Is EUR/CHF Ready for the Next Upside Expansion?🔔 EUR/CHF Bullish Breakout | TMA Retest Trade Map Ahead!

📌 Asset

EUR/CHF – “EURO vs SWISSY”

📊 Forex Market | Swing / Day Trade Opportunity

📈 Market Bias

Bullish 🔼

The bullish structure is confirmed after a Triangular Moving Average (TMA) breakout followed by a clean retest, signaling trend continuation and renewed buyer strength.

This setup favors trend-following bulls and pullback buyers looking to position early before momentum expansion.

🧠 Trading Plan Logic

✅ TMA Breakout confirms trend shift

🔁 Retest validates buyer commitment

📊 Structure supports continuation, not exhaustion

🔓 Entry Strategy (Layered Execution 🧩)

Entry: Any price level

➡️ Executed using the Thief Layer Strategy (multi-limit order system)

📥 Buy Limit Layers

0.93200

0.93300

0.93400

0.93500

🧠 You may increase or reduce layers based on volatility, session, and position sizing.

This method improves average entry price, reduces emotional execution, and captures liquidity pullbacks effectively.

🛑 Stop Loss (Risk Control Zone)

SL @ 0.93000 🚨

Dear Ladies & Gentlemen (Thief OG’s),

This stop loss is not mandatory. Adjust SL placement according to:

Your own risk model

Account size

Volatility conditions

⚠️ Capital protection always comes before profits.

🎯 Target Zone (Profit Area)

TP @ 0.94300 💰

Why this zone matters:

⚡ High-Voltage Electric Wall (Strong historical resistance)

📉 Overbought conditions expected

Liquidity trap potential near highs

➡️ Smart traders escape with profits, not hope.

Again, TP is flexible — manage exits based on your system and market reaction.

🔍 Related Pairs to Watch (Correlation Check 👀)

💱 FX:EURUSD

EUR strength here supports bullish pressure in EUR/CHF

Watch for continuation above key intraday supports

💱 OANDA:USDCHF

CHF weakness vs USD often aligns with CHF weakness vs EUR

A falling USD/CHF = supportive for EUR/CHF upside

💱 OANDA:EURJPY

Risk-on confirmation pair

Bullish EUR/JPY adds confidence to EUR strength across the board

💱 OANDA:CHFJPY

If CHF/JPY weakens, it signals safe-haven outflows, favoring EUR/CHF longs

🧠 Correlation is not for entry — it’s for confirmation.

⚠️ Risk Disclaimer

Dear Ladies & Gentlemen (Thief OG’s),

I do not recommend copying my SL or TP blindly.

You control your risk.

You take your profits.

You own your results.

💬 Final Thought

Structure favors bulls, liquidity favors patience, and execution favors discipline.

Trade the plan — not emotions.

📌 If this idea adds value, support it with a 👍, 💬, or ⭐ to help it reach more traders.

Happy trading & trade safe 🚀📊

Eurchfbuy

EURCHF | Strategic BUY Opportunity🟢💼 EURCHF | Strategic BUY Opportunity (Structured Upside Setup)

Overview:

EURCHF is showing bullish continuation potential, with price holding strength near a key demand area, favoring further upside movement.

Buy Zone (Focus Area):

🟢 0.9310 – 0.9315

This zone represents a strong accumulation area where buyers are actively supporting price.

Upside Objectives:

🎯 0.9340 – Primary upside reaction

🚀 0.9360 – Possible extension with momentum

🔍 0.9380 – Level to be re-evaluated based on price behavior

Why This Setup Works:

✔ Price holding above a clear demand zone

✔ Bullish structure remains intact

✔ Upside momentum supported by controlled price action

Trade Management Insight:

Partial profit-taking at initial targets helps protect capital while allowing room for extended upside moves.

Execution Guidance:

Enter only after price shows acceptance or bullish confirmation within the buy zone. Patience improves precision.

Final Note:

As long as price respects the demand area, upside continuation remains the higher-probability scenario.

