#ETC/USDT The price is moving within an ascending channel#ETC

The price is moving within a descending channel on the hourly timeframe. It has reached the upper boundary and is heading towards breaking it. A retest of this boundary is expected.

The Relative Strength Index (RSI) is showing an upward trend, as it has approached the upper boundary. A bearish reversal is expected.

There is a key support zone in green at 10.17. The price has bounced from this zone several times and is expected to bounce again.

A consolidation trend is observed above the 100-period moving average, which we are approaching. This trend supports a decline towards this level.

Entry Price: 10.26

Target 1: 10.39

Target 2: 10.57

Target 3: 10.80

Stop Loss: Above the green support zone.

Don't forget one simple thing: Money Management.

For any questions, please leave a comment.

Thank you.

Etcusdtlong

#ETC/USDT The price is moving within an ascending channel

#ETC

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 12.42. The price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 12.54

First Target: 12.63

Second Target: 12.77

Third Target: 12.92

Stop Loss: Below the green support zone.

Don't forget one simple thing: Money Management.

For inquiries, please leave a comment.

Thank you.

#ETC/USDT The price is moving within an ascending channel #ETC

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 11.92. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 11.95

First target: 12.25

Second target: 12.48

Third target: 12.79

Don't forget a simple principle: money management.

Place your stop-loss below the green support zone.

For any questions, please leave a comment.

Thank you.

#ETC/USDT The price is moving within an ascending channel#ETC

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 13.86. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 13.86

First target: 13.93

Second target: 14.16

Third target: 14.43

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

#ETC/USDT #ETC The price is moving within an ascending channel #ETC

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at the 15.50 price, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 16.00

First target: 16.20

Second target: 16.63

Third target: 17.00

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

#ETC/USDT Might Be Good Zone to Bounce From#ETC

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 15.50, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 15.85

First target: 16.08

Second target: 16.32

Third target: 16.68

Don't forget a simple money management rule:

Place your stop-loss order below the support zone in green.

Once the first target is reached, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

#ETC/USDT Might Be Good Zone to Bounce From#ETC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 15.41, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 15.60

First target: 15.76

Second target: 16.06

Third target: 16.37

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

ETCUSDT — The Final Defense Zone Before a Major Move?Ethereum Classic (ETC) is once again standing at its final line of defense — the multi-year support zone between 16.40–13.50, which has successfully absorbed selling pressure several times since 2021.

This area is not just a price range; it’s a psychological stronghold that separates the potential for a massive rebound from the risk of a full-scale breakdown.

For more than three years, ETC has been forming a range-base accumulation structure, where every dip into this zone has triggered strong buying interest.

However, each rally has also failed to create higher highs — a clear signal that supply pressure remains dominant in the mid-term structure.

At this point, the market is in equilibrium — a tension zone between buyers defending the historical base and sellers pressing for continuation.

The next decisive move will be determined right here, inside the yellow block.

---

Bullish Scenario — Reclaim and Rally

If price holds above 16.40 and manages to close a weekly candle above 20.94 with strong buying volume, ETC could begin a structural reversal toward 24.95 and 36.85.

Such a move would confirm that the capitulation phase has ended and that a new accumulation cycle is underway.

Key confirmations:

Weekly close above 20.94

Higher low formed above 16.4

Rising weekly volume

Upside targets:

24.95 → 36.85 → 48.30

---

Bearish Scenario — Breakdown of the Base

Failure to defend the zone, especially with a weekly close below 13.50, would confirm a breakdown of the multi-year base.

This could trigger a new distribution phase, with potential downside targets at 11.00, 8.00, and possibly a wick toward 7.00 as liquidity gets swept.

Key confirmations:

Weekly close below 13.50

Failed retest (support turns to resistance)

Increasing sell volume

Downside targets:

11.20 → 8.00 → potential liquidity sweep near 7.00

---

Pattern Structure

Range Base Accumulation: multi-year accumulation between 13–36 since 2021.

Descending Structure: a series of lower highs, showing continuous supply pressure.

Liquidity Sweep: a deep wick to the 7.0 area indicates previous stop-hunts and possible smart-money accumulation.

Decision Point: 16.4–13.5 remains the make-or-break level that will define ETC’s long-term direction.

---

Conclusion

ETC is at a major decision point after years of sideways consolidation.

