DeGRAM | EURGBP reached the resistance level📊 Technical Analysis

● EUR/GBP rejected resistance at 0.8738 with bearish wicks, signaling exhaustion.

● Price is now pulling back below 0.8724, with scope to retest supports at 0.8711 and 0.8692 in the short term.

💡 Fundamental Analysis

● EUR remains pressured as ECB maintains a cautious stance, while GBP finds relative support from firm labor data.

✨ Summary

EUR/GBP faces rejection at 0.8738, with downside targets at 0.8711 and 0.8692. Resistance confirmed, short-term pressure remains bearish.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Eurgbpsignal

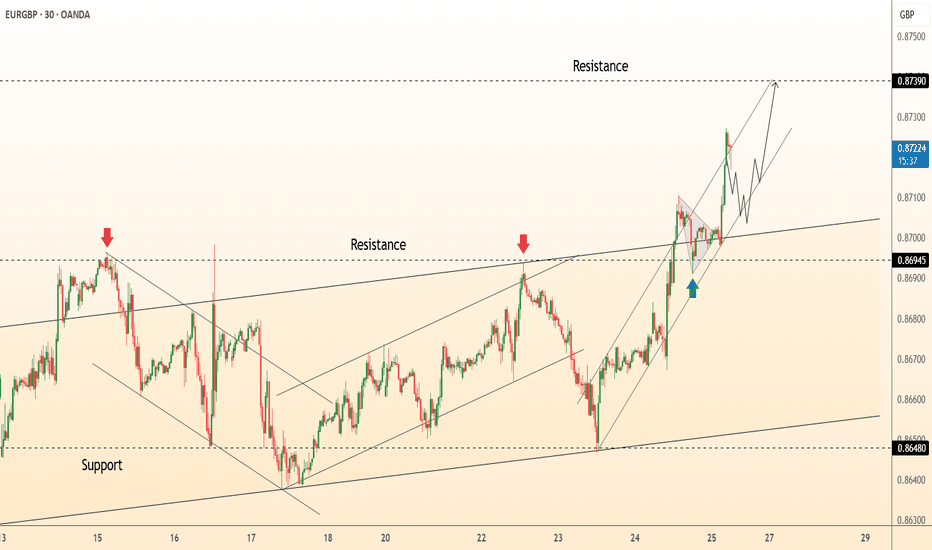

DeGRAM | EURGBP is preparing for a correction📊 Technical Analysis

● EUR/GBP is facing rejection at the 0.8704 resistance line after a sharp rally, with multiple failed attempts highlighting strong selling pressure.

● The projected path shows a breakdown toward 0.8662 support, with further downside potential toward 0.8635 if bearish momentum strengthens.

💡 Fundamental Analysis

● Euro remains pressured by weaker eurozone growth outlook, while GBP is supported by sticky UK inflation keeping the BoE on a hawkish stance.

✨ Summary

Bearish below 0.8704; targets 0.8662 → 0.8635. Invalidation on a close above 0.8705.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DeGRAM | EURGBP reached the support level📊 Technical Analysis

● EUR/GBP is rebounding from the 0.8640 support area, maintaining its position within the ascending channel and confirming the structure with higher lows.

● Price action points to an advance toward 0.8684, with scope for an extension toward 0.8711 if resistance in the red zone is breached.

💡 Fundamental Analysis

● The euro is supported by ECB officials signaling vigilance on inflation persistence, while the pound faces pressure from weak retail data and cautious BoE policy tone.

