EURCHF | Strategic BUY Opportunity🟢💼 EURCHF | Strategic BUY Opportunity (Structured Upside Setup)

Overview:

EURCHF is showing bullish continuation potential, with price holding strength near a key demand area, favoring further upside movement.

Buy Zone (Focus Area):

🟢 0.9310 – 0.9315

This zone represents a strong accumulation area where buyers are actively supporting price.

Upside Objectives:

🎯 0.9340 – Primary upside reaction

🚀 0.9360 – Possible extension with momentum

🔍 0.9380 – Level to be re-evaluated based on price behavior

Why This Setup Works:

✔ Price holding above a clear demand zone

✔ Bullish structure remains intact

✔ Upside momentum supported by controlled price action

Trade Management Insight:

Partial profit-taking at initial targets helps protect capital while allowing room for extended upside moves.

Execution Guidance:

Enter only after price shows acceptance or bullish confirmation within the buy zone. Patience improves precision.

Final Note:

As long as price respects the demand area, upside continuation remains the higher-probability scenario.

⸻

✨ Special Note for Serious Traders

If you value structured levels, calm execution, and professional risk control over emotional trading, feel free to connect. I work with traders who focus on consistency, not noise.

🔒 Professional approach. Disciplined risk. Sustainable growth.

Eurchfsell

EUR/CHF Outlook: Is the Euro Losing Strength Against the Swissy?💼 EUR/CHF “Euro vs Swissy” | Forex Market Opportunity Blueprint 🧠

🔻 Bearish Swing Trade Plan – Thief’s Layering Strategy

📊 Market Context:

The EUR/CHF pair is showing a clear bearish structure after a Triangular Moving Average (TMA) pullback trend reversal — confirming strong downside potential. A major support zone has been breached, signaling that bears are firmly in control.

💥 Plan Summary:

This setup aligns with Thief’s signature multi-layer entry strategy, focusing on precision layering and risk scaling for optimal profit capture.

🎯 Thief’s Layered Entry Zones:

💣 Sell Limit 1 → 0.92500

💣 Sell Limit 2 → 0.92400

💣 Sell Limit 3 → 0.92300

💣 Sell Limit 4 → 0.92200 (optional for advanced layering)

🧩 You can increase or reduce layers based on your own comfort & volatility assessment. The goal is smooth entry stacking — not emotional trading.

🛑 Stop Loss (SL):

Thief SL @ 0.92700

Dear Ladies & Gentlemen (Thief OG’s) — remember, this SL is adaptive. Manage according to your own strategy and risk appetite. This isn’t a signal — it’s a structure.

💰 Target Zone (TP):

🎯 Primary TP: 0.91800

As moving averages turn into strong resistance & overbought signals appear, the market forms a bull trap. Be the early one to exit with profits before the herd wakes up.

🔍 Correlation & Related Pairs to Watch

💵 OANDA:USDCHF : Often moves inversely with EUR/CHF — stronger USD tends to pressure EUR/CHF lower.

💶 FX:EURUSD : Watch for bullish exhaustion here; a decline supports the bearish EUR/CHF narrative.

💷 OANDA:GBPCHF : Another CHF cross showing similar CHF strength patterns — confirming broader Swissy momentum.

📈 These pairs help validate directional bias — if CHF is strong across the board, it’s a green light for continuation on EUR/CHF shorts.

⚙️ Thief’s Blueprint Note:

Trading is an art — strategy, patience, and psychology are your real edge. Use your own levels, risk rules, and profit-taking plan. Don’t copy blindly — learn the rhythm, not just the recipe.

🔥 If you value structured swing setups & strategic planning — drop a like, follow, and comment your view below!

Let’s see how the market respects this Thief Blueprint. 💎

EUR/CHF – MACD Momentum Analysis (Sell Bias) Take Profit:0.92902Quantum Pulse Professional Market Outlook

The EUR/CHF pair has generated a strong SELL signal under the MACD Momentum framework. Current price action shows clear signs of weakening bullish pressure, with momentum gradually tilting in favor of sellers. The structure remains highly technical, with no major fundamental catalysts interfering, making this setup clean and actionable.

