Here’s Where Ethena (ENA) Price Could Go Next* Ethena has just emerged out of a bear flag, but whether it has legs to stand on or if further downside can be expected is now in question.

* The recent bounce has been a weak one, which shows a measure of restraint on the part of traders who are holding out for further signs.

* On-chain data points to stabilization, not strong buying, which keeps ENA in a wait-and-see phase for now.

When you zoom out and look at Ethena’s recent price action, it’s clear the market isn’t panicking anymore, even after a sharp breakdown.

The ENA price didn’t drift lower slowly. Once the bear flag broke, the price dropped fast, falling more than 30% in a short span. That move wiped out late buyers and cooled off the optimism that had built up during consolidation. Since then, though, the tone has shifted. Instead of continuing lower, the market looks like it’s taking a pause.

Over the past few sessions, the ENA price has been hovering around the $0.2000–$0.2100 area. This is the first zone where selling pressure has clearly slowed after the breakdown.

The price isn’t cascading lower anymore, and dips into this range are getting absorbed more quickly. That indicates sellers are losing urgency, even if buyers aren’t stepping in aggressively yet.

That matters. After slicing through multiple support levels during the selloff, this is the first place where the market seems willing to stabilize instead of accelerate lower. It doesn’t mean a bottom is in, but it does suggest the market is digesting the move rather than reacting emotionally.

On-chain data supports that view. ENA’s market cap stopped falling sharply once the price reached this area and has moved mostly sideways since. Capital isn’t rushing out anymore, even if fresh inflows haven’t arrived.

What’s next for Ethena?

The main challenge remains overhead resistance. The ENA price continues to stall near $0.2160 on the daily chart.

Every bounce so far has failed before reclaiming that level, keeping the broader trend intact. Until that zone is cleared and held, upside moves are better seen as relief bounces, not true reversals.

For now, ENA remains in wait-and-see mode. The damage has already been done, and what the market needs next isn’t hope, but confirmation.

Ethena

ETHENA ENA ENAUSD 3D-1W TFThis coin can clearly be considered a pump-and-dump asset as it consistently falls to the accumulation zone and then rapidly goes upward.

However! it’s important to keep in mind that exchanges tend to train traders to expect a specific pattern.

Once the majority notices it and starts buying aggressively in the accumulation zone again the coin may simply be dumped and scammed leaving traders with nothing

Ethena ENA price analysisIs CRYPTOCAP:ENA setting up for a trend reversal?

The OKX:ENAUSDT daily chart is repeating familiar patterns typically seen at the early stages of an uptrend. While this doesn’t guarantee continuation, the structure is worth monitoring.

Key Levels

• Downside risk: –25% to retest the previous lows

• Upside target: +200% toward the upper consolidation range

• Higher targets remain possible if momentum expands

Thesis

The current structure offers a favorable risk-to-reward ratio for mid-term traders, provided CRYPTOCAP:ENA maintains local support and CRYPTOCAP:BTC volatility doesn’t accelerate.

Question:

Do you consider this a valid accumulation zone for CRYPTOCAP:ENA , or is the market still too fragile?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud

FireHoseReel : ENA : Ethena Charging Toward Daily Resistance🔥 Welcome FireHoseReel !

Let’s dive into the ENA setup and break down the key levels.

👀 ENA – 4H Timeframe Analysis

ENA is approaching its daily resistance on the 4H chart, and a confirmed breakout above this level can activate our long trigger and push price higher with momentum.

📊 Volume Analysis

ENA showed a clear volume increase during the breakout of its descending pattern (falling channel) — an early signal that a new bullish phase could be forming.

However, breaking the nearby daily resistance requires another strong wave of buy volume; without it, price may face rejection.

🔁 ENA/BTC – A Different Perspective Looking at ENA/BTC, we can see that this pair is also moving toward a key daily resistance level, just like ENA/USDT.

A breakout on the BTC pair could accelerate momentum and help ENAUSDT trigger earlier.

The structural overlap between the two charts gives strong confluence and increases confidence in our setups.

📌 Trading Scenarios

🔼 Long Scenario

• Daily resistance at 0.2814 breaks

• Buy volume increases

• Volume convergence forms after the breakout

• This activates the long trigger and may lead to higher continuation.

