EUR/USD Weekly: Structural Shift; Long-Term Bearish TrendSummary:

OANDA:EURUSD EUR/USD has transitioned from a bullish to a bearish structure on the weekly timeframe, indicating a potential long-term reversal. Over the past 168 days, price action confirmed a market structure shift after breaking the swing low established during the week of June 30, 2025. This breach marked the beginning of a bearish phase.

Key Technical Observations:

Bearish Pin Bar Confirmation:

During the week of September 15, 2025, a textbook bearish pin bar formed, invalidating prior buying orders and reinforcing bearish sentiment.

Resistance Zone & Accumulation Phases:

Strong resistance persists between 1.17774 – 1.18299, acting as the primary accumulation zone following the initial phase from July 28 to September 29, 2025. Current price action suggests we are in Phase Two of the buying climax, targeting this resistance before a potential rollover.

Lower Highs & Lower Lows:

The market continues to print lower highs and lower lows. The bearish mother bar from July 28, 2025 remains dominant, with multiple inside bars failing to break its high—evidence of sustained bearish pressure.

Liquidity & Institutional Activity:

The 1.1299 level is a critical liquidity pool and may see a third test. Volume Price Analysis indicates repeated invalid buying attempts on up legs, likely driven by institutional positioning to absorb retail buy-side liquidity. Recent upticks appear to be profit-taking and repositioning rather than genuine bullish momentum.

Outlook:

Expect EUR/USD to remain under bearish pressure, with a potential rollover during the first 5–7 months of 2026. Unless the key resistance zone is decisively breached, the structural bias favors sellers.

Charting

Primary Trend: Bearish

Key Resistance: 1.17774 – 1.18299

Critical Support / Liquidity Zone: 1.13900

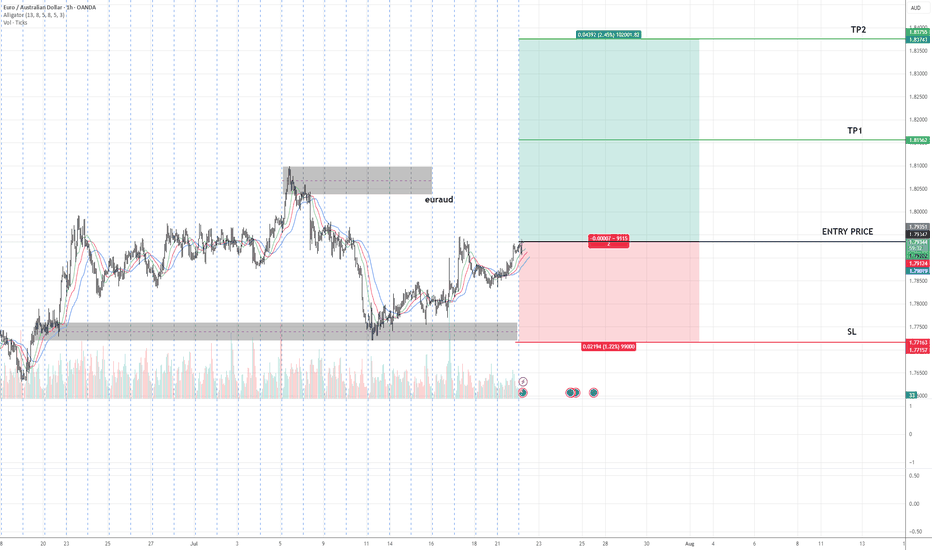

Euraudforecast

Is EUR/AUD Entering a Short-Term Distribution Phase?🔻 EUR/AUD Bearish Pressure Building — Can Sellers Control the Zone?

📌 Asset

EUR/AUD — EURO vs AUSSIE DOLLAR

📊 FOREX Market | Profit Pathway Setup (Day Trade)

🧭 Market Plan

🔴 Primary Bias: BEARISH

📉 Sellers remain in control as price trades below key equilibrium zones.

🎯 Entry Strategy

📍 Entry: Any price level

⚙️ Flexible execution — suitable for scalp / intraday structure followers

⏳ Wait for confirmation on lower timeframes if required.

🛑 Risk Management

🚫 Stop Loss: 1.77000

⚠️ Dear Ladies & Gentlemen (Thief OG’s)

Adjust your SL based on your own strategy & risk management rules.

This SL is not mandatory — protect capital first.

🎯 Profit Objective

🎯 Target: 1.75000

🧠 Why this level?

✔️ Strong historical support

✔️ Oversold reaction zone

✔️ Liquidity trap probability

✔️ Correlation support from related AUD & EUR flows

⚠️ Dear Ladies & Gentlemen (Thief OG’s)

This TP is not a recommendation — manage profits according to your own plan.

🔗 Related Pairs to Watch (Correlation Guide)

💱 EUR/USD

• Weak EUR momentum = added downside pressure on EUR/AUD

• Watch USD strength → indirect EUR weakness signal

💱 AUD/USD

• AUD strength supports further EUR/AUD downside

• Risk-on sentiment favors AUD over EUR

💱 EUR/JPY

• EUR risk exposure gauge

• Continued selling = confirms EUR-side weakness

💱 AUD/JPY

• Risk appetite proxy

• Strength here supports AUD demand across the board

➡️ Key Idea:

📉 EUR weakness + AUD resilience = bearish continuation bias on EUR/AUD

🌍 Fundamental & Economic Factors to Consider

🇪🇺 Euro Side (EUR)

• Slower Eurozone growth outlook

• Inflation cooling keeps policy expectations capped

• EUR remains sensitive to risk-off flows

🇦🇺 Australian Dollar Side (AUD)

• Commodity-linked strength supports AUD

• China demand expectations directly impact AUD sentiment

• Risk-on environments favor AUD inflows

🗓 Upcoming Focus (High Impact)

⏰ Eurozone inflation & PMI data

⏰ Australia employment & inflation updates

⏰ Global risk sentiment (equities, commodities)

📌 Volatility may expand around data releases — manage exposure accordingly.

🧠 Technical + Flow Summary

✔️ Bearish structure intact

✔️ Sellers defending higher levels

✔️ Downside liquidity resting near 1.75000

✔️ Correlation alignment favors shorts

💬 Final Note

📌 This idea is for educational & market-structure insight only.

💼 Always trade with proper risk management.

👍 Like | 💬 Comment | ⭐ Save

Let the chart do the talking.

EUR/AUD – Doji Signal Suggests Bullish Reversal PotentialEUR/AUD – Doji Signal Suggests Bullish Reversal Potential (65% Probability)

(autosignalfx.com - visit and generate unlimited trading signals)

A new BUY signal has been identified on EUR/AUD, driven by the appearance of a Doji candlestick pattern on the current timeframe.

This setup carries a 65% historical backtest probability, indicating a moderately strong bullish continuation scenario within the prevailing trend.

🔍 Technical Analysis

The Doji formation is a key sign of market indecision, often appearing after extended corrective moves. In bullish contexts—such as the current EUR/AUD structure—a Doji often acts as a reversal or continuation trigger, signaling a likely return of buyers.

Key observations:

Price has stabilized after a controlled pullback

Doji indicates seller exhaustion and potential demand re-entry

The pair continues to trade within a broader bullish trend structure

Trend-following model signals confirm the upside bias

This combination strengthens the case for upward continuation.

🌍 Market Context

Fundamental conditions also support a bullish outlook:

Eurozone economic sentiment remains resilient relative to AUD

Interest rate differentials favor EUR in certain time horizons

AUD softness continues due to commodity demand fluctuations and global risk dynamics

Market sentiment shows increasing preference for EUR cross stability

In short, the macro backdrop aligns with the technical signal, providing additional support for bullish positions.

📌 Key Technical Levels

Immediate Resistance – 1.78703

Short-term barrier; clearing this opens the way for bullish momentum extension.

Immediate Support – 1.77633

This level sits just below the Doji formation and provides structural protection for bulls.

Major Resistance – 1.79950

A strong overhead level and the next meaningful upside target.

Major Support – 1.76386

Critical structural floor; a break below would invalidate medium-term bullish bias.

🎯 Trade Setup (0.10 Lot Example)

Parameter Level

Entry 1.78168

Stop Loss (SL) 1.77968

Take Profit (TP) 1.78568

Risk $50

Potential Profit $100

Risk–Reward Ratio 1 : 2

The setup offers a clean, tightly controlled bullish opportunity with favorable R:R.

🛡 Risk Management Guidance

Keep risk disciplined and structured:

Limit exposure to 1–2% of total account capital

Add positions only on retests or additional confirmation candles

Move SL to break-even once price clears 1.78703

Partial profit-taking can be considered before major resistance at 1.79950

Avoid entering close to high-impact EUR or AUD economic releases

A Doji-based setup requires confirmation and disciplined management.

📌 Final Thoughts

EUR/AUD is displaying a promising bullish continuation scenario, supported by a Doji reversal signal, trend alignment, and supportive macro conditions.

A push above 1.78703 could activate stronger bullish momentum toward 1.79950, while strict SL discipline at 1.77968 helps maintain controlled risk.

This setup fits well for traders seeking a structured, technically supported bullish entry within a trending environment.

EURAUD Regains Momentum as Aussie Struggles with China DemandEURAUD is bouncing back from its recent lows as the euro finds renewed footing amid stabilizing European data, while the Australian dollar continues to face headwinds from China’s sluggish demand and a cautious RBA. The pair has regained short-term traction, but a retest of support before a continuation higher remains a likely technical scenario.

Current Bias

Bullish, with potential for a near-term pullback toward support before resuming higher toward 1.7930 and 1.8160.

Key Fundamental Drivers

Eurozone: Inflation has cooled, but the ECB maintains a restrictive stance for longer, citing a slow disinflation path. Recent data suggest stabilization in manufacturing, keeping EUR sentiment supported.

Australia: The RBA remains cautious, citing mixed employment and slowing household spending. China’s uneven recovery and weaker commodity demand continue to weigh on the AUD.

Yield Differential: Slightly favors the euro as ECB holds higher rates for longer compared to the RBA’s neutral bias.

Macro Context

The broader macro backdrop supports moderate EUR strength against AUD. Europe’s soft landing narrative contrasts with Australia’s export dependence on China, where growth momentum remains weak. Commodity flows, particularly iron ore and LNG, are subdued, limiting AUD upside. Meanwhile, geopolitical stability in Europe provides relative support to the euro, especially as global risk sentiment fluctuates.

Interest rate expectations:

ECB: Expected to hold rates into Q2 2026, with cuts only if inflation undershoots the 2% target.

RBA: Markets lean toward potential easing mid-2026 if consumption weakens further.

Growth trends remain in Europe’s favor relative to expectations, while Australia’s domestic softness and high mortgage costs curb expansion.

Primary Risk to the Trend

A stronger-than-expected rebound in China’s industrial output or commodity prices could lift AUD sharply, forcing EURAUD lower. Conversely, an ECB dovish pivot or renewed eurozone fiscal stress could undermine euro resilience.

Most Critical Upcoming News/Event

RBA Statement and Governor Bullock speech (for forward guidance on rates)

Eurozone Q3 GDP revision and inflation expectations data

China trade and inflation prints (key sentiment driver for AUD)

Leader/Lagger Dynamics

EURAUD acts as a lagger to EURUSD direction but leads cross pairs like EURNZD and GBPAUD due to its balance between growth sensitivity and yield divergence. It also mirrors shifts in commodity-linked risk sentiment while tracking China’s macro outlook indirectly.

Key Levels

Support Levels: 1.7750 / 1.7560

Resistance Levels: 1.7930 / 1.8160

Stop Loss (SL): 1.7520

Take Profit (TP): 1.7930 (partial), 1.8160 (extended)

Summary: Bias and Watchpoints

EURAUD’s current structure supports a bullish bias, reinforced by Europe’s relative policy stability and Australia’s commodity-linked weakness. A short-term dip toward 1.7750 could offer renewed buying interest, targeting 1.7930 and 1.8160 while keeping SL at 1.7520 to protect against a deeper retracement. The main watchpoints ahead are RBA communication and China’s macro data — both potential catalysts that could challenge euro gains. For now, the bias remains constructive while fundamentals and yield spreads lean in favor of EUR strength.

EUR/AUD Poised for 4H Bullish Run - Join Now!💰 EUR/AUD: The Epic Aussie Loot Grab — Bullish Breakout Bonanza! 🎉

Asset: EUR/AUD (Euro vs. Aussie Dollar)

Strategy: Market Wealth Strategy Map (Swing/Day Trade)Vibe: Pirate-Style Plunder with a Cheeky Grin 😎

🏴☠️ The Plot: Raiding the Market’s Treasure Chest!

Ahoy, Plunder Pirates! The EUR/AUD is primed for a bullish breakout on the 4-hour chart. The candles are slicing through the Triangular Moving Average (TMA) dynamic resistance like a cutlass, and the Bull Buccaneers are sailing from the accumulation zone to uncharted highs. Time to nab some pips! 💸

💎 Key Technicals:

💎 Breakout Signal: Price surges past the TMA dynamic resistance on the 4H chart, hoisting the bullish flag.

💎 Accumulation Zone: Bulls have been stashing their loot in the lower range, ready to storm higher.

💎 Market Waves: Overbought waters and strong resistance lie ahead, so chart your escape route wisely!

⚔️ The Plunder Plan: Pirate-Style Entry Tactics

Here’s how to raid the market with multiple limit orders (layered boarding strategy):

💎 Entry Point:

⚓ Primary Entry: Post-breakout above 1.79000 (or any price level after the signal).

🗝️ Layered Limit Orders: Set buy limit orders at 1.78000, 1.78500, and 1.79000 for a cunning, multi-level boarding.

Captain’s Tip: Add more layers to suit your risk, but don’t dive in without a map!

💎 Stop Loss (SL):

🚩 Pirate SL at 1.77200.

Note: Ahoy, Plunder Pirates! This SL is my compass, but it’s your ship! Set your stop loss based on your risk tolerance. Sail at your own peril!

💎 Take Profit (TP):

🎯 Target: 1.81500, where the navy (strong resistance + overbought conditions) might spring a trap. Grab your loot and sail away!

Note: This TP is my call, but you’re the captain. Secure your treasure at your discretion! 💰

👀 Related Pairs to Watch (Correlations & Tides)

Keep your spyglass on these correlated pairs to navigate the seas:

💎 FX:EURUSD : The Euro’s strength against the USD often steers EUR/AUD. A bullish EUR/USD could fuel our breakout. Watch for USD storms!

💎 OANDA:AUDUSD : The Aussie Dollar’s dance with the USD can sway EUR/AUD’s winds. A weakening AUD strengthens our bullish voyage.

💎 FX:USDJPY : A risk-on pair that signals market currents. A rising USD/JPY may sink AUD, boosting EUR/AUD’s sails.

Why $ Matters: The USD’s strength or weakness shifts the tides across these pairs. A weaker USD (e.g., from dovish Fed signals) could propel EUR/AUD’s bullish winds. Stay sharp, pirates! 🏴☠️

⚠️ TradingView House Rules Compliance

This Pirate-Style Plunder is crafted for fun and education, following TradingView’s code:

💎 No promises of treasure — trading is a stormy sea, and you’re at the helm.

💎 All levels (entry, SL, TP) are suggestions, not orders from the captain.

💎 Sail smart and manage your risk like a seasoned pirate!

✨ Footer

“If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

Disclaimer: This is a Pirate-Style Trading Strategy just for fun. Trading involves risks, and past performance is not a crystal ball for future results. Always chart your own course and trade at your own risk.

#EURAUD #ForexTrading #SwingTrading #DayTrading #BullishBreakout #PirateStrategy #TechnicalAnalysis #ForexPlunder

#EURAUD:2200+ Pips Major Swing Buy In Making | Swing Trading |EURAUD is currently in distribution phase. Given recent price behaviour, a significant selling volume is forming and the price could reach our target area by the end of the month or the end of the next week. Three targets have been identified and can be set according to your own plans and risk management.

Best wishes and safe trading.

Team Setupsfx

#EURAUD: Big +1200 PIPS Swing Buy In Making! Comment Your Views!

OANDA:EURAUD

The EURAUD price is currently accumulating and on the verge of distribution. We recommend waiting for the price to break through the trading trend line before considering a buy entry. Our target is 1.90, a significant move that will take time to reach. We suggest conducting your own research and wish you the best in your trading endeavours.

**Trading Entries**

- **First Entry:** At the retest following the breakout of the bearish trendline.

- **Second Entry:** To fill the liquidity gap.

We would appreciate your support by liking and commenting on our ideas. This will encourage us to provide further educational content.

#forex #swingtrading #euraud

Team Setupsfx

#EURAUD: Two Swing Bullish Entry Worth Thousands Pips! EURAUD is currently at a critical level, and the price isn’t yet decided for the next move. However, the current price behaviour suggests strong bullish volume presence in the market. There are two areas to buy from. The first is activated, and we think price could just be starting the next bull run from this point. The second entry is a safe point if price does decide to drop further and fill up the daily Fair Value Gap.

We wish you the best in trading.

If you want to support us, you can do the following:

- Like the idea

- Comment on the idea

- Share the idea

If you have any questions or concerns about the analysis or trading in general, please let us know in the comment box.

Team Setupsfx_

❤️🚀

EURAUD - Short Term Sell IdeaM15 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

EURAUD possible tripple bottom and bullish for 1.7755#EURAUD broker previous two trendline support levels i.e. 1.7674 & 1.7635. Price may test previous demand zone level i.e. 1.7530-7467. split your risk into two trading position as 0.5% risk from the top of the demand zone 17530, use remaining 0.5% risk from the bottom of the demand zone 1.7467. stop loss below the daily demand level i.e. 1.7440, target: 1.7755.

Grab Pips Fast! EUR/AUD Thief Strategy Unleashed🔥 Thief Trader Heist Plan: EUR/AUD (Euro vs. Aussie) Swing/Scalping Trade 🚨💰

🌟 Yo, Thief OG's, Money Makers, and Market Robbers! 🌟

Get ready to pull off a slick heist on the EUR/AUD Forex Market with our Thief Trading Style! 🤑💸 This is a Bullish plan, so buckle up and let’s steal some pips! 🎯🚀

📈 Heist Plan: Bullish EUR/AUD

Asset: EUR/AUD (Euro vs. Aussie) 💶🇦🇺

Strategy: Thief Layering Method (Multiple Limit Orders) 🕵️♂️

Objective: Snag profits before the market fights back at the high-voltage resistance zone! ⚡️

🔔 Entry: The Heist Begins!

Thief Layering Strategy: Deploy multiple buy limit orders at key levels to stack your entries like a pro! 🏦

🎯 1.80500

🎯 1.80300

🎯 1.80000

🎯 1.79800

💡 Pro Tip: Add more layers based on your risk appetite and market conditions!

Alternative Entry: If you’re feeling bold, enter at any price level using the Thief Layering Style for maximum flexibility! 🦹♂️

Setup: Set an alert on your chart to catch the perfect entry moment. Don’t sleep on this! ⏰

🛑 Stop Loss: Protect Your Loot!

Thief SL: Set at 1.79000 to keep your heist safe. 🛡️

OG Advice: Adjust your SL based on your risk tolerance, lot size, and layering strategy. This is your heist, so own it! 💪

Warning: Don’t place SL too tight—give the market some room to breathe, or you’ll get caught! ⚠️

🎯 Target: Cash Out Like a Boss!

Profit Zone: Aim for 1.82500 to lock in those gains. 💵

Danger Zone: Watch out for the high-voltage electric resistance and overbought zone around 1.83000. Escape with your stolen pips before the market flips! 🚨

Escape Plan: Take profits early if you sense resistance kicking in. Don’t get greedy, thieves! 🏃♂️💨

📰 Market Intel: Why Bullish?

Fundamentals: Check COT reports, macro data, and sentiment analysis for EUR/AUD. The bullish vibe is backed by solid market signals. 📊

Intermarket Analysis: Euro strength vs. Aussie weakness is setting the stage for this move. Stay sharp! 🧠

Volatility Alert: Avoid trading during major news releases to protect your positions. Use trailing stops to lock in profits. 🚫🗞️

💥 Boost the Heist!

Hit that Boost Button to supercharge our Thief Trading Crew! 🚀

Share this plan with your fellow robbers to make the market tremble! 🤝💪

Stay tuned for the next heist plan, and let’s keep stealing pips with style! 🤑🐱👤🎉

EUR/AUD – Elliott Wave Setup Push to 1.819?FX:EURAUD is gearing up for a bullish move on the 4-hour chart, with an entry zone in the red box between 1.791-1.80 near a key support level. The target at 1.819 aligns with the next resistance, offering a solid upside potential. Set a stop loss on a 4hours close below 1.79 to manage risk effectively. This setup is enhanced by Elliott Wave analysis on the EUR/AUD 4H chart, we can clearly spot a classic Elliott Wave structure (1 to 5) in play.

🔹 Price is now in corrective wave (4), approaching the key support zone (1.791 – 1.800) . From here, we may see the beginning of wave (5) bullish leg targeting new highs.

✅ Entry: 1.791 – 1.800 (red support box)

❌ Stop Loss: Candle close below 1.790

🎯 Target: 1.819 (potential wave (5) top)

📈 If this Elliott Wave count plays out, the next bullish impulse could be strong.

👉 Do you think wave (5) can extend beyond 1.819? Share your thoughts below!

Your comments and support keep me motivated to share more setups 🙏🔥

#EURAUD #Forex #Trading #ElliottWave #TechnicalAnalysis #ForexSetup #PriceAction #ForexSignals #SwingTrading #ForexCommunity #TradingView

EURAUD ON THE WAY TO FILL FVG ? - {12/08/2025}Educational Analysis says that EURAUD (FX Pair) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - FXCM

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Stock brings to the table for us in the future.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFITS OR LOSS,

Happy Trading,

FX Pairs & Crypto Curreny Trade Analysis.

My Analysis is:-

Short term trend may be go to the external demand zone.

Long term trend breaks the new high after going from discount zone.

Short trade idea analysis (Education Purpose)

Confirmation - InternalCHOch

Market Order @$1.78755

Stop loss @1.78957

Take profit @1.69231

Please check the comment section to see how this turned out.

euraud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

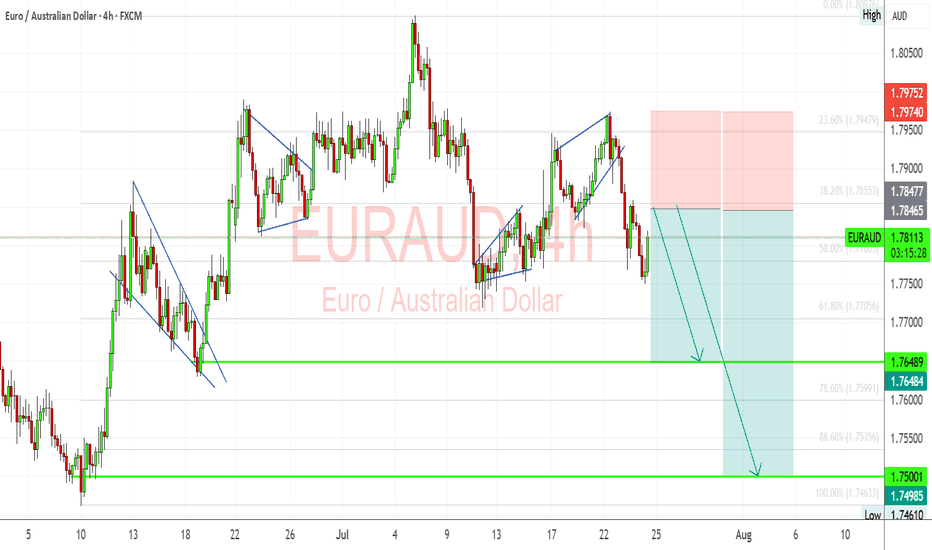

EURAUD Breakdown: Bearish Continuation Ahead of ECBEURAUD is showing signs of renewed downside pressure as fundamental and technical forces align in favor of Australian dollar strength. With the European Central Bank expected to hold rates steady and provide a cautious growth outlook, the euro remains vulnerable. Meanwhile, upside surprises in Australian inflation and supportive commodity dynamics continue to boost AUD sentiment. Technically, the pair has broken down from a rising wedge, confirming bearish momentum and setting the stage for further declines toward key support near 1.7648 and potentially 1.7500.

🟢 Current Bias: Bearish

🔑 Key Fundamentals:

ECB: Markets expect the ECB to hold rates steady this week. While this ends a 7-year streak of cuts, the bank has turned cautiously neutral, with no clear signal of future tightening. Core inflation remains subdued, and growth momentum across Germany and the euro area is weak.

RBA & Australia: The RBA faces persistent inflation risks after the June CPI surprised to the upside, putting rate hikes back on the table. The Aussie dollar is drawing strength from this, especially with rising commodity prices and China's potential fiscal stimulus aiding demand-side confidence.

Macro Divergence: Australia’s macro picture is improving vs. the eurozone. AUD has tailwinds; EUR is under pressure from stagnant growth and tepid inflation outlook.

⚠️ Risks to Bias:

ECB Surprise: A sudden hawkish tone from the ECB (e.g., lifting forecasts or emphasizing wage-driven inflation risk) could spark short-term EUR upside.

RBA Softness: A dovish RBA pivot or weak Aussie data could weaken AUD strength and slow EURAUD downside.

Geopolitical Risk: Broader global volatility (e.g., US-China, oil disruptions) could cause flows into euro as a semi-safe haven.

📅 Key News/Events to Watch:

ECB Rate Decision & Press Conference – July 25

Eurozone Flash GDP + CPI – Next week

China industrial data (AUD-sensitive)

RBA August Meeting Statement (early Aug)

📉 Technical Breakdown (4H Chart):

Price broke bearish from a wedge consolidation.

Minor bullish pullbacks are being sold into, confirming a distribution phase.

Targets:

1st Target: 1.76480 (support & fib confluence)

2nd Target: 1.7500–1.7460 zone (major swing low)

Resistance: 1.7855–1.7975 zone is key invalidation area.

Structure favors lower highs & continuation patterns until support zones break.

🧭 Leader/Lagger Behavior:

AUD is leading the move. Strong CPI and China demand backdrop are fueling bullish AUD momentum.

EUR is lagging, tracking broader USD risk tone and internal Eurozone data weakness.

EURAUD is currently reactive to external forces rather than setting direction for other pairs.

✅ Summary: Bias and Watchpoints

Bias: Bearish

Fundamentals: Weak Eurozone growth vs. hotter Aussie inflation and hawkish RBA tone.

Risk: ECB hawkish tilt or a dovish shift from the RBA.

Event to Watch: ECB press conference and Aussie CPI commentary from policymakers.

Leader/Lagger: Lagger — following AUD strength rather than leading.

EURAUD – Planning Ahead, Not PredictingAs usual, I have marked my level.

🎯 I’m waiting for the price to reach it and if a valid sell signal appears, I will enter a short position.

If the level is broken cleanly,

I’ll wait for a pullback and enter a buy trade.

We are just traders, not predictors.

We have no impact on the market —

we are just a tiny part of a huge system.

🧠 So I never say: “Price will come here, then must fall.”

That’s not my mindset.

My belief is simple:

Manage risk, be prepared for everything.

One trade won’t make me rich,

and I won’t let one trade destroy me.

📌 Stop-loss is the first and last rule.

Trading without a stop-loss is just gambling.

EURAUD Buy Setup – Advanced Analysis Entry: As marked on chart

🎯 TP1: As highlighted on chart

🎯 TP2: As highlighted on chart

🛑 SL: As defined on chart

📊 Technical Insight:

Price has completed a higher low formation, indicating the potential start of a new uptrend phase.

The market has shown an accumulation phase followed by a breakout above minor resistance, suggesting strong demand at current levels.

Volume analysis supports the breakout, with increased participation on bullish pushes and decreasing volume on retracements, confirming healthy trend dynamics.

📍 As long as price holds above the stop loss zone, we expect continuation towards TP1 and TP2 in line with the primary trend.