📌 Signal Summary

Bias: SELL

Model: MACD Momentum

Volatility: Moderate

Risk/Reward: ~1:2.5

Session: Any (broad liquidity)

This signal is supported by momentum divergence across the last 200 bars, indicating exhaustion of the bullish leg and potential continuation of the broader bearish structure.

📊 Technical Outlook

1. Momentum & Structure

MACD shows bearish momentum acceleration, with histogram contracting upward and signal lines positioned for downward expansion.

Price is trading firmly below a micro-resistance cluster and struggling to break higher — a classic sign of trend exhaustion.

Candle bodies are shrinking near resistance, indicating buy-side weakness.

2. Market Conditions

Liquidity remains stable across overlapping sessions.

No high-impact CHF or EUR announcements within the next few hours, keeping the pair technically driven.

EUR remains soft across the board, increasing correlation pressure on EUR/CHF.

📌 Key Technical Levels

Level Type Price

Immediate Resistance 0.93245

Immediate Support 0.93185

Major Resistance 0.93275

Major Support 0.93155

Price is currently reacting beneath 0.93245 resistance, a level that historically triggers intraday reversals.

🎯 Trade Parameters

Entry: 0.93215

Stop Loss: 0.93372

Take Profit: 0.92902

This places the stop above both the immediate and major resistance zones, protecting the trade from intraday noise. The TP aligns with the next liquidity pocket below the 0.93155 support — a high-probability target.

🧠 Trade Rationale

Bearish divergence aligning with MACD momentum shift.

Price pressing against resistance with no bullish follow-through.

Market sentiment favors CHF strength in low-volatility periods.

Clean downside liquidity pool visible toward 0.92900 zone.

📉 Risk Management Guidance

Risk only 1–2% of account capital.

Consider enabling a trailing stop once price breaks below 0.93155.

Monitor volatility spikes around EUR macro sessions.

If price closes above 0.93372, bearish bias becomes invalid.

📌 Analyst Conclusion

EUR/CHF is showing high-quality bearish confluence, with momentum, structure, and liquidity all favoring downside continuation. As long as the pair remains capped under intraday resistance at 0.93245 – 0.93275, selling pressure should dominate toward the 0.92900 region.

EUR/CHF – Bearish Momentum Unfolding! MA Breakout Confirmed🎯 EUR/CHF: The Swiss Heist – Bears Taking Control! 🐻💰

📊 Market Overview

Pair: EUR/CHF (Euro vs Swiss Franc)

Strategy Type: Swing/Day Trade

Bias: 🔴 BEARISH

Setup Confirmation: Moving Average breakout validated ✅

🎭 The "Thief" Strategy Breakdown

Hey traders! 👋 Welcome to another edition of the Thief's playbook where we steal profits from the market like professionals! 😎

Current Setup: EUR/CHF is showing strong bearish momentum after breaking below key moving averages. The technicals are screaming "SHORT" louder than my broker when I hit margin call! 🚨 (Just kidding... or am I? 👀)

🎯 Trade Plan – The Layered Entry Heist

📍 Entry Strategy: "The Thief Layering Method"

Instead of going all-in like a casino gambler, we're using multiple sell limit orders (layering strategy) to build our position like a professional bank robber plans multiple escape routes! 🏦💼

Suggested Layer Entries:

🔸 Layer 1: 0.93200

🔸 Layer 2: 0.93100

🔸 Layer 3: 0.93000

OR you can enter at any current price level based on your risk appetite and market timing! ⏰

(Pro tip: You can add more layers based on your account size and risk tolerance. More layers = More stealth mode activated! 🥷)

🛑 Risk Management (The Escape Plan)

Stop Loss: 0.93400 🚪

⚠️ Important Note: Dear Ladies & Gentlemen (Fellow Thief OG's! 🎩),

I'm NOT recommending you blindly follow my stop loss. This is YOUR money, YOUR risk, YOUR decision! Set your SL based on your own risk management rules. Trade smart, not hard! 🧠💪

🎁 Profit Target (The Treasure Chest)

Target: 0.92500 🏆

Why this target?

✅ Strong support zone

✅ Oversold conditions expected

✅ Potential bull trap area (careful, traders might get trapped here!)