If the support holds, the asset could trigger a macro reversal and join the next major crypto bull cycle.

But if it breaks down, the fall could be steep — as liquidity below this zone is thin.

The 16.4–13.5 zone is the last line between hope and capitulation.

Watch the weekly close — that’s where the next big move will be decided.

---

#ETC #ETCUSDT #EthereumClassic #CryptoAnalysis #SwingTrading #TechnicalAnalysis #SupportResistance #WeeklyChart #CryptoBreakout #MarketStructure

#ETC/USDT Might Be Good Zone to Bounce From#ETC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 15.10, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 15.21

First target: 15.41

Second target: 15.65

Third target: 15.90

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#ETC/USDT Might Be Good Zone to Bounce From#ETC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 18.00, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 18.80

First target: 19.19

Second target: 19.60

Third target: 20

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

ETC/USDT — Major Support Retest, Breakout or Breakdown?🔎 Current Market Outlook

Current price: ~20.49 USDT

Price is approaching the critical support zone at 17–14 USDT (highlighted yellow).

This area has acted as a multi-year demand zone since 2021, where buyers repeatedly defended the level and triggered rebounds.

However, ETC has consistently failed to break major resistance levels, forming lower highs within a prolonged sideways range.

This makes the 17–14 zone a decision point: will buyers once again absorb supply and push for a rebound, or will sellers finally break the structure and trigger a deeper bearish trend?

---

📐 Market Structure & Price Pattern

1. Major Support Zone (17–14 USDT):

Tested multiple times since 2021.

Holding above → suggests strong accumulation.

Breaking below → could end the long-term sideways trend.

2. Key Resistance Levels:

25.08 USDT → first resistance to watch for breakout.

38.16 USDT → medium-term resistance.

56.30 & 75.65 USDT → major long-term supply zones.

Higher targets: 118.76 & 179.33 USDT (only relevant in a super bullish cycle).

3. Price Pattern:

Large sideways structure with lower highs.

Repeated tests of 17–14 → showing this demand zone is still crucial for market direction.

---

🐂 Bullish Scenario (If Buyers Defend)

Confirmation: Weekly close above 25.08 with strong volume.

Implication: Signals a new higher high on the weekly timeframe.

Targets:

TP1 → 38.16

TP2 → 56.30

TP3 → 75.65

Key Note: As long as 17–14 holds, ETC remains in accumulation territory with potential for a strong rebound in the next bullish phase.

---

🐻 Bearish Scenario (If Sellers Break Through)

Confirmation: Weekly close below 14 USDT.

Implication: Multi-year demand zone is invalidated.

Targets: Without solid support below, price could drop towards the psychological 10 USDT level or even lower.

Warning: A breakdown here would mark the end of the long-term sideways phase and trigger a deeper bearish leg.

---

🎯 Trading Strategy & Risk Management

1. Conservative Approach:

Wait for breakout >25.08 → enter long.

Targets: 38.16–56.30.

Stop loss below 22.

2. Aggressive Approach (buy the zone):

Enter within 17–14.

Stop loss below 14.

First target 25.08, scale out at 38.16.

3. Short Setup:

Only valid if weekly close <14 (confirmed breakdown).

Short-term target: 12 → 10 USDT.

⚠️ Note: This is a high risk/reward zone. Position sizing and clear stop-loss levels are critical.

---

✨ Conclusion

The 17–14 USDT support zone is ETC’s lifeline.

Holding above → accumulation continues, with rebound potential toward 25.08 → 38.16.

Breaking below 14 → long-term bearish breakdown with risk of a sharp decline.

Breakout above 25.08 → the first real trigger of a bullish trend reversal.

ETC is at a make-or-break moment. Traders should closely watch how weekly candles react around 17–14.

---

#ETC #EthereumClassic #Crypto #Altcoins #TechnicalAnalysis #PriceAction #SwingTrade #SupportResistance #CryptoAnalysis #ChartPatterns

#ETC/USDT Might Be Good Zone to Bounce From#ETC

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the ascending channel, at 20.00.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 20.43, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 20.95

First target: 21.30

Second target: 22.00

Third target: 22.77

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

ETC/USDT — Testing Golden Pocket: Rebound or Breakdown?Ethereum Classic (ETC) is currently at a critical decision zone after being rejected around the 24.46 USDT resistance. The price has now pulled back into the Fibonacci golden pocket (0.5–0.618) at 20.22–19.20 USDT, a key support zone that previously acted as a major flip level (resistance → support).

