GBPCHF Breakdown Phase or One Last Bounce Before Deeper LowsGBPCHF has shifted from choppy range behavior into a more directional, lower-high / lower-low sequence, and that’s usually the early warning that character has changed. The latest drop into support wasn’t just a drift — it was impulsive. What I’m watching now is whether this small bounce turns into a proper reclaim of broken structure, or just a pause before continuation lower. With CHF still bid on defensive flows and GBP more data-sensitive, the pressure balance still leans downside unless buyers prove otherwise.

Current Bias

Bearish

Structure shows descending highs, channel pressure, and a recent support break with only a shallow rebound so far. Bias favors downside continuation unless price reclaims the broken structure zone overhead.

Key Fundamental Drivers

CHF safe-haven demand: Swiss franc continues to attract defensive flows when macro and geopolitical uncertainty rises.

BoE policy path: Bank of England is restrictive but increasingly data-dependent, with markets watching for eventual easing timing.

UK growth softness: UK growth momentum is uneven, making GBP vulnerable to negative surprises.

Rate spread vs safety: Even when UK yields are higher than Swiss yields, CHF can outperform when risk sentiment weakens.

Macro Context

Interest rate expectations:

BoE remains cautious with rates still elevated, but forward expectations lean toward gradual easing if inflation continues to cool. Swiss policy is lower-rate, but CHF strength is often flow-driven, not yield-driven.

Economic growth trends:

UK growth is patchy and sensitive to consumer and housing data. Switzerland is slower growth but financially stable — which supports CHF in defensive rotations.

Capital and risk flows:

When equity and credit markets wobble, CHF tends to gain against higher-beta European currencies like GBP.

Geopolitical themes:

Ongoing geopolitical tension and trade frictions keep a background bid under safe-haven currencies, including CHF.

Primary Risk to the Trend

The main risk to the bearish view is a strong upside surprise in UK inflation or labor data that pushes BoE easing expectations further out and strengthens GBP broadly.

A strong global risk rally is another upside risk, which would typically weaken CHF and lift GBPCHF.

Most Critical Upcoming News/Event

UK CPI and wage data

UK labor market releases

Bank of England speakers

Major geopolitical or risk-sentiment shocks

These are the events most likely to shift GBP or CHF flow balance.

Leader/Lagger Dynamics

GBPCHF is generally a lagger cross.

It tends to follow:

Broader GBPUSD direction for the GBP leg

Safe-haven flow signals seen in USDCHF and gold for the CHF leg

It can influence:

Other GBP crosses slightly, but usually after GBPUSD moves first.

CHF strength typically shows up in USDCHF and gold before GBPCHF fully adjusts.

Key Levels

Support Levels:

1.0500 zone — near support shelf

1.0440–1.0450 — secondary support

1.0360–1.0370 — major downside target zone

Resistance Levels:

1.0600–1.0620 — broken structure resistance

1.0760 area — higher resistance ceiling

Stop Loss (SL):

Above 1.0620 for bearish continuation setups

Take Profit (TP):

TP1: 1.0500

TP2: 1.0440

TP3: 1.0360 zone

Summary: Bias and Watchpoints

GBPCHF currently holds a bearish bias after a structural shift lower and a momentum break into support. CHF safe-haven demand and uneven UK growth keep pressure tilted to the downside unless GBP can reclaim the 1.06+ structure zone. Downside levels to watch sit at 1.0500, then 1.0440 and potentially 1.0360 if momentum extends. Invalidation for the bearish view sits above the broken resistance band with a protective stop above that area. The key watchpoints are UK inflation and labor data — if they surprise hot, GBP can squeeze; if not, the path lower stays cleaner.

Gbpchflong

GBPCHF M30 | Bullish Bounce Off Key SupportMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 1.06291

- Overlap support

- 78.6% Fib retracement

Stop Loss: 1.06046

- Overlap support

Take Profit: 1.06527

- Multi-swing high resistance

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

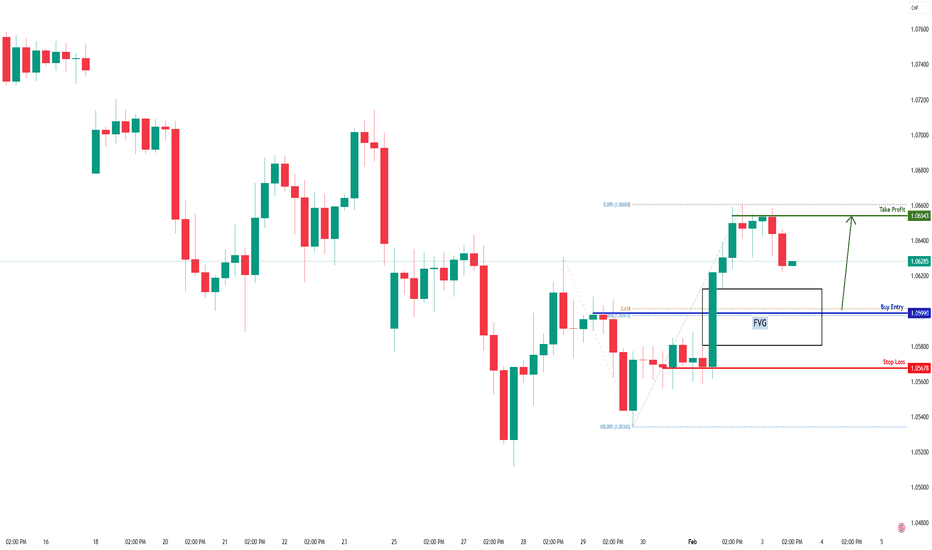

GBPCHF H4 | Bullish Bounce Off Pullback SupportMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 1.05990

- Pullback support

- 50% Fib retracement

- 61.8% Fib projection

- Fair value gap

Stop Loss: 1.05678

- Multi-swing low support

Take Profit: 1.06543

- Multi-swing high resistance

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

GBPCHF Buy Trade IdeaHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBP/CHF Bullish Continuation? Key Levels Under the MicroscopeGBP/CHF Bullish Swing/Day Trade Setup — Thief Layer Entry 🔥💰

📌 Asset: GBP/CHF — British Pound 🇬🇧 vs Swiss Franc 🇨🇭

📌 Market: Forex (FX)

📌 Strategy Style: Swing / Day Trade ✔️

🚀 Bullish technical setup confirmed with exponential/dual EDSMA pullback + momentum shift.

🧠 Trade Plan:

We are targeting a bullish continuation on GBP/CHF with layered entry strategy (multiple limit buys). This Thief layering 🔐 technique aims to build position at key pullback zones — reduce execution risk and maximize reward.

👉 Layered Buy Limit Entries (your discretion, can add more):

✔️ 1️⃣ 1.07300

✔️ 2️⃣ 1.07400

✔️ 3️⃣ 1.07500

💠 You can increase layers based on your risk tolerance and liquidity zones.

🔑 Entry Strategy:

“Thief Method” — Multi-limit buys (Layered Limits)

Set incremental buy limits into the pullback — scale in to capture the next breakout leg. Best used with LONDON session volatility. 🔄

🎯 Targets & Levels

📍 Primary Target: 🎉 1.07900 — strong resistance region from recent highs + overbought supply zone (escape with profit before liquidity sweep).

📉 Stop Loss: 📍 1.07200

✔️ This is the Thief SL zone — below key support / MA confluence.

⚠️ Note: Always manage SL/TP based on your own risk comfort. I am not recommending rigid SL/TP — you decide and trade your plan.

🧠 Technical Rationale

🔹 Price has reacted off moving averages & demand zone showing bullish signals.

🔹 Oscillators (RSI/Stoch) likely heading out of oversold on pullbacks — supporting long bias.

🔹 Market sentiment for this pair shows buying interest among traders.

🗂 Related Pairs to Watch & Correlations

👀 Watchlist:

GBP/USD — confirms broader pound strength/weakness.

EUR/CHF — CHF risk-off indicator (safe-haven flows).

USD/CHF — overall CHF trend driver.

📌 Key Points / Correlation Logic:

📌 GBP rising vs USD and EUR could push GBP/CHF higher.

📌 CHF strength (safe haven) typically compresses GBP/CHF during risk off — watch CHF pairs for correlation signals.

📅 Fundamental & Economic Factors (London Time)

⚠️ Important Macro Drivers to Watch (London GMT):

📆 Bank of England monetary policy cues — interest rate outlook & growth data pressures GBP.

📆 UK GDP / Inflation releases — volatility on GBP strength/weakness.

📆 Swiss National Bank (SNB) policy stance impacts CHF valuation — SNB has kept relatively conservative bias.

