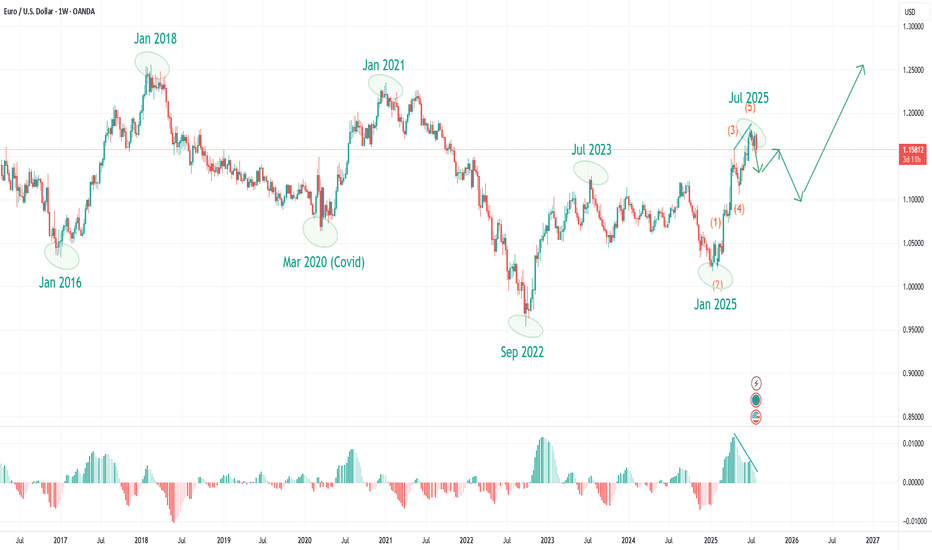

EURUSD Weekly PlanFrom a mid-term perspective, I remain bullish, but only after the current correction is completed.

The primary corrective scenario for me is a test of the 1W FVG, as the 1W OB is not providing a buyer reaction at the moment.

After the 1W FVG test, I will look for long opportunities through confirmation on the 1D and 4H timeframes.

Eurusdweekly

EURUSD Still Bearish | Perfect Sell-on-Rally Zone FormingEURUSD is trading inside a clear descending channel on the H1 timeframe. Price action continues to respect the channel structure, forming lower highs and lower lows, which confirms ongoing bearish momentum.

The pair recently pulled back toward the channel midline / dynamic resistance, where selling pressure re-emerged. Moving averages are also acting as dynamic resistance, keeping price capped to the downside.

As long as price remains below the upper channel boundary, the bearish bias remains valid.

🔴 Sell Trade Setup

Sell Zone: 1.1720 – 1.1730

Stop Loss: 1.1765

Take Profit 1: 1.1690

Take Profit 2: 1.1665

Risk–Reward: 1:2+

📌 Trade Logic

Descending channel intact.

Price below key moving averages.

Rejection from resistance zone.

Bearish structure remains unbroken.

Selling rallies inside the channel offers. the best probability setup.

❌ Invalidation

A strong H1 close above 1.1765 will invalidate this bearish setup and suggest a possible trend shift.

⚠️ Notes:

Watch for volatility during upcoming economic events

Wait for H1 candle confirmation before entry

Apply proper risk management (1–2% per trade)

📊 Market Bias

Trend: Bearish

Strategy: Sell on pullbacks

Timeframe: H1

👍 Like & follow for more clean price action setups.

💬 Comment if you see a breakout or continuation.

Q4 | W50 | D8 | Y25 | - EURUSD FRGNT DAILY FORECAST📅 Q4 | W50 | D8 | Y25 |

📊 EURUSD FRGNT DAILY FORECAST

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:EURUSD

Analysis of the New Dimension of Multi-Core Logic TradingSubdivided highlights of the economic recovery in the Eurozone provide fundamental support: The Eurozone economy is not completely weak; there are structural recovery highlights that support the euro. The comprehensive PMI in October rose to 52.2, reaching a new high in 17 months, and has maintained an expansionary trend for 10 consecutive months. Among the core economies, Germany performed outstandingly, with its PMI index reaching the best since May 2023. Industrial orders rebounded month-on-month, and export data also showed signs of recovery. As the engine of the Eurozone economy, Germany's recovery provided a solid economic foundation for the euro. At the same time, the Eurozone's CPI rose by 2.2% year-on-year in September, approaching the 2% inflation target of the European Central Bank. This moderate inflation state avoided the risk of deflation and did not require concerns about aggressive policy adjustments due to excessive inflation, creating favorable conditions for the stable strengthening of the euro.

Increased potential weakness scenarios for the US dollar are beneficial for the euro's upward movement: The current resilience of the US dollar is not flawless, and there are multiple factors that may trigger a correction. On the one hand, the market's expectation for a 12-month Fed rate cut has reached 65%. If the subsequent US consumer or employment data shows a slight decline, it will further strengthen the expectation of a rate cut, putting pressure on the US dollar index. On the other hand, the US dollar index has been fluctuating around 99.50 recently, lacking the strong momentum for continuous upward movement. If it fails to break through, a large number of profit-taking sell orders may trigger a rapid decline in the US dollar. While the euro is the main rival currency of the US dollar, it often gains significant upward momentum when the US dollar weakens. This provides a favorable external environment for the euro to rise against the US dollar.

Short-term technical indicators show a bullish launch signal: From the short-term K-line perspective, the euro against the US dollar has formed a small upward trend with gradually rising lows at the 1-hour level. At the indicator level, the 5-day moving average is diverging upward, providing effective support for the exchange rate. Although the MACD indicator once contracted the red energy bar, it showed signs of expanding again after the low point of 1.1515, indicating that the short-term bullish momentum is reaccumulating. At the same time, the recent price movement has seen an increase in trading volume simultaneously, with good volume-price coordination, confirming the validity of the current upward trend, and the RSI indicator is in the neutral to strong range of 55, not reaching the overbought threshold, indicating that there is still upward space in the short term, providing technical basis for short-term bullish trading.

Trading Strategy for EUR/USD

buy:1.15000-1.15100

tp:1.15500-1.15800

sl:1.14800

EURUSD: Bearish-Neutral. Look For Lower Prices vs USDWelcome back to the Weekly Forex Forecast for the week of Nov.17-21st.

The EURUSD is ranging and choppy. But if the US Dollar is to remain strong, and pushes higher this week, expect the EURUSD to slide lower.

Look for the bearish BOS to indicate the pullback is over as a confirmation for shorts.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

EURUSD: Bearish! Sell The Rally!Welcome back to the Weekly Forex Forecast for the week of Nov.10 - 14th.

The EURUSD is completing a pullback, as mentioned in my last EU video. Now is the time I would be looking out for the retracement to end and the next bearish leg to begin.

Look for valid sells of the rally.

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

EURUSD FRGNT Daily Forecast -Q4 | W45 | D3| Y25 |📅 Q4 | W45 | D3| Y25 |

📊 EURUSD FRGNT Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

OANDA:EURUSD

EURUSD – Weekly Market Outlook (Read Caption)EUR/USD continues to trade within a controlled bearish structure after rejecting the 4H resistance area. Price has confirmed a break of structure, keeping short-term sentiment bearish while testing the nearby support zone that could attract a temporary rebound before continuation.

Key Levels:

Resistance Zone: 1.1600 – 1.1570

Support Zone: 1.1520 – 1.1490

Structure Break Area: Near 1.1540

Reasoning:

The 4H price action shows consistent lower highs and bearish candles after rejection from resistance. Momentum remains in sellers’ favor, suggesting a potential continuation toward the 1.1490 area if the support gives way.

However, if bullish rejection forms around the current support range, a short-term rebound toward 1.1570 may occur. Fundamentally, ongoing USD strength amid cautious risk sentiment continues to pressure the Euro this week.

Disclaimer:

This analysis is for educational purposes only and not financial advice. Always trade with a defined plan and manage risk appropriately before taking any position.

EUR/USD Outlook - EUR/USD Awaits Next Directional MoveHi Everyone,

EUR/USD saw a brief relief rally before spending the remainder of the week consolidating within range.

Looking ahead, we’ll be watching closely to see whether the correction phase is complete. If price holds above the 25 September low at 1.16451, a retest of the 17 September high near 1.19193 remains likely. However, a break below that low would open the door for a move toward 1.15721 and potentially 1.14041, where fresh buying interest may re-emerge.

While there’s still scope for a deeper correction toward 1.14041, our immediate focus remains on 1.15721 as the key level to monitor.

The impulsive rally from the 1st August low continues to underpin our broader bullish outlook on EUR/USD. We expect the pair to retest support and reinforce it as a base for the next leg higher, with upside targets remaining at the 1.19290 zone and ultimately the 1.20000 handle.

We’ll be monitoring price action closely to see whether this recovery gains traction and if buyers can sustain momentum through resistance. The longer-term outlook remains bullish, provided price continues to hold above the key support levels.

We’ll keep updating you throughout the week as the structure develops and share how we’re managing our active positions.

Thanks again for all the likes, boosts, comments, and follows — your support is truly appreciated!

All the best for the rest of the week.

Trade safe.

BluetonaFX

UPDATE - EUR/USD Extends Rally as Bullish Structure Holds FirmHi Everyone,

A quick update on our EUR/USD idea shared earlier in the week:

We saw the anticipated break higher, clearing both the 1.17889 level and the yearly high at 1.18300, which now shifts our focus to the higher levels above. In the near term, any pullbacks are expected to hold above the 1.16550 support, keeping the broader bullish structure intact.

The impulsive rally from the 1st August low continues to underpin our bullish outlook on EUR/USD. Our broader view remains unchanged: we expect the pair to continue building momentum for another leg higher. With the decisive break above 1.17889, the focus now turns to the 1.18350–1.19290 zone, and ultimately the 1.20000 handle.

We’ll be monitoring price action closely to see whether this recovery gains traction and if buyers can sustain momentum through resistance. The longer-term outlook remains bullish, provided price continues to hold above the key support levels.

We’ll keep updating you throughout the week as the structure develops and share how we’re managing our active positions.

Thanks again for all the likes, boosts, comments, and follows — your support is truly appreciated!

All the best for the rest of the week.

Trade safe.

BluetonaFX

EUR/USD Outlook - Bulls Eye Fresh Breakout as Momentum BuildsHi Everyone,

EUR/USD consolidated above the 1.15880–1.16180 support zone last week and came close to testing resistance. Looking ahead, we anticipate a break higher, with the next target set at 1.17889 and a possible move toward the yearly high around 1.18200. Any pullbacks in the near term are expected to hold above the 1.16550 support, maintaining the bullish structure.

The impulsive rally from the 1st August low continues to underpin our bullish outlook on EUR/USD. Our broader view remains unchanged: we expect the pair to continue building momentum for another leg to the upside. A decisive break above 1.17889 would open the path toward the 1.18350–1.19290 zone, and ultimately the 1.20000 handle.

We’ll be monitoring price action closely to see whether this recovery gains traction and if buyers can sustain momentum through resistance. The longer-term outlook remains bullish, provided price continues to hold above the key support levels.

We’ll keep updating you throughout the week as the structure develops and share how we’re managing our active positions.

Thanks again for all the likes, boosts, comments, and follows — your support is truly appreciated!

All the best for the rest of the week.

Trade safe.

BluetonaFX

EUR/USD - Recovery Gains TractionHi Everyone,

As expected, EUR/USD pushed higher last week, and we continue to anticipate an attempt toward the 1.17889 resistance; ideally with a test early in the week. The 1.15880–1.16180 zone has now established itself as support, providing a base for further entries with the upside target in focus.

The impulsive rally from the 1st August low continues to underpin our bullish outlook on EUR/USD.

Our broader view remains unchanged: we expect the pair to continue building momentum for another leg to the upside. A decisive break above 1.17889 would open the path toward the 1.18350–1.19290 zone, and ultimately the 1.20000 handle.

We’ll be monitoring price action closely to see whether this recovery gains traction and if buyers can sustain momentum through resistance. The longer-term outlook remains bullish, provided price continues to hold above the key support levels.

We’ll keep updating you throughout the week as the structure develops and share how we’re managing our active positions.

Thanks again for all the likes, boosts, comments, and follows — your support is truly appreciated!

All the best for the rest of the week.

Trade safe.

BluetonaFX

UPDATE - EUR/USD Holding Support, Upside Still on the CardsHi Everyone,

A quick update on the idea shared earlier this week — we’re still looking for the Fiber to attempt a move toward the 1.17889 resistance. Yesterday’s dip found support between the 1.15880–1.16180 zone, which could provide the base for another push toward the upside target.

That said, a deeper retracement toward the 1.15200 zone may still be required to attract fresh buying interest and cannot be ruled out.

The impulsive rally from the 1st August low continues to reinforce our bullish outlook on EUR/USD.

Our broader view remains unchanged: we expect the pair to continue building momentum for another leg to the upside. A decisive break above 1.17889 would open the path toward the 1.18350–1.19290 zone, and ultimately the 1.20000 handle.

We’ll be monitoring price action closely to see whether this recovery gains traction and if buyers can sustain momentum through resistance. The longer-term outlook remains bullish, provided price continues to hold above the key support levels.

We’ll keep updating you throughout the week as the structure develops and share how we’re managing our active positions.

Thanks again for all the likes, boosts, comments, and follows — your support is truly appreciated!

All the best for the rest of the week.

Trade safe.

BluetonaFX

UPDATE - EUR/USD Holding Support, Upside Still on the CardsHi Everyone,

A quick update on the idea shared earlier this week — we’re still looking for the Fiber to attempt a move toward the 1.17889 resistance. Yesterday’s dip found support between the 1.15880–1.16180 zone, which could provide the base for another push toward the upside target.

That said, a deeper retracement toward the 1.15200 zone may still be required to attract fresh buying interest and cannot be ruled out.

The impulsive rally from the 1st August low continues to reinforce our bullish outlook on EUR/USD.

Our broader view remains unchanged: we expect the pair to continue building momentum for another leg to the upside. A decisive break above 1.17889 would open the path toward the 1.18350–1.19290 zone, and ultimately the 1.20000 handle.

We’ll be monitoring price action closely to see whether this recovery gains traction and if buyers can sustain momentum through resistance. The longer-term outlook remains bullish, provided price continues to hold above the key support levels.

We’ll keep updating you throughout the week as the structure develops and share how we’re managing our active positions.

Thanks again for all the likes, boosts, comments, and follows — your support is truly appreciated!

All the best for the rest of the week.

Trade safe.

BluetonaFX

Deeper Pullback or Renewed Push? EUR/USD at a Critical JunctureHi Everyone,

As highlighted in our previous idea, we anticipated a pullback toward the 1.16550 area before renewed interest around the 1.17889 level. However, price extended into a deeper retracement, revisiting the 1.15800 level before consolidating back above the 1.16550 support.

Looking ahead, we expect the Fiber to attempt a move toward the 1.17889 resistance. That said, a deeper retracement toward the 1.15200 zone may still be required to attract fresh buying interest.

The impulsive rally from the 1st August low continues to reinforce our bullish outlook on EUR/USD.

Our broader view remains unchanged: we expect the pair to continue building momentum for another leg to the upside. A decisive break above 1.17889 would open the path toward the 1.18350–1.19290 zone, and ultimately the 1.20000 handle.

We’ll be monitoring price action closely to see whether this recovery gains traction and if buyers can sustain momentum through resistance. The longer-term outlook remains bullish, provided price continues to hold above the key support levels.

We’ll keep updating you throughout the week as the structure develops and share how we’re managing our active positions.

Thanks again for all the likes, boosts, comments, and follows — your support is truly appreciated!

All the best for the rest of the week.

Trade safe.

BluetonaFX

EUR/USD Holds Firm – Eyeing Pullback Before Next Leg HigherHi Everyone,

Despite what was a fundamentally turbulent week in the markets, our trading delivered a flawless run last week!

As highlighted in our previous idea, EUR/USD found support near the 1.16000 zone before mounting a push higher toward the 1.17889 level. Looking ahead into next week, we anticipate a pullback toward the 1.16550 area, which could provide the base for another attempt to reach 1.17889.

The impulsive rally from the 1st August low continues to reinforce our bullish outlook on EUR/USD.

Our broader view remains unchanged: we expect the pair to continue building momentum for another leg to the upside. A decisive break above 1.17889 would open the path toward the 1.18350–1.19290 zone, and ultimately the 1.20000 handle.

We’ll be monitoring price action closely to see whether this recovery gains traction and if buyers can sustain momentum through resistance. The longer-term outlook remains bullish, provided price continues to hold above the key support levels.

We’ll keep updating you throughout the week as the structure develops and share how we’re managing our active positions.

Thanks again for all the likes, boosts, comments, and follows — your support is truly appreciated!

All the best for the rest of the week.

Trade safe.

BluetonaFX

EUR/USD: Is the Next Big Correction Already Underway?EUR/USD: After 120 Days Up, Are We Entering a Year-Long Correction? What Market Cycles Reveal.

As EUR/USD traders digest the stunning 120-day, five-wave rally from the January 2025 lows to the July 2025 highs, the big question now is—what's next? The clues are right in front of us, and they suggest we may be headed into an extended corrective phase, one that could last until the very start of 2026.

What the Current Structure Shows

Motive Wave Complete: The impulsive surge just wrapped up a textbook five-wave move, with each leg unfolding cleanly and culminating in a July top. Motive waves like this are the engines of market trends—fast-moving, decisive, and packed with momentum.

Corrective Phase Incoming: But all trends eventually pause, and here the evidence points to a shift. Corrective waves—unlike their trending counterparts—are time-consuming, choppy, and have a tendency to frustrate impatient traders. The completed motive wave took just 120 days, but corrections often take much longer to play out. According to this chart, the probable timeline for this correction extends into December 2025, or possibly beyond.

Why the Count Is Labelled This Way

Wave Duration Clue: One of the most reliable Elliott Wave principles is that corrective phases outlast the sharp, high-energy motive moves that precede them. With the motive wave spanning four months, a comparable correction stretching into late 2025 makes perfect structural sense.

Cycle Awareness, Major Turning Points, and MACD Divergence:

Flip to the weekly turning points chart, and a deeper pattern emerges: Major EUR/USD direction changes consistently cluster around the start of a new year, with minor tops and bottoms often forming near mid-year. Over the last eight years, six out of seven major pivots have landed at those cycle pivots.

Notably, if you look at the weekly chart’s MACD, there’s now a clear bearish divergence—while price clocked new highs into July, the MACD failed to confirm, rolling over and diverging lower. This kind of momentum divergence at a major turning point is classic for trend exhaustion and aligns perfectly with the idea that a correction is not only likely, but perhaps overdue.

This powerful confluence—timing, price structure, and momentum—underscores just how much “cycle” and structure awareness can add to your trading playbook.

What to Watch Next (Trade Planning)

Timing the Correction: If the correction follows historical precedent, expect sideways or choppy price action well into Q4 2025, with the next big directional opportunity around the calendar turn into 2026.

Cycle-Based Strategies: Recognising these cycles lets you prepare for reversals, especially if price is diverging from the MACD at those major timing windows.

Structure > Prediction: The motive phase is where you ride the trend; cycles, structure, and momentum help you avoid exhaustion traps and see when patience is required.

EUR/USD Update: Bullish Outlook Towards 1.14190 and BeyondHi Everyone,

As we projected in our analysis last week, EUR/USD corrected throughout the week and approached a retest of the 1.12000 level.

We expect the price to potentially retest 1.12000 and confirm it as support before advancing further to challenge the May 26 high of 1.14190. This would further reinforce our outlook for a potential long-term bullish trend.

Of course, the price could also challenge the 1.14190 high without a second retracement, should there be strong buying pressure early in the week. A successful breach of this level would likely drive the price higher towards the 1.15240 level.

We will provide further updates on the expected path for EUR/USD should the price reach this target.

The longer-term outlook remains bullish, with expectations for the rally to extend toward the 1.2000 level, provided the price holds above the key support at 1.10649.

We will continue to update you throughout the week with how we’re managing our active ideas and positions. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for the week ahead. Trade safe.

BluetonaFX

EUR/USD remains capped below 1.1400, bullish bias prevailsEUR/USD's near-term outlook is neutral. The pair oscillates below a flat 20 SMA, while longer-term (100/200) SMAs maintain upward slopes. Momentum is flat around 100, and the RSI is only slightly higher near 45, suggesting limited upward potential.