TheGrove | EURUSD buy | Idea Trading AnalysisEURUSD broke through multiple Support level and is now holding above the trendline and key level zone. The current pullback toward the marked support cluster suggests a potential continuation of the bullish move, provided price holds this structure.

EUR/USD is trading within a rising channel, with price holding above the ascending support line after a clear bullish and is moving on Resistance LEVEL.

Hello Traders, here is the full analysis.

GOOD LUCK! Great BUY opportunity EURUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

Eurusdsignal

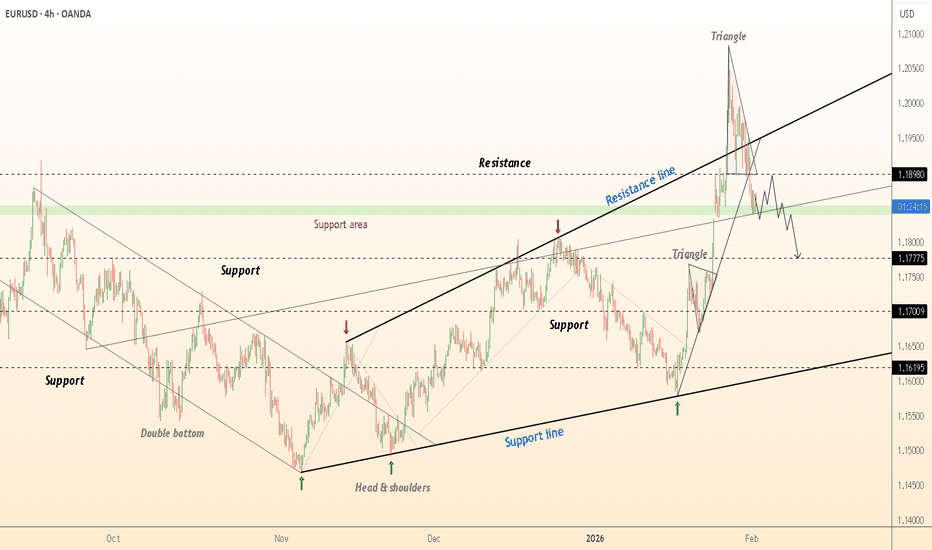

DeGRAM | EURUSD exited from the triangle📊 Technical Analysis

● Price completed a corrective decline and rebounded from a rising support line, forming a new higher low and signaling bullish structure recovery.

● A short-term triangle consolidation is developing just below the resistance area (~1.190–1.195), suggesting accumulation before a breakout toward higher resistance levels near 1.199 and 1.203.

💡 Fundamental Analysis

● The euro remains supported as markets price in a cautious ECB stance, while US data shows signs of slowing momentum, pressuring the dollar.

● Reduced USD demand amid softer macro expectations supports short-term EUR/USD upside continuation.

✨ Summary

Higher low confirmed, triangle breakout pending; key resistance at 1.195–1.199, upside bias holds while price stays above rising support.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | EURUSD is testing the resistance area📊 Technical Analysis

● After a descending trend and triangle breakdown, price formed a rising support line and recently broke above the resistance area (~1.1840–1.1850), signaling shift from bearish to bullish control.

● Higher highs & higher lows have formed with sustained break above the 1.1872 and 1.1899 key resistances, confirming momentum toward next targets at ~1.1950 and ~1.1985.

💡 Fundamental Analysis

● Euro strength picks up as ECB rate hold but hawkish bias persists, supporting EUR vs USD.

● Soft US data and expectations of delayed Fed cuts weaken the dollar, boosting EUR/USD upside.

✨ Summary

Trend flip confirmed above resistance area; rising structure targets 1.1950–1.1985; ECB hawkish and weaker USD support upside.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | EURUSD sideways movement📊 Technical Analysis

● $EUR/USD is currently testing support around 1.1780 after forming a series of lower highs.

● A triangle formation suggests a potential breakout, with the resistance area at 1.1810.

💡 Fundamental Analysis

● Recent weaker-than-expected US data has fueled speculation about a dovish stance from the Federal Reserve, strengthening the Euro.

✨ Summary

● Expect a breakout above 1.1795 with targets at 1.1809 and 1.1815.

● Key support at 1.1775, critical for sustaining the bullish momentum.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

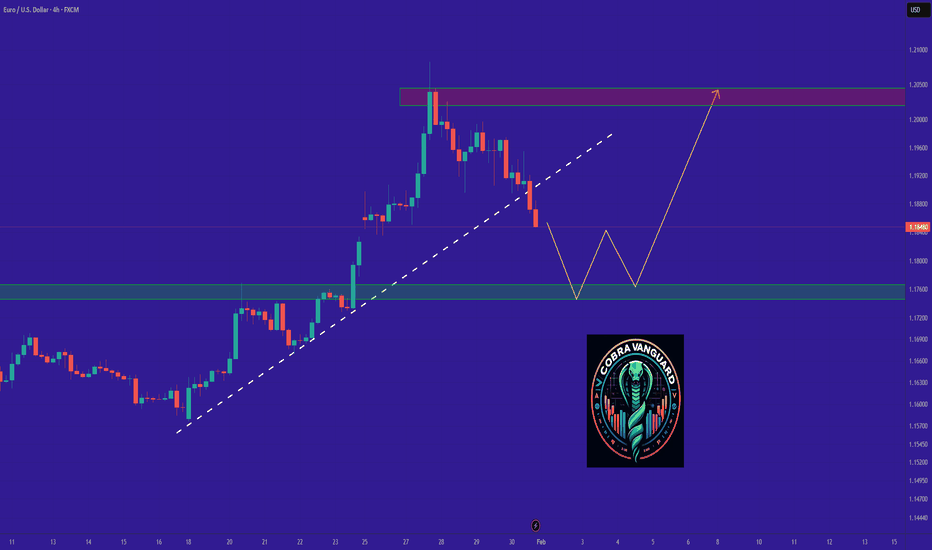

EURUSD Cooling Off After the Rally – Where’s the Real Entry?1️⃣ What happened recently

After a strong bullish leg that pushed EURUSD close to 1.2100, the pair entered a corrective phase.

Over the past few days, price action has shifted into a tight consolidation, showing a temporary balance between buyers and sellers after the impulsive move higher.

2️⃣ Key question

Is this consolidation just a pause before another push higher, or the start of a deeper correction?

3️⃣ Why a continuation higher is possible

- The impulsive move up suggests underlying bullish pressure.

- 1.2100 has become a newly formed resistance and a natural magnet for price.

- A break and hold back above 1.1850 would signal renewed bullish intent and increase the probability of a retest of 1.21.

4️⃣ Trading plan

Despite the bullish potential, chasing price at current levels offers poor risk-to-reward.

From my perspective, the only trade that justifies the risk is buying a deeper dip.

➡️ The zone around 1.1720 is the area of interest.

➡️ A spike into that region could provide a better entry.

➡️ Strategy: buy dips into 1.1720, not the break above short term resistance.

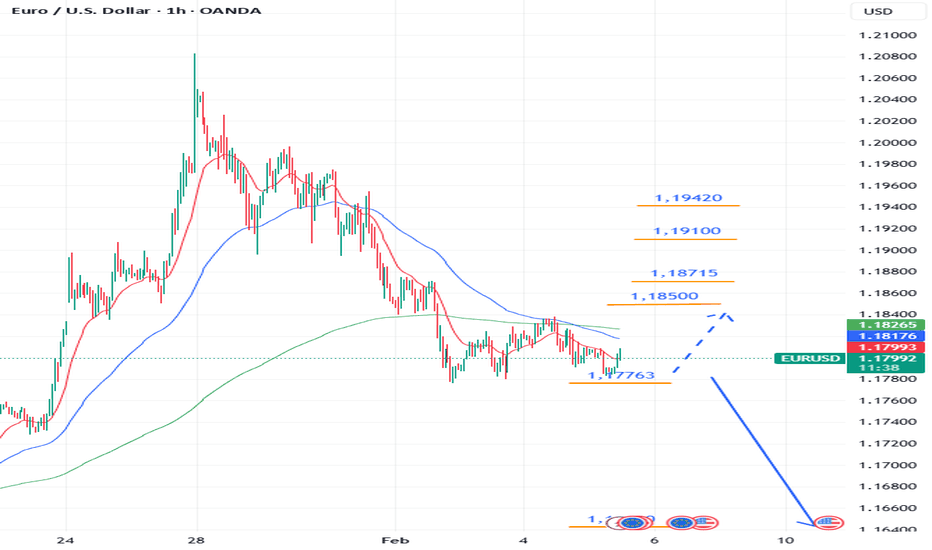

Coinranger|EURUSD. Continued decline🔹DXY continues to move higher. Potential to reach 98.353 - the first extension of the upward move

🔹This evening at 18:00 UTC+3, the JOLTS employment report

🔹The earnings season continues in the US.

By level:

Above

1.18500 - first upward move

1.18715 - or here

1.19100 - full upward move

1.19420 - first extension

Below

1.17763 - full downward move

1.16500 - first downward extension

There's a chance of a slight pullback and then a further decline, or a significant drop from the current level. There are a potential early stops possible at M15 levels.

---------------

Share your thoughts in the comments!

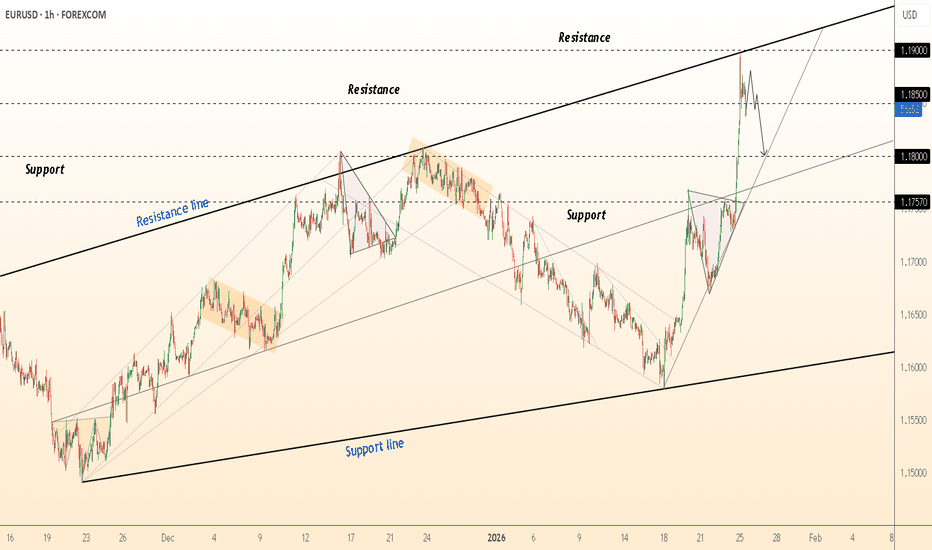

DeGRAM | EURUSD will retest the support area📊 Technical Analysis

● EUR/USD is holding above a well-defined short-term support area near 1.1780–1.1800, where multiple reactions confirm active buying interest. Price continues to form higher lows along the ascending support line, signaling a constructive recovery phase.

● The pair is consolidating below a flat-to-rising resistance line around 1.1830–1.1860. A successful pullback and bounce from support favors a continuation move toward this resistance zone, with bullish structure intact while above 1.1780.

💡 Fundamental Analysis

● Softer USD momentum amid mixed US macro data and stabilizing risk sentiment supports short-term EUR strength.

✨ Summary

● Price is supported above 1.1780 with higher lows in place.

● Short-term upside toward 1.1830–1.1860 is favored while support holds.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Coinranger|EURUSD. Potential return to growth🔹DXY has made its first wave up. The potential of a move is still up to 97.43, but we could already be starting to reverse.

🔹Manufacturing PMI (18:00 UTC+3) and budget funding vote today

🔹The earnings season continues in the US

Levels:

Above

1.21657 - first extension up

1.20657 - full set up

1.20000 - first wave up

Below

1.18470 - first wave down

1.17763 - full set down

1.16500 - first extension down

The situation is unclear for now. While the PMI will influence the trend, it's difficult to say how the pice will react on the vote. Let's watch the US session.

---------------

Share your thoughts in the comments!

DeGRAM | EURUSD fixed under the resistance line📊 Technical Analysis

● EUR/USD is trading near the upper boundary of a rising structure, where price has formed a tightening triangle after a sharp impulsive rally, signaling exhaustion. Rejection from the descending resistance line around 1.1900 highlights strong supply pressure.

● Multiple historical reactions from this zone and a loss of short-term momentum suggest a corrective move toward the 1.1780–1.1700 support area, aligned with prior structure and trendline support.

💡 Fundamental Analysis

● Expectations of prolonged restrictive US monetary policy and resilient US macro data continue to support the dollar, limiting EUR upside in the medium term.

✨ Summary

● Price is capped below key resistance near 1.1900.

● Medium-term downside toward 1.1780–1.1700 is favored while below resistance.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | EURUSD is forming a descending triangle📊 Technical Analysis

● EUR/USD continues to respect a descending resistance line, but repeated defenses of the 1.1900 support area signal selling pressure is weakening. Higher lows near support and a failed breakdown suggest a short-term base is forming.

● Price is consolidating below resistance around 1.1970–1.2000, with a potential bullish correction targeting the descending trendline if 1.1900 holds.

💡 Fundamental Analysis

● Softer US macro momentum and expectations of a more cautious Fed stance are limiting USD upside, allowing room for a short-term EUR rebound.

✨ Summary

● Strong support near 1.1900 remains intact.

● A short-term recovery toward 1.1970–1.2000 is favored while above 1.1900.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

EURUSD possible bullish for 1.2070-80#EURUSD broke and closed above 1.1918 which is the strong resistance level of last year and the high of 17th september 2025. need corrective wave to test demand zone for another leg higher. patience is the main key in trading. 1.172-1.1670 daily demand zone for long. stop loss 1.1660, target: 1.2070.

Coinranger|EURUSD. Uncertainty at 1.19906🔹DXY has completed a full set of downward extensions on h1. Ideally, it should pullback, but its size is still uncertain. We could continue to fall.

🔹Today at 22 UTC+3 is the Fed rate. At 22:30 UTC+3 is the FOMC press conference. The rate is expected to remain at the same level as before - 3.75%.

🔹It's earnings season in the US.

Levels:

Above

1.12319 - the first extension on the h4

1.21042 - the first extension on the h1

1.20600 - a full set on the h4

Below

1.19100 - potential pullback if we don't hold at current levels soon or don't move higher.

It's difficult to say anything specific yet; minor movements are occurring on the euro on the m5/m15, which will likely determine our next move by this evening.

---------------

Share your thoughts in the comments!

EURUSD 4H Bullish Continuation | ERL→IRL & HTF Draw on LiquidityHello traders,

In this 4-hour EURUSD analysis, my bias remains bullish, fully aligned with the higher-timeframe structure and the ERL → IRL concept toward a clear draw on liquidity.

From a structural perspective, price is showing strong bullish order flow, consistently respecting bullish PD Arrays, which confirms institutional bullish intent. After breaking above the previous week’s high (external liquidity), the market formed a bullish Fair Value Gap (FVG) — a key area of interest for continuation.

📌 Primary expectation:

Price retraces into the 4H bullish FVG, where I will wait for lower-timeframe confirmation before considering long positions toward the next liquidity draw.

📌 Alternative continuation condition:

Since price is currently trading within the bullish FVG, if a 1H candle closes above the 1AM candle, that candle can be considered a bullish order block, offering an earlier continuation entry toward the draw on liquidity.

⚠️ As always, execution depends on confirmation and proper risk management.

Let the price do the talking 📈

Coinranger|EURUSD. Potential for a decline to 1.17619🔹DXY fell even more overnight than on Friday. It could go even lower, but it's unlikely to do so without a reversal.

🔹No interesting news on the euro today.

🔹Earnings season is starting in the US, but there's nothing particularly interesting there today.

According to current levels on EUR:

Below:

Preliminary wave set for M15

1.17924

1.17619

1.17060

Above:

1.18448 - the end of the first upward extension

1.18752 - the end of the second upward extension (we may return here)

1.19135 - the first wave in a new set

After a significant rise, we're likely to correct today, most likely to 1.17619

-------------------

Share your thoughts in the comments!

DeGRAM | EURUSD will achieve the $1.18📊 Technical Analysis

● EUR/USD has reached the upper boundary of a broad ascending channel and printed a sharp impulsive rally into major resistance near 1.1900, signaling potential exhaustion.

● Price action shows a steep corrective structure after a vertical move, with a projected pullback toward the broken support zone around 1.1800–1.1750.

💡 Fundamental Analysis

● Persistent USD demand is supported by expectations of prolonged restrictive Fed policy, while ECB rhetoric remains cautious, limiting further EUR upside.

✨ Summary

● The pair is overstretched at channel resistance.

● Short-term downside correction is favored toward 1.1800, with invalidation above 1.1900.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | EURUSD will test the support area📊 Technical Analysis

● EUR/USD is in a bullish trend after breaking out from a descending channel, forming an ascending wedge.

● The price is testing resistance levels near 1.17794, with the support line from the previous triangle formation holding strong.

💡 Fundamental Analysis

●Recent market sentiment is bullish, with expectations for a potential rate hike in the Eurozone, supporting EUR strength.

✨ Summary

● EUR/USD shows a bullish structure, with key resistance at 1.17794 and support at 1.17200.

● Look for a break above 1.17794 for further upside momentum.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

EURUSD 4H Bullish Continuation | ERL → IRL Liquidity ModelFollowing my previous daily bullish bias, EURUSD continues to respect the ERL to IRL liquidity framework. Price has already grabbed the liquidity above the previous day’s high, fulfilling the external liquidity objective.

Currently, price is trading within a bullish 4-hour Fair Value Gap (FVG). As long as this PD array holds, I expect a bullish reaction from this zone, followed by a continuation toward higher prices.

The overall structure and higher-time-frame context support the idea of another bullish leg from this area.

Invalidation occurs if price closes decisively below the bullish 4H FVG.

EURUSD Daily Bullish Outlook | ERL → IRL Hello traders,

In this daily timeframe analysis of EURUSD, I remain bullish, supported by multiple higher-time-frame confluences.

After a strong bullish leg, price has retraced more than 50% of the previous impulse, bringing it into a discount zone, which aligns perfectly with a bullish daily Fair Value Gap (FVG) and a previous inversion level. This area represents strong institutional interest.

From a liquidity perspective, the market appears to be rotating from ERL (External Range Liquidity) into IRL (Internal Range Liquidity), which commonly precedes continuation in the direction of the higher-time-frame bias.

As long as price respects this daily bullish FVG, I expect bullish continuation and a push toward higher prices, targeting external liquidity on the upside.

This idea becomes invalid if price delivers a strong daily close below the bullish FVG.

Trade safe and manage risk properly.

Cheers 🍀

DeGRAM | EURUSD will return to 1.1715📊 Technical Analysis

● EUR/USD is consolidating inside a narrowing triangle after a strong impulsive rally, with price holding above the rising support line and forming higher lows, indicating sustained bullish pressure.

● Repeated rejections from the descending resistance line suggest compression, while support near 1.1670–1.1680 continues to attract buyers, favoring a breakout toward 1.1730–1.1760 if the structure holds.

💡 Fundamental Analysis

● The euro remains supported by easing USD momentum amid expectations of a more cautious Fed stance and stable Eurozone macro data, reducing downside pressure on EUR/USD.

✨ Summary

● Short-term bullish bias within a compression pattern. Key support at 1.1670. Upside targets lie near 1.1730 and 1.1760 while price stays above the rising support line.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Coinranger|EURUSD. Uncertainty at 1.17375. Continued🔹Yesterday, the DXY failed to achieve a reversal, and today there's nothing left to do one.

🔹Davos continues.

🔹All the interesting news on the euro has already been released at the time of this post issue.

The levels are the same:

Below:

Will be recalculated on Monday.

1.16827 - the first wave down on m15

1.16470 and 1.16200 - a potential first wave down on h1

Above:

1.17658 - 1.17788 - the first potential wave in a new uptrend. This is a full set on m15

1.17917 - additional level above on m15 (not marked on the chart)

So far, the story looks more like growth, but there's simply nothing to support a serious one. Therefore, we're moving within the old markings.

------------------

Share your opinion in the comments

DeGRAM | EURUSD formed the descending wedge📊 Technical Analysis

● EUR/USD rebounded sharply from the medium-term support area near 1.1680, breaking the descending channel and reclaiming the rising support line, which signals a structural shift toward higher lows.

● Price is consolidating inside a descending wedge after the impulse move, suggesting a bullish continuation toward the upper resistance zone if the wedge resolves upward.

💡 Fundamental Analysis

● The euro is supported by easing USD momentum amid softer US data expectations and a more balanced Fed outlook, improving risk sentiment in favor of EUR.

✨ Summary

● Bullish medium-term bias. Key support: 1.1680–1.1700. Upside targets: 1.1738 → 1.1758, with continuation favored while above rising support.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | EURUSD broke a descending structure📊 Technical Analysis

● EUR/USD has broken above the former descending trend and is now holding above the key support zone near 1.1653–1.1661, with a strong impulsive leg indicating buyer conviction.

● The upward move formed higher highs and is now targeting the resistance trendline around 1.1672–1.1695; repeated rejections at these levels would confirm short-term strength.

💡 Fundamental Analysis

● Euro strength is supported by softer USD momentum as markets price easing US rate expectations and improving Eurozone risk sentiment, boosting short-term EUR demand.

✨ Summary

● Bullish continuation above 1.1653 support. Near-term targets: 1.1672 → 1.1695. Momentum remains positive while above the support zone.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!