EURAUD Sitting on Major Demand: Base FormingEURAUD has been in a steady grind lower, and now it’s parked right on a higher-timeframe demand zone after a series of sharp impulsive drops and weak corrective bounces. This is the kind of location where reversals can start — but only if structure actually shifts. Right now, I see pressure slowing, reaction wicks, and small trendline breaks inside the zone, but not a confirmed trend reversal yet. For me, this is a reaction area first, trend change second — and confirmation matters.

Current Bias

Neutral with rebound potential

Broader structure is still bearish, but price is sitting at a well-defined support base. Bias is neutral here with scope for an upside corrective bounce — provided support holds and we get acceptance back above near resistance.

Key Fundamental Drivers

EUR side:

Eurozone inflation is cooling but not collapsing, keeping the ECB cautious rather than aggressively dovish.

ECB tone supports EUR on dips when data is not deteriorating sharply.

AUD side:

AUD is sensitive to global growth and China demand signals.

Recent activity and business indicators out of Australia have been mixed, not strongly AUD-bullish.

Relative rate expectations:

ECB and RBA policy paths are not dramatically diverging right now, which pushes this cross to be more growth and risk-flow driven.

Macro Context

Interest rate expectations:

ECB is in wait-and-assess mode on inflation. RBA is also cautious, with markets watching domestic inflation and labor closely. No extreme rate divergence — so macro data surprises matter more than policy levels.

Economic growth trends:

Eurozone growth is slow but stabilizing in pockets. Australia is highly exposed to Asia and China demand cycles. Any improvement in China data tends to favor AUD and weigh on EURAUD.

Commodity flows:

AUD is strongly tied to metals and bulk commodities. Stabilizing commodity prices tend to support AUD and cap EURAUD rallies.

Geopolitical themes:

Global trade and geopolitical tensions can hurt growth sentiment — that usually weighs more on AUD than EUR and can lift EURAUD during risk-off phases.

Primary Risk to the Trend

The main downside risk (for a bounce scenario) is a strong China or Australian data surprise that boosts AUD broadly and breaks this support zone cleanly.

The main upside risk (against the broader downtrend) is a run of weak Eurozone data that pushes ECB expectations more dovish.

Most Critical Upcoming News/Event

Australian employment and inflation data

China CPI / activity indicators

Eurozone CPI and ECB speakers

Broad global risk sentiment shifts

These are the releases most likely to break the current base.

Leader/Lagger Dynamics

EURAUD is a lagger cross.

It usually follows:

EURUSD for the EUR leg

AUDUSD and commodity sentiment for the AUD leg

It can influence:

GBPAUD and EURNZD after a move is underway.

AUDUSD and EURUSD typically move first — EURAUD adjusts after.

Key Levels

Support Levels:

1.6810–1.6760 demand zone (current base)

Break below opens continuation lower

Resistance Levels:

1.7060–1.7070 first resistance

1.7240 secondary resistance

1.7460 major resistance ceiling

Stop Loss (SL):

Below 1.6760 for bounce/reversal setups

Take Profit (TP):

TP1: 1.7060

TP2: 1.7240

TP3: 1.7460 if larger reversal develops

Summary: Bias and Watchpoints

EURAUD is sitting on a major support zone after a sustained down-move, so the immediate bias is neutral with rebound potential, even though the broader trend is still bearish. This is a location where corrective upside toward 1.7060 and possibly 1.7240 makes sense if the base holds. A clean break below the 1.6760 area invalidates the bounce idea and signals trend continuation lower. The key watchpoints are Australian and China data — if they come in strong, AUD likely leads and this floor gives way; if they disappoint, a relief rally in EURAUD becomes the higher-probability path.

