FUN/USDT — Last Defense Zone: Reversal or Breakdown Warning?FUN/USDT has dropped back into its Last Defense Zone at 0.0023–0.0019, a major historical support block that previously triggered strong bullish impulses. Price returning to this area highlights two key dynamics:

1. Demand is still active, shown by repeated long rejection wicks whenever price tags the zone.

2. Market psychology is at an extreme, where only patient and disciplined traders can capitalize on the opportunity.

The broader structure remains in a corrective downtrend, but the formation of a multi-touch support base signals the early stages of potential accumulation — a foundation that often precedes larger macro reversals.

---

Bullish Scenario — Reversal From the Accumulation Block

A bullish shift becomes more probable once price closes above 0.0027–0.0028 on the 4D timeframe. This breakout would signal buyers reclaiming structure and initiating a possible trend reversal.

Upside Targets:

Target 1: 0.00335 — minor supply / historical reaction zone

Target 2: 0.00950 — major inefficiency fill

Extended Target: 0.02480 — macro liquidity cluster

If the reversal forms within the support block, the upside potential far outweighs the downside risk — making this one of the best asymmetric setups on the chart.

---

Bearish Scenario — Breakdown From Support

The bearish scenario activates if the market closes below 0.0019.

Such a breakdown would confirm a structural failure and typically invites stronger selling pressure.

A close below 0.0019 likely leads to:

loss of key historical support

entry into downside price discovery

continuation toward 0.0012 or lower

This zone is the hard invalidation level for any medium-term bullish bias.

---

Pattern & Structure Details

The chart highlights several notable technical elements:

Accumulation Range forming inside 0.0023–0.0019

Repeated bullish rejection wicks — early signs of underlying demand

Descending structure losing momentum (trend exhaustion)

Early double-bottom behavior on support

Liquidity clusters above at 0.00335 and 0.00950

Overall, the support block is the most critical zone for FUN/USDT heading into late 2025 and early 2026.

#FUNUSDT #FUN #CryptoAnalysis #TechnicalAnalysis #SupportZone #ReversalPattern #BreakdownAlert #Altcoins

Funlong

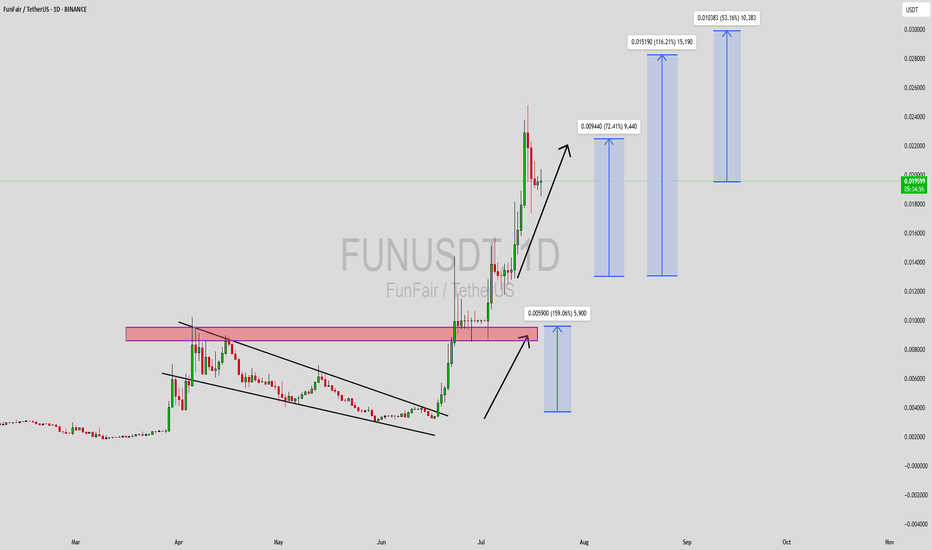

FUNUSDT Forming Bullish WaveFUNUSDT is currently showcasing a bullish wave pattern, signaling the potential continuation of its upward momentum. This type of pattern often indicates growing market interest and renewed buyer activity. As seen in the recent chart movements, the price has begun forming higher lows and higher highs, a key structural sign of bullish strength. The presence of good volume further validates the ongoing buying pressure, making this setup appealing to short-term traders and swing investors.

FUNToken, designed for the online gaming and gambling ecosystem, is gaining traction due to the increasing adoption of decentralized applications in these sectors. As regulatory clarity improves and user interest rises, utility-based tokens like FUN often see renewed demand. The project’s low market cap and strong community engagement create a favorable environment for speculative rallies, particularly during altcoin market uptrends.

With expectations of a 20% to 30% gain, FUNUSDT offers a moderate yet promising short-term opportunity. The bullish wave pattern suggests room for continued price expansion, especially if key resistance levels are broken with momentum. Traders should keep an eye on breakout confirmations and ensure risk is managed effectively, as low-cap tokens often experience higher volatility.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

FUN/BTC TA Update (Bull Market Started?)FUN/BTC

Last Dec 5, we posted buy signal for FUN after breaking above the down-line resistance and 200 Day MA. Price has reached our Take Profit Target 4 at this stage.

See link here:

[SHORT] FUN/BTC - Basic Supply and Demand :)Consolidation above Demand Zone, watch out for the Uptrend :) "Be Wholesaler, Not Retail Trader" :)

Personal Interpretation

Trade on Your Own Risk