#FET/USDT bullish momentum#FET

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.2280. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.2440

First target: 0.2522

Second target: 0.2630

Third target: 0.2765

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

Fetusdtlong

FET/USDT – Long Trade Setup (Daily)FET/USDT – Long Trade Setup (Daily)

Price forming a base after a strong downtrend

Falling wedge/compression near support

Price below cloud, but selling pressure weakening

Long Plan

Entry Zone: 0.19 – 0.205

Stop Loss: 0.1840

Targets:

T1: 0.26

T2: 0.32

T3: 0.37+

DYOR | NFA

FET/USDT — Decision Point: The 0.21–0.14 Zone That Defined!The FET/USDT weekly chart is revisiting one of the most historically significant zones in its entire price history — the 0.21–0.14 demand block.

This zone is not just a support area. It has consistently acted as the boundary between Accumulation and Capitulation since 2019. Every major FET rally began only after this zone was defended.

And now, price has returned to this zone once again — making this a major decision point for the next macro trend.

---

Why This Zone Matters

The 0.21–0.14 range served as the structural base for the powerful rallies in 2020, 2021, and the AI-driven surge in 2024.

The sharp downside wick below the zone followed by a fast recovery suggests a liquidity grab, hinting that larger players may still be accumulating here.

Price action is forming a compression pattern, a structure that typically precedes explosive breakouts — either up or down.

This is a point where the market rarely stays quiet for long.

---

Technical Structure & Pattern

FET has formed Lower Highs since the 2024 peak → medium-term downtrend still intact.

But price reactions within 0.21–0.14 remain strong, indicating an early-stage reaccumulation pattern.

The wick sweep below the zone resembles a potential Wyckoff Spring, not yet confirmed but clearly visible.

In simple terms:

If this zone holds, a long-term reversal can begin. If it fails, the chart opens the door to a new bearish leg.

---

Bullish Scenario

🔵 1. Demand Holds: “Buyers Take Control”

If the weekly candle closes above 0.21–0.18, it signals that buyers are still defending this historical demand block.

A stronger confirmation appears once price reclaims 0.30, the nearest structural resistance.

➡️ Bullish Targets:

0.30 → short-term confirmation

0.50 – 0.60 → mid-range resistance

0.90 – 1.50 → major recovery zone

2.50 – 3.40 → full cycle retracement if the AI narrative reignites

This would frame the 0.21–0.14 zone as a macro reaccumulation base before the next expansion phase.

---

Bearish Scenario

🔴 1. Clean Breakdown: “Demand Fails”

A weekly close below 0.14 would invalidate the entire multi-year structure.

If that happens:

the demand block collapses,

bearish continuation becomes highly likely,

and the chart enters a deeper macro range.

➡️ Bearish Targets:

0.10 – 0.07 → historical liquidity zone from 2019–2020

Further downside becomes possible if momentum accelerates

A breakdown below 0.14 would turn FET into a completely new market structure.

---

Key Insight

FET is currently sitting on a zone that has defined every major trend shift for the past 5 years.

The next weekly closes will determine whether we are entering:

a Phase B Accumulation → new macro rally, or

a structural breakdown → multi-month bearish continuation.

This is the calm before a major move — and the 0.21–0.14 zone remains the battlefield.

---

#FETUSDT #FetchAI #CryptoAnalysis

#KeyLevel #DecisionPoint #WeeklyChart #CryptoTA

#SupportZone #Wyckoff #SmartMoneyConcepts #AINarrative

FETUSDTThe overall trend of BINANCE:FETUSDT remains bearish as long as the price stays below the major moving averages. However, a potential bullish correction could start if buyers defend the key demand zone around $0.2100. A break above $0.3400 would strengthen bullish momentum and shift focus toward higher resistance targets.

Supports

$0.2100

$0.1120

Resistances

$0.3400

$0.5500

$0.7800

#FET/USDT bullish momentum#FET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.2500, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.2667

First target: 0.2707

Second target: 0.2795

Third target: 0.2884

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

FET/USDT — Testing the Critical Support Zone: Will Reversal?The FET/USDT (4D timeframe) chart shows the price currently sitting at the major support area between $0.25 and $0.20, highlighted by the yellow block. This zone has historically acted as a strong demand area, which previously triggered a massive rally toward the $1+ region in late 2023.

The recent sharp drop indicates heavy selling pressure, but the presence of a long lower wick (rejection) around this area suggests that buyers are still defending this key level — signaling a potential buying reaction zone or early accumulation phase.

---

Pattern Description

The price structure is currently in a descending pattern, but it’s now reaching a potential bottom area. The current setup could evolve into a double bottom or accumulation base formation if the price can hold above $0.20 for the next few candles. This region is crucial for defining whether FET is forming a cycle low before a major rebound.

---

Bullish Scenario

Price holds above $0.25–$0.20 and confirms with a bullish reversal candle (hammer or engulfing).

Break and hold above $0.30 will be the first bullish confirmation.

Mid-term targets: $0.385 – $0.57 – $0.78.

If momentum strengthens, the next potential target is $1.09.

---

Bearish Scenario

If price breaks below $0.20 and fails to recover, the next key support lies around $0.113 (historical low).

A confirmed breakdown below $0.20 signals loss of major structure, opening room for a deeper distribution phase.

In an extreme bearish case, FET may form a new cycle low before any sustainable recovery.

---

Conclusion

The $0.25–$0.20 zone is the key decision point for FET/USDT in the medium term.

Holding this support would strengthen the case for a bottom formation and reversal setup,

but losing it would likely confirm a continuation of the downtrend toward lower levels.

---

#FETUSDT #FetchAI #CryptoAnalysis #TechnicalAnalysis #AltcoinUpdate #SupportZone #CryptoReversal #BullishScenario #BearishScenario #MarketStructure #AIcrypto

FET/USDT — Bullish Reversal or Bearish Continuation?FET/USDT is now trading at 0.575 USDT, right inside the critical support zone between 0.50–0.62 (yellow box). This level has been a major battleground since early 2024, repeatedly holding back sellers and triggering strong rebounds.

Looking closely, the chart has formed a Descending Triangle pattern:

Lower highs show persistent selling pressure.

Horizontal support at 0.50–0.62 acts as the last stronghold for buyers.

Price is already near the apex, signaling that a major breakout is likely approaching.

---

🟢 Bullish Scenario

Trigger: a decisive 4D close above the descending trendline and the 0.70–0.78 resistance zone, supported by strong volume.

Narrative: a breakout here would flip the structure into a classic bear trap, trapping shorts and fueling an aggressive rally.

Targets:

TP1 = 0.784 (+36% from current levels)

TP2 = 1.135 (+97%)

TP3 = 1.617 (+181%)

Strategy: safer entry after breakout + successful retest, with stop loss below 0.62.

---

🔴 Bearish Scenario

Trigger: a confirmed 4D close below 0.50 USDT with rising sell volume.

Narrative: once this key support breaks, buyers lose control, and a strong downside move may follow.

Targets:

Breakdown target from pattern = 0.216 USDT (−62% from current levels).

Next historical support lies near 0.16 USDT.

Strategy: avoid long entries during breakdown. Safer approach is waiting for support confirmation below, or consider short setups.

---

📌 Conclusion

FET is standing at a make-or-break zone. The 0.50–0.62 range will decide its next major move:

A breakout could trigger a multi-stage rally,

While a breakdown risks opening a capitulation phase toward much lower levels.

Key point: wait for 4D close confirmation + volume before committing. Patience will define profit.

---

#FETUSDT #FetchAI #CryptoAnalysis #ChartPattern #DescendingTriangle #Altcoin #CryptoTrading #SupportResistance #BreakoutSetup

FET/USDT — Symmetrical Triangle: Ready for Breakout or BreakdownSummary

The FET/USDT (1D) chart is forming a symmetrical triangle — a consolidation pattern where descending highs and ascending lows converge. Price is trading around 0.7020 inside a tight range, with volatility shrinking as it approaches the apex. Major resistance levels are 0.9089, 1.2319, 1.6173, 2.2200, while the key support lies at 0.3444.

---

Pattern Explanation

Pattern Name: Symmetrical Triangle.

Nature: Neutral; direction depends on breakout confirmation.

Context: Formed after a strong downtrend (Dec–Apr) followed by higher lows since April, suggesting possible accumulation.

Key Point: Breakout/breakdown probability increases as the price nears the apex. Always confirm with volume.

---

Measured Move Projection

Triangle height: 2.2200 – 0.3444 = 1.8756.

Breakout projection from ~0.7020 = 2.5776 (long-term measured move target).

Realistically, price will face major resistances first: 0.9089 → 1.2319 → 1.6173 → 2.2200.

---

Bullish Scenario

Confirmation:

Daily close above descending trendline and ideally 0.9089.

Volume expansion above average.

Retest of breakout zone turning into support.

Targets:

Conservative 1: 0.9089.

Conservative 2: 1.2319.

Aggressive: 1.6173 → 2.2200 → measured move ~2.58.

Trading idea:

Aggressive: enter on breakout with stop loss below breakout candle (~<0.65).

Conservative: wait for breakout + retest above 0.9089, enter on retest.

---

Bearish Scenario

Confirmation:

Daily close below ascending trendline.

Volume spike on sell-side.

Retest failure of broken support as resistance.

Targets:

Initial target: 0.3444.

Extended bearish levels: 0.30 → 0.20 if momentum accelerates.

Trading idea:

Short on retest after breakdown or enter on close confirmation.

Stop loss above retest level (e.g. >0.75 if breakdown occurs around 0.70).

---

Key Notes / Risk Management

Watch volume for confirmation, avoid fakeouts.

Confluence with indicators: RSI, MACD, MA 50/200.

Manage risk: use stop loss, avoid overexposure (1–3% per trade).

Keep an eye on fundamentals or project-related news that could trigger sudden volatility.

---

FET/USDT — forming a Symmetrical Triangle near the apex. A breakout above 0.9089 with strong volume could target 1.23 / 1.62 (ext. 2.22 → measured ~2.58). Breakdown below the rising support risks a drop toward 0.344. Always wait for confirmation and manage risk.

#FETUSDT #FET #CryptoAnalysis #TrianglePattern #Breakout #AltcoinAnalysis #SupportResistance #CryptoTrading #TechnicalAnalysis

#FET/USDT Preparing for a Major Rally ?#FET

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.655, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.650.

Entry price: 0.665

First target: 0.688

Second target: 0.716

Third target: 0.750

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

FET/USDT Testing Fibonacci – Bounce Incoming or Breakdown Ahead?📊 Technical Analysis Overview:

FET/USDT is currently testing a strong demand zone aligned with the Fibonacci Retracement 0.5 – 0.618 levels, specifically between $0.648 and $0.584. This “golden pocket” area is historically significant and often acts as a pivot zone for price reversals.

🔍 Chart Pattern:

The price formed a series of higher highs and higher lows from March to June, indicating a bullish structure.

Since July, momentum has weakened, and the price has corrected back into the key support zone that previously acted as a base for a rally.

---

📈 Bullish Scenario:

If price holds above $0.584 and forms a reversal candlestick (e.g., bullish engulfing or hammer), a strong rebound is likely.

Key upside targets:

$0.818 (minor resistance)

$0.904 (psychological level)

Potential breakout toward $1.225 if bullish volume returns.

📉 Bearish Scenario:

A decisive breakdown below $0.584 with high volume could trigger further downside toward:

$0.42 – $0.345 (next major support zone)

This move could confirm a bearish continuation pattern such as a descending triangle if resistance continues to hold.

---

🎯 Strategic Outlook:

The current zone is a make-or-break level, and the market is at a decision point. Traders should wait for a clear confirmation through price action and volume before committing to directional trades.

#FETUSDT #CryptoAnalysis #FibonacciSupport #AltcoinSetup #FetchAI #TechnicalOutlook #BullishOrBearish #SupportZone #GoldenPocket

$FETUSDT Support level. NYSE:FET just broke out of a falling wedge, which is a bullish sign.

It’s now holding above the 80-day EMA, a solid support level.

If this breakout holds, we could see a strong move toward $0.988, which is about a 43% increase from current levels.

Keep an eye on it.

DYRO, NFA

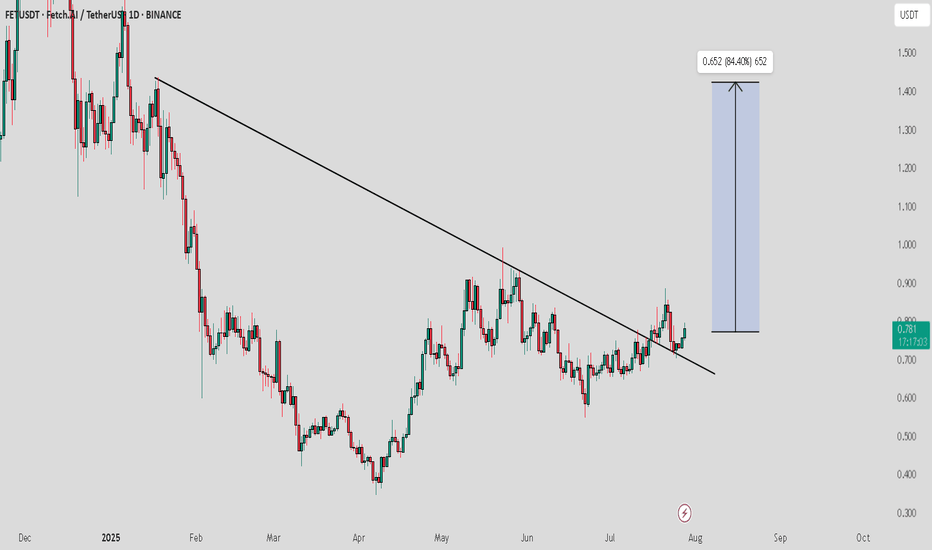

FET/USDT Breakout Imminent? Preparing for a Major Rally!

🧠 Key Pattern: Descending Trendline Breakout

On the daily chart (1D), FET/USDT (Fetch.AI) has been consolidating under a strong descending trendline since its late 2024 highs. Currently, price action is coiling tightly just below this resistance, signaling a potential explosive breakout.

The price is trading near $0.72, right below the trendline — is this the calm before a major move?

🔍 Technical Analysis Overview

📉 Previous Downtrend Structure:

After peaking above $2, FET underwent a prolonged correction phase marked by lower highs and lower lows.

Sellers dominated for months, but the momentum is now shifting.

📈 Current Setup:

FET is forming a series of higher lows since March — an early sign of bullish reversal.

Volume is showing slight increases, which often precedes breakout attempts.

✅ Bullish Scenario (Breakout Rally)

If the price breaks and closes above the descending trendline (~$0.75–$0.78):

1. Initial Resistance: $0.818 → minor overhead supply zone.

2. Confirmation Level: $0.904 → breakout validation zone.

3. Major Upside Targets:

$1.225 → psychological resistance & previous consolidation level.

$1.599 & $1.809 → Fibonacci extension targets from prior impulse.

$2.147 – $2.195 → potential retest of the previous high.

📌 Upside Potential: Over +150%, if breakout is confirmed with strong volume and sustained momentum.

❌ Bearish Scenario (Rejection & Pullback)

If the price gets rejected from the trendline:

Possible pullback to $0.65, the recent higher low support.

Breakdown below this could extend the move toward $0.55 or even $0.47.

Major support: $0.345 → long-term demand zone.

📉 A failed breakout (fakeout) is possible if volume does not support the move.

📊 Trading Strategy Suggestions:

Breakout Entry: Above $0.78 with stop-loss below $0.70.

Retest Entry: Wait for a pullback to confirm support at the trendline after breakout.

Volume Confirmation is Critical — avoid chasing without strong bullish candles.

🧠 Narrative Bonus:

Fetch.AI remains one of the top AI-related projects in the crypto space. As the AI narrative resurfaces, a technical breakout could align with renewed fundamental attention — creating the perfect storm for a rally.

📌 Conclusion:

FET/USDT is positioned at a highly critical technical and psychological level. A confirmed breakout could initiate a large bullish wave, while rejection could drag the price lower. Manage your risk wisely and watch for volume cues.

#FETUSDT #FetchAI #BreakoutSetup #CryptoTrading #AltcoinRally #TechnicalAnalysis #DescendingTrendline #CryptoSignals #AIcoins

#FET/USDT#FET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are seeing a rebound from the lower boundary of the descending channel. This support is at 0.634.

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.661

First target: 0.684

Second target: 0.720

Third target: 0.754

FETUSDT Major Resistance Cracked, Eyes on Sky!BINANCE:FETUSDT has recently broken out from a significant resistance level that previously acted as a strong barrier. After this breakout, the price action displayed a textbook retest of the former resistance—now turned support which held firm, confirming the bullish move.

This successful retracement signals strength in the current uptrend and opens the door for potential continuation towards higher highs. The market structure is showing signs of higher lows and increasing momentum, which could fuel a strong rally in the near term.

While the setup looks promising, it’s essential to emphasize risk management. Always use a stop-loss to protect your capital and manage your position sizing according to your trading plan. The crypto market can be volatile, and smart risk control separates long-term winners from short-term chasers.

All eyes are now on NYSE:FET for its next move. If momentum continues, we could witness a significant upward leg. Stay sharp and let the trend be your guide!

BINANCE:FETUSDT Currently trading at $0.88

Buy level : Above $0.8

Stop loss : Below $0.63

Target 1: $1.1

Target 2: $1.4

Target 3: $2.1

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

$FET has formed an ascending triangle pattern!NYSE:FET has formed an ascending triangle pattern!

After getting rejected from the $0.93–$0.95 resistance zone, price pulled back but it's holding above this lower trend-line support and this 100EMA.

If this support holds, we could see a move back toward the resistance zone, and maybe even a breakout above it.

DYOR, NFA

#FET/USDT#FET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.814.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.823

First target: 0.866

Second target: 0.912

Third target: 0.957

Eyes on FET – The Calm Before the Bullish Storm?BINANCE:FETUSDT previously broke out of a clean descending channel, flipping the trend and shifting into a bullish structure. Since the breakout, the price has been forming consistent higher highs and higher lows — a clear sign of growing momentum. Right now, it’s testing a local resistance zone. A strong breakout above this level could trigger a significant move to the upside, potentially setting the stage for a new bullish leg. Keep an eye on volume confirmation and price action at the resistance.

As always, manage your risk carefully — smart stop loss placement is key in volatile markets. Let the trend be your friend, but don’t forget your seatbelt!

BINANCE:FETUSDT Currently trading at $0.8

Buy level : Above $0.8

Stop loss : Below $0.63

Target : $2.1

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

#FET/USDT#FET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.696.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.721

First target: 0.779

Second target: 0.817

Third target: 0.863

#FET/USDT#FET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.695.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, which supports the upward trend.

We are heading towards stability above the 100 moving average.

Entry price: 0.730

First target: 0.765

Second target: 0.810

Third target: 0.850

FET/USDT – Daily Technical AnalysisFET/USDT – Daily Technical Analysis

On the daily chart , FET has key weekly support at $0.340 and weekly resistance at $2.00. After a strong upward move, the price has now reached the top of its descending trendline, which may lead to a potential short-term correction.

This correction could extend down to the daily support level at $0.50, which is around 20% below the current price.

However, if the price manages to break above the daily resistance at $0.80, it would signal bullish continuation, with a short-term target at $1.00.

🟢 Support Levels:

$0.50 (daily support – potential correction target)

$0.340 (weekly support – major long-term level)

🔴 Resistance Levels:

$0.80 (daily resistance – key breakout level)

$1.00 (initial bullish target after breakout)

$2.00 (weekly resistance – major long-term barrier)

#FET/USDT#FET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 620.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.625

First target: 0.659

Second target: 0.647

Third target: 0.659

#FET/USDT Futures Trade Setup!#FET looks good if you missed.

Two options to enter:

1. You can accumulate .5869 to .6080

2. Wait for the US Open and buy at CMP with confirmations.

Targets : .6377 .6522, .6755, .6838 and .7021

SL .5772

Dyor, NFA

Do hit the like button if you want me to post more setups like this.

Thank you

#PEACE