Foryou

AVAX - Rising Wedge at $14.12 | ETF Filings Spark +11% Rally

Executive Summary

Avalanche (AVAX) trading at $14.12 within a rising wedge on the 2H timeframe. Price surged +11% this week as institutional ETF filings sparked a rally. Now testing upper resistance with two scenarios: bullish breakout above $14.75 or pullback to $12.00-$12.75 support zone before continuation.

BIAS: NEUTRAL - Watching for Breakout or Pullback

Current Market Data

Current: $14.123 (-0.82%)

Day's Range: $14.033 - $14.516

52-Week: $9.013 - $44.575

Market Cap: $6.08B

24h Volume: $384.76M

Technical Rating: Neutral

Performance:

1W: +11.80% | 1M: +6.89% | 3M: -53.89%

6M: -23.09% | YTD: +14.80% | 1Y: -66.85%

Key Catalyst

Institutional ETF filings sparked +11% rally

AVAX among altcoins with ETF filing momentum

Fortune 100 companies expected to launch blockchains on Avalanche

Strong ecosystem for enterprise adoption

Technical Structure - 2H

Rising Wedge Pattern:

Rising support and resistance trendlines (yellow dashed)

Wedge narrowing toward apex

Can break either direction

Currently testing upper resistance

Key Levels:

Resistance:

$14.50 - $14.75 - Upper resistance / breakout level

$15.00 - Psychological resistance

$16.00+ - Extended bullish target

Support:

$14.00 - Immediate support

$12.75 - Upper support zone

$12.00 - $12.75 - Major support zone (purple)

$11.75 - Deep support (red line)

SCENARIO ANALYSIS

BULLISH: Breakout Above $14.75

Trigger: 2H close above $14.75 with volume

Targets: $15.00 → $16.00 → $18.00

Catalyst: ETF momentum continues

BEARISH: Pullback to Support Zone

Rejection at upper wedge resistance

Pullback to $12.00-$12.75 support zone

Healthy retest before continuation

Buy opportunity at support

My Assessment

Rising wedge at resistance after +11% ETF-driven rally. Two scenarios: breakout above $14.75 or pullback to $12.00-$12.75 support zone. ETF filings provide fundamental catalyst. Watch for confirmation before entry.

Strategy:

Long above $14.75 breakout → Target $15, $16, $18

Or wait for pullback to $12.00-$12.75 support

Long at support with stop below $11.75

Target $14.50+ on bounce

List your thoughts below!

USD/JPY)Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of USDJPY – 4H chart using SMC + Fibonacci OTE + EMA support.

⸻

Market Context (4H)

• Primary bias: Bullish continuation

• Higher-timeframe structure remains bullish

• Price is holding above EMA 200, confirming HTF trend

• Recent drop is a corrective pullback, not a reversal

⸻

Structure & Price Behavior

• Price made an impulsive move up → now correcting

• Pullback is moving into a discount zone

• Market is aligning with OTE (Optimal Trade Entry) levels

• EMA 200 + EMA 50 are acting as dynamic support

This is a textbook pullback → continuation setup.

⸻

Key Buy Zone (OTE + HTF Demand)

~155.40 – 155.70

Why this zone matters:

• Fibonacci OTE (0.705 – 0.79)

• HTF demand zone

• EMA 200 confluence

• Prior structure support

• Marked reaction area (green arrow)

This is where smart money typically reloads longs.

⸻

Trade Idea (Primary Scenario)

BUY Setup

• Entry: 155.40 – 155.70

• Stop Loss: Below 155.00

• Targets:

• TP1: 156.50

• TP2: 157.20

• Final TP: 157.75 (marked target point / liquidity above highs)

Risk–Reward: ~1:3+

⸻

Confirmation Checklist

Wait for confirmation inside the zone:

• Bullish engulfing candle

• Strong rejection wicks

• Lower-TF CHoCH

• No acceptance below EMA 200

⸻

Invalidation

• 4H close below ~155.00

• Acceptance below HTF demand + EMA 200

If invalidated → expect deeper correction toward lower support.

⸻ Mr SMC Trading point

Summary

This setup shows a high-probability bullish continuation

• Trend intact

• Pullback into discount

• OTE + EMA + demand confluence

• Clear upside liquidity target

Please support boost this analysis

EUR/USD) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of EURUSD – 4H chart, aligned with SMC + structure + EMA support.