This area carries heavy significance as it has served as a battleground for liquidity multiple times. The reaction here will likely determine whether ETC continues its mid-term bullish structure or slips back into a deeper bearish trend.

---

🔎 Market Structure & Pattern

Mid-term structure: ETC is trading within a wide range between the historical support of 12.70 and the upper resistance near 39.93.

Short-term focus: The 19.20–20.22 golden pocket is the decision point for the next move.

Bullish bias holds as long as this level remains intact.

Bearish risk emerges if the golden pocket fails, triggering a deeper breakdown.

---

🚀 Bullish Scenario

1. Strong rejection at the golden pocket with bullish reversal candles (engulfing / pin bar) → buyer confirmation.

2. Short-term target: 24.46 (nearest resistance).

3. Break and close above 24.46 on the 2D timeframe opens upside targets at 28.90 → 33.71 → 37.24 → 39.93.

4. Supporting signals: RSI holding above 50 + volume expansion on breakout.

---

⚠️ Bearish Scenario

1. Breakdown confirmed if the 2D candle closes below 19.20 → support failure.

2. Downside targets: 16.00 → 14.50 → 12.70 (historical low).

3. A weak bounce forming only a lower high below 24.46 would strengthen bearish continuation.

4. Confirmation: high volume on breakdown + strong bearish candles without lower wicks.

---

📝 Trader’s Notes

The golden pocket zone (19.20–20.22) is the decision point for the next macro move.

Aggressive traders may consider longs here with tight stops below 18.00.

Conservative traders should wait for a confirmed breakout above 24.46 before entering.

Risk management is crucial: aim for at least 1:2 risk-to-reward ratio.

---

📌 Key Levels

Support: 19.20–20.22

Nearest resistance: 24.46

Bullish targets: 28.90 → 33.71 → 37.24 → 39.93

Bearish targets: 16.00 → 14.50 → 12.70

#ETCUSD #EthereumClassic #ETC #CryptoAnalysis #Altcoin #TechnicalAnalysis #SupportResistance #Fibonacci #PriceAction #SwingTrade

#ETC/USDT Might Be Good Zone to Bounce From#ETC

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the ascending channel, at 19.61.

We have a downtrend on the RSI that is about to be broken and retested, supporting the upside.

There is a major support area in green at 19.34, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 20.30.

First target: 20.83.

Second target: 21.32.

Third target: 21.95.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

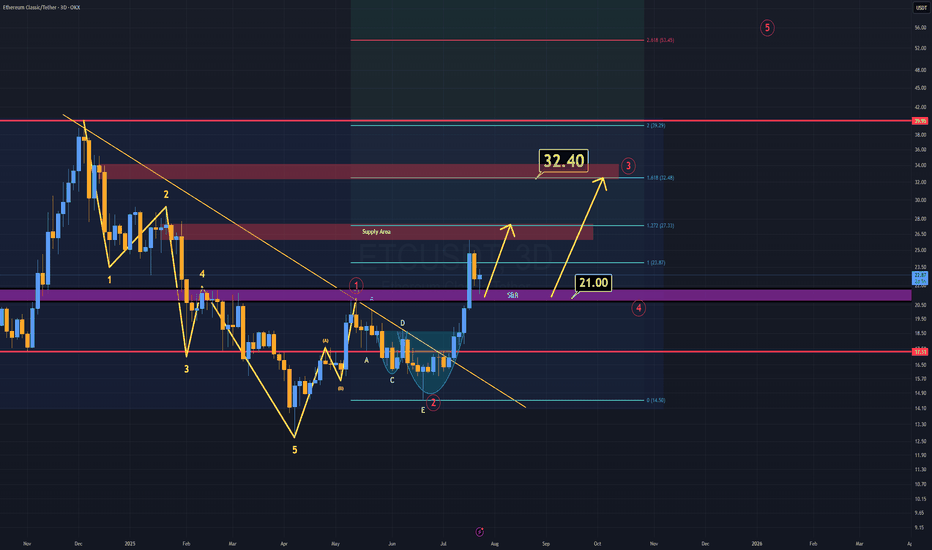

ETC Analysis (3D)ETC is showing a strong bullish structure, just like many other altcoins.

