GBPAUD Strategy: Using Volume Profile to Catch the Next MoveThe GBPAUD has been getting absolutely crushed lately, driven by a powerhouse Aussie Dollar and a struggling Pound Sterling. 🥊 We’ve officially slammed into a major support zone, and the price action is looking seriously overextended. 🏎️💨

In this deep dive, I’m breaking down the exact market structure and price action cues I’m watching. While we are due for a corrective pullback, make no mistake—I’m hunting for the next high-probability short entry before the weekly close. 🎯

What we cover in this video:

📊 Volume Profile Analysis: Locating high-volume nodes for precise entries.

📉 VWAP Integration: Using value-based pricing to confirm the trend.

🏗️ Market Structure: Identifying the breakdown points in the current bearish cycle.

🧠 Trade Planning: Mapping out the pullback vs. the continuation.

⚠️ Disclaimer: Not financial advice. For educational purposes only.

Gbpaudshort

GBPAUD: Bearish Drop to 1.896?FX:GBPAUD is eyeing a bearish reversal on the 4-hour chart , with price testing resistance near recent highs in a downward trendline, converging with a potential entry zone that could spark downside momentum if sellers defend amid volatility. This setup suggests a pullback opportunity post-rally, targeting lower support levels with 1:3.5 risk-reward .🔥

Entry between 1.98200–1.98800 for a short position. Target at 1.89600 . Set a stop loss at 2.00615 , yielding a risk-reward ratio of 1:3.5 . Monitor for confirmation via a bearish candle close below entry with rising volume, leveraging the pair's dynamics near resistance.🌟

Fundamentally , GBPAUD is trading around 1.952 in early February 2026, with key events this week for both currencies. For the Australian Dollar, the RBA Interest Rate Decision on February 3 at 3:30 AM UTC (previous 3.85%) is critical, where a hike or hawkish guidance could strengthen AUD amid strong data. For the British Pound, the BoE Interest Rate Decision on February 5 at 12:00 PM UTC (previous 3.75%) represents major risk, with a potential hold or cut pressuring GBP if dovish. Overall, diverging central bank policies could favor AUD strength over GBP. 💡

📝 Trade Setup

🎯 Sell Entry:

1.98200 – 1.98800

(Entry from current price is acceptable with strict risk management.)

🎯 Target:

1.89600

❌ Stop Loss:

Daily close above 2.00615

⚖️ Risk / Reward:

≈ 1 : 3.5

💡 Your view?

gbpaud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPAUD to continue in the downward move?GBPAUD - 24h expiry

There is no indication that the selloff is coming to an end.

Daily signals for sentiment are at oversold extremes.

Offers ample risk/reward to sell at the market.

The lack of interest is a concern for bulls.

Our outlook is bearish.

We look to Sell at 1.9875 (stop at 1.9935)

Our profit targets will be 1.9695 and 1.9655

Resistance: 1.9886 / 1.9950 / 2.0050

Support: 1.9823 / 1.9750 / 1.9700

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

#GBPAUD ShortI believe there is a short coming for GA is Friday/ end of the week. Usually, Fridays a bit tricky and risky but at times it continues the trend of Thursday close, and as of now is a strong bearish. Even though I like catching pullbacks, I just believe on a Friday, it will just liquidate is current trend and try to set up the bullish move next week. There is also no price down there in recent months which means orders are waiting to get tapped in and most of them are going to be sell stops because if price falls to that area everyone will predict it will fall as it creating new lows, until the market makers liquidate those sell stops and buy out those orders and push price bullish, while trapping retail traders and small banks. reversing the trend and there planning this move friday to set them up next week.

GBPAUD to find sellers at market price?GBPAUD - 24h expiry

Intraday rallies continue to attract sellers and there is no clear indication that this sequence for trading is coming to an end.

Our outlook is bearish.

20 1day EMA is at 2.0118.

Offers ample risk/reward to sell at the market.

There is no clear indication that the downward move is coming to an end.

We look to Sell at 2.0115 (stop at 2.0171)

Our profit targets will be 1.9955 and 1.9925

Resistance: 2.0145 / 2.0189 / 2.0204

Support: 2.0100 / 2.0060 / 2.0028

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

GBPAUD to find resistance at current market price?GBPAUD - 24h expiry

Intraday rallies continue to attract sellers and there is no clear indication that this sequence for trading is coming to an end.

2.0204 has been pivotal.

Bespoke resistance is located at 2.0190.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

We look to Sell at 2.0179 (stop at 2.0236)

Our profit targets will be 2.0011 and 1.9971

Resistance: 2.0163 / 2.0204 / 2.0240

Support: 2.0100 / 2.0065 / 2.0000

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

gbpaud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPAUD to find sellers at current market price?GBPAUD - 24h expiry

Daily signals are mildly bearish.

50 1day EMA is at 2.0251.

Offers ample risk/reward to sell at the market.

Early optimism is likely to lead to gains although extended attempts higher are expected to fail.

Our outlook is bearish.