🔽 Short Scenario

cal support at 0.2267 breaks

• Sellers gain control and strong sell pressure appears

• This scenario can trigger a deeper sell-off.

🎯 Personal View

I personally prefer the long scenario, especially since ENA was recently listed on Hyperliquid Spot, which may boost liquidity and accelerate upward momentum.

🛞 Risk Management & Disclaimer

Please remember to always use proper risk management and position sizing. Nothing in this analysis is financial advice. The market can change quickly, so always trade based on your own strategy, research, and risk tolerance. You are fully responsible for your own trades.

TradeCityPro | ENA: Market Shake-Off and Support Rebuild Zone👋 Welcome to TradeCity Pro!

In this analysis, I’ll review ENA, one of the DeFi projects that currently holds a market cap of $3.02 billion, ranking 36th on CoinMarketCap.

📅 Daily Timeframe

First, let’s take a look at the market as a whole — yesterday, some extremely unusual events occurred, which I’ll explain in detail in Bitcoin’s analysis.

✨ For now, the result of these events has been a sharp market decline, which has also affected this coin. ENA has now stabilized below the $0.5 support zone and printed a very long shadow to much lower levels.

🔍 Currently, the price is far below its last major high at $0.8124 and has formed a lower high at $0.6296.

✔️ There was a support zone around $0.5, but since the price has closed below it, the next key support lies at $0.3699.

📊 The final strong support zone is around $0.25, which is considered ENA’s main support level.

💥 For now, it’s better to stay on the sidelines and wait for the market to build a new structure. The recent move was highly emotional and volatile, making it difficult to accurately interpret the market’s behavior at the moment.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Ethena ENA price analysis🔗 #Ethena ( #ENA ) is part of the #Ethereum ecosystem and looks fundamentally strong.

⏳ The current OKX:ENAUSDT consolidation strongly resembles CRYPTOCAP:ETH phases before major rallies.

🛡️ Key support: $0.40–0.45 — buyers need to hold this level.

📈 If successful, there’s potential for a 10x growth, with market cap rising from $3B to $30B — realistic in today’s market.

📊 Conclusion: this support zone is crucial for ENA’s future trend.

🤔 Do you believe Ethena can repeat Ethereum’s story?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud.

Ethena $ENAENA has been under selling pressure for several weeks, but price is now approaching a key breakout level from the downtrend line.

Breakout entry: above the trendline

Target zone: $0.8745 – $0.9070 (+55%)

Risk: limited if the breakout fails

R/R ratio: highly favorable

If the breakout is confirmed with volume, a strong move toward the target zone becomes very likely.

DYOR and NFA

Follow on X - for more details!

ENA Looks Bearish (12H)ENA is one of the symbols that has rallied strongly and has now reached strong resistance zones. A bearish 3D formation is visible on the chart, and momentum has dropped significantly, which may indicate the start of a bearish trend for ENA.

Currently, it is near a weak support that may cause temporary pullbacks to the upside, providing opportunities to open sell/short positions. One entry can be taken on a pullback upward, and another if the price reaches the red SWAP zone.

The target can be the green box area.

A daily candle closing above the invalidation level will invalidate this outlook.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

ENAUSD 1D Golden Cross targets 1.10500.Ethena (ENAUSD) has been trading within a Triangle pattern ever since it's very start and since the June 22 Low it's been unfolding the new Bullish Leg

Following the formation of a 1D Golden Cross (August 08), this sequence resembles the November 28 2024 Bullish Cross, which was the pattern's previous Bullish Leg that peaked just above the 0.9 Fibonacci retracement level.

Based on that, our short-term Target is 1.10500 right at the top of the Triangle.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Ethena Bullish Momentum Builds, Eyes 30% Rally to $0.85Hello✌

Let’s analyze Ethena’s upcoming price potential 📈.

BINANCE:ENAUSDT has demonstrated strong bullish momentum recently, supported by positive fundamental developments 📈. The price is currently near key daily and Fibonacci support levels. If these hold, a potential 30% upside targeting $0.85 looks likely 🚀.

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks , Mad Whale

[Deep Dive] ENA – Edition 5: From Channel Break to $1?BINANCE:ENAUSDT ENA has just completed one of the cleanest bullish breakouts we’ve seen this month — transitioning from months of compression inside a bearish channel to an aggressive impulsive rally.

