FILUSDT The daily chart of BINANCE:FILUSDT shows an overall bearish structure, but weakening selling pressure and price consolidation suggest that downside momentum is fading at current levels.

Price is moving inside a lower-range trading zone, and a breakout above the range high could be the first sign of a bearish trend correction.

Supports:

1.150

Resistances:

1.311

1.600 to 1.700

2.100

2.500

FILUSDTPERP

#FIL/USDT Ready for a Breakout? Analysis of a Long Accumulatio#FIL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 1.54, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 1.60

First target: 1.70

Second target: 1.77

Third target: 1.80

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

FIL/USDT — Brutal Rejection or the Beginning of Major Reversal?FIL/USDT is entering one of the most critical decision zones of the entire 2025 structure. After spending months inside a clean, well-defined downtrend (yellow trendline), FIL attempted a breakout — only to be met with a violent wick rejection, signaling heavy supply waiting above.

Price has now fallen back into the Golden Retracement zone (0.5–0.618 Fibonacci) — a region that often determines whether a market forms a true reversal or continues its larger downtrend. What happens here is pivotal.

---

🔶 Key Structure & Pattern Insights

1. Long-Term Downtrend Still in Control

Clear formation of lower highs and lower lows visible since early 2025.

The yellow descending trendline has acted as major resistance for almost the entire year.

2. False Breakout (Wick Rejection)

FIL broke above the trendline but failed to close above it.

This usually indicates upside liquidity grab, not a confirmed reversal.

3. Price Returns to the Critical Fibonacci Zone

0.5 = 2.155

0.618 = 1.968

A textbook retest region where major directional decisions often occur.

4. Layered Resistance Levels Above

If FIL stabilizes, these become the upside checkpoints:

2.65 → key confirmation level

3.27 → first major resistance

4.875 / 6.07 / 7.88 → structural targets if a full reversal unfolds

---

🟢 Bullish Scenario (True Reversal Potential)

Bullish bias becomes valid ONLY if:

✔ Price holds above 2.15–1.97 and forms a higher low

✔ A 2D/weekly close occurs above 2.65

If both conditions are met → the trend reversal becomes official.

Bullish targets:

3.27 – first major confirmation

4.875 – upside continuation

6.07 – mid-term target

7.88 – high zone that may trigger market FOMO

Additional Bullish signals:

Volume expansion on the 2.65 breakout

Clean retest of the Fibonacci zone

Strong-bodied candles instead of wick-driven spikes

---

🔴 Bearish Scenario (False Breakout Confirmed)

Bearish continuation strengthens if:

❌ Price breaks & closes below 1.97 (0.618 Fib)

If this happens → the previous breakout is fully confirmed as a false break, and the downtrend resumes.

Downside targets:

1.70–1.50 → major structural support

Breakdown below this region could send FIL to deeper lows

Additional Bearish signals:

Strong rejection near 2.15–2.20

Increasing sell volume

Weak reaction every time price retests the trendline

---

🎯 Key Takeaways

FIL is currently sitting at a major reversal zone or a continuation breakdown point.

📌 2.15–1.97 is the main battlefield

📌 Closing above 2.65 = multi-week bullish potential

📌 Losing 1.97 = downtrend continuation

📌 Watch 2D and weekly closes very closely

This is a decision zone — not a place for FOMO, but a place for precision and disciplined planning.

---

#FIL #FILUSDT #Filecoin #CryptoAnalysis #TechnicalAnalysis #TrendReversal #Fibonacci #Breakout #Rejection #CryptoTrading

#FIL/USDT Ready for a Breakout? Analysis of a Long Accumulatio#FIL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 1.47, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 1.54.

First target: 1.57.

Second target: 1.60.

Third target: 1.64.

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

FIL/USDT — The Big Test: Real Breakout or Just Another Trap?After months of being trapped under a strong descending trendline, Filecoin (FIL) is finally showing signs of awakening. A strong bullish candle on the 2D timeframe has pierced through the long-term downtrend line — but the question remains: is this the beginning of a true reversal, or just a fake breakout before another drop?

---

🔹 Overview

Current price around $2.24, testing the descending trendline (yellow).

Key resistance levels: $2.65 → $3.27 → $4.875 → $6.07 → $7.88 (High $8.42).