📆 Risk Sentiment & Safe-Haven Demand — CHF strengthens during global uncertainty.

💡 Fundamental trigger example:

Dovish BoE bias or strong SNB data could flatten bullish GBP/CHF moves. Conversely, unexpected UK data beat or risk-on sentiment → GBP/CHF tends to rally.

🎢 Market Structure & Order Flow (Fun, Smart Callouts)

📌 Liquidity hunts near round levels (1.070/1.080) — price loves grabbing stops then reversing.

📌 Thief OGs know layering plays smooth into these levels. 💎👀

📌 Thief OG Alert! 🏴☠️

Study your own execution, use London Session activity, and trade the reaction, not the rumor.

This isn’t financial advice — trade smart, protect capital, and always adapt SL/TP to YOUR strategy.

GBPCHF Buy Trade IdeaHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBP/CHF Buyers Defend SMA – Bullish Structure Holds Strong📊 GBP/CHF – Pound Sterling vs Swissy

Forex Market Trade Opportunity Guide (Day / Swing Trade)

🧭 Market Bias

🟢 BULLISH

The bullish structure remains intact and technically confirmed after a clean Simple Moving Average (SMA) pullback, indicating that buyers are defending value zones and stepping back into the trend with strength.

🔍 Trade Plan – Technical Confirmation

✅ Primary Trend: Bullish

✅ Key Confirmation: Simple Moving Average Pullback

✅ Market Behavior: Healthy retracement, no structural breakdown

✅ Momentum: Buyers absorbing pullbacks → continuation favored

This setup favors trend continuation traders rather than counter-trend positions.

🎯 Entry Strategy – Thief Layer System

📌 Flexible Entry Allowed – Any Price Level

🕵️♂️ Thief Strategy (Layered Limit Orders)

Layering helps reduce emotional entries, improves average pricing, and allows smoother position building during pullbacks.

📥 Buy Limit Layers

1.05800

1.06000

1.06200

1.06400

(You may increase or reduce layers based on volatility & position sizing.)

🛑 Risk Management – Stop Loss

🔻 Thief SL: 1.05600

Dear Ladies & Gentlemen (Thief OG’s),

This stop loss is not mandatory. Adjust your SL based on:

Account size

Volatility conditions

Personal risk model

Capital protection always comes before profit.

🎯 Profit Objective

📈 Target Zone: 1.07500

⚠️ Triangular Moving Average acting as dynamic resistance

📊 Market showing overbought conditions

Possible liquidity trap near highs

👉 Smart money rule: Escape with profits near resistance, don’t wait for perfection.

Dear Ladies & Gentlemen (Thief OG’s),

This TP is a guideline, not a command. Scale out or trail profits based on your system.

🔗 Related Pairs to Watch (Correlation Insight)

💷 SPREADEX:GBP Strength Confirmation

FX:GBPUSD – If GBPUSD continues higher, it confirms Sterling strength, supporting upside in GBP/CHF.

OANDA:EURGBP – A bearish EURGBP indicates GBP outperformance, bullish for GBP/CHF.

🇨🇭 LSE:CHF Risk Sentiment Gauge

OANDA:USDCHF – A bullish USDCHF often signals CHF weakness, which supports GBP/CHF upside.

OANDA:EURCHF – Rising EURCHF also confirms Swiss Franc softness.

📌 Key Insight:

👉 Strong GBP + Weak CHF = Clean Fuel for GBP/CHF Continuation

🧠 Why This Setup Matters

Trend-aligned strategy (higher probability)

SMA pullback = institutional participation zone

Layering reduces emotional execution

Clear invalidation & profit zone defined

⚠️ Final Note

This idea is shared for educational and technical analysis purposes only.

You are fully responsible for your own risk, execution, and trade management.

📌 If this analysis adds value, boost it with a 👍 Like, 💬 Comment, and ⭐ Follow for more clean market blueprints.

Trade smart. Protect capital. Let structure do the work. 💼📈

GBPCHF is Ready for a breakthroughHello Traders

In This Chart XAGUSD HOURLY Forex Forecast By FOREX PLANET

today XAGUSD analysis 👆

🟢This Chart includes_ (XAGUSD market update)

🟢What is The Next Opportunity on XAGUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPCHF: A Final Push Down Before A Strong Bullish Reversal! GBPCHF has been in strong bearish trend where buyers have failed countless times, suggesting a strong sellers hold in the market. In our opinion, price may fall further before the bullish momentum and volume kick in the market, currently fundamentals does not support GBP when we compare it with CHF. Therefore, we should patiently wait for price to complete its full move taking any buying entry.

Good luck and trade safe!

Team Setupsfx_

GBPCHF Idea 23.11.2025I currently have several scenarios on the GBPCHF market. The closest one is a short when the SFP is above the monthly level at 1.062, which is also between two Fibo levels. Another potential short is at 1.081, where it immediately falls several levels below the Golden Pocket level and the Fibo level of 0.618 for a possible long and possibly a second SFP below the current wave at 1.036, where a deviation could theoretically be created.

GBPCHF Sterling Slips as Swiss Franc Regains Safe-Haven StrengthGBPCHF continues to drift lower within a well-defined descending channel, reflecting renewed Swiss franc strength amid cautious global sentiment and persistent pressure on the British pound. The latest rebound toward 1.0600 appears corrective, with sellers likely to step back in as risk appetite fades and the Bank of England’s dovish tone contrasts sharply with the Swiss National Bank’s measured stability.

Current Bias

Bearish. The pair remains under sustained downside pressure, with the recent rally likely forming a lower high within the broader downtrend.

Key Fundamental Drivers

Bank of England (BoE): The BoE’s latest policy hold reinforces a dovish stance as inflation eases but growth stagnates. Rate cuts in 2026 remain on the table if wage data continue to cool.

Swiss National Bank (SNB): The SNB’s subtle preference for a stronger franc to contain imported inflation underpins CHF resilience. With inflation below 2%, policymakers remain comfortable maintaining current conditions.

Risk Sentiment: Elevated geopolitical tensions and market caution continue to favor the franc over the pound, especially during risk-off trading sessions.

Macro Context

The macro backdrop supports CHF outperformance as the U.K. grapples with weak GDP growth, fiscal constraints, and softer consumer confidence. The SNB benefits from Switzerland’s structural current account surplus and its safe-haven status during periods of uncertainty.

Interest rate expectations currently show:

BoE: Policy on hold at 4%, with easing expectations building for 2026 as inflation normalizes.

SNB: No immediate policy shift expected, but the bank remains vigilant against imported price pressures from a weaker euro or higher global energy costs.

Commodity flows play a limited direct role here, but the broader risk environment—particularly in Europe’s trade and energy dynamics—continues to favor CHF stability.

Primary Risk to the Trend

The main risk would come from an unexpected improvement in U.K. economic data or a dovish turn from the SNB. A recovery in global risk appetite could also weaken the franc, prompting a short-term rebound in GBPCHF toward the upper channel.

Most Critical Upcoming News/Event

U.K. GDP and labor market reports next week

SNB Chairman Thomas Jordan’s upcoming remarks

Global equity and bond volatility metrics, which directly influence CHF demand

Leader/Lagger Dynamics

GBPCHF generally acts as a lagger to broader GBP and CHF sentiment. It tends to follow GBPUSD’s directional cues but reacts more strongly to sudden shifts in global risk sentiment that move CHF. When risk aversion spikes, GBPCHF typically leads declines among pound crosses.

Key Levels

Support Levels: 1.0500 / 1.0420

Resistance Levels: 1.0610 / 1.0700

Stop Loss (SL): 1.0720

Take Profit (TP): 1.0500 (initial), 1.0420 (extended)

Summary: Bias and Watchpoints

GBPCHF remains bearish, with the broader downtrend firmly intact as macro fundamentals favor the franc. A rejection near 1.0600 would strengthen the case for a continuation lower toward 1.0500 and 1.0420, while a break above 1.0720 would neutralize the bias.

With the BoE signaling caution and U.K. data softening, GBP’s recovery potential remains limited. Meanwhile, the SNB’s quiet but firm preference for a stronger franc adds further weight to downside pressure. Unless risk appetite returns decisively or U.K. data surprises to the upside, GBPCHF’s bias stays tilted lower into mid-November.

GBPCHF - APPROACHES KEY DEMAND ZONESymbol - GBPCHF

GBPCHF continues to correct, forming lower-lows amid ongoing macroeconomic uncertainty and US policy concerns. The currency pair remains within a bearish structure, yet it is now approaching a critical demand zone located near 1.0555 – 1.0530, where a potential reaction from buyers could emerge.

