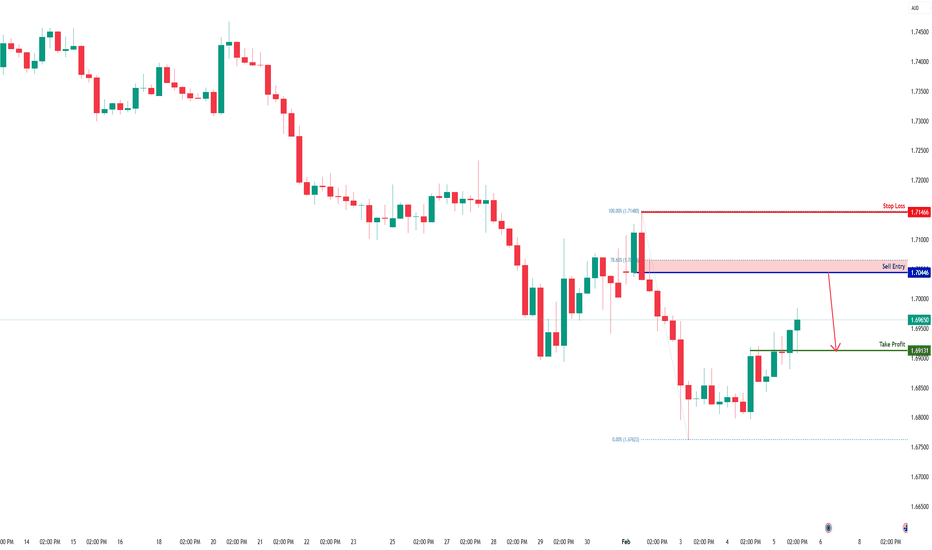

EURAUD H4 | Bearish Reaction Off Pullback ResistanceMomentum: Bearish

Price is currently below the ichimoku cloud.

Sell entry: 1.70446

- Pullback resistance

- 78.6% Fib retracement

Stop Loss: 1.71466

- Swing high resistance

Take Profit: 1.69131

- Pullback support

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

EURAUD

EURAUD Will Go Higher! Long!

Here is our detailed technical review for EURAUD.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 1.686.

The above observations make me that the market will inevitably achieve 1.693 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

EURUSD: breakdown below 1.18🛠 Technical Analysis: On the H4 timeframe, EURUSD is in a corrective phase after the sharp rally toward the 1.20 area, with sellers pushing price back into a consolidation range. The pair is currently compressing around the 1.1800 support zone, which is acting as the key pivot for the next move. Price is also trading below the SMA 50, while the SMA 100 and SMA 200 sit just beneath current price as a critical “last line” of support. A confirmed breakdown below 1.1780 would validate continuation lower toward the next support at 1.1719. If buyers reclaim 1.1843 and then break above the 1.1890 resistance zone, the bearish continuation idea weakens and the market may attempt another push higher.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: 1.17809

🎯 Take Profit: 1.17191 (extended target: 1.16200 support zone)

🔴 Stop Loss: 1.18428

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Potential bullish reversal?EUR/AUD is falling towards the support level, which is a pullback support, and could bounce from this level to our take profit.

Entry: 1.6870

Why we like it:

There is a pullback support level.

Stop loss: 1.6774

Why we like it:

There is a swing low support level.

Take profit: 1.7020

Why we like it:

There is a pullback resistance level that is slightly above the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

AUDUSD: reaction from 0.70🛠 Technical Analysis: On the D1 timeframe, AUDUSD has rallied aggressively and is now pressing into a major resistance band around 0.6990–0.7020. The steep advance into this zone increases the odds of a pause, a rejection, or a brief false breakout before a corrective pullback starts. Price is still holding above the rising structure and remains above the SMA 50/100/200, but the move is stretched versus the moving-average cluster below. A clean rejection from resistance would favor a retracement toward the first demand area around 0.6627 (near the SMA100 zone). If bearish momentum expands, the next larger support zone marked on the chart sits around 0.6330–0.6350. A sustained daily hold above the resistance (and especially above 0.7116) would invalidate the sell scenario and shift bias back to continuation.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on rejection / false-break attempt at 0.6990–0.7020

🎯 Take Profit: 0.6627 (extended target: 0.6330–0.6350 support zone)

🔴 Stop Loss: 0.7116

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Bearish continuation setup?EUR/AUD could rise towards the pivot, which is a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse to the 1st support.