📉 Bearish Phase

For most of 2025, ENA traded within a descending parallel channel, stuck in a cycle of lower highs and lower lows. Momentum was firmly in the bears’ hands, and every rally attempt was quickly rejected at the channel’s upper bound.

📈 Bullish Breakout

In late July, the tide shifted. Price broke decisively above the channel, retested the breakout zone, and entered a steep ascending channel. This bullish structure is now guiding price toward the $0.90 and $1.00 resistance zones — key psychological and technical targets.

The current move has left an orange demand zone ($0.70–$0.72) in its wake, which could act as a magnet for a healthy retest before another push higher.

🔥 Fundamental Tailwinds

ENA (Ethena) has been making headlines in the DeFi yield space with its synthetic dollar protocol USDe, offering stable and high on-chain yields. Recent updates include:

Expansion of USDe collateral integrations across major DeFi protocols.

Strategic partnerships with lending and derivatives platforms, increasing USDe’s utility.

Continued growth in circulating USDe supply, signaling strong adoption.

As yields and DeFi activity heat up, ENA could continue to attract liquidity — especially with narratives around on-chain stable yields gaining momentum.

🧠 Key Levels to Watch

- Support: $0.70–$0.72 (demand zone)

- Immediate Resistance: $0.90

Major Breakout Target: $1.00 — a key round number and potential profit-taking zone.

A clean retest of the orange zone followed by bullish confirmation could offer one of the best risk-to-reward entries in weeks.

💬 What’s your take — will ENA clear $1 on this run, or does it need a deeper pullback first?

🔔 Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk accordingly.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

ENAUSDT 4H Chart Analysis | Bullish Breakout Setup in FocusENAUSDT 4H Chart Analysis | Bullish Breakout Setup in Focus

🔍 Let’s dive into the ENAUSDT perpetual contract and analyze the recent price action, spotlighting key technical signals and a potential breakout scenario.

⏳ 4-Hour Overview

The 4-hour chart shows ENAUSDT consolidating above a critical ascending trendline, with price action tightening into a symmetrical triangle formation. Multiple attempts to break down have resulted in a fake breakout, as indicated by low volume during the breakdown — a classic sign of seller exhaustion.

🔺 Bullish Breakout Setup:

On the upside, a confirmed breakout above the $0.6800 resistance could pave the way for a bullish continuation towards the $0.8000 target zone. The structure suggests increasing buying pressure as long as price holds above the trendline and key support ($0.6050).

📊 Key Highlights:

- Price retested the ascending trendline; buyers defended it aggressively.

- A fake breakout with low volume suggests trap for bears and quick recovery by bulls.

- The next major resistance comes at $0.6800, with a projected target at $0.8000 upon breakout.

- Short-term support sits at $0.6050. Price action above this level remains constructive.

🚨 Conclusion:

Watch for a decisive move beyond triangle resistance. A high-volume breakout above $0.6800 could trigger a sharp move toward $0.8000. Bulls are building momentum — keep an eye on volume to confirm breakout strength.