✨ Summary

Bullish above 0.8640; targets 0.8684 → 0.8711. Invalidation on a close below 0.8640.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

Profit from EUR/GBP's Fall! Bearish Setup Live! 🏴☠️ EUR/GBP "The Chunnel Heist" — Forex Swing Trade Plan 😎💰

Welcome, fellow market money makers, to The Chunnel Bank Job Plan! 🚂💨 We're diving into the EUR/GBP with a cheeky, yet calculated, swing/day trade plan to loot some pips with style. This bearish setup is primed for action, and we’re using a slick layering strategy to stack the odds in our favor. Let’s break it down with a professional wink and a grin! 😜

📊 Market Setup: Bearish Breakout Confirmed 🐻

Why the Bearish Vibe? The Triangular Moving Average (TMA) has been smashed by sellers, signaling a confirmed downtrend. 📉 The bears are in control, and we’re riding their coattails!

Asset: EUR/GBP (aka "The Chunnel" — connecting the UK and Europe with a pip-plundering plan).

Timeframe: Swing/Day Trade (perfect for those who like quick hits with a side of swagger).

🕵️♂️ The Heist Plan: Layered Sell Limit Entries

We’re pulling off this heist with a Thief’s Layering Strategy — multiple sell limit orders to maximize entry precision. Think of it as setting multiple traps for the market to fall into. 🕸️

Entry Levels (Sell Limits):

🎯 0.86600

🎯 0.86550

🎯 0.86500

🎯 0.86450

🎯 0.86400

Pro Tip: Feel free to add more layers based on your risk appetite — the more, the merrier! Just keep it sharp and calculated. 😉

Entry Flexibility: You can enter at any price level if you spot a good setup. Use your thief’s intuition to pick the best entry point, but layering gives us an edge. 🗝️

🛑 Stop Loss: The Thief’s Escape Hatch

Stop Loss: Set at 0.86800 to keep our heist safe. This is the line in the sand where we tip our hats and exit if the market outsmarts us. 🎩

Note: Dear Ladies & Gentlemen (Thief OGs), this is my suggested SL, but you’re the master of your own loot! Adjust based on your risk tolerance. Trade smart, not hard. 💡

🎯 Target: Where We Cash Out 💸

Take Profit: Aiming for 0.86000, where we expect strong support, an oversold RSI, and a potential trap for unsuspecting bulls.

Escape Plan: Grab your profits before the market flips! This is a high-probability zone, but don’t get greedy — escape with your loot! 🏃♂️

Note: As always, Thief OGs, this is my TP suggestion. You decide when to pocket the cash. Risk management is your best mate in this game. 🕶️

🔗 Related Pairs to Watch 👀

Keep an eye on these correlated pairs (all in USD terms for clarity) to spot confluence or divergence in the market:

FX:GBPUSD : A rising GBP/USD could pressure EUR/GBP lower, as a stronger GBP weakens the pair. Watch for bearish momentum here to confirm our setup.

FX:EURUSD : If EUR/USD is dropping, it supports our bearish EUR/GBP bias, as Euro weakness fuels the downtrend.

OANDA:USDCHF : Monitor for USD strength, which could indirectly influence GBP and EUR dynamics.

Key Correlation Insight: EUR/GBP often moves inversely to GBP/USD. If GBP/USD rallies, it’s a tailwind for our bearish EUR/GBP heist. Keep tabs on these pairs for confirmation! 📡

🗝️ Key Points to Nail This Heist

Trend Confirmation: The TMA breach is our green light. Sellers are in charge, so don’t fight the trend! 🚨

Layering Strategy: Multiple sell limits spread risk and increase the chance of catching the move. It’s like casting a wide net for pips. 🐟

Risk Management: Stick to your SL and TP, or tweak them to fit your style. The market is a wild beast — tame it with discipline. 🦁

Market Traps: Watch for oversold conditions near 0.86000. Bears could get exhausted, so be ready to exit with your profits! 🏦

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#️⃣ #EURGBP #ForexTrading #SwingTrading #DayTrading #ThiefStrategy #BearishSetup #TradingView #PipHeist

EURGBP Daily Forecast -Q3 | W38 | D15 | Y25| 📅 Q3 | W38 | D15 | Y25|

📊 EURGBP Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:EURGBP

EURGBP Daily Forecast -Q3 | W38 | Y25📅 Q3 | W38 | Y25

📊 EURGBP Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:EURGBP

EURGBP Daily Forecast -Q3 | W36 | D4 | Y25📅 Q3 | W36 | D4 | Y25

📊 EURGBP Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:EURGBP

DeGRAM | EURGBP is testing the support level📊 Technical Analysis

● EUR/GBP rebounded from 0.8643 support and is consolidating inside a rising channel, holding the midline trend as dynamic support.

