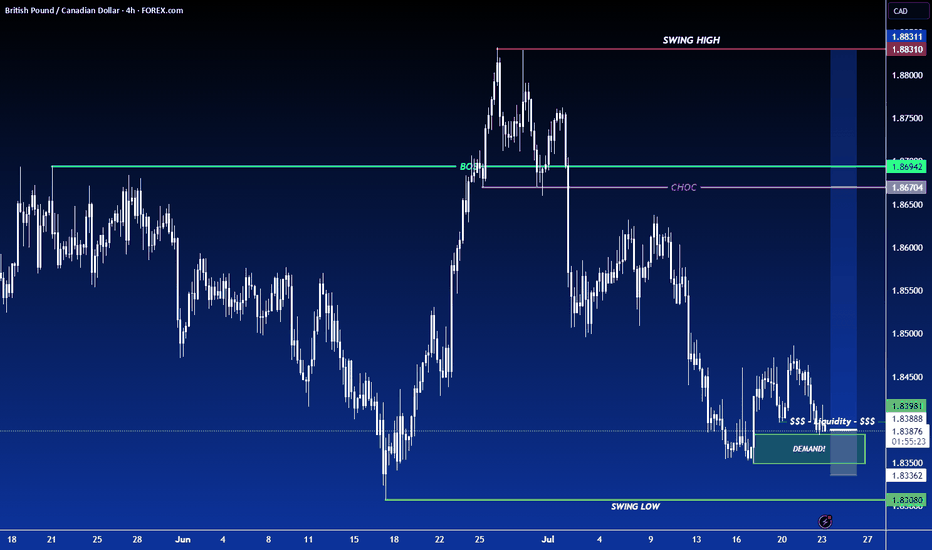

GBP/CAD Valid For Buy Now To Get 150 Pips ! Don`t Miss It !Here is my 4H GBP/CAD chart, this will be my Second time to enter from this area of support. If u take a closer look u will see how strong and stubborn this support area and it pushes the price very high each time it comes near it, so Prefer to enter a buy trade right now cuz we have a very good bullish price action on smaller time frames ( 30 / 15 Mins ) and we have a good confirmations specially after this huge movement to downside without any correction so i think it`s a good place to enter a buy trade and we can target from 50 to 150 pips target .if we have a 4H Closure below my support then this idea will not be valid anymore .

Reasons To Enter :

1- Perfect Support .

2- Clear Old bullish Price Action .

3- Over Sold .

4- 15 / 30 Mins T.F , Confirmations .

Gbpcadbuy

GBPCAD: Sterling Holds Its Ground Against LoonieGBPCAD pair is bouncing from channel support, suggesting that buyers are regaining control after a period of consolidation. With UK inflation still sticky and the Bank of England cautious on cutting rates too quickly, sterling remains underpinned. On the other hand, the Canadian dollar is tied closely to oil, which has stabilized but lacks strong momentum. This mix sets up a compelling opportunity as GBPCAD looks ready to test higher resistance within its ascending channel.

Current Bias

Bullish – price action is rebounding off channel support, supported by fundamentals that favor GBP over CAD.

Key Fundamental Drivers

UK inflation remains above target, keeping BoE wary of aggressive rate cuts.

Canadian growth remains soft despite oil prices holding near $64, limiting CAD strength.

Market sentiment favors GBP given policy divergence.

Macro Context

Interest Rates: BoE leaning cautious on cuts; BoC more open to easing with weaker growth outlook.

Economic Growth: UK growth modest but stable; Canada facing softer momentum.

Commodities: Oil steadies around $64, providing CAD some support but not a breakout driver.

Geopolitics: Tariff escalations weigh more heavily on Canada (export-reliant) than on the UK.

Primary Risk to the Trend

A strong rebound in oil or hawkish BoC tone could strengthen CAD, undermining the bullish case for GBP. On the UK side, fiscal concerns around the November budget could weigh on sterling.