Pivot: 1.6950

1st Support: 1.67841

1st Resistance: 1.70398

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

AUDUSD: false breakout setup🛠 Technical Analysis: On the H4 timeframe, AUDUSD remains elevated after a strong rally, but price is now reacting under the key resistance zone around 0.7090–0.7100. The chart may highlights a classic false breakout scenario: a spike above the 0.71 area followed by closing below resistance would be a high-probability trigger for a short. Momentum is still supported by the moving averages (SMA 50/100/200 are rising below price), but the recent push looks stretched and vulnerable to a correction. The nearest downside magnet is the marked support at 0.6904, which aligns with the previous consolidation base. If sellers gain control from resistance, a move back into that demand zone becomes the primary expectation. A sustained breakout and hold above the resistance area would invalidate the short setup and shift bias back toward continuation higher.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on a false breakout 0.71 resistance

🎯 Take Profit: 0.69042

🔴 Stop Loss: 0.71560

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

EUR/AUD Thinking Of Going Up , Let`s Get This 150 Pips !Here Is My 2H EUR/AUD Chart and here is my opinion , if you take a look on the chart we will see that we have a start for up trendline and we have 2 bounces from the trendline and now we are waiting for third touch to can enter a buy trade to go up at least for 150 pips cuz the price melted to downside without any correction , so i`m waiting the price to go down a little and touch my trendline and give me any bullish price action on smaller time frames to confirm my entry and give me a good chance to use small stop loss and we can targeting from 70 to 150 pips in this trade , if we have a 4H Closure Below This Support m than this idea will not be valid anymore .

Reasons To Enter :

1- Perfect Support .

2- Perfect 2 Touches For Trendline .

3- Over Sold .

4- 15 / 30 Mins T.F , Confirmations .

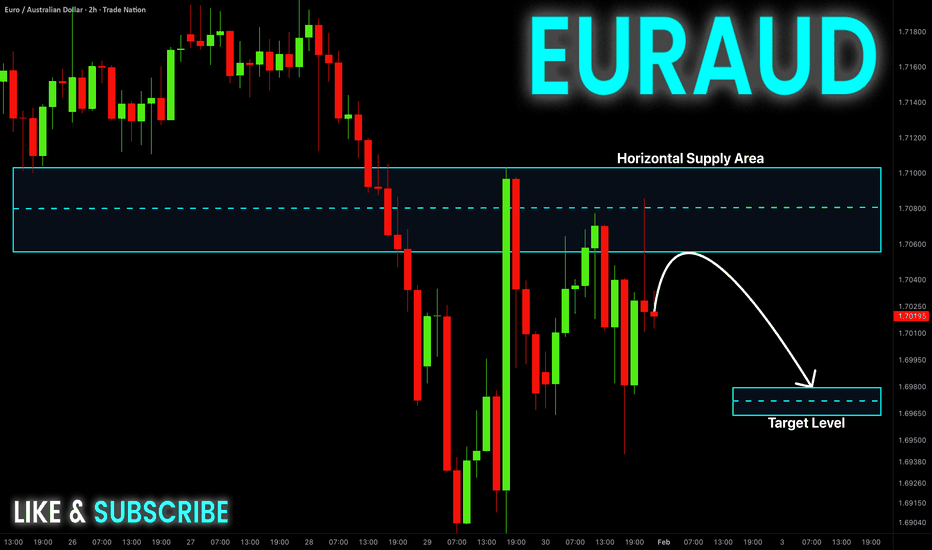

EUR-AUD Local Short! Sell!

