last week was a consolidation week and within the next two weeks we can have a bullish continuation, the resumption of the bullish move that started with the 7-April low.

Good morning my fellow Cryptocurrency trader, how are you feeling in this wonderful week?

What is a good opportunity?

A project that has really good potential for growth and at the same time, high certainty, sure to grow and stable. This pair has those qualities.

We also want a good entry price and timing. Timing is good all across.

Entry prices could be better but that would be being greedy. If ENS can move beyond $100, easily, then anything below $25 can be a good entry. Of course, a price of $15 is many times better, but not everybody can buy at $15 at the same time. And being honest, it is not easy to catch the exact bottom. We can even see it happening but our finances might not be in the right place when this is happening or some other situation prevents us taking action, but it is never too late. The market always offers a second chance and this chance is now.

Ethereum Name Service has great potential for growth. My strategy is very simple, buy and hold. Set a sell order 300%-500% above my entry level, when it fills, look for a pair that is still trading at bottom prices and repeat.

If you are glued to your screen, you can track the market and sell higher. Or you can sell portions at each target, or you can hold long-term. There are many ways to approach the market, right now, it is not about selling but buying. Right now is the time to buy. Late 2025 is the time to sell.

Thank you for reading.

Namaste.

ENS SWING Trade SetupENS Showing strong momentum towards upside and dropped without touching POI, So it can go higher first then it may take correction, spot and future trader can take risk on this. Wait for the entries and enter from 20-19 level, if price reverse from any other point, then wait for the 4hrs candle closing above 26 and target the 30-32$ level. for scalp and day trading get long from 22.40 SL 21.65 and set tp 25.56 & 27.79$.

ENS — Eyeing the BreakoutSpotting early momentum on ENS — we've entered around 14.383, with a backup limit order waiting on x2 margin at 13.891 for a potential dip grab.

This setup shows solid structure and looks ready to test higher if we hold above key support. The chart’s shaping up for a possible leg up, and I’m eyeing targets at:

14.536 → 14.680 → 14.876 → 15.126 → 15.591

Stop is tight at 13.516 to protect capital. Let’s see how it plays out — looks like we might catch some real movement here.

More thoughts in my profile @93balaclava

Personally I trade on a platform that offers low fees and strong execution. DM me if you're curious.