💡 Thief's Wisdom: Take your profits BEFORE the market takes them back! Don't get greedy – escape with your loot while the coast is clear! 🏃♂️💨

⚠️ Important Note: Dear Ladies & Gentlemen (Fellow Thief OG's! 🎩),

I'm NOT recommending you follow only my take profit level. You can secure profits at your own comfort zones! Partial profits? Full exit? It's YOUR call! Remember: Money in your account > Money on the chart! 💰

🔍 Technical Analysis Deep Dive

What's happening technically:

📉 Moving average breakout confirmed (bears in control)

📊 Price action showing lower highs and lower lows

🎯 Momentum favoring the downside

🔮 Key resistance turned support now acting as resistance (classic flip!)

The Swiss franc has been flexing its safe-haven muscles lately, and when SNB (Swiss National Bank) gets involved, the franc tends to show strength! 💪🇨🇭

👀 Related Pairs to Watch (Correlation Game)

Keep your eyes peeled on these bad boys for confirmation:

OANDA:USDCHF 💵🇨🇭 – Watch for franc strength across the board

FX:EURUSD 🇪🇺💵 – Euro weakness would confirm our bias

OANDA:GBPCHF 🇬🇧🇨🇭 – Similar safe-haven dynamics

OANDA:XAUUSD (Gold) 🥇 – Gold & CHF often move together in risk-off scenarios

Correlation Logic: If EUR is weak AND CHF is strong = Perfect storm for our bearish setup! ⛈️📉

🎓 Key Takeaways

✅ Bearish structure intact

✅ Multiple entry opportunities (layering = smart trading!)

✅ Clear risk management zones

✅ Realistic profit targets

✅ Correlation plays to monitor

Remember: The market doesn't care about your bills, your dreams, or your Lambo wishlist! 🏎️ Trade with discipline, manage your risk, and never risk what you can't afford to lose!

📢 Community Love

✨ "If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!"

⚠️ Disclaimer

This is the "Thief Style" trading strategy – just for educational and entertainment purposes! 🎭

This analysis is NOT financial advice. I'm not your financial advisor, your broker, or your fairy godmother! 🧚♀️ Trading forex carries substantial risk of loss and is not suitable for all investors. Always do your own research, trade at your own risk, and never invest more than you can afford to lose. Past performance does not guarantee future results. By using this analysis, you acknowledge that all trading decisions are your own responsibility!

Trade safe, trade smart, stay profitable! 🎯💎

#EURCHF #ForexTrading #TechnicalAnalysis #SwingTrading #DayTrading #BearishSetup #ForexSignals #TradingStrategy #PriceAction #MovingAverage #SwissFranc #Euro #ForexAnalysis #ThiefStrategy #LayeringStrategy #RiskManagement #TradingCommunity #ForexLife #ChartAnalysis #MarketAnalysis

EUR/CHF: Bearish Drop to 0.92920?FX:EURCHF is signaling a bearish move on the 4-hour chart, with an entry zone between 0.93673-0.93773 near a resistance level.

The target at 0.92920 aligns with key support, offering a clear downside play. Set a stop loss on a daily close above 0.93965 t o manage risk effectively. 🌟

📝 Trade Plan:

✅ Entry Zone: 0.93673 – 0.93773 (resistance area)

❌ Stop Loss: Daily close above 0.93965 to manage risk

🎯 Target: 0.92920 (key support zone)

Ready for this move? Drop your take below! 👇

EURCHF Daily Forecast -Q3 | W37 | D9 | Y25📅 Q3 | W37 | D9 | Y25

📊 EURCHF Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

OANDA:EURCHF

EURCHF Daily Forecast -Q3 | W37 | Y25📅 Q3 | W37 | Y25

📊 EURCHF Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

OANDA:EURCHF

EURCHF - Short Term Sell IdeaH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

EUR/CHF Breakout Done , Let`s Sell To Get 100 Pips !Here is my 4H T.F EUR/CHF Chart and we have a very clear breakout and the price confirmed already by amazing bearish candle closed below my Support , So we can sell now and targeting from 50 to 100 pips .

Reasons :

1- Clear Breakout

2- Bearish P.A .

3- Clear Confirmation .