Major support zones sit at $1.25–$1.50, with psychological support near $1.05.

---

🔸 Technical Pattern Analysis

The chart shows a prolonged accumulation phase beneath a descending trendline — a typical setup before a major directional shift.

The latest breakout candle signals possible momentum change, yet the market hasn’t given full confirmation.

If the next 2D close holds above the trendline and the $2.65 level, that would strongly suggest the end of the long-term downtrend, opening the door for a new bullish expansion phase.

---

🚀 Bullish Scenario

Confirmation Signs:

2D close above $2.65 with strong volume and a clean retest.

RSI and MACD showing momentum shift to the buyers.

Upside Targets:

First target: $3.27 (initial breakout zone).

Next targets: $4.875 → $6.07 → $7.88, if momentum continues.

Strategy:

Conservative entry after retest on trendline / $2.65.

Stop loss below $1.95.

Risk-to-Reward: 2:1 up to 3:1 if breakout holds.

Bullish Narrative:

“If the retest holds, FIL could be entering a new accumulation breakout phase — signaling the end of the long-term downtrend and the start of a mid-term rally toward $4–6.”

---

⚠️ Bearish Scenario

Conditions:

Failure to close above the trendline and fall back below $2.00–$2.20.

Rising sell volume confirming a false breakout or bull trap.

Implications:

Price could revisit the consolidation range $1.50–$1.25,

or even drop to $1.05 if bearish momentum strengthens.

Strategy:

Short entries only on clear rejection candles (strong red 2D + high volume).

Downside targets: $1.50 → $1.25, Stop Loss above $2.65.

Bearish Narrative:

“A failed breakout would indicate the market isn’t ready for a trend reversal — FIL may return to deeper consolidation before any sustainable move up.”

---

🔍 Key Takeaways

Breakout vs Breakdown — the chart is at a critical crossroads.

2D close above $2.65 = bullish confirmation.

Rejection from the trendline = potential for another false rally and continuation of the downtrend.

Momentum suggests something big is approaching — patience and confirmation are key.

---

🧭 Conclusion

The FIL/USDT chart currently represents a classic battle between bulls and bears.

A breakout of a long-term descending trendline doesn’t happen often — and its confirmation will decide the direction for months ahead.

If buyers manage to hold above the breakout level and print a new higher high, FIL could enter a significant recovery phase.

But if momentum fades and sellers regain control, the correction may deepen before any true reversal.

#FIL #FILUSDT #Filecoin #CryptoAnalysis #BreakoutWatch #TrendlineBreak #CryptoTrading #AltcoinAnalysis #TechnicalAnalysis

FIL can touch 1$ in the coming weeksFIL / USDT

The price just brokedown the Huge trading range (2022-2025) on weekly chart and price still find difficulty to restore the broken support

Our view for this coin in mid term is bearish and few weeks we can see FIL hits 1$ 📉

This is my macro view for FILUSD as long as price doesn’t reclaim the support with strong volume

Best of wishes

FILUSDT TRADE IDEA.Market Context: FIL has broken structure to the upside, showing bullish momentum on the 15m timeframe.

POI (Point of Interest): Price has created a clear OB + FVG confluence zone around 2.44 – 2.46, which is highlighted as the demand zone.

Liquidity Sweep (SSL): Before reversing up, price may sweep the short-term liquidity resting below the recent lows.

Outlook: As long as the demand zone holds, structure suggests continuation toward higher levels, with potential to retest recent highs near 2.52 – 2.55.

FIL/USDT — Bearish Continuation vs Potential Reversal?Currently, Filecoin (FIL) is trading at a critical decision point on the daily timeframe. The chart shows a clear descending triangle pattern, formed by a downtrend resistance line and a horizontal support zone around $1.96 – $2.28.

This pattern is typically seen as a bearish continuation, but it can also trigger a strong reversal breakout if price breaks above resistance with significant volume. In short, the market is now at a make-or-break zone — either a breakdown to new lows or a bullish breakout that could spark a strong rally.