⸻

✨ Special Note for Serious Traders

If you value structured levels, calm execution, and professional risk control over emotional trading, feel free to connect. I work with traders who focus on consistency, not noise.

🔒 Professional approach. Disciplined risk. Sustainable growth.

EUR/CHF – MACD Momentum Analysis (Sell Bias) Take Profit:0.92902Quantum Pulse Professional Market Outlook

The EUR/CHF pair has generated a strong SELL signal under the MACD Momentum framework. Current price action shows clear signs of weakening bullish pressure, with momentum gradually tilting in favor of sellers. The structure remains highly technical, with no major fundamental catalysts interfering, making this setup clean and actionable.

📌 Signal Summary

Bias: SELL

Model: MACD Momentum

Volatility: Moderate

Risk/Reward: ~1:2.5

Session: Any (broad liquidity)

This signal is supported by momentum divergence across the last 200 bars, indicating exhaustion of the bullish leg and potential continuation of the broader bearish structure.

📊 Technical Outlook

1. Momentum & Structure

MACD shows bearish momentum acceleration, with histogram contracting upward and signal lines positioned for downward expansion.

Price is trading firmly below a micro-resistance cluster and struggling to break higher — a classic sign of trend exhaustion.

Candle bodies are shrinking near resistance, indicating buy-side weakness.

2. Market Conditions

Liquidity remains stable across overlapping sessions.

No high-impact CHF or EUR announcements within the next few hours, keeping the pair technically driven.

EUR remains soft across the board, increasing correlation pressure on EUR/CHF.

📌 Key Technical Levels

Level Type Price

Immediate Resistance 0.93245

Immediate Support 0.93185

Major Resistance 0.93275

Major Support 0.93155

Price is currently reacting beneath 0.93245 resistance, a level that historically triggers intraday reversals.

🎯 Trade Parameters

Entry: 0.93215

Stop Loss: 0.93372

Take Profit: 0.92902

This places the stop above both the immediate and major resistance zones, protecting the trade from intraday noise. The TP aligns with the next liquidity pocket below the 0.93155 support — a high-probability target.

🧠 Trade Rationale

Bearish divergence aligning with MACD momentum shift.

Price pressing against resistance with no bullish follow-through.

Market sentiment favors CHF strength in low-volatility periods.

Clean downside liquidity pool visible toward 0.92900 zone.

📉 Risk Management Guidance

Risk only 1–2% of account capital.

Consider enabling a trailing stop once price breaks below 0.93155.

Monitor volatility spikes around EUR macro sessions.

If price closes above 0.93372, bearish bias becomes invalid.

📌 Analyst Conclusion

EUR/CHF is showing high-quality bearish confluence, with momentum, structure, and liquidity all favoring downside continuation. As long as the pair remains capped under intraday resistance at 0.93245 – 0.93275, selling pressure should dominate toward the 0.92900 region.

EURCHF Daily Forecast -Q3 | W37 | D9 | Y25📅 Q3 | W37 | D9 | Y25

📊 EURCHF Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

OANDA:EURCHF

EURCHF – Pullback & New SetupIn my previous analysis (tagged below), I entered a short position. Price reached Reward 2, then pulled back and took me out at breakeven.

This is where you see the power of partial exit — it protects you from losses and keeps your risk low.

With this approach, I rarely see a 5% drawdown, but of course, nothing is guaranteed in trading.

The market broke my level strongly, and that’s okay. We don’t fight the market — we follow it.

Now I’m waiting for a pullback to the broken level, and I’ve also identified another nearby key zone.

If I get a valid signal at either level, I’ll enter a buy trade.

🧠 Remember: Trade with the market, not against it.

Drop the ego, drop the bias — let price lead.

EUR/CHF Bullish Vault Raid – The Franc Robbery Begins!💣EUR/CHF Bullish Heist: Thief's Franc Escape Plan 🚨💰

🚨Asset: EUR/CHF "Euro-Franc" Forex Market

📈Plan: Bullish

🎯Entry: Any price level (No breakout entry nonsense – we're stealthy robbers)

🛑Stop Loss: 0.93200

🏆Target: 0.94300

👑Thief's Statement:

Hey Money Muggers & Market Marauders! 🥷💰

Today, we strike the Euro-Franc vault with a clean bullish heist plan. No noise, no breakout bait — just silent limit orders stacked like layers on a cake 🍰.