● A close above 0.8694 resistance would confirm bullish continuation toward 0.8738, while dips to 0.8669 remain corrective within the uptrend.

💡 Fundamental Analysis

● Euro strength is underpinned by ECB’s firm stance on maintaining restrictive rates, while sterling is capped by renewed concerns over slowing UK consumer spending.

✨ Summary

Bullish above 0.8643; targets 0.8694 → 0.8738. Invalidation on a close below 0.8640.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EURGBP Daily Forecast -Q3 | W35 | D2 | Y25

📅 Q3 | W35 | D2 | Y25

📊 EURGBP Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:EURGBP

EURGBP – Q3 W36 Y25 Weekly Forecast Higher Time Frame Context (W📈 EURGBP – Q3 W36 Y25 Weekly Forecast

🧠 Higher Time Frame Context (Weekly/Daily)

Price has closed above the Higher Time Frame (HTF) 50EMA, signaling strength and suggesting a bullish bias going into Monday of Week 36.

The strong weekly candle close in W35 indicates bullish pressure from the lows, reinforcing the idea of a higher-probability long setup.

I expect a rejection from the Daily 50EMA, aligning with HTF continuation expectations.

🔔 Bias: Long — in alignment with the HTF momentum and structure.

🔄 Recent Price Action & Short-Term Trade Plan

On Friday of W35, I closed my short position toward the end of my trading period.

Despite the HTF bullish bias, price is currently rejecting a 4H order block that created a higher low on the 4H timeframe.

This suggests that intra-day pullbacks (shorts) may still play out early in the week, particularly toward key long POIs (Points of Interest).

⚠️ Caution & Adjustments

I remain tentative about holding shorts, as the trading range is tight and higher time frame pressure is building to the upside.

My focus will shift to watching price react to long POIs, where I will:

Wait for a break of structure (BOS) on the lower timeframes (15M 5M 1M)

Enter on the pullback for a long, aiming for a higher high on the 4H chart by mid-week.

🧭 Execution Summary

Aspect Outlook / Plan

Higher Time Frame Bias ✅ Bullish – Strong weekly close above 50EMA

Current Price Action 🔄 Intra-day short-term rejection from 4H OB

Shorts ⚠️ Possible early-week pullbacks — small range, manage risk tightly

Long Plan 🟢 Await long POI tap + LTF BOS for long continuation

Target 🎯 Potential higher high on 4H by mid-W36

🧠 Final Thoughts

“Let price come to you. Let structure confirm it.”

Patience is key early in the week — I’ll be waiting for confirmation before positioning long, while allowing short-term shorts to play out cautiously.

FRGNT

EURGBP – Potential Short Setup (London/NY Crossover) Q3 | W35 |

📉 EURGBP – Potential Short Setup (London/NY Crossover)

Q3 | W35 | D29 | Y25

🧠 Setup Overview:

Asia session highs filled ✅

Post-London showed bullish pressure, but we’re now looking for NY to sell from the highs 📉

Anticipating a 4H bearish candle close (classical formation) for confirmation

📌 Key Confluences:

Price is expected to pull back into 4H imbalance, aligning with:

A projected Lower Low on the 15m

Formation of a new Order Block + Void

This area will serve as a refined short POI for continued downside movement

🎯 Target:

Shorts aligned with 4H trend continuation, aiming toward the Daily 50EMA

🧠 Execution Plan:

Wait for 4H candle confirmation + 15m BOS

Look for entry at OB/void zone within 4H imbalance

Risk remains capped — no confirmation = no trade

Discipline over prediction. Let structure lead.

