Gbpchfanalysis

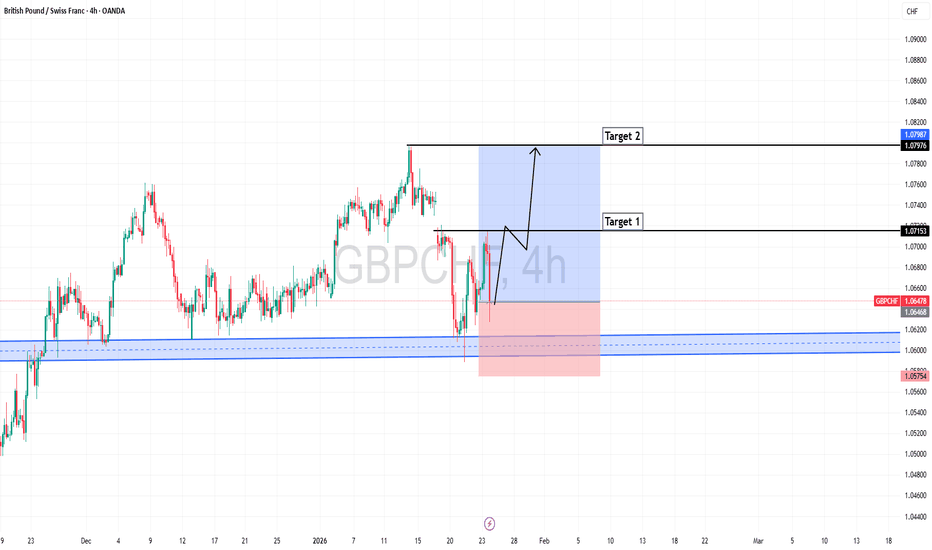

GBPCHF Buy Trade IdeaHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPCHF Buy Trade IdeaHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPCHF Buy Trade IdeaHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

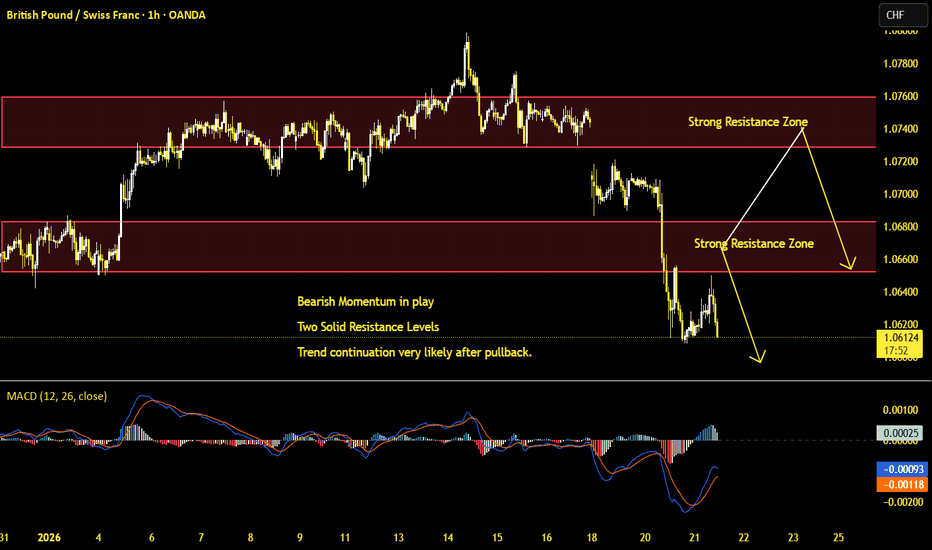

GBPCHF Short Term Sell IdeaH1 - Strong bearish momentum.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------

GBP/CHF Bullish Continuation? Key Levels Under the MicroscopeGBP/CHF Bullish Swing/Day Trade Setup — Thief Layer Entry 🔥💰

📌 Asset: GBP/CHF — British Pound 🇬🇧 vs Swiss Franc 🇨🇭

📌 Market: Forex (FX)

📌 Strategy Style: Swing / Day Trade ✔️

🚀 Bullish technical setup confirmed with exponential/dual EDSMA pullback + momentum shift.

🧠 Trade Plan:

We are targeting a bullish continuation on GBP/CHF with layered entry strategy (multiple limit buys). This Thief layering 🔐 technique aims to build position at key pullback zones — reduce execution risk and maximize reward.

👉 Layered Buy Limit Entries (your discretion, can add more):

✔️ 1️⃣ 1.07300

✔️ 2️⃣ 1.07400

✔️ 3️⃣ 1.07500

💠 You can increase layers based on your risk tolerance and liquidity zones.

🔑 Entry Strategy:

“Thief Method” — Multi-limit buys (Layered Limits)

Set incremental buy limits into the pullback — scale in to capture the next breakout leg. Best used with LONDON session volatility. 🔄

🎯 Targets & Levels

📍 Primary Target: 🎉 1.07900 — strong resistance region from recent highs + overbought supply zone (escape with profit before liquidity sweep).

📉 Stop Loss: 📍 1.07200

✔️ This is the Thief SL zone — below key support / MA confluence.

⚠️ Note: Always manage SL/TP based on your own risk comfort. I am not recommending rigid SL/TP — you decide and trade your plan.

🧠 Technical Rationale

🔹 Price has reacted off moving averages & demand zone showing bullish signals.

🔹 Oscillators (RSI/Stoch) likely heading out of oversold on pullbacks — supporting long bias.

🔹 Market sentiment for this pair shows buying interest among traders.

🗂 Related Pairs to Watch & Correlations

👀 Watchlist:

GBP/USD — confirms broader pound strength/weakness.

EUR/CHF — CHF risk-off indicator (safe-haven flows).

USD/CHF — overall CHF trend driver.

📌 Key Points / Correlation Logic:

📌 GBP rising vs USD and EUR could push GBP/CHF higher.

📌 CHF strength (safe haven) typically compresses GBP/CHF during risk off — watch CHF pairs for correlation signals.

📅 Fundamental & Economic Factors (London Time)

⚠️ Important Macro Drivers to Watch (London GMT):

📆 Bank of England monetary policy cues — interest rate outlook & growth data pressures GBP.

📆 UK GDP / Inflation releases — volatility on GBP strength/weakness.

📆 Swiss National Bank (SNB) policy stance impacts CHF valuation — SNB has kept relatively conservative bias.

📆 Risk Sentiment & Safe-Haven Demand — CHF strengthens during global uncertainty.

💡 Fundamental trigger example:

Dovish BoE bias or strong SNB data could flatten bullish GBP/CHF moves. Conversely, unexpected UK data beat or risk-on sentiment → GBP/CHF tends to rally.

🎢 Market Structure & Order Flow (Fun, Smart Callouts)

📌 Liquidity hunts near round levels (1.070/1.080) — price loves grabbing stops then reversing.

📌 Thief OGs know layering plays smooth into these levels. 💎👀

📌 Thief OG Alert! 🏴☠️

Study your own execution, use London Session activity, and trade the reaction, not the rumor.

This isn’t financial advice — trade smart, protect capital, and always adapt SL/TP to YOUR strategy.

GBPCHF is Ready for a breakthroughHello Traders

In This Chart XAGUSD HOURLY Forex Forecast By FOREX PLANET

today XAGUSD analysis 👆

🟢This Chart includes_ (XAGUSD market update)

🟢What is The Next Opportunity on XAGUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPCHF is Ready for a breakthroughHello Traders

In This Chart XAGUSD HOURLY Forex Forecast By FOREX PLANET

today XAGUSD analysis 👆

🟢This Chart includes_ (XAGUSD market update)

🟢What is The Next Opportunity on XAGUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPCHF: A Final Push Down Before A Strong Bullish Reversal! GBPCHF has been in strong bearish trend where buyers have failed countless times, suggesting a strong sellers hold in the market. In our opinion, price may fall further before the bullish momentum and volume kick in the market, currently fundamentals does not support GBP when we compare it with CHF. Therefore, we should patiently wait for price to complete its full move taking any buying entry.

Good luck and trade safe!