🎭We ain’t chasing price… we let price chase us! Smart thieves wait. Pullbacks? That’s our entry door 🧨🚪.

🔑Gameplan:

📦 Entry:

🕵️♂️Layer up your Buy Limit orders near recent pullbacks or swing lows.

⏳Wait on the 15M or 30M timeframe for the cleanest setups.

📉No breakout entries – thieves don’t chase, we trap.

🛡️Stop Loss (SL):

🧱Set at 0.93200 — hidden just below the thief's last cover zone.

🎲Risk based on your position size & how many orders you layer.

🎯Keep it tactical. One mistake and the vault closes!

🏁Target (TP):

💎0.94300 is the escape tunnel.

💨Exit fast if heat rises before the target hits. Smart thieves know when to run!

👊Scalpers’ Note:

🪝Only ride long waves — don’t swim against the current.

💣Use trailing SL to secure the loot as price climbs.

👑Big pockets? Dive in. Small pockets? Swing with precision.

🧠Why We Rob Here:

EUR/CHF fundamentals align with the bulls. We're riding sentiment, intermarket flow, and positioning from big money. COT, macro signals, and FX momentum all say: Thieves, it's go time! 🚨

📢News Alert:

❌ Avoid entries during high-impact news – it ain’t worth jail time (or stop hunts).

🎯Use a trailing SL to protect gains if caught mid-heist during volatility.

🔥Like the Plan? Hit that Boost Button 💥

Join the Thief Squad and let’s rob the FX banks together 💵💎

Catch you in the next heist drop 🐱👤🚀

EURCHF – Waiting for the Signal, Not the MiracleWe are currently in a great area for a potential short, and the marked zone looks ideal for an entry—but only if a valid signal confirms it.

We’re not upset if the level gets broken.

We don’t say “this strategy doesn’t work.”

Why? Because we know the market is not under our control.

If price breaks above and gives a clean pullback, we’ll go long.

Simple. No ego. No bias.

Also, the lower level marked on the chart seems to be a great zone for either taking profit from shorts or initiating fresh longs.

🎯 We follow the market, not fight it.

EURCHF - Expecting Bullish Continuation In The Short TermH1 - Strong bullish momentum.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

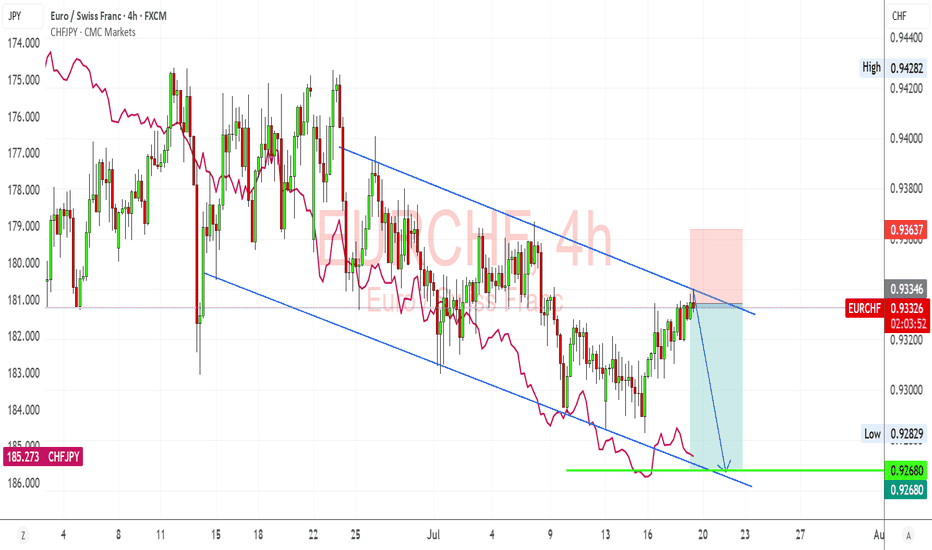

EURCHF – Bearish Channel Holds Firm, CHF Strength Set to ResumeEURCHF just tapped into the descending channel resistance again and is showing signs of rejecting. I'm expecting a bearish continuation here, especially given the strong CHF momentum recently, supported by safe-haven flows and Swiss inflation stability. If the pair fails to break above 0.9340, I’m watching for a downside push back toward 0.9270–0.9265, completing another leg within the structure.