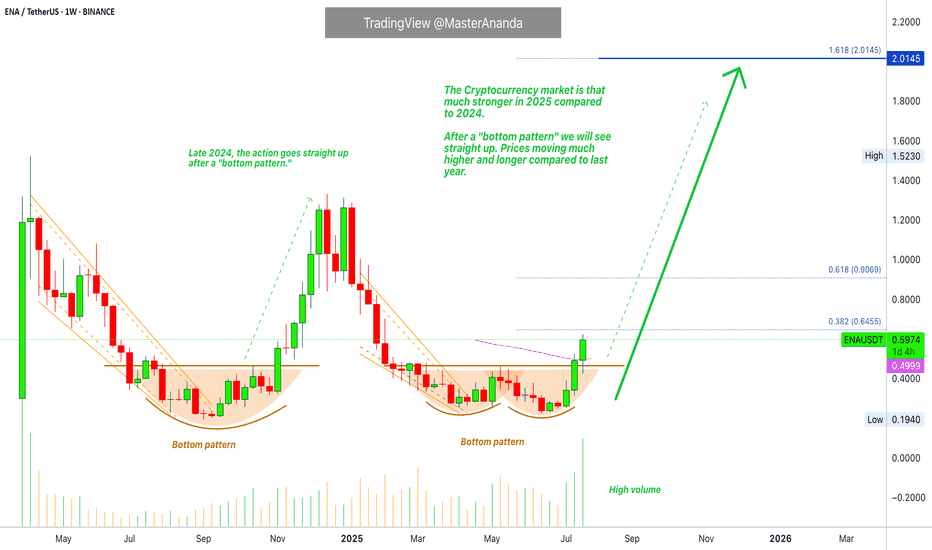

Ethena · Millions Overnight? It Can Be DoneEthena is starting its 2025 bullish cycle with three full green candles. The current week has the highest volume since the first week of trading in April 2024. Normally the first week of trading tends to produce the highest volume. ENAUSDT is matching those days now and market conditions are so much better in 2025 compared to 2024.

The entire bullish period last year lasted less than two months. That's it. This wasn't an uptrend nor a bull market, it was more like a bullish jump. A momentary event. ENAUSDT right now is entering the 2025/26 bull market. Growth can be sustained for a period of 6 months or longer. Sometimes a bull market trend can last 8 months, 12 months, or even 16 months or longer. We have many examples across the market.

This week Ethena is trading above EMA55 weekly for the first time ever. The bullish bias is confirmed.

When I saw this pair it was already moving, not the bottom catch that I like and go for and yet, I still went ahead on it because it is still early when you consider the bigger picture; practice what you preach.

We missed the bottom but it is still early, there is plenty of room available for growth. Trading is easy when the market is approached with the right mentality, with a simple working plan. Buy and hold. Watch how the market will take care of the rest.

Just deposit and continue to invest, as much as you can. Continue to add to each position you like and grow; let it grow. Check back every 3 weeks, every 1-2 months; watch your money grow. It is truly that simple. Timing is very important for this strategy and the best timing is now. Right now we are on the verge of a major advance, no need to wait. You can buy today and start earning within days.

A few months back, we had to wait for months. A few weeks back, we had to wait for weeks. Entering the market now, the wait is short but patience is key.

It will go higher than what is shown on the chart. This publication is to alert you of a great timing, be ready to wait. Make sure to do your own planning. The risk is minimum when trading spot. The worst case scenario is a long wait. If things go right; enter green, stay green and profits-capital grow.

Success can be achieved but the hard part is being around now, when prices are low. It is easy to be around when there is hype and everything is 1,000% up. But can you beat the impulse to sell when the right choice is to buy? Can you take action now and go ahead?

If you are reading this now, you are in the right track but for many people it is not that easy, they are allergic to low prices and they won't be reading this until it is too late. 90% of the people will only become aware of these opportunities that I am showing you daily when it is too late.

That's ok. We use the experience to learn. When I first started I went through the same process. The euphoria got my attention and when I became aware of the market everything was already high up. We tend to join at the market top. But then we go through the entire cycle, the market is here to stay. We get to buy the bottom, we gain experience and in the end we can always win if we never give up. Persistence and consistency, be ready to hold.

If you can hold your altcoins when prices are low, you will reap the rewards at the time of the bull run. Millions to be made overnight. Years of preparation, but it can be done.

Namaste.