Team Setupsfx_

GBPCHF is Ready for a breakthroughHello Traders

In This Chart XAGUSD HOURLY Forex Forecast By FOREX PLANET

today XAGUSD analysis 👆

🟢This Chart includes_ (XAGUSD market update)

🟢What is The Next Opportunity on XAGUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPCHF Idea 23.11.2025I currently have several scenarios on the GBPCHF market. The closest one is a short when the SFP is above the monthly level at 1.062, which is also between two Fibo levels. Another potential short is at 1.081, where it immediately falls several levels below the Golden Pocket level and the Fibo level of 0.618 for a possible long and possibly a second SFP below the current wave at 1.036, where a deviation could theoretically be created.

GBPCHF is Ready for a breakthroughHello Traders

In This Chart XAGUSD HOURLY Forex Forecast By FOREX PLANET

today XAGUSD analysis 👆

🟢This Chart includes_ (XAGUSD market update)

🟢What is The Next Opportunity on XAGUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBP/CHF: Bearish Slide to 1.04?FX:GBPCHF is signaling a bearish slide on the 4-hour chart , with price adhering to a downward trendline since April 2025, forming lower highs and approaching a good entry point near cumulative sell liquidation levels—indicating potential for further downside if sellers break through toward support zones.

Entry zone between 1.056-1.0585 for a short position. Targets at 1.0447 (first) and 1.04 (second) 🎯. Set a stop loss on a close above 1.065 to manage risk effectively📊. Look for confirmation with a bearish close below entry and increasing volume, amid GBP weakness against the safe-haven CHF. 🌟

Fundamentally , on Friday, November 21, 2025, we have the UK Retail Sales report, which could pressure GBP if weaker than expected (forecasted at -0.3% MoM after September's 0.5% rise). Additionally, the SNB Chairman Schlegel's speech on Friday at 12:40 GMT may introduce volatility to CHF, potentially strengthening it if hawkish tones emerge. 💡

📝 Trade Setup

🎯 Entry Zone (Short): 1.0560 – 1.0585

🎯 Targets:

• TP1: 1.0447

• TP2: 1.0400

❌ Stop Loss: Close above 1.0650

What's your view on this setup? Drop your thoughts below! 👇

GBPCHF Sterling Slips as Swiss Franc Regains Safe-Haven StrengthGBPCHF continues to drift lower within a well-defined descending channel, reflecting renewed Swiss franc strength amid cautious global sentiment and persistent pressure on the British pound. The latest rebound toward 1.0600 appears corrective, with sellers likely to step back in as risk appetite fades and the Bank of England’s dovish tone contrasts sharply with the Swiss National Bank’s measured stability.

Current Bias

Bearish. The pair remains under sustained downside pressure, with the recent rally likely forming a lower high within the broader downtrend.

Key Fundamental Drivers

Bank of England (BoE): The BoE’s latest policy hold reinforces a dovish stance as inflation eases but growth stagnates. Rate cuts in 2026 remain on the table if wage data continue to cool.

Swiss National Bank (SNB): The SNB’s subtle preference for a stronger franc to contain imported inflation underpins CHF resilience. With inflation below 2%, policymakers remain comfortable maintaining current conditions.

Risk Sentiment: Elevated geopolitical tensions and market caution continue to favor the franc over the pound, especially during risk-off trading sessions.

Macro Context

The macro backdrop supports CHF outperformance as the U.K. grapples with weak GDP growth, fiscal constraints, and softer consumer confidence. The SNB benefits from Switzerland’s structural current account surplus and its safe-haven status during periods of uncertainty.

Interest rate expectations currently show:

BoE: Policy on hold at 4%, with easing expectations building for 2026 as inflation normalizes.

SNB: No immediate policy shift expected, but the bank remains vigilant against imported price pressures from a weaker euro or higher global energy costs.

Commodity flows play a limited direct role here, but the broader risk environment—particularly in Europe’s trade and energy dynamics—continues to favor CHF stability.

Primary Risk to the Trend

The main risk would come from an unexpected improvement in U.K. economic data or a dovish turn from the SNB. A recovery in global risk appetite could also weaken the franc, prompting a short-term rebound in GBPCHF toward the upper channel.

Most Critical Upcoming News/Event

U.K. GDP and labor market reports next week

SNB Chairman Thomas Jordan’s upcoming remarks

Global equity and bond volatility metrics, which directly influence CHF demand

Leader/Lagger Dynamics

GBPCHF generally acts as a lagger to broader GBP and CHF sentiment. It tends to follow GBPUSD’s directional cues but reacts more strongly to sudden shifts in global risk sentiment that move CHF. When risk aversion spikes, GBPCHF typically leads declines among pound crosses.

Key Levels

Support Levels: 1.0500 / 1.0420

Resistance Levels: 1.0610 / 1.0700

Stop Loss (SL): 1.0720

Take Profit (TP): 1.0500 (initial), 1.0420 (extended)

Summary: Bias and Watchpoints

GBPCHF remains bearish, with the broader downtrend firmly intact as macro fundamentals favor the franc. A rejection near 1.0600 would strengthen the case for a continuation lower toward 1.0500 and 1.0420, while a break above 1.0720 would neutralize the bias.

With the BoE signaling caution and U.K. data softening, GBP’s recovery potential remains limited. Meanwhile, the SNB’s quiet but firm preference for a stronger franc adds further weight to downside pressure. Unless risk appetite returns decisively or U.K. data surprises to the upside, GBPCHF’s bias stays tilted lower into mid-November.

#GBPCHF: Major Swing Sell Opportunity! GBPCHF, there are two areas where you can sell it from. The first is the current market, where you can take a risk sell entry. However, if you’re looking for a safer entry, you may want to consider taking a second entry. This will be safer since the price would have filled the liquidity area.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

GBPCHF - APPROACHES KEY DEMAND ZONESymbol - GBPCHF

GBPCHF continues to correct, forming lower-lows amid ongoing macroeconomic uncertainty and US policy concerns. The currency pair remains within a bearish structure, yet it is now approaching a critical demand zone located near 1.0555 – 1.0530, where a potential reaction from buyers could emerge.

Despite the prevailing downside momentum, the pair is entering a zone of interest that may attract bullish activity. If the bulls succeed in defending this demand zone, a notable reversal from these levels could follow.

Resistance levels: 1.0560, 1.0535

Support levels: 1.0600, 1.0647, 1.0685

If the price fails to hold above the current support and liquidity zone highlighted in the chart, another wave of selling could develop. Although, given the existing market context, the probability of a deeper decline appears limited.

GBPCHF: Wait For Breakthrough Then Swing BuyGBPCHF has been accumulating and currently all time low, we can see price distributing in soon time, however, before it does we need a stronger confirmation in form of breakthrough of the trend line. Once price has breached the trend line we can enter when price does the reconfirmation, this will give us enough confidence to enter swing buy position with strict risk management. If you like the idea then do consider liking and commenting our ideas.

good luck and trade safe!

Team Setupsfx_❤️🚀

GBP/CHF: Ready for the Next Big Move? Dual Scenario Analysis💷 GBP/CHF “Pound Sterling vs Swiss Franc” — Forex Market Profit Playbook 🧠💰

Style: Swing / Day Trade

Bias: 🟢🔴 Flexible Bias — Ready for Either Breakout!

🎯 Trade Setup Overview

We’re watching GBP/CHF closely for a potential breakout opportunity on either side of the zone. The market’s preparing a move — we just need confirmation from price action.

📈 Entry Levels:

✅ Long Entry (Buy) — If breakout occurs above resistance → 1.07700

🔻 Short Entry (Sell) — If breakout occurs below support → 1.06500

🛑 Stop Loss Zones (a.k.a. “Thief SL” 😎)

🟢 For Bullish Entry: SL → 1.06700

🔴 For Bearish Entry: SL → 1.07500

⚠️ Note to my Fellow Thief OG’s:

I’m not recommending you copy my exact SL. It’s your money, your risk, and your reward. Manage accordingly like a true market bandit! 💼💸

💰 Profit Targets (TP Levels)

🎯 Target 1 → 1.09500

↳ Zone aligns with strong resistance + overbought region + possible liquidity trap.