Euraudshort

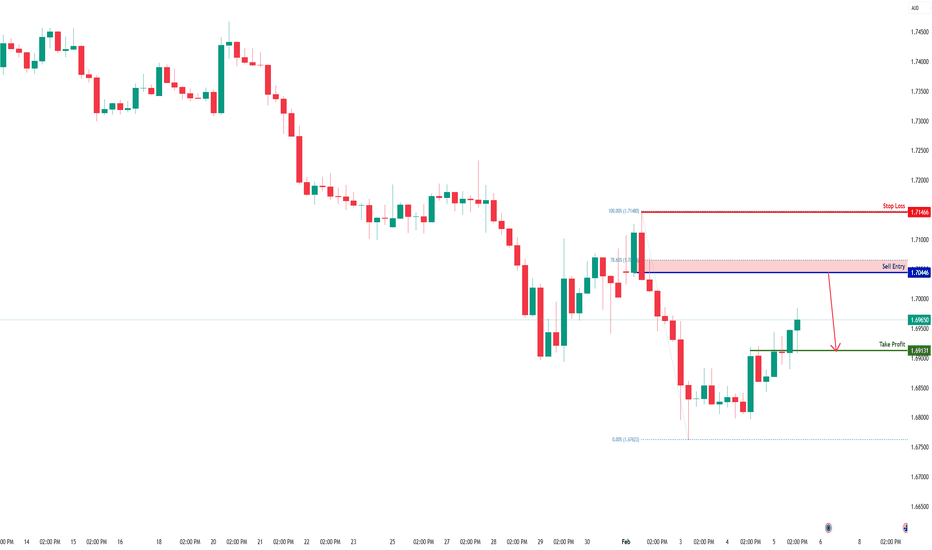

EURAUD H4 | Bearish Reaction Off Pullback ResistanceMomentum: Bearish

Price is currently below the ichimoku cloud.

Sell entry: 1.70446

- Pullback resistance

- 78.6% Fib retracement

Stop Loss: 1.71466

- Swing high resistance

Take Profit: 1.69131

- Pullback support

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

euraud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURAUD to continue in the downward move?EURAUD - 24h expiry

There is no clear indication that the downward move is coming to an end.

Although we remain bearish overall, a correction is possible without impacting the trend lower.

Short term RSI has turned negative.

Risk/Reward would be poor to call a sell from current levels.

The measured move target is 1.7400.

We look to Sell at 1.7450 (stop at 1.7500)

Our profit targets will be 1.7350 and 1.7325

Resistance: 1.7450 / 1.7500 / 1.7510

Support: 1.7400 / 1.7375 / 1.7350

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

EURAUD Gaining Momentum | Upside Targets in Sight🌅📈 EURAUD Gaining Momentum | Upside Targets in Sight 🎯

Overview:

EURAUD is showing bullish continuation strength, with price holding firmly near a key support area, favoring further upside expansion.

Buy Zone (Focus Area):

🟢 1.7400

This level is acting as a strong base where buyers are stepping in with confidence.

Upside Targets:

🎯 Target 1: 1.7450 – Initial upside reaction

🎯 Target 2: 1.7500 – Momentum continuation

🎯 Target 3: 1.7550 – Higher structure target

Why This Setup Works:

✔ Price holding above a clear support level

✔ Bullish structure remains intact

✔ Smooth upside path with well-defined targets

Trade Management Insight:

Booking partial profits at each target helps secure gains while allowing participation in extended upside movement.

Execution Guidance:

Wait for price stability or bullish confirmation near the buy level before entering. Discipline improves precision.

Final Note:

As long as price respects the base level, the probability favors continuation toward higher targets.

⸻

✨ Special Note for Serious Traders

If you value clean entries, clear targets, and professional risk control over impulsive trading, feel free to connect. I work with traders who focus on structure, patience, and consistency.

🔒 Structure first. Targets next. Consistency always.

euraud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Potential 600Pips on EURAUDWait for price to rally into the 1.7780 – 1.7805 region.

Confirmation:

A structural shift, confirmed by a break and close below 1.7690.

Possible Entries

Entry 1

Sell Limit @ 1.7885

Stop Loss @ 1.7838

Entry 2

Sell Limit @ 1.7870

Stop Loss: Refined on entry

Target Levels

T1: 1.7484

T2: 1.7330

T3: 1.7180

This move can be anticipated to develop between 19:00 UTC, 17th December 2025 and 02:00 UTC, 26th January 2026.

This setup offers a projected risk-to-reward of approximately 1:11 when executed from refined entries.

Trade Safe.

Patience is the Way!

Ieios

EURAUD to continue in the downward move?EURAUD - 24h expiry

There is no clear indication that the downward move is coming to an end.

Although we remain bearish overall, a correction is possible without impacting the trend lower.

Short term RSI has turned negative.

Risk/Reward would be poor to call a sell from current levels.

