Eurusdtrading

EUR/USD Price Outlook – Trade Setup📊 Technical Structure

TICKMILL:EURUSD EUR/USD is consolidating above a well-defined short-term support zone around 1.1900–1.1904 on the 15-minute timeframe after a sharp impulsive rally. Recent price action shows higher lows forming above support, indicating that downside momentum has weakened. As long as price holds above this support zone, the structure favours a bullish continuation toward the upper resistance band near 1.1923–1.1927.

🎯 Trade Setup (Bullish Bias)

Entry Zone: 1.1900 – 1.1904

Stop Loss: 1.1898

Take Profit 1: 1.1923

Take Profit 2: 1.1927

Risk–Reward Ratio: Approx. 1 : 4.4

📌 Invalidation:

A sustained break and close below 1.1898 would invalidate the bullish setup.

🌐 Macro Background

The US Dollar remains under pressure amid concerns over US lab or market weakness and growing expectations for further Federal Reserve easing. Meanwhile, the Euro is supported by stable ECB policy expectations and improving risk sentiment. In the short term, this macro backdrop supports buy-on-dips behaviour, especially when price stabilizes above key technical support.

🔑 Key Technical Levels

Resistance Zone: 1.1923 – 1.1927

Support Zone: 1.1900 – 1.1904

Bullish Invalidation: Below 1.1898

📌 Trade Summary

EUR/USD is holding above a critical intraday support zone following a strong rebound. As long as price remains above 1.1898, the bias favours buying pullbacks, targeting a move back toward the upper resistance zone.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

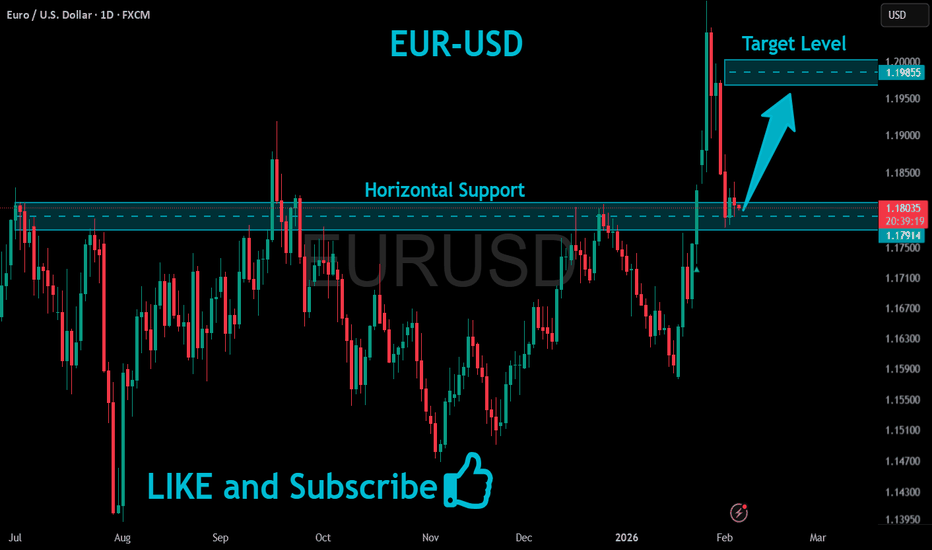

EURUSD: Bullish Bias Building After Liquidity SweepI expect a weekly low to be set below the Monday Range Low.

At the moment, I remain bullish and expect to see at least a reversal toward the marked targets above; at best, a break and expansion of the global Dealing Range.

Once the marked targets are reached, it will be necessary to reassess the situation and evaluate any new variables.

Set alerts and wait

EURUSD Rejection From Supply or Launchpad for the Next Leg Up?EURUSD is sitting at one of those decision zones where structure and macro are about to pick a winner. Price pushed hard into higher-timeframe supply, rejected, and is now grinding inside a tightening structure while dollar and yield expectations stay data-dependent. From my side, this is not a “chase the middle” spot — it’s a location trade. Either we reclaim supply and squeeze higher, or we lose structure and rotate back toward deeper demand. The fundamentals right now actually make both paths realistic — which is exactly why the levels matter more than opinions.

Current Bias

Neutral short term, mildly bullish if resistance breaks cleanly

Price is compressing after rejection from the upper supply zone. Structurally this looks like a decision range. Bias shifts bullish only on confirmed acceptance above the highlighted resistance band. Failure keeps downside rotation in play.

Key Fundamental Drivers

US side: Services PMI remains in expansion, but softer private payroll signals have slightly cooled aggressive USD strength expectations.

Fed policy: Still restrictive, but in hold mode. Market is highly sensitive to inflation prints and labor data for timing of eventual cuts.

