GBP/CAD Gave Fake Breakout , Short Setup Valid To Get 200 Pips !Here is my 4H Chart on GBP/CAD , We Have A Fake Breakout and then the price Back below my old res and we have a very good bearish Price Action on 1 And 2 Hours T.F Also the price playing very good around my res and i`m waiting the price to retest the broken area and giving a good bearish price action For the second time on smaller time frames to can get a confirmation to enter , So i see it`s a good chance to sell this pair if it go up a little to retest the broken area and then we can sell it and targeting 100 to 150 pips . and if we have a daily closure again above my new res then this idea will not be valid anymore .

Reasons To Enter :

1- Perfect Breakout .

2- Clear Bearish Price Action .

3- Bigger T.F Giving Good Bearish P.A .

4 - Perfect 15 Mins Closure .

5- The Price Respect The Res Again .

Gbpcadshort

GBPCAD - Price Is At A Strong Daily ResistanceGBPCAD has been trading in a broad rising channel with repeated reactions from the upper and lower boundaries, so fading extremes of the range is reasonable.

Price is at a strong daily resistance and at the top of the rising channel, so the idea is to wait for a clear bearish rejection there and then look for short entries with tight stops above the high and targets first toward mid‑range, then possibly the lower support zone if downside momentum strengthen

GBPCAD | FRGNT WEEKLY FORECAST | Q1 | W5 | Y26📅 Q1 | W5 | Y26

📊 GBPCAD — FRGNT WEEKLY FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:GBPCAD

GBPCAD— FRGNT DAILY CHART FORECAST Q1 | W4 | D29 | Y26📅 Q1 | W4 | D29 | Y26

📊GBPCAD— FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:GBPCAD

GBPCAD — FRGNT FUN COUPON FRIDAY Q1 | D23 | W3 | Y26📅 Q1 | D23 | W3 | Y26

📊 GBPCAD — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:GBPCAD

TheGrove | GBPCAD SELL | Idea Trading AnalysisGBPCAD broke down sharply from the rising channel, confirming a bearish. the impulsive sell-off invalidated prior bullish structure and pushed price below key intraday supports.

GBPCAD is moving on Resistance area..

The chart is above the support level, which has already become a reversal point twice.

We expect a decline in the channel after testing the current level.

We expect a decline in the channel after testing the current level

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity GBPCAD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

GBPCAD is in The Buy ModeHello Traders

In This Chart GBPCAD HOURLY Forex Forecast By FOREX PLANET

today GBPCAD analysis 👆

🟢This Chart includes_ (GBPCAD market update)

🟢What is The Next Opportunity on GBPCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

GBPCAD SELL | Idea Trading AnalysisGBPCAD is moving on support line .

The chart is above the support level. The volatility of the movement has decreased.

The price has reached the resistance level.

We expect a decline in the channel after testing the current level

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity GBPCAD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

#GBPCAD: Price Consolidating, Wait for Big Move! CAPITALCOM:GBPCAD Overview! 📈

🔺The GBP/CAD price is currently consolidating. A significant price action move is required before we can consider taking a buy entry. In our view, the price may decline to our identified buying zone prior to the reversal.

Entry, Exit and Stop Loss 📊

🔺Entry: The entry zone is marked in solid red. However, the price could fall further below to a buying buffer zone and then reverse.

🔺Exit: The second horizontal line can be used as a stop loss but a smaller or larger stop loss may be more appropriate depending on your assessment.

🔺Take Profit(Exit)There are three targets. The first is likely achievable for the price to reach, however the second and third may take considerable time to complete.

Like And Comment which will encourage us to post such more educational content.

Team Setupsfx_❤️🏆

GBP/CAD - Triangle Breakout (17.11.2025)🧠 Setup Overview

GBP/CAD has broken below a symmetrical triangle, signaling a potential bearish continuation after repeated rejections from the upper trendline. The pair is now trading under the breakout level, with sellers showing strong control. If bearish momentum continues, the next support zones become key targets.

📊 Trading Plan 🔻 Bearish Scenario (Primary Bias)

Look for a clean breakdown retest and rejection for confirmation

Bearish continuation expected toward the support areas below

🎯 Targets:

1st Support: 1.8335

2nd Support: 1.8287

⚡ Fundamental Outlook — Today (17 Nov 2025)

GBP Sentiment – The Pound remains under pressure as markets expect the Bank of England to stay cautious, given ongoing inflation uncertainty and slowing economic data.

CAD Sentiment – The Canadian dollar stays supported by stable Bank of Canada policy and improving expectations around the energy sector.

– Rising US bond yields indirectly support CAD’s strength through its correlation with risk-on flows.

➡️ Overall: Fundamentals align with the bearish bias on GBP/CAD.

#GBPCAD #Forex #TechnicalAnalysis #TriangleBreakout #PriceAction #CAD #GBP #ChartPatterns #ForexTrader #TradingView #KABHI_TA_TRADING #ChartsDontLieTradersDontQuit #BearishSetup #MarketOutlook #FXMarket

⚠️ Disclaimer

This analysis is for educational purposes only and not intended as financial advice.

Always wait for confirmation and follow your risk management rules.

💬 Support My Work ❤️

If this helped you:

👍 LIKE, 💬 COMMENT, and 🔔 FOLLOW

Your support encourages more clean chart breakdowns & daily setups!

GBP/CAD Rejection at Supply → Next Stop: 1.8350📉 GBP/CAD Analysis – Rising Wedge Breakdown in Motion

GBP/CAD has broken down from a Rising Wedge formation, signaling a potential bearish continuation. Price rejected strongly from the Key Zone (≈1.8550–1.8580), followed by a break + retest of the supporting trendline.

If downside pressure holds, we may see price move toward the Key Zone near 1.8350 (psychological level).

🔎 Technical Insights

✅ Rising Wedge breakdown confirms bearish structure

✅ Retest of support-turned-resistance

✅ Momentum shifting lower

🎯 Downside target → 1.8350 (Key Zone)

A clean continuation move could unfold if sellers sustain control below current structure.

🌍 Fundamental Outlook

• The Bank of Canada (BoC) remains cautious as inflation pressures ease, reducing expectations for aggressive tightening…supportive for CAD strength.

• The Bank of England (BoE) faces slower growth and uncertain monetary outlook, limiting GBP momentum.

• Softer UK business activity + Canada’s stable macro backdrop may help fuel further decline.

Overall fundamentals reinforce bearish sentiment on GBP/CAD.

✅ Support this analysis with a

LIKE 👍 | COMMENT 💬 | FOLLOW 🔔

Your engagement keeps the content flowing!

⚠️ Disclaimer:

This outlook is for educational purposes only. It is not financial advice. Please conduct your own analysis before trading.

GBPCAD: Bears Ready to Push Into Wave 5GBPCAD has completed a clear 1-2-3 move to the downside, followed by a corrective Wave 4 that has pushed the price higher inside a rising channel. This correction now looks nearly complete, as the price is struggling to break above the resistance. Once Wave 4 is finished, the chart suggests a final drop into Wave 5 toward the lower support zone. That would complete the overall bearish structure before any larger reversal can happen. In simple terms: correction is almost done → one more leg down expected.

Stay tuned!

@Money_Dictators

Thank you :)

GBPCAD Forming Rising ChannelGBPCAD on the daily timeframe has broken down from a rising channel structure, signaling a potential bearish reversal after a strong bullish rally earlier this quarter. The pair is now trading below the 1.8600 resistance zone, which acted as both a structural and psychological level for buyers. This breakdown confirms that sellers are gaining control, and a corrective pullback toward 1.8550–1.8600 could provide an ideal short opportunity before continuation to the downside. Price currently hovers near 1.8410, and a rejection from resistance could accelerate bearish momentum targeting the 1.8200 and possibly 1.8000 levels.

From a fundamental perspective, the Canadian dollar continues to gain strength supported by firm crude oil prices and a stable outlook for the Bank of Canada’s monetary stance. Meanwhile, the British pound is under pressure due to weak UK manufacturing and consumer confidence data, alongside expectations that the Bank of England may maintain rates longer amid slowing growth. These mixed macro signals add to the bearish tone for GBPCAD, as the loonie benefits from commodity stability while the pound struggles with domestic economic concerns.

If sellers maintain dominance below 1.8600, GBPCAD could continue to slide lower in the coming sessions. However, traders should monitor potential pullbacks as liquidity builds around the broken channel support, now acting as resistance. A clear bearish rejection in that zone would validate the continuation move, offering a high-probability setup for further downside profit.

GBPCAD: Sterling Holds Its Ground Against LoonieGBPCAD pair is bouncing from channel support, suggesting that buyers are regaining control after a period of consolidation. With UK inflation still sticky and the Bank of England cautious on cutting rates too quickly, sterling remains underpinned. On the other hand, the Canadian dollar is tied closely to oil, which has stabilized but lacks strong momentum. This mix sets up a compelling opportunity as GBPCAD looks ready to test higher resistance within its ascending channel.

Current Bias

Bullish – price action is rebounding off channel support, supported by fundamentals that favor GBP over CAD.

Key Fundamental Drivers

UK inflation remains above target, keeping BoE wary of aggressive rate cuts.

Canadian growth remains soft despite oil prices holding near $64, limiting CAD strength.

Market sentiment favors GBP given policy divergence.

Macro Context

Interest Rates: BoE leaning cautious on cuts; BoC more open to easing with weaker growth outlook.

Economic Growth: UK growth modest but stable; Canada facing softer momentum.

Commodities: Oil steadies around $64, providing CAD some support but not a breakout driver.

Geopolitics: Tariff escalations weigh more heavily on Canada (export-reliant) than on the UK.

Primary Risk to the Trend

A strong rebound in oil or hawkish BoC tone could strengthen CAD, undermining the bullish case for GBP. On the UK side, fiscal concerns around the November budget could weigh on sterling.

Most Critical Upcoming News/Event

UK: November fiscal budget and BoE commentary.

Canada: Employment data and BoC monetary policy statement.

Leader/Lagger Dynamics

GBPCAD acts as a lagger, following the broader moves in GBPUSD and oil-driven CAD flows. It tends to reflect relative performance between GBP/USD and USD/CAD.

Key Levels

Support Levels: 1.8539, 1.8403

Resistance Levels: 1.8747, 1.8888

Stop Loss (SL): 1.8539

Take Profit (TP): 1.8888

Summary: Bias and Watchpoints

GBPCAD holds a bullish bias as sterling finds strength against a softer Canadian dollar backdrop. Price is rebounding from channel support, with key upside targets at 1.8747 and 1.8888. A stop loss below 1.8539 keeps the setup protected. The main risks to this view are an oil-driven CAD rally or UK fiscal concerns. Overall, the trade favors buying dips within the channel, with the BoE’s cautious stance versus Canada’s softer growth outlook forming the backbone of the bullish case.

GBP/CAD Near Strong Res Area , Short Valid To Get 200 Pips !Here is my opinion on 4H GBP/CAD Chart , the price touch a very strong res area that forced the price to respect it and go down for more than 500 pips for 4 times , and now the price trying to touch it so we can enter a sell trade now or waiting the price to go back to retest the same area again and give us a good bearish price action to can enter a sell trade and we can targeting from 100 : 200 pips . if we have a daily closure above my res area this idea will not be valid anymore .

Entry Reasons :

1- Very Strong Daily Res Area .

2- Perfect Bearish Price Action .

3- Bigger Time Frames Confirmed .

4- Perfect Touch For The Area .

5- Clear Price Action .

GBP/CAD Near Strong Res Area , Short Valid To Get 150 Pips !Here is my opinion on 4H GBP/CAD Chart , the price touch a very strong res area that forced the price to respect it and go down for more than 500 pips for 2 times , and now the price touch it and moved 60 pips to downside so now i`m waiting the price to go back to retest the same area again and give me a good bearish price action to can enter a sell trade and we can targeting from 100 : 200 pips . if we have a daily closure above my res area this idea will not be valid anymore .

Entry Reasons :

1- Very Strong Daily Res Area .

2- Perfect Bearish Price Action .

3- Bigger Time Frames Confirmed .

