EURUSD Outlook | Downtrend Pullback Meets USD StrengthHey Traders,

In today’s trading session, we are closely monitoring EURUSD for a potential selling opportunity around the 1.19000 zone. EURUSD remains in a well-defined downtrend and is currently undergoing a corrective pullback, approaching a key trendline confluence and the 1.19000 support-turned-resistance area, which may act as a strong rejection zone for bearish continuation.

From a fundamental perspective, the recent nomination of a new Federal Reserve Chair is expected to support the US Dollar in the short term, as markets anticipate a more conventional and fiscally disciplined policy stance. This near-term USD strength could add further downside pressure on EURUSD and is also short-term bearish for Gold, reinforcing the broader risk-off bias.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

Eur-usd

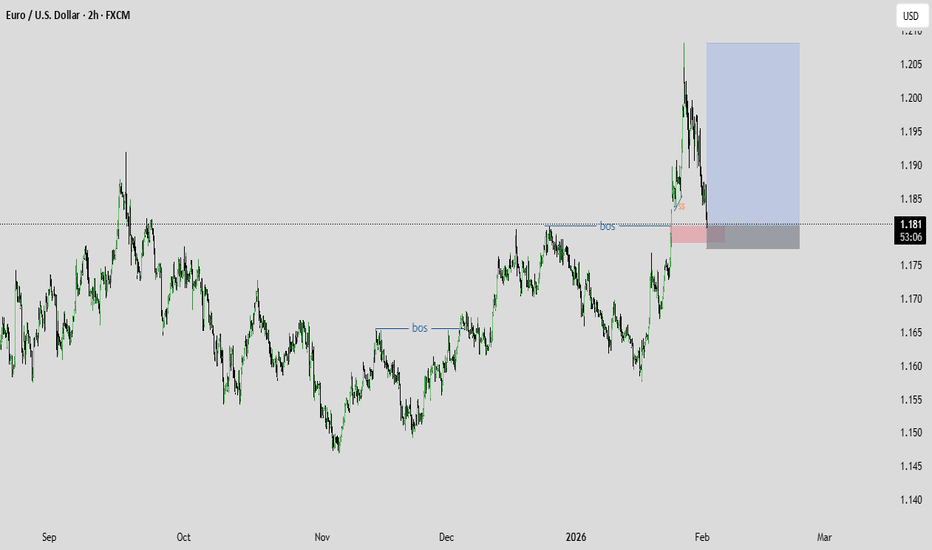

eurusd bulish opportunityThe market shows a general bullish structure into 2026, with clear higher highs and higher lows forming from November onward.

Two BOS (Break of Structure) points are marked in blue, indicating bullish structure breaks where price continued higher after consolidations.

In early February, price makes a strong impulsive rally, breaking above prior resistance around 1.18, followed by a sharp pullback.

The pullback taps a zone labeled “SS” (likely Supply / Sell-side or Support-to-Resistance flip) near 1.18–1.175.

A trade setup box is drawn:

Entry zone: around 1.18

Stop loss: just below the gray/red area (below recent structure)

Take-profit target: the blue zone above, around 1.20–1.205

This suggests a bullish continuation idea, looking to buy the retracement into former resistance turned support, targeting a move to new highs.

EURUSD closed January below the 1M MA200! Bear Cycle confirmed?The EURUSD pair closed last month's (January's) 1M candle below its 1M MA200 (orange trend-line) even though it broke above it for the first time in 8 years (since February 2018)! As mentioned on our last week's analysis, that was would be a strong bearish signal long-term, as the pair hasn't closed a 1M candle above the 1M MA200 since November 2014 and every test or approach near it was a market Top, like January 2021 and February 2018.

So as long as the market keeps closing monthly candles below its 1M MA200, we will stay bearish, looking towards a 2-year Bear Cycle, similar to 2021 - 2022 and 2018 - 2019. As mentioned last week, we have a minimum Target at 1.0200 (near the Jan 2025 Low Support) for this Bear Cycle.

In addition, look the huge 1M RSI Lower Highs Bearish Divergence (against the price's Higher Highs) following the June 2025 rejection on the 8-year Resistance. An extra signal of strength reversal.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bullish bounce off?Fiber (EUR/USD) is falling towards the pivot which aligns with the 61.8% Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 1.1763

1st Support: 1.1679

1st Resistance: 1.1942

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Falling towards pullback support?Fiber (EUR/USD) is falling towards the pivot, which is a pullback support that is slightly above the 61.8% Fibonacci retracement and could bounce to the 1st resistance, which acts as a swing high resistance.