---

🔎 Pattern Details & Key Levels

Pattern: Descending Triangle (lower highs + flat support)

Major Support Zone: $1.96 – $2.28 (strong demand zone, price has bounced multiple times)

Dynamic Resistance: descending trendline pressing since early 2025

Static Resistance Levels: $2.737 – $3.094 – $3.537 – $4.832

Psychological Levels above: $6.0 – $8.0

Measured Move Targets (triangle height):

Upside breakout = ≈ $3.51

Downside breakdown = ≈ $1.19

---

✅ Bullish Scenario

Trigger: Daily close above the descending trendline + confirmed breakout above $2.737 with strong volume.

Additional confirmation: Successful retest of trendline / $2.737 as new support.

Targets:

Short-term: $3.09

Primary measured move: $3.51

Extended targets: $3.53 – $4.83 (if momentum continues)

Upside potential: From $2.28 → $3.51 = +53.6%

---

❌ Bearish Scenario

Trigger: Daily close below $1.964 with convincing volume.

Additional confirmation: Failed retest of $1.96 as resistance.

Targets:

Primary measured move: ≈ $1.19

Psychological area: $1.00 (potential liquidity zone)

Downside risk: From $2.28 → $1.19 = -47.8%

---

📌 Conclusion

FIL/USDT is at a major crossroad.

Holding the $1.96–$2.28 support + breakout above the trendline opens the door to $3.51 and potentially $4.83.

Losing this support would confirm a bearish breakdown towards $1.19.

Best approach: Wait for daily close + volume confirmation to avoid false breakouts/breakdowns.

⚠️ Disclaimer: This analysis is for educational purposes only, not financial advice. Always apply proper risk management.

---

> FIL/USDT is now testing a decision zone with a descending triangle pattern on the daily chart.

Bullish case: Breakout above $2.737 → targets $3.09 to $3.51

Bearish case: Breakdown below $1.964 → target $1.19

$1.96 – $2.28 remains the critical support — either the last defense before a deeper drop, or the launchpad for the next rally.

🚨 Watch for daily close & volume to confirm the move!

#FIL #FILUSDT #Filecoin #Crypto #TechnicalAnalysis #DescendingTriangle #SupportResistance #Breakout #BearishScenario #BullishScenario #CryptoTrading

FIL/USDT – Major Trendline Breakout Imminent?The FIL/USDT chart is showcasing a significant descending trendline that has been respected since its peak in late December 2024. Price action has recently approached this trendline again, and a potential breakout scenario is forming. This setup may signal a major shift in trend after months of persistent decline.

🔍 Technical Analysis:

Trendline Resistance:

The long-term descending yellow trendline has capped every bullish rally since early 2025. A breakout above this trendline would be a major bullish technical signal.

Support Level:

Key horizontal support has been held at around $1.96, which has formed a strong base.

Potential Breakout Projection:

Upon breakout, $2.746 is the first resistance to watch.

A successful retest of this level could lead to a stair-step rally targeting:

$3.222

$3.537

$4.803

$5.863

$6.758

And potentially $8.069–$8.425 if momentum continues.

Bullish Pattern:

The projected move shows a potential impulse wave pattern following the breakout, indicating staged profit-taking zones for traders.

🧠 Strategic Consideration:

A daily candle close above the trendline with volume confirmation would be the first sign of trend reversal.

Conservative traders may wait for a retest of the trendline as support before entering.

Targets can be approached progressively based on price action near each resistance level.

⚠️ Risk Management:

Watch for fakeouts near the trendline.

A break below the key support of $1.96 would invalidate the bullish thesis.

FILUSDTFIL is showing signs of a potential trend reversal 📊

Price has formed a higher low and is now approaching the key resistance at 2.485 USDT. A breakout above this level could open the way toward the next major zones around 2.887 and even 3.189 USDT 🚀

However, if rejection occurs, we might see a pullback toward the 2.272 USDT support area 🔁

Currently, momentum is leaning bullish and favoring a move higher, especially if the descending trendline gets broken with strength 💪

FIL bull-pollbakThe Filecoin ( BINANCE:FILUSDT ) chart, after a correction to $2.65, is attempting to pull back to the broken level around $2.77. If it fails to break this resistance, another decline towards support levels at $2.525 and then $2.39 is likely, which could act as a potential starting point for a new upward movement towards targets at $3.02 and $3.30.

