ETHFI/USDT – Critical Decision Point| Accumulation or Breakdown?ETHFI is currently trading within its most critical zone since mid-year — the 1.00–0.85 range, which has long acted as the last stronghold of buyers. This area is a battle zone between large-scale accumulation or the final signal of distribution.

After facing prolonged downward pressure and failing to reclaim resistance at 1.80, the price is now retesting a strong demand zone — the same area that triggered a major rally earlier this year. The reaction from this region will define ETHFI’s next macro direction in the coming quarter.

The structure suggests the market is in a macro consolidation phase, where liquidity is being collected from both sides before the next major move. A stable 3D candle close above 1.00 could act as the first trigger for a new upward cycle, while a decisive close below 0.85 would confirm a continuation of the multi-month bearish trend.

---

🔶 Technical Structure & Pattern Analysis

Yellow Zone (1.00–0.85) is the key demand zone — the area where buyers previously stepped in aggressively.

Price is currently moving sideways above this zone, indicating potential accumulation in progress.

The previous sharp drop followed by long lower wicks suggests sellers may be losing momentum.

Key resistance remains at 1.40 – 1.80, while a 3D breakout above 1.40 would signal a structural shift to bullish.

---

🚀 Bullish Scenario

If ETHFI manages to hold and close a 3D candle above 1.00 and then breaks 1.40:

Buyers regain control, shifting structure to higher highs and higher lows.

Step targets:

1.80 → strong resistance level that capped previous rallies

2.42 → key confirmation of reversal

2.95 – 5.10 → potential expansion/euphoria phase

Main validation: 3D close above 1.40 with rising volume.

Defensive support: 0.90–0.95 as short-term buyer defense.

---

⚠️ Bearish Scenario

If price breaks below 0.85 and closes a 3D candle under this zone:

It confirms a major breakdown from the consolidation structure, opening room for deeper correction:

0.70 → next minor support

0.55 → critical retracement area

0.34 → historical extreme low

Such breakdowns often trigger panic selling or a capitulation move.

Bears remain in control if any retest of 0.85 fails to reclaim the zone.

---

📊 Key Levels (Quick Summary)

Major Support (Demand Zone): 1.00 – 0.85

Immediate Resistance: 1.40

Next Resistances: 1.80 → 2.42 → 2.95 → 5.10 – 5.40

Bearish Targets: 0.70 → 0.55 → 0.34

---

🧭 Macro Outlook & Sentiment Interpretation

ETHFI stands at a crossroads — is this the final phase of capitulation or the foundation of a long-term accumulation before reversal?

The 1.00–0.85 range could attract institutional buyers, yet without volume confirmation and a clear higher-high structure, the risk of a breakdown remains high.

This psychological zone will likely define ETHFI’s direction heading into Q1 2026.

---

🧠 Extra Insights for Traders

Wait for 3D candle close confirmation before committing to direction.

Avoid FOMO during sideways movement — focus on confirmed breakouts.

The best setups come from valid retests of support/resistance zones with real momentum.

Watch closely how price reacts in the yellow zone — whether it bounces with strong volume or breaks down impulsively.

---

#ETHFI #ETHFIUSDT #CryptoAnalysis #SwingTrade #CryptoSetup #TechnicalAnalysis #CryptoMarket #ReversalZone #CryptoTrading #SupportResistance #3DChart #CryptoOutlook

ETHFIUSDT

ETHFI – Potential Rebound from Major Support ZoneETHFI is currently testing a critical support zone between $0.60 and $0.80, a level that previously held strong during market corrections. Price structure appears to be respecting this level, and the RSI is nearing oversold territory, hinting at a possible momentum shift. This combination sets the stage for a potential bounce if current conditions hold.

🔹 Trade Idea Setup

📌 Entry Zone: $0.60 – $0.80

🎯 Take Profit Targets:

• TP1: $1.90

• TP2: $2.90

🛑 Stop Loss: $0.18

This setup presents a favorable risk-reward ratio, with entry at support and clearly defined targets. RSI signals are adding confluence, but always watch for volume confirmation and broader market behavior.

ETHFI has formed a bullish Head & Shoulders pattern📊 CRYPTOCAP:ETHFI Market Update

CRYPTOCAP:ETHFI has formed a bullish Head & Shoulders pattern 🟢

👉 Currently testing the red resistance zone 🔴

👉 If a breakout occurs, the first target will be the blue line level 🎯

⚡ Watch closely — breakout confirmation is key.

ETHFI 1H Analysis - Key Triggers Ahead👋🏻 Hey everyone! How’s it going? Hope you’re all doing well.

❄️ Welcome to Crypto Winter.

⏰ Today, we’ll be analyzing ETHFI and exploring its potential opportunities.

👀 On the 1-hour timeframe of the ETHFI coin, we can see that after an upward move and completing a very strong bullish leg, this coin has entered an accumulation phase, and with a breakout and confirmation above the top of this accumulation zone, it can resume its bullish move and continue higher. This coin is one of the strong DeFi coins that is responsible for restaking.

The identified triggers for this coin are the breakout of the taker seller zone and the price level of 1.533, which almost overlap. This means that this zone has both maker seller and taker seller, and with good buying volume, we can pass through this area.

🧮 Looking at the RSI oscillator, we see one important level at 70. Once momentum crosses this zone, the ETHFI could make a strong move with momentum, potentially entering either the overbought area.

🕯 The volume size and number of green candles at the end of this compression have increased, and even several times it has given indecision candles, and then moved to the bottom of this compression. Usually, to break the taker seller zone, we need a whale candle that in the pullback or stop hunt gives us an indecision candle.

💸 On the 1-hour timeframe of the ETHFIBTC pair, this trading symbol is currently in accumulation and moving upward. If this move is maintained and the interest rate news also comes with a multi-level decrease, this trading symbol can eliminate its taker seller zone in the pairs it has, fill the sell orders, and continue moving upward.

🧠 For entering this coin and taking a long trade, we must wait for the taker seller zone to break, and then enter the trade with an indecision candle. We can also set a stop loss, but it is not very safe because if unexpected news comes, the market can have high volatility. Risk management & capital management must not be forgotten, since the news will be released in 30 minutes.

❤️ Disclaimer : This analysis is purely based on my personal opinion and I only trade if the stated triggers are activated .

ETHFI/USDT Trading SetupEthfi/usdt break out of the pattern showing bullish strong momentum in coming weeks we can see higher price

- leverage Max 2x-3x (use small amount)

- Spot holder can buy and hold till the target hit

- Entry: 1.4 to 1.5 rang

- Stop Loss: 1.3

- Take Profit: tp1 1.9, tp2 2.5, tp3 3

Best Of Luck

ETHFI Next Leg Could Deliver 200%+CRYPTOCAP:ETHFI has broken out of its bull flag pattern and cleared the key resistance trendline. This breakout signals a shift in momentum, showing that buyers are stepping back in with strength.

The structure looks constructive as long as price holds above the breakout zone, opening the door for a potential continuation move to the upside. Sustained momentum here could mark the beginning of a broader bullish leg.

In simple terms: ETHFI just confirmed a breakout, and holding above resistance keeps the bulls in control.

DYOR, NFA

Stay tuned for more updates

#PEACE

ETHFI Squeeze: One Close Away From a Massive RallyCRYPTOCAP:ETHFI is coiling inside a tightening structure with higher lows forming consistently. The price is pressing against the upper resistance trendline.

If ETHFI manages to break and close above the marked zone, it could trigger a massive breakout move as trapped sellers get squeezed and fresh buyers step in.

Keep a close watch, this setup is building energy for its next big move.

DYOR, NFA

#PEACE

More update coming soon, stay tuned!