The key difference? ETC has already confirmed its breakout.

As long as ETC holds above the $21 level, I believe the minimum target sits at $32 in the coming weeks.

According to Elliott Wave Theory, that $32 region also marks the end of wave 3, which perfectly aligns with a daily supply block, a strong technical confluence.

Recently, ETC tapped the rebuy zone, highlighted in purple (S/R zone) on the chart.

Lower timeframes also support this bullish continuation scenario.

Momentum is on the side of the bulls.

S wishes you the best of luck!

#ETC/USDT Forming Strong Bullish Potential#ETC

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 21.80, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 21.20.

Entry price: 22.50

First target: 23.70

Second target: 24.66

Third target: 25.90

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

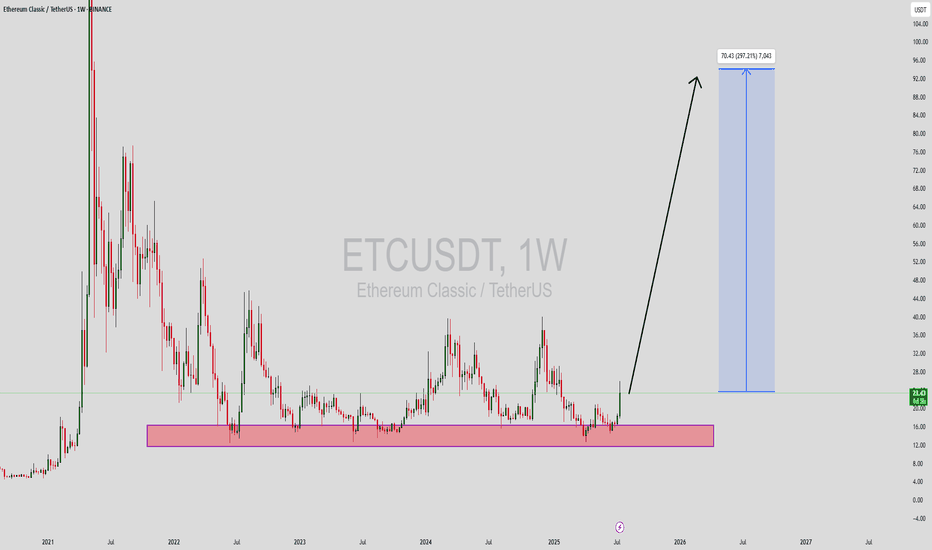

ETCUSDT Forming Strong Bullish PotentialEthereum Classic (ETCUSDT) is currently showing strong bullish potential as it emerges from a long-term accumulation zone. The weekly chart highlights a clearly defined support range where ETC has consistently rebounded in past cycles, and recent price action suggests another powerful move to the upside is brewing. With increased volume and momentum forming around the $15–$17 range, the price has broken out with significant strength, targeting an impressive 240% to 250% rally in the mid to long term.

Technically, ETC has printed a long-term rounded bottom pattern, signaling a possible trend reversal. Such formations often lead to explosive upside moves once the neckline resistance is broken, and ETC appears to be in that breakout phase now. A projected target near $80–$95 aligns well with historical resistance zones from previous bull runs. This is an ideal setup for position traders looking for a high-risk, high-reward opportunity.

Investor sentiment around Ethereum Classic is turning bullish again, driven by renewed interest in proof-of-work (PoW) assets and a potential alternative to Ethereum following its full transition to proof-of-stake. With Ethereum Classic maintaining its original blockchain structure, it continues to attract a niche set of supporters and miners. Growing community support and speculative demand could be key drivers behind this expected price surge.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Ethereum Classic:Buying opportunity?hello friends 👋

Considering the price drop we had, you can see that buyers are coming in less and less in the support areas that we specified for you, and this can be a good signal to buy in these areas step by step with capital and risk management and move to the specified goals.

🔥Follow us for more signals🔥

*Trade safely with us*

#ETC/USDT#ETC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 16.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading for stability above the 100 moving average.

Entry price: 16.50

First target: 17

Second target: 17.50

Third target: 18

#ETC/USDT#ETC

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 16.50, which acts as strong support from which the price can rebound.

Entry price: 16.62

First target: 16.80

Second target: 17.00

Third target: 17.24