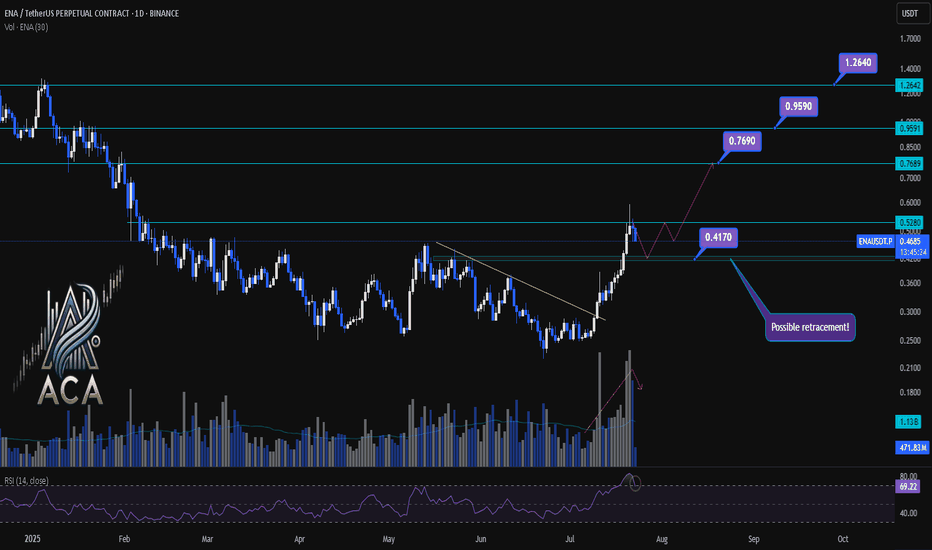

ENA/USDT Chart Analysis | Volatility Signals & Bullish TriggersENA/USDT Chart Analysis | Volatility Signals & Bullish Triggers

🔍 Let’s dive into the ENA/USDT perpetual contract and analyze recent price action, focusing on momentum shifts and key breakout scenarios.

⏳ Daily Overview

The daily chart shows that ENA recently reentered the overbought zone on the RSI, which can serve as a potential trigger for traders watching momentum shifts. Earlier, price action broke decisively above a long-standing descending trendline, resulting in a rapid, nearly 100% surge, a classic RR2 move off the trendline. This breakout coincided with a visible uptick in trading volume, confirming strong demand behind the move.

Now, during the ensuing rest or correction phase, trading volume is decreasing—often a constructive sign suggesting either profit-taking or a healthy pullback rather than panic selling.

🔺 Bullish Trigger & Setup:

- RSI Signal: Reentry into the RSI overbought zone is a potential long trigger, especially if confirmed by price action.

- Confirmation Level: A daily close with strong volume above $0.528 would add conviction to a bullish setup.

- Trendline Reference: The break above the recent trendline fueled the rapid advance, showing the importance of watching such key resistance levels.

📊 Key Targets (on further bullish confirmation):

- $0.769 — First upside resistance.

- $0.959 — Next bullish target.

- $1.264 — Extension target if momentum continues and broader market sentiment remains supportive.

🚨 Conclusion:

Eyes are on the $0.528 level—closing above it with volume, especially while RSI holds in the overbought zone, could provide the next strong entry signal. Current declining volume during pullbacks suggests this is likely a profit-taking phase or standard correction, not bearish capitulation. Keep monitoring RSI, volume profile, and price closes for the next actionable opportunity.

Phemex Analysis #91: Pro Tips for Trading Ethena (ENA)Launched in 2024, Ethena ( PHEMEX:ENAUSDT.P ) has swiftly risen as a powerful innovator in decentralized finance (DeFi). Its flagship synthetic dollar stablecoin, USDe, has achieved remarkable growth—ballooning from a mere $100 million supply at the beginning of 2024 to an impressive $5.8 billion, securing the third position among stablecoins by market capitalization. Concurrently, the ENA token itself delivered an astounding 550% price surge over the last five months, placing Ethena firmly among the top 10 DeFi protocols by total value locked (TVL), currently at approximately $5.8 billion.

In December 2024, Ethena expanded its stablecoin offerings by launching USDtb, a stablecoin backed 1:1 by cash and cash equivalents, with a remarkable 90% of reserves held in BlackRock’s USD Institutional Digital Liquidity Fund via Securitize. Ethena’s innovative USDe and the newly introduced USDtb represent crypto-native alternatives to established stablecoins such as USDT and USDC, promising censorship resistance and enhanced on-chain transparency.

Given USDtb's institutional-grade backing and advanced risk mitigation, it stands to substantially impact the broader stablecoin ecosystem, particularly as traditional USD-backed stablecoins face heightened regulatory scrutiny.

With Ethena’s significant innovations and market momentum in mind, let's carefully examine several potential price scenarios traders should be prepared for.

Possible Scenarios

1. Breakout Rise (Bullish Scenario)

Technical analysis indicates that ENA has formed a notable "triple bottom" around the $0.25 area, suggesting robust buying interest at this support level. If this support further solidifies, ENA could soon experience a bullish breakout above the immediate resistance at $0.37.