ETHFI ; Has purchase confirmation been given?Hello friends

Given the decline we had, the price has been in a good support and then managed to break through its resistance and now in the pullback we need to see the reaction of the buyers. If the Fibonacci support is maintained, the price can move to the specified Fibonacci steps, which has been specified.

Don't forget capital and risk management.

*Trade safely with us*

ETHFI ANALYSIS🔮#ETHFI Analysis 💰💰

#ETHFI is trading in a symmetrical triangle in a weekly time frame and if it breakouts with high volume then we can see a bullish momentum in #ETHFI. Before that we will see little bit bearish movement towards its support zone and that a bullish movement.

🔖 Current Price: 1.218

⏳ Target Price: $1.608

⁉️ What to do?

- We can trade according to the chart and make some profits in #ETHFI. Keep your eyes on the chart, observe trading volume and stay accustom to market moves.💲💲

🏷Remember, the crypto market is dynamic in nature and changes rapidly, so always use stop loss and take proper knowledge before investments.

#ETHFI #Cryptocurrency #Pump #DYOR

ETHFI/USDT — Symmetric Triangle at the Decision Point!The chart shows a symmetric triangle pattern (descending resistance + ascending support) approaching its apex. Price is currently testing the descending resistance area around 1.25 (red label) — a major decision point. Key horizontal targets/support levels are already marked on the chart (yellow).

---

Pattern Description

* Pair: ETHFI / USDT, 2-Day timeframe.

* Previous long-term trend: bearish (descending resistance line from the left).

* After bottoming near \~0.32–0.40, price formed higher lows (rising support) and lower highs (falling resistance) → creating a symmetric triangle / wedge.

* Volume typically contracts as the pattern nears the apex — this is a neutral-to-continuation pattern: often continues in the prior trend (bearish) but can also break upward strongly if there’s a catalyst.

---

Key Levels

Resistance / Upside targets:

* 1.250 — near-term resistance (↑ +6.4%).

* 1.784 — next major (↑ +51.8%).

* 2.390 (↑ +103.4%).

* 2.959 (↑ +151.8%).

* 5.024 (↑ +327.6%).

* 7.001 (↑ +495.8%).

* 8.660 (High, ↑ +637.0%).

Support / Downside levels:

* 0.850 (↓ −27.7%).

* 0.650 (↓ −44.7%).

* 0.500 (↓ −57.4%).

* 0.400 (↓ −66.0%).

* 0.320 (↓ −72.8%).

---

BULLISH Scenario (if breakout occurs):

* Breakout confirmation: 2D candle close above the descending resistance line + above 1.250, with increased volume. Ideally, a retest as support after the breakout.

* First target: 1.784 (conservative TP). If momentum is strong: 2.39 → 2.959.

* Risk management: stop loss below breakout candle or below the rising support line (e.g., entry at 1.30, stop \~1.00–1.05). Use position sizing to keep per-trade risk small (1–3% of capital).

* Significance: a break above will signal a potential *trend reversal* from long-term downtrend to accumulation/uptrend.

BEARISH Scenario (if breakdown occurs):

* Breakdown confirmation: 2D candle close below the rising support line with increased sell volume; failed retest confirms weakness.

* First target: 0.850. If selling pressure continues: 0.65 → 0.50 → 0.32.

* Risk management: if shorting, stop above retest/resistance (or above 1.25 if a failed breakout).

* Significance: since the prior long-term trend is bearish, a breakdown has high probability of trend continuation to the downside.

---

Trade Ideas

* Conservative: set alerts for 2D close > 1.25 + higher volume; partial entry, partial TP at 1.78, trail the rest.

* Aggressive: enter on breakout & retest of resistance as support.

* Bear setup: short after confirmed close below rising support & failed retest; target 0.85 first.

---

Technical & Psychological Notes:

* Pattern is very close to the apex → large move likely within the next few weeks on the 2D chart.

* Volume & candle close are key to avoid chasing fake breakouts.

* Also watch general crypto sentiment & news catalysts as they can trigger breakouts against the technical bias.

#ETHFI #Crypto #TechnicalAnalysis #Triangle #Breakout #SupportResistance #Altcoins #CryptoTrading #BullBear

ETHFI/USDT Chart Analysis - Bullish Breakout Potential

Looking at the ETHFI /USDT chart, we’re seeing a potential bullish breakout forming. After a strong downtrend, price has recently broken the resistance trendline, indicating a possible upward movement. A target of $1.60 (approx. 24% upside) is in sight if the price holds above the trendline.

Key Points:

Breakout above resistance: A strong push above the trendline could signal further upside.

Target Level: $1.60 (24.26% increase).

Momentum: ETH has been showing strength, so keep an eye on confirmation for entry points.

As always, manage your risk and consider the broader market conditions before entering.

ETHFI Bullish DivergenceBINANCE:ETHFIUSDT

Trade Setup:

Target 1: 1.054 (0.786 Fibonnaci Golden Zone).

Target 2: 1.130 (0.618 Fibonnaci Golden Zone).

Target 3: 1.184 (0.786 Fibonnaci Golden Zone).

Target 4: 1.410 (0 Fibonnaci).

Stop Loss: 0.835 (1.272 Fibonnaci).

RSI Analysis: The RSI is showing a bullish divergence, suggesting potential bullish momentum. The current RSI is around 22.36, approaching oversold territory, so caution is advised.

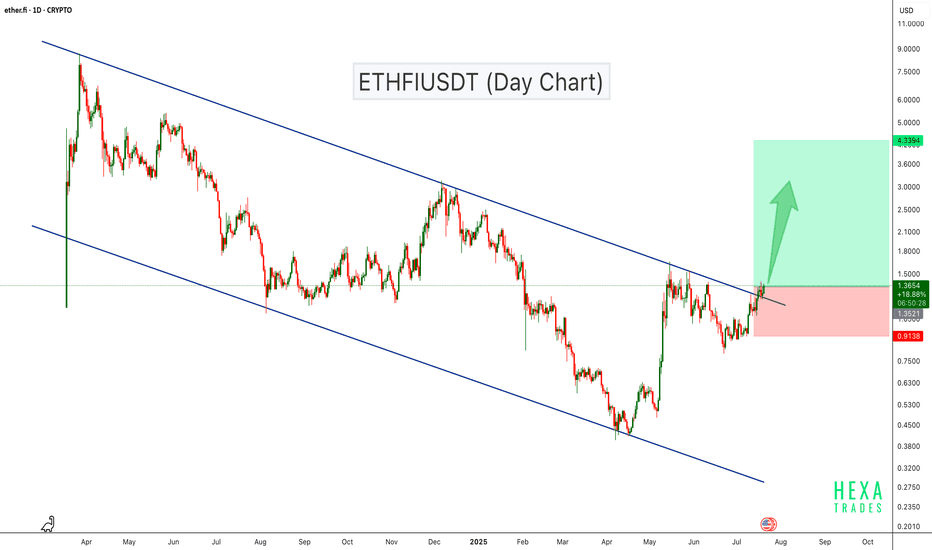

ETHFI Breaks Out of Descending Channel – Bullish Rally Ahead?ETHFI has been trading inside a descending channel for over a year, consistently respecting both resistance and support levels. Recently, the price broke above the channel resistance with strong bullish candles, suggesting a potential trend reversal.

This breakout indicates growing bullish momentum, and if the price sustains above the breakout level, we could see a move towards the $4.00–$4.70 range in the coming weeks.