🔑 Key Zones on the FIL Chart:

Primary Resistance: $2.77 (Pullback to broken level)

First Support: $2.525

Second Support: $2.39

First Bullish Target: $3.02

Second Bullish Target: $3.30

#FIL/USDT#FIL

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 2.60, which acts as strong support from which the price can rebound.

Entry price: 2.64

First target: 2.72

Second target: 2.78

Third target: 2.87

#FIL/USDT#FIL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 2.68.

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 2.73

First target: 2.78

Second target: 2.86

Third target: 2.95

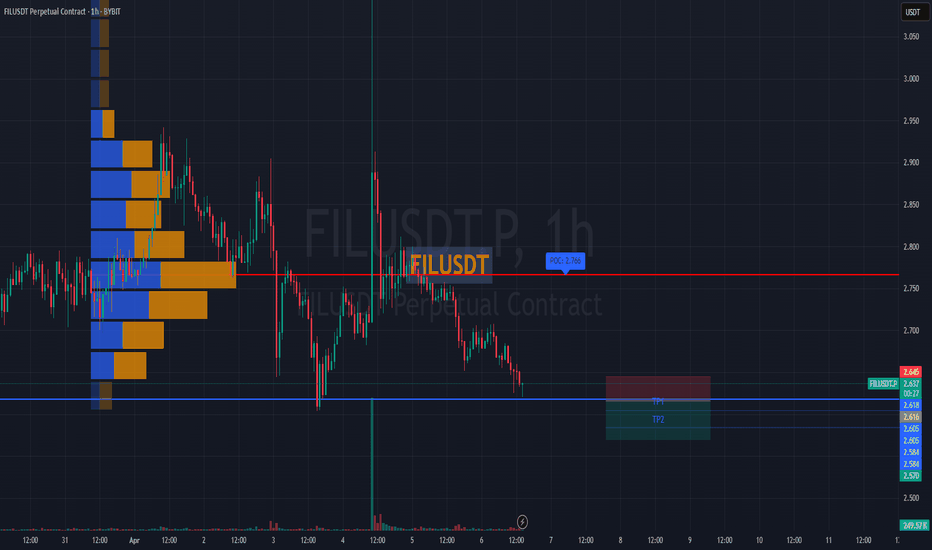

#FILUSDT remains under bearish pressure📉 SHORT BYBIT:FILUSDT.P from $2.616

🛡 Stop loss $2.645

🕒 1H Timeframe

⚡️ Overview:

➡️ The POC (Point of Control) BYBIT:FILUSDT.P is located at $2.766, far above the current price — this highlights strong historical selling pressure.

➡️ Price is forming lower highs and lower lows, confirming a bearish trend.

➡️ The breakdown below $2.616 triggered the short setup with further downside potential.

➡️ Volume spikes during red candles indicate continued seller activity.

🎯 TP Targets:

💎 TP 1: $2.605

💎 TP 2: $2.584

💎 TP 3: $2.570

📢 Watch the $2.616 zone — holding below increases downside probability.

📢 If price moves above $2.645, the setup becomes invalid.

BYBIT:FILUSDT.P remains under bearish pressure — short bias stays valid under current structure.

Filecoin FIL Will Continue Bear MarketHello, Skyrexians!

Recently we made the most hated article about Bitcoin Dominance growth, but this chart reflects great what can happen soon. The mistake of the most traders here is that they are sure that alseason will come now. Most of crypto shows weakness and we need to be more realistic. Today we take a look at BINANCE:FILUSDT as an example of bear market continuation for risky assets!

Let's take a look at the weekly chart. Current bear market can be seen as an ABC. The most common mistake that people think that wave B is an accumulation, but this is redistribution and the new mark down phase is starting now. The support will be broken because there is no other way. There was a chance for altcoin season in November when price has formed the anticipated wave 1, but wave 2 has broken this belief and now we are in the wave C. Current wave is wave 3, but to the downside. Targets are very low, they cannot be measured, but FIL may easily touch $1. This bear market will be finished with the ending diagonal, like most of major trends. This information is not for panic, but be ready for the big crash again. Anyway, now there is a great price for long term accumulation, the only one question will you be able to see -70% from the current portfolio value?

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!