GBPAUD Short Term Sell IdeaH4 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Gbpaudsetup

GBP/AUD At Perfect Place For Buy , Ready To Get This 200 Pips ?Here is my 4H GBP/AUD chart, this will be my Second time to enter from this area of support. If u take a closer look u will see how strong and stubborn this support area and it pushes the price very high each time it comes near it, so I will enter a buy trade Now cuz the price give us a very clear and strong bullish Price action and the price respect the support so much so we can enter a buy trade now . I will be targeting from 100 to 150 pips in this trade .If we have a daily closure below my support , this idea will not be valid anymore and we will see more movement to downside .

Reasons To Enter :

1- Perfect Breakout .

2- Clear Bullish Price Action .

3- Bigger T.F Giving Good Bullish P.A .

4 - Perfect 4H Closure .

5- The Price Respect The Support Again .

GBPAUD: Sterling Aims for Recovery as Aussie Momentum FadesAfter a sharp dip, GBPAUD is holding firm at a key demand zone and looks ready to bounce back. The setup is supported by stronger UK fundamentals compared to Australia, where the RBA faces slowing growth despite hotter inflation. With the pair now stabilizing at support, the path higher toward resistance zones is back in focus.

Current Bias

Bullish – the pair is holding support and showing signs of recovery toward higher resistance.

Key Fundamental Drivers

UK inflation remains sticky above 3%, keeping the BoE cautious on rate cuts.

Australia’s Q3 CPI surprised to the upside (3.1% y/y), but weak labor data and softer growth keep RBA under pressure.

Sterling is generally outperforming high beta currencies during risk uncertainty.

Macro Context

Interest Rates: BoE expected to delay aggressive cuts; RBA may cut earlier despite hot CPI due to growth weakness.

Economic Growth: UK growth modest but stable, while Australia is showing cracks in labor markets and consumption.

Commodity Flows: AUD remains tied to China’s outlook and commodity demand, which is still soft.

Geopolitics: Trade war tensions hurt AUD more than GBP, given Australia’s China exposure.

Primary Risk to the Trend

A dovish BoE shift or stronger-than-expected China data could support AUD and weaken GBP’s advantage.

Most Critical Upcoming News/Event

UK: November budget, BoE meeting.

Australia: RBA November meeting, Q3 CPI details, and labor market updates.

China: PMI readings as AUD proxy drivers.

Leader/Lagger Dynamics

GBPAUD acts as a leader among GBP crosses when BoE policy dominates the narrative. Against AUD, it reflects relative macro divergence (UK stability vs. Australia-China weakness). It tends to influence GBP/NZD and to follow GBP/USD momentum.

Key Levels

Support Levels: 2.0243, 2.0126

Resistance Levels: 2.0495, 2.0648

Stop Loss (SL): 2.0126

Take Profit (TP): 2.0648

Summary: Bias and Watchpoints

GBPAUD carries a bullish bias as sterling steadies at key support while the Aussie remains weighed down by growth concerns despite firmer inflation. A stop loss below 2.0126 protects against a deeper reversal, while upside targets stand at 2.0495 and 2.0648. The BoE’s cautious stance versus RBA’s weaker growth backdrop tilts the balance toward GBP strength. Traders should keep an eye on UK fiscal policy headlines and Australia’s RBA November decision as the most immediate catalysts for momentum.

GBPAUD Potentially bearish on the dailyOANDA:GBPAUD retested a major zone just shortly after the resistance at 2.04412 and currently attempting a bounce off from that area. If this holds as a new found resistance with today's candle closing bearish, we just might see price dropping further towards the 1.96842 area. Until then, fingers crossed

Results are not typical, past results does not guarantee future results. Do your due diligence and share your opinion as we updated this trade together.

GBPAUD Overextended: Preparing for a Midweek Pullback📉 Taking a closer look at GBP/AUD, we can see that price is well and truly overextended within a strong bearish trend 🔻. While the downside momentum remains intact, price is now approaching a key support zone, an area where we could expect a potential retracement or temporary relief rally.

As we’re currently midweek, traders should stay alert ⚠️ — this is often the time when the market delivers aggressive pullbacks or reversals, catching late sellers off guard. If price rallies back into a clear resistance level, I’ll be watching closely for a break of market structure to the downside to confirm a short setup 🎯.

For now, patience and precision are key — let the market come to you and wait for confirmation before taking action.

💬 Disclaimer: This analysis is for educational purposes only and not financial advice. Always conduct your own research and use proper risk management.