🔍 Technical Setup (4H):

Channel Structure: EURCHF remains firmly within a downward-sloping parallel channel since mid-June.

Resistance Rejection: Price recently tested upper channel resistance (~0.9335–0.9340 zone), aligning with trendline rejection.

Target Support: 0.9270–0.9265 (channel base and key horizontal level).

Confluence: CHFJPY overlay (pink line) is rising again, suggesting renewed CHF strength—this usually weighs on EURCHF.

💡 Fundamental Insight:

EUR Side:

ECB officials remain cautious, but with recent EU data showing weaker growth (especially PMIs and sentiment), euro upside is capped.

The ECB is likely to pause further tightening, while other central banks like SNB remain firm on inflation risks.

CHF Strength:

The Swiss National Bank (SNB) still leans hawkish, with stable inflation giving room to hold rates steady or tighten if needed.

CHF benefits from risk-off flows amid global tariff headlines, China slowdown, and Middle East tensions.

Rising CHFJPY = clear CHF strength across the board.

⚠️ Risks:

If eurozone data surprises to the upside (e.g., inflation rebounds), EURCHF could break out of the channel.

A sudden drop in geopolitical tension or strong risk-on rally could weaken CHF as safe-haven demand falls.

SNB jawboning or FX intervention is always a wildcard.

🧭 Summary:

I’m bearish on EURCHF while it respects this well-defined descending channel. The technicals show consistent lower highs and lower lows, while the fundamentals continue to support CHF strength due to risk aversion, stable inflation, and a resilient SNB. My short bias is valid as long as price remains below 0.9340, with downside targets at 0.9270–0.9265. CHFJPY rising confirms franc leadership across FX markets, and EURCHF is likely a lagger following broader CHF strength.

EURCHF Analysis – “Euro Inches Higher, But Safe-Haven CHF LurksEURCHF is breaking out from a symmetrical triangle, indicating potential bullish momentum.

Key resistances to watch:

0.9445 – local swing high

0.9498 – potential measured target from the triangle breakout

Entry on retest of the triangle may offer a favorable risk-reward opportunity.

However, upside could be capped if CHF regains strength.

Structure Bias: Bullish breakout, confirmation needed with a clean retest and sustained move above 0.9440

📊 Current Bias: Cautiously Bullish

🧩 Key Fundamentals Driving EURCHF

EUR Side (Neutral to Slightly Bearish):

ECB remains cautious: June’s Economic Bulletin showed soft patches in core inflation and weak consumer activity.

German & French PMIs are mixed; services weaker than expected.

Political uncertainty (France snap elections) weighs on EUR sentiment in the medium term.

CHF Side (Fundamentally Stronger):

SNB is cautious but hawkish: Monetary policy assessment showed a steady hand, maintaining rates with no clear signal of easing.

Safe-haven flows persist due to:

Middle East risk (Israel–Iran escalation)

Russia–Ukraine tensions

Weak equity sentiment

CHF remains supported on global risk aversion, even with SNB standing pat.

⚠️ Risks That May Reverse or Accelerate Trend

Breakout fails to hold → Bearish fakeout leads to drop toward 0.9290 again

Renewed CHF strength from geopolitical shocks

Eurozone political turbulence (especially France & ECB doves)

🗓️ Important News to Watch

🇨🇭 Swiss CPI, SNB statements

🇪🇺 Eurozone PMI Flash (June 21), CPI (June 28), and political updates

Global market risk sentiment (VIX, bonds, oil, Iran/Israel news)

🏁 Which Asset Might Lead the Broader Move?