Most Critical Upcoming News/Event

UK: November fiscal budget and BoE commentary.

Canada: Employment data and BoC monetary policy statement.

Leader/Lagger Dynamics

GBPCAD acts as a lagger, following the broader moves in GBPUSD and oil-driven CAD flows. It tends to reflect relative performance between GBP/USD and USD/CAD.

Key Levels

Support Levels: 1.8539, 1.8403

Resistance Levels: 1.8747, 1.8888

Stop Loss (SL): 1.8539

Take Profit (TP): 1.8888

Summary: Bias and Watchpoints

GBPCAD holds a bullish bias as sterling finds strength against a softer Canadian dollar backdrop. Price is rebounding from channel support, with key upside targets at 1.8747 and 1.8888. A stop loss below 1.8539 keeps the setup protected. The main risks to this view are an oil-driven CAD rally or UK fiscal concerns. Overall, the trade favors buying dips within the channel, with the BoE’s cautious stance versus Canada’s softer growth outlook forming the backbone of the bullish case.

GBP/CAD Roadmap: Kijun Pullback + Heikin Ashi Signal📈 GBP/CAD – “Wealth Strategy Map” (Swing/Day Trade)

🏦 Asset: GBP/CAD – Pound vs. Canadian Dollar

📊 Trading Plan

The bullish trend is confirmed ✅ through a Heikin Ashi doji reversal combined with a Kijun-sen pullback on the Ichimoku system and a double bottom retest structure.

I’ll be using a layered entry method (stacking limit orders at key price levels) to build into the position. This creates flexibility and smoother exposure to volatility.

🎯 Entry Strategy (Layering Method)

Multiple buy limit orders placed in layers:

1️⃣ 1.86250

2️⃣ 1.86500

3️⃣ 1.86750

4️⃣ 1.87000

5️⃣ 1.87250

(More layers can be added depending on personal preference & market conditions)

This style allows gradual exposure rather than a single risky entry.

🛡️ Stop Loss

Initial protective stop suggested near 1.85500, just below key breakout structure.

⚠️ Important: Always adjust your SL according to your own risk tolerance & strategy. This is not a fixed recommendation — manage risk responsibly.

🎯 Take Profit Target

Projected upside potential towards 1.90500, which aligns with strong resistance, overbought levels, and potential liquidity traps.

⚠️ Exit strategy matters! Lock profits before exhaustion to “escape the trap.”

📝 Notes for Traders

This setup is based on trend confirmation + layered entries to maximize flexibility.

Both stop loss and take profit levels should be adjusted to your personal risk management style.

Remember: Markets reward discipline, not stubbornness.

🔗 Related Pairs to Watch

FX:GBPUSD – Correlation with GBP strength trends.

OANDA:USDCAD – Tracks CAD moves against USD, often a mirror for CAD sentiment.

OANDA:EURCAD – Good cross-check for CAD-driven volatility.

OANDA:GBPAUD – Another GBP cross, sometimes moves in tandem with GBP/CAD.

Watching these can give extra confirmation on whether momentum is GBP-driven or CAD-driven.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#GBPCAD #Forex #TradingStrategy #SwingTrade #DayTrade #LayeringStrategy #Ichimoku #HeikinAshi #TechnicalAnalysis #TradingView

GBP/CAD Technical Outlook: Layered Entry Strategy Explained🤑 GBP/CAD: "Pound vs. Loonie Heist" — Swing/Day Trade Wealth Map 🚀

🎉 Ladies & Gentlemen, welcome to the Thief’s Lair! Buckle up for a slick, professional, and slightly cheeky GBP/CAD trading plan that’s ready to snatch profits from the Forex market! This Pound vs. Loonie Dollar setup is primed for action with a bullish vibe, confirmed by technicals that scream “Let’s ride!” 😎 Let’s break it down with style and precision to make those pips rain! 💸

📈 The Setup: Bullish Bandits on the Move! 🦸♂️

🔍 Market Mood: Bullish momentum confirmed! 📈 The Triangular Moving Average (TMA) shows a solid 38.2% Fibonacci pullback, signaling a textbook retracement.

🕯️ Heikin Ashi Power: Doji candles are flashing bullish strength 💪, with institutional riders joining the party. The trend is our friend, and it’s time to hop on!

🌍 Why GBP/CAD?: The Pound is flexing against the Loonie, backed by macroeconomic vibes like UK economic resilience and CAD’s sensitivity to oil price swings. Keep an eye on crude oil moves for extra context! 🛢️

🕵️♂️ The Thief’s Strategy: Layered Limit Order Heist 🏦

🎯 Entry Plan: We’re setting up a sneaky layered limit order strategy to maximize our entries. Stack those buy limits like a pro thief stacking cash! 💰

📊 Buy Limit Layers:

1.85800 🟢

1.86000 🟢

1.86200 🟢

1.86500 🟢

💡 Pro Tip: Feel free to add more layers based on your risk appetite! Customize your heist to fit your style. 😎

❓ Why Layering?: This approach lets us scale into the trade, catching the best entries as the market dances around our levels. It’s like setting multiple traps for the pips! 🕸️

🛑 Stop Loss: Protect Your Loot! 🔒

🚨 Thief’s SL: Set at 1.85400 to keep our risk tight. This level sits below key support, giving us room to breathe while dodging market traps.

📝 Note: Dear Thief OG’s, this SL is my suggestion, but you’re the boss of your bucks! Adjust based on your risk tolerance and account size. 💼

🎯 Take Profit: Cash Out Before the Cops Close In! 👮♂️

🏆 Target: Aim for 1.88500, where strong resistance meets an overbought RSI zone. The market’s screaming “trap ahead!” so let’s grab profits and ghost! 👻

📝 Note: Thief OG’s, this TP is my call, but you decide when to pocket the cash. Take profits at your own risk and vibe! 💸

🔗 Related Pairs to Watch

Because GBP/CAD doesn’t move alone, here are correlations worth tracking:

💷 GBP/USD ( FX:GBPUSD ) → Often mirrors GBP momentum against the dollar.

USD/CAD ( OANDA:USDCAD ) → Strong CAD moves can spill over to GBP/CAD.

EUR/CAD ( OANDA:EURCAD ) → CAD correlation check.

Gold ( OANDA:XAUUSD ) → Sometimes inverse to CAD (commodity-driven).

Keep these on your radar to confirm strength or weakness in CAD/GBP.

🧠 Key Points to Nail This Trade 🧠

✅ Technical Confirmation: TMA + Fibonacci 38.2% pullback + Heikin Ashi Doji = a high-probability setup.

⚖️ Risk Management: Use the layered entry to spread risk and keep your SL tight to avoid getting caught!

📅 Market Context: Monitor UK economic data (e.g., PMI, BOE updates) and CAD’s oil-driven moves for better timing.

🏃♂️ Escape Plan: Watch for RSI overbought signals near 1.88500 to secure profits before a potential reversal.

⚠️ Disclaimer ⚠️

This is a Thief-Style Trading Strategy crafted for fun and educational purposes. Trading involves risks, and I’m not a financial advisor. Make your moves at your own risk, and always do your own research! 😎

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#GBPCAD #Forex #SwingTrading #DayTrading #ThiefStrategy #ForexCommunity #MarketOutlook #TechnicalAnalysis

GBP/CAD 382 MA Retest – A Clean Setup for Swing Buyers!🎯 GBP/CAD: The Great British Heist Setup!💰

📊 Asset Overview

GBP/CAD (British Pound Sterling vs Canadian Dollar)

Market: Forex

Trade Type: Swing/Day Trade

Style: The Thief Method 🦹♂️💼

🔍 Market Analysis

The Setup: Bullish Confirmation Play

We're eyeing a bullish confirmation with a clean retest pullback at the 382 Moving Average inside a triangular pattern formation. The Sterling is showing strength against the Loonie, and this pullback to the 382 MA could be your golden ticket for entry! 🎫✨

🎯 Trading Plan

📍 Entry Strategy

You've got two paths to infiltrate this trade:

Option 1: Market Execution 💨

Enter at current price levels when price retests and bounces off the 382 Moving Average

Option 2: The Thief Layering Strategy 🎯

Multiple limit orders stacked like a pro heist team:

Layer 1: 1.87500

Layer 2: 1.87800

Layer 3: 1.88000

Layer 4: 1.88300

Pro Tip: You can add more layers based on your risk appetite and account size! The more layers, the better your average entry becomes. 🧠💡

🛡️ Risk Management

Stop Loss: 1.87000 🚨

This is the Thief's recommended escape hatch. However, this is NOT financial advice — adjust your stop loss based on YOUR risk tolerance and trading plan. You're the boss of your own money! 👑💰

🎯 Profit Targets

Target: 1.90000 🏁

This level acts as a police barricade 🚔 — expect strong resistance here! Multiple confluences:

Historical resistance zone

Potential overbought conditions

Classic trap territory for late entries

Exit Strategy: Take profits in stages! Don't be greedy. Lock in gains and let the rest ride if momentum continues.

⚠️ Reminder: This is MY target level, but YOU control YOUR exits. Take profits when YOU'RE comfortable. Risk management is KING! 👑

🔗 Related Pairs to Watch

Keep your eyes on these correlated markets for confirmation:

💵 OANDA:USDCAD — The Loonie's behavior against the Dollar can signal CAD strength/weakness

💷 FX:GBPUSD (Cable) — Pound strength indicator across the board

🛢️ Crude Oil ( BLACKBULL:WTI / BLACKBULL:BRENT ) — Canadian Dollar is oil-sensitive; rising oil = stronger CAD

💰 OANDA:XAUUSD (Gold) — Risk-on/risk-off sentiment gauge

Key Correlation Point: If USD/CAD is falling while GBP/USD is rising, that's your double confirmation that GBP/CAD should climb! 📈🔥

⚙️ Technical Confluences

✅ Price retesting the 382 Moving Average as dynamic support

✅ Triangular pattern formation suggesting consolidation before breakout

✅ Bullish market structure intact

✅ Higher lows pattern forming

✅ Volume supporting the upside move

🎭 The Thief's Final Words

This setup combines technical precision with strategic layering — the hallmark of the Thief method! The 382 MA has been a reliable dynamic support level, and this retest presents a high-probability entry zone. Whether you're a swing trader looking for multi-day moves or a day trader scalping intraday momentum, this plan adapts to YOUR style.

Remember: Markets don't care about your feelings. Stick to the plan, manage your risk, and let probability work in your favor! 🎲📊

📢 Community Love

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#GBPCAD #ForexTrading #SwingTrading #DayTrading #TheThiefMethod #ForexSignals #TechnicalAnalysis #MovingAverage #PriceAction #ForexCommunity #TradingView #ForexStrategy #RiskManagement #BullishSetup #ForexAnalysis #GBP #CAD #CurrencyTrading #ForexEducation #TradingIdeas

GBPCAD – Key Level, Buy Setup & Dual StrategyRight now, price is sitting on a major level.

📌 If a valid buy signal shows up, I’ll enter a long position.

But that’s not all…

🔁 If price reaches the next resistance level, I’ll:

Hold my long position

Open a short position there

This way: ✅ If price reverses → my long trade is closed by trailing stop

✅ And my short trade runs into profit

→ I profit both from below and above

⚠️ If my short trade’s SL hits, no worries —

My long is still open and growing in profit.

📈 But if the resistance breaks and we get a pullback,

➡️ I’ll activate pyramiding and build more position with zero added risk.

GBP/CAD: Smart Money Heist Strategy – Ready for the Breakout?💼💣 GBP/CAD Forex Bank Heist Plan 🚨 | "Thief Trading Style" 💹💰

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Welcome to all strategic traders, market tacticians & opportunity seekers! 🧠💸

Here’s our latest Forex blueprint based on the exclusive “Thief Trading Style” – a blend of tactical technicals, smart fundamentals, and stealthy price action moves. We’re preparing for a potential breakout heist on the GBP/CAD a.k.a “The Pound vs Loonie”.

🗺️ Heist Strategy Overview:

The market is forming a bullish setup with signs of consolidation, breakout potential, and trend reversal dynamics. We're eyeing a long entry, but timing is everything. This setup seeks to "enter the vault" just as resistance is breached and ride the move until the ATR High-Risk Zone—where many market players may exit.

🎯 Entry Plan:

📈 Primary Trigger Zone: Watch for a break and close above 1.87000.

🛎️ Set an alert! You’ll want to be ready when the opportunity knocks.

📍Entry Tips:

Place Buy Stop orders above the moving average or

Use Buy Limit entries on pullbacks near recent 15/30min swing lows.

(Perfect for both scalpers and swing traders!)

🛑 Stop Loss Placement:

Thief Trading Style uses a flexible SL system:

Recommended SL at the nearest 4H swing low (~1.85700)

Adjust SL based on your lot size, risk appetite & number of orders

🎤 Reminder: Set SL after breakout confirmation for buy-stop entries. No fixed rule—adapt to your style but manage risk wisely.

🎯 Target Zone:

🎯 Primary TP: 1.89000

🏃♂️ Or exit earlier if price enters a high-risk reversal area

🧲 Scalpers: Stick to long-side trades only and protect your profits with a trailing SL.

🔍 Why GBP/CAD? (Fundamental Notes):

Current momentum is bullish, supported by:

📊 Quant & Sentiment Analysis

📰 Macro Fundamentals & COT Data

📈 Intermarket Trends & Technical Scoring

Get the full data klick it 🔗

⚠️ Caution During News:

To avoid volatility spikes:

Refrain from entering new positions during high-impact news

Use trailing SLs to protect running profits

❤️ Show Support & Stay Tuned:

Smash the 🔥Boost Button🔥 if you love this kind of analysis!

Support the strategy, strengthen our community, and let’s continue this journey of smart, stylish trading.

Stay tuned for the next “heist plan” update—trade smart, stay alert, and manage your risk like a pro. 🏆📈🤝

GBPCADThe first level I’ve marked is a short-term zone.

If we get a strong buy signal there with good R/R, I’ll enter and trail aggressively.

The second level is a stronger demand zone and a better area for potential long setups.

❗️Remember: These are just scenarios — not predictions.

We stay ready for whatever the market delivers.

"Pound vs Loonie Forex Heist: Snag GBP/CAD Profits with Thief"🌍 Hello, Global Money Heisters! Ciao, Hola, Salaam, Bonjour! 🌟

Dear Profit Pirates & Cash Chasers, 🤑💸✨

Here’s the slick plan to raid the GBP/CAD "Pound vs Loonie" Forex Vault with 🔥Thief Trading Style🔥, blending sharp technicals and juicy fundamentals. Follow the chart’s long entry strategy to hit the high-risk RED Zone. It’s a wild spot—overbought, consolidating, with bears lurking for a trap. Let’s nab those profits and treat ourselves! 🎉💰

---

GBP/CAD Real-Time Data (May 15, 2025, UTC+1) 📈

- Current Rate: ~1.8540 CAD per GBP, down -0.04% today but holding strong. 📊

- Retail Sentiment: ~65% bullish, eyeing a GBP climb. 😎

- Institutional Sentiment: ~55% bullish, cautiously optimistic. 💼

---

Heist Plan Highlights 🏴☠️

- Entry 📌: Wait for GBP/CAD to smash past 1.8650 (previous high) for a bullish breakout. Set Buy Stop above the Moving Average or Buy Limit at recent 15/30-min swing lows for pullbacks. Set an alert to catch the move! 🚨

- Stop Loss 🛑: Place SL at 1.8400 (4H swing low) for day trades. Adjust based on your risk, lot size, or multiple orders. If using Buy Stop, set SL post-breakout to avoid whipsaws. 🔥

- Target 🎯: Aim for 1.8950 or bail early if the RED Zone feels too hot. 🏃♂️

- Scalpers 👀: Stick to long scalps with trailing SL to lock in gains. Swing traders, join the heist with bigger moves! 💸

---

Why GBP/CAD is Hot 🔥

- Bullish Momentum: Technicals show GBP strength, backed by retail (65%) and institutional (55%) optimism. 📈

- Fundamentals: Check COT reports, macro news, and intermarket analysis for the full picture. Stay sharp with sentiment and future trends! 📰🌎

- News Alert 🚨: Avoid new trades during big news drops. Use trailing SL to protect running positions. 🛡️

---

Boost the Heist! 💪

Hit that Boost Button to supercharge our Thief Trading squad! 🚀 Let’s make stealing pips a breeze. Stay tuned for the next epic heist plan, Money Makers! 🤑🐱👤🎉

Happy Trading, and let’s loot the market together! 🤝❤️

GBP/CAD Bullish Setup:Targeting 1.86500 from Demand Zone SupportTrendline ➡️

Price is respecting an upward trendline 📈 connecting higher lows 🔵 (marked by dots).

Channel ➡️

Price is moving inside an ascending channel 🚀 (controlled bullish movement).

EMA (70) ➡️

The red curve ➰ is the 70 EMA. Price is near it — showing indecision but still respecting it ⚖️.

Demand Zone ➡️

A strong demand zone 🔵 is marked between 1.8400–1.8440 where buyers jump in 🛒 whenever price touches it.

Support Zone ➡️

A nearby support zone 🛡️ is around 1.8480–1.8500. It's acting like a stepping stone 🧗♂️ for price to climb.

Target ➡️

The target 🎯 is clearly marked at 1.86500 — aiming for a nice breakout! 🚀📈

Summary

🔵 Stay above the demand zone ➡️ good for buys!

🛡️ Watch the support ➡️ could be a retest and bounce!

❌ If price breaks below demand zone, the setup is invalid ⚠️.

Simple Trading Plan:

✅ Buy near 🔵 demand or 🛡️ support.

✅ Target 🎯 1.86500.

❌ Stop Loss below 🔵 1.8390 area.

#GBPCAD:Last Idea +400 Pips Up! Here is second entryIn our last analysis, the GBPCAD currency pair showed a smooth move. The price hit support levels, which means it might keep going up. We think it’ll go up by about 600 pips and might reach the 1.90 area.

Since there aren’t many places to stop for this trade, it’s important to set take profit levels based on your risk management plan.

We hope you’re doing well with your trading. If you find our ideas helpful, please let us know by liking, commenting, or sharing them.

Thanks for being a great supporter!

Team Setupsfx

GBPCAD Tests Bearish Trendline – Focus Shifts to BoC DecisionGBPCAD is currently respecting a well-defined descending trendline, showing multiple rejections and a sustained series of lower highs. The latest retest near 1.8460 was met with selling pressure, aligning with the broader bearish channel.

Key Levels:

Current Price: 1.8458

Resistance Area: 1.8470 – 1.8600 (trendline & previous highs)

Support Targets:

TP1: 1.8120 (key structure)

TP2: 1.7980

TP3: 1.7900 (major support zone)

Bearish Technical Confluence:

✅ Multiple rejections at trendline

✅ Lower highs & lower lows continue

✅ Potential reversal candlestick pattern forming

✅ Bearish breakout could accelerate toward 1.7980

📉 Fundamental Outlook – BoC Rate Decision in Focus (April 16)

Market Sentiment Split:

Initially, economists leaned toward a BoC hold, as recent data and trade optimism gave the central bank room to pause.

However, March CPI undershot expectations, triggering increased speculation of a rate cut.

Key Data Highlights:

Headline CPI fell to 2.3% YoY vs 2.6% previously, well below the 2.7% forecast.

Drop mainly due to gasoline and transport costs, which BoC may look through.

Core inflation (median 2.9%, trimmed 2.8%) remains elevated, supporting arguments for a hold.

Analyst Viewpoint:

“We still marginally favor a BoC hold given the proximity to elections and resilience in core inflation, but our conviction is lower after the CPI miss.” – Knightley & Pesole, ING

Market Reaction:

Loonie sold off post-CPI, but analysts believe the sell-off may be short-lived if BoC surprises with a hawkish hold.

Swap market odds of a cut rose to 45%, up from 33% pre-CPI.

🎯 Combined Technical + Fundamental Setup

If BoC holds rates, expect CAD strength → GBPCAD could accelerate downward toward 1.8120 → 1.7900.

If BoC cuts, GBPCAD may spike temporarily toward 1.8600, but downside pressure may resume unless accompanied by dovish forward guidance.

🛠️ Trade Plan:

Sell Bias Below: 1.8470

Entry Trigger: Bearish confirmation or post-BoC rejection

TP1: 1.8120

TP2: 1.7980

TP3: 1.7900

Invalidation Zone: Break and close above 1.8600

GBP/CAD 4H ANALYSIS – BULLISH BREAKOUT OR REVERSAL ?📉 Descending Channel

🔴 The price was moving inside a downward trend (channel) 📉, but it broke out ✅, signaling a potential bullish move 📈.

📍 Demand Zone (Support) at 1.85000 - 1.84201

🟦 Buyers stepped in here, pushing the price up 🚀.

🛑 Stop Loss: 1.84201 🔻 (If price falls below this, the bullish setup may fail ❌).

📍 Resistance Area Around 1.86000 - 1.86500

🔵 Key level to watch! If the price breaks above this zone, expect more upside 📈.

🎯 Target Point: 1.87727

🎯 If buyers remain strong, price could hit this level next! 🎯🚀

📊 Indicator Check:

📍 9-period DEMA (1.85000) 🟡 – Price is above this moving average, favoring a bullish bias ✅.

🔥 Possible Trade Setup:

✅ Buy Entry near 1.85000 - 1.85500

🎯 Target: 1.87727 📈

🛑 Stop Loss: 1.84201 🚨

If price breaks below 1.85000, be cautious ⚠️! A reversal to the downside could happen.

🚀 Overall Bias: Bullish (📈) above 1.85000, Bearish (📉) below **1

GBPCAD’s Bullish Surge: What’s Next? 💹 The GBPCAD has been in a strong bullish trend, reaching into previous highs on the daily timeframe—a key liquidity zone! 💰 This is a crucial area where smart money may take profits or induce a retracement before the next move.

📉 Given that price is currently overextended, I’m not looking to buy at these highs. Instead, I’ll be watching for a potential pullback into an unresolved imbalance, where we could see a high-probability long setup—if price action confirms the move. 🧐

💡 Patience is key in trading. Chasing price at extreme levels often leads to significant losses. I’ll be waiting for the right conditions to align before looking for an opportunity.

⚠️ Not financial advice. Always trade responsibly!

📊 Let me know your thoughts in the comments below.. 👇

Wed 22nd Jan 2025 GBP/CAD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/CAD Buy. Enjoy the day all. Cheers. Jim

GBPCAD Scenario 1.1.2025According to the data we have available, it is possible that the market could move slightly up to the price level of 1.81500, since the market is forming as a range, it is quite likely to expect an SFP below the low and a subsequent move up to the aforementioned level. If it does not hold support at the level of 1.81600, it is possible that the market will move up even higher.