GBP/AUD Near The Best Place For Buy , 200 Pips Waiting !Here is my 4H GBP/AUD chart, this will be my Second time to enter from this area of support. If u take a closer look u will see how strong and stubborn this support area and it pushes the price very high each time it comes near it, so I will enter a buy trade once the price is near it and it gives me a bullish price action. I will be targeting from 100 to 200 pips in this trade.

Reasons To Enter :

1- Perfect Support .

2- Clear Old bullish Price Action .

3- Over Sold .

gbpaud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpaud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

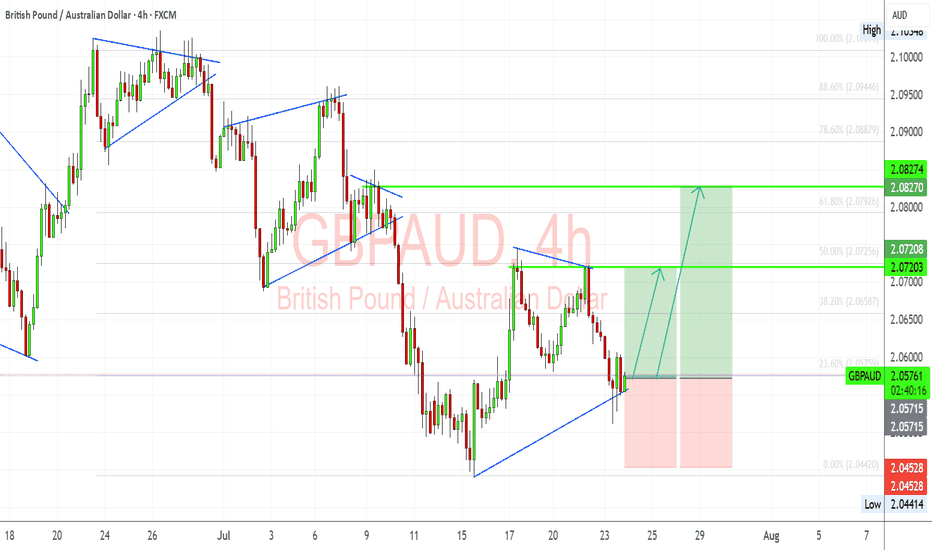

GBPAUD - Short Term Buy IdeaH4 - Strong bullish move.

Downtrend line breakout.

Currently it looks like a pullback is happening.

Expecting further continuation higher until the two Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

GBP/AUD Gave Fake Breakout , Long Setup Valid To Get 200 Pips !Here is my 2H Chart on GBP/AUD , We Have A Fake Breakout and then the price Back above my old support and we have a very good bullish Price Action on 1 And 2 Hours T.F Also the price playing very good around my support and i`m waiting the price to retest the broken area and giving a good bullish price action on smaller time frames to can get a confirmation to enter , So i see it`s a good chance to buy this pair @ 2.04000 if it go down a little to retest the broken area and then we can buy it and targeting 100 to 150 pips . and if we have a daily closure again below my old support then this idea will not be valid anymore .

Reasons To Enter :

1- Perfect Breakout .

2- Clear bullish Price Action .

3- Bigger T.F Giving Good bullish P.A .

4 - Perfect 15 Mins Closure .

5- The Price Respect The support Again .

GBPAUD IS GOING LONG THIS WEEK! Don't you think? Hey Traders!

This is my TA for GA this week, I do believe that this pair has been trending up and has had heavy rejection to the downside in the 4 hour time table, so that paird with impactful news that looks to have AUD consumers to be negative impact I believe AUD will fall in strength giving GBP the extra confirmation to push higher!

I am a scalping trader that trades when pairs hit level of exhaust or pullbacks on Binary Options, so I will be looking to take buys at S-zones and sells at R-zones! I trade 1m, 3M, 5M, And 15m bids on Binary options.

This is my first publish I would love any comments and feedback from the community! Thanks for your time!

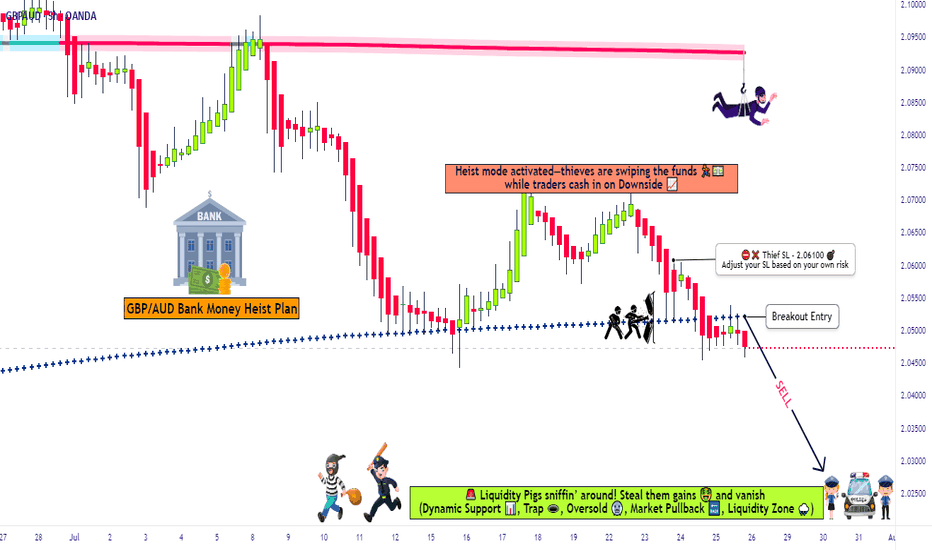

Is GBP/AUD Setting Up for a Classic Bearish Swing?😂 Pound vs. Aussie: The Great Thief Heist Strategy! 💰 GBP/AUD Swing Trade 💸

Asset: GBP/AUD (Pound vs. Aussie)

Market: Forex

Strategy: Cash Flow Management (Swing/Day Trade)

Bias: 🐻 Bearish

Vibe: Thief Style — Sneaky, Smart, and Stylish! 😎

📜 The Master Plan: Steal the Pips Like a Pro!

Ready to pull off the ultimate pip heist? This GBP/AUD setup uses a Thief Layering Strategy — a cunning approach with multiple sell limit orders to maximize entries while keeping risk in check. Let’s dive into the plan with a grin! 😜

🎯 Entry: Deploy your inner thief with multiple sell limit orders (layering style):

2.03700

2.03500

2.03200

2.03000

Pro Tip: Feel free to add more layers based on your risk appetite — the more, the merrier!

You can also enter at any price level if you’re feeling extra sneaky. Just keep it calculated! 🧠

🛑 Stop Loss:Set your Thief SL at 2.04300.

Note: Dear Ladies & Gentlemen (Thief OGs), this SL is my suggestion, but you’re the master of your loot! Adjust it to your risk tolerance and protect your stash. 💼

🏆 Take Profit:Aim for the strong support zone at 2.01500, where oversold conditions and a potential trap await. Escape with your profits before the market flips the script! 🎭

Note: Thief OGs, this TP is my call, but you decide when to cash out. Take the money and run at your own risk! 🏃♂️

🔍 Why This Setup? Key Technicals

Bearish Momentum: GBP/AUD is showing signs of weakness, with price action hinting at a downward slide. 📉

Support Zone: The 2.01500 level aligns with historical support and oversold RSI signals — a perfect spot for profit-taking.

Trap Alert: Watch for false breakouts or reversals near 2.01500. Stay sharp and don’t get caught! 🕵️♂️

Layering Strategy: Multiple limit orders spread risk and increase the chance of catching the move. It’s like setting multiple traps for the pips!

💵 Related Pairs to Watch

Keep an eye on these correlated pairs (priced in USD) for additional context:

FX:GBPUSD : If the pound weakens against the dollar, it could amplify GBP/AUD’s bearish move. Watch for similar bearish setups here.

OANDA:AUDUSD : A stronger Aussie dollar vs. USD could pressure GBP/AUD lower. Check for bullish signals in AUD/USD to confirm the trend.

Key Correlation: GBP/AUD often moves inversely to AUD/USD due to the Aussie’s influence. Monitor USD strength via the DXY (Dollar Index) for broader market context.

⚠️ Risk Management (Thief Style)

Position Sizing: Only risk what you’re willing to lose. This is a heist, not a gamble! 🎰

Stay Nimble: Markets are sneaky — be ready to adjust your SL or TP if price action shifts.

Trade Your Plan: Stick to your strategy, but don’t be afraid to improvise like a true thief if the market throws a curveball. 🌀

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

Disclaimer: This is a Thief Style Trading Strategy crafted for fun and educational purposes. Trading involves risks, and all decisions are your own. Trade responsibly and enjoy the heist! 😎

#GBPAUD #Forex #SwingTrading #ThiefStrategy #Bearish #TechnicalAnalysis #TradingView

GBPAUD I Technical Analysis and Opportunity for This WeekWelcome back! Let me know your thoughts in the comments!

** GBPAUD Analysis - Listen to video!

We recommend that you keep this on your watch list and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

GBP/AUD Trade Setup – Bullish Flag Breakout in PlayGBPAUD has formed a clean bullish flag structure after a significant impulsive move upward. Following the correction, we’re now testing breakout levels with clear Fibonacci confluence and bullish structure support around 2.0560. I'm anticipating a push toward the next resistance levels if buyers defend this trendline.

🔎 Technical Highlights (My View):

Bullish Flag Pattern: The corrective flag has broken to the upside and is being retested. This suggests a possible continuation of the bullish trend.

Fibonacci Support: Price bounced near the 23.6% retracement of the previous bullish leg, which acts as a minor but effective support in trending moves.

Bullish Trendline Holding: The ascending trendline from the July lows continues to act as dynamic support. This shows sustained buyer interest.

Target Zones:

TP1: 2.0720 – aligns with 50% retracement and recent structure.

TP2: 2.0827 – aligns with 78.6% retracement and past resistance.

SL: Below 2.0450 to invalidate the setup.

🏦 Fundamental Context:

GBP Strength: The Bank of England remains more hawkish than the RBA. UK inflation data remains sticky, and traders are still pricing in the potential for another hike if services inflation remains elevated.

AUD Weakness: AUD is under pressure due to soft labor market data and declining commodity demand from China. RBA minutes also struck a cautious tone, which weighs on the Aussie.

China Risk: AUD is sensitive to Chinese sentiment. Current trade and tariff tensions are adding indirect bearish pressure to the AUD.

⚠️ Risks to My Setup:

If Aussie labor or CPI data surprises to the upside, AUD could regain strength.

UK economic data deterioration (e.g., services PMI, wage inflation) could weaken GBP.

Break below 2.0450 would invalidate the bullish setup and suggest potential range continuation.

📅 Upcoming Catalysts to Watch:

UK Retail Sales – A strong print supports GBP continuation.

AU CPI (Trimmed Mean) – Any upside surprise could limit AUD downside.

China Industrial & Services PMI (if released soon) – indirect AUD mover.

⚖️ Summary – Bias & Trade Logic

I’m currently bullish GBP/AUD, expecting a continuation of the prior uptrend now that price has broken and retested the flag structure. Fundamentally, GBP is supported by relatively hawkish BoE expectations, while AUD remains pressured by RBA caution and China-linked macro weakness. My bias stays bullish as long as the trendline holds and Aussie data doesn’t surprise significantly.

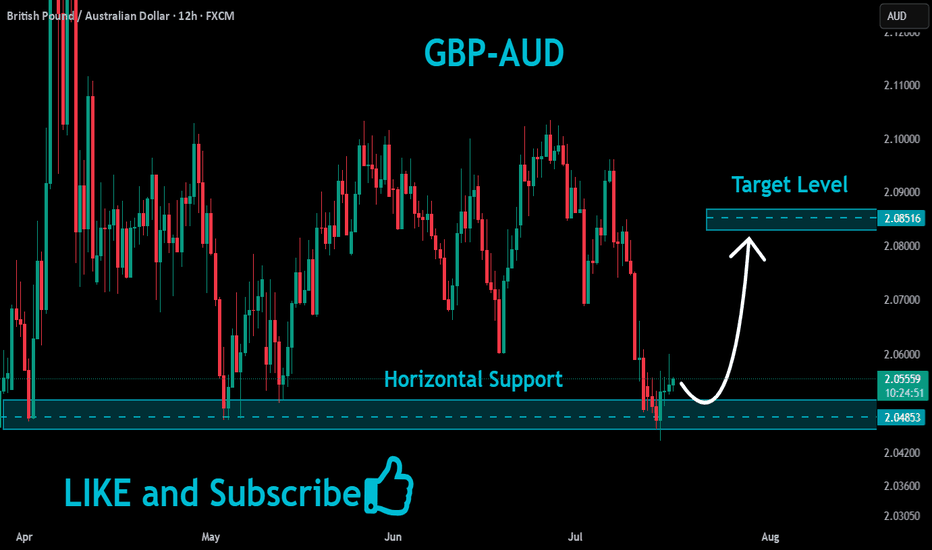

GBP/AUD At Very Interesting Buy Area , Don`t Miss 150 Pips !Here is my GBP/AUD 4H Chart and this is my opinion , the price moved very hard to downside And now creating new wave in the 4H Up Trendline and the price at strong support now 2.05000 which is forced the price many times to go up , so it`s my best place to enter a buy trade , and if you checked the chart you will see the price creating the new higher low to complete the new higher high . if we have a daily closure below my support area then this idea will not be valid anymore .

GBPAUD Potential Bullish Reversal Setup – Key Breakout Levels GBPAUD is showing signs of a potential bullish reversal after a prolonged downtrend, with price consolidating within a descending wedge pattern. The pair is testing a breakout point, and fundamentals favor a bullish recovery supported by GBP strength relative to AUD weakness.

Technical Analysis (4H Chart)

Pattern: Descending wedge formation, often a bullish reversal structure.

Current Level: 2.0507, holding within the wedge and preparing for a potential breakout.

Key Support Levels:

2.0416 – immediate support and invalidation zone if broken.

2.0350 – extended support if bearish pressure resumes.

Resistance Levels:

2.0650 – near-term breakout level.

2.0740 – secondary bullish target if breakout confirms.

Projection: If the wedge breaks upward, price could rally toward 2.0650 initially, then 2.0740 for further confirmation of bullish momentum.

Fundamental Analysis

Bias: Bullish if breakout confirms.

Key Fundamentals:

GBP: BOE remains cautious but leans toward maintaining tight policy amid sticky inflation.

AUD: RBA is constrained by weaker growth and trade risks linked to global tariffs, limiting AUD upside.

Global Sentiment: Risk-off sentiment weighs on AUD, favoring GBP relative strength.

Risks:

Hawkish RBA surprise or strong China data could strengthen AUD.

BOE dovish signals may cap GBP upside.

Key Events:

BOE policy updates and UK inflation data.

RBA meeting and Chinese economic releases.

Leader/Lagger Dynamics

GBP/AUD is a lagger, often following EUR/AUD and GBP/USD movements, but it could gain momentum if GBP strength broadens against risk-sensitive currencies.

Summary: Bias and Watchpoints

GBP/AUD is setting up for a bullish reversal, with key breakout confirmation above 2.0650. A move toward 2.0740 would reinforce this scenario. The main watchpoints are BOE policy tone, RBA updates, and China’s economic signals.

High-Stakes GBP/AUD Short Plan – Grab the Bag & Escape Early!💥🔥GBP/AUD HEIST OPERATION: The Pound vs Aussie Bear Trap Masterplan 🔥💥

(Thief Trader Exclusive TradingView Drop – Smash Boost If You’re Ready To Rob The Market!)

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

Welcome, Money Makers & Market Robbers! 🤑💰✈️

This isn't just analysis — it's a high-stakes forex heist, engineered using Thief Trading Style's elite blend of technical, macro, sentiment, and quantitative insights. We're cracking the GBP/AUD vault with sharp bearish setups targeting a major liquidity zone — aka the Police Barricade Support Area! 🚨🔫

📉 Plan of Attack – Short Entry Setup

This isn’t your typical chart — this is blueprint-grade precision. Here's the GBP/AUD short strategy for Day & Swing Traders:

🚪 ENTRY ZONE

Initiate bearish positions at or near recent highs (wick level).

Use limit orders stacked (layering/DCA style) on the 15m or 30m retest zones for sniper entries.

Look for wicks with rejection — that’s where the fake bullish robbers get trapped!

🛑 STOP LOSS

Place SL just above recent 4H swing highs (2.06100 as a reference).

Adjust according to position size and the number of orders you’re layering.

🎯 TARGET ZONE

Aim for 2.02500, or book partial profits earlier if the heist gets heat.

Escape before the alarms ring! Secure the bag and vanish like a pro.

🔍Fundamental & Sentiment Heist Intel 📚

This bearish pressure on GBP/AUD isn’t random — it’s triggered by a perfect storm:

COT Positioning flips 📊

Aussie strength from commodities & RBA commentary 📈

GBP uncertainty from macro tightening & economic data ⚖️

Sentiment exhaustion at highs + false bullish trap 📉

Consolidation zone breakdown = smart money move! 💼

Wanna go deep? 🧠

Tap into COT, Macro Trends, Intermarket Analysis & Thief’s proprietary scoreboardsss 📡🔗

⚠️ News & Position Management Alert 🚧

📰 Avoid entry around key news drops

🔒 Lock in profits with trailing SL

💼 Secure capital > Chase greed

🔥 SHOW SOME LOVE 🔥

💖 Smash that ❤️ BOOST button — it powers our next big heist!

Together, we rob the market with style, skill, and precision.

See you on the next breakout robbery mission, legends!

Stay dangerous. Stay profitable. Stay Thief. 🐱👤💵🚀

GBP/AUD Ready To Go Up After Melted , 2 Entries Valid !Here is my GBP/AUD 1H Chart and this is my opinion , the price moved very hard to downside without any correction and the price at strong support now 2.05000 which is forced the price many times to go up , so it`s my best place to enter a buy trade , and if you checked the chart you will see the price now creating a reversal pattern and i put my neckline and if we have a closure above it to confirm the pattern we can enter another entry to increase our contracts . if we have a daily closure below my support area then this idea will not be valid anymore .