EUR/CAD BUYERS WILL DOMINATE THE MARKET|LONG

EUR/CAD SIGNAL

Trade Direction: long

Entry Level: 1.611

Target Level: 1.614

Stop Loss: 1.609

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURCAD

EURCAD The Target Is UP! BUY!

My dear friends,

Please, find my technical outlook for EURCAD below:

The price is coiling around a solid key level - 1.6121

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 1.6151

Safe Stop Loss - 1.6102

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

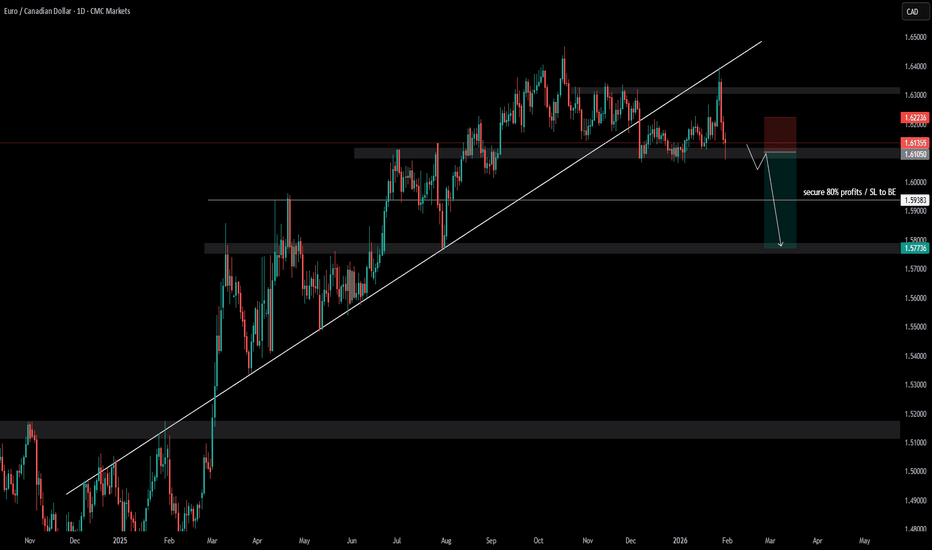

EUR/CAD BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

EUR/CAD is making a bullish rebound on the 1H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 1.608 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURCAD: Bullish Forecast & Bullish Scenario

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy EURCAD.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURCAD: Expecting Bullish Continuation! Here is Why:

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current EURCAD chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURCAD H4 | Bullish Bounce Off Pullback SupportMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 1.62026

- Pullback support

- 78.6% Fib retracement

Stop Loss: 1.61423

- Swing low support

Take Profit: 1.62890

- Pullback resistance

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

Falling towards key support?EUR/CAD is falling towards the support level, which is an overlap support that aligns with the 61.8% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.62248

Why we like it:

There is an overlap support level that aligns with the 61.8% Fibonacci retracement.

Stop loss: 1.61572

Why we like it:

There is an overlap support that lines up with the 78.6% Fibonacci retracement.

Take profit: 1.63410

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Falling towards key support?EUR/CAD is falling towards the pivot, which has been identified as an overlap support and could bounce to the 1st resistance.

Pivot: 1.62314

1st Support: 1.6150

1st Resistance: 1.63457

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

EUR-CAD Pullback Ahead! Sell!

Hello,Traders!

EURCAD has pushed into a well-defined higher-timeframe supply zone after strong bullish momentum. Buy-side liquidity appears swept, favoring a bearish reaction and pullback toward lower demand. Time Frame 12H.

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCAD: Weak Market & Bearish Continuation

Balance of buyers and sellers on the EURCAD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the sellers, therefore is it only natural that we go short on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