EURCHF is lagging behind EURUSD and USDCHF, but provides clean geopolitical risk signals. If markets stabilize, this pair has upside potential. However, if fear returns, CHF may quickly regain control, trapping long trades.

EURCHF Builds Momentum Above Key Support as ECB Meeting LoomsEURCHF is trading above the previous breakout zone near 0.9396–0.9400, confirming a shift toward bullish structure. Price action shows a clean breakout from consolidation, aiming for the 0.9485–0.9546 resistance zones next, supported by strong momentum.

Support Zone: 0.9385–0.9400 (previous resistance turned support)

Immediate Resistance: 0.9485 (61.8% Fib level)

Target Zones:

TP1: 0.9485 (61.8% Fib retracement)

TP2: 0.9545 (78.6% Fib retracement)

Risk Level: Stop-loss below 0.9380 for protection.

✅ Bullish Factors:

Bullish break above mid-range structure and retesting successfully

Clean bullish market structure and higher lows developing

50% Fibonacci retracement break supports further upside momentum

Weak CHF fundamentals due to global risk appetite and cautious SNB stance

🧠 Fundamental Insights:

ECB Outlook:

ECB is heading toward a "complex June meeting" with Klaas Knot warning that while short-term tariffs may suppress inflation, long-term risks are two-sided.

Despite likely rate cuts, the ECB remains cautious due to trade war uncertainty and global pressures.

Eurozone Risks:

Upcoming GDP and CPI reports expected to show sluggish growth and cooling inflation, which could limit upside for EUR in medium term.

CHF Fundamentals:

Market sentiment favors risk assets, weakening the traditional safe-haven CHF.

No aggressive SNB tightening expected soon.

Recent Headlines:

US Treasury Sec Bessent highlights European concerns about Euro strength.

Weaker CHF amid global calm and stable financial markets.

📌 Trading Plan:

Bias: Bullish while holding above 0.9400

Entry: On dips near 0.9415–0.9420

Target 1: 0.9485

Target 2: 0.9545

Stop-loss: Below 0.9380

⚠️ Watch:

If EUR zone GDP or CPI disappoints heavily this week, expect sharp pullback risk.

A drop back below 0.9380 would invalidate the bullish breakout scenario.

EURCHF Buy from Key Demand Zone – Recession Fears Cloud UpsideEURCHF has bounced sharply from a long-standing demand zone around 0.9200–0.9260, forming a potential double bottom. Price action suggests a bullish correction is underway, with upside targets at:

🎯 TP1: 0.9352

🎯 TP2: 0.9409

🎯 TP3: 0.9499

🚨 Invalidation Zone: Below 0.9200

The strong rejection from this support zone, combined with bullish structure building, signals the potential for a sustained recovery — if sentiment allows.

🧠 Fundamental Overview:

🔺 Eurozone PMI & Trade Data – Mixed Signals

French & German Flash Manufacturing PMIs remain under 50, indicating contraction

German Flash Services PMI (50.3) shows marginal expansion

Eurozone Trade Balance: 14.9B, slightly below expectations

⚠️ These results suggest slow economic recovery and limited growth momentum in the euro area.

🗣️ ECB Comments – Market Confidence Hit

ECB's Kazaks:

“Tariff war is adding economic risks”

“Euro area recession probability is rising”

These statements added to market caution, triggering euro weakness on concerns of slowing growth and potential ECB dovishness if downside risks worsen.

💡 CHF Context:

Safe-haven flows remain strong due to global uncertainty

However, CHF strength may be capped by Swiss low inflation and potential SNB interventions if EURCHF stays too low

🔍 EURCHF Outlook: Bullish Rebound with Caution

Technical view favors bullish retracement toward resistance zones

Fundamentals are weak, but the deeply discounted EURCHF pair could see short-term recovery before facing macro resistance

Recession and tariff war fears could keep upside limited or choppy

📌 Strategy Summary:

Buy Bias above 0.9260

Targets:

TP1: 0.9352

TP2: 0.9409

TP3: 0.9499

SL: Below 0.9200 (daily close)

EUR/CHF "Euro vs Swissy" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/CHF "Euro vs Swissy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (2.04000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2.08000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

EUR/CHF "Euro vs Swissy" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

💸💲🧠 Fundamental Analysis

Interest Rates: The European Central Bank (ECB) is expected to maintain a hawkish stance, which could lead to a stronger euro and support the EUR/CHF.