However, traders should exercise patience as the $0.50 zone represents strong resistance. It is expected that ENA’s price may fluctuate considerably before breaking confidently above this key psychological level.

Pro Tips:

Entry Strategy: Look to enter positions upon a confirmed breakout above $0.37, ideally with increasing trading volume.

Risk Management: Place stop-losses slightly below recent lows around $0.24–$0.25 to safeguard against false breakouts or reversals.

Profit-Taking: Consider partial profit-taking as the price approaches the critical resistance zone near $0.50.

2. Bearish Drop (Caution Scenario)

In a bearish scenario, potentially driven by broader negative market sentiment, ENA’s price could experience renewed downward pressure. A decisive, high-volume breakdown below the crucial support at $0.25 would strongly signal this bearish trend continuation.

Pro Tips:

Short Opportunities: Advanced traders might explore short-selling opportunities if ENA convincingly breaks below the $0.25 support.

Risk Mitigation: Set tight stop-losses to manage exposure, particularly if trading in volatile conditions.

3. Accumulation Phase (Neutral Scenario)

If the key $0.25 support successfully withstands selling pressure, Ethena’s price may enter a period of consolidation, bouncing between $0.25 (support) and $0.37 (resistance). Such consolidation typically reflects market indecision and accumulation before a substantial directional move.

Pro Tips:

Range Trading: Consider employing strategies such as grid trading to benefit from regular price oscillations within this trading range.

Observation and Patience: Stay observant for changes in volume or price momentum, as these could signal an imminent breakout or breakdown.

Conclusion

Ethena (ENA) is positioned at an intriguing crossroads, supported by impressive fundamentals, innovations, and growing market influence. Traders should closely monitor the outlined technical scenarios—recognizing key support and resistance levels, employing disciplined risk management, and capitalizing strategically based on evolving market conditions. With careful planning and timely execution, traders can confidently navigate Ethena’s current volatility and capture potential upside opportunities.

🔥 Tips:

Armed Your Trading Arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

ENA - Already Over-Sold!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈ENA has been overall bearish trading within the falling channel marked in red and it is currently retesting the lower bound of the channel.

Moreover, the blue zone is a strong demand.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of demand and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #ENA approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

ENAUSD: Strong bullish wave startingEthena is neutral on its 1D technical outlook (RSI = 52.271, MACD = 0.053, ADX = 32.166) as it's trading between the 1D MA200 and 1D MA50. The last time a rebound was supported by the 1D MA50, was in October 2024 and was the start of a Channel Up to the top of the Rectangle. Go long and TP = 1.3000.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Ethena Short-Term Trade-Setup: Easy Profits 708%Ethena is now ready to produce a new advance, higher prices. The (1) shows a low before the last bullish jump. The (2) is a higher low which tends to lead to a higher high.

Looking at the Altcoins market, looking at Bitcoin and how strong it is; looking at the volume and candles, all is green.

ENAUSDT is ready to grow short-term, which means fast; the next advance is likely to start within days. The start will happen soon but the end is far away.

Look, the bottom has been forming for months. The bearish wave ended in March, then the market flush and now the recovery; prices are still low.

The thing is that once the action starts, there is no going back, it will happen so fast that by the time you look at the market, at the chart, everything will be 100% to 200% up. There will be more growth, but is better to get in early.

Thanks a lot for your continued support.

Buy and hold.

Namaste.

ENA is repeating a bullish fractal (1D)Look at the red, white, yellow, and green boxes in order, and then pay attention to the white trigger lines. You’ll notice that the previous phases | the end of the bearish trend (red box), followed by a bullish move for breakout (white box), then a pullback (yellow box), and finally the main bullish move (green box) | are now repeating.

Also, the price is currently sitting within the trading range marked by the two green lines, which is a key area. After the pullback is completed, a bullish wave is expected to begin, potentially reaching at least around the previous all-time high (ATH).

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Breakout trading possible range: 0.4140-0.4424

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(ENAUSDT 1D chart)

The key is whether it can break through the 0.4140-0.4424 range and rise.

It is expected that breakout trading will be possible if the 0.4140-0.4424 range breaks through.

However, it is judged that it is possible to lead to additional rise only if it rises above 0.5082 at once and maintains the price.

Therefore, if breakout trading was not possible, trading is possible if support is confirmed near 0.4140-0.4424.