Eurozone side: Inflation is easing but not fast enough for aggressive ECB easing. That keeps EUR from being structurally weak.

Rate spread: Still USD-supportive overall, but not widening further right now — which reduces upside momentum for USD.

Macro Context

Interest rate expectations: Fed on hold with cuts expected later rather than sooner. ECB cautious on cuts due to sticky components of inflation. That narrows forward policy divergence slightly compared with prior months.

Growth trends: US growth signals are mixed but still expansionary in services. Eurozone growth is slower but stabilizing in pockets rather than collapsing.

Commodity flows: No strong commodity shock driving EUR directly. Oil firmness supports USD via inflation expectations more than it hurts EUR specifically.

Geopolitical themes: Elevated geopolitical tension keeps safe-haven flows active at times, which tends to support USD on spikes but not always trend-sustainably.

Primary Risk to the Trend

The biggest risk to a bullish EURUSD break is a hot US inflation print that reprices Fed cuts later and pushes US yields higher. That would strengthen USD broadly and likely trigger rejection from resistance with continuation lower.

On the flip side, a soft CPI would raise the odds of a topside break.

Most Critical Upcoming News/Event

US CPI (top priority)

US payrolls / labor data follow-through

ECB speaker guidance on rate path

Those will decide whether rate spread expectations widen again toward USD — or compress toward EUR.

Leader/Lagger Dynamics

EURUSD is a major leader pair.

It often drives:

Broad USD index direction

EUR crosses like EUR/JPY and EUR/CHF

It tends to lead sentiment shifts in FX before smaller USD pairs adjust.

If EURUSD breaks higher, expect synchronized pressure in USD pairs like USD/CHF and USD/JPY.

This is not a lagging pair — it’s a tone setter.

Key Levels

Support Levels:

1.1800–1.1780 structure support zone

1.1500–1.1480 major higher-timeframe demand (green zone on chart)

Resistance Levels:

1.1900–1.1950 supply band

1.2050–1.2100 major upper resistance zone

Stop Loss (SL):

Below 1.1780 for bullish structure idea

Or below 1.1480 for wider swing positioning

Take Profit (TP):

TP1: 1.1950 zone

TP2: 1.2050–1.2100 zone

Summary: Bias and Watchpoints

EURUSD is in a decision range with a neutral short-term bias and a conditional bullish tilt if price can reclaim and hold above the 1.1900–1.1950 supply zone. The fundamental backdrop is balanced: Fed still restrictive but not tightening further, ECB cautious but not aggressively dovish. The main threat to upside is a hot US CPI that drives yields and USD higher. Key invalidation for the bullish structure sits below 1.1780, with deeper protection near 1.1480. Upside targets sit at 1.1950 first, then 1.2050–1.2100 if acceptance occurs. As a leader pair, whichever side EURUSD breaks will likely echo across the broader USD complex.

EURUSD: Is this a start of swing bullish move? Comment your viewThe EURUSD price is currently trading at a crucial level, potentially signalling a strong bullish reversal. We need to confirm a break of the bearish pressure trendline; once achieved, it will be a strong reversal signal. Enter with strict risk management.

If you like our idea, please like and comment below with your thoughts on this move.

Team Setupsfx_

EUR/USD Price Outlook – Trade Setup📊 Technical Structure

TICKMILL:EURUSD EUR/USD is facing strong selling pressure around the 1.1800–1.1810 resistance zone, where multiple rejection candles have formed. The pair failed to hold above the rising trendline, signalling a false breakout and momentum exhaustion. Price action remains capped below resistance, suggesting the recent rebound is corrective rather than impulsive. As long as EUR/USD stays below 1.1820, the short-term structure favours bearish continuation.

🎯 Trade Setup (Bearish)

Entry Zone: 1.1802 – 1.1810

Stop Loss: 1.1815

Take Profit 1: 1.1750

Take Profit 2: 1.1740

Risk–Reward (R:R): Approximately 1 : 3.99

📌 Invalidation:

This bearish setup is invalidated if price closes firmly above 1.1815.

🌐 Macro Background

From a macro perspective, market sentiment remains cautious ahead of the ECB interest rate decision, supporting a defensive USD tone. Although stronger-than-expected German Factory Orders offered temporary support to the Euro, investors are reluctant to chase upside. Any dovish nuance or concern from the ECB regarding recent Euro strength could reinforce downside pressure on EUR/USD.

🔑 Key Technical Levels

Resistance Zone: 1.1802 – 1.1810

Support Zone: 1.1740 – 1.1750

Bearish Invalidation Level: Above 1.1815

📌 Trade Summary

EUR/USD remains technically weak below key resistance, with price action favouring a sell-on-rallies approach. Unless the pair reclaims and holds above 1.1820, the downside bias toward the 1.1750 support zone remains intact.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

EUR/USD Mean Reversion Opportunity | Bearish Bias🎯 EUR/USD "THE FIBER" - BEARISH HEIST SETUP | Day Trade Alert 💰

📊 ASSET BREAKDOWN

Pair: EUR/USD (Euro/US Dollar) - "The Fiber" 🌍💵

Market: Forex | Major Currency Pair

Session Focus: European + US Overlap (High Liquidity Zone)

Trade Style: Day Trade Setup - Bearish Bias 🐻📉

🎯 TRADE PLAN - THE HEIST BLUEPRINT

🔴 Entry Strategy

Entry Zone: Any Current Price Level (Market Execution Preferred)

Bias: Bearish Momentum Expected

🎁 Target Zone - "THE VAULT"

TP Level: 1.17500 🏦💎

Reasoning: Moving Average acting as police barricade 🚧 = Strong Support + Oversold Conditions + Bull Trap Formation + Technical Correction Zone = Escape Route with Profits! 💸

⚠️ Note for Thief OG's: This TP is MY level, not financial advice. You make YOUR money, you take YOUR money at YOUR risk. Your bag, your rules! 🎒✨

🛑 Stop Loss - "THE EMERGENCY EXIT"

SL Level: 1.18200 🚨

Thief's Insurance Policy - Protect your capital, protect your craft!

⚠️ Note for Thief OG's: This SL is MY safety net. Trade smart, not hard. Your risk tolerance = your decision. Don't let the market rob YOU! 🏃♂️💨

🔗 CORRELATED PAIRS TO WATCH - THE CREW 👀

💵 USD Pairs (Dollar Strength Plays)

GBP/USD (Cable) - Watch for USD strength confirmation

USD/JPY (The Gopher) - Risk-on/Risk-off sentiment gauge

USD/CHF (The Swissie) - Safe-haven flow indicator

AUD/USD (The Aussie) - Commodity currency correlation

NZD/USD (The Kiwi) - Risk appetite barometer

🌍 EUR Cross Pairs (Euro Weakness Plays)

EUR/GBP - European currency dynamics

EUR/JPY - Euro risk sentiment

EUR/CHF - Regional strength comparison

📈 Key Correlation Points:

DXY (US Dollar Index) ⬆️ = EUR/USD ⬇️ (Inverse correlation)

If USD pairs rally together → Strong dollar environment = EUR/USD bearish ✅

If EUR crosses weaken → Euro weakness = Support for bearish setup ✅

📰 FUNDAMENTAL & ECONOMIC FACTORS - THE INTEL 🕵️♂️

🇺🇸 US Economic Factors (USD Bullish Drivers)

Federal Reserve Policy: Hawkish stance + higher-for-longer rates narrative 📈

US Economic Data: Strong employment data (NFP) + resilient GDP growth

Inflation Watch: Core PCE, CPI data influencing Fed decisions

Treasury Yields: Rising 10Y yields = USD demand ⬆️

🇪🇺 Eurozone Economic Factors (EUR Bearish Risks)

ECB Policy Divergence: Potential rate cut discussions vs Fed hawkishness

Economic Growth: Sluggish German manufacturing + EU recession concerns

Energy Prices: European energy dependency = economic headwind

Political Uncertainty: EU fiscal policy debates

📅 UPCOMING NEWS TO WATCH ⏰

US NFP (Non-Farm Payrolls) - Major USD volatility event

FOMC Minutes/Speeches - Fed policy direction clues

ECB Press Conference - Euro rate path guidance

US CPI/PPI Reports - Inflation trajectory data

EU PMI Data - Economic health indicators

Retail Sales (US & EU) - Consumer strength metrics

🎲 Risk Events:

Geopolitical tensions affecting EUR sentiment

Central bank surprise announcements

Energy market shocks impacting Eurozone

🎭 THIEF TRADER STYLE - MOTIVATION VAULT 💪

"The market doesn't reward the greedy; it rewards the patient thief who knows when to strike." 🦊💰

"Bulls make money, bears make money, pigs get slaughtered—but THIEVES? We take what the market gives and vanish into profit!" 🏃♂️💨✨

"Every trade is a heist. Plan your entry, execute flawlessly, and escape with the bag before the market knows you were there." 🎯🎒

"Stop losses aren't losses—they're the cost of doing business in the greatest casino on Earth. Protect your capital like it's the Crown Jewels!" 👑🛡️

"Technical analysis is your blueprint. Fundamentals are your intel. Risk management is your getaway car. NEVER forget the car!" 🚗💨

"In trading, like in heists: Amateurs focus on the prize. Professionals focus on the exit strategy." 🚪✅

"The best traders don't predict the future—they prepare for multiple scenarios and profit from ANY outcome." 🧠📊

⚡ FINAL WORDS FROM THE THIEF 🎩

Ladies & Gentlemen, Thief OG's, market ninjas, and chart wizards!

This ain't financial advice—this is a treasure map 🗺️. Whether you follow it or forge your own path, remember: The market pays those who respect it and punishes those who don't.

Set your alerts 🔔, manage your risk 🛡️, and may the pips be ever in your favor! 🍀💵

Stay sharp. Stay profitable. Stay legendary. 🔥👑

💬 Drop a 🚀 if you're riding this trade with me! Comment your TP level below! 👇

🔥 LIKE & FOLLOW for more Thief-Style setups that print! 💰📈

#EURUSD: Three Take Profit With One Swing Entry! 2026 TargetDear Traders, 🚀

Hope you are doing great, we have an excellent opportunity coming up for EURUSD, buying at our buying zone can be beneficial for swing traders. There is one entry zone, and there are three targets or take profit points. We are expecting the trade to completed by end of the year.

We will keep you all updated❤️

Team Setupsfx_

#EURUSD: +548 Pips Opportunity; Entry at Drawn Area! The EURUSD price is likely to reject from the drawn area presenting a potential buying opportunity. This could be a swing trade with a target of approximately 548 pips. Three targets are available for selection to suit your trading plan.

Team Setupsfx_🚀❤️

EUR/USD Price Outlook – Trade Setup📊 Technical Structure

TICKMILL:EURUSD EUR/USD is showing signs of short-term exhaustion after failing to sustain momentum above the 1.1955–1.1975 resistance zone. Price has started to rotate lower, suggesting that sellers are stepping in near the supply area following the recent rally.

The structure favours a corrective downside move as long as price remains capped below resistance. The projected path indicates a minor pullback toward resistance for liquidity before a continuation lower toward the 1.1860–1.1845 support zone.

🎯 Trade Setup (Bearish Bias)

Entry Zone: 1.1955 – 1.1975

Stop Loss: 1.2005

Take Profit 1: 1.1860

Take Profit 2: 1.1845

Risk–Reward Ratio: Approx. 1 : 2.31

📌 Invalidation:

A sustained break and close above 1.2000 would invalidate the bearish setup and signal renewed bullish strength.

🌐 Macro Background

The US Dollar is attempting a modest recovery after hitting multi-year lows, creating short-term pressure on EUR/USD. Additionally, ECB officials have expressed concern about the Euro’s rapid appreciation, which could further limit upside momentum.

With markets reassessing USD positioning and monitoring central bank signals, the near-term macro backdrop supports the possibility of a technical pullback rather than immediate continuation higher.

🔑 Key Technical Levels

Resistance Zone: 1.1955 – 1.1975

Support Zone: 1.1845 – 1.1860

Bearish Invalidation: Above 1.2000

📌 Trade Summary

EUR/USD is struggling to hold above a key resistance area after an extended rally. As long as price stays below 1.1975, the bias favors a sell-on-rallies approach, targeting a corrective decline toward the support band.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

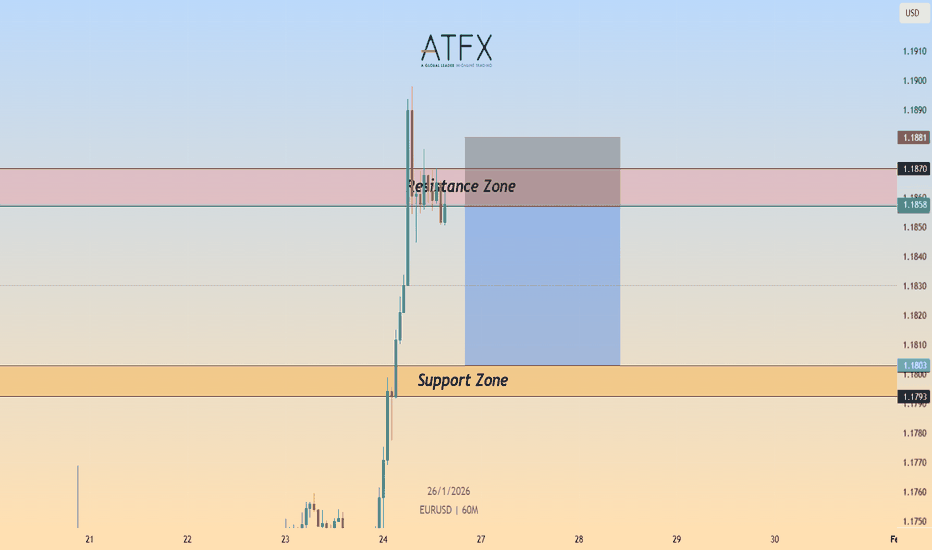

EUR/USD Price Outlook – Trade Setup📊 Technical Structure

TICKMILL:EURUSD EUR/USD has surged aggressively into the 1.1860–1.1870 resistance zone after a near-vertical rally from the 1.1750 region. Price is now stalling and consolidating beneath this key supply area, forming a tight range just below resistance.

This type of impulsive upside move followed by sideways compression typically signals bullish exhaustion and opens the door for a corrective pullback. The current structure favours a mean-reversion decline toward the 1.1803–1.1793 support zone, which previously acted as a demand area and aligns with the next major downside liquidity pocket.

As long as price remains capped below the resistance zone, the near-term bias remains bearish.

🎯 Trade Setup (Bearish Bias)

Entry Zone: 1.1860 – 1.1870

Stop Loss: 1.1881

Take Profit 1: 1.1803

Take Profit 2: 1.1793

Risk–Reward Ratio: Approx. 1 : 2.27

📌 Invalidation

A sustained break and close above 1.1881 would invalidate the bearish setup and signal continuation toward the 1.1900 psychological level.

🌐 Macro Background

EUR/USD has been supported by broad US Dollar weakness, driven by growing concerns over unpredictable US policy direction and fading confidence in the Dollar’s safe-haven role. Commerzbank warned that the market could be approaching a “tipping point,” where Dollar depreciation becomes difficult to contain.

However, with EUR/USD now trading near major technical resistance around 1.1870–1.1900, the macro-driven rally appears overextended. Any stabilization in US policy rhetoric or risk sentiment could trigger a technical pullback, reinforcing the bearish setup from resistance.

🔑 Key Technical Levels

Resistance Zone: 1.1860 – 1.1870

Support Zone: 1.1803 – 1.1793

Bearish Invalidation: Above 1.1881

📌 Trade Summary

EUR/USD has rallied sharply into a well-defined resistance zone and is now consolidating below it. As long as price remains capped below 1.1860–1.1870, the setup favours a sell-on-rallies approach, targeting a corrective move toward 1.1803–1.1793.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

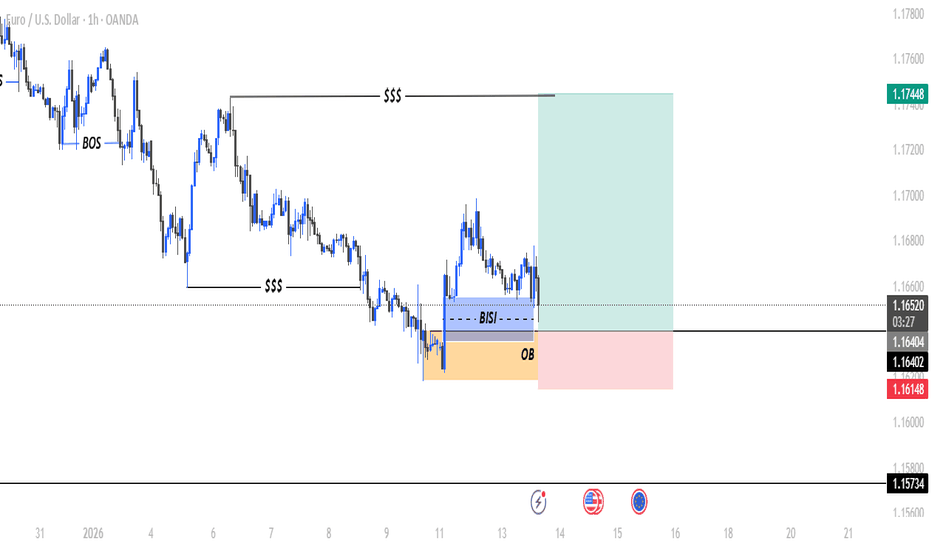

EURUSD technical analysis and trade idea EURUSD 🌍 The macro narrative heading into this week is dominated by the relief rally following the removal of immediate tariff threats regarding the "Greenland dispute" 🏦. While sentiment has shifted back to Risk-On, all eyes are locked on the upcoming FOMC meeting this Wednesday. The market is pricing in a pause, but any hawkish commentary on "Fed independence" could trigger volatility.

We are seeing a clear Bullish Market Structure on the H4 📈, characterized by impulsive moves breaking structure (BoS) to the upside. The price action has printed a higher high around 1.1900, confirming that bulls are currently in control.

Key Zone: There is a high-probability confluence zone developing where the corrective Parallel Channel (flag) intersects with the Fibonacci 50% - 61.8% Retracement levels (1.1815 - 1.1795) 📉. This area acts as a "value gap" where institutional orders are likely resting.

We are currently trading just below the Weekly Open (1.18616). I am watching for an initial "Judas Swing" (false move) lower into our Key Zone to sweep early buyer liquidity 🧹 before the true trend resumes.

My Trade Plan 🎯

Bias: Long. I will remain patient and let the price come to me, avoiding the "FOMO" at the top of the range.

Entry Protocol: I will wait for a pullback into the 1.1815 - 1.1795 buy zone. Entry will be taken only on a confirmed bullish break of market structure on the 30m chart ⏳.

Invalidation (SL): Stop loss placed strictly below the recent swing low and the channel structure (approx. 1.1760) 🛑.

Exit Strategy: Close 50% at 1R to bank profits, then trail the stop loss below market structure. 🏃♂️.

EUR/USD Price Outlook – Trade Setup📊 Technical Structure

TICKMILL:EURUSD EUR/USD is currently trading within a descending channel, after being rejected from the 1.1720–1.1727 resistance zone. Price has failed to sustain upside momentum and is now rolling over from the upper boundary of the channel, signalling weak bullish follow-through.

The recent rebound has stalled beneath the resistance band, forming a lower-high structure inside the broader corrective downtrend. The projected path suggests a minor pullback and consolidation near resistance, followed by a downside continuation toward the 1.1695–1.1689 support zone, rather than an upside breakout.

🎯 Trade Setup (Bearish Bias)

Entry Zone: 1.1720 – 1.1727

Stop Loss: 1.1730

Take Profit 1: 1.1695

Take Profit 2: 1.1689

Risk–Reward Ratio: Approx. 1 : 2.6

📌 Invalidation

A sustained break and close above 1.1730 would invalidate the bearish setup and signal a potential upside breakout from the descending channel.

🌐 Macro Background

While the Euro remains supported by broad US Dollar weakness linked to renewed US–EU trade tensions and Trump’s Greenland ambitions, near-term upside momentum in EUR/USD is showing signs of exhaustion.

Markets are now awaiting Trump’s speech at the Davos Summit and remarks from ECB President Christine Lagarde, which could act as short-term volatility catalysts. Any signs of geopolitical de-escalation or a temporary pause in the “Sell America” trade could trigger a technical pullback in EUR/USD.

Against this backdrop, EUR/USD remains vulnerable to profit-taking and corrective downside pressure from the upper resistance band.

🔑 Key Technical Levels

Resistance Zone: 1.1720 – 1.1727

Support Zone: 1.1689 – 1.1695

Bearish Invalidation: Above 1.1730

📌 Trade Summary

EUR/USD is showing rejection from a key resistance zone within a descending channel, with fading upside momentum. As long as price remains capped below 1.1720–1.1727, the bias favours a sell-on-rallies approach, targeting a pullback toward the lower support band.

⚠️ Disclaimer

This analysis is for reference only and does not constitute investment or trading advice. Financial markets involve risk, and traders should manage positions according to their own risk tolerance.

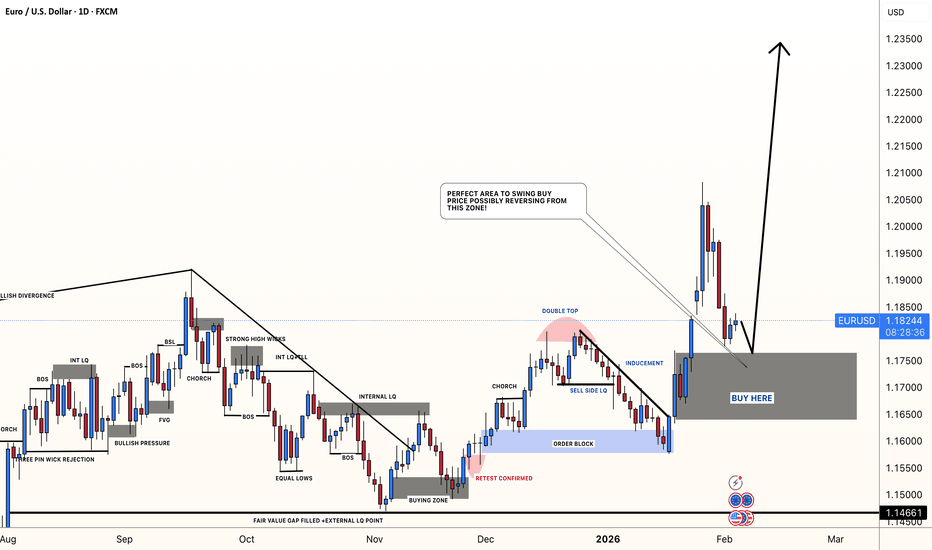

EURUSD Smart Money Concept (SMC) Setup | BOS + Liquidity + OB Ex📊 Description

This idea is purely based on Smart Money Concepts (SMC) and price action logic, not random entries.

🔍 Market Structure Insight

• Price previously showed a clear Break of Structure (BOS), confirming a shift in direction.

• After BOS, the market started moving in a controlled bearish structure, creating liquidity zones ($$$) on both sides.

• Smart money collected liquidity before moving price further.

💡 Key Concept Used

• Liquidity Sweep ($$$) → Smart money grabs stops

• Order Block (OB) → Institutional entry zone

• BISI / Imbalance → Price inefficiency that tends to get respected

• Premium–Discount Logic → Entry taken from a logical discount area

Price tapped into the Order Block + imbalance zone, which aligns perfectly with SMC rules.

This is where smart money usually enters — not retail traders.

🎯 Trade Plan Logic

• Entry is taken from a high-probability OB zone

• Stop loss is placed safely below the structure (risk controlled)

• Targets are aligned with previous liquidity and imbalance zones

• Risk–Reward is clean and logical (not emotional trading)

This setup is not about guessing — it’s about waiting for price to come to you.

🧠 Why This Idea Matters

This analysis represents:

• Patience over over-trading

• Structure over indicators

• Logic over emotions

I believe one clean setup is better than 10 random trades.

⸻

💬 Your Turn

If this analysis makes sense to you:

• Drop your feedback in the comments

• Share this idea with traders who respect real price action

• Like 👍 if you want more SMC-based ideas

Let’s grow together by sharing knowledge, not noise 📈🔥

Is EUR/USD Entering a Bullish Continuation Phase?📌 EUR/USD – “THE FIBRE”

💱 Forex Market Trade Opportunity Guide

(Swing Trade | Day Trade)

🔵 Market Bias

🟢 BULLISH STRUCTURE CONFIRMED

Price action aligns with trend continuation mechanics, supported by multi-indicator confluence and momentum expansion.

🧠 Trade Plan – Technical Confluence

✔️ Triangular Moving Average BREAKOUT

✔️ Hull Moving Average Pullback & Retest (dynamic support confirmation)

✔️ CCI Oscillator Golden Cross (momentum acceleration signal)

📊 This setup reflects trend resumption after healthy retracement, often favored by smart money continuation models.

🎯 Entry Strategy

🟢 YOU CAN ENTER AT ANY PRICE LEVEL

🔹 Traders may scale in using price acceptance above dynamic averages

🔹 Suitable for layered entries based on individual risk frameworks

🛑 Risk Management

🔴 Stop Loss (Reference Level): 1.16500

⚠️ Dear Ladies & Gentlemen (Thief OG’s)

Risk parameters must always be adjusted based on your own strategy, capital, and exposure model.

This level is not mandatory.

🏁 Profit Zone / Exit Logic

🎯 Primary Target: 1.18500

🚓 Police force zone acting as:

Strong historical resistance

Overbought price area

Liquidity trap potential

High probability reaction / correction zone

➡️ Protect profits aggressively near this zone.

⚠️ Dear Ladies & Gentlemen (Thief OG’s)

TP levels are guidelines, not financial advice. Partial profits are encouraged.

🔗 Related Pairs to Watch (Correlation & Confirmation)

💵 USD-Driven Correlation

TVC:DXY (US Dollar Index)

🔻 Weakness in DXY generally supports EUR/USD upside

🔺 Any sharp DXY reversal may cap EUR/USD gains

💶 EUR Strength Basket

OANDA:EURJPY

📈 Bullish momentum confirms EUR strength vs safe-haven JPY

OANDA:EURGBP

🔄 Range behavior here helps identify relative EUR demand

OANDA:EURCHF

🧭 Stability above key levels supports risk-on EUR flows

💷 Cross-Market Confirmation

FX:GBPUSD

✔️ Parallel bullish structure adds USD weakness confirmation

OANDA:USDCHF

🔻 Bearish bias here often aligns with EUR/USD bullish continuation

🧩 Key Insight

📌 When EUR pairs show synchronized strength and USD pairs weaken,

➡️ EUR/USD continuation probability increases significantly.

🏁 Final Note

This setup is built on trend alignment, momentum confirmation, and structured risk logic.

Discipline, patience, and execution consistency are what turn setups into profits.

📈 Trade smart. Manage risk. Protect capital.

EUR/USD Market Structure Signals Upside Potential🔔 EUR/USD Breakout Watch — Is the Fibre Ready for the Next Leg Higher?

📌 Asset

EUR/USD — “THE FIBRE”

FOREX Market Trade Opportunity Guide (Day / Swing Trade)

📈 Market Bias

🟢 Bullish Plan — Pending Order Setup

Momentum is building as price approaches a key resistance breakout zone, suggesting potential continuation once liquidity above the level is cleared.

🎯 Entry Strategy

✅ Buy after confirmed resistance breakout @ 1.18000

📌 You may enter at any price level after breakout confirmation

📌 Patience is key — let the market show acceptance above resistance

🛑 Stop Loss

🔻 Thief SL @ 1.17500

⚠️ Dear Ladies & Gentlemen (Thief OG’s):

Adjust your stop-loss according to your own risk management & position sizing.

I do not recommend blindly following my SL.

🎯 Target Zone

🚔 Police Barricade Area @ 1.18700

Strong resistance zone

Overbought conditions may appear

Possible bull trap & corrective move

👉 Escape with profits once price reacts

⚠️ Dear Ladies & Gentlemen (Thief OG’s):

I do not recommend using only my TP. Secure profits based on your own trading plan.

🔗 Related Pairs to Watch (USD Correlation)

💵 GBP/USD

Positive correlation with EUR/USD

Strength here often confirms USD weakness

💵 AUD/USD

Risk-on sentiment gauge

Bullish AUD/USD supports EUR/USD upside

💵 USD/JPY

Inverse correlation

Weak USD usually pushes USD/JPY lower while EUR/USD rises

💵 DXY (US Dollar Index)

Key driver

Sustained weakness below resistance favors EUR/USD bulls

🌍 Fundamental & Economic Factors to Monitor

📊 Eurozone Factors

ECB policy outlook & interest rate guidance

Inflation (CPI) and PMI data affecting EUR strength

Economic growth stability across core EU economies

📊 US Factors

Federal Reserve rate expectations

Inflation data (CPI, PCE) impacting USD demand

Labor market releases influencing USD volatility

📰 Upcoming High-Impact Events

Central bank speeches

Inflation & employment reports

Risk sentiment from global macro developments

📌 Volatility is expected around major data releases — manage exposure wisely.

🧠 Trader’s Reminder

💡 Trade the confirmation, not the hope

💡 Protect capital first, profits second

💡 Discipline > Emotion

👍 If this setup aligns with your market view, drop a like & share your thoughts below.

📊 Follow for more structured Forex, Index & Commodity trade blueprints.

⚔️ Trade smart. Trade disciplined.

EURUSD: Reversal Almost Confirmed +1500 Pips In Making! FX:EURUSD

As outlined in our previous analysis, the price fell further than anticipated. Given this region, we believe the price has reversed from a crucial level. Consequently, we anticipate a significant price increase. A swing bullish move is possible, potentially gaining around +1500 pips if successful. Please like and comment if you enjoy our work.

Good luck and trade safely!

Team Setupsfx_

EURUSD: Wave Dynamics Between Correction and ImpulseEURUSD: Wave Dynamics Between Correction and Impulse

EURUSD Wave Overview (D1 and H4)

As a trader who has been practicing wave analysis for over ten years, I note that the current structure of the EURUSD pair demonstrates the completion of an extended correction and the potential for a new move.

Chart D1: The global picture indicates that the market is ending its sideways phase. The wave structure appears to be the end of a corrective sequence, which serves as the foundation for the next trend move.

Chart H4: Local dynamics confirm the formation of key entry points. Here, the first signs of an emerging impulse are visible, which could mark the beginning of a larger wave.

Main Scenario

After the completion of the corrective phase, a downward impulse sequence is expected to develop. This movement will be accompanied by increased seller activity and a gradual shift in priority to the downside.

Alternative Scenario

If the price holds above recent highs and forms a stable upward impulse structure, the priority will shift to continued growth. In this case, the correction will be considered incomplete, and the pair may experience a further rebound.

Trading Idea

Conservative approach: wait for confirmation of a breakout of key levels and enter with the trend.

Aggressive approach: use local impulses on H4 for earlier entries, but with tight stops.

In both cases, it is important to maintain strict risk management and adjust the plan as new impulses emerge.

Results

EURUSD is at the transition point between a correction and a new impulse. The wave structure on D1 and H4 provides clear guidelines for trading: watch for confirmation of the scenario and act with discipline.