EURCHF – Waiting for the Signal, Not the MiracleWe are currently in a great area for a potential short, and the marked zone looks ideal for an entry—but only if a valid signal confirms it.

We’re not upset if the level gets broken.

We don’t say “this strategy doesn’t work.”

Why? Because we know the market is not under our control.

If price breaks above and gives a clean pullback, we’ll go long.

Simple. No ego. No bias.

Also, the lower level marked on the chart seems to be a great zone for either taking profit from shorts or initiating fresh longs.

🎯 We follow the market, not fight it.

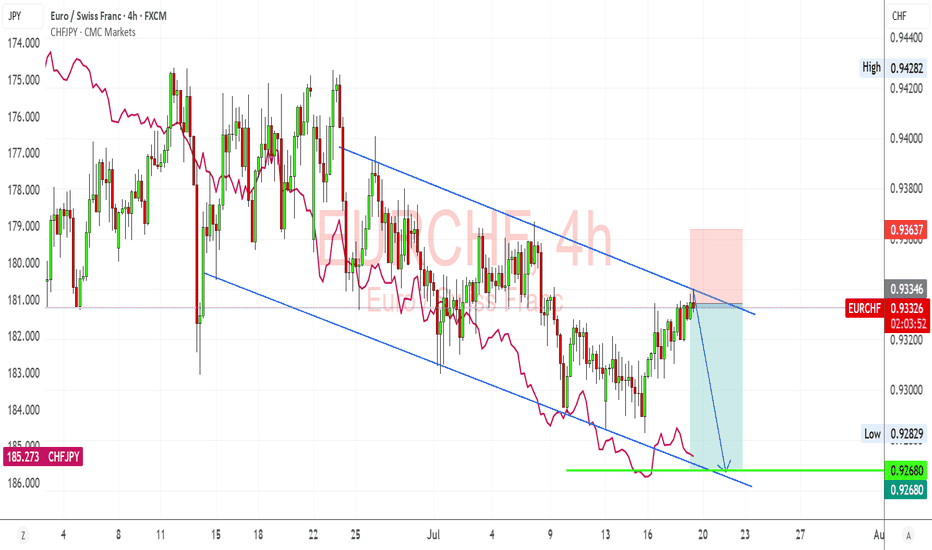

EURCHF – Bearish Channel Holds Firm, CHF Strength Set to ResumeEURCHF just tapped into the descending channel resistance again and is showing signs of rejecting. I'm expecting a bearish continuation here, especially given the strong CHF momentum recently, supported by safe-haven flows and Swiss inflation stability. If the pair fails to break above 0.9340, I’m watching for a downside push back toward 0.9270–0.9265, completing another leg within the structure.

🔍 Technical Setup (4H):

Channel Structure: EURCHF remains firmly within a downward-sloping parallel channel since mid-June.

Resistance Rejection: Price recently tested upper channel resistance (~0.9335–0.9340 zone), aligning with trendline rejection.

Target Support: 0.9270–0.9265 (channel base and key horizontal level).

Confluence: CHFJPY overlay (pink line) is rising again, suggesting renewed CHF strength—this usually weighs on EURCHF.

💡 Fundamental Insight:

EUR Side:

ECB officials remain cautious, but with recent EU data showing weaker growth (especially PMIs and sentiment), euro upside is capped.

The ECB is likely to pause further tightening, while other central banks like SNB remain firm on inflation risks.

CHF Strength:

The Swiss National Bank (SNB) still leans hawkish, with stable inflation giving room to hold rates steady or tighten if needed.

CHF benefits from risk-off flows amid global tariff headlines, China slowdown, and Middle East tensions.

Rising CHFJPY = clear CHF strength across the board.

⚠️ Risks:

If eurozone data surprises to the upside (e.g., inflation rebounds), EURCHF could break out of the channel.

A sudden drop in geopolitical tension or strong risk-on rally could weaken CHF as safe-haven demand falls.

SNB jawboning or FX intervention is always a wildcard.

🧭 Summary:

I’m bearish on EURCHF while it respects this well-defined descending channel. The technicals show consistent lower highs and lower lows, while the fundamentals continue to support CHF strength due to risk aversion, stable inflation, and a resilient SNB. My short bias is valid as long as price remains below 0.9340, with downside targets at 0.9270–0.9265. CHFJPY rising confirms franc leadership across FX markets, and EURCHF is likely a lagger following broader CHF strength.

EURCHF Analysis – “Euro Inches Higher, But Safe-Haven CHF LurksEURCHF is breaking out from a symmetrical triangle, indicating potential bullish momentum.

Key resistances to watch:

0.9445 – local swing high

0.9498 – potential measured target from the triangle breakout

Entry on retest of the triangle may offer a favorable risk-reward opportunity.

However, upside could be capped if CHF regains strength.

Structure Bias: Bullish breakout, confirmation needed with a clean retest and sustained move above 0.9440

📊 Current Bias: Cautiously Bullish

🧩 Key Fundamentals Driving EURCHF

EUR Side (Neutral to Slightly Bearish):

ECB remains cautious: June’s Economic Bulletin showed soft patches in core inflation and weak consumer activity.

German & French PMIs are mixed; services weaker than expected.

Political uncertainty (France snap elections) weighs on EUR sentiment in the medium term.

CHF Side (Fundamentally Stronger):

SNB is cautious but hawkish: Monetary policy assessment showed a steady hand, maintaining rates with no clear signal of easing.

Safe-haven flows persist due to:

Middle East risk (Israel–Iran escalation)

Russia–Ukraine tensions

Weak equity sentiment

CHF remains supported on global risk aversion, even with SNB standing pat.

⚠️ Risks That May Reverse or Accelerate Trend

Breakout fails to hold → Bearish fakeout leads to drop toward 0.9290 again

Renewed CHF strength from geopolitical shocks

Eurozone political turbulence (especially France & ECB doves)

🗓️ Important News to Watch

🇨🇭 Swiss CPI, SNB statements

🇪🇺 Eurozone PMI Flash (June 21), CPI (June 28), and political updates

Global market risk sentiment (VIX, bonds, oil, Iran/Israel news)

🏁 Which Asset Might Lead the Broader Move?

EURCHF is lagging behind EURUSD and USDCHF, but provides clean geopolitical risk signals. If markets stabilize, this pair has upside potential. However, if fear returns, CHF may quickly regain control, trapping long trades.

EURCHF SHORT FORECAST Q2 W25 D20 Y25EURCHF SHORT FORECAST Q2 W25 D20 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly 50EMA Rejection

✅15' Order block

✅1H Order Block

✅4H Highs

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

QUICK PLAY - EURCHF SHORT FORECAST Q2 W23 D3 Y25EURCHF SHORT FORECAST Q2 W23 D3 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅4 hour order block

✅4 hour 50 EMA rejection

✅Intraday 15' order block to be identified

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF SHORT FORECAST Q2 W20 D16 Y25EURCHF SHORT FORECAST Q2 W20 D16 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅4 Hour order block rejection

✅4 Hour 50 EMA rejection

✅Intraday 15' order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF SHORT FORECAST Q2 W20 D14 Y25EURCHF SHORT FORECAST Q2 W20 D14 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅4 Hour order block rejection

✅4 Hour 50 EMA rejection

✅Intraday 15' order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF SHORT FORECAST Q2 W20 D12 Y25EURCHF SHORT FORECAST Q2 W20 D12 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅4 Hour order block rejection

✅4 Hour 50 EMA rejection

✅Intraday 15' order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF SHORT FORECAST Q2 W19 D7 Y25EURCHF SHORT FORECAST Q2 W19 D7 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅15' & 1' order block identified

✅Daily 50 EMA rejection

✅Intraday 15' order block

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURCHF Builds Momentum Above Key Support as ECB Meeting LoomsEURCHF is trading above the previous breakout zone near 0.9396–0.9400, confirming a shift toward bullish structure. Price action shows a clean breakout from consolidation, aiming for the 0.9485–0.9546 resistance zones next, supported by strong momentum.

Support Zone: 0.9385–0.9400 (previous resistance turned support)

Immediate Resistance: 0.9485 (61.8% Fib level)

Target Zones:

TP1: 0.9485 (61.8% Fib retracement)

TP2: 0.9545 (78.6% Fib retracement)

Risk Level: Stop-loss below 0.9380 for protection.