⸻

Market Context (4H)

• Primary bias: Bullish continuation

• Higher-timeframe structure remains higher highs & higher lows

• Price is trading above EMA 200, confirming bullish HTF bias

• Current move is a healthy correction, not trend reversal

⸻

What Price Is Doing

• Price is consolidating inside a descending corrective channel

• The pullback has reached a discount area

• Price tapped a bullish order block (OB) + EMA support

• This is typical re-accumulation before continuation

⸻

Key Zones

HTF Demand / Order Block

~1.1720 – 1.1740

• Marked OB zone

• Confluence with EMA 50 & EMA 200

• Previous resistance → support flip

• Strong reaction zone (green arrow)

Invalidation Zone

~1.1680

• Acceptance below this level weakens bullish structure

⸻

Trade Idea (Primary Scenario)

BUY Setup (Continuation Play)

• Entry: 1.1720 – 1.1740

• Stop Loss: Below 1.1680

• Targets:

• TP1: 1.1780

• TP2: 1.1820

• Final TP: 1.1867 (HTF target / liquidity above highs)

Risk–Reward: ~1:3+

⸻

Confirmation Checklist

Look for:

• Bullish engulfing or strong rejection from OB

• Lower-TF CHoCH

• Failure to close below demand

• Momentum expansion to the upside

⸻

Invalidation

• 4H close below 1.1680

• Acceptance below HTF demand + EMA 200

If invalidated → expect deeper pullback toward lower demand.

⸻ Mr SMC Trading point

Summary

This setup represents a classic bullish continuation:

• Trend intact

• Correction into discount

• OB + EMA confluence

• Clear upside liquidity target

Please support boost this analysis

GBP/JPY) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of GBPJPY – 1H chart using SMC + structure break + support flip.

⸻

Market Context

• Bias: Bullish continuation

• Strong impulsive move up → market entered consolidation

• Structure shows accumulation above key support

• EMA alignment:

• EMA 50 above EMA 200

• EMA 50 acting as dynamic support

⸻

What the Market Did

• After the impulsive rally, price formed a descending corrective structure

• That structure was broken to the upside → bullish BOS

• Price is now holding above a key support zone (blue area)

This signals re-accumulation, not distribution.

⸻

Key Support / Demand Zone (Blue Area)

~210.20 – 210.60

Why this zone matters:

• Previous resistance → support flip

• Multiple reactions (acceptance)

• EMA 50 sitting inside the zone

• Liquidity sweep below support → quick recovery

This is where buyers are defending positions.

⸻

Trade Idea (Continuation Long)

Buy on pullback or buy on confirmation

• Entry: 210.30 – 210.60

• Stop Loss: Below support (~209.90)

• Targets:

• TP1: 211.50 (recent high)

• TP2: 212.60

• Final TP: 213.30 – 213.50 (marked target point / liquidity above highs)

Risk–Reward: ~1:3+

⸻

Confirmation Triggers

Best confirmations:

• Bullish engulfing candle from support

• Strong rejection wick (liquidity grab)

• Lower-TF CHoCH

• Momentum expansion after pullback

⸻

Invalidation

• 1H close below ~209.90

• Acceptance below EMA 50 + support zone

If this happens → bullish continuation idea is invalid, and price may rotate deeper.

⸻ Mr SMC Trading point

Summary

This setup is a classic bullish continuation after consolidation:

• Trend intact

• Structure break

• Support flip + EMA confluence ✔

Please support boost this analysis

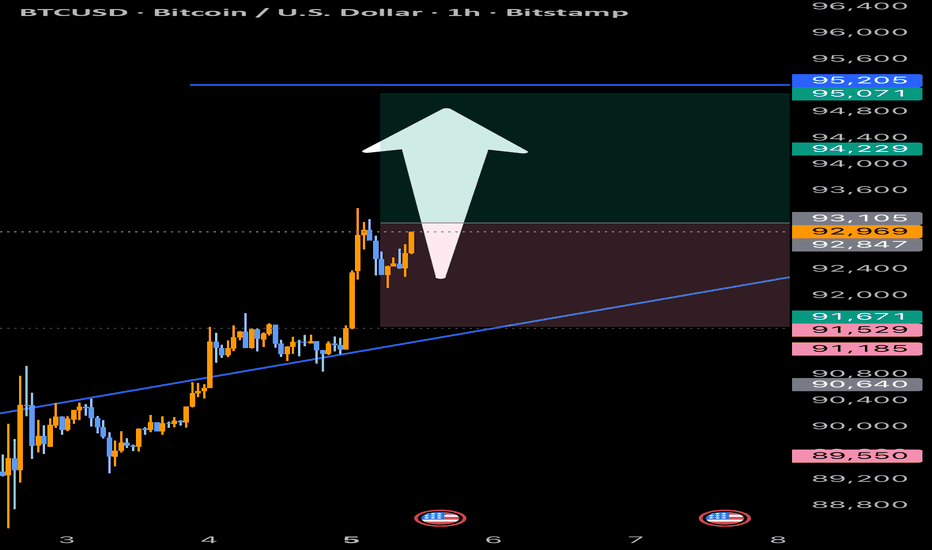

BTC/ISD)Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of BTCUSDT – 1H chart using SMC + Fibonacci OTE + EMA confluence.

⸻

Market Context

• Bias: Bullish continuation

• Clear impulsive bullish displacement broke previous structure

• Price is holding above EMA 50 & EMA 200

• Current move down is a controlled pullback, not a reversal

⸻

What the Market Is Doing

• After the impulse, price retraced to rebalance inefficiency

• Pullback is occurring into discount within an uptrend

• Structure remains intact → buyers still in control

⸻

Key Buy Zone (Blue Area)

~87,600 – 88,050

This zone is high-probability because of:

• Fib OTE zone (0.705 – 0.79)

• SMC demand / order block

• EMA 50 support (~87,983)

• Prior consolidation before impulse

• Long lower wicks → sell-side liquidity taken

This is where smart money typically reloads longs.

⸻

Fibonacci Logic

Measured from the impulse low → high:

• 0.5 / 0.62 = shallow retracement

• 0.705 – 0.79 = optimal trade entr

Ideal location for trend continuation setups

⸻

Trade Idea (Continuation Long)

Buy on confirmation inside demand

• Entry: 87,650 – 88,050

• Stop Loss: Below demand (~87,100)

• Targets:

• TP1: 88,900 (recent high)

• TP2: 89,600

• Final TP: 90,360 (marked target point / liquidity above highs)

Risk–Reward: ~1:3 to 1:4

⸻

Confirmation Triggers (Important)

Only enter if you see:

• Bullish engulfing or strong rejection wick

• Lower-timeframe CHoCH

• Failure to accept below the OTE zone

• Momentum expansion after tapping demand

⸻

Invalidation

• 1H close below ~87,100

• Acceptance below EMA 50 + demand

If this happens → bullish idea is invalid, and price may seek deeper liquidity.

⸻ Mr SMC Trading point

Summary

This is a textbook bullish continuation setup:

• Strong impulse

• OTE + demand + EMA confluence

• Clear upside liquidity target

Please support boost this analysis

XAU/USD)Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of XAUUSD (Gold) – 4H chart using SMC + EMA + HTF support logic.

⸻

Market Context (4H)

• Primary bias: Bullish continuation (after correction)

• Strong impulsive sell-off was corrective, not a trend change

• Overall higher-timeframe structure is still bullish

• Price is now reacting from a key HTF support zone

⸻

What Just Happened

• Price swept sell-side liquidity aggressively

• Immediate rejection from lows → strong bullish reaction

• This indicates smart-money absorption at discount

• Market is now in a recovery / rebalancing phase

⸻

Key Levels on Chart

HTF Demand / Strong Support Zone

~4,285 – 4,325

• Labeled as key strong support level

• Previous consolidation base

• Where institutions previously accumulated

• Area of highest-probability defense

FVG / Re-entry Zone

~4,345 – 4,365

• Inefficiency left by impulsive drop

• Ideal pullback / continuation zone

• Price already reacting here (green arrow)

⸻

Trade Idea (Primary Scenario)

BUY Setup (Continuation Play)

• Entry: 4,345 – 4,365

• Stop Loss: Below 4,285

• Targets:

• TP1: 4,403 (EMA 50 / mid-structure)

• TP2: 4,480

• Final TP: 4,520 (marked target point / liquidity above highs)

RR potential: ~1:3+

⸻

Confirmation Checklist

Before committing size, look for:

• Bullish engulfing from FVG

• Strong rejection wicks

• Lower-timeframe CHoCH

• Price holding above the strong support zone

⸻

Invalidation

• 4H close below ~4,285

• Acceptance below HTF demand

If that happens → bullish continuation is invalid, and deeper downside is possible.

⸻ Mr SMC Trading point

Summary

This setup shows classic HTF liquidity grab → reaction → continuation:

• Sell-side liquidity taken

• Strong HTF demand respected

• FVG acting as re-entry

• Clear upside liquidity target

Please support boost this analysis

EUR/USD) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of EURUSD – 2H chart using SMC + Fibonacci OTE + EMA trend continuation.

⸻

Market Context

• Bias: Bullish continuation

• Overall structure shows higher highs & higher lows

• Strong impulsive move followed by healthy corrective channels

• Price is holding above EMA 200, confirming HTF bullish bias

• EMA 50 is acting as dynamic intraday support

⸻

What Price Is Doing

• After a strong bullish displacement, price entered a descending corrective channel

• That channel has now broken to the upside (bullish BOS)

• Current pullback is a retest / re-accumulation, not weakness

This is classic trend → correction → continuation behavior.

⸻

Key Buy Zone (Blue Area)

~1.1735 – 1.1750

Why this zone is high-probability:

• SMC demand / order block

• Fib OTE zone (0.705 – 0.79)

• EMA 50 + EMA 200 confluence

• Previous resistance → support flip

• Multiple reactions already marked (green arrows)

This zone represents institutional rebalance, not retail buying.

⸻

Fibonacci Logic

Measured from the latest impulse low → swing high:

• 0.5 / 0.62 = shallow pullback

• 0.705 – 0.79 = optimal trade entry (OTE)

Textbook continuation location in a bullish market

⸻

Trade Idea (Continuation Long)

Buy on confirmation inside demand

• Entry: 1.1735 – 1.1750

• Stop Loss: Below demand (~1.1710)

• Targets:

• TP1: 1.1780 (recent high)

• TP2: 1.1820

• Final TP: 1.1880 – 1.1890 (marked target point / liquidity above highs)

Risk–Reward: ~1:3+

⸻

Confirmation Triggers (Important)

Only take the trade if you see:

• Bullish engulfing or strong rejection wick from the zone

• Lower-timeframe CHoCH

• Failure to accept below the OTE zone

• Momentum expansion after tapping demand

⸻

Invalidation

• 2H close below ~1.1710

• Acceptance below EMA 200 + demand zone

If this occurs → bullish continuation idea is invalid, and price may rotate deeper.

⸻ Mr SMC Trading point

Summary

This setup is a textbook bullish continuation:

• Trend intact

• Corrective structure resolved

• OTE + demand + EMA confluence

• Clear upside liquidity target

Key edge: wait for price to confirm buyers inside discount — don’t chase the highs.

Please support boost this analysis

EUR/USD)Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of EURUSD – 1H chart using SMC + Fibonacci OTE + EMA confluence.

⸻

Market Context

• Bias: Bullish continuation

• Overall structure remains higher highs & higher lows

• Price is still above the EMA 200, keeping the higher-timeframe bullish bias intact

• The recent downside move is a corrective pullback, not a reversal

⸻

Why Price Is Pulling Back

• After the impulsive rally, price tapped short-term resistance (0 level)

• Profit-taking caused a retracement into discount

• Pullback is orderly and aligned with trend structure

⸻

Key Buy Zone (Blue Area)

~1.1728 – 1.1742

This zone is high-probability due to strong confluence:

• SMC demand / order block

• Fib OTE zone (0.705 – 0.79)

• EMA 200 support

• Rising internal trendline

• Marked buyer reaction (green arrow)

This area is where institutions typically rebalance long positions.

⸻

Fibonacci Logic

Measured from the latest impulse low → high:

• 0.5 / 0.62 = shallow retracement

• 0.705 – 0.79 = optimal trade entry (OTE)

Ideal location for trend continuation longs

⸻

Trade Idea (Continuation Long)

Buy on confirmation inside demand

• Entry: 1.1730 – 1.1740

• Stop Loss: Below demand (~1.1705)

• Targets:

• TP1: 1.1779 (EMA 50 / mid-range)

• TP2: 1.1800

• Final TP: 1.1820 (marked target point / liquidity above highs)

Risk–Reward: ~1:3+

⸻

Confirmation Triggers (Very Important)

Only take the trade if you see:

• Bullish engulfing or strong rejection wick

• Lower-timeframe CHoCH

• Failure to accept below the OTE zone

• Momentum expansion after tapping demand

⸻

Invalidation

• 1H close below ~1.1705

• Acceptance below EMA 200 + demand

If this happens → bullish idea is invalid, and price may seek deeper support.

⸻ Mr SMC Trading point

Summary

This setup is a textbook bullish pullback:

• Trend intact

• OTE + demand confluence

• Clear upside liquidity target

Please support boost this analysis

XAU/USD)Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of XAUUSD (Gold) – 1H chart using SMC + Fibonacci OTE + trend-channel continuation.

⸻

Market Context

• Bias: Bullish continuation

• Price is respecting a well-defined ascending channel

• Market structure remains higher highs & higher lows

• EMAs:

• EMA 50 above EMA 200

• EMA 50 acting as dynamic support

• Recent consolidation near highs = absorption, not reversal

⸻

What Price Is Doing

• After the impulsive rally, price paused at internal resistance

• This pause is forming a controlled pullback

• The projected path shows a dip into discount → continuation higher

This is classic trend continuation behavior.

⸻

Key Buy Zone (Lower Blue Area)

~4,475 – 4,495

Strong confluence here:

• SMC demand / order block

• Fib OTE zone (0.705 – 0.79)

• EMA 50 support (~4,498)

• Rising channel support

• Clear reaction point (green arrow)

This is the high-probability long zone, not the current price.

⸻

Fibonacci Logic

Measured from the impulse low → recent high:

• 0.5 / 0.62 = shallow retracement

• 0.705 – 0.79 = optimal trade entry (OTE)

Institutions typically rebalance longs here in an uptrend

⸻

Trade Idea (Continuation Long)

Buy on confirmation inside demand

• Entry: 4,475 – 4,495

• Stop Loss: Below demand & channel (~4,455)

• Targets:

• TP1: 4,535 (recent high)

• TP2: 4,560

• Final TP: 4,575 – 4,580 (marked target / upper channel liquidity)

Risk–Reward: ~1:3 or better

⸻

Confirmation Triggers (Important)

Only execute if you see:

• Bullish engulfing or strong rejection wick from the zone

• Lower-timeframe CHoCH

• Failure to accept below the OTE zone

• Momentum expansion after tapping demand

⸻

Invalidation

• 1H close below ~4,455

• Acceptance below channel support + EMA 50

If this occurs → bullish continuation idea is invalid, and price may rotate deeper.

⸻Mr smc Trading point

Summary

This setup is a textbook bullish pullback:

• Trend intact

• OTE + demand + EMA confluence

• Clear upside liquidity target

Key edge: wait for price to come discount and confirm buyers, don’t chase highs.

Please support boost this analysis

XAU/USD)Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of XAUUSD (Gold) – 1H chart using trend structure + SMC + Fibonacci OTE.

⸻

Market Context

• Overall bias: Bullish

• Price is respecting a rising channel

• Market structure still shows higher highs & higher lows

• Recent drop is a healthy pullback, not a trend reversal

⸻

Why Price Is Pulling Back

• Price reacted near short-term resistance (0 level)

• Profit-taking + liquidity sweep caused a retracement

• Pullback is heading into a discount zone within an uptrend

⸻

Key Buy Zone (Blue Area)

~4,465 – 4,480

This zone has strong confluence:

• SMC demand / order block

• Fib OTE zone (0.705 – 0.79)

• EMA 50 support

• Rising trendline support

• Clear reaction level (green arrow)

This is where buyers are expected to defend the trend.

⸻

Fibonacci Logic

Measured from the recent impulse low → high:

• 0.5 / 0.62 → shallow retracement

• 0.705 – 0.79 → institutional rebalance zone

Textbook area for trend continuation entries

⸻

Trade Idea (Continuation Long)

Buy on confirmation inside demand

• Entry: 4,465 – 4,480

• Stop Loss: Below demand & trendline (~4,450)

• Targets:

• TP1: 4,500 (internal structure high)

• TP2: 4,525

• Final TP: 4,551 (marked target point / liquidity above highs)

Risk–Reward: ~1:3 or better

⸻

Confirmation Triggers (Important)

Only enter if you see:

• Bullish engulfing or strong rejection wick

• Lower-TF CHoCH

• Failure to close below the demand zone

• Momentum expansion after tapping the zone

⸻

Invalidation

• 1H close below ~4,450

• Acceptance below trendline + EMA 50

If this happens → bullish idea is invalid, and price may seek the lower support.

⸻ Mr SMC Trading point

Summary

This setup is a high-probability bullish pullback:

• Trend intact

• Fib OTE + demand

• Clear upside liquidity target

Please support boost this analysis