Pivot: 1.1802

1st Support: 1.1679

1st Resistance: 1.2039

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off?EUR/USD is falling towards the support level, which is a pullback support that is slightly below the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.1806

Why we like it:

There is a pullback support level that is slightly below the 50% Fibonacci retracement.

Stop loss: 1.1701

Why we like it:

There is an overlap support level that is slightly above the 78.6% Fibonacci retracement.

Take profit: 1.1937

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EURUSD H4 | Bullish Bounce Off Pullback SupportThe price is falling towards our buy entry level at 1.18033, which is a pullback support that is slightly below the 50% Fibonacci retracement.

Our stop loss is set at 1.1730, which is an overlap support.

Our take profit is set at 1.1941, a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

EURUSD Under Pressure? Warsh Fed Pick Puts 1.19500 in Play!Hey Traders,

In today’s trading session, we are closely monitoring EURUSD around the 1.19500 zone. EURUSD remains in a broader downtrend and is currently undergoing a corrective pullback, approaching a key trendline confluence and the 1.19500 support-turned-resistance area, which may act as a critical reaction zone.

From a fundamental perspective, markets are digesting President Trump’s announcement of Kevin Warsh as the new Fed Chair. Warsh is widely viewed as a conventional and fiscally disciplined choice, which could be USD-supportive in the near term. This shift in expectations may apply downside pressure on EURUSD, while also being short-term bearish for Gold, as tighter policy credibility supports the Dollar.

As always, wait for confirmation at key levels and manage risk accordingly.

Trade safe,

Joe.

EUR/USD - Buy Entry (H1 - Flag Pattern)The EUR/USD Pair, Price has been trading within a Flag Pattern on the H1 chart, forming consistent higher highs and higher lows. Price action is now testing the upper boundary of the Pattern, signalling a possible breakout. FX:EURUSD

✅Market Context:

1️⃣Strong Upward Structure Inside the Pattern.

2️⃣Buyers are showing strength near Resistance.

3️⃣Breakout above the Trendline indicates Momentum continuation toward higher zones.

✅Trade Plan:

Entry: Buy after Confirmed Breakout above the Resistance (H1 candle close above trendline or retest of the breakout).

💰Take Profit (TP): At the Key Zone – a Major Resistance area identified ahead.

🛑Stop Loss (SL): Below the Pattern Structure.

✅Psychological Discipline :

1️⃣Stick to plan – No Revenge Trades.

2️⃣Accept losing trades as Part of the Strategy.

3️⃣Risk only 1–2% of your account balance per trade.

✅ Support this analysis with a

LIKE 👍 | COMMENT 💬 | FOLLOW 🔔

It helps a lot & keeps the ideas coming!

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Forex trading involves high risk. Trade only with capital you can afford to lose and always do your own research.

EURUSD potential LongsEURUSD is currently in a clear bullish market structure. This is a buy idea, not an active trade yet.

Price has not tapped my entry zone, so I’m patiently waiting for a retrace into the marked premium / supply area. Location aligns with prior lows and bullish imbalance, giving good upside potential if price delivers.

The setup only becomes valid once price reaches the zone and shows lower-timeframe bullish confirmation (structure shift or strong rejection). Until then, no entry. patience over forcing trades.

Bias remains bullish as long as structure holds.

Falling towards pullback support?Fiber (EUR/USD) is falling towards the pivot, which is a pullback support and could bounce to the 1st resistance.

Pivot: 1.1804

1st Support: 1.1730

1st Resistance: 1.2039

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Falling towards 50% Fib support?EUR/USD is falling towards the support level, which is a pullback support slightly below the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.1806

Why we like it:

There is a pullback support that is slightly below the 50% Fibonacci retracement.

Stop loss: 1.1701

Why we like it:

There is an overlap support that aligns with the 78.6% Fibonacci retracement.

Take profit: 1.2037

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

TradingView (www.tradingview.com)

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

QuyetP | EURUSD: Buy Until the Trend BreaksFX:USDOLLAR is in a strong bearish trend as we all see.

OANDA:EURUSD price just retraced exactly at the 1H base zone and swept previous 1H low - just a breakout + retest setup.

That is enough reasons for me to enter a continuation buy setup.

"If a trading setup needs too much explanation, it’s probably not a good trade." :)

EURUSD is Nearing an Important Support!Hey Traders, in today's trading session we are monitoring EURUSD for a buying opportunity around 1.18200 zone, EURUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.18200 support and resistance area.

Trade safe, Joe.

Bullish continuation?EUR/USD is falling towards the support level, which is a pullback support that is slightly below the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.1806

Why we like it:

There is a pullback support that is slightly below the 38.2% Fibonacci retracement.

Stop loss: 1.1748

Why we like it:

There is a pullback support that aligns with the 50% Fibonaci retracement.

Take profit: 1.1908

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EURUSD ahead of biggest test in 8 years! Collapse or Golden era?The EURUSD pair is going for its most important test in 8 years, the 1M MA200 (orange trend-line). This level last tested in February 2018, causing a massive rejection, which kick-started the Bear Cycle of 2018 - 2019. Technically that was the Bearish Leg of the 11-year Bearish Megaphone pattern that the pair has been trading in basically since the last time it closed a 1M candle above the 1M MA200, which was in November 2014.

The previous Bearish Leg of 2021 - 2022 also started close to the 1M MA200 but the price got rejected a little lower. Nonetheless, it did create a Lower Highs trend-line, which is currently sitting marginally above the 1M MA200. As a result, EURUSD is approaching a massive Resistance Zone, while at the same time its 1M RSI is attempting to re-test its 66.50 Resistance, which got rejected in June 2025 and also started 8 years ago with the first Lower High.

As a result, until the price closes a 1M candle above the 1M MA200 (would be the first in more than 11 years), we believe it is more likely to see a rejection starting the new Bearish Leg. However the development that confirmed that during the previous two Bearish Legs was a 1M candle closing below the 1W MA50 (red trend-line). If that takes place, it will be the confirmation signal for a long-term Sell.

As far as Targets are concerned, the Jan 2025 Low is our first candidate, targeting 1.0200 fulfils this condition as well as the 0.618 Channel Fibonacci level, which has priced three bottoms in the past 6 years (green circles). A monthly close below Support 1 (Jan 2025 Low) could grant an extension to the 0.786 Channel Fib at 0.9800, which is where another three Lows were price (blue circles).

In any event, if the 1M RSI turns oversold (below 30.00) it has been the ultimate long-term Buy Signal within 11 years and we will turn into long-term buyers regardless of the actual price of EURUSD at the time.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EURUSD H4 | Bearish Reversal Off Fib LevelsThe price is reacting off our sell entry level at 1.1869, which aligns with the 127.2% Fibonacci extension and the 100% Fibonacci projection.

Our stop loss is set at 1.1902, which aligns with the 141.4% Fibonacci extension.

Our take profit is set at 1.1807, which is a pullback support.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

Bullish bounce setup?Fiber (EUR/USD) could make a short-term pullback to the pivot and could bounce to the swing high resistance.

Pivot: 1.1694

1st Support: 1.15504

1st Resistance: 1.1918

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

EUR/USD - H4 Weekly Outlook - Breakout Loading ?📝 Description 🔍 Market Structure

EUR/USD remains in a strong H4 uptrend, supported by a rising trend OANDA:EURUSD line and higher-high / higher-low structure. Price is currently compressing below a key resistance zone, suggesting a breakout or pullback scenario is loading.

🔴Trendline support respected multiple times

🔴Price holding above key moving averages

🔴Momentum slowing near resistance → decision zone

📍 Key Support & Resistance

🟢 Resistance Zone: 1.1760 – 1.1800

(June & September highs in focus)

🔴 1st Support: 1.1600 – 1.1580

🔴 2nd Support: 1.1540 – 1.1520

#EURUSD #ForexTrading #WeeklyOutlook #BreakoutSetup #PriceAction #SupportResistance #TradingView #Kabhi_TA_Trading

⚠️ Disclaimer

This analysis is for educational purposes only.

Forex trading involves risk — always manage position size and use a stop-loss.

💬 Support & Engagement👍 Like if you’re waiting for the breakout

💬 Comment: Breakout or Pullback first?

🔁 Share with traders watching EUR/USD

EURUSD Outlook | Bullish Structure + Key Demand Zone!Hey Traders,

In today’s trading session, we are closely monitoring EURUSD for a potential buying opportunity around the 1.17000 zone. EURUSD remains in a well-defined uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 1.17000 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

Bearish drop off?Fiber (EUR/USD) has rejected off the pivot, which aligns with the 61.8% Fibonacci retracement and could drop to the 1st support.

Pivot: 1.1717

1st Support: 1.1631

1st Resistance: 1.1779

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off key level?EUR/USD is falling towards the support level, which is an overlap support that aligns with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.1678

Why we like it:

There is an overlap support level that aligns with the 50% Fibonacci retracement.

Stop loss: 1.1621

Why we like it:

There is a pullback support level that aligns with the 78.6% Fibonacci retracement.

Take profit: 1.1776

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.