Cheers

Hexa

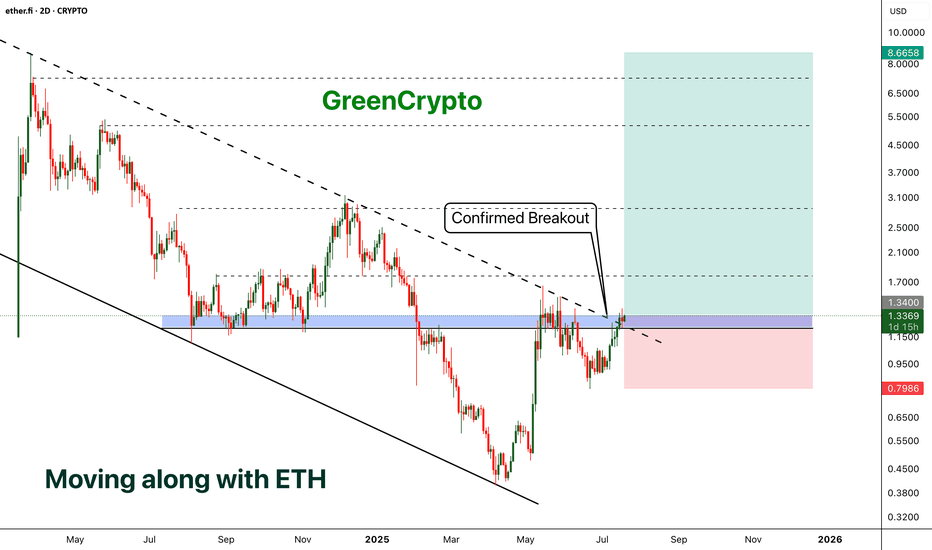

ETHFI - Moving along with the ETH- ETHFI has finally broken out from the descending channel pattern and now price is above the trending resistance line.

- We can expect a minor reversal (chances are less ) and parabolic move from here.

- I'm expecting at-least 500+% profit from this opportunity

Entry Price: 1.3384

Stop Loss: 0.7965

TP1: 1.7657

TP2: 2.5436

TP3: 4.5055

TP4: 5.6136

TP5: 8.5626

Max Leverage 5x.

Don't forget to keep stoploss.

Support us by Liking and following.

Thanks and Cheers!

GreenCrypto

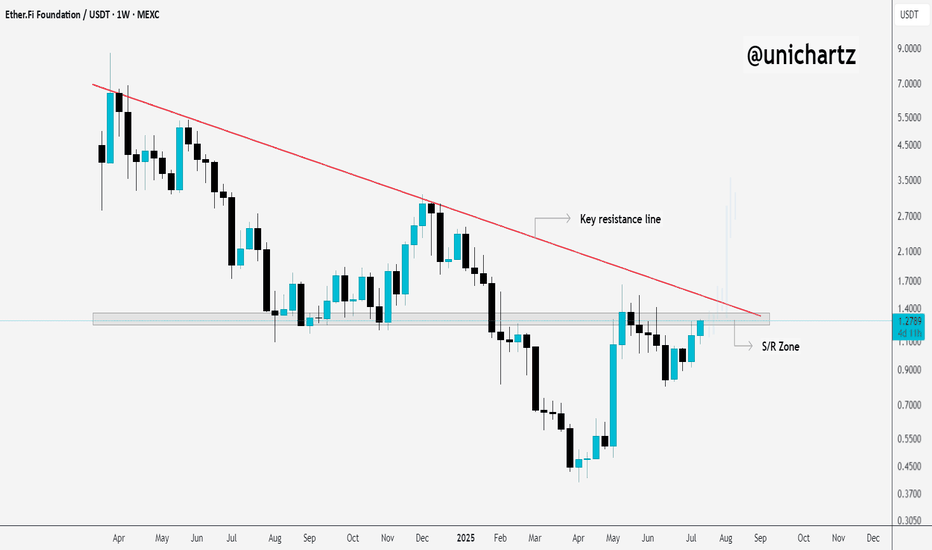

ETHFI Bulls Need to Flip This Level for Upside ContinuationCRYPTOCAP:ETHFI is still hovering around the key S/R zone and trading just below the major trendline resistance on the weekly timeframe.