We look to Sell at 2.0249 (stop at 2.0321)

Our profit targets will be 2.0049 and 2.0019

Resistance: 2.0250 / 2.0300 / 2.0350

Support: 2.0180 / 2.0120 / 2.0075

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

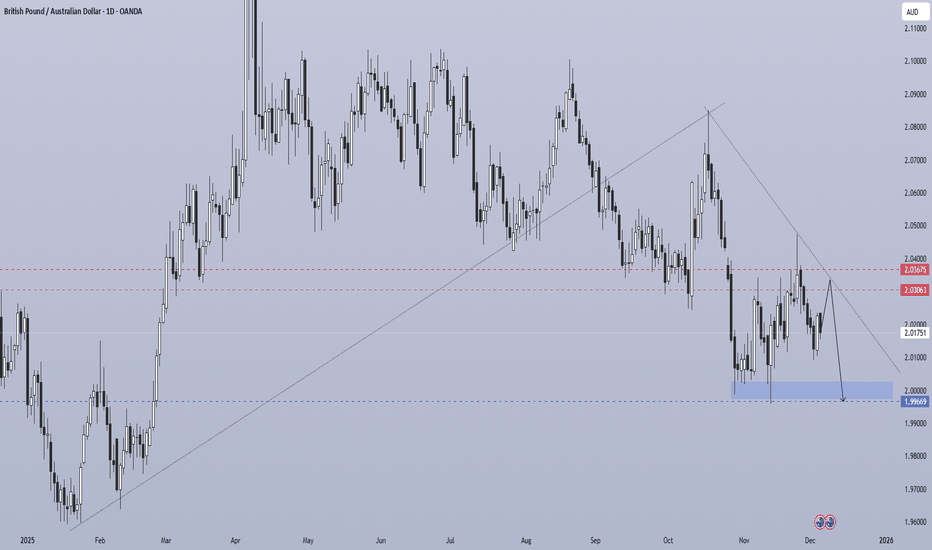

GBPAUD - D11. Higher-Timeframe Structure

GBPAUD has been in a clear macro downtrend since August.

The diagonal trendline confirms continuous lower highs being formed.

Recent bullish pushes are corrective retracements, not trend reversals.

2. Current Market Context

Price is currently:

Pulling back toward a premium zone where sellers are likely positioned.

Approaching two key resistance levels you marked:

2.03063

2.03675

These levels represent:

Prior supply

Liquidity resting above equal highs

A likely area for smart money to engineer a reaction to resume the downtrend

This is consistent with the bearish arrow drawn on your chart.

3. Supply & Liquidity

The red zone overhead is:

A previous BOS origin

A clean supply block

A sweepable liquidity pocket (good for stop hunts)

The market will likely:

Push into this zone,

Sweep short-term highs,

Then reverse bearish.

4. Downside Target

The blue zone around 1.99669 is the main demand/liquidity objective.

Why this level?

Untapped daily demand

Clean imbalance → price magnet

Below previous lows → sell-side liquidity pool

Confluence with structural continuation targets

Your arrow accurately reflects this expected flow.

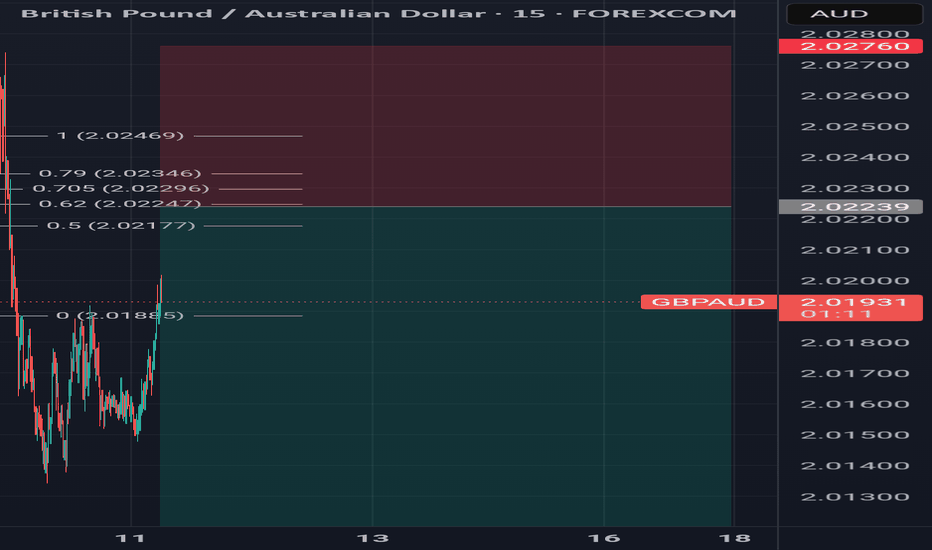

GBPAUD Short Term Sell IdeaH4 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

GBPAUD forming a top?GBPAUD - 24h expiry

Posted a Double Top formation.

A Doji style candle has been posted from the high.

The bearish engulfing candle on the 4 hour chart is negative for sentiment.

50 1day EMA is at 2.0338.

Offers ample risk/reward to sell at the market.

We look to Sell at 2.0315 (stop at 2.0388)

Our profit targets will be 2.0095 and 2.0045

Resistance: 2.0327 / 2.0366 / 2.0400

Support: 2.0253 / 2.0200 / 2.0116

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

GBPAUD is Holding Below the ResistanceHello Traders

In This Chart GBPAUD HOURLY Forex Forecast By FOREX PLANET

today GBPAUD analysis 👆

🟢This Chart includes_ (GBPAUD market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPAUD has formed a double top.GBPAUD - 24h expiry

Posted a Double Top formation.

We look for a temporary move higher.

The bearish engulfing candle on the 4 hour chart is negative for sentiment.

The overnight rally has been sold into and there is scope for further bearish pressure going into this morning.

Risk/Reward would be poor to call a sell from current levels.

We look to Sell at 2.0305 (stop at 2.0381)

Our profit targets will be 2.0085 and 2.0045

Resistance: 2.0260 / 2.0343 / 2.0400

Support: 2.0150 / 2.0100 / 2.0030

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

gbpaud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Short gbpaudIt's not part of my main setup but I'm seeing similarities(at least for this week) between that and the euraud setup I posted. Euraud had 2 Fvg candles on the 4hr timeframe. I picked the oldest Fvg on the 4hr. Price may not come there. Gbpaud however has just one Fvg and price is currently in it but I expected deeper retracement into it. From there I expect price to keep selling

GBPAUD: Sterling Aims for Recovery as Aussie Momentum FadesAfter a sharp dip, GBPAUD is holding firm at a key demand zone and looks ready to bounce back. The setup is supported by stronger UK fundamentals compared to Australia, where the RBA faces slowing growth despite hotter inflation. With the pair now stabilizing at support, the path higher toward resistance zones is back in focus.

Current Bias

Bullish – the pair is holding support and showing signs of recovery toward higher resistance.

Key Fundamental Drivers

UK inflation remains sticky above 3%, keeping the BoE cautious on rate cuts.

Australia’s Q3 CPI surprised to the upside (3.1% y/y), but weak labor data and softer growth keep RBA under pressure.

Sterling is generally outperforming high beta currencies during risk uncertainty.

Macro Context

Interest Rates: BoE expected to delay aggressive cuts; RBA may cut earlier despite hot CPI due to growth weakness.

Economic Growth: UK growth modest but stable, while Australia is showing cracks in labor markets and consumption.

Commodity Flows: AUD remains tied to China’s outlook and commodity demand, which is still soft.

Geopolitics: Trade war tensions hurt AUD more than GBP, given Australia’s China exposure.

Primary Risk to the Trend

A dovish BoE shift or stronger-than-expected China data could support AUD and weaken GBP’s advantage.

Most Critical Upcoming News/Event

UK: November budget, BoE meeting.

Australia: RBA November meeting, Q3 CPI details, and labor market updates.

China: PMI readings as AUD proxy drivers.

Leader/Lagger Dynamics

GBPAUD acts as a leader among GBP crosses when BoE policy dominates the narrative. Against AUD, it reflects relative macro divergence (UK stability vs. Australia-China weakness). It tends to influence GBP/NZD and to follow GBP/USD momentum.

Key Levels

Support Levels: 2.0243, 2.0126

Resistance Levels: 2.0495, 2.0648

Stop Loss (SL): 2.0126

Take Profit (TP): 2.0648

Summary: Bias and Watchpoints

GBPAUD carries a bullish bias as sterling steadies at key support while the Aussie remains weighed down by growth concerns despite firmer inflation. A stop loss below 2.0126 protects against a deeper reversal, while upside targets stand at 2.0495 and 2.0648. The BoE’s cautious stance versus RBA’s weaker growth backdrop tilts the balance toward GBP strength. Traders should keep an eye on UK fiscal policy headlines and Australia’s RBA November decision as the most immediate catalysts for momentum.

GBPAUD to continue in the downward move?GBPAUD - 24h expiry

Daily signals are bearish.

The overnight rally has been sold into and there is scope for further bearish pressure going into this morning.

20 1day EMA is at 2.0276.

Previous resistance located at 2.0285.

We look for a temporary move higher.

We look to Sell at 2.0275 (stop at 2.0351)

Our profit targets will be 2.0055 and 2.0015

Resistance: 2.0192 / 2.0260 / 2.0342

Support: 2.0134 / 2.0100 / 2.0020

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

GBPAUD Potentially bearish on the dailyOANDA:GBPAUD retested a major zone just shortly after the resistance at 2.04412 and currently attempting a bounce off from that area. If this holds as a new found resistance with today's candle closing bearish, we just might see price dropping further towards the 1.96842 area. Until then, fingers crossed

Results are not typical, past results does not guarantee future results. Do your due diligence and share your opinion as we updated this trade together.

GBPAUD I Correction and potential bearish continuationWelcome back! Let me know your thoughts in the comments!

** GBPAUD Analysis - Listen to video!

We recommend that you keep this on your watch list and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!