Inflation: Eurozone inflation is expected to rise, which could lead to higher interest rates and support the EUR/CHF.

GDP Growth: Eurozone GDP growth is expected to accelerate, which could lead to a stronger euro and support the EUR/CHF.

Trade Balance: The Eurozone's trade surplus is expected to widen, which could support the EUR/CHF.

💸💲🧠 Macroeconomic Analysis

Unemployment Rates: Eurozone unemployment is expected to decline, which could lead to higher consumer spending and support the EUR/CHF.

Consumer Confidence: Eurozone consumer confidence is expected to rise, which could lead to higher consumer spending and support the EUR/CHF.

Manufacturing PMI: Eurozone manufacturing PMI is expected to rise, which could lead to higher economic growth and support the EUR/CHF.

💸💲🧠 Global Market Analysis

Risk Appetite: Global risk appetite is expected to rise, which could lead to a stronger euro and support the EUR/CHF.

Commodity Prices: Commodity prices are expected to rise, which could lead to higher inflation and support the EUR/CHF.

Global Economic Growth: Global economic growth is expected to accelerate, which could lead to a stronger euro and support the EUR/CHF.

💸💲🧠 COT Data Analysis

Non-Commercial Traders: Non-commercial traders are net long the EUR/CHF, indicating a bullish sentiment.

Commercial Traders: Commercial traders are net short the EUR/CHF, but the position is decreasing, indicating a potential bullish reversal.

Open Interest: Open interest in the EUR/CHF is increasing, indicating a rising bullish sentiment.

💸💲🧠 Intermarket Analysis

EUR/USD Correlation: The EUR/CHF has a strong positive correlation with the EUR/USD, indicating that the EUR/CHF tends to move in the same direction as the EUR/USD.

CHF/JPY Correlation: The EUR/CHF has a moderate negative correlation with the CHF/JPY, indicating that the EUR/CHF tends to move in the opposite direction of the CHF/JPY.

💸💲🧠 Quantitative Analysis

Moving Averages: The EUR/CHF has broken above its 200-day moving average, indicating a bullish trend.

Relative Strength Index (RSI): The RSI for the EUR/CHF has broken above 50, indicating a bullish momentum.

Bollinger Bands: The EUR/CHF has broken above the upper band of its Bollinger Bands, indicating a strong bullish momentum.

💸💲🧠 Market Sentiment Analysis

Sentiment Indicators: Sentiment indicators, such as the EUR/CHF sentiment index, are indicating a bullish sentiment.

Institutional Traders: Institutional traders, such as hedge funds and banks, are net long the EUR/CHF, indicating a bullish sentiment.

Retail Traders: Retail traders, such as individual investors, are also net long the EUR/CHF, indicating a bullish sentiment.

Positioning: Market participants are net long the EUR/CHF, indicating a bullish sentiment.

💸💲🧠Positioning and Trend Analysis

Short-Term Trend: The short-term trend for the EUR/CHF is bullish, with a potential target of 0.9800.

Medium-Term Trend: The medium-term trend for the EUR/CHF is bullish, with a potential target of 1.0000.

Long-Term Trend: The long-term trend for the EUR/CHF is bullish, with a potential target of 1.0500.

💸💲🧠 Overall Summary Outlook

Based on the analysis, the EUR/CHF is expected to trade with a bullish bias in the short, medium, and long term, with potential targets of 0.9800, 1.0000, and 1.0500 respectively.

💸💲🧠 Future Prediction

Based on the analysis, here are some potential future price levels for the EUR/CHF:

Bullish Targets:

Short-term: 0.9800

Medium-term: 1.0000

Long-term: 1.0500

Bearish Targets:

Short-term: 0.9400

Medium-term: 0.9200

Long-term: 0.9000

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/CHF "Euro vs Swiss" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/CHF "Euro vs Swiss" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 0.95100

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental Outlook 📰

Economic Factors:

Eurozone economic growth: A pickup in Eurozone economic growth, driven by domestic demand and investment, could support the EUR.