Hello,Traders!

EURAUD taps a well-defined supply zone after a corrective bounce. Weak follow-through and bearish order flow suggest distribution, with liquidity resting below recent lows. Time Frame 2H.

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURAUD BEARISH BIAS|SHORT|

✅EURAUD trades into a premium supply zone after a corrective pullback. Bearish displacement hints at smart money distribution, with downside liquidity resting below recent lows. Expect continuation lower. Time Frame 3H.

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

EURAUD Is Very Bearish! Sell!

Take a look at our analysis for EURAUD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 1.701.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 1.694 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

EURAUD: Retail Is 83% LONG… Next Leg Could Still Be DownLooking at EURAUD on the daily timeframe, my bias remains bearish. The structure is clear: lower highs, lower lows, strong downside impulses, and weak pullbacks. Price is currently around 1.70, a key decision area where the market could either build a technical retracement or continue directly toward lower demand zones.

Retail sentiment shows around 83% of traders are long on EURAUD. I read this from a contrarian perspective, especially in a trending market. When positioning is heavily skewed against the main direction, it often acts as fuel for continuation rather than reversal.

From the COT perspective, speculators remain strongly net long on the euro, while AUD positioning is lighter. To me, this suggests possible crowding on the euro side, where profit-taking could add further downside pressure on the pair. Even if the euro positioning is technically positive, price action does not currently support a bullish EURAUD scenario.

Seasonality also aligns with this view, as January has historically not been particularly supportive for the euro, while AUD performance tends to be more mixed. It’s not a standalone signal, but it doesn’t contradict the bearish structure.

Technically, I’m watching the 1.724–1.732 resistance zone as the first potential reaction area on a pullback. Higher up, the 1.75–1.79 supply cluster would be a premium area to look for weakness. On the downside, my key references remain 1.69, then 1.67–1.68 demand, and in extension 1.64–1.65.

As long as price respects the bearish daily structure, I view retracements as opportunities, not reversals. This bias would only shift if the market reclaims and holds above 1.73, and especially above 1.75, where the structure would begin to change.

EURUSD: wedge breakout to 1.21🛠 Technical Analysis: On the H4 timeframe, EURUSD is still trending higher inside a clear ascending channel after the local/global bullish signals near the mid-support base. Price is now compressing in a short-term wedge (lower highs vs. rising structure), which often precedes an expansion move in the direction of the broader trend. The current pullback is holding above key dynamic supports, with price staying above the SMA 50/100/200 cluster — keeping the bullish bias intact. A confirmed break above the wedge’s upper boundary should trigger continuation toward the next upside objective marked near 1.21. A sustained breakdown below the wedge/structure would invalidate the breakout idea and shift focus back to the lower support zones.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: 1.19570

🎯 Take Profit: 1.20943

🔴 Stop Loss: 1.18659

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

EURAUD: Bearish Trend Continuation 🇪🇺🇦🇺

EURAUD will likely continue falling after completing

a correctional movement.

The next major historic support is 1.682.

Look for selling, expecting a bearish continuation to that level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/AUD Market Analysis: Macro + Structure [MaB]1. The Macro Context (The "Why") 🌍

Hi traders! Before looking at the candles, let's look at the money.

My fundamental scoring table speaks clearly: there is a huge differential that we cannot ignore.

Key Factor Analysis:

🏦 Rate Expectations: Explanation: The BCE remains neutral at 2.15%, holding for two consecutive meetings, while the RBA maintains a higher rate of 3.6% with a neutral but relatively hawkish stance. Score EUR: 0 Score AUD: +1

+4

🎈 Inflation: Explanation: Eurozone inflation is at 1.9%, below the 2% target, creating dovish pressure. Conversely, Australian inflation is high at 3.8%, well above target, maintaining hawkish pressure. Score EUR: -1 Score AUD: +1