This area has been a strong rejection point in the past, so it’s a crucial level to watch.

If we get a clean breakout and weekly close above this zone, it could trigger a breakout from the long-term downtrend, potentially kicking off a fresh bullish move.

Keep a close eye. A decisive move is coming.

DYOR, NFA

ETHFI/USDT – BREAKOUT ALERT! Descending Trendline Under Pressure

After over a year of relentless bearish pressure, ETHFI is now approaching a critical technical juncture that could mark the beginning of a major trend reversal. The chart displays a long-term descending trendline, and bulls are now challenging it with growing strength. This setup could lead to a powerful breakout and a potential trend shift.

🧩 Technical Pattern Overview:

🔸 Descending Trendline Resistance – Established since April 2024, acting as a dominant resistance across multiple retests.

🔸 Base Accumulation – Price has formed a strong base between $0.80–$1.00, indicating declining selling pressure and potential accumulation.

🔸 Volatility Squeeze – Price action is tightening near the apex of the descending triangle, suggesting that a breakout (up or down) is imminent.

🔸 Breakout Watch – A confirmed breakout above $1.25 would be a major bullish signal.

🐂 Bullish Scenario (Confirmed Breakout):

If the price breaks and closes above $1.25 with strong volume:

🎯 Potential Upside Targets:

Target 1: $1.784 – Previous local resistance

Target 2: $2.390 – Former consolidation zone

Target 3: $2.959 – Key psychological resistance

Extended Targets: $5.024 and $7.001 if a sustained rally unfolds

Ultimate ATH: $8.660 – If the broader crypto market enters full bullish mode

💡 Catalysts to Watch: Altseason, project news, favorable macro sentiment, or exchange listings.

🐻 Bearish Scenario (Rejection at Resistance):

If ETHFI fails to break out and gets rejected at the descending trendline:

🔻 Potential Downside Levels:

$1.088 – Immediate support

$0.88 – Minor support

$0.70 – Historical support zone

$0.50 to $0.35 – Deeper bearish targets if selling resumes

⚠️ Fakeouts are common during volatile phases — always wait for confirmation with volume.

📌 Conclusion & Strategy:

ETHFI is at a make-or-break level. A confirmed breakout could trigger a strong upward rally with high risk/reward potential. However, failure to break resistance could lead to continued consolidation or even downside.

🔍 Traders should watch for a clean breakout above $1.25, preferably with high volume. Risk management is key — define your invalidation levels and stick to your plan.

🧠 Trading Recommendations:

🟢 Breakout traders: Wait for confirmation > $1.25

🟡 Accumulate: Between $0.90–$1.00

🔴 Stop-loss: Below $0.85 for conservative risk

📈 Risk/Reward after breakout: Attractive (1:3 or better)

#ETHFI #ETHFIUSDT #CryptoBreakout #DescendingTrendline #AltcoinAnalysis #TechnicalAnalysis #BreakoutTrading #CryptoSignals #BullishReversal

ETHFIUSDT Breakout Loading!CRYPTOCAP:ETHFI is consolidating within a symmetrical triangle on the 4H chart, with price tightening between descending resistance and rising support. A breakout or breakdown is likely soon. Watch for volume confirmation. Key levels to watch: $1.35 (resistance) and $1.00 (support). Breakout could lead to $1.50+, while breakdown risks a drop toward $0.95.

ETHFIUSDT breakdown alertETHFIUSDT breakdown alert

ETHFIUSDT has broken down from a triangle pattern and appears to have completed a retest of the breakdown zone. If the price fails to reclaim this level and continues to reject it, we could see further downside pressure in the coming sessions.

Key levels to monitor:

– Breakdown zone now acting as resistance

– Immediate support below

– Volume confirmation to validate the move

Watch ETHFI closely — if the retest holds, it may lead to continued bearish momentum.