✅ Bullish Factors:

Bullish break above mid-range structure and retesting successfully

Clean bullish market structure and higher lows developing

50% Fibonacci retracement break supports further upside momentum

Weak CHF fundamentals due to global risk appetite and cautious SNB stance

🧠 Fundamental Insights:

ECB Outlook:

ECB is heading toward a "complex June meeting" with Klaas Knot warning that while short-term tariffs may suppress inflation, long-term risks are two-sided.

Despite likely rate cuts, the ECB remains cautious due to trade war uncertainty and global pressures.

Eurozone Risks:

Upcoming GDP and CPI reports expected to show sluggish growth and cooling inflation, which could limit upside for EUR in medium term.

CHF Fundamentals:

Market sentiment favors risk assets, weakening the traditional safe-haven CHF.

No aggressive SNB tightening expected soon.

Recent Headlines:

US Treasury Sec Bessent highlights European concerns about Euro strength.

Weaker CHF amid global calm and stable financial markets.

📌 Trading Plan:

Bias: Bullish while holding above 0.9400

Entry: On dips near 0.9415–0.9420

Target 1: 0.9485

Target 2: 0.9545

Stop-loss: Below 0.9380

⚠️ Watch:

If EUR zone GDP or CPI disappoints heavily this week, expect sharp pullback risk.

A drop back below 0.9380 would invalidate the bullish breakout scenario.

EURCHF Buy from Key Demand Zone – Recession Fears Cloud UpsideEURCHF has bounced sharply from a long-standing demand zone around 0.9200–0.9260, forming a potential double bottom. Price action suggests a bullish correction is underway, with upside targets at:

🎯 TP1: 0.9352

🎯 TP2: 0.9409

🎯 TP3: 0.9499

🚨 Invalidation Zone: Below 0.9200

The strong rejection from this support zone, combined with bullish structure building, signals the potential for a sustained recovery — if sentiment allows.

🧠 Fundamental Overview:

🔺 Eurozone PMI & Trade Data – Mixed Signals

French & German Flash Manufacturing PMIs remain under 50, indicating contraction

German Flash Services PMI (50.3) shows marginal expansion

Eurozone Trade Balance: 14.9B, slightly below expectations

⚠️ These results suggest slow economic recovery and limited growth momentum in the euro area.

🗣️ ECB Comments – Market Confidence Hit

ECB's Kazaks:

“Tariff war is adding economic risks”

“Euro area recession probability is rising”

These statements added to market caution, triggering euro weakness on concerns of slowing growth and potential ECB dovishness if downside risks worsen.

💡 CHF Context:

Safe-haven flows remain strong due to global uncertainty

However, CHF strength may be capped by Swiss low inflation and potential SNB interventions if EURCHF stays too low

🔍 EURCHF Outlook: Bullish Rebound with Caution

Technical view favors bullish retracement toward resistance zones

Fundamentals are weak, but the deeply discounted EURCHF pair could see short-term recovery before facing macro resistance

Recession and tariff war fears could keep upside limited or choppy

📌 Strategy Summary:

Buy Bias above 0.9260

Targets:

TP1: 0.9352

TP2: 0.9409

TP3: 0.9499

SL: Below 0.9200 (daily close)

SHORT ON EUR/CHFEUR/CHF is currently at a major resistance level and his recently mitigated a FVG sitting in the same zone.

Price has been rising in what seems like forever on this pair, we finally have gotten our change of character (choc) to the downside with sweeps of liquidity and fvg's now balanced out.

I expect price to fall to the next demand level where plenty of liquidity sits.

I am selling EUR/CHF now looking to make over 200 pips to the downside.

EURCHF at Key Resistance Zone - Potential Drop to 0.95000OANDA:EURCHF has reached a significant resistance zone, marked by prior price rejections, suggesting strong selling interest. This area has previously acted as a key supply zone, increasing the likelihood of a bearish reversal if sellers regain control.

If the price confirms resistance within this zone through bearish price action (e.g., wicks or rejection candles), we could see a move toward 0.95000, which represents a logical target based on recent structure.

However, if the price breaks and holds above this resistance area, the bearish outlook may be invalidated, potentially opening the door for further upside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!