+2

📈 Growth/GDP: Explanation: The Eurozone faces concerning stagnation with growth at 0.7%. Australia shows more solid growth at 2.3%, though high inflation makes it sensitive. Score EUR: -1 Score AUD: 0

+2

🏭 PMI Data: Explanation: EUR PMI is mixed (Manufacturing 49.4, Services 51.9). AUD Services PMI saw a significant acceleration (+4.9 to 56.0), indicating strong expansion. Score EUR: 0 Score AUD: 0

+4

⚖️ Risk Sentiment: Explanation: EUR is acting as semi-cyclical and neutral, while AUD remains cyclical but currently in a neutral regime with no specific bias. Score EUR: 0 Score AUD: 0

+2

🗞️ News Catalyst: Explanation: No significant fiscal crisis news for either region; focus remains on the divergent inflation paths and PMI momentum. Score EUR: 0 Score AUD: 0

+1

Currency Score Summary:

Total Score EUR: -1 (Weak) Total Score AUD: +3 (Strong)

+2

Synthesis:

EUR (Weak, Score -1): Stagnant growth and below-target inflation are weighing on the Euro. AUD (Strong, Score +3): Higher interest rates and accelerating services PMI make the Aussie the clear favorite.

Conclusion: With this scenario, we are only looking for Short setups. Going against this bias would be statistical suicide.

+3

2. The Technical Setup (The "Where") 📉

Timeframe: 4H | Pair: EUR/AUD

The SMC Market Structure + Price Zones indicator gave us the confirmation we needed for our statistical edge. Here is where the indicator makes the difference. Look at the dashboard on the right, numbers don't lie:

🚀 Continuation Rate (66.7%): We are well above the 60% threshold. This tells us the market is in a healthy, directional trend. Statistically, betting on continuation pays off more than looking for a reversal.

🔥 Streak (4) & Streak Pct (3): We are at the 4th consecutive impulse. It's a mature trend, sitting in the 3rd percentile of extension—watch those stop losses, but as long as the music plays, we dance.

🔄 Retest (79.8%): The indicator tells us that statistically, when price creates a new Break of Structure (BOS), it retraces into the previous zone 79.8% of the time. This gives us high confidence that our entry zone will be reached.

💥 BOS/Ret Rate (57.8%): This parameter tells us that once price retraces inside the previous zone, it has a 57.8% probability of reacting and creating a new BOS.

🎯 Extension Rate (1.66x): The algorithm projects an ambitious target. We expect this move to extend 1.66 times the current pullback leg. That's where we'll take profit.

3. Execution Plan on Chart

Moving to the chart, the SMC Market Structure + Price Zones indicator supports us in pinpointing liquidity to define entry and stop loss:

Entry and Stop Loss: We place a limit entry in the Supply Zone 4H (Red Band) at 1.71276 and the stop loss a few pips above the zone at 1.71846.

Take Profit: We leverage the asset's statistical analysis offered by the Extension Rate and place the target by measuring with Fibonacci at 1.6x relative to the pullback leg.

Trade Parameters: Entry Price: 1.71276 Stop Loss: 1.71846 Take Profit: 1.67569

⚠️ Disclaimer: This analysis is based on a proprietary algorithm and is shared exclusively for educational and didactic purposes. It does not constitute financial advice or investment solicitation in any way. Trading involves significant risk.

EUR/AUD LONG FROM SUPPORT

Hello, Friends!

We are going long on the EUR/AUD with the target of 1.718 level, because the pair is oversold and will soon hit the support line below. We deduced the oversold condition from the price being near to the lower BB band. However, we should use low risk here because the 1W TF is red and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURAUD downtrend consolidation resistance at 1.7380The EURAUD currency pair continues to display a bearish outlook, in line with the prevailing downward trend. Recent price action suggests an oversold bounce back, potentially setting up for a spike higher and a retest of the resistance zone ahead of another move lower if resistance holds.

Key Level: 1.7380

This zone, previously a consolidation area, now acts as a significant resistance level.