-

If it rises above 0.5082 and is supported, there is a possibility that it will rise significantly as there is no special resistance zone.

In other words, it seems possible that it will break through 0.7907 and 1.0382.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems that it has been maintaining an upward trend following a pattern since 2015.

That is, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

TradeCityPro | ENA: Expansion Pattern Near Critical Break Levels👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ENA coin for you. The Ethena project is one of the DeFi projects in crypto that has attracted a lot of hype in this category.

💥 ENA coin, with a market cap of $1.7 billion, ranks 50th on CoinMarketCap.

📅 Daily Timeframe

As you can see on the daily chart, there is an Expanding Triangle, and the price is fluctuating within this pattern.

📚 One key characteristic of an Expanding Triangle is that while the price is within the triangle, it tends not to respect static levels such as supports and resistances. Currently, the price is within the triangle and, as you can see, it doesn’t respond significantly to static zones.

📈 For this coin to become bullish, the triangle must break to the upside and the triangle trigger at 0.37 should be activated. In that case, the price can move upward and begin a bullish trend. Full confirmation of the bullish reversal will come with price stabilization above 0.4746.

✔️ For continued downward movement, the first trigger is the break of 0.2694. If you already hold this coin, you can use this level as a stop-loss — and once the price closes below it, you can trigger your stop-loss.

📊 For short positions, the break of 0.2694 is a valid trigger, but the issue is that it activates before the triangle breaks, and I personally prefer not to open a position within an Expanding Triangle — I’d rather wait and enter after it breaks.

🔽 Another trigger for a bearish move is the break of 0.2054. This is the main support for ENA, and if it breaks, the price will register a new All-Time Low.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

ENA is standing at a classic “make-or-break base-build” juncture

🕞 60-Second Read

Trend on the 1-D chart is still structurally bearish , yet price (spot 0.350 USDT) just printed a higher-low off the April wick and reclaimed the mid-channel line. Two large upside voids are now in play.

Hot-Zone #1 – 0.292 (15 m imbalance): fresh demand, 17 % under spot.

Hot-Zone #2 – 0.496 (3 MP-High retest): range cap & first breaker, 42 % above.

Hot-Zone #3 – 0.836 → 0.892 (Feb pivot ↔ Yearly EC): macro supply shelf.

🎲 Probability Dashboard

HTF Trend & Structure – -2

Liquidity Map (voids above) – +1

Momentum (vector flips) – +1

Derivatives (funding ≈ flat) – 0

Net Score = 0

Bear / Neutral / Bull odds ≈ 40 % / 30 % / 30 %

📈 Trade Playbook

Strategy 1

1. Layered Limit Grid – Aggressive Counter-Trend Long

Entry layers (size %):

0.300 – 25 % of your allocated ENAUSDT size

0.280 – 35 %

0.260 – 25 %

0.240 – 15 %

SL = 0.215

TP ladder:

0.350 – 20 % off-load

0.496 – 25 %

0.836 – 30 %

1.040 – 25 %

Weighted R:R ≈ 7.3

Strategy 2

2. Layered Limit Grid – Conservative Breakout Long

Trigger: daily close > 0.496, then place grid orders.

Entry layers (size %):

0.510 – 40 %

0.570 – 30 %

0.650 – 20 %

0.836 – 10 %

SL = 0.440

TP ladder:

0.836 – 30 %

1.040 – 30 %

1.516 – 25 %

1.550 – 15 %

Weighted R:R ≈ 4.8

Setup Logic

Price reclaimed mid-channel but remains inside a 69 % upside void to 0.836.

Stacked un-retested highs (0.496 / 0.836 / 1.040) act as magnetic targets.

Yearly S1 (0.220) converges with vector zone support – ideal invalidation.

Risk Radar

Perp OI up 18 % WoW – a funding spike could squeeze late longs.

Two token unlocks (2 & 5 May) add ≥ 200 M ENA supply.

Macro: FOMC (1 May) & BTC flow volatility may spill into alts.

ENA must flip 0.496 to sprint through the 0.84-1.04 air-pocket; fail that and liquidity magnets at 0.30 → 0.22 take the wheel. Trade the grid – not the hopium.

(Not financial advice – always do your own research.)