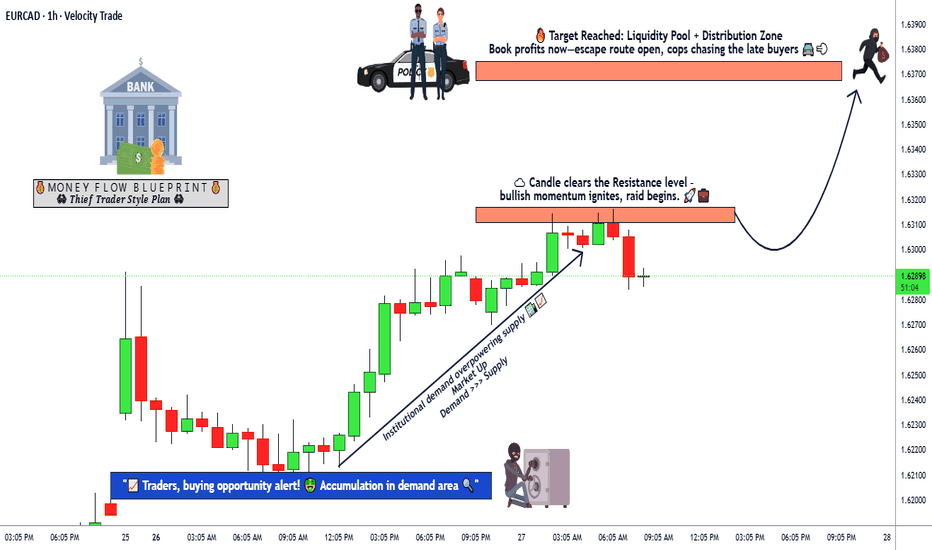

EUR/CAD | Bullish Breakout & Momentum Continuation Setup💶🍁 EUR/CAD "EURO vs CANADIAN DOLLAR" Premium Forex Trading Strategy 🔥

🎯 Day Trading & Swing Trading Opportunity Guide (Jan 2026 - Live Market Data)

📊 CURRENT LIVE MARKET DATA 📈

Current Price: 1.6134 USD/CAD (+0.29%) ⬆️

52-Week High: 1.6466 | 52-Week Low**: 1.4688

Weekly Range: 1.61464 - 1.62974 (As of Jan 26, 2026)

Volatility Rating: 0.23% (Lower volatility = Cleaner moves!) ✅

Market Sentiment: STRONG BUY (Technical Rating) 💪

🚀 BULLISH TRADING PLAN 🚀

📍 ENTRY POINT - Your Green Light to GO! 🟢

Entry Zone: After Resistance Breakout @ 1.63200 CAD

This level acts as a strong psychological barrier

Confirmation = Candle close above 1.6320

Wait for pullback + continuation pattern for safer entry

Risk/Reward Setup = OPTIMAL ✨

🎯 PRIMARY TARGET (Conservative) 🎯

Target Level 1: 1.63700 CAD

Why: Police barricade resistance + overbought conditions detected

Caution: Watch for profit-taking & potential correction trap ⚠️

Action: Consider taking 50% profit here, move SL to breakeven

Reward: +50 pips per lot (Clean & Quick)

🔥 EXTENDED TARGET (Aggressive) 🔥

Target Level 2: 1.64200 - 1.64500 CAD

Requires sustained bullish momentum

Technical resistance weakening

Only chase if daily candle structure confirms

Excellent for swing traders (2-3 day holds)

🛑 STOP LOSS - Protect Your Capital! 🛡️

SL Placement: 1.62700 CAD

Placed below support confirmation level

Provides 50-pips breathing room for volatility

Risk Management = PRIORITY #1

Max Risk: Keep to 1% of your trading capital per trade

📰 FUNDAMENTAL FACTORS TO WATCH 🔔 (Real Data - Jan 2026)

🏦 EUROPEAN CENTRAL BANK (ECB) STANCE 🇪🇺

Current Rate Status:

Main Refinancing Rate: 2.15% ✅ (Unchanged since July 2025)

Deposit Facility Rate: 2.00% ✅

ECB Holding Pattern: Data-Dependent Approach

Key ECB Fundamentals:

Inflation Projection 2026: 1.9% (Below 2% target) 📉

Economic Growth 2026: 1.2% (Slower than 2025's 1.4%)

Services Inflation: Sticky at 3.8-3.9% YoY ⚠️

Wage Growth: Expected to stabilize below 3% by end-2026

ECB Outlook: "Good place" = No hurry for rate changes (Dec 2025)

Impact on EUR:

EUR strength supported by stable rates

No rate cuts expected in 2026 = Euro floor protection 🏛️

Strong euro could dampen inflation further

Market odds of hike by end-2026 = Only ~30%

🍁 BANK OF CANADA (BoC) POSITION 🇨🇦

Current Rate Status:

Overnight Rate Target: 2.25% (Paused cutting cycle)

Rate Decision Upcoming: January 28, 2026 🗓️

Key BoC Fundamentals:

Rate Trajectory 2026: HOLD expected all year (75% economist consensus)

Economic Growth: 1.2-1.8% expected (Gradual pickup from 1.7% in 2025)

Inflation: Hovering at 2.0% target (Well-controlled) ✅

Labour Market: Mixed signals - Job gains in Dec but employment stalling

Unemployment Rate: 6.5% (Lower end, but caution warranted)

Major Risk Factor: USMCA Trade Review (July 2026) ⚡ = BIGGEST HEADWIND

Impact on CAD:

Weaker bias due to trade uncertainty 📍

Rate pause = CAD limited upside potential

Tariff uncertainty = CAD defensive positioning

Cut odds if economy falters = CAD depreciation signal

💰 CORRELATED PAIRS TO MONITOR 📊

Pair 1: OANDA:USDCAD 🔗

Inverse Relationship: When USD/CAD rises = EUR/CAD often falls

Current Level: ~1.38 (CAD weakness = EUR/CAD support)

Watch: If USD/CAD breaks 1.3900 = EUR/CAD bullish acceleration 🚀

Pair 2: FX:EURUSD 🔗

Direct Correlation: Strong positive = EUR/CAD strength linked

Current Level: ~1.1605

Watch: If EUR/USD rallies above 1.165 = EUR/CAD leg higher

Key Level: ECB vs Fed rate differential matters!

Pair 3: OANDA:GBPCAD 🔗

Alternative Long: Currently 1.8643 (+0.90%)

Stronger CAD Weakness Signal: If GBP/CAD rallies hard

Correlation Check: Use as confirmation for EUR/CAD direction

Pair 4: OANDA:CADJPY 🔗

Risk Sentiment Indicator: Japanese Yen strength = Risk-off

Trade Flows: Watch commodity-related USD/JPY moves

Alert Signal: If JPY strengthens = EM currencies weaken including CAD

📌 ECONOMIC CALENDAR - KEY DATES TO WATCH 🗓️

THIS WEEK - CRITICAL! 🔴

Jan 28, 2026 (TOMORROW!): Bank of Canada Rate Decision @ 2:45 PM ET

Expected: Hold at 2.25% ✅ (90% market odds)

Watch: Forward guidance on rate path

Volatility: HIGH - EUR/CAD could swing 30-50 pips

UPCOMING WEEK

Feb 5, 2026: ECB Governing Council (No rate change expected)

Fed Meeting: Monitor US economic data weekly

Canadian Employment Report: Watch hiring trends

MONTHLY RELEASES

Eurozone CPI Inflation: Watch services component (sticky!)

Canadian GDP Data: Q4 2025 results key for growth outlook

Both Central Banks: Wage pressure monitoring = inflation sticky risk

🎓 TRADING NOTES & RISK DISCLAIMERS ⚠️

❌ IMPORTANT RISKS

THIS IS NOT INVESTMENT ADVICE - Trade at your own risk!

Leverage Risk: Forex amplifies gains AND losses

Political Risk: USMCA renegotiation = Major CAD wild card

Central Bank Surprise: Never assume - market moves on unexpected data

Geopolitical: Energy market volatility (Venezuela situation) = Oil/CAD impact

Bank of Canada Jan 28: Rate decision could trigger 50+ pip moves

✅ PRO TRADER RULES

Position Sizing: Risk only 1% of account per trade (non-negotiable!)

Stop Loss: ALWAYS use SL - no exceptions for "Thief OGs"

Take Profits: Bank your gains at targets - Don't be greedy

Confirmation: Wait for candle close above 1.63200 before entry

Journal Everything: Track wins/losses for continuous improvement

🌟 FINAL CHECKLIST BEFORE TRADING ✅

Price above 1.6320? (Breakout confirmed)

Stop loss ready at 1.6270? (Risk defined)

Position size = 1% risk? (Capital protected)

BoC & ECB data checked? (Fundamentals aligned)

EUR/USD & USD/CAD correlated? (Multi-pair confirmation)

Chart pattern supports entry? (Technical + Fundamental match)

Trading plan written down? (Emotions controlled)