Despite the prevailing downside momentum, the pair is entering a zone of interest that may attract bullish activity. If the bulls succeed in defending this demand zone, a notable reversal from these levels could follow.

Resistance levels: 1.0560, 1.0535

Support levels: 1.0600, 1.0647, 1.0685

If the price fails to hold above the current support and liquidity zone highlighted in the chart, another wave of selling could develop. Although, given the existing market context, the probability of a deeper decline appears limited.

GBPCHF: Wait For Breakthrough Then Swing BuyGBPCHF has been accumulating and currently all time low, we can see price distributing in soon time, however, before it does we need a stronger confirmation in form of breakthrough of the trend line. Once price has breached the trend line we can enter when price does the reconfirmation, this will give us enough confidence to enter swing buy position with strict risk management. If you like the idea then do consider liking and commenting our ideas.

good luck and trade safe!

Team Setupsfx_❤️🚀

GBP/CHF: Ready for the Next Big Move? Dual Scenario Analysis💷 GBP/CHF “Pound Sterling vs Swiss Franc” — Forex Market Profit Playbook 🧠💰

Style: Swing / Day Trade

Bias: 🟢🔴 Flexible Bias — Ready for Either Breakout!

🎯 Trade Setup Overview

We’re watching GBP/CHF closely for a potential breakout opportunity on either side of the zone. The market’s preparing a move — we just need confirmation from price action.

📈 Entry Levels:

✅ Long Entry (Buy) — If breakout occurs above resistance → 1.07700

🔻 Short Entry (Sell) — If breakout occurs below support → 1.06500

🛑 Stop Loss Zones (a.k.a. “Thief SL” 😎)

🟢 For Bullish Entry: SL → 1.06700

🔴 For Bearish Entry: SL → 1.07500

⚠️ Note to my Fellow Thief OG’s:

I’m not recommending you copy my exact SL. It’s your money, your risk, and your reward. Manage accordingly like a true market bandit! 💼💸

💰 Profit Targets (TP Levels)

🎯 Target 1 → 1.09500

↳ Zone aligns with strong resistance + overbought region + possible liquidity trap.

⚠️ Escape with profits before the market traps the crowd!

🎯 Target 2 → 1.05000

↳ Zone aligns with strong support + oversold region + potential reversal zone.

⚠️ Exit gracefully — don’t get caught in the comeback trap!

⚠️ Note to my Fellow Thief OG’s (again):

You can set your own Take Profit (TP). I’m sharing my zones — not your destiny. Trade smart, not emotional.

🧩 Market Context & Correlation Watchlist

Keep an eye on correlated assets that influence GBP/CHF movement:

💷 $GBP/USD → Direct impact from GBP strength/weakness.

🧊 $USD/CHF → Often inversely correlated — when USD strengthens, CHF weakens.

💶 $EUR/CHF → Tracks Swiss Franc sentiment and safe-haven flows.

💹 $GBP/JPY → Risk sentiment gauge for GBP strength across majors.

📊 Key Insight:

If global risk appetite improves → CHF weakens (boosting GBP/CHF).

If risk sentiment drops → CHF strengthens (pressuring GBP/CHF).

🧠 Thief Trader Notes

This plan thrives on discipline & confirmation.

Don’t rush entries — wait for breakout retests or candlestick confirmations.

Remember: even the market respects patience more than greed! ⚔️

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

⚠️ Disclaimer

This is a Thief-style trading strategy, shared for educational only.

Not financial advice — trade at your own risk and use proper risk management.

#GBPCHF #ForexAnalysis #SwingTrade #DayTrading #PriceAction #BreakoutStrategy #SmartMoneyConcepts #TechnicalAnalysis #ThiefTrader #TradingCommunity #ForexSetups #MarketInsights

GBPCHF: Support Rebound Signals Recovery PotentialGBPCHF has been under pressure for weeks, but the pair is now showing signs of life after bouncing from a well-defined support zone. The technical picture points to a potential relief rally, with bulls aiming to reclaim higher ground if momentum continues. This setup comes at a time when GBP fundamentals are holding up better than expected, while CHF strength looks stretched amid global risk sentiment swings.

Current Bias

Bullish – GBPCHF is attempting a reversal from a solid support zone with clear upside targets in sight.

Key Fundamental Drivers

GBP: UK inflation remains sticky, keeping the BoE cautious about cutting too soon. That offers GBP relative support.

CHF: The franc has been driven by safe-haven demand amid global uncertainty, but this tailwind looks to be losing steam as risk sentiment steadies.

Relative Outlook: GBP’s resilience against a slowing Swiss growth backdrop makes room for a rebound.

Macro Context

Interest Rates: BoE is leaning hawkish relative to the SNB, where rate cuts or prolonged policy easing remain on the table.

Economic Growth: The UK economy is fragile but not contracting, whereas Swiss data show stagnation in manufacturing and exports.

Geopolitical Themes: CHF is sensitive to geopolitical shocks, but easing tensions would diminish its safe-haven bid.

Primary Risk to the Trend

Renewed risk-off flows (e.g., Middle East escalation, global equities selloff) could boost CHF and cap GBPCHF upside.

Most Critical Upcoming News/Event

UK inflation and BoE commentary.

Swiss CPI and SNB’s tone on FX interventions.

Leader/Lagger Dynamics

GBPCHF is typically a lagger, following GBP’s performance against the USD and CHF’s safe-haven flows. It is often influenced by moves in GBPUSD and USDCHF.

Key Levels

Support Levels: 1.0580, 1.0521

Resistance Levels: 1.0656, 1.0733

Stop Loss (SL): 1.0521

Take Profit (TP): 1.0733

Summary: Bias and Watchpoints

GBPCHF looks bullish after defending the 1.0580–1.0600 support area, with upside targets at 1.0656 and 1.0733. A stop at 1.0521 provides protection in case of renewed CHF strength. Fundamentally, sticky UK inflation and a cautious BoE favor GBP resilience, while CHF’s safe-haven advantage may fade if risk sentiment stabilizes. This makes GBPCHF an attractive recovery play, but traders must stay alert to global risk shocks that could revive CHF demand.

GBPCHF will Fly after Stop Loss HuntingIn This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBP/CHF Bank Heist Plan: Will the Pullback Fuel the Breakout?💸 GBP/CHF Forex Bank Heist Plan 🏦 (Swing + Scalping Setup)

📌 Trade Idea (Educational Purpose Only)

Plan: Bullish Pullback at Simple Moving Average, expecting upside momentum 📈

Entry Method (Thief Layering Strategy 🕵️):

Multiple limit orders stacked like layers 🎭

1.07900

1.08000

1.08100

1.08200

(You can increase or adjust layers as per your own risk tolerance)

Stop Loss (Protect Your Bag 💼):

Suggested at 1.07600 — but every Thief OG adjusts their SL to their own style & risk.

Target 🎯:

SMA acting like a dynamite resistance 💥 near 1.09000 (overbought zone).

Plan to exit before the guards catch us 👮 at 1.08900.

⚠️ Note to Thief OG’s: This isn’t a fixed TP recommendation. Manage your exits — take the bag and escape when YOU feel it’s right.

❓ Why This Plan?

SMA pullbacks often fuel continuation moves 🔄.

Market sentiment is mixed but leaning slightly bearish — this gives our layered long setup better risk-reward if momentum flips bullish.

CHF safe-haven flows are strong, but GBP’s macro resilience + BoE stance create a possible underdog bounce scenario 🏆.

📊 GBP/CHF Market Report - September 4, 2025 🚀

💱 Current Rate

1 GBP = 1.075 CHF

(Slight dip today, but stable after recent fluctuations. Weekly high: 1.085, low: 1.075)

😊 Trader Sentiment Outlook

Retail Traders: 62% Bearish 🐻 | 38% Bullish 📈

Institutions: 55% Bullish 📈 | 45% Bearish 🐻

Mood: Neutral to Mildly Bearish 😐

😱 Fear & Greed Index

45/100 – Fear Zone 😨

(Market cautious, but greed could build if news flips positive.)

📈 Fundamental & Macro Score

6/10 – Mildly Positive 👍

Positives (GBP): UK GDP steady, BoE firm on rates, services strong.

Negatives (CHF): Swiss trade surplus, CHF safe-haven appeal.

Macro: UK inflation 2.6% > target; Swiss CPI +0.2%.

🎯 Outlook

Mild Downside Bias 🐻⬇️

But breakout above 1.085 could turn things bullish fast. Range-bound near 1.070–1.080 for now.

🔗 Related Pairs to Watch

OANDA:EURCHF

OANDA:USDCHF

FX:GBPUSD

OANDA:EURGBP

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#GBPCHF #Forex #SwingTrading #Scalping #LayeringStrategy #ThiefPlan #FXMarket #TradingView #BankHeistPlan

GBPCHF Fly from the Double Bottom Support Level.In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPCHF Bears Press Against Downtrend ChannelGBPCHF continues to grind lower within a clear descending channel. Each rally attempt is being capped by trendline resistance, with price now hovering near 1.0800. The pound’s weakness, driven by slowing UK growth and dovish Bank of England expectations, contrasts with the franc’s resilience as a defensive play. The setup favors further downside, provided sellers can maintain pressure below the channel top.

Current Bias

Bearish – Sellers remain in control as long as the pair trades within the descending channel.

Key Fundamental Drivers

UK: Stagnating growth, cooling inflation, and expectations that the BoE will ease sooner rather than later.

Switzerland: Stable inflation and a cautious SNB, paired with strong safe-haven demand for CHF.

Global: Ongoing tariff disputes and recession fears keep flows tilted toward CHF over GBP.

Macro Context

Interest rates: The BoE is leaning toward rate cuts as UK data softens. The SNB is less aggressive, keeping CHF supported.

Economic growth: UK economy has stalled, while Switzerland maintains relative stability.

Geopolitical themes: Tariffs, European stagnation, and global risk aversion continue to favor CHF.

Primary Risk to the Trend

A surprise hawkish BoE tone or stronger-than-expected UK data could shift sentiment back toward GBP, lifting the pair out of the channel.

Most Critical Upcoming News/Event

BoE September policy meeting – pivotal for GBP direction.

Swiss CPI and SNB commentary – will confirm whether CHF strength persists.

Leader/Lagger Dynamics

GBPCHF acts as a lagger, often following moves in GBPUSD and EURCHF. CHF flows tend to dominate during risk-off conditions, making GBPCHF sensitive to broader sentiment shifts.

Key Levels

Support Levels: 1.0728, 1.0668

Resistance Levels: 1.0815, 1.0860

Stop Loss (SL): 1.0860 (above channel resistance)

Take Profit (TP): 1.0668 (lower channel support)

Summary: Bias and Watchpoints

GBPCHF bias is bearish with SL at 1.0860 and TP at 1.0668. Weak UK fundamentals and dovish BoE expectations weigh on the pound, while CHF benefits from safe-haven flows and SNB’s steady stance. The key watchpoint is the BoE’s policy tone—any hawkish surprise could trigger a rebound, but as long as the pair stays below resistance, sellers have the upper hand toward 1.0668.

GBPCHF Massive Bullish Breakout!

HI,Traders !

#GBPCHF is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

GBP/CHF: Big Move Loading! Secure Your Entries Fast!💰 GBP/CHF "POUND vs SWISS" BANK HEIST 💰

🔥 THIEF TRADING GANG – LAYER UP & LOOT THIS BREAKOUT! 🔥

🎯 PLAN: BULLISH RAID 🎯

🚨 ENTRY: AFTER BREAKOUT @ 1.09300 (OR ANY PRICE – THIEF STYLE!)

🛠️ THIEF STRAT: MULTIPLE LIMIT ORDERS (LAYERED ENTRIES) – Stack them like stolen cash! 💵💵💵

(Adjust layers based on your risk appetite – OG Thieves know how to play this game!)

⛔ STOP LOSS: 1.08600 (THIEF SL – Adjust based on your heist strategy!)

🎯 TARGET: 1.10500 (Take profits & escape before the cops come! 🚔💨)

🔫 WHY THIS TRADE?

📈 BULLISH BREAKOUT CONFIRMED! (Price stealing liquidity & running!)

💣 LAYERED ENTRIES = SMARTER HEIST! (No FOMO, just calculated robbery!)

🤑 LOW RISK, HIGH REWARD! (Perfect for Thief Traders who love stealing pips!)

⚠️ WARNING – THIEF TRADER RULES:

✅ USE TRAILING STOP IF PRICE RUNS! (Lock in profits like a pro bandit!)

✅ AVOID NEWS TIME! (Cops (whales) will trap you! 🚨)

✅ BOOST & LIKE IF YOU’RE MAKING MONEY! (More boosts = More heists! 🚀)

🔥 HIT THE LIKE & BOOST BUTTON IF YOU’RE READY TO LOOT! 🔥

🚀 THIEF TRADING GANG – WE STEAL, WE WIN, WE REPEAT! 🚀