Bearish Scenario (rejection at 1.7380):

A failed test and rejection at 1.7380 would likely resume the bearish momentum.

Downside targets include:

1.7090 – Initial support

1.7050 – Intermediate support

1.7010 – Longer-term support level

Bullish Scenario (breakout above 1.7380):

A confirmed breakout and daily close above 1.7380 would invalidate the bearish setup.

In that case, potential upside resistance levels are:

1.7460 – First resistance

1.7510 – Further upside target

Conclusion

EURAUD remains under bearish pressure, with the 1.7380 level acting as a key inflection point. As long as price remains below this level, the bias favours further downside. Traders should watch for price confirmation around that level to assess the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Stop!Loss|Market View: EURUSD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the EURUSD currency pair☝️

Potential trade setup:

🔔Entry level: 1.19043

💰TP: 1.19701

⛔️SL: 1.18587

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: The US dollar remains under pressure early this week, and this trend is likely to continue until at least mid-week. Against this backdrop, euro buyers are effectively pushing toward resistance at 1.18960, which will likely lead to an upward breakout toward 1.19 and 1.2. A buy entry is being considered through a breakout.

Thanks for your support 🚀

Profits for all ✅

EURAUD H4 | Heading Towards 61.8% Fib ResistanceBased on H4 chart analysis, we could see the price rise to our sell entry level at 1.7315, which is a pullback resistance that aligns with the 61.8% Fibonaci retracement.

Our stop loss is set at 1.7481, which is an overlap resistance that is slightly above the 50% Fibonacci retracement.

Our take profit is set at 1.7102, which is a pullback support.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLChttps://fxcm.com/en: Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

EURAUD LONGBeautiful zone by EURAUD and I'm long from this level here, it miiight go a little lower, but i think i have covered the zone with this SL 😉

⚠️ Disclaimer ⚠️

🛑The ideas I post here are just my vision of the market and not a signal, financial advice or something.

👁️Unfortunately I don't have enough time in front of the the computer to update or post every idea or trade management I do.

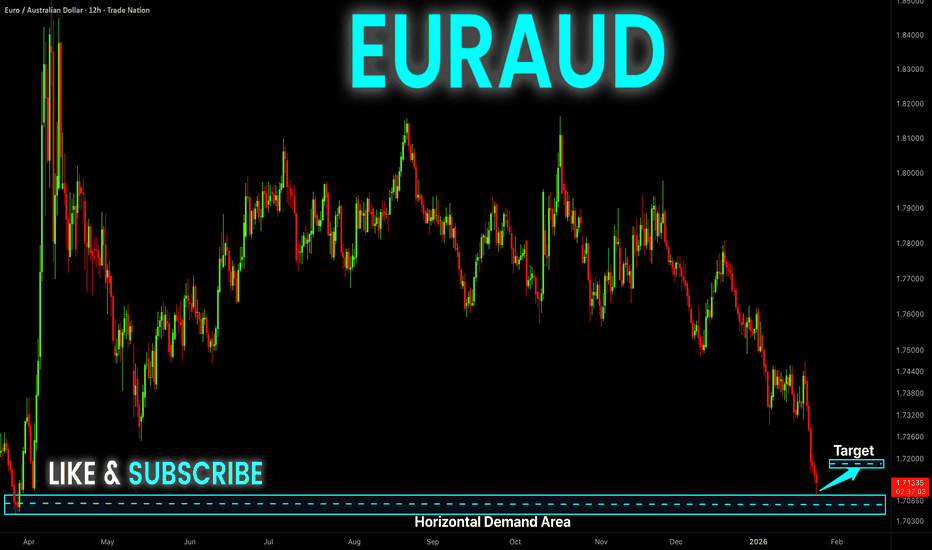

EUR-AUD Swing Long! Buy!

Hello,Traders!

EURAUD taps a higher-timeframe demand after extended sell-side expansion. Liquidity appears absorbed, with slowing bearish momentum hinting at a corrective bounce from discount toward nearby imbalance. Time Frame 12H.

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.