– FRGNT

EURGBP – Daily Chart Analysis Q3 | W35 | D29 | Y25📊 EURGBP – Daily Chart Analysis

Q3 | W35 | D29 | Y25

🕯️ The previous daily candle closed bullish, and notably above the 50EMA. This is a key technical signal that shifts our short-term bias to the upside, suggesting bullish momentum is in play.

📈 Based on this close, I’ll be focusing on long opportunities from the lows, targeting areas where price may look to mitigate inefficiencies left behind.

🔍 Key Technical Breakdown:

The bullish daily candle created a 4H Order Block and left an imbalance below, both of which sit within a broader daily Point of Interest (POI).

Within this POI, there are clear 1H and 15-minute order blocks and voids, acting as refined zones of interest for potential entries.

These areas mark where I’ll be paying close attention to price reaction and structure.

🧠 Execution Plan:

I’m not entering blindly at the POI.

I’ll be monitoring lower timeframes (M15/M5) for a clean break of structure (BOS) or a liquidity sweep followed by bullish intent.

Only after confirmation will I look to enter long — risk remains capped and measured.

If price fails to hold the POI or shows strong bearish momentum, I’ll step aside and wait for clarity.

📌 Key Takeaways:

The bias is bullish only with confirmation — stay mechanical, not emotional.

Structure > impulse — don’t let a single bullish candle dictate your entry.

Maintain solid risk management — max 1% risk per trade, with clear invalidation levels.

Let the market come to you. No confirmation = no trade.

FRGNT

FX:EURGBP

EURGBP – DAILY FORECAST Q3 | W35 | D28 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W35 | D28 | Y25

🔍 Daily Forecast | EURGBP

Here’s a concise breakdown of the current chart setup 🧠📈:

📌 Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

We wait for a confirmed break of structure 🧱✅ before executing any position.

This keeps us disciplined, and in sync with what the price action is actually telling us — not what we want it to say.

📈 Risk Management Protocols

🔑 Core Principles:

Max 1% risk per trade

Execute only at pre-identified levels

Use alerts, not emotion

Stick to your RR plan (minimum 1:2)

🧠 You’re not paid for how many trades you take — you're paid for how well you manage risk.

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work for you. 🎯📊

FRGNT

FX:EURGBP

EURGBP Daily Forecast — Q3 W35 D37 Y25📊 EURGBP Daily Forecast — Q3 W35 D37 Y25

Good morning traders,

EURGBP is currently holding just above the Daily 50 EMA — a key potential rejection zone that supports a bullish outlook. 📍

We're also sitting within a High Timeframe (HTF) Daily Order Block, adding significant confluence to a long bias. 🟢

🔎 Top-Down Analysis:

📆 Daily: Price above 50 EMA + HTF OB

🕓 4H: Subtle Break of Structure (BoS) visible

🕐 1H: BoS is clean and confirmed — indicating growing bullish pressure

This multi-timeframe alignment strengthens the long idea. ✅

🎯 Execution Plan:

Use the 1H BoS zone as your area of interest

🔽 Drill down to the 15-min OB within that zone for precise entries

📉 Await a BoS on the 1' or 5' timeframe for aggressive entries

📈 Or wait for a 15' BoS for a more conservative confirmation

Once confirmed, we’re looking to execute a long trade from this zone.

🧠 Final Thoughts:

Stack confluences ✅

Trust your top-down analysis 📊

Manage risk and execute confidently 🛡️

Best of luck today — trade safe, and trade well.

FRGNT

FX:EURGBP

EUR/GBP Analysis – 4H Chart | Possible Trend Reversal Ahead?The EUR/GBP pair is currently trading around 0.8642 after a recent downtrend from the 0.8750 region. On the chart, we can see...

✔ Zig Zag Pattern: A clear series of lower highs and lower lows indicate a short-term bearish structure.

✔ Trendline Resistance: The blue descending trendline is acting as a dynamic resistance, and price has recently tested this level.

✔ Support Zone: Strong support is visible near 0.8638 – 0.8620, which has held multiple times in the past.

📉 RSI Analysis

The RSI (14) on the 4H timeframe is hovering near the 50 level, suggesting neutral momentum after recovering from an oversold area in early August. This signals potential consolidation before the next big move.

Key Observations

Price is currently consolidating around the 0.8640 area after rejecting lower levels.

A break above the trendline could signal a shift towards bullish momentum.

If rejected again, expect further downside toward 0.8600 or even 0.8550 in the medium term.

📈 Possible Scenarios

Bullish Case:

If price breaks and closes above 0.8670, we may see a move toward 0.8720 and 0.8750.

Bearish Case:

If price fails to break the trendline and drops below 0.8638, expect continuation to 0.8600 and 0.8550.

Strategy

Aggressive Buyers: Watch for a breakout retest above 0.8670.

Sellers: Look for rejection near trendline resistance for short entries with tight stops.

What do you think? Will EUR/GBP break the trendline or continue the downtrend? Drop your analysis in the comments!

DeGRAM | EURGBP will test the support level📊 Technical Analysis

● EUR/GBP has bounced off the lower boundary of its descending channel around 0.8600, forming a short-term higher-low signal.

● A rally above the sloping resistance (former mid-channel line near 0.8620) would validate the bounce and likely extend gains toward 0.8670 resistance.

💡 Fundamental Analysis

● UK GDP growth of 0.3% in Q2 exceeded forecasts and boosted sterling resilience, tempering rate-cut expectations from the Bank of England. Market sentiment sees fewer BoE cuts ahead.

● Mixed UK labor data—slower hiring but sustained wage growth—reinforces the BoE’s cautious stance, supporting GBP rather than encouraging dovish easing.

● Meanwhile, investors expect ECB rates to stay "higher for longer," reducing pressure for euro weakening despite prior policy divergence.

✨ Summary

Long above 0.8620; target ~0.8670. Setup invalidated if price closes below 0.8600.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DeGRAM | EURGBP reached the lower boundary of the channel📊 Technical Analysis

● EURGBP rebounded from the lower boundary of its descending channel, signaling a potential short-term trend reversal.

● A break above 0.8634 resistance could trigger a rally toward 0.8694, while holding above 0.8607 keeps the bullish scenario intact.

💡 Fundamental Analysis

● Euro support is emerging as ECB officials hint at delaying further easing, while UK growth data underperformed expectations, softening GBP demand.

✨ Summary

Bullish above 0.8607; targets 0.8634 → 0.8694. Invalidation below 0.8607.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DeGRAM | EURGBP is rolling back to support📊 Technical Analysis

● EUR/GBP has broken down from the rising channel, with price now correcting toward the channel’s lower support line—highlighting a shift from bullish to neutral-to-bearish momentum.

● A potential rebound is likely if support near 0.8611–0.8620 holds, which could pave the way for a recovery back toward 0.8695 resistance. Failure here opens the path toward 0.8600 or lower.

💡 Fundamental Analysis

● The pound has been bolstered by markets scaling back rate‑cut expectations, following a 5‑4 BoE split vote and cautionary tone on inflation and further easing.

● GBP is also supported by the weaker euro, amid investor concern over an uneven US‑EU trade deal that’s undermining confidence in euro‑zone strength.

✨ Summary

Buy from 0.8611–0.8620; target 0.8695. Setup invalid if price closes below 0.8600.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EUR/GBP Thief Trade: Swipe Profits Before Overbought Trap!🦹♂️ EUR/GBP "THE CHUNNEL HEIST" – BULLISH LOOT IN PROGRESS! 🚨💰

(Thief Trading Strategy – Escape Before the Cops Arrive!)

🎯 DEAR MARKET PIRATES & PROFIT SNATCHERS,

Based on our 🔥Thief Trading Style Analysis🔥, we’re executing a bullish heist on EUR/GBP ("The Chunnel"). The vault is wide open—time to swipe the loot before the high-risk resistance police barricade (aka overbought trap) shuts us down!

📜 THE MASTER PLAN:

✔ Entry (📈): "The Bullish Vault is Unlocked!"

Buy Limit Orders (15-30min TF) near recent swing lows/highs.

Thief’s DCA Trick: Layer entries like a pro robber—multiple limit orders for max loot.

✔ Stop Loss (🛑): "Hide Your Stash Wisely!"

SL at nearest 4H candle wick (0.86000)—adjust based on your risk appetite & lot size.

Remember: A good thief always has an escape route!

✔ Target (🎯): 0.88000 (or escape earlier if the cops get suspicious!)

🔎 SCALPERS & SWING BANDITS – LISTEN UP!

Scalpers: Stick to LONG-ONLY heists! Use trailing SL to protect profits.

Swing Thieves: If you’re low on cash, join the slow robbery—DCA & hold!

📡 WHY THIS HEIST IS HOT:

Bullish momentum in play (but BEWARE of overbought traps!).

Fundamental Drivers: Check COT Reports, Macro Data, & Sentiment.

🚨 TRADING ALERT: NEWS = POLICE RAID RISK!

Avoid new trades during high-impact news.

Trailing SL = Your Getaway Car! Lock profits before volatility strikes.

💥 BOOST THIS HEIST – STRENGTHEN THE GANG!

👉 Smash the LIKE & BOOST button to fuel our next market robbery!

👉 Follow for more heists—profit awaits! 🚀💰

🦹♂️ Stay Sharp, Stay Ruthless… See You on the Next Heist!

DeGRAM | EURGBP is testing the upper boundary of the channel📊 Technical Analysis

● EURGBP confirmed a breakout from both the wedge and prior descending trendline, now holding above 0.8720 and grinding along the rising intraday channel.

● Bullish continuation is supported by a double retest of the wedge top, with 0.8751 as the next upside target in line with the channel resistance.

💡 Fundamental Analysis

● GBP weakened after dovish BoE statement warning of economic stagnation, while the Euro gained from improved German factory orders and hawkish ECB commentary.

✨ Summary

Buy above 0.8720; breakout continuation eyes 0.8751. Bull bias void on a 1 h close below 0.8710.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EURGBP Bullish Momentum Trade PlanWatching EUR/GBP closely 🔍 — after an extended bullish trend 🐂 and a sharp corrective pullback 📉, we’re now seeing renewed upside momentum and signs of bullish continuation 📈. My current bias is long ✅. Price has retraced back into equilibrium, and with movement beginning to pick up, I’m actively hunting for an entry 🎯 — aiming for a retest of the previous high, with stops tucked below the most recent low 🛡️. Everything is broken down in the video and should not be taken as financial advice ⚠️.

DeGRAM | EURGBP exited the channel📊 Technical Analysis

● Breakout: price burst from the July descending wedge, reclaimed 0.8695 former cap, and is now riding a steep intraday channel of higher-highs; the channel mid-line aligns with the broken wedge roof, adding fresh support.

● A pennant is consolidating just above 0.8695; its measured pole and the outer channel top converge at the next horizontal barrier 0.8739.

💡 Fundamental Analysis

● Softer UK July composite-PMI (47.9 vs 50.2 prior) revived BoE cut bets, while ECB speakers flagged “premature to talk easing,” narrowing the rate gap in the euro’s favour.

✨ Summary

Long 0.8695-0.8705; pennant break targets 0.8739. Bias void on a 30 m close below 0.8648.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!