Inflation: Rising inflation in the Eurozone, driven by stronger economic growth and higher wages, could lead to higher interest rates and support the EUR.

Trade balance: An improvement in the Eurozone's trade balance, driven by stronger exports and weaker imports, could support the EUR.

Monetary Policy Factors:

ECB's monetary policy: A less dovish stance from the European Central Bank (ECB), potentially leading to higher interest rates, could support the EUR.

SNB's intervention: A decrease in the Swiss National Bank's (SNB) intervention in the FX market could limit CHF appreciation and support the EUR.

Political Factors:

Eurozone political stability: Greater political stability in the Eurozone, potentially driven by a more unified EU policy, could support the EUR.

Swiss politics: Political uncertainty in Switzerland, potentially driven by a more fragmented government, could weaken the CHF.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

0.92 In Focus: Imminent Reversal or New Lows Ahead?Are we about to see a double bottom reversal, or will price break down again?

Going back to my idea posted in December 2023 (see related post), we had a great buying opportunity on the dip below 0.94, followed by a strong rally towards parity, falling just 80 pips short.

That upward move ended in May, and since then, the price has broken down again, with last month taking out last year's low, hitting a new all-time low at 0.921. So, what’s next?

Will the price continue to break down, or are we seeing signs of a double bottom reversal on the weekly charts? Let’s break it down.

On the weekly charts, after hitting the new low last month, we saw a strong reaction with a nearly 360-pip rally before the price broke down again. Zooming into the daily charts (image below), it looks like we could see a move back down under 0.93 into the marked buy zone.

Looking more closely at the daily chart with the MACD indicator, there are signs of a double bottom pattern forming, along with bullish divergence, signaling a potential buying opportunity on dips below 0.93.

Supporting this further, divergence signals are also forming on the 4-hour charts (see image below), with the price slowly grinding down while the MACD moves higher. This is clear evidence that momentum is slowing as we approach a key higher-timeframe area of interest.

Given these signals, I expect one final breakdown under 0.93, followed by a strong rally. However, I won’t be blindly entering buy trades here.

Instead, I’ll wait for the final push down and look for BUY signals on my TRFX indicator from the 4-hour to daily timeframes, with the strongest signal likely appearing on the daily.

If this setup plays out, I fully expect a move back up to test parity, with my first target being last month’s high at 0.958, where we could encounter some resistance. The second target will be the 2024 high at 0.992.

For this setup to be invalidated, we would need to see a clear weekly break and close below 0.925.

Let me know your thoughts below! :)

EUR/CHF Bank Money Heist Plan on Bullish SideHola ola My Dear,

Robbers / Money Makers & Losers,

This is our master plan to Heist EUR/CHF Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss : Recent Swing Low using 30M timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

EURCHF Technical Analysis and Trade Idea👀👉 I’m closely monitoring the EURCHF currency pair. Currently, we’re observing a market structure break with a higher high on the chart, along with the potential formation of a base that could lead to further upward movement. If the market conditions align as discussed in the video, I’ll be looking for a buying opportunity.

This analysis highlights key elements of technical analysis, including trend identification, price action, and market structure. We'll also outline a potential trade setup and explore strategies to enhance the likelihood of success.

Please remember, this analysis is for educational purposes only and should not be considered financial advice. The observations made are speculative and do not guarantee future market outcomes. It’s crucial to verify current price actions before making any trading decisions.

This presentation provides a thorough review of the current trend, market structure, and price dynamics. However, it’s essential to understand that while this information is educational, it does not ensure trading success. Trading in the foreign exchange market carries significant risks, and we strongly recommend applying sound risk management practices in all your trades.

We urge you to conduct extensive research and carefully consider all factors before making any trading decisions. Stay informed, exercise caution, and approach the markets with a well-crafted strategy. 📊✅