⚠️ Escape with profits before the market traps the crowd!

🎯 Target 2 → 1.05000

↳ Zone aligns with strong support + oversold region + potential reversal zone.

⚠️ Exit gracefully — don’t get caught in the comeback trap!

⚠️ Note to my Fellow Thief OG’s (again):

You can set your own Take Profit (TP). I’m sharing my zones — not your destiny. Trade smart, not emotional.

🧩 Market Context & Correlation Watchlist

Keep an eye on correlated assets that influence GBP/CHF movement:

💷 $GBP/USD → Direct impact from GBP strength/weakness.

🧊 $USD/CHF → Often inversely correlated — when USD strengthens, CHF weakens.

💶 $EUR/CHF → Tracks Swiss Franc sentiment and safe-haven flows.

💹 $GBP/JPY → Risk sentiment gauge for GBP strength across majors.

📊 Key Insight:

If global risk appetite improves → CHF weakens (boosting GBP/CHF).

If risk sentiment drops → CHF strengthens (pressuring GBP/CHF).

🧠 Thief Trader Notes

This plan thrives on discipline & confirmation.

Don’t rush entries — wait for breakout retests or candlestick confirmations.

Remember: even the market respects patience more than greed! ⚔️

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

⚠️ Disclaimer

This is a Thief-style trading strategy, shared for educational only.

Not financial advice — trade at your own risk and use proper risk management.

#GBPCHF #ForexAnalysis #SwingTrade #DayTrading #PriceAction #BreakoutStrategy #SmartMoneyConcepts #TechnicalAnalysis #ThiefTrader #TradingCommunity #ForexSetups #MarketInsights

GBPCHF Buy Trade IdeaHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPCHF: Support Rebound Signals Recovery PotentialGBPCHF has been under pressure for weeks, but the pair is now showing signs of life after bouncing from a well-defined support zone. The technical picture points to a potential relief rally, with bulls aiming to reclaim higher ground if momentum continues. This setup comes at a time when GBP fundamentals are holding up better than expected, while CHF strength looks stretched amid global risk sentiment swings.

Current Bias

Bullish – GBPCHF is attempting a reversal from a solid support zone with clear upside targets in sight.

Key Fundamental Drivers

GBP: UK inflation remains sticky, keeping the BoE cautious about cutting too soon. That offers GBP relative support.

CHF: The franc has been driven by safe-haven demand amid global uncertainty, but this tailwind looks to be losing steam as risk sentiment steadies.

Relative Outlook: GBP’s resilience against a slowing Swiss growth backdrop makes room for a rebound.

Macro Context

Interest Rates: BoE is leaning hawkish relative to the SNB, where rate cuts or prolonged policy easing remain on the table.

Economic Growth: The UK economy is fragile but not contracting, whereas Swiss data show stagnation in manufacturing and exports.

Geopolitical Themes: CHF is sensitive to geopolitical shocks, but easing tensions would diminish its safe-haven bid.

Primary Risk to the Trend

Renewed risk-off flows (e.g., Middle East escalation, global equities selloff) could boost CHF and cap GBPCHF upside.

Most Critical Upcoming News/Event

UK inflation and BoE commentary.

Swiss CPI and SNB’s tone on FX interventions.

Leader/Lagger Dynamics

GBPCHF is typically a lagger, following GBP’s performance against the USD and CHF’s safe-haven flows. It is often influenced by moves in GBPUSD and USDCHF.

Key Levels

Support Levels: 1.0580, 1.0521

Resistance Levels: 1.0656, 1.0733

Stop Loss (SL): 1.0521

Take Profit (TP): 1.0733

Summary: Bias and Watchpoints

GBPCHF looks bullish after defending the 1.0580–1.0600 support area, with upside targets at 1.0656 and 1.0733. A stop at 1.0521 provides protection in case of renewed CHF strength. Fundamentally, sticky UK inflation and a cautious BoE favor GBP resilience, while CHF’s safe-haven advantage may fade if risk sentiment stabilizes. This makes GBPCHF an attractive recovery play, but traders must stay alert to global risk shocks that could revive CHF demand.