The measured move target is 1.7250.

We look to Sell at 1.7400 (stop at 1.7450)

Our profit targets will be 1.7300 and 1.7250

Resistance: 1.7400 / 1.7450 / 1.7500

Support: 1.7350 / 1.7300 / 1.7250

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Is EUR/AUD Entering a Short-Term Distribution Phase?🔻 EUR/AUD Bearish Pressure Building — Can Sellers Control the Zone?

📌 Asset

EUR/AUD — EURO vs AUSSIE DOLLAR

📊 FOREX Market | Profit Pathway Setup (Day Trade)

🧭 Market Plan

🔴 Primary Bias: BEARISH

📉 Sellers remain in control as price trades below key equilibrium zones.

🎯 Entry Strategy

📍 Entry: Any price level

⚙️ Flexible execution — suitable for scalp / intraday structure followers

⏳ Wait for confirmation on lower timeframes if required.

🛑 Risk Management

🚫 Stop Loss: 1.77000

⚠️ Dear Ladies & Gentlemen (Thief OG’s)

Adjust your SL based on your own strategy & risk management rules.

This SL is not mandatory — protect capital first.

🎯 Profit Objective

🎯 Target: 1.75000

🧠 Why this level?

✔️ Strong historical support

✔️ Oversold reaction zone

✔️ Liquidity trap probability

✔️ Correlation support from related AUD & EUR flows

⚠️ Dear Ladies & Gentlemen (Thief OG’s)

This TP is not a recommendation — manage profits according to your own plan.

🔗 Related Pairs to Watch (Correlation Guide)

💱 EUR/USD

• Weak EUR momentum = added downside pressure on EUR/AUD

• Watch USD strength → indirect EUR weakness signal

💱 AUD/USD

• AUD strength supports further EUR/AUD downside

• Risk-on sentiment favors AUD over EUR

💱 EUR/JPY

• EUR risk exposure gauge

• Continued selling = confirms EUR-side weakness

💱 AUD/JPY

• Risk appetite proxy

• Strength here supports AUD demand across the board

➡️ Key Idea:

📉 EUR weakness + AUD resilience = bearish continuation bias on EUR/AUD

🌍 Fundamental & Economic Factors to Consider

🇪🇺 Euro Side (EUR)

• Slower Eurozone growth outlook

• Inflation cooling keeps policy expectations capped

• EUR remains sensitive to risk-off flows

🇦🇺 Australian Dollar Side (AUD)

• Commodity-linked strength supports AUD

• China demand expectations directly impact AUD sentiment

• Risk-on environments favor AUD inflows

🗓 Upcoming Focus (High Impact)

⏰ Eurozone inflation & PMI data

⏰ Australia employment & inflation updates

⏰ Global risk sentiment (equities, commodities)

📌 Volatility may expand around data releases — manage exposure accordingly.

🧠 Technical + Flow Summary

✔️ Bearish structure intact

✔️ Sellers defending higher levels

✔️ Downside liquidity resting near 1.75000

✔️ Correlation alignment favors shorts

💬 Final Note

📌 This idea is for educational & market-structure insight only.

💼 Always trade with proper risk management.

👍 Like | 💬 Comment | ⭐ Save

Let the chart do the talking.

euraud analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

euraud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURAUD buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EUR/AUD: Is the Euro Losing Ground Against the Aussie Dollar?💶 EUR/AUD – Euro vs Aussie Dollar | “Profit Pathway Setup” 💰

Market Type: Forex

Trade Bias: Bearish (Day Trade Setup)

🧠 Trade Plan

📉 Bearish outlook confirmed after a solid support-level breakout — showing potential continuation if momentum sustains.

The moving averages are acting as dynamic resistance, suggesting sellers remain in control while buyers hesitate to commit.

🎯 Setup Details

Entry: Any price level as per your trading style or confirmation signal.

Stop-Loss: @ 1.77000 (Thief SL – personal choice only!)

Take-Profit: @ 1.74700 — The moving average acts as a strong dynamic support, with oversold conditions and a possible liquidity trap. Be smart — escape with profits before the market flips!

💬 Note to all Ladies & Gentlemen (Thief OGs): I’m not recommending you use only my SL or TP. Manage your own trade wisely — make money, take money, and always trade at your own risk.

🧩 Key Technical Insights

📊 Price structure confirms a bearish momentum after a key support break.

🧭 Dynamic resistance is forming near the moving averages, maintaining downward pressure.

💫 RSI and short-term momentum indicators show oversold conditions — a caution zone for late sellers.

💥 Trap formation below 1.7500 could trigger quick liquidity reversals; secure profits before it snaps back.

🌍 Correlated Pairs to Watch

Watch these related pairs for directional clues and sentiment confirmation:

FX:EURUSD : If EUR weakens further, it strengthens the bearish outlook on EUR/AUD.

OANDA:AUDUSD : Strong Aussie performance supports downside continuation in EUR/AUD.

OANDA:EURNZD : Often moves similarly — watch for bearish extensions or reversal traps.

OANDA:GBPAUD : A bullish move here could hint at upcoming AUD weakness or exhaustion.

⚡ Summary

EUR/AUD is moving with a clear bearish rhythm — the “Profit Pathway” is open for those who play smart and stay alert.

As long as the resistance near 1.77000 holds, sellers maintain control with a potential drop toward 1.74700.

Remember, every thief knows when to take the cash and dash before the cops (buyers) show up! 🏃♂️💰

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#EURAUD #Forex #DayTrade #TradingView #TechnicalAnalysis #ThiefTrader #FXStrategy #BearishSetup #PriceAction #ForexCommunity #EUR #AUD #MarketAnalysis

EUR/AUD Bearish Confirmed , Short Setup To Get 150 Pips !Here is my 4H Chart on EUR/AUD , We Have A Fake Breakout and also clear Stop Hunt which is take all stop losses above my res area before going to downside very hard , it`s a clear action from market makers , and now the price Back below my old res with amazing bearish candle and we have a very good bearish Price Action on 2 And 4 Hours T.F Also the price playing very good around my res and i`m waiting the price to retest the broken area and giving me a good bearish price action on smaller time frames to can get a confirmation to enter , So i see it`s a good chance to sell this pair if it go up a little to retest the broken area and then we can sell it and targeting 100 to 200 pips . and if we have a daily closure again above my new res then this idea will not be valid anymore .

Reasons To Enter :

1- Perfect Breakout .

2- Clear Bearish Price Action .

3- Bigger T.F Giving Good Bearish P.A .

4 - Perfect 15 Mins Closure .

5- The Price Respect The Res Again .

EUR/AUD – Doji Signal Suggests Bullish Reversal PotentialEUR/AUD – Doji Signal Suggests Bullish Reversal Potential (65% Probability)

(autosignalfx.com - visit and generate unlimited trading signals)

A new BUY signal has been identified on EUR/AUD, driven by the appearance of a Doji candlestick pattern on the current timeframe.

This setup carries a 65% historical backtest probability, indicating a moderately strong bullish continuation scenario within the prevailing trend.

🔍 Technical Analysis

The Doji formation is a key sign of market indecision, often appearing after extended corrective moves. In bullish contexts—such as the current EUR/AUD structure—a Doji often acts as a reversal or continuation trigger, signaling a likely return of buyers.

Key observations:

Price has stabilized after a controlled pullback

Doji indicates seller exhaustion and potential demand re-entry

The pair continues to trade within a broader bullish trend structure

Trend-following model signals confirm the upside bias

This combination strengthens the case for upward continuation.

🌍 Market Context

Fundamental conditions also support a bullish outlook:

Eurozone economic sentiment remains resilient relative to AUD

Interest rate differentials favor EUR in certain time horizons

AUD softness continues due to commodity demand fluctuations and global risk dynamics

Market sentiment shows increasing preference for EUR cross stability

In short, the macro backdrop aligns with the technical signal, providing additional support for bullish positions.

📌 Key Technical Levels

Immediate Resistance – 1.78703

Short-term barrier; clearing this opens the way for bullish momentum extension.

Immediate Support – 1.77633

This level sits just below the Doji formation and provides structural protection for bulls.

Major Resistance – 1.79950

A strong overhead level and the next meaningful upside target.

Major Support – 1.76386

Critical structural floor; a break below would invalidate medium-term bullish bias.

🎯 Trade Setup (0.10 Lot Example)

Parameter Level

Entry 1.78168

Stop Loss (SL) 1.77968

Take Profit (TP) 1.78568

Risk $50

Potential Profit $100

Risk–Reward Ratio 1 : 2

The setup offers a clean, tightly controlled bullish opportunity with favorable R:R.

🛡 Risk Management Guidance

Keep risk disciplined and structured:

Limit exposure to 1–2% of total account capital

Add positions only on retests or additional confirmation candles

Move SL to break-even once price clears 1.78703

Partial profit-taking can be considered before major resistance at 1.79950

Avoid entering close to high-impact EUR or AUD economic releases

A Doji-based setup requires confirmation and disciplined management.

📌 Final Thoughts

EUR/AUD is displaying a promising bullish continuation scenario, supported by a Doji reversal signal, trend alignment, and supportive macro conditions.

A push above 1.78703 could activate stronger bullish momentum toward 1.79950, while strict SL discipline at 1.77968 helps maintain controlled risk.

This setup fits well for traders seeking a structured, technically supported bullish entry within a trending environment.

EURAUD BUY SIgnal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURAUD Regains Momentum as Aussie Struggles with China DemandEURAUD is bouncing back from its recent lows as the euro finds renewed footing amid stabilizing European data, while the Australian dollar continues to face headwinds from China’s sluggish demand and a cautious RBA. The pair has regained short-term traction, but a retest of support before a continuation higher remains a likely technical scenario.

Current Bias

Bullish, with potential for a near-term pullback toward support before resuming higher toward 1.7930 and 1.8160.

Key Fundamental Drivers

Eurozone: Inflation has cooled, but the ECB maintains a restrictive stance for longer, citing a slow disinflation path. Recent data suggest stabilization in manufacturing, keeping EUR sentiment supported.

Australia: The RBA remains cautious, citing mixed employment and slowing household spending. China’s uneven recovery and weaker commodity demand continue to weigh on the AUD.

Yield Differential: Slightly favors the euro as ECB holds higher rates for longer compared to the RBA’s neutral bias.

Macro Context

The broader macro backdrop supports moderate EUR strength against AUD. Europe’s soft landing narrative contrasts with Australia’s export dependence on China, where growth momentum remains weak. Commodity flows, particularly iron ore and LNG, are subdued, limiting AUD upside. Meanwhile, geopolitical stability in Europe provides relative support to the euro, especially as global risk sentiment fluctuates.

Interest rate expectations:

ECB: Expected to hold rates into Q2 2026, with cuts only if inflation undershoots the 2% target.

RBA: Markets lean toward potential easing mid-2026 if consumption weakens further.

Growth trends remain in Europe’s favor relative to expectations, while Australia’s domestic softness and high mortgage costs curb expansion.

Primary Risk to the Trend

A stronger-than-expected rebound in China’s industrial output or commodity prices could lift AUD sharply, forcing EURAUD lower. Conversely, an ECB dovish pivot or renewed eurozone fiscal stress could undermine euro resilience.

Most Critical Upcoming News/Event

RBA Statement and Governor Bullock speech (for forward guidance on rates)

Eurozone Q3 GDP revision and inflation expectations data

China trade and inflation prints (key sentiment driver for AUD)

Leader/Lagger Dynamics

EURAUD acts as a lagger to EURUSD direction but leads cross pairs like EURNZD and GBPAUD due to its balance between growth sensitivity and yield divergence. It also mirrors shifts in commodity-linked risk sentiment while tracking China’s macro outlook indirectly.

Key Levels

Support Levels: 1.7750 / 1.7560

Resistance Levels: 1.7930 / 1.8160

Stop Loss (SL): 1.7520

Take Profit (TP): 1.7930 (partial), 1.8160 (extended)

Summary: Bias and Watchpoints

EURAUD’s current structure supports a bullish bias, reinforced by Europe’s relative policy stability and Australia’s commodity-linked weakness. A short-term dip toward 1.7750 could offer renewed buying interest, targeting 1.7930 and 1.8160 while keeping SL at 1.7520 to protect against a deeper retracement. The main watchpoints ahead are RBA communication and China’s macro data — both potential catalysts that could challenge euro gains. For now, the bias remains constructive while fundamentals and yield spreads lean in favor of EUR strength.

euraud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

euraud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

euraud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

euraud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

euraud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade