Eurusdtradesignal

EUR/USD 4H Technical Analysis: Breakout Confirmation & Next MoveOn the 4-hour timeframe, EUR/USD has successfully broken out of a long-term descending trendline. After the breakout, the pair made a retest, confirming bullish continuation. Currently price is slightly correcting downward but still holding above key support zones.

🔍 Key Technical Highlights

📌 1. Breakout From Downtrend

The downward sloping trendline has been broken.

Price retested the breakout area — confirming valid breakout.

📌 2. Moving Averages (SMA Support)

SMA (9) remains above SMA (20) — showing short-term bullish momentum.

Current correction is holding around SMA (20), acting as support.

📌 3. Higher Lows Forming

Since mid-November, price has been forming higher lows.

This pattern supports bullish continuation.

📊 Important Price Levels

Zone Type Price

Immediate Support 1.1600

SMA Support Zone 1.1625

Major Support 1.1500

Immediate Resistance 1.1680

Major Resistance 1.1750

🧭 Market Sentiment

Bias remains bullish as long as:

EUR/USD trades above 1.1600

No strong candle closes below SMA (20)

🎯 Potential Future Scenarios

📈 Bullish Scenario

If price bounces from 1.1625 and breaks 1.1680:

➡️ Next Target: 1.1750

📉 Bearish Scenario

If price drops below 1.1600:

➡️ Next Downside Target: 1.1500

Outlook Summary

Trend Direction Confidence

Bullish Uptrend Medium–Strong

Frequently Asked Questions

Q1: Should traders look for buying opportunities?

Yes — above 1.1600, but with bullish confirmation.

Q2: Where is short (sell) opportunity?

Below 1.1600 (strong candle close preferred).

Q3: Was the breakout fake?

No. The breakout and retest confirm validity.

📌 Final Thoughts

EUR/USD remains technically bullish. The breakout structure is healthy, moving averages support the trend, and the market may aim for 1.1750 if 1.1680 breaks.

Analysis of the New Dimension of Multi-Core Logic TradingSubdivided highlights of the economic recovery in the Eurozone provide fundamental support: The Eurozone economy is not completely weak; there are structural recovery highlights that support the euro. The comprehensive PMI in October rose to 52.2, reaching a new high in 17 months, and has maintained an expansionary trend for 10 consecutive months. Among the core economies, Germany performed outstandingly, with its PMI index reaching the best since May 2023. Industrial orders rebounded month-on-month, and export data also showed signs of recovery. As the engine of the Eurozone economy, Germany's recovery provided a solid economic foundation for the euro. At the same time, the Eurozone's CPI rose by 2.2% year-on-year in September, approaching the 2% inflation target of the European Central Bank. This moderate inflation state avoided the risk of deflation and did not require concerns about aggressive policy adjustments due to excessive inflation, creating favorable conditions for the stable strengthening of the euro.

Increased potential weakness scenarios for the US dollar are beneficial for the euro's upward movement: The current resilience of the US dollar is not flawless, and there are multiple factors that may trigger a correction. On the one hand, the market's expectation for a 12-month Fed rate cut has reached 65%. If the subsequent US consumer or employment data shows a slight decline, it will further strengthen the expectation of a rate cut, putting pressure on the US dollar index. On the other hand, the US dollar index has been fluctuating around 99.50 recently, lacking the strong momentum for continuous upward movement. If it fails to break through, a large number of profit-taking sell orders may trigger a rapid decline in the US dollar. While the euro is the main rival currency of the US dollar, it often gains significant upward momentum when the US dollar weakens. This provides a favorable external environment for the euro to rise against the US dollar.

Short-term technical indicators show a bullish launch signal: From the short-term K-line perspective, the euro against the US dollar has formed a small upward trend with gradually rising lows at the 1-hour level. At the indicator level, the 5-day moving average is diverging upward, providing effective support for the exchange rate. Although the MACD indicator once contracted the red energy bar, it showed signs of expanding again after the low point of 1.1515, indicating that the short-term bullish momentum is reaccumulating. At the same time, the recent price movement has seen an increase in trading volume simultaneously, with good volume-price coordination, confirming the validity of the current upward trend, and the RSI indicator is in the neutral to strong range of 55, not reaching the overbought threshold, indicating that there is still upward space in the short term, providing technical basis for short-term bullish trading.

Trading Strategy for EUR/USD

buy:1.15000-1.15100

tp:1.15500-1.15800

sl:1.14800

EUR/USD weakened (depreciated) and traded around 1.1550EUR/USD weakened (depreciated) and traded around 1.1550 after experiencing three consecutive days of losses. This weakening was caused by a strengthening US Dollar (USD) driven by good news regarding the US government shutdown.

A. Hopes for an End to the Government Shutdown (Supporting the USD)

- Good News: The USD received support after reports that a group of centrist Democratic Senators agreed to support a deal that would reopen the US government and fund several departments for next year.

- Contents of the Deal: This agreement would ensure federal employees receive their paychecks and allow delayed federal fund transfers to resume.

B. Economic Concerns (Constraining the USD)

- Shutdown Impact: US Treasury Secretary Scott Bessent said that the impact of the US federal shutdown on the economy is worsening.

- Consumer Sentiment Falls: The US dollar weakened after the University of Michigan Consumer Sentiment Index fell sharply to 50.3 in November (the lowest since June 2022), reflecting concerns about the government shutdown.

- Inflation Outlook: Bessent expects prices to decline over the coming months.

2. Factors Supporting the Euro (EUR)

The EUR/USD pair has the potential to regain its footing as the Euro (EUR) could receive support from the divergence in monetary policy outlooks between the ECB and the Fed:

- ECB Hawkishness: Market expectations for an interest rate cut by the European Central Bank (ECB) have declined sharply (only a 45% chance of a cut by September 2026, down from 80% in October).

- ECB Official Comments: ECB officials have urged caution regarding inflation. Vice President Luis de Guindos even warned that any decline in inflation below 2% is likely to be temporary.

Outlook Conclusion:

Although the USD strengthened on news of the shutdown resolution, EUR/USD could find support due to the ECB's relatively more hawkish stance compared to market expectations regarding the Fed, which tends to support the Euro.

#EURUSD: +1100 Pips Selling Opportunity Comment Your Views?EUR/USD has consolidated on the weekly timeframe and recently shown signs of distribution, suggesting a potential downward move. As of the latest market data, EUR/USD is trading around 1.0670, having failed to hold above the 1.0750 resistance zone. Furthermore, the pair has slipped below the 50-day moving average, indicating weakening bullish momentum.

The European Central Bank has maintained interest rates at 4.00%, while the Federal Reserve has hinted at keeping rates higher for longer, strengthening the US dollar. Recent US data, including a better-than-expected Non-Farm Payrolls report and a stable CPI at 3.2%, further supports the downside bias in EUR/USD.

This setup presents a swing selling opportunity with a primary target near 1.0550, aligning with the previous support zone. Traders may consider using smaller interim targets, such as 1.0620 and 1.0580, while adjusting positions according to their trading plans and risk management strategies.

Good luck and trade safely!

Team Setupsfx_

EUR/USD Bullish Continuation in Play — How High Can It Go?💶 EUR/USD “THE FIBRE” | Forex Money Liquidity Hunt Plan (Swing/Day Trade) 📊💼

📈 Trading Plan: Bullish Bias

Setup: Demand Zone 🔥 + Heikin Ashi Doji reversal confirmed 🟢 + Re-Accumulation spotted (buyers stepping in).

Narrative: Market showing strong intent from bulls, eyeing higher liquidity pools 🏦.

🎯 Entry Strategy (Layering Method)

We don’t chase — we layer! 🧑💼

Multiple limit orders (layered entries) can be set around these levels:

1.16500

1.16750

1.17000

1.17250

1.17500

(Traders may adjust / expand layering based on their style ✅).

🛡️ Stop Loss Guidance

Example SL: 1.16000 (below demand zone structure).

⚠️ Note: Adjust based on your own risk tolerance + strategy — flexibility is key.

🎯 Target Zone

Key Resistance: ~1.19500 ⚔️

Momentum shows overbought risk + possible liquidity trap in that area 🚨.

Best practice: Secure profits early, scale out gradually.

🔑 Key Notes for Traders

This is not financial advice 🚫. Manage risk, adapt levels, and trade safe.

Targets/SL shared are reference points only — every trader is responsible for their own execution.

🌍 Related Pairs to Watch

OANDA:EURGBP : Often mirrors EUR strength but reacts slower — useful for cross confirmation.

FX:USDJPY : Inverse correlation with risk appetite; USD weakness here may boost EUR/USD.

TVC:DXY (US Dollar Index): Always track! If TVC:DXY drops, EUR/USD usually pushes higher.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#EURUSD #Forex #SwingTrade #DayTrading #HeikinAshi #LiquidityHunt #LayeringStrategy #TradingPlan #PriceAction #DemandZone

EURUSD: wedge narrowing with downside targets in sightOn the daily chart, EURUSD has formed a rising wedge pattern, and the current price action indicates readiness for a decline. Attempts to hold above 1.1800 have failed, pressure has increased, and last week’s close can be viewed as a potential false breakout.

The first downside target is at 1.1413, where a strong support level lies. Further targets may shift to 1.0750 and 1.0480 levels that have accumulated significant volume over the past few months. A full breakdown of the wedge would give momentum to the bearish scenario and increase pressure on the euro.

From a fundamental perspective, the picture remains mixed: the 200 EMA capping from above and the sideways movement in the dollar index confirm the likelihood of euro weakness, but every pullback continues to be aggressively bought, preventing a collapse. If the dollar gains additional support from US macroeconomic data or Federal Reserve policy, the bearish scenario will become dominant.

EURUSD Analysis: Pullback, Structure Break, and Next Trade Setup📈 EURUSD remains in a strong bullish trend. After experiencing a deep pullback, we’re now beginning to see signs of a bullish structure break on the 30-minute timeframe ⏱️.

📊 In my previous analysis, I highlighted that price was becoming overextended and a sharp retracement was likely. That scenario has now played out ✅.

🔎 At this stage, I’m watching closely for a valid bullish setup to present itself, at which point I’ll be looking for opportunities to go long 🚀.

⚠️ Disclaimer: This is educational analysis only and not financial advice. Always manage risk carefully.

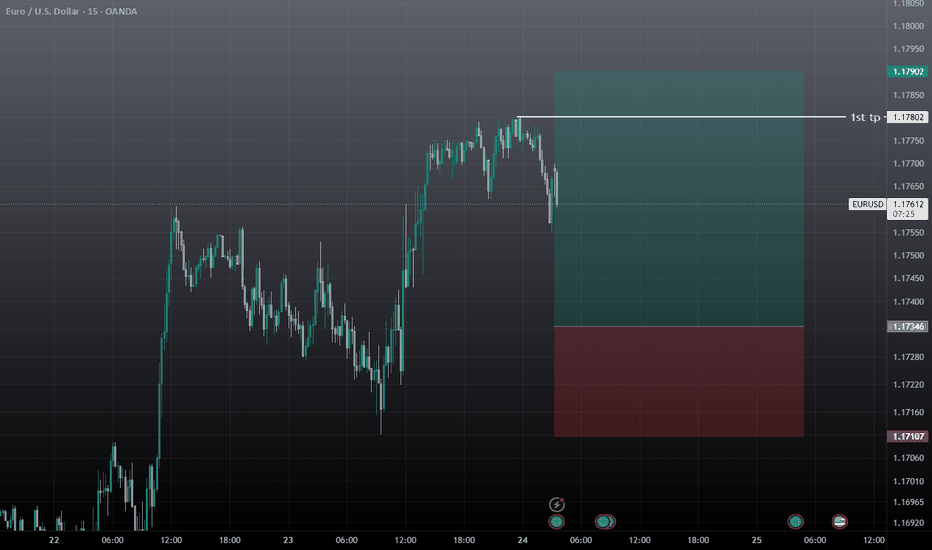

Support zone on EURUSDEURUSD is currently in a correction after its rise to 1,1730.

Yesterday, we identified a support zone between 1,1613 and 1,1552.

The price has already moved down to 1,1619 and continues to move lower.

Watch for a reaction from this zone and a potential continuation of the bullish trend.

The target is a breakout above 1,1830!

EUR/USD Structure Intact — Path Higher Remains in PlayHi Everyone,

Since the 1st August low, EUR/USD has rallied swiftly back above the 1.16000 level, reclaiming the key 1.16450 zone. If the current consolidation holds above the 1.15888–1.16170 area, this should provide a base for further upside toward 1.17889.

A sustained push into this level in the coming sessions would further confirm renewed buying interest.

Our broader outlook remains unchanged: we continue to expect the pair to build momentum for another leg higher. A decisive break above 1.18350 could open the path toward the 1.19290 area and ultimately the 1.20000 handle.

We’ll be monitoring price action closely to see whether this recovery gains traction and if buyers can maintain momentum through resistance. The longer-term outlook remains bullish, provided price continues to respect the key support zone.

We’ll keep you updated throughout the week as the structure develops and share how we’re managing our active positions.

Thanks again for all the likes, boosts, comments, and follows. We truly appreciate the support!

All the best for the rest of the week.

Trade safe.

BluetonaFX

Fiber Battle Plan: Bulls Prepare for EUR/USD Uprising🏴☠️💸 EUR/USD "Fiber Heist Plan" – Thief Trader's Bullish Raid! 💸🏴☠️

🔓 The Vault is CRACKED – Time to LOAD UP! 🚀📈💰

🎯 MASTER PLAN:

Asset: EUR/USD ("Fiber")

Direction: BULLISH HEIST 🐂💪

Entry Strategy: Layered Limit Orders (Sneaky thief-style accumulation)

Trigger: Hull MA CROSS confirmed + Price > 1.16300 🎯

Stop Loss: 1.15100 (Guarding the loot!) 🛡️

Target: 1.18000 (Bank it & bounce!) 💰🔥

🕵️ THIEF TRADER’S BREAKDOWN:

💡 "Weak hands shake, WE TAKE!" – This is a high-probability bullish raid with layered entries for MAXIMUM stealth.

✅ ENTRY TACTICS:

Buy Limit Orders stacked near swing lows (1.16300 zone)

Only trigger AFTER Hull MA confirms bullish flip (No early fomo!)

Scale in like a pro thief – don’t dump all bullets at once.

⚔️ RISK CONTROL (MANDATORY!):

SL at 1.15100 (Break this? ABORT MISSION.)

No revenge trading! Stick to the plan or get caught slippin’.

🎯 PROFIT SECURING:

First TP: 1.18000 (Lock in gains!)

Trailing SL option (If momentum stays strong, let it RUN!)

🚨 THIEF’S WARNING:

⚠️ News = Trap Zone! (Avoid fresh entries during high-impact news)

⚠️ No greed! Secure profits before the market reverses on you.

⚠️ Follow the Hull MA like a shadow – if it flips bearish, RE-EVALUATE!

🔥 SUPPORT THE HEIST!

💥 SMASH THAT LIKE & BOOST BUTTON if you're riding with the Thief Trading Crew!

💬 Comment "🚀 LOADED!" if you're in!

We steal smart, trade sharp, and stack profits like bandits. Stay lethal, traders! 🐱👤💸🔥

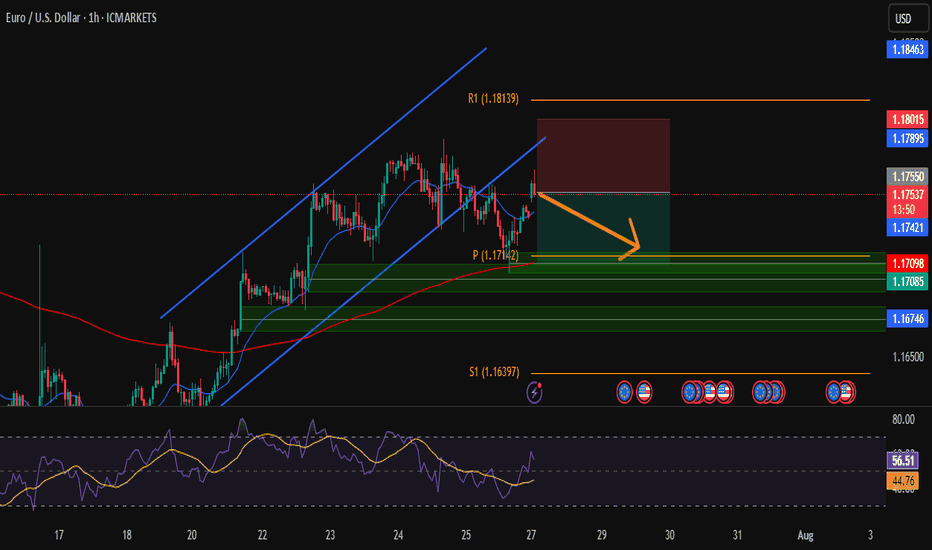

EUR/USD – Short from Channel TopHi Traders , Took a short on EUR/USD after price rejected the top of the ascending channel.

Entry: 1.17545

Stop Loss: 1.18015

Take Profit: 1.17098

📌 Why I took this trade:

Price is showing rejection at the upper trendline + near resistance (R1). RSI is cooling off, so I’m expecting a move back to the demand zone around 1.1710.

Clean structure, low risk, good reward.

Just my take, not financial advice.

What do you think — continuation or rejection?

EURUSD LONG TERM UPEURUSD Live Trading Session/ EURUSD analysis #forex #forextraining #forexHello Traders

In This Video EURUSD HOURLY Forecast By World of Forex

today EURUSD Analysis

This Video includes_ (EURUSD market update)

EURUSD Analysis today | Technical and Order Flow

#usdjpy #usdchftechnicalanalysis #usdjpytoday #gold

What is The Next Opportunity on EURUSD Market

how to Enter to the Valid Entry With Assurance Profit?

This Video is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts.

Disclaimer: Financial Trading Has Large Potential Rewards, But Also Large Potential Risk. You must be aware of the Risk and Be Welling to Accept Them in order to Trade the Financial Market . Please be Carefully With Your Money.

We are talking about future market, anything can Happen,Markets are Always like that.dnt Risky more Than 2% of your account

Now you can join with our "vip premium" service

Join us and let's make trading together

EUR/USD Holding the Line: Bullish Channel Setup!Hi traders! Analyzing EUR/USD on the 30-min timeframe, price is currently reacting near the bottom of a well-defined ascending channel, signaling a potential bullish continuation within the trend:

🔹 Entry: 1.17071

🔹 Take Profit: 1.17423

🔹 Stop Loss: 1.16825

After a corrective move downwards, price tapped into a key trendline support, aligning with prior structure and psychological level near 1.1700. The RSI is showing a bullish divergence near oversold levels, adding confluence to a possible reversal.

As long as price holds above the lower boundary of the channel, bulls may look to target the mid-to-upper region of the range, aligning with previous highs and dynamic resistance.

🟢 The trend remains intact as long as higher lows are respected.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for managing their own risk and strategy.

EUR/USD Could Take Off From Here! Strategic SetupHi traders! , Analyzing EUR/USD on the 30 minute timeframe, price is currently reacting from a strong support zone near 1.1696, showing potential for a bullish rebound after a sharp drop.

🔹 Entry: 1.1696

🔹 Take Profit (TP): 1.1770

🔹 Stop Loss (SL): 1.1621

After a strong downside move, EUR/USD is attempting a recovery from a key intraday support area. The RSI is bouncing from oversold conditions (around 34), indicating a possible short-term shift in momentum.

Price is also approaching the 200 EMA from below, and a break above could confirm bullish continuation toward the 1.1770 resistance zone. The setup offers a solid risk-reward ratio and aligns with mean reversion expectations.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for their own decisions and risk management.