📊 SUMMARY SCORECARD

🔵 Technical Setup: 8/10 ✅ Bullish

🔵 Fundamental Support: 7/10 ✅ EUR Stable / CAD Weak

🔵 Risk/Reward Ratio: 9/10 ✅ Excellent (1:1.5)

🔵 Market Volatility: 6/10 ⚠️ Moderate

🔵 Trade Timing: 8/10 ✅ Early Setup Phase

🟢 OVERALL OPPORTUNITY: 8/10 🟢 BUY SETUP READY

🚀 THIS IS YOUR TRADE ZONE - STAY DISCIPLINED & STAY PROFITABLE! 🚀

Remember: Great traders aren't measured by their biggest win. They're measured by consistency, discipline, and how well they manage risk. Build your legacy one disciplined trade at a time.

Let's GET THIS MONEY! 💰💪

-Thief Trader (The Professional Forex Blueprint)

EURCAD BEARISH BIAS|SHORT|

✅EURCAD is trading into a higher-timeframe supply zone after a strong bullish displacement. Signs of buy-side liquidity exhaustion suggest a potential bearish reaction and pullback toward discounted levels. Time Frame 11H.

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

EURCAD The Target Is DOWN! SELL!

My dear subscribers,

My technical analysis for EURCAD is below:

The price is coiling around a solid key level - 1.6283

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.6245

My Stop Loss - 1.6312

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EUR/CAD BEARS ARE GAINING STRENGTH|SHORT

EUR/CAD SIGNAL

Trade Direction: short

Entry Level: 1.623

Target Level: 1.619

Stop Loss: 1.625

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURCAD Set To Grow! BUY!

My dear followers,

This is my opinion on the EURCAD next move:

The asset is approaching an important pivot point 1.6162

Bias - Bullish

Safe Stop Loss - 1.6152

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.6181

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EUrCAD H4 | Bearish Reversal Off Overlap ResistanceBased on the H4 chart analysis, we could see the price rise to our sell entry level at 1.6231, which is an overlap resistance that aligns with the 78.6% Fibonacci projection.

Our stop loss is set at 1.6300, which is a swing high resistance that aligns with the 127.2% Fibonacci extension.

Our take profit is set at 1.6155, which is an overlap support level.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

EURCAD H4 | Bullish Bounce Off Key SupportMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 1.61400

- Swing low support

- 78.6% Fib retracement

- 100% Fib projection

Stop Loss: 1.61045

- Swing low support

Take Profit: 1.62255

- Multi-swing high resistance

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

EURCAD - Anticipating the Price to FallThis image displays a technical analysis chart, specifically for the EUR/CAD (Euro/Canadian Dollar) currency pair, illustrating a potential trading setup. 💴

The chart uses common trading terms to show a transition from a potential bullish (uptrend) to a bearish (downtrend) market bias, suggesting an opportunity to initiate "short" positions.

Chart Analysis 📊

Bullish Phase: The price initially moved in an upward-sloping channel or triangle, indicating buying pressure.

Bearish Transition: The price hit a "supply" zone, an area where selling interest is strong enough to potentially reverse the upward momentum. 📉

Recommendation: The chart suggests that as the price respects this resistance area, traders should "look for shorts," meaning they anticipate the price to fall (a bearish move) and can position their trades to profit from this decline. ⬇️

EURCAD A Fall Expected! SELL!

My dear friends,

Please, find my technical outlook for EURCAD below:

The instrument tests an important psychological level 1.6173

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.6157

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Bearish reevrsal off pullback resistance?EUR/CAD has rejected off the pivot and could drop to the 1st support.

Pivot: 1.62314

1st Support: 1.6150

1st Resistance: 1.63012

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

EUR/CAD BUYERS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

It makes sense for us to go long on EUR/CAD right now from the support line below with the target of 1.620 because of the confluence of the two strong factors which are the general uptrend on the previous 1W candle and the oversold situation on the lower TF determined by it’s proximity to the lower BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURCAD H4 | Potential Bullish Bounce OffBased on the H4 chart analysis, we can see that the price has bounced off our buy entry level at 1.61313, which is an overlap support that aligns witht he 61.8% Fibonacci retracement.

Our stop loss is set at 1.60725, which is a pullback support.

Our take profit is set at 1.62331, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au