GBPCAD: Bearish FVG Retracement Setup🔍 Market Context

Strong bullish rally from Aug 12 → Aug 14 created an extended push.

Price broke down after topping out, showing sellers stepping in.

Current price is trading around 1.8686, below the trendline break.

📌 My Sell Idea

I’m waiting for price to retrace back into the bearish FVG around 1.8700–1.8710 before looking for continuation lower.

This makes sense because:

The FVG is still unfilled.

Market momentum has shifted bearish.

The level aligns with structure, making it a clean rejection zone.

✅ Strength of Your Setup

FVG retracement zone above price (1.8700–1.8710).

Momentum shift after strong bearish candles.

Clear downside target around 1.8635 (previous demand/liquidity).

Solid R:R: SL above the FVG, TP at next support.

⚠️ Things to Watch

If price pushes too far above the FVG, the idea weakens. London/NY session volatility may cause a fake-out wick into supply before dropping. If price drops without retrace, don’t chase — wait for the next setup.

🎯 Execution Plan

Sell Entry: 1.8700–1.8710

SL: 1.8720–1.8730 (above supply)

TP1: 1.8660

TP2: 1.8635

👑 Professional Take

This is a clean FVG retracement play. This is a strong, simple play. The key is patience: let the market come to Us. If it doesn’t retrace, I'll simply miss the trade.

GBPCAD - ShortGBPCAD Analysis - SELL 👆

In this Chart GBPCAD H4 Timeframe: By Nii_Billions.

❤️This Chart is for GBPCAD market analysis.

❤️Entry, SL, and Target is based off our Strategy.

This chart analysis uses multiple timeframes to analyze the market and to help see the bigger picture on the charts.

The strategy uses technical and fundamental factors, and market sentiment to predict a BEARISH trend in GBPCAD, with well-defined entry, stop loss, and take profit levels for risk management.

🟢This idea is purely for educational purposes.🟢

❤️Please, support our work with like & comment!❤️

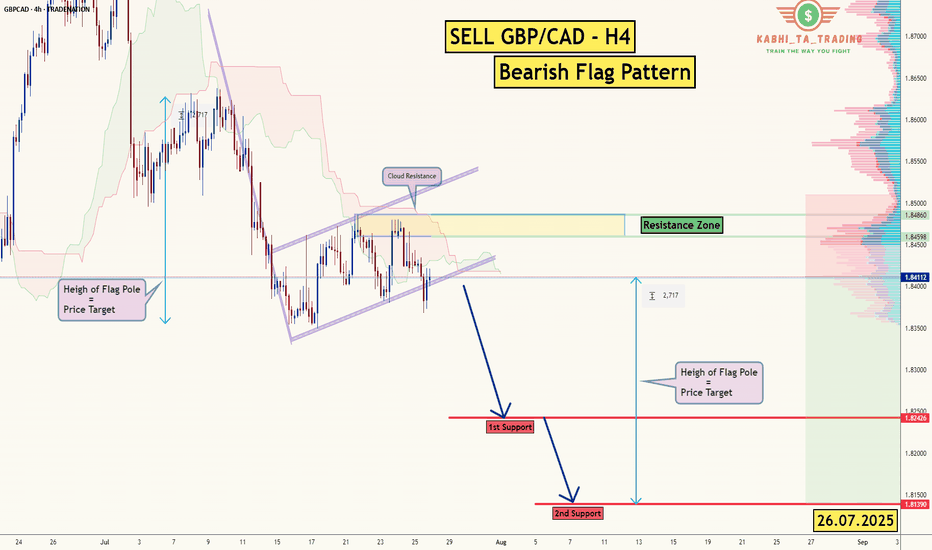

GBP/CAD - H4 - Bearish Flag (26.07.2025)The GBP/CAD Pair on the H4 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Bearish Flag Pattern. This suggests a shift in momentum towards the downside in the coming Days.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.8242

2nd Support – 1.8139

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCAD is in the bearish directionHello Traders

In This Chart gbpcad HOURLY Forex Forecast By FOREX PLANET

today GBPCAD analysis 👆

🟢This Chart includes_ (GBPCAD market update)

🟢What is The Next Opportunity on GBPCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart