Fcpotrader

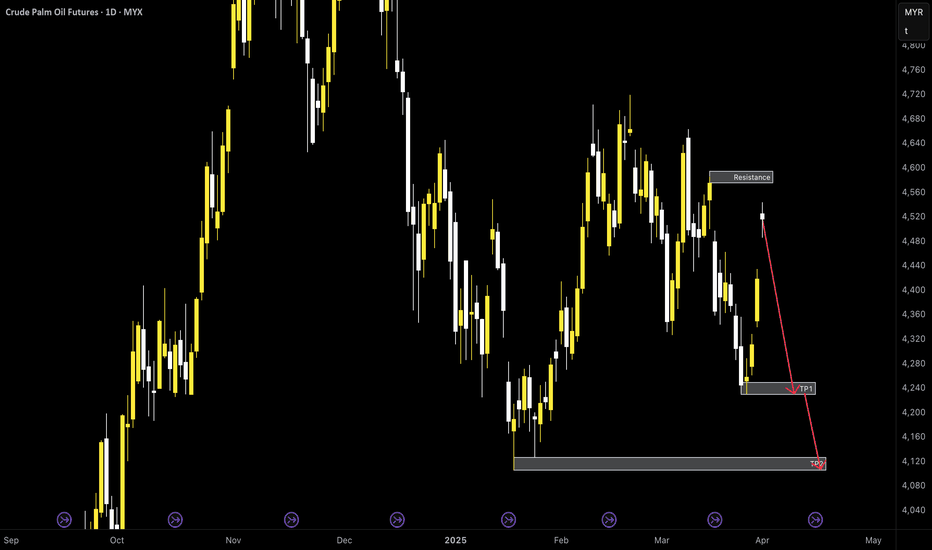

FCPO Week 43 2025: Consolidation or bearish to 4300?Happy Deepavali!

Price has shifted from bullish to a potential bearish. Momentum to go higher has been greatly reduced. A key reversal created on Friday could be the Lower High for a bearish move.

There is a potential of double top. Still early since it is yet to confirm. If price can break and close below 4490 then bearish could go and test 4300. Price will confirm double top once if break below 4270 area.

If there is no momentum this week then another consolidation is expected with a view for a break to a lower price.

Happy trading.

FCPO Week 41 2025: 4100 or 4600?2 scenarios next week MYX:FCPO1! :

1) Bullish: if price close above 4490 then it is bullish towards 4600.

2) Bearish: if price close below 4330 then it is bearish towards 4100.

3) Consolidation: If you trade consolidation there are about plus minus 150 points in between bullish and bearish scenarios.

Happy trading and good luck!

FCPO Week 35 2025: Retracement?The concept is that price didn't go up in a straight line. Therefore I'm expecting that price will retrace a bit towards 4330 area before continuing higher with 4600 as target. However if price fail to defend the support area (as shown in chart) then there is likelihood that price is going lower towards 4200.

Happy trading.

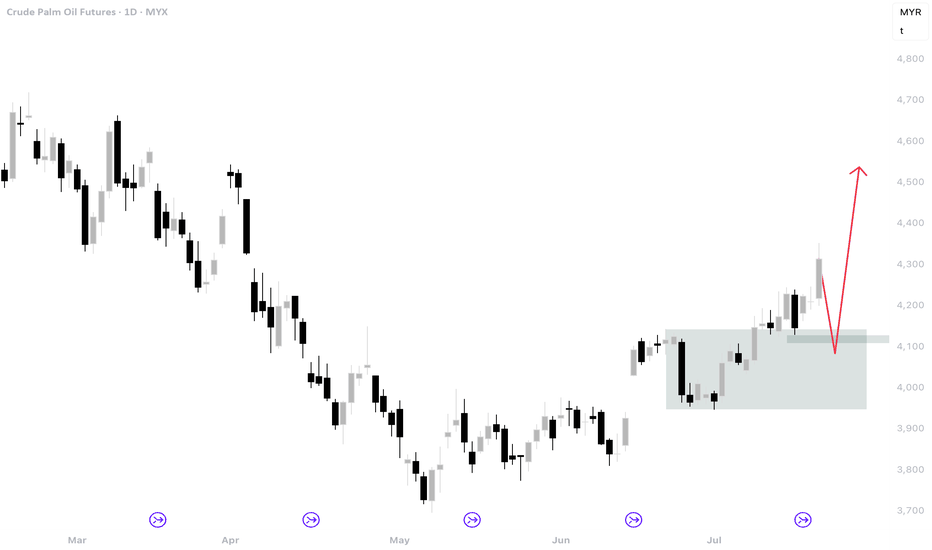

FCPO WEEK 23 2025: Bullish Potential.Price hold support steadily even though still failed to make any move higher. It seems that 3700 is a support area for now. There are two possibilities this week:

#1 - We might see consolidation this week and price might move sideways.

#2 - Price to retrace a bit and then make a breakout towards 4000. This would be ideal and the best scenario.

Happy trading!

FCPO WEEK 21 2025: BEARISH.I think the price will continue lower next week. There is a brief retracement higher last week but the price went back lower immediately. Look at the weekly candle. A bearish key reversal that almost cancelled out the bullish reversal from the previous week. At this moment bearish is still strong therefore expecting price to go lower to test 3600 area.

FCPO WEEK 21 2025: Towards 4000?There are 2 scenarios for this week:

Scenario #1 - if price to close and stay above 3857 then there is possibility that it will continue going higher towards 4000 area. However this might be a limited move higher because the overall trend is still bearish. I think that the price will likely retest the 3700 and consolidate for a bit before going bullish.

Scenario #2 - if price to close and stay below 3745 then it should open a move lower towards 3638 area. It would be the lowest price since Aug 2024. This might be the lowest low that we need for price to establish a bullish trend.

If Scenario #1 happens then it will be interesting to analyse the price action to determine the momentum and see whether price already establish a sign that it is ready to go even higher.

Happy trading!

25) FKLI : uptrend and expecting it to resumes its bullresumes frm 22), I need to continue writing bcox I find out that once I stopped writing, my trading becomes sucks. I lack the critical thinking that is needed to trade and my performance dropped. Although time is demanding, I try make out the time to write. keep it as simple as possible.

so, fkli is simple. it is in uptrend and no sign of reversing. expecting retracement back to 1525-1535 range for a possible long position. fkli-may needs to fall below the previous higher-low 1508-1510 to signal a possible reversal of trend. that's all...

PLS remember, I am not a guru and this is not a signal service provider. THIS is mere for fun.

#tradersupporttrader #FCPO #FKLI #futurestrader #cpop #malaysiatrader #bursa #BursaMalaysia

Disclaimer : "I am not a guru and I am working hard to make profit same as everyone else. This is not a recommendation of buy or sell, just a mere idea of trading and trading journal. Please consult your financial advisor for any thought of buying or selling. Trade at your own risk."

24) FCPO : downtrend and within the rangeupdate frm 23), I have stopped for almost two months...I will continue updating if got any time...the rest of the time is well-spent for making money. haha

fcpo-july is in downtrend. the range is within the range from 3840 support and 3960 resistance. See if price come back to these regions then we can make some fine decisions to either long or short.

PLS remember, I am not a guru and this is not a signal service provider. THIS is mere for fun.

#tradersupporttrader #FCPO #FKLI #futurestrader #cpop #malaysiatrader #bursa #BursaMalaysia

Disclaimer : "I am not a guru and I am working hard to make profit same as everyone else. This is not a recommendation of buy or sell, just a mere idea of trading and trading journal. Please consult your financial advisor for any thought of buying or selling. Trade at your own risk."

FCPO Week 18 2025: 50-50.Last week price failed to make a new low but instead making a push higher. It might hint that the trend is shifting to bullish but at the current moment it is 50-50. A big bearish key reversal on Friday might indicate that bearish is not done yet. Furthermore look at the weekly candle. The upper and lower wicks are about the same length and the body is more or less in the middle. Next week price action in the 50-50 area might give a clue on where price will go next. However only a close higher or lower of the current high and low of the area will provide confirmation of the future price movement.

FCPO WEEK 16 2025: 50-50 price action.There is an argument for bullish price next week. However as it stands now the price is still in the 50-50 price action. There is not enough argument to confirm bullish movement. Meaning there is possibility also that it might go south next week.

Scenario 1: If price stays above the 4000 and push higher then it will be bullish. Possibly towards 4500.

Scenario 2: If price move below and stays below 4000 then bearish is back in control to push price possibility towards 3700.

Start of the week it will be reactive mode.

FCPO Week 14 2025: Retracement before going BEARISH.Price went higher today and this might be only a retracement before going lower again. For the remaining of the week, price might consolidate a bit before having any momentum to continue lower. If it indeed going lower, price will up the gaps before targeting TP1. Depending on price action TP2 is a possibility.

For price to fully go bullish, a close above 6600 is required.

FCPO week 13 2025: Lower to 4200?Looks like the price is going lower and it is bearish. Hopefully next week it could have enough momentum to continuously pushing lower and take out the support area towards 4200. Depending on price action, price would probably going much lower to 4000 where a much stronger support is expected. The only way for price to continue higher is to close above the 4500.

FCPO Week 10 2025: Still 50-50.There is a hint that the price might continue higher. 4480 to 4470 is a support area and it seems to be holding right now. However in order to continue higher price needs to overcome the current resistance area which is around 4560. Closing above the resistance will open the door to 4630 level. That is scenario 1. For scenario 2, if price close below 4470 level then it most probably going lower initially to 4400 level and possibly lower towards 4350.

For now it is still wait and see condition.

Good luck!

23) FCPO : Bear is making its call, but possible reversal...?update frm 20), Fcpo-May were in bearish last week but price frm 4500 is still holding. At least, it is still holding at 4490 and what so special about the end of the week was, formation of Double-Bottom which seemed more like a "Higher-Low" was formed. Price was able to rebound frm low and was tapped out at 1560 resistance.

Fcpo-May needs to break above 4576, the previous lower-high (blue-line), to confirm a possible shift-of-trend. Higher resistance is at 4622-4634 and 4700.

-IF the bear pulls back the price, THEN market will find some support at 4528-4490.

-IF price is below 4490-4500, THEN lower support is at pretty far at 4400, 4300.

PLS remember, I am not a guru and this is not a signal service provider. THIS is mere for fun.

#tradersupporttrader #FCPO #FKLI #futurestrader #cpop #malaysiatrader #bursa #BursaMalaysia

Disclaimer : "I am not a guru and I am working hard to make profit same as everyone else. This is not a recommendation of buy or sell, just a mere idea of trading and trading journal. Please consult your financial advisor for any thought of buying or selling. Trade at your own risk."