#FTT/USDT : Go to work, it's good#FTT

The price is moving within a descending channel on the hourly timeframe. It has reached the upper boundary and is heading towards breaking it. A retest of this boundary is expected.

The Relative Strength Index (RSI) is showing an upward trend, as it has approached the upper boundary. A bearish reversal is expected.

There is a key support zone in green at 0.4850. The price has bounced from this zone several times and is expected to bounce again.

A consolidation trend is observed above the 100-period moving average, which we are approaching. This trend supports a decline towards this level.

Entry Price: 0.5055

Target 1: 0.5175

Target 2: 0.5367

Target 3: 0.5593

Stop Loss: Above the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

FTTUSD

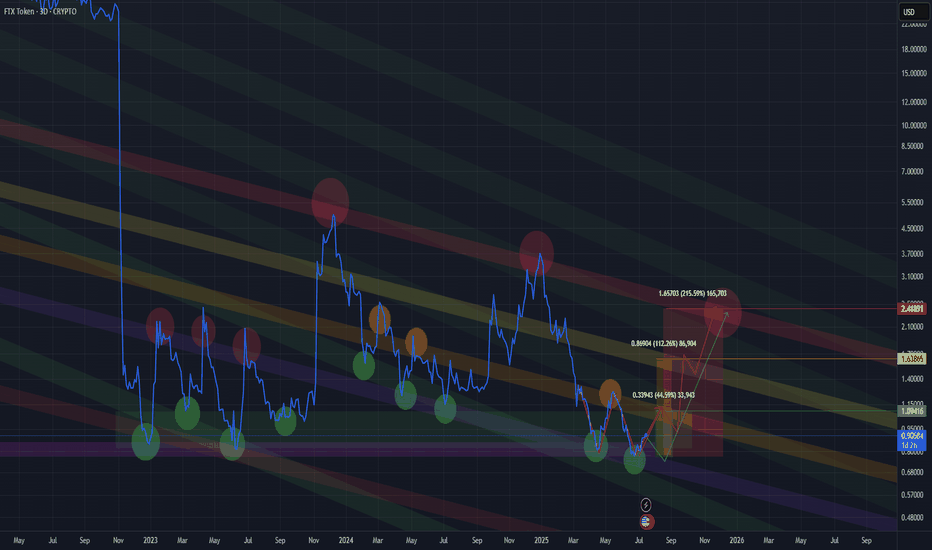

FTT – Potential Reversal Structure 2$->8$The chart shows a clear bullish divergence forming on the weekly timeframe, which aligns with the structure seen during the major 2020 shakeout. Once again, the price was pushed below the long-term descending channel, triggering an aggressive stop-hunt before quickly reclaiming the range — a classic deviation pattern.

If the asset still hasn’t been delisted despite everything that happened, it suggests that there may be underlying reasons for keeping the token alive. Markets often move ahead of headlines, so a sudden fundamental catalyst shouldn’t be ruled out. Some traders even speculate about potential legal or regulatory news related to the former FTX leadership, which could shock the market if it appears unexpectedly. Whether this materializes or not, the technical structure alone remains notable.

From a TA perspective:

Price has printed a bullish divergence on the weekly RSI.

A long-term falling channel remains intact, with price bouncing off its lower boundary.

A shakeout similar to 2020 may have cleared late sellers and leveraged shorts.

If momentum continues, the first target zone sits around $2–3, aligning with local resistance.

The main structural target is a retest of the 0.618 Fibonacci retracement of the major decline from $8 — a level that often acts as a magnet in recovery phases.

This setup remains speculative and highly volatile, but the technical picture suggests a potential medium-term relief rally if the market continues to absorb sell pressure.

FTT/USDT – The Final Accumulation Zone Before a Major Move?FTT’s price is once again testing the critical support zone (0.88–0.70), which has served as the final stronghold for buyers for more than a year.

Each touch of this area has triggered a bounce, yet the strength of each rebound has weakened over time — signaling consistent selling pressure from the upper levels.

The lower-high structure formed since 2024 highlights medium-term bearish dominance. However, the most recent weekly candle closed back above the demand area after briefly dipping to 0.5130 — a strong indication of massive liquidity absorption from weak hands.

This suggests that the yellow zone is not just a technical support level, but rather a psychological battlefield between capitulating sellers and silent accumulators.

---

Technical Structure and Pattern

A Range Base Pattern has formed at the bottom, where price remains trapped between the 1.23 supply zone and the 0.88–0.70 demand area.

A False Breakdown (Spring Phase) is clearly visible — potentially marking the beginning of a re-accumulation phase.

However, as long as the price fails to break and close above 1.2378, the overall structure remains neutral with a bearish bias.

---

Bullish Scenario

If FTT successfully breaks and closes above 1.2378 on the weekly timeframe, it could signal a medium-term trend reversal.

Layered upside targets could extend toward:

1.8574 → 2.2752 → 3.7113 → 5.5686

A confirmed breakout above 1.23 would also mark the transition from a distribution phase to a bullish expansion phase, opening room for a potential recovery rally similar to the one seen in 2023–2024.

---

Bearish Scenario

However, if selling pressure intensifies and the weekly candle closes below 0.70, it would confirm a loss of structural support, opening the door to a deeper downside move.

A breakdown below 0.70 could drive price toward the extreme liquidity zone below 0.35, where new buyers might emerge for a possible long-term bottom reaccumulation.

---

Conclusion

FTT currently stands at the most critical equilibrium zone in its historical price action.

Each weekly candle in this area carries the potential for a major reaction — either as the beginning of a new recovery, or the final descent before long-term restructuring.

Momentum is building quietly.

Those who hold through this zone might witness the early stages of a major shift, while latecomers may only watch the rebound from afar.

---

#FTT #FTTUSDT #CryptoAnalysis #MarketStructure #SwingSetup #WeeklyChart #AltcoinAnalysis #AccumulationZone #BreakoutWatch #LiquiditySweep #CryptoTechnicalAnalysis

Hi, I see A very good Swing trade opportunityHi, I see A very good Swing trade opportunity

Risk Reward is very good

Some of you will say FTT is doomed, will I am a chart analyst, and there is a very good sign of accumulation in the chart.

The SL is around the corner (-15%) with almost 700% possible gain , so it worth the risk.

good luck every one

#FTT/USDT : Go to work, it's good#FTT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.8890, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.9360

First target: 0.9681

Second target: 1.000

Third target: 1.0580

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

FTT : Go to work, it's goodHello friends🙌

✅after the decline we had, you can see that the price was supported by buyers in the support area we identified with Fibonacci and broke its resistance.

✅Now you can buy in the support areas we have identified for you with risk and capital management and move towards the set goals.

🔥Follow us for more signals🔥

*Trade safely with us*

FTTUSDT at the Edge! Breakdown or Massive Breakout?📌 Overview: A Rebirth from the Dead Zone

FTT/USDT is currently in one of its most technically compelling phases in the past two years. After suffering a catastrophic 98% crash following the collapse of the FTX ecosystem in 2022, price action now shows signs of long-term accumulation at a historically strong demand zone — potentially forming a solid base for a medium to long-term recovery.

The crucial support zone between $0.70 and $0.90 has been tested multiple times since late 2022 and has consistently held against extreme sell pressure. This suggests the presence of a strong historical demand area. Now that the price is once again reacting bullishly from this zone, the door is opening for a potential technical rebound.

---

🧠 Forming Pattern: Accumulation & Bottoming Structure

1. Base Accumulation Range:

A long period of sideways movement after the major crash.

Indicates exhaustion of selling pressure and possible stealth accumulation by smart money.

2. Potential Double Bottom or Rounded Bottom:

If this rebound holds, a double bottom could be confirmed with a breakout above $1.238.

A rounded bottom formation could signal a major reversal rally if backed by volume and catalysts.

---

🟢 Bullish Scenario (Reversal in Progress):

If buyers hold the current support and push through resistance levels:

🔓 Break above $1.238 = key reversal confirmation.

🚀 Potential bullish targets:

$1.857 – Previous minor resistance.

$2.275 – Former breakout zone.

$3.711 – Key structural level with historical liquidity.

$5.569 – Major psychological and technical target.

Strong confirmation if the breakout is supported by volume and a full-bodied weekly candle.

---

🔴 Bearish Scenario (Further Downside):

If price fails to hold the support zone:

📉 A breakdown below $0.696 would invalidate the bullish setup and could lead to:

New price discovery below $0.50

A potential “death spiral” if sell volume increases rapidly.

This scenario is extreme and would heavily depend on broader market sentiment and the future of the FTX recovery process.

---

🧭 Key Levels & Technical Insights:

Element Details

Strong Demand Zone $0.70 – $0.90 (multi-tested since 2022)

Bullish Trigger Level Break & retest of $1.238 with volume

Reversal Targets $1.857, $2.275, $3.711, and $5.569

Bearish Breakdown Loss of $0.696 = potential for new lows

Early Momentum Current bounce suggests possible start of reversal

---

💡 Final Thoughts:

> "FTT is no longer in a panic phase — it’s in a decision phase: will it rise as a ‘Phoenix Token’ from the ashes of FTX, or fall back into obscurity?"

Given the technical setup and long-term structure, this could be one of the most pivotal moments for FTT. Traders and investors should watch this level closely — the next major move is likely to begin from this very zone.

#FTTUSDT #FTTAnalysis #CryptoReversal #AltcoinWatch #TechnicalAnalysis #SupportResistance #BullishSetup #BearishScenario #DoubleBottom

FTX Set to Begin Creditor Payouts in 2025: What It Means?The long-anticipated creditor repayments for FTX are finally set to commence, marking a pivotal moment in the exchange's financial restructuring. However, as with any major development in the crypto space, there are conditions, concerns, and market implications that traders need to be aware of. Here’s a breakdown of the upcoming FTX payout process and its potential impact on the price of $FTT.

FTX Creditor Payouts: Key Details

On February 18, 2025, certain FTX creditors will begin receiving their payouts, with those in the Convenience Class (claims up to $50,000) first in line. Under the restructuring plan, these creditors will receive 119% of their recorded claims, valued based on November 2022 asset prices, along with an additional 9% annual interest. However, all payments will be made strictly in stablecoins—excluding Bitcoin, altcoins, or any other crypto assets.

To receive payouts, users must complete KYC verification, submit tax documents, and select a distribution platform. Available payout platforms include Kraken and BitGo, but regional restrictions will apply, particularly in jurisdictions like Ukraine.

John J. Ray III, the chairman of the FTX liquidation committee, emphasized the importance of this step, stating:

"Today's announcement reflects the outstanding success of our recovery and coordination efforts over the past 28 months. These efforts are ongoing, and our focus remains on executing these distributions in accordance with our plan while also continuing to pursue the recovery of outstanding assets."

Scam Alerts and Delays in Compensation

As FTX prepares to distribute funds, scammers have seized the opportunity to defraud unsuspecting users. Fraudulent emails, phishing websites, and malware-laced links have surfaced, posing significant threats to creditors. Users are advised to only engage through official FTX channels and to verify any communications regarding payouts.

FTT Price Action: What’s Next?

The FTX Token ( TSX:FTT ) has experienced notable volatility amid these developments. At the time of writing, TSX:FTT is down 5.41%, trading in bearish territory, with eyes on its 1-month low as a support level.

A drop to this critical support zone could serve as an attractive entry point for traders, given that the level previously acted as resistance before flipping to support. If TSX:FTT manages to hold this range, it may attract fresh buyers looking for a reversal opportunity.

Conversely, a break above the 1-month resistance zone could trigger a strong influx of buyers, potentially leading to a 50% price surge. This scenario would depend on overall market sentiment and any further updates regarding FTX’s ongoing asset recovery efforts.

Market Sentiment and Final Thoughts

While the launch of FTX creditor repayments is a step forward in closing one of crypto’s biggest bankruptcy cases, uncertainties remain. Traders should monitor key technical levels for TSX:FTT while staying updated on regulatory and legal developments surrounding FTX’s liquidation.

Ftx token ( FTT)Ftt usdt Daily analysis

Time frame 4hours

Risk rewards ratio >2.5 👈👌👈👈

First target 4.5 $

Second target 5.45 $

LS should have been chosen very close to the entry point (a little below the diagonal line), but in order not to be caught, I chose LS much lower, so that over time and as the price grows, I will also raise LS and make it risk-free.

Good news has also been heard in cyberspace about the new management of the FTX exchange, which is paying off its debts, and this is a positive sign for the future this currency and it is likely to return to its original position, the price range before the problems it had with the Binance exchange. (20-25$)

$FTT FTT ftx 2 year consolidation between 0.9 - 2.8.... Uptrend?TSX:FTT Ftt Ftx consolidation has spanned from Nov. 2022 till now

A 2-year consolidation between price range 0.9-2.8

Current price: $3.1

My SuperAI just confirmed a super Uptrend on the 3day Timeframe.

A break out from this range will lead up to major resistance 5.5, 6.4

A continuous uptrend can lead up to $21

Invalidation of this #FTT idea is under $2.7

FTTUSDT %378 Daily Volume Spike FTTUSDT has recorded a 378% daily increase in trading volume.

To capitalize on this increase:

I will closely observe the price movement toward the blue boxes on the chart.

I will evaluate potential upward breakouts in lower time frames from these regions to identify entry opportunities.

This strategy allows for careful monitoring and reduces unnecessary risk.

Let me know if you want further edits or additions!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

FTT is about to riseFrom the point where we placed the green arrow on the chart, it seems that FTT has initiated an ABC pattern or a more complex structure. Wave B also appears to be a triangle that is nearing completion.

We expect FTT to soon enter a major wave C.

As long as the green zone is maintained, it can pump toward the TPs.

Closing a daily candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

FTT - UPDATE IDEA IDEAL FRACTAL FLOKI\FTT we're going clear on all my past ftt ideas. Into the 9 buck range, first significant resistance is the 4 buck zone. There may be a price lag there, but overall I expect a strong rise to 9 bucks by early spring